Maximizing Profit Potential with Proper Position Sizing in Forex

Forex trading is a highly volatile and dynamic market that offers immense profit potential for traders. However, the key to success in forex trading lies not only in making profitable trades but also in managing risk effectively. One of the crucial aspects of risk management in forex trading is proper position sizing.

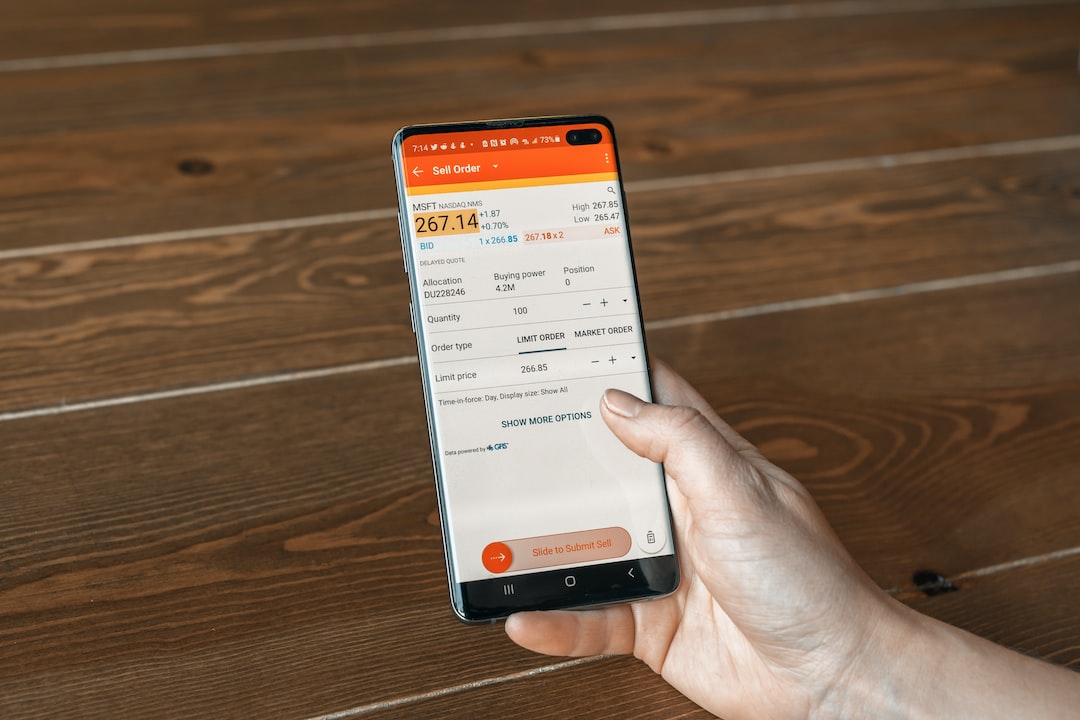

Position sizing refers to determining the appropriate amount of capital to allocate to each trade based on the trader’s risk tolerance and the potential reward of the trade. By properly sizing their positions, traders can maximize their profit potential while minimizing the risk of substantial losses. In this article, we will explore the importance of proper position sizing in forex trading and discuss various strategies to help traders optimize their trading performance.

Why is Proper Position Sizing Important?

Proper position sizing is a critical component of successful forex trading for several reasons. Firstly, it helps traders manage their risk exposure. Forex markets can be highly volatile, and a single trade can result in significant gains or losses. By sizing their positions appropriately, traders can limit the potential loss on any given trade and protect their trading capital.

Secondly, proper position sizing allows traders to take advantage of profitable opportunities while minimizing the impact of losing trades. Forex trading involves a series of trades, and it is essential to maintain a balance between risk and reward. By allocating an appropriate percentage of their capital to each trade, traders can ensure that their winning trades outweigh their losing trades in the long run.

Moreover, proper position sizing helps traders maintain psychological discipline. Emotions such as fear and greed can often cloud a trader’s judgment, leading to impulsive decisions and irrational behavior. By adhering to a consistent position sizing strategy, traders can keep their emotions in check and make rational trading decisions based on their predetermined risk tolerance and trading plan.

Position Sizing Strategies

There are several position sizing strategies that traders can employ to maximize their profit potential in forex trading. It is important to note that no single strategy guarantees success, and traders should choose a strategy that aligns with their risk tolerance and trading style. Here are a few commonly used position sizing strategies:

1. Fixed Percentage Position Sizing: This strategy involves allocating a fixed percentage of trading capital to each trade. For example, a trader might decide to risk 2% of their capital on each trade. This approach ensures consistency in risk management and prevents overexposure to any single trade.

2. Volatility-Based Position Sizing: This strategy adjusts position size based on the volatility of the currency pair being traded. When the market is more volatile, traders may reduce their position size to account for the increased risk. Conversely, during periods of lower volatility, traders may increase their position size to capitalize on potential larger moves.

3. Kelly Criterion: The Kelly Criterion is a mathematical formula used to calculate the optimal position size based on the probability of success and the potential reward of a trade. This strategy aims to maximize the long-term growth of a trader’s capital by optimizing the risk-reward ratio.

4. ATR-Based Position Sizing: The Average True Range (ATR) is a technical indicator that measures market volatility. Traders can use ATR to determine the appropriate position size based on the current market conditions. A higher ATR value might indicate a larger position size, while a lower ATR value might warrant a smaller position size.

Conclusion

Proper position sizing is a crucial element of successful forex trading. By allocating an appropriate percentage of their capital to each trade, traders can manage risk effectively and maximize their profit potential. It is essential to choose a position sizing strategy that aligns with one’s risk tolerance and trading style. Consistency and discipline in position sizing, along with a well-defined trading plan, can significantly enhance a trader’s chances of success in the challenging world of forex trading.