Forex spread is the difference between the bid price and the ask price of a currency pair. It is the cost of trading in the forex market and is an essential factor to consider when entering or exiting a trade. Understanding how to calculate forex spread is important for traders to manage their risks and maximize their profits.

The bid price is the price at which buyers are willing to purchase a currency pair, while the ask price is the price at which sellers are willing to sell the currency pair. The difference between the bid and ask price is the forex spread. For example, if the bid price for the EUR/USD currency pair is 1.1000 and the ask price is 1.1005, the spread would be 0.0005 or 5 pips.

Calculating forex spread is relatively easy. The formula to calculate the spread is:

Spread = Ask Price – Bid Price

For example, let’s say the EUR/USD currency pair has a bid price of 1.1000 and an ask price of 1.1005. Using the formula, we can calculate the spread as follows:

Spread = 1.1005 – 1.1000 = 0.0005 or 5 pips

Pips are the smallest unit of measurement in the forex market and are used to calculate the spread. They represent the fourth decimal place in a currency pair quote. For example, in the EUR/USD currency pair quote of 1.1005, the fifth decimal place represents a fraction of a pip.

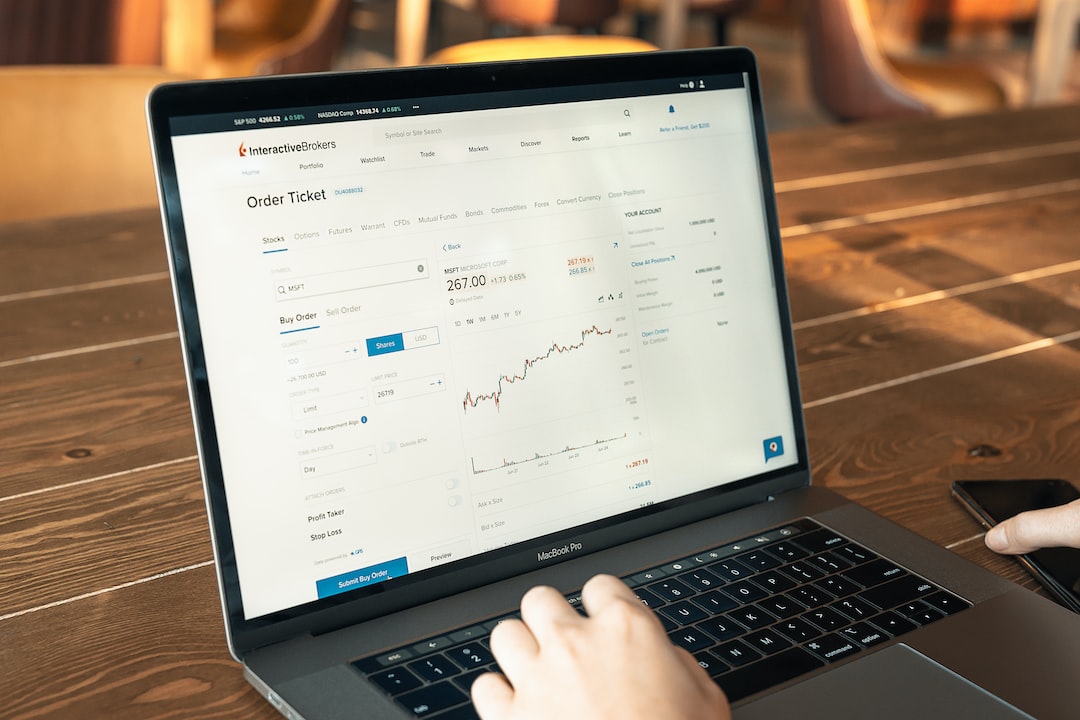

Most forex brokers provide real-time spreads for the currency pairs they offer. The spread can vary depending on the liquidity of the currency pair, the time of day, and market conditions. It is important to check the spread before entering a trade to ensure that it is reasonable and does not eat into potential profits.

Forex spread can be fixed or variable. Fixed spreads remain constant regardless of market conditions, while variable spreads can widen or narrow depending on the volatility of the market. Fixed spreads are typically higher than variable spreads, but they provide traders with a level of certainty in their trading costs.

Understanding the forex spread is important for traders to manage their risks and maximize their profits. A wider spread means that traders will need to make a larger profit to break even, while a narrower spread allows for more flexibility in trading strategies. It is also important to note that while the spread is a cost of trading, it is not the only cost to consider. Other costs include commissions, rollover fees, and slippage.

In conclusion, calculating forex spread is an essential skill for traders to have. It is a cost of trading that can significantly impact profits and must be considered when entering or exiting a trade. Traders should be aware of the spread for the currency pairs they trade and choose a broker that offers reasonable spreads and trading costs. By understanding the forex spread, traders can make informed trading decisions and maximize their potential profits.