Forex trading has become a popular method of investment for many people around the world. It is an exciting and challenging way to earn money, but it requires knowledge and experience to be successful. One of the most important things to understand in forex trading is the lot size. A lot is the standard unit of measurement in forex trading, and it determines the size of your trades. So, how much money do you need to buy a standard lot in forex trading?

First, let’s define what a standard lot is. A standard lot is the largest size of a trade that can be made in forex trading. It is equal to 100,000 units of the base currency, which is the first currency in a currency pair. For example, if you are trading the EUR/USD pair, the base currency is the euro. Therefore, one standard lot of EUR/USD is equal to 100,000 euros.

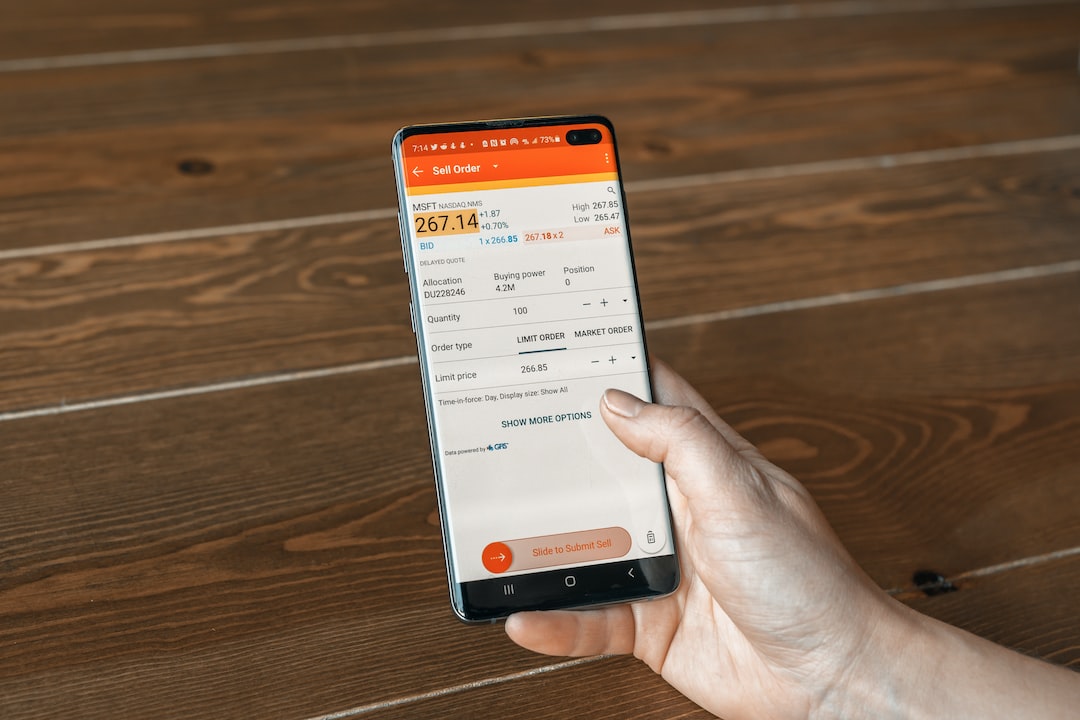

To buy a standard lot, you need to have enough capital in your trading account to cover the cost of the trade. The cost of the trade is determined by the exchange rate of the currency pair you are trading, as well as the leverage you are using. Leverage is a tool that allows you to trade with more money than you have in your account.

For example, let’s say you want to buy one standard lot of the EUR/USD pair, and the current exchange rate is 1.2000. This means that one euro is equal to 1.2000 US dollars. Therefore, the cost of one standard lot of EUR/USD is 100,000 euros x 1.2000 = 120,000 US dollars.

If you are using a leverage of 1:100, which is a common leverage ratio in forex trading, you will only need to have 1% of the total cost of the trade in your account. In this case, you will need to have 1% of 120,000 US dollars, which is 1,200 US dollars. This is called the margin requirement.

The margin requirement is the amount of money you need in your trading account to open a position. It is a small percentage of the total trade size, and it is used as collateral to cover any potential losses. If the trade goes against you and you lose money, the margin requirement will be used to cover those losses.

It is important to note that the margin requirement can vary depending on the leverage you are using, the currency pair you are trading, and the broker you are using. Some brokers may require a higher margin requirement for certain currency pairs or during high volatility periods.

In addition to the margin requirement, there are other costs associated with forex trading, such as spreads, commissions, and overnight financing charges. Spreads are the difference between the bid and ask price of a currency pair, and they represent the cost of trading. Commissions are fees charged by brokers for executing trades. Overnight financing charges are fees charged for holding positions overnight.

Therefore, when calculating how much money you need to buy a standard lot in forex trading, you need to consider all of these costs. You should also have a solid trading strategy and risk management plan in place to minimize your losses and maximize your profits.

In conclusion, buying a standard lot in forex trading requires a significant amount of capital, depending on the currency pair you are trading and the leverage you are using. The margin requirement is a small percentage of the total trade size, but it is important to consider all of the costs associated with forex trading when calculating how much money you need. With the right knowledge, experience, and strategy, forex trading can be a lucrative investment opportunity.