Forex vs. Stocks: What’s the Difference and Which is Better for You?

The world of financial markets offers a plethora of investment opportunities, and two of the most popular options are Forex and stocks. Both Forex (foreign exchange) and stocks provide individuals with the chance to invest and potentially make profits. However, it is crucial to understand the differences between these two markets before deciding which one is better suited to your needs and goals.

The Differences

1. Market Size: Forex is the largest financial market globally, with a daily trading volume of around $6 trillion. In contrast, the stock market is comparably smaller, with a daily trading volume of about $200 billion. The vast size of the Forex market means it offers greater liquidity and more significant opportunities for profit.

2. Trading Hours: The Forex market operates 24 hours a day, five days a week, allowing investors to trade currencies at any time. On the other hand, stock exchanges have fixed trading hours, usually from 9:30 am to 4:00 pm in their respective time zones. This flexibility in Forex trading allows individuals to fit their investment activities around their schedule.

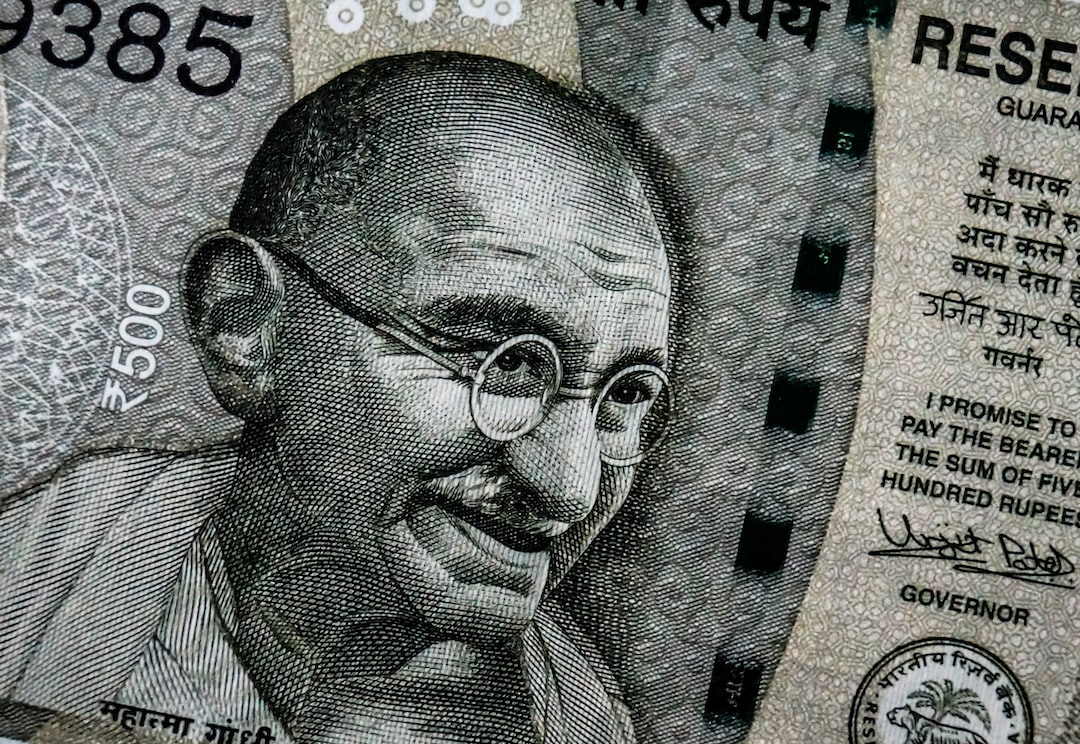

3. Market Focus: Forex trading primarily involves currency pairs, such as EUR/USD or GBP/JPY. The focus is on the relative value of one currency against another. In contrast, stock trading involves buying and selling shares of individual companies. The stock market allows investors to participate in the success of specific companies and industries.

4. Volatility and Risk: Forex markets are known for their high volatility, with exchange rates fluctuating rapidly due to various economic and geopolitical factors. This volatility can provide opportunities for substantial profits but also exposes investors to higher levels of risk. Stocks, while still subject to market volatility, tend to be less volatile than Forex. However, individual stocks can experience significant price swings based on company-specific news.

5. Leverage: Forex trading allows investors to trade on margin, meaning they can control large positions with a relatively small investment. Leverage can amplify profits, but it also increases the risk of losses. Stock trading generally does not offer the same level of leverage as Forex.

Which is Better for You?

Determining whether Forex or stocks are better for you depends on various factors, including your risk tolerance, investment goals, and available time for trading.

1. Risk Tolerance: If you are comfortable with higher levels of risk and are willing to actively monitor and manage your trades, Forex may be suitable for you. The volatility in Forex markets can provide opportunities for significant profits, but it also carries a higher risk of losses.

2. Investment Goals: If your goal is to invest in specific companies and benefit from their success, then stock trading may be a better fit. Stocks allow you to participate in the growth of individual companies and potentially receive dividends. Forex trading focuses on currency pairs and fluctuations in exchange rates.

3. Time Commitment: Forex trading offers the advantage of being available 24/5, allowing individuals to trade at their convenience. If you have limited time for trading, stock investing may be a more suitable option as it does not require constant monitoring.

4. Education and Experience: Both Forex and stock trading require a certain level of knowledge and understanding of the markets. However, Forex trading is often considered more complex due to the involvement of multiple currencies and economic factors. If you have a solid understanding of global economics and are willing to dedicate time to learning, Forex trading may be a good choice.

Ultimately, the decision between Forex and stocks depends on your individual circumstances and preferences. It is crucial to conduct thorough research, consider your risk tolerance, and consult with a financial advisor before making any investment decisions. Additionally, it is worth noting that diversification across different asset classes, including both Forex and stocks, can provide a balanced and well-rounded investment portfolio.

In conclusion, Forex and stocks offer unique opportunities for investors to make profits and grow their wealth. Understanding the differences between these markets, such as market size, trading hours, volatility, and leverage, is crucial in determining which option is more suitable for your needs and goals. Carefully consider your risk tolerance, investment goals, and available time for trading before deciding whether Forex or stocks are the better choice for you.