Forex Trading 101: What is it, How Does it Work, and Why Should You Invest in it?

Forex, or foreign exchange, trading is the largest and most liquid financial market in the world. With over $6 trillion traded daily, it offers ample opportunities for individuals to profit from fluctuations in currency exchange rates. In this article, we will explore the fundamentals of forex trading, how it works, and why you should consider investing in it.

What is Forex Trading?

Forex trading involves the buying and selling of currencies with the aim of making a profit. Unlike traditional stock trading, where investors buy shares of companies, forex trading revolves around the exchange rate between two currencies. Traders speculate on whether a currency will appreciate or depreciate against another and take positions accordingly.

How Does Forex Trading Work?

Forex trading takes place in the decentralized over-the-counter market, known as the interbank market. There is no physical location for trading, as it is conducted electronically through computer networks. Major financial institutions, such as banks, hedge funds, and multinational corporations, are the primary participants in this market.

The forex market operates 24 hours a day, five days a week, allowing traders from all around the world to engage in trading at any time. This continuous nature of the market ensures that traders can react to news and events in real-time, providing them with ample opportunities to profit from price movements.

Currency pairs are the foundation of forex trading. Each currency pair represents the exchange rate between two currencies. For example, the EUR/USD pair represents the exchange rate between the Euro and the US Dollar. The first currency in the pair is the base currency, while the second currency is the quote currency.

When trading forex, traders speculate on the direction of the exchange rate. If they believe the base currency will appreciate against the quote currency, they will buy the currency pair (known as going long). Conversely, if they expect the base currency to depreciate, they will sell the currency pair (known as going short).

Why Should You Invest in Forex Trading?

1. Liquidity: The forex market is highly liquid, meaning that traders can easily enter and exit positions at any time. This ensures that traders can execute trades without significant price slippage and enjoy tight bid-ask spreads.

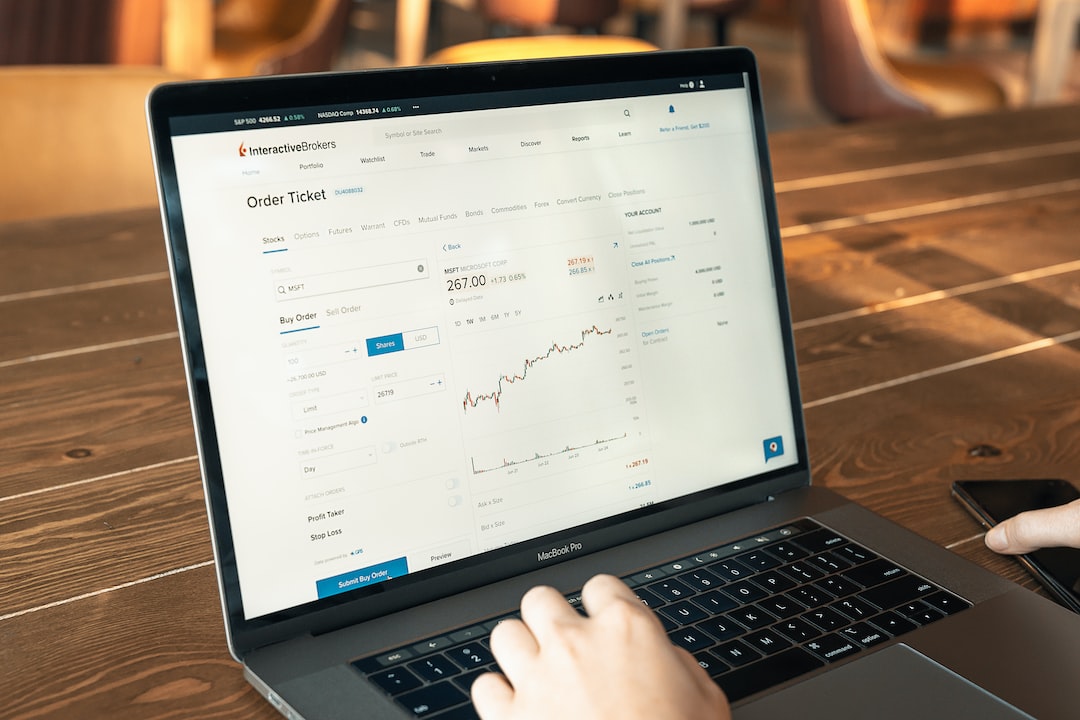

2. Accessibility: Forex trading is accessible to individuals with different levels of capital. Unlike other financial markets, which may have high barriers to entry, forex trading allows traders to start with small amounts of capital. Additionally, with advancements in technology, online forex trading platforms have made it easier than ever to participate in the market.

3. Flexibility: The forex market offers a wide range of trading opportunities. Traders can choose from a vast selection of currency pairs, allowing them to diversify their portfolios and take advantage of various market conditions. Moreover, with the availability of leveraged trading, traders can amplify their potential profits.

4. Volatility: The forex market is known for its volatility, which presents lucrative trading opportunities. Price movements can be triggered by economic data releases, geopolitical events, or even central bank decisions. Traders who can accurately predict and respond to these events have the potential to earn significant profits.

5. Education and Resources: Forex trading is not a gamble, but rather a skill that can be learned and mastered. There are numerous educational resources available online, including tutorials, webinars, and demo accounts. These resources provide traders with the knowledge and tools necessary to develop effective trading strategies.

In conclusion, forex trading is a dynamic and potentially lucrative investment opportunity. With its high liquidity, accessibility, flexibility, and volatility, it offers traders the chance to profit from currency exchange rate fluctuations. However, it is important to note that forex trading carries risks, and traders should educate themselves and practice sound risk management strategies before diving into the market.