The foreign exchange market, or Forex, is the largest and most actively traded financial market in the world. With a daily trading volume of over $5 trillion, it offers immense opportunities for investors to profit from fluctuating currency prices. However, Forex trading also poses significant risks, particularly for those who are new to the market. One of the biggest risks is falling prey to Forex brokers who are scams. In this article, we will discuss how to identify Forex brokers who are not scams.

What is a Forex broker?

A Forex broker is an intermediary that facilitates transactions between buyers and sellers of foreign currencies. They provide traders with access to the interbank market, where currencies are bought and sold in large volumes. Forex brokers earn their profits through spreads, which are the differences between the bid and ask prices of currencies.

How to identify Forex brokers who are not scams?

1. Regulation

The first and foremost thing to check when evaluating a Forex broker is their regulatory status. A legitimate Forex broker will be regulated by a reputable financial authority such as the Financial Conduct Authority (FCA) in the UK, the National Futures Association (NFA) in the US, or the Australian Securities and Investments Commission (ASIC) in Australia. These regulatory bodies ensure that Forex brokers adhere to strict standards of transparency, fairness, and client protection.

2. Reputation

The reputation of a Forex broker is another crucial factor to consider. A reputable broker will have a track record of providing quality services and treating their clients fairly. You can check the broker’s reputation by reading online reviews, checking their social media presence, or asking for recommendations from other traders.

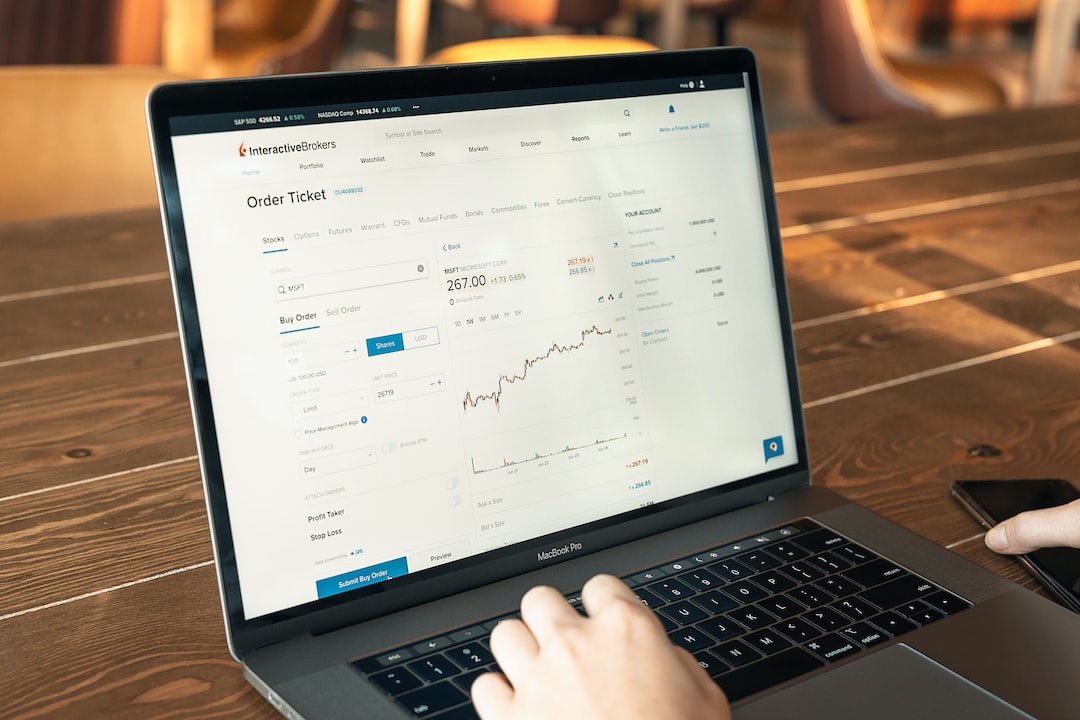

3. Trading platform

A reliable Forex broker will offer a user-friendly and stable trading platform that allows traders to execute trades quickly and efficiently. The platform should also provide access to a wide range of trading tools and indicators to help traders make informed decisions.

4. Customer support

A good Forex broker will offer responsive and helpful customer support to assist traders with any issues or questions they may have. The broker should provide multiple channels of communication, such as phone, email, and live chat, and should be available 24/7.

5. Account types and minimum deposits

A legitimate Forex broker will offer a range of account types to suit the needs of different traders, from beginners to advanced traders. The broker should also have reasonable minimum deposit requirements that are within the reach of most traders.

6. Fees and spreads

A reputable Forex broker will have transparent and competitive fees and spreads. They should disclose all their fees upfront and not have any hidden charges that could catch traders off guard.

7. Education and training

A reliable Forex broker will offer educational resources and training to help traders improve their skills and knowledge. The broker should provide access to webinars, tutorials, and other educational materials to help traders make informed decisions.

Conclusion

Forex trading can be a lucrative and exciting venture, but it also poses significant risks. One of the biggest risks is falling prey to Forex brokers who are scams. By following the above guidelines, you can identify Forex brokers who are not scams and choose a reliable and trustworthy broker to trade with. Remember, always do your due diligence before entrusting your money with any Forex broker.