Dealer-forex or forex dealer refers to a financial institution or an individual who facilitates the buying and selling of currencies in the forex market. They act as intermediaries between individual traders and the larger forex market. Forex dealers are responsible for executing trades, managing risks, and providing liquidity to the market.

The forex market is the largest financial market in the world, with an estimated daily turnover of over $5 trillion. This market operates 24 hours a day, five days a week, and is open to traders from all over the world. The forex market is a decentralized market, which means that there is no central exchange or clearinghouse. Instead, the market is made up of a network of banks, financial institutions, and individual traders.

Forex dealers play a crucial role in the forex market by providing liquidity to the market. Liquidity refers to the ease with which a trader can buy or sell a currency pair without affecting its price. Forex dealers achieve this by maintaining a large inventory of currencies and by continuously quoting bid and ask prices to their clients. The bid price is the price at which a dealer is willing to buy a currency pair, while the ask price is the price at which the dealer is willing to sell the same currency pair.

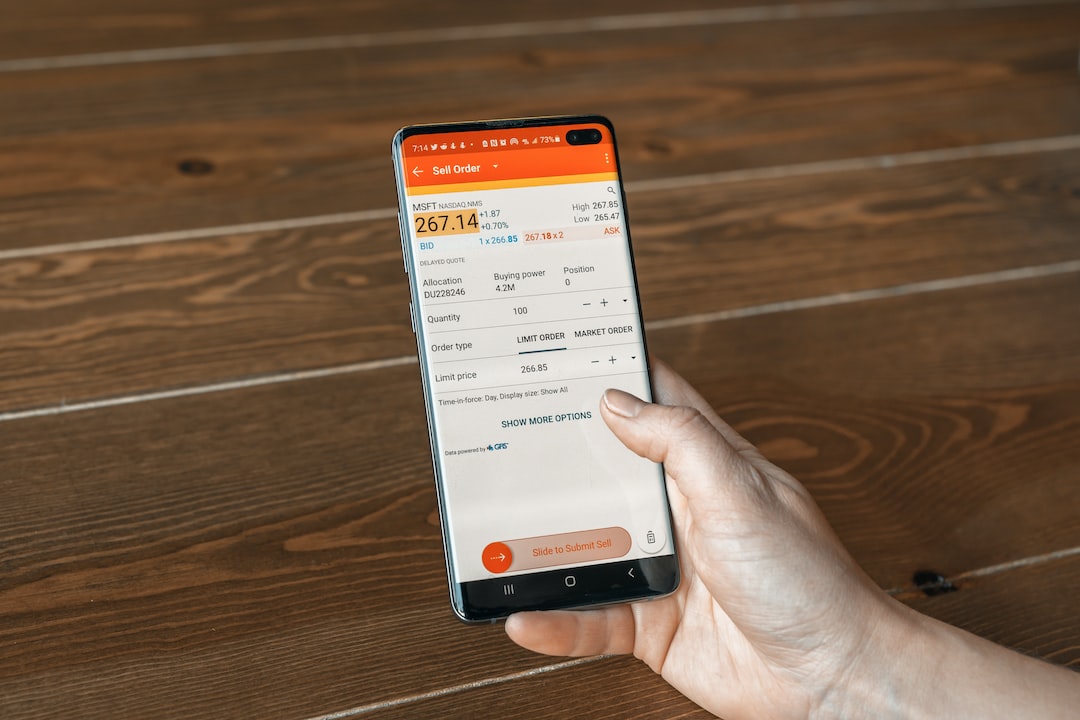

When a trader wants to buy or sell a currency pair, they can do so through a forex dealer. The dealer will quote them a bid and ask price, and the trader can choose to execute the trade at either price. The difference between the bid and ask price is known as the spread, and it represents the profit that the dealer makes on the transaction.

Forex dealers also play a crucial role in managing risk in the forex market. They use a variety of risk management tools, such as stop-loss orders and hedging strategies, to protect themselves from market volatility. For example, a forex dealer may use a stop-loss order to automatically close out a position if the price of a currency pair moves against them by a certain amount. This helps to limit their losses and protect their capital.

Forex dealers also have access to a wide range of market data and analysis tools, which they use to make informed trading decisions. They monitor economic indicators, such as inflation rates and GDP growth, as well as political events and market sentiment to identify trends and opportunities in the market.

In addition to providing liquidity and managing risk, forex dealers also offer a range of services to their clients. They may provide educational resources, such as trading guides and webinars, to help traders improve their skills and knowledge. They may also offer trading platforms and tools, such as charting software and trading signals, to help traders make more informed trading decisions.

Overall, forex dealers play a crucial role in the forex market by providing liquidity, managing risk, and offering a range of services to traders. They are essential intermediaries between individual traders and the larger forex market, and their expertise and experience help to ensure the smooth functioning of the market.