Copy Forex Trades: A Beginner’s Guide to Automated Trading

The world of forex trading can be overwhelming for beginners. With complex charts, technical analysis, and constant monitoring of the market, it’s easy to feel lost and uncertain. However, with the advent of automated trading, beginners have a powerful tool at their disposal to simplify the trading process and potentially increase their chances of success. In this article, we will explore the concept of copy forex trades, also known as mirror trading or social trading, and provide a comprehensive guide for beginners on how to get started.

What is Copy Forex Trades?

Copy forex trades refers to the practice of automatically replicating the trades of successful traders in real-time. This is made possible through innovative platforms that connect traders from all around the world. By copying the trades of experienced traders, beginners can benefit from their expertise, knowledge, and proven strategies, without having to spend years learning the intricacies of the forex market.

How Does it Work?

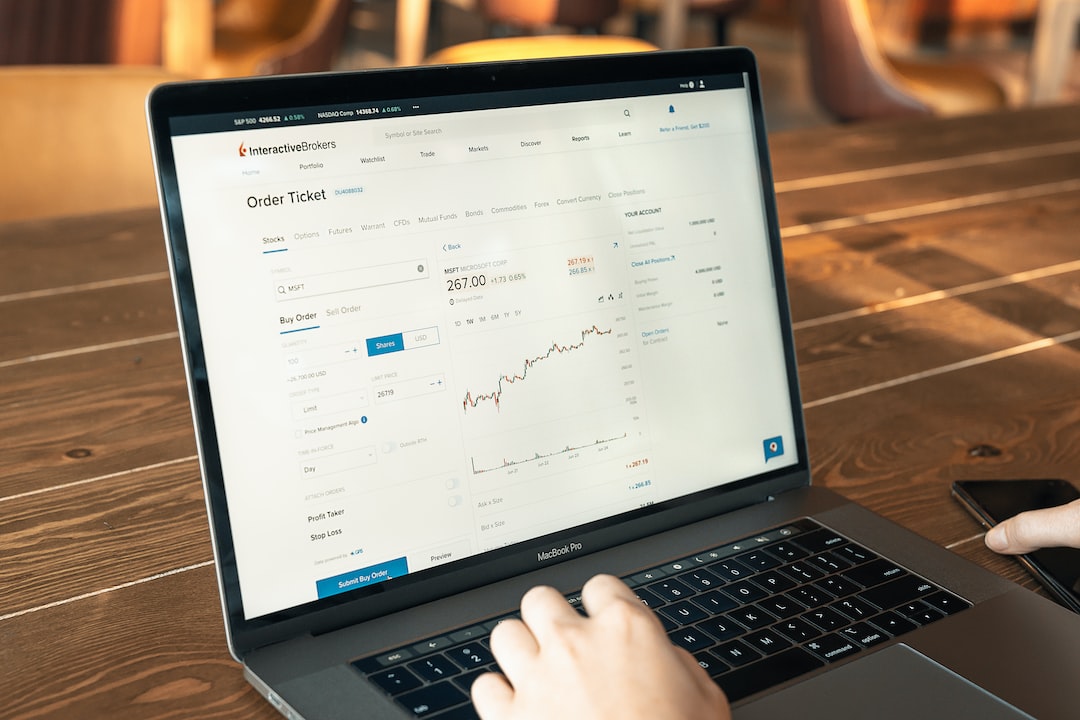

To get started with copy forex trades, beginners need to choose a reputable copy trading platform. These platforms provide a wide range of data and tools that allow users to find and select the most suitable traders to copy. Once a trader is selected, the platform will automatically replicate their trades in the user’s account.

It’s important to note that copy forex trades are executed in real-time, ensuring that the copied trades reflect the exact same entry and exit points as the original trader. This means that beginners can enjoy the potential profits or losses that the copied trades generate.

Benefits of Copy Forex Trades for Beginners

1. Learning Opportunity: Copying trades allows beginners to learn from experienced traders. By closely observing their strategies, risk management techniques, and decision-making process, beginners can gain valuable insights into the forex market and improve their own trading skills.

2. Time-Saving: Copying trades eliminates the need for extensive market analysis and constant monitoring. Beginners can save a significant amount of time by relying on the expertise of successful traders.

3. Diversification: Copy trading platforms provide access to a wide range of traders with different trading styles and strategies. This allows beginners to diversify their portfolios and reduce the risk of relying on a single trader.

4. Emotional Control: Emotions can often cloud judgment and lead to poor decision-making in forex trading. By automating the trading process, beginners can remove the emotional element and stick to a predetermined strategy, leading to more disciplined and rational trading.

Choosing the Right Trader to Copy

Selecting the right trader to copy is crucial for the success of copy forex trades. Here are some factors to consider when choosing a trader:

1. Performance History: Evaluate the trader’s performance over a significant period of time. Look for consistent profitability and low drawdowns.

2. Risk Management: Pay attention to the trader’s risk management strategy. A trader who employs proper risk management techniques is more likely to protect their capital and generate consistent returns.

3. Trading Style: Consider the trader’s trading style and strategy. Make sure it aligns with your risk tolerance and investment goals.

4. Transparency: Look for traders who provide detailed information about their trading history, strategy, and risk management techniques. Transparency is a sign of credibility and reliability.

5. Social Interaction: Some copy trading platforms allow users to interact with the traders they are copying. Engaging in discussions and asking questions can provide additional insights into the trader’s approach and mindset.

Risks and Considerations

While copy forex trades offer numerous benefits, it’s important for beginners to be aware of the potential risks involved:

1. Lack of Control: Copying trades means relinquishing control over trading decisions. Beginners should carefully consider whether they are comfortable with this aspect of copy trading.

2. Market Volatility: The forex market is known for its volatility, and even experienced traders can incur losses. Beginners should be prepared for potential losses and ensure they have a proper risk management strategy in place.

3. Past Performance: While past performance can be a good indicator, it doesn’t guarantee future success. Beginners should not solely rely on historical performance when selecting traders to copy.

4. Platform Reliability: Choosing a reputable copy trading platform is crucial. Beginners should thoroughly research and read user reviews to ensure the platform is secure, reliable, and offers a wide range of traders to choose from.

Conclusion

Copy forex trades provide beginners with an opportunity to enter the forex market with confidence and potentially increase their chances of success. By carefully selecting experienced traders to copy and utilizing the benefits of automation, beginners can learn from the best and build a strong foundation for their own trading journey. However, it’s important to remember that copy trading is not a guaranteed path to profits. It requires continuous learning, proper risk management, and a realistic understanding of the forex market.