The Role of Expert Forex Brokers: Choosing the Right Partner for Your Trading Journey

Making the decision to enter the world of forex trading is an exciting one, but it can also be overwhelming. With so many different currency pairs, trading strategies, and market movements to keep track of, it’s important to have a reliable partner by your side. That’s where expert forex brokers come in. In this article, we will explore the role of these professionals and discuss how to choose the right broker for your trading journey.

First and foremost, it’s important to understand what a forex broker is. A forex broker is a financial institution or individual that provides traders with access to the foreign exchange market. They act as intermediaries between you, the trader, and the market itself. Without a broker, it would be nearly impossible for individual traders to participate in the forex market.

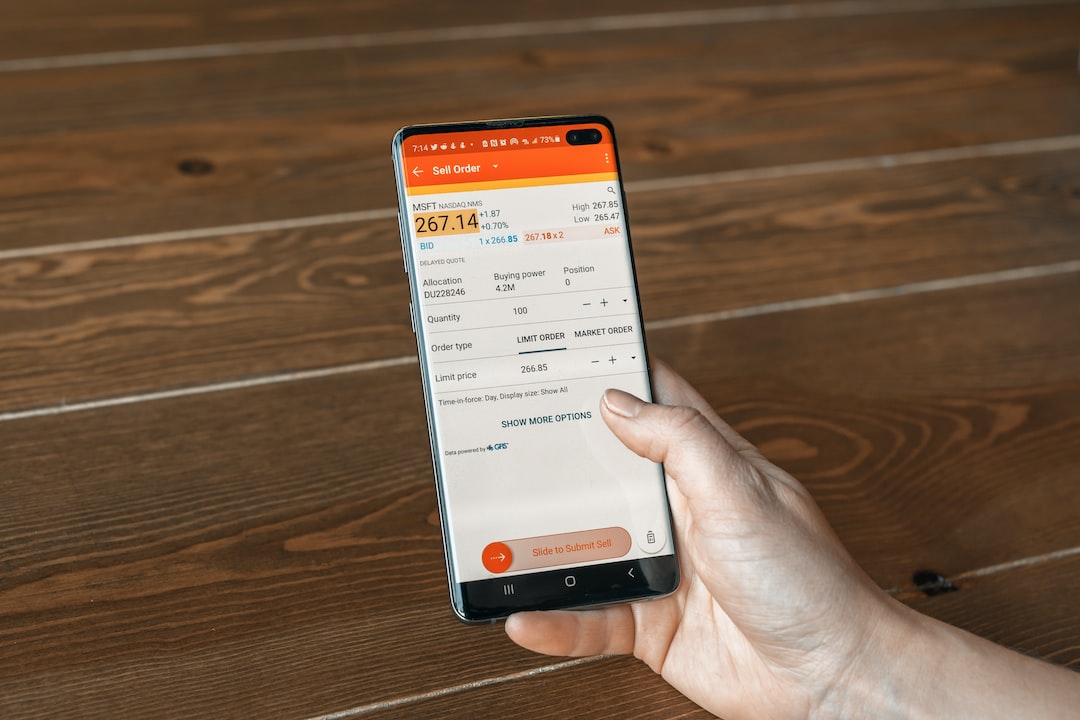

One of the key roles of an expert forex broker is to provide you with a trading platform. This is the software that you will use to execute trades, monitor the market, and access various financial instruments. A good trading platform should be user-friendly, reliable, and offer a range of analytical tools to help you make informed trading decisions. Your broker should also provide real-time market data and news updates to keep you informed about the latest market trends.

Another important role of an expert forex broker is to offer you a variety of trading accounts to choose from. Different traders have different needs and risk tolerance levels, so it’s essential to have options that align with your specific requirements. For example, a beginner trader may prefer a demo account to practice their trading skills without risking real money, while a more experienced trader may opt for a standard or premium account with additional features.

In addition to providing trading platforms and account options, expert forex brokers also offer educational resources and support. Forex trading is a complex and ever-changing field, and it’s crucial to constantly update and expand your knowledge to stay ahead. A good broker will provide you with access to educational materials such as webinars, video tutorials, and ebooks. They should also have a dedicated support team that can assist you with any technical or trading-related questions or issues that you may encounter.

When it comes to choosing the right forex broker for your trading journey, there are several factors to consider. Firstly, you should ensure that the broker is regulated by a reputable financial authority. This will give you peace of mind knowing that your funds are protected and that the broker operates in accordance with strict regulations.

Secondly, consider the trading conditions offered by the broker. This includes factors such as spreads, commissions, leverage, and minimum deposit requirements. Low spreads and commissions can significantly impact your trading profitability, while leverage allows you to amplify your trading position. However, it’s important to use leverage responsibly, as it can also increase your risk exposure.

Furthermore, it’s essential to assess the broker’s reputation and track record. Look for reviews and feedback from other traders to get an idea of their experiences with the broker. Additionally, consider the broker’s customer service and availability. Forex markets operate 24/5, so it’s crucial to have access to support whenever you need it.

In conclusion, expert forex brokers play a vital role in the success of your trading journey. They provide you with access to the forex market, offer reliable trading platforms, educational resources, and support. When choosing a broker, consider factors such as regulation, trading conditions, reputation, and customer service. By selecting the right partner, you can enhance your trading experience and increase your chances of achieving your financial goals in the forex market.