Forex Weekend: How to Use the Time to Plan and Prepare for the Week Ahead

The forex market is a 24-hour global marketplace that never sleeps. However, trading activity tends to slow down during weekends as most financial institutions and retail traders take a break from the hustle and bustle of the markets. While the market may appear calm during this time, it is crucial for forex traders to utilize the weekend effectively to plan and prepare for the week ahead. In this article, we will explore some essential strategies to make the most out of your forex weekend.

1. Review the Previous Week

Before diving into the new week, it is essential to review the previous week’s trading activities. Take some time to analyze your trades, assess your performance, and identify any patterns or mistakes. Look for successful trades and determine what contributed to their success. Similarly, identify losing trades and examine the reasons behind those losses. This reflection will help you learn from your mistakes and refine your trading strategy.

2. Stay Updated with Market News

The forex market is influenced by various economic, political, and social factors. Staying updated with the latest news during the weekend can provide valuable insights into potential market movements. Use this time to read financial news, reports, and analysis from reputable sources. Keep an eye on economic indicators, geopolitical events, and central bank announcements that could impact currency exchange rates. By staying informed, you can anticipate potential market trends and adjust your trading plan accordingly.

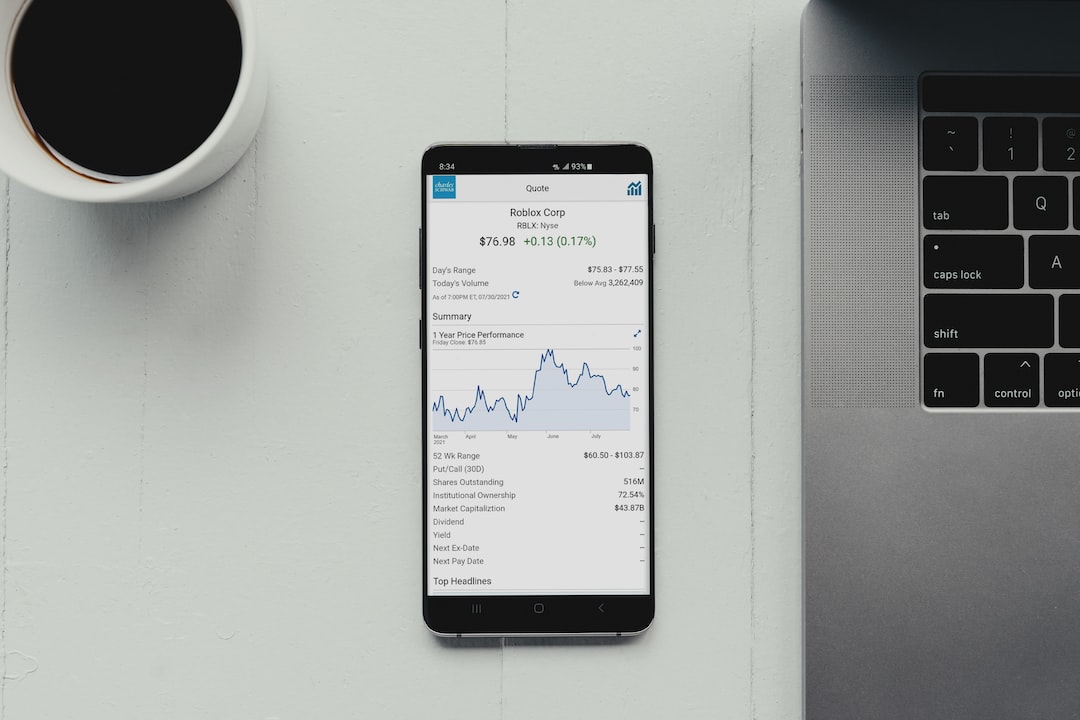

3. Analyze Charts and Develop a Trading Plan

The weekend is an ideal time to analyze charts, identify key support and resistance levels, and develop a trading plan for the upcoming week. Use technical analysis tools to analyze price patterns, trends, and indicators. Identify potential entry and exit points based on your analysis. Determine your risk tolerance and define your position sizing strategy. A well-structured trading plan will help you stay disciplined and focused during the hectic trading week.

4. Explore New Trading Strategies

The forex weekend is an opportune time to explore new trading strategies. Research and learn about different trading techniques, indicators, and methodologies. Consider backtesting these strategies on historical data to determine their effectiveness. However, remember that no strategy guarantees success in the forex market. It is crucial to thoroughly understand any new strategy and test it thoroughly before implementing it in live trading.

5. Manage Your Trading Journal

A trading journal is an invaluable tool for every forex trader. It allows you to record your trades, emotions, and thoughts during the trading process. Use the weekend to update your trading journal, review past entries, and identify any recurring patterns or mistakes. Analyzing your trading journal can help you identify strengths and weaknesses in your trading approach. It enables you to fine-tune your strategy, manage risk better, and enhance your overall trading performance.

6. Take Time for Self-Development

While it is crucial to focus on technical analysis and market research, it is equally important to take time for self-development during the weekend. Engage in activities that help you relax, rejuvenate, and maintain a positive mindset. Read books on trading psychology, mindset, or personal development. Practice meditation or engage in physical activities to reduce stress. A focused and disciplined mind is essential for successful forex trading.

7. Plan for Contingencies

The forex market is unpredictable, and unexpected events can occur at any time. Utilize the weekend to plan for contingencies and develop risk management strategies. Identify potential market risks and prepare contingency plans to mitigate them. Determine stop-loss levels and consider implementing trailing stops to protect your profits. By planning for contingencies, you can reduce the impact of unexpected market movements on your trading performance.

In conclusion, the forex weekend is a valuable period for traders to plan and prepare for the week ahead. By reviewing past trades, staying updated with market news, analyzing charts, exploring new strategies, managing your trading journal, and taking time for self-development, you can enhance your trading performance and stay ahead in the forex market. Utilize this time effectively, and you will be well-prepared to tackle the challenges and opportunities that the new trading week brings.