Zero Hedge is a popular financial blog that was founded in 2009 by Dan Ivandjiiski and Colin Lokey. The blog has gained a significant following due to its alternative perspective on financial news and its criticism of mainstream media coverage. Zero Hedge has also gained notoriety for its anonymous contributors and its willingness to publish controversial content.

The blog covers a wide range of financial topics including stocks, bonds, commodities, currencies, and cryptocurrencies. Zero Hedge is particularly known for its coverage of macroeconomic trends and its analysis of central bank policies. The blog’s contributors often provide a contrarian viewpoint to mainstream financial news, which has helped to attract a loyal following of traders and investors.

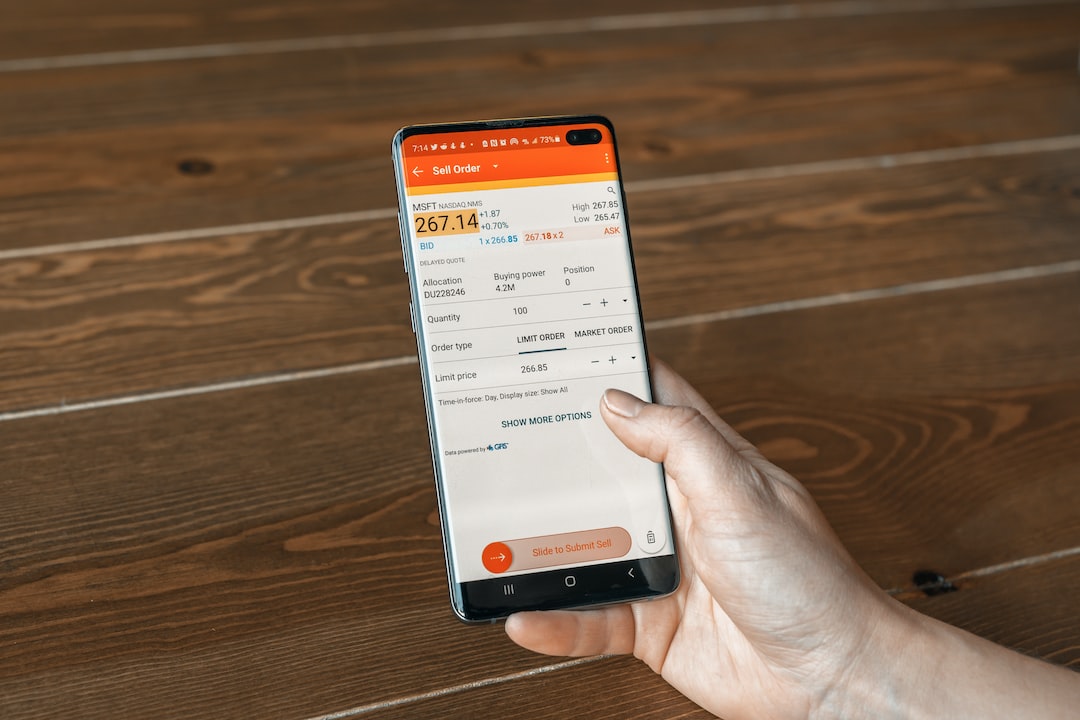

In addition to its coverage of financial news, Zero Hedge also provides trading insights and commentary. The blog has developed a reputation for being a valuable resource for traders who are looking for a unique perspective on the markets. Zero Hedge’s contributors often provide in-depth analysis of market trends and offer trading strategies that are based on their analysis.

While Zero Hedge can be a valuable resource for traders, it is important to note that the blog’s content can be controversial and sometimes includes conspiracy theories. Traders should approach the content on Zero Hedge with a critical eye and should always do their own research before making any trading decisions.

When it comes to choosing a forex trading platform, there are many options available. The best platform for you will depend on your individual trading needs and preferences. Here are some factors to consider when choosing a forex trading platform:

1. Regulation: It is important to choose a trading platform that is regulated by a reputable financial authority. Regulated platforms are required to follow strict rules and guidelines, which helps to protect traders from fraud and unethical practices.

2. Trading tools: Look for a platform that offers a variety of trading tools such as charting software, technical indicators, and risk management tools. These tools can help you to make informed trading decisions and manage your risk effectively.

3. User interface: A trading platform should be easy to use and navigate. Look for a platform that has a user-friendly interface and offers customizable settings.

4. Customer support: Choose a platform that offers reliable customer support. Look for a platform that has a dedicated support team that is available 24/7 to assist you with any issues or questions.

5. Fees and commissions: Consider the fees and commissions associated with the platform. Look for a platform that offers competitive fees and transparent pricing.

Some popular forex trading platforms include MetaTrader 4, cTrader, and TradingView. Each of these platforms offers unique features and benefits, so it is important to research and compare them before making a decision.

In conclusion, Zero Hedge can be a valuable resource for traders who are looking for a unique perspective on financial news and trading insights. However, traders should approach the blog’s content with a critical eye and do their own research before making any trading decisions. When choosing a forex trading platform, consider factors such as regulation, trading tools, user interface, customer support, and fees and commissions.