Today in the early Asian trading session, the USD/CAD currency pair successfully extended its previous day recovery streak and remained bullish around above the mid-1.3000 level. However, the bullish sentiment around the currency pair could be attributed to the modest downticks in the crude oil prices, which ultimately undermined the demand for the commodity-linked currency the loonie, and contributed to the currency pair gains. On the contrary, the broad-based U.S. dollar weakness, triggered by the multiple factors, has become one of the major factors that kept the lid on any further gains in the currency pair. Currently, the USD/CAD currency pair is currently trading at 1.3067 and consolidating in the range between 1.3054 – 1.3073.

Despite the renewed optimism about a potential treatment/vaccine for the highly infectious virus, the market trading sentiment has ben flashing mixed signals as the coronavirus woes overshadowed vaccine hopes. However, the increasing market worries over the potential economic fallout from the constant rise in new COVID-19 cases keep weighing on the market trading sentiment. As per the latest report, the country keeps reporting record cases daily, more than 100K per day. Essentially all American states are getting a worse status report of the COVID-19, strengthened by record hospitalizations and daily cases rising past-100,000 in the last few days. As in result, New York has declared a 10 p.m. curfew on bars, gyms, and restaurants to curb the spread. It is also worth mentioning that the COVID-19 hospitalizations in the U.S. exceeded 60,000.

On the bullish side of the story, the prevalent optimism over the potential vaccine for the highly infectious coronavirus disease helps the market trading sentiment limit its deeper losses. The leading vaccine producers like Pfizer and Moderna still show progress over the vaccine for the deadly virus. This was witnessed after the U.S. infectious disease expert Dr. Anthony Fauci said that Moderna could begin analyzing vaccine data within days. However, the market trading mood mostly ignored the U.S. official’s another push to keep vaccine optimism high amid surging virus cases and hospitalizations in the U.S.

Despite the risk-off market sentiment, the broad-based U.S. dollar failed to extend its overnight gains. It edged lower on the day, mainly due to the heavy optimism over the potential vaccine for the highly infectious coronavirus disease. Apart from this, coronavirus’s resurgence keeps fueling the fears that the U.S. economic recovery could be halt, which also keeps the greenback under pressure. However, the U.S. dollar losses could be considered the major factor that pushes the currency pair down. Meanwhile, the U.S. Dollar Index that tracks the greenback against a bucket of other currencies dropped to 92.922.

At the crude oil front, the WTI crude oil prices failed to extend its overnight winning streak and remained under some selling pressure on the day. However, the fresh declines in crude oil could be attributed to reports suggesting the next wave of lockdowns throughout the world, which is threatening the crude oil demand once again. Apart from this, the reason for the modest losses in crude oil prices could also be associated with the latest reports suggesting that OPEC’s oil output in October rose by 320,000 BPD in the wake of recovery in Libya’s production. Thus, the pullback in oil prices undermined demand for the commodity-linked currency – the loonie and remained supportive of the USD/CAD pair’s ongoing recovery momentum.

Moving ahead, the market traders will keep their eyes on the U.S. economic calendar, which highlights the latest data concerning U.S. inflation and jobless claims. In the meantime, the Brexit trade talks’ updates could not lose their importance on the day.

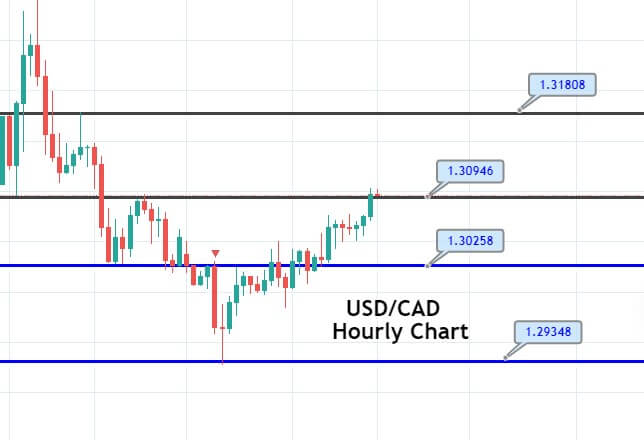

Daily Support and Resistance

S1 1.2951

S2 1.3003

S3 1.3032

Pivot Point 1.3055

R1 1.3084

R2 1.3107

R3 1.3158

The USD/CAD is trading with bullish sentiment at 1.3094, facing immediate resistance at 1.3100. Crossing above this level may drive further upward movement until 1.3177 level. On the downside, the USD/CAD may find support at 1.3025, and below this, the next support level stays at 1.2975 level. The MACD is in support of buying; thus, we may look for a buying trade over the 1.3105 level today. Good luck!