In this week’s BTC/USD analysis, we will be taking an in-depth look at the most recent technical formations, as well as look for the possible price outcomes in the following days.

Overview

The crypto sector was nothing short of explosive as Bitcoin pushed past its old all-time highs and reached almost as high as $24,000. The largest cryptocurrency by market cap went into skyrocket mode without facing much resistance until it hit a wall near $23,800. As it failed to break this level twice, it started a consolidation phase.

While Bitcoin’s sentiment is extremely bullish, many analysts call for a pullback and say that the most recent push to the upside is still much overextended. However, Bitcoin is consolidating sideways rather than pulling back. One thing is certain, Bitcoin is preparing for its next move.

Technical factors

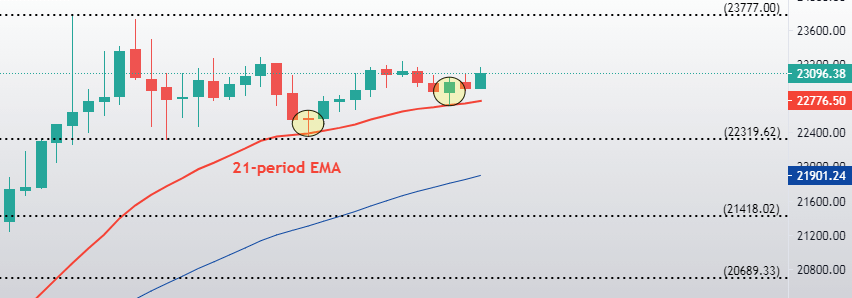

Bitcoin is currently in consolidation mode after it hit a wall twice near the $23,800 price level. The price range is getting narrower and narrower as time passes, indicating a strong breakout move out of the current boundaries inevitable. On top of that, Bitcoin’s volume has been steadily declining after the final attempt above $23,777. When it comes to support, Bitcoin’s downside is protected by the 21-period moving average as well as the $22,320 Fib retracement line.

While a move to the downside should be considered healthy, the current price bouncing off of its support levels might be just good enough for BTC to push towards the upside once again.

Likely Outcomes

We can expect three main outcomes for Bitcoin, with the ones starting with an upswing being just slightly more plausible.

- Bitcoin’s price can easily shoot up past $23,777 and enter price discovery mode yet again. Not much to say about the target levels there, except that the possible resistance zones might be Fib extensions from the current Fib retracement levels.

- Bitcoin’s price is most likely to push towards the upside, hit the all-time high level, and fail to break it, therefore prompting a pullback. In this case, the price will most likely fall below $22,320 and head straight for the $21,420 or even lower (some analysts are calling for a drop below $20,000 and a CME Futures gap fill).

- Bitcoin’s price might head straight down and break the $22,320 level, in which case the market will steadily test every single support level that has worked until now.

In any case, a significant increase in volume will be required, and traders should certainly pay attention to it.