XM is an award-winning broker and is the trading name of Trading Point Holdings Limited which is a company based in Cyprus. XM has won a number of awards such as Best Customer Service awards, Best FX Service Awards and many more. When a broker is consistently winning rewards it may seem like a no brainer, in this review we will dive deeper into what XM really offer, and to see if they are suitable for traders like you and me.

XM offers a website in three different regions, Global, AU, and CY, depending on which site you use there may be a few differences to what we have written, for the purpose of this review, we are using the global site as this will be suitable for more people. Remember to double-check the information when signing up, just in case any details are different from what we state.

Account Types

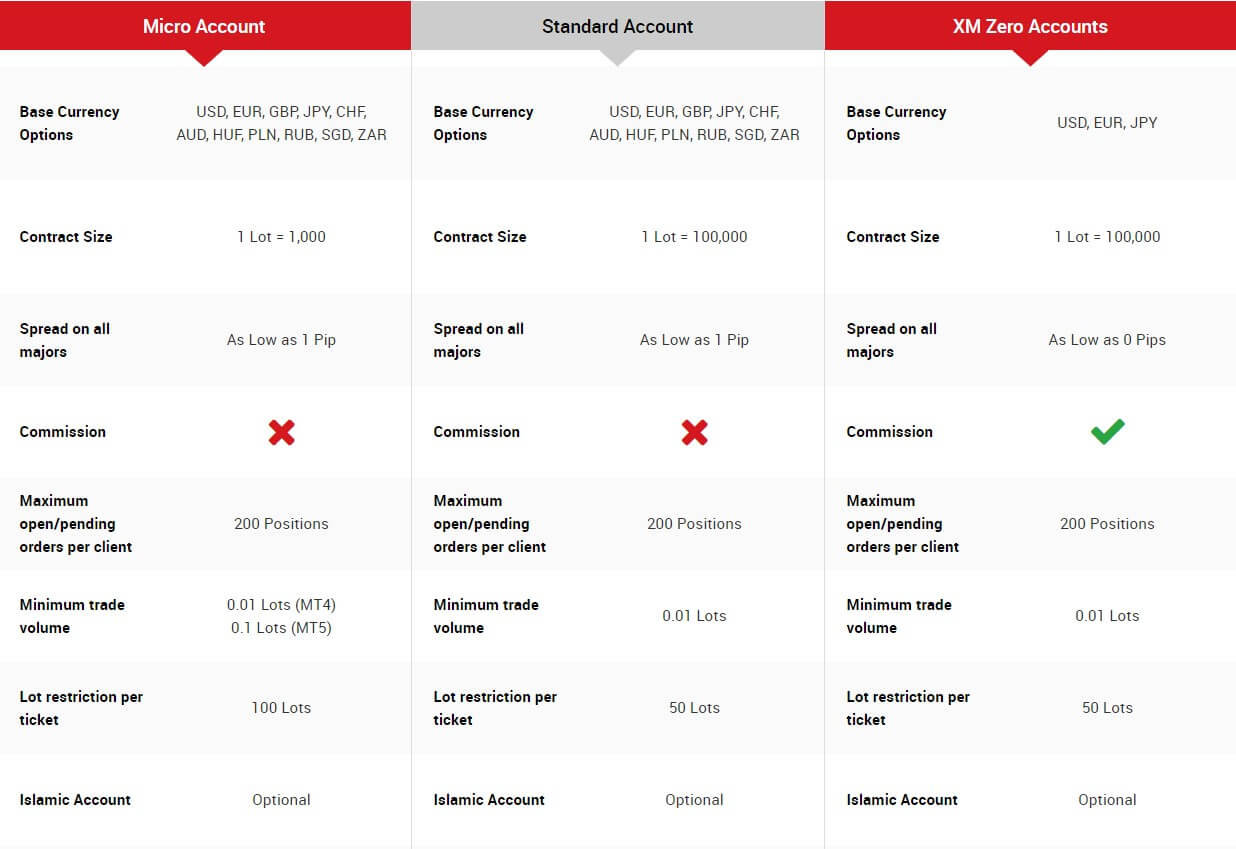

There are five different account types available with XM, three standard accounts, one share-based account and one zero spread account which is classed in its own category. We are going to have a little look at them in more detail.

Micro Account:

The micro account is the entry-level account for XM it works the same way as a cent account does on other brokers as a lot is equal to 1,000 base currency unite It offers a low minimum deposit of $5 and can have a base currency in USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, and ZAR. The leverage on offer is dependant on your account balance and is as follows 1:1 to 1:888 ($5 – $20,000), 1:1 to 1:200 ($20,001 – $100,000), 1:1 to 1:100 ($100,001 +).

The account offers negative account protection and has spreads starting at 1 pip, however, they can often be seen higher, there is no commission charged on this account. There can be a maximum of 200 open positions and there is a minimum trade size of 0.01 if using MetaTrader 4 and 0.1 if using MetaTrader 5. Bonuses are available, hedging is allowed and if you are not able to accept or pay swaps, a swap-free Islamic account is also available.

Standard Account:

The Standard account has many of the same features as the micro account, the main difference is that a lot is equal to 100,000 currency base units instead of the micro accounts 1,000 units. Minimum deposit, base currencies, leverage, spreads, commission, max open positions, negative balance protection, bonuses, hedging and access to Islamic swap-free accounts all remain the same. The only other changes are that the minimum trade size is set at 0.01 lots across the board and there is a maximum trade size of 50 lots. All other details remain the same.

XM Ultra Low Account:

The XM Ultra Low Account takes both the micro and standard accounts and changes a few of the features. It has a minimum deposit of $50 and the base currencies available have been reduced to EUR, USD, GBP, AUD, ZAR and SGD. Contract sizes are based on whether you use a micro or standard account, spreads are lowered to a minimum of 0.6 pips but can often be seen quite a bit higher. All other aspects of the accounts remain the same as the micro or standard counterpart, the only other difference is that trading bonuses are not available with this account (no deposit bonus is available).

Shares Account:

The shares account does what it says on the tin, it is based around shares rather than trading, so if you want a forex trading experience, this is not the account for you. It has a minimum deposit of $10,000 and a minimum trade of 1 share. You can have up to 50 positions open and there is no leverage available on this account.

XM Zero Account:

The XM Zero account gets its own section on the XM website as it is the account that XM is pushing the most. From just the name, you can already guess what it’s aim is, it has a 0 pip spread (although it can sometimes be 0.1 or equivalent). Due to having low to zero spreads, a commission is charged on this account, that commission is $3.5 per lot, this is relatively low and beats a lot of the competition where the industry average seems to be sat at around $6 per lot. There is reduced leverage with the maximum being set at 1:30, it is also available to sue with both MetaTrader 4 and MetaTrader 5. Base currencies are restricted to USD, EUR, and JPY and there is also a VPS service available with this account.

There is plenty to choose from with a number of different features, so whatever you are looking for there should be something to help fill your needs.

Platforms

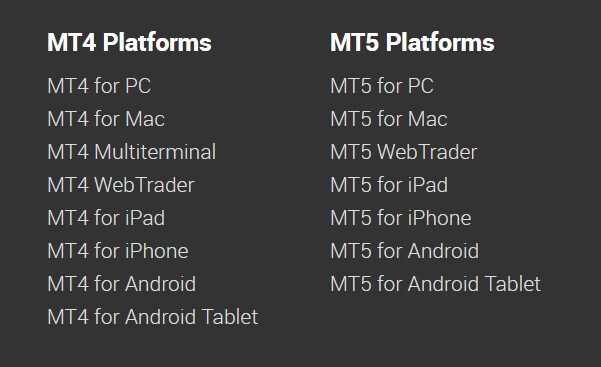

XM claims to have 16 different platforms available to use, but in reality, there are two, within those two there are a number of different ways to access them which XM are touting as separate platforms.

MetaTrader 4 (MT4):

MetaTrader 4 is one of the world’s most used trading platforms, it has been around for a long time and has a well-established user base. It offers high levels of customization and is compatible with hundreds and thousands of indicators and expert advisers. MT4 is available as a desktop download for both Windows PC and Mac, it also has applications for iOS and Android devices. There is a WebTrader that allows you to trade using your internet browser and there is also a multi-terminal that allows you to trade with multiple different accounts at the same time.

MetaTrader 5 (MT5):

MT5 is the younger broker of MT4 and is designed by the same company. It is a more streamlined design and interface, due to it being newer, it does not have as many indicators and expert advisors but the numbers are constantly growing due to its improved functionality over its older sibling. Similarly to it’s older counterpart, it is available as a desktop download for PC and Mac, an app for Android and iOS devices and as a browser-based trading platform, the multi-terminal is not available with MT5.

Both platforms offer functionality such as one-click trading and have access to hundreds of different trading instruments along with various other technical analysis tools and functionalities.

Leverage

Leverage is based on a number of factors and can be broken down into different categories based on account equity and what instruments are being traded, in regards to account equity, below figures are currently valid:

- 1:1 to 1:888 ($5 – $20,000)

- 1:1 to 1:200 ($20,001 – $100,000)

- 1:1 to 1:100 ($100,001 +)

When it comes to the XM Zero account, the following leverages are valid:

- 1:30 Forex Major Pairs

- 1:20 Other Forex Pairs

- 1:20 Major Indices

- 1:10 Minor Indices

- 1:20 CFDs on Gold

- 1:5 CFDs on Shares

- 1:10 CFDs on Commodities

Trade Sizes

Trade sizes are based on the account that you use, if you are using a micro account or the ultra low micro account then you have a minimum lot size of 0.01 with MT4 and 0.1 with MT5. When using any other account then the minimum trade size is 0.01 lots, also known as a micro lot. The share account has a minimum position of 1 share.

The maximum trade size for the micro-based accounts is 100 lots, which the other accounts are all set at 50 lots. While it may seem low, it is an appropriate level for 99% of retail traders who will never reach 50 lot trades.

Trading Costs

All accounts come with a spread based pay structure except for the zero account, the zero account comes with a commission of $3.5 per lot traded, this is relatively low when looking at the industry standard of around $6.

The other accounts have spreads starting in a range of 0.6 pips to 1 pip, however, they can often be seen slightly higher.

All accounts are charged swap fees, either needing to pay or receiving them when holding a trade overnight, these numbers can be found directly within the trading terminals. If you are of Islamic faith, you can get swap-free accounts for most account types.

Assets

When it comes to tradable instruments, XM offers plenty of them so there should always be something available for you to trade. We have broken them down into various categories to get a better understanding of what is on offer.

- Forex: 55+ instruments

- Commodities: 8 instruments

- Indices: 18 indices and 12 future indices

- Stocks: 1,200 stocks

- Metals: Gold and Silver

- Energies: 5 instruments

Spreads

Spreads can be as low as 0 pips if you are using the XM Zero Account. However moving into the more spread based accounts, the Ultra Low accounts have the spreads increase to a minimum of 0.6 pips and the micro and standard accounts rising further to a minimum of 1 pip. While these are the minimum numbers, fluctuations occur in the markets so they may rise higher and certain currency pairings naturally have higher spreads.

Minimum Deposit

The overall minimum deposit for XM is $5, this can be used on the micro and standard accounts, in order to use the ultra low accounts this figure rises to $50, and the XM Zero Account has a minimum deposit of $200.

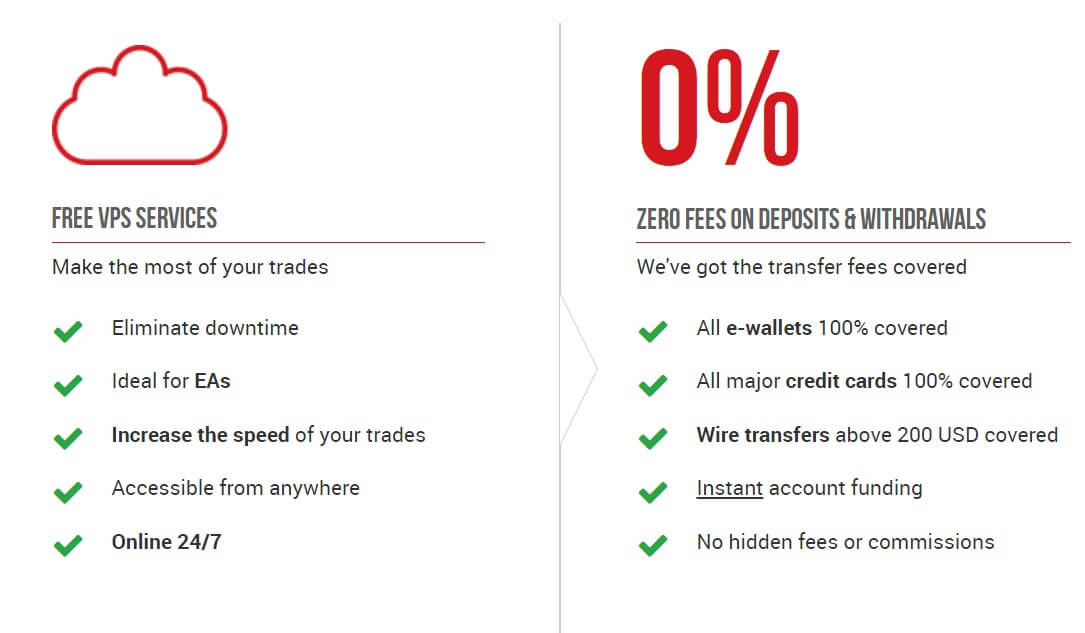

Deposit Methods & Costs

XM offers a number of different deposit methods, the good news is that none of them have a fee in order to deposit. The current methods on offer are bank transfer, Visa / MasterCard, Neteller, Skrill, MuchBetter Wallet, and Trustly. Unfortunately, there is currently no support for PayPal.

Withdrawal Methods & Costs

Withdrawals can be completed using the same methods as depositing. There is no fee charged if the withdrawal is over $200, however, withdrawals under $200 may receive a $15 fee. When using Visa or MasterCard or electronic wallets such as Skrill, you are only able to withdraw the amount you have deposited, any extra must use bank transfer.

It is a shame to see fees being added to lower withdrawal amounts as many brokers are not getting rid of withdrawal fees completely.

Withdrawal Processing & Wait Time

The amount of time it takes to process a withdrawal will depend on the methods you are using, for bank transfers it can take between 3 and 5 business days which is the standard time for bank transfer processing. Car transactions will take between 1 and 5 days depending on your card issuer and electronic wallets are processed within 24 hours.

Bonuses & Promotions

XM offers a number of different bonuses across their sites, so be sure to check out the offers in your own region, on the global site there are two offers available.

Free VPS: Clients who maintain an account balance over $5,000 and trade at least 5 lots per month are able to receive a free VPS. If you fall below this threshold then you are required to pay $28 a month.

0 Fees on Deposits and Withdrawals: Not really an offer, just confirmation that there are no fees for withdrawing and depositing.

There have been deposit bonuses and no deposit bonuses on offer in the past, so be sure to keep checking back to see if any new bonuses or promotions have come up.

Educational & Trading Tools

XM offers three different categories to help you become a better trader:

Research: Research offers a number of different sections to help you become a better trader, they offer market news and events to help you understand what is going on in the world, technical summaries as well as technical analysis to help give you a better idea of certain trading setups. There is an economic calendar and some videos that offer daily analysis to help you trade and understand certain trade setups.

Research: Research offers a number of different sections to help you become a better trader, they offer market news and events to help you understand what is going on in the world, technical summaries as well as technical analysis to help give you a better idea of certain trading setups. There is an economic calendar and some videos that offer daily analysis to help you trade and understand certain trade setups.

Learning: For learning, there are a number of different courses aiming to help teach you both the basics and slightly more advanced ideas within the forex industry and trading. There are video courses as well as seminars and webinars to get involved in and ask questions. There are also tutorials on how to use the trading platforms on offer from XM.

Tools: There are a couple of tools on offer, there are some trading calculators to help you work out profits, trades and other aspects of trading, there are also some indicators to download to help you improve your own analysis.

The education section is quite robust and helpful, as are some of the analysis tools. The daily videos, in particular, can be very helpful.

Customer Service

XM go all out when it comes to accessibility to their customer service team, they have members of the team speaking in over 25 different languages, so whatever language you speak, there should be someone available to help you.

They have physical addresses and phone numbers for three different offices based in Cyprus, Australia and Greece, there are also phone numbers and email addresses for different departments including the support desk, affiliate department, marketing resources, back-office, client relations, and the PR inquiries.

We tested the support desk via telephone, they were helpful and responsive, our call was picked up within a couple of minutes and all questions answered clearly and concisely, which is a big bonus.

Demo Account

Any major broker would be expected to offer demo accounts and XM doesn’t falter here, they offer each client up to 5 demo accounts, each starting with up to $100,000. These accounts last forever as long as they are being used, after a long period of inactivity they may be closed but new ones can be opened. Simply fill in the online form to open up your demo account.

Countries Accepted

There are some countries excluded from using the XM sites, some of them include the USA, Canada, Israel, and Iran. There are more exclusions but they are not listed on the site, be sure to get in contact with the XM customer service team in case you are unsure if you are in an accepted country. One way to check is to go to sign up to a new account and see if your country is in the drop-down list if it is not then your country is currently excluded from using XM.

Conclusion

XM is a well-established company, receiving many different awards for various aspects of its running operations. Offering a wide range of accounts and instruments you should easily be able to find a trading environment and instruments to suit your needs. Customer service was quick and helpful and very accessible. There are no fees for withdrawals over $200, however, the only downside to this was the $15 fee for withdrawals under $200. There isn’t too much else to say, other than XM seems like a very competent broker and one that we do recommend at this time.

If you like this XM broker review, be sure to check out some of the other reviews to help find the broker that is right for you.

One reply on “XM Review”

Hi how can I withdraw my money direct into my account without using webmoney or neteller?