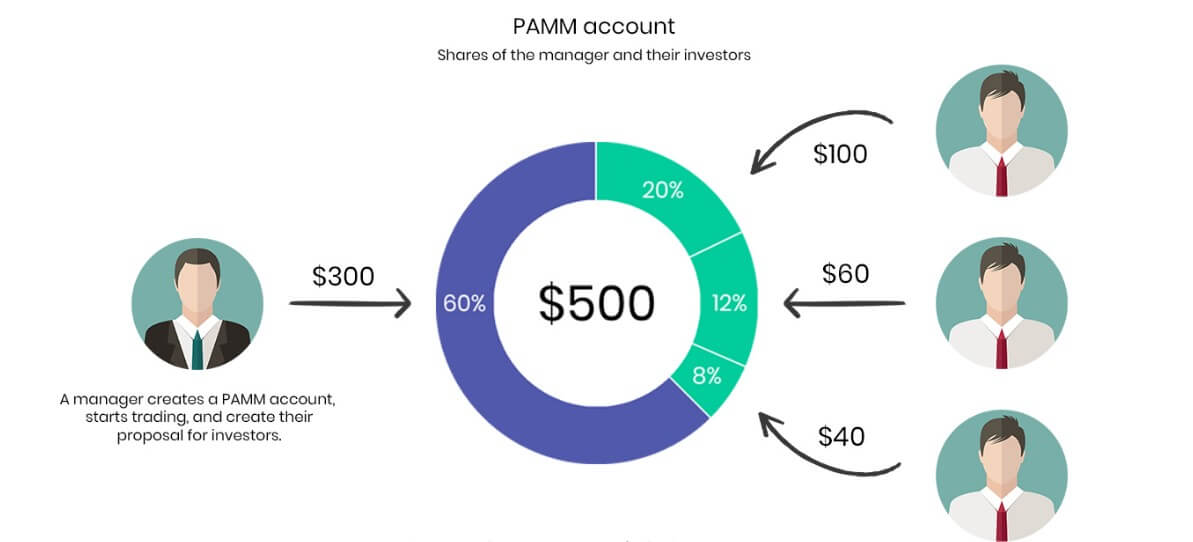

You will see that some Forex/CFD brokers, usually the largest, offer a “PAMM Account”. What is this type of account? In short, “PAMM” (in English “percentage allocation management module” or “percentage allocation money management”) means “management module of percentage allocation” or “management of money in percentage allocation”. In other words, a PAMM account is primarily an account managed where a merchant operates on behalf of others through his account.

PAMM accounts work with the Forex/CFD broker using a software application that allows broker clients the ability to assign part or all of their accounts to management by a particular operator. The managing merchant then trades his own money, but it is supplemented by the money of other customers, who each receive a percentage of the profits or losses made by the merchant in their own accounts.

Example of a PAMM Account

Imagine that you are a retailer with your own account and other traders with the same broker ask you to manage their accounts. Let’s say you have 10,000 USD and Trader B gives you 50,000 USD to manage and Trader C gives you 40,000 USD to manage. It is now trading a total of $100,000 with a 10% allocation percentage. The allocation of operator B will be 50% and operator C 40% in line with the capital contributed to the global fund. You place a purchase order to buy 1 lot in EUR /USD. Your agent will assign the order between the parties for this trade as follows: 0.1 lots for you, 0.4 lots for Trader B, and 0.5 lots for Trader C.

Advantages of the PAMM account

A PAMM account allows a merchant to manage other people’s money easily, simply by operating normally through their existing platform. The PAMM software performs all the required calculations. Indeed, there is no limit to the number of “clients” for which the holder of a PAMM account can manage money. The account administrator can benefit from his own trades and get a percentage of the proceeds of the money he or she also manages. When the trade goes well and is profitable, it is a win-win all year round.

A special advantage that has a PAMM account for the investor is that the investor knows that the trader is risking his own funds, and has “skin in the game”, which would tend to increase confidence that the operator will be working in the style that they actually believe in, the best of their ability.

The PAMM accounts are monitored by the Broker, and the investors are reassured to know that they are aware that the money manager cannot access the actual funds contributed or make any withdrawals. On the contrary, there is a situation in which the investor must issue a check and deliver it to a money manager, and you will immediately see a huge advantage of a PAMM account.

Disadvantages of a PAMM Account

The biggest disadvantage of a PAMM account is that all parties involved must be customers of the same Forex Broker/CFD. Most of the larger brokers offer PAMM accounts, but there are other solutions available in the market that achieve the same result but can bridge different brokerages and trading platforms, such as copy exchange software, or other brands that offer PAMM style configurations but have bridges so that they can connect to accounts in most brokers. On the other hand, in reality, there is a small but realistic technical advantage for all parties to work through the same broker and platform, reducing the risk of latency problems or communication errors.

How Does it Work?

Many brokers offering PAMM accounts keep a detailed list of their PAMM money managers so investors can do some research and decide who wants to manage their funds. The lists contain details of the path of each trader’s performance and more information about who they are and what their business philosophy is. The Broker provides a limited-power document (LPOA) that both parties sign, which gives the money manager the right to manage the investor’s money according to the agreed terms and conditions: investors can, of course, end at any time and have the capacity to the negotiation of your funds transferred back to them. Monitoring, review, record keeping, etc. are facilitated through the intermediation offered by the PAMM account.

Can I have a PAMM account or make an investment in one? The answer is “yes”: if you already have a satisfied Forex/CFD broker, just ask them if they offer PAMM accounts. If they don’t, there are many brokers offering PAMM accounts.