Tusarfx is primarily a Forex broker, founded in 2011, but also deals in metals, gold, and silver. The website is available in several languages, including English, Russian, Indonesian, Chinese, Malay, and Thai. We can deduce from the broker’s interest in adding these languages that he wants to target the Asian public.

Tusarfx is an introductory broker (IB) of the offshore financial services provider FXCL. Introductory brokers are only intermediaries between brokers and traders. They only act as marketing agents, who get clients for their partner.

TusarFX is registered in a tax haven and offers four types of account with leverage of up to 1:500, Tusarfx customers can start with an initial investment of only $1, being able to use the popular Metatrader4 platform.

Tusarfx is the trademark of TUSARFX Ltd. This company is registered in Nevis, an island country in the West Indies. The broker does not mention anything on his website about whether or not he has a license. The financial authorities of St. Kitts and Nevis, the Financial Services Regulatory Commission (FSRC), regulate only the banking sector and tend not to pay attention to the island’s registered foreign exchange and CFD brokers.

The situation of FXCL is similar: the broker is currently registered in Saint Vincent and the Grenadines (SVG), where foreign exchange brokers are neither licensed nor controlled by any regulatory agency.

We have also discovered that the Indonesian government blocked more than 100 forex broker websites in 2013, including those of Tusarfx. But, although FXCL is an offshore broker, it has been trading for more than 10 years and has built a reputation for being a trustworthy, well-rated company.

Here is the review of this broker, after having made a thorough investigation about the company and having tested its platform. Make sure you read it before you invest with Tusarfx.

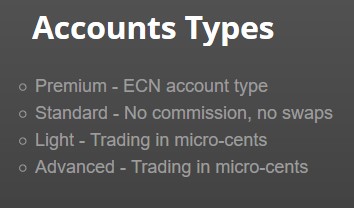

ACCOUNT TYPES

Tusarfx offers us 4 types of commercial accounts; the broker calls them, Premium account, Standard account, Light account, and Advanced account. Here we detail the characteristics of each one of them.

Tusarfx offers us 4 types of commercial accounts; the broker calls them, Premium account, Standard account, Light account, and Advanced account. Here we detail the characteristics of each one of them.

Premium Account

- Minimum Deposit, Starting from 1.00 USD

- Maximum Deposit, 10.000 USD

- Deposit Method, Bank transfer, Credit or Debit card, OKPAY, DengiOnline, Perfect Money, Western Union, and MoneyGram.

- Trading Platform, MetaTrader 4, Android Mobile Trader, iPhone Mobile Trader, Windows Mobile Trader.

- Deposit Currency, USD/ EUR/ RUR

- Margin Call Level, 60%. Stop Out Level 40%

- Maximum Leverage 1:500

- Spread, Dynamic, from 1.1 pip with a 5 digit price feed

- Maximum Position Size 2 standard 100k lot

- Minimum Position Size 0.01

- Maximum Number of Orders Online, 30

- Swap accounts – 0.6 pip per standard lot

- Swap-free accounts – 1.6 pip per standard lot

Standard Account

- Minimum Deposit, Starting from 1.00 USD

- Maximum Deposit, 7.000 USD

- Deposit Method, Bank transfer, Credit or Debit card, OKPAY, DengiOnline, Perfect Money, Western Union, and MoneyGram.

- Trading Platform, MetaTrader 4, Android Mobile Trader, iPhone Mobile Trader, Windows Mobile Trader

- Deposit Currency, USD/ EUR/ RUR

- Margin Call Level, 40%

- Stop Out Level 20%

- Maximum Leverage 1:500

- Spread, FIXED from 2 pips

- Maximum Position Size, 2 standard 100k lot

- Minimum Position Size 0.01

- Maximum Number of Orders Online, 50

- Commission, No Commission

Light Account

- Minimum Deposit, Starting from 1.00 USD

- Maximum Deposit, 7.000 USD

- Deposit Method, Bank transfer, Credit or Debit card, OKPAY, DengiOnline, Perfect Money, Western Union, and MoneyGram

- Trading Platform, MetaTrader 4, Android Mobile Trader, iPhone Mobile Trader, Windows Mobile Trader

- Deposit Currency, USD/ EUR/ RUR

- Margin Call Level, 40%

- Stop Out Level 20%

- Maximum Leverage 1:500

- Spread, FIXED from 2 pips

- Maximum Position Size, 2 standard 100k lot

- Minimum Position Size 0.01

- Maximum Number of Orders Online, 70

- Commission, No Commission

Advanced Account

- Minimum Deposit, Starting from 1.00 USD

- Maximum Deposit, 7.000 USD

- Deposit Method, Bank transfer, Credit or Debit card, OKPAY, DengiOnline, Perfect Money, Western Union, and MoneyGram

- Trading Platform, MetaTrader 4, Android Mobile Trader, iPhone Mobile Trader, Windows Mobile Trader

- Deposit Currency, USD/ EUR/ RUR

- Margin Call Level, 60%

- Stop Out Level 40%

- Maximum Leverage 1:500

- Spread, Dynamic, from 1.1 pip with a 5-digit price feed

- Maximum Position Size, 2 standard 100k lot

- Minimum Position Size 0.01

- Maximum Number of Orders Online, 50

- Commission, No Commission

We can observe that the main differences between the different accounts are found, in the spread, the margin call, the stop out, the maximum deposit, the Maximum Number of Orders Online, and the commissions.

MC / SO levels depend on account type: 40% / 20% for Standard and Light account types and 60% / 40% for Premium and Advanced.

PLATFORMS

Tusarfx offers the MT4 platform. As Tusarfx is an IB from another company, it is normal that offer trading on a Metatrader4 (MT4), powered by FXCL. Most traders use the MT4 platform, and therefore having it available in a broker’s offer is always good news.

This platform is known worldwide because it is very reliable, customizable, and easy to use. It is equipped with an excellent advanced graphics package, a wide range of integrated technical indicators, offers automated trading options with your well-known Expert Advisors (Eas), and a comprehensive backtesting environment for your strategies.

LEVERAGE

Leverage is a trading instrument that offers the ability to trade more funds than is presented in its balance. Leverage helps to maximize profits even with small market fluctuations, thus increasing the “risk-benefit” correlation. Tusarfx offers leverage of up to 1:500.

Leverage for metals will be half the size of leverage for Forex.

For example: if the leverage for Forex instruments is 1:500, the leverage for metals will be 1:250.

Keep in mind that trading with greater leverage does not guarantee better results, in fact, it is often said that leverage is the main reason why beginners lose money in markets.

TRADE SIZES

The minimum Position Size is 0.01 lots (micro lot), while the maximum Position Size is 2 standard 100k lots. We are struck by the fact that the maximum size is only 2 lots. Most brokers offer the possibility to trade with greater trade size.

TRADING COSTS

Spreads are reasonable, as we will see in the corresponding section. As for trading fees, 3 of the 4 accounts offered by Tusarfx have no commission, and Tusarfx only charges a commission on the Premium account, which costs 0.6 pip per standard lot.

Spreads are reasonable, as we will see in the corresponding section. As for trading fees, 3 of the 4 accounts offered by Tusarfx have no commission, and Tusarfx only charges a commission on the Premium account, which costs 0.6 pip per standard lot.

The broker announces that if the account is not used, inactivity fees may be charged, but does not specify the time or amount. On the other hand, there is the cost of Swap, which is common in all brokers. The Swap is any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

ASSETS

When we tested the MT4 platform offered by Tusarfx in demonstration mode, we noticed that its asset portfolio is not very extensive. It included less than 30 currency pairs and CFDs on precious metals (Gold and Silver). We understand that many traders will lose trading instruments as popular as the S&P 500, the DAX 30, or trading Stock CFDs.

SPREADS

Trade conditions are apparently good. The spreads advertised on the Tusarfx website are really good on most types of accounts: fixed on 2 pips or floating, starting from 1.1 pips in EUR / USD. Additionally, when we tested the broker’s MT4 Demo platform, we found that the spread in EUR / USD effectively fluctuated around 1.1 pips.

MINIMUM DEPOSIT

Tusafx provides all facilities to any potential customer, as their minimum deposit requirement is only USD 1.00. So you can start trading in minimal quantities, and affordable to any public.

DEPOSIT METHODS & COSTS

Tusarfx offers wire transfers and deposits using all types of credit cards through the payment systems OKPAY, Dengionline, and Perfect Money. It also offers deposits through Western Union and Moneygram payment systems. This broker does not charge deposit fees, but banks and payment systems can charge a specific transaction fee directly to the customer.

WITHDRAWAL METHODS & COSTS

Tusarfx does not charge withdrawal fees, but banks and payment systems may charge a specific transaction fee to the customer. With this broker, withdrawal requests of more than 700 USD must be processed only by bank transfer.

Can a withdrawal be made to a bank account in a tax haven? Yes, but with this broker, by choosing bank transfer as a withdrawal method, you will be charged an additional $1,000 if you withdraw your funds from an offshore bank. Offshore banks are banks located in the following countries: Burma, Cuba, Iran, Liberia, Lebanon, Syria, North Korea, Iraq, Zimbabwe, Hong Kong, etc. Also, know that Tusarfx does not cooperate with banks of the following countries, Liberia, Ivory Coast, North Korea, Japan, Iran, Iraq, Lebanon, the Democratic Republic of the Congo, Sudan, Somalia, Eritrea, Libya, Guinea-Bissau.

WITHDRAWAL PROCESSING & WAIT TIME

For the process of a withdrawal, we need to log in to our customer area of the broker’s website, choose the withdrawal section, and complete a small online form. Your request will be executed in one or two business days, and from there, it will take the bank to deposit your funds into your bank account, which can be between 2 and 5 additional business days.

BONUSES & PROMOTIONS

Tusarfx offers a complicated Bonus system. Basically, it can be summed up to a 50% bonus for the initial deposit, up to a maximum of 2,000 USD, and always an additional 20% bonus for the remaining deposits.

Loss deposit bonus. The broker always returns 0.6 pips per lot operated, directly to your account. For the refund of losses we give the following example:

- If you have lost 100 – 300 USD – Tusarfx pays you back 50% of your loss.

- If you lost 301 – 500 USD – Tusarfx pays you back 60% of your loss.

- If you lost 501 – 1000 USD – Tusarfx returns 70% of your loss.

But in order to be paid this bonus, you must deposit twice the amount of the bonus. For example, You have lost 200 USD. To get a 50% loss refund (200 / 2 = 100 USD) you must deposit at least 200 USD.

This type of Bonus makes us think that this broker is Market Maker. The broker offers an Introducing Broker program. An Introducing Broker is an agent that introduces customers to a broker. The IB’s receive compensation, in the form of a commission, for the clients they introduce but do not collect from the clients.

This type of Bonus makes us think that this broker is Market Maker. The broker offers an Introducing Broker program. An Introducing Broker is an agent that introduces customers to a broker. The IB’s receive compensation, in the form of a commission, for the clients they introduce but do not collect from the clients.

The most common forms of commission are CPA or Cost per Acquisition (a fixed payment for each customer), a % of the Spread, or a commission per lot operated established by the broker. In this case, TusarFX pays 40% of the spread, up to 3 pip per 1 standard lot.

EDUCATIONAL & TRADING TOOLS

There is a news section with little content. It also has a Forex calculator. It has come to our attention that Tusarfx, despite having a quite complete website, does not have an economic calendar, a tool that we consider necessary and very interesting for the trader routine, as it allows us to know the most important daily events, and which may affect the different financial assets.

There is a news section with little content. It also has a Forex calculator. It has come to our attention that Tusarfx, despite having a quite complete website, does not have an economic calendar, a tool that we consider necessary and very interesting for the trader routine, as it allows us to know the most important daily events, and which may affect the different financial assets.

This broker has a partnership with FX Instructor, which is a course provider. Tusarfx offers its clients free Forex courses, a sophisticated daily Forex forecast, and a technical analysis of the markets. Unfortunately, the link to access and view the content does not work, so we cannot assess the quality of that educational content.

CUSTOMER SERVICE

To get in touch with Tusafx customer service, we have 3 ways of contact, email, and online form you’ll find on the web, and a live chat. The available email addresses are:

- [email protected] – technical support and troubleshooting

- [email protected] – trading terms, conditions

- [email protected] – partnership, advertising

- [email protected] – promotions

DEMO ACCOUNT

A Demo account can benefit the trader in 2 ways :

– Practicing commercial techniques

– Learning the different tools of the platform.

It is widespread for traders to open a Demo account before depositing money into a real account. It is also important to know that the Demo account retains the same live prices and market conditions, simulating the exposure in a real account.

Tusarfx offers us a demo account on the MT4 platform. To access it, we must fill out a form with our personal data and some account details. We will then receive an email from the broker with instructions for installation.

COUNTRIES ACCEPTED

According to the policies applied by Tusarfx, Canadian, Japanese, and US citizens (regardless of residence), residents of Canada, and the US (regardless of citizenship) cannot open trading accounts with this bróker.

CONCLUSION

Tusarfx is an offshore company that acts as an introductory agent for FXCL, a company that is also registered in a tax haven. Although FXCL’s reputation is not bad, Tusarfx customers are exposed to the risks of trading with an unregulated broker.

As always, our best advice for traders looking for a reliable currency broker is to look for those licensed by reputable financial institutions, such as the Financial Conduct Authority (FCA) in the UK, or ASIC in Australia, for example.

We found good spreads and very generous leverage, up to 1: 500. The methods of deposit and withdrawal are varied, and in short, the years that this broker has been in the market gives us some confidence, together with the fact that we have not found negative customer reviews on other websites.

And finally, here are the highlights of our review of Tusarfx, where we value that there are many more positive than negative aspects:

Advantages:

- Generous leverage, up to 1: 500.

- Spreads are acceptable.

- MT4 platform is available.

- Very affordable initial deposit.

- It is an IB of a known runner (FXCL)

Disadvantages:

- No financial regulation.

- His portfolio of assets is not very varied.