During a larger part of 2019 traders have witnessed probably the least volatile forex market in history. These periods are often followed by steady bullish equities markets when most of the capital goes on this side of trading. Forex traders that use trend following methods have two options in these situations. Trade as they are still in trending markets and give back what they have earned during the previous year or use this environment to their advantage. The situation from 2019 is perfect grounds to learn, test, and separate consistent traders from the rest.

To some degree, trading forex does not put you in a position where you feel out of control, like in the stock market with reports or crypto with so many unannounced events, etc. In forex, even when trades do not go your way, you still have some control. There are a few ways to recognize dead markets, some are quite obvious but beginner traders may need more clarification. Taking advantage of dead markets does not come from trading, it is by adjusting our trading systems to avoid them. Experiencing dead markets in real-time is a great opportunity to secure our future results. So traders will need a plan, and we will put in place one as an example of what you should do when you enter flat waters.

First, a tool is needed to measure how volatile the forex market is. Volatility can also be substituted with volume, what we want to measure is the activity on the market. One such example tool used by prop traders is the Euro FX VIX ($EVZ), Index created by CBOE. Pay attention to our Volume articles about incorporating filter indicators into your system. This tool is just another filtering method that can be applied to your plan outside the usual MT4/5 indicator combo. Now, the $EVZ Index is published by a few charting sources, one can be Yahoo Finance, barchart.com, TradingView or you can even go to the CBOE site. If you notice the “Euro” in the Index name, do not think it applies to the EUR currency only, it is a good indicator for the overall forex market volatility.

$EVZ presented as a histogram on Yahoo!Finance:

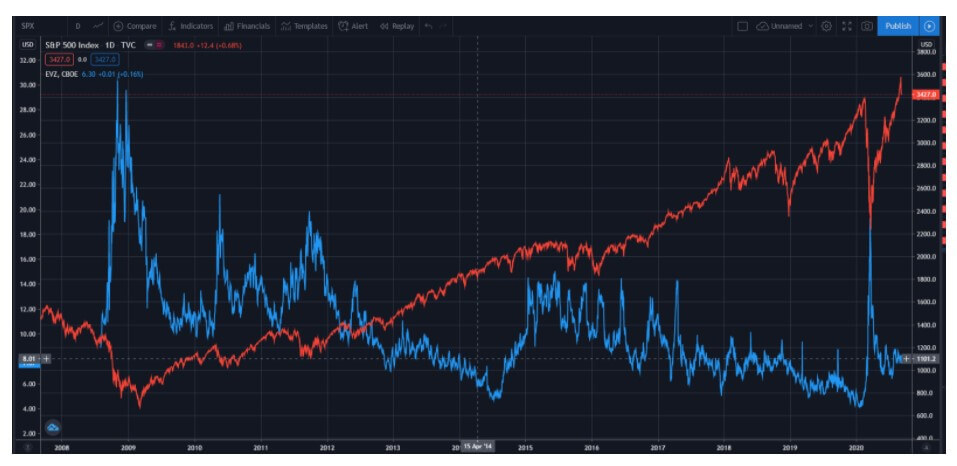

In the picture above we can notice a sharp jump in the activity once the world was hit with the COVID-19 pandemic. Just a few weeks before, the $EVZ was bottoming below the 5 mark for quite some time. The whole of 2019 was one of the quietest long periods in forex history. The Index can also be represented as a bar chart but you should not pay attention to the highs and lows, just focus on the close value. The 2019 anomaly created a stir as trend traders found their systems losing more than usual and just after the dead period traders experienced the pandemic shock. To adapt, a completely different instruction has to be used for your trading plan. Another interesting correlation to dead markets is the movement of the equities market. What some traders have found is that when S&P 500, for example, is trending but slowly, in constant small increments each day, forex markets start to die out.

In the picture above we can see whenever a gradual S&P 500 (red line) increase is present, the $EVZ (blue line) Index is slowly waning out. Immediately after a disruption in the equities market, the forex is full of currency flows. Downward equity moves are especially sensitive as people move the money out of equities and move into forex or other markets where investing is more lucrative. The negative correlation is evident, since 2017 the S&P 500 is slowly moving up and forex is not what it has been before 2014 where trend traders’ standard gain was around 200 to 300 pips a day.

If we take a look at the ATR indicator, calm periods can also be spotted which can drive trend followers impatient. They will not get signals, the signals are not resulting in long trends or more likely they are fake moves. Trend following strategies have only one weak moment and that is until the Take Profit target is hit. After that, prop traders secure their wins by scaling out and moving Stop Loss orders to breakeven. Signals that end with a reversal before the TP is most likely a loss and are more common in dead markets.

Trader’s psychology is at the test here. When you are in a dead market and you are losing, this is a good thing! It is time to take advantage of this. Understand these conditions happen and will happen again. The next time it happens your trading plan will be ready. Chaos theory applies, the order goes into chaos, and chaos back to order. In case you are a beginner and just testing your system for the first time in 2019, know your system will be adjusted to this dead market and may even be not as successful as you would want. On the other hand, since you are a beginner, you should be trading on a demo without any real capital to lose. To some traders, if you are trading in dead markets and still on breakeven, your system is on a good track to endure dead markets and reap consistent gains when it is not. When you are testing your volume indicators or tools, dead markets are extremely good for forwarding tests. Once you have picked your favorite volume indicator it should filter most of the flat mini periods in a dead market by keeping you from taking any trades and even give you small winners sometimes from rare trends worth taking. This element is crucial but some may find it is the hardest to find.

If you are still struggling to find a good volume indicator then just go and use the $EVZ we have presented. Create a set of risk management rules for your trading and apply them to your trading system. As an example some prop traders use, whenever $EVZ value is below 8, reduce your positions to 50% of what you normally take. If it goes below 7, use only 25%, stop trading below 6. This measure alone will benefit your end line and filter 90% of bad signals when combined with your volatility indicator. When you realize you are losing consistently at some game or market, avoidance is one great and simple measure that will help. Avoidance or filtering your signals in an environment where you lose is the same principle, just formulated into a strict trading plan. Even though it is fun to be in action, your ability to avoid it is what will separate you from others.

Another interesting conclusion prop traders made during the dead markets is that the USD pairs are just not good even for small trend signals. So their suggestion is just to avoid all signals from these markets once you measure a dead market. Sticking to cross pairs is also going to be tricky but you can make one adjustment to increase your odds. Scaling out principles explained in one of our articles where you leave out a part of a position to continue riding the trend may not be a good idea in dead markets.

Since trends are not going to last for very long, it is just better to take a whole position at your first take profit target. So whenever $EVZ is below 8, for example, make this adjustment to your system. Those 200+ pip trends are not going to happen, so all of your high percentage setups may just lack that extra mile that makes all the difference on your account. Just avoid aiming for big and cut everything at your first price target. If you are following our ATR based money management, your risk to reward ratio will be 1:1 in these conditions. This is not good money management for normal conditions and will not provide you with a positive account, it is just temporary. The risk of a reversal is increasing as you keep your position longer, so based on testing it is just better to end sooner.

Once the market is active again know that your volume indicator and system are still calculating historic movements and the signal is not there yet. More often than not, the first trend after the calm phase will be missed since your indicators are lagging. As mentioned in the Volume articles, these indicators need data and would be useless if too sensitive. Be ready to accept missing out on first movements after the dead market. Do not attempt to make indicators more sensitive just to grab the first trend, it will make your system susceptible to fake breakouts frequent in calm markets and you will face new losing streaks. Experts even say the first strong moves are likely to be corrected after a day or two, and that means 1 or 2 candles if you are trading on a daily chart. Relax and know your account endured the storm (calm market) of fake moves where other traders not accounting for the volume (which is quite often) lost their morale and most of their accounts. Robust trading plans with these elements are only a result of your hard work majority of traders just lack.

Lastly, there is one more adjustment you can make when you are close to being out of the game. It is an extreme indication something went wrong with your plan, money management, or psychology part, but if you are on the line for some reason try changing your target timeframe. Daily charts may lack conviction but smaller time frames are certainly better. Here, your daily chart trading system (for example) will be performing in an environment it is not designed to so expect less impressive results. However, the system you have designed should be universal, if you are following the structure we have provided before. Smaller time frames have a lot of other factors you need to pay attention to. This also means you need more time, more nerves, and less sleep. News event moves here are bigger and more unpredictable, then we have trading sessions and more factors. The smaller time frames we go to, the more nuances can get our trends to reverse.

However, here is also where you will find your volume if you desperately need to trade. Such needs may come if you are expected to trade by your client or a prop firm and you are in a dead market. Sometimes it may happen because you need income. If you need income by trading forex with money you cannot afford to lose, know you will fail in the long term. Other reasons to change your timeframe such as impatience will also lead to failure. Simply know forex does not forgive, it can only serve those who put in the work in the system and train their mindset.