Tradize is a foreign exchange broker based in Saint Vincent and the Grenadines and was founded in 2013. Tradize promise to provide professional trading conditions with tight spreads and no or low commissions, reliability. However, they mention another broker name here instead of their own, which is rather strange. In this review, we will look into the services being offered to see how they perform against the competition.

Account Types

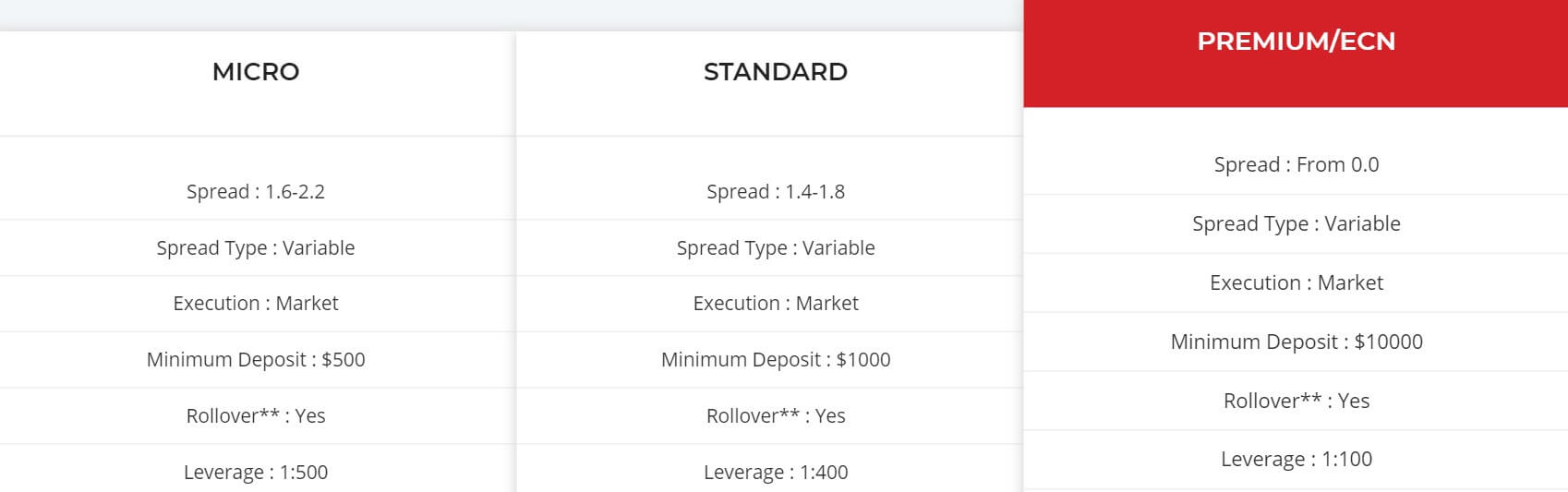

There are three different accounts available when signing up with Tradize. Each one has its own entry requirement and trading conditions, so let’s get an overview of each.

Micro Account:

This account requires a minimum deposit of at least $500, it comes with a variable spread starting with a range of 1.6 pips to 2.2 pips. The leverage on the account is up to 1:500 and there are 44 currency pairs, 4 metals, oils, equities, indices, and Bitcoin available to trade. Minimum trade sizes start from 0.01 lots and go up in increments of 0.01 lots. The margin call is set at 50% and stop out at 30%. There is no added commission on this account.

Standard Account:

This account requires a minimum deposit of at least $1,000, it comes with a variable spread starting with a range of 1.4 pips to 1.8 pips. The leverage on the account is up to 1:400 and there are 44 currency pairs, 4 metals, oils, equities, indices, and Bitcoin available to trade. Minimum trade sizes start from 0.01 lots and go up in increments of 0.01 lots. The margin call is set at 50% and stop out at 30%. There is no added commission on this account. The account also comes with a free VPS if your balance is over $5,000.

Premium / ECN Account:

This is the top tier account and so requires a minimum deposit of at least $10,000. The spreads on the account start from 0 pips and due to this, there is an added commission of $10 per round lot traded. The leverage on the account goes up to 1:100 and the trade sizes start at 1 lot and go up in increments of 0.01 lots. The margin call level is set at 50% with the stop out level at 20%. OIt comes with an account manager and a free VPS.

Platforms

The only platform on offer is MetaTrader 4 (MT4), MT4 is one of the worlds most used and most loved trading platform, being used by hundreds and thousands of users. Offering high accessibility, available as a desktop download (PC and Mac), a web trader and as an application for mobile devices. Some of its features include a market watch, multiple order types, thousands of indicators, a huge number of compatible expert advisors, trading history, analysis tools, multiple charts, automated trading and many more.

Leverage

The leverage that you get depends on the account you are using and the following is the maximum leverage available per account.

- Micro: 1:500

- Standard: 1:400

- Premium / ECN: 1:100

The leverage can be selected when opening up a new account and should you wish to change it on an already an open account you will need to contact the customer service team with your change request.

Trade Sizes

When using the Micro or Standard account the trade sizes start from 0.01 lots and go up in increments of 0.01 lots. When using the Premium / ECN account the trade sizes start at 1 lot and go up in increments of 0.01 lots. We do not know what the maximum trade size is, however, whatever it is, we would not recommend trading over 50 lots in a single trade. We are also not aware of how many open trades you can have at any one time.

Trading Costs

The Premium / ECN account has an added commission of $10 per round lot traded which is slightly higher than the industry average of $6 per round lot. The other accounts use a spread based system that we will look at later in this review. There are also swap charges which are an interest charge for holding trades overnight, these can often be viewed within the MetaTrader 4 platform and can be both positive or negative.

Assets

Assets

Unfortunately, there doesn’t seem to be a breakdown of the available assets and instruments so we cannot give you a breakdown, or examples of what is available. This is a little disappointing as potential clients need to know what is available to trade, especially if they like trading a certain asset or instrument.

Spreads

The only information we have on spreads is the information provided on the account overview page. That information is as follows:

- Micro: Variable from 1.6 pips to 2.2 pips

- Standard: Variable from 1.4 pips to 1.8 pips.

- Premium / ECN: Variable from 0 pips

As there is not a full breakdown of instruments we cannot give concrete examples. The spreads are variable though so this means that they move with the markets when there is a lot of volatility they will often be seen higher.

Minimum Deposit

The minimum deposit required to pen up an account is $500 which will get you the Micro account, if you want an ECN account then you will need to deposit at least $10,000.

Deposit Methods & Costs

Unfortunately, there isn’t a dedicated finance or funding page to the site, the only information that we have are some images at the bottom of the page which indicate that Visa, MasterCard, Skrill, and Neteller are available for depositing. Nowhere on the site does it indicate if there are or are not any added fees for depositing, but be sure to check with your bank or processor to see if they add any of their won.

Withdrawal Methods & Costs

As there was no information on depositing there is also not any on withdrawing and the methods or costs available. This is a real shame and Tradize should be making this information public, as not know how you can get your money out and if it will cost you is a bit put off for a lot of potential traders.

Withdrawal Processing & Wait Time

We do not know the processing times. However, we can expect your withdrawal requests to be fully processed between 1 to 7 working days based on the method (whatever they are) used.

Bonuses & Promotions

It does not appear that there are any active promotions at the time of writing this review if you want a bonus you could contact the customer service team to see if there are any upcoming ones you could take part in.

Educational & Trading Tools

Educational & Trading Tools

There are two things to mention in this section, the first being an economic calendar which is your standard calendar showing upcoming news events and the markets that they may affect. The second is some technical analysis, this is regularly updated and posted and provides ideas of where the market may move and why.

Customer Service

Should you wish to contact Tradize there are limited ways to do it, you can use the online submission form to fill in your query and send it off, you should then get a reply via email. The second way is via email directly. There is also a postal address available but no phone number.

Address: Cedar Hill Crest P.O.BOX 1825,VillaSt. Vincent

Email: [email protected]

Demo Account

There doesn’t seem to be a demo account available, we may have just missed it or you need to be a full member to access them. Demo accounts allow potential new clients to test the servers and treading conditions and allows existing clients to test new strategies without any risk. It would be good for Tradize to ensure demo accounts are available for their clients.

Countries Accepted

The following is presented on the website: “Tradize brand does not provide services to residents of the USA, Japan, British Columbia, Quebec and Saskatchewan, and some other regions.“ If you are not sure of your eligibility, then be sure to get in contact with the customer service team to check before signing up.

Conclusion

The review started off strange with Tradize mentioning another broker name instead of their own in their introduction. There are three accounts to choose from, each offering something different, spreads and commission are both quite high when comparing to the competition. There is a complete lack of information on the tradable instruments and the deposit/withdrawal methods which really put us off. Potential clients need to know all this information especially as we will be giving them our money, not knowing how or what it will cost makes us think twice. All of that combined with the limited ways to contact the customer service team doesn’t give us a lot of confidence and we would recommend looking elsewhere.

One reply on “Tradize Review”

Please don’t invest in tradize. You have to follow up for months to get your money. After some time they stop to respond to your email.

BIG RISK