Introduction

In total, there are five major trading sessions in the Forex market, and we have already discussed the New York Breakout Strategy. In this article, let’s learn the best way to trade the Forex London session. The London session is one of the biggest market movers because a lot of trading volume for instrument trading occurs in this session. The volume of the instrument essentially means the total amount of money that moves the market in any particular session.

Most of the financial centers and major banks start their day around the London session. These banks and institutions try to accommodate their clients in this session alone. This is one of the reasons why the price action is quite volatile and aggressive in this session. In other words, for retail traders, the London session is a prime window to make huge profits from the market. Because of the higher the volatility, the more the trading opportunities.

In this article, we will be sharing some of the proven techniques that can you can use to trade the London Session. The key to finding success while trading the London session is to be extremely disciplined. It is crucial to follow the rules of the strategy and do the required analysis before the London opening. If we miss our entries at the time of the London opening, we can’t expect a second chance to get back with the trend.

London session opens at 8 AM GMT. If you are not aware of the exact time when the London sessions open, you can make use of the Forex Time Zone Converter to accurately find the opening of this session in your local time.

London Session – Breakout Trading Strategy

We have backtested the strategies that have been mentioned below. The results revealed that most of the time, these strategies provide trading opportunities during the first three hours of the London session. Sometimes, the volatility picks up 30 minutes before the opening of the London suggest. But we always recommend you activate your trades only after the opening of the London session.

- Find out any currency pair which is in a strong uptrend.

- Price action must hold below the resistance line if the market is ranging before the opening of the London session.

- Wait for the breakout to happen in the London session.

- Let the price action hold above the breakout to confirm if the breakout is valid.

- Take a buy entry.

- Place the stop-loss below the breakout line.

- Take-profit can be placed at the next resistance area.

The same is the opposite in a down-trending market and when we are willing to go short.

Identifying The Currency Pair

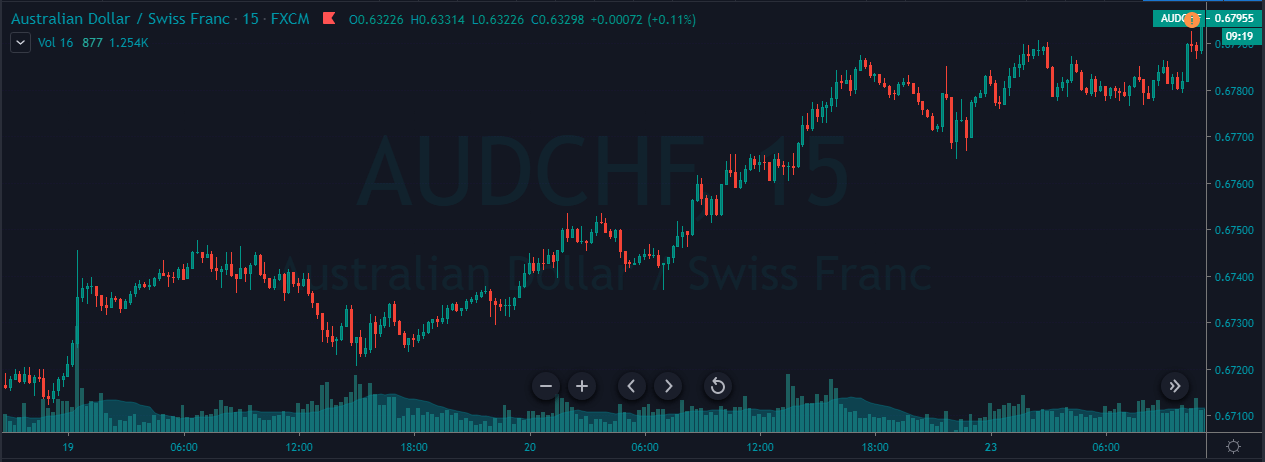

The below AUD/CHF Forex pair represents an up-trending market.

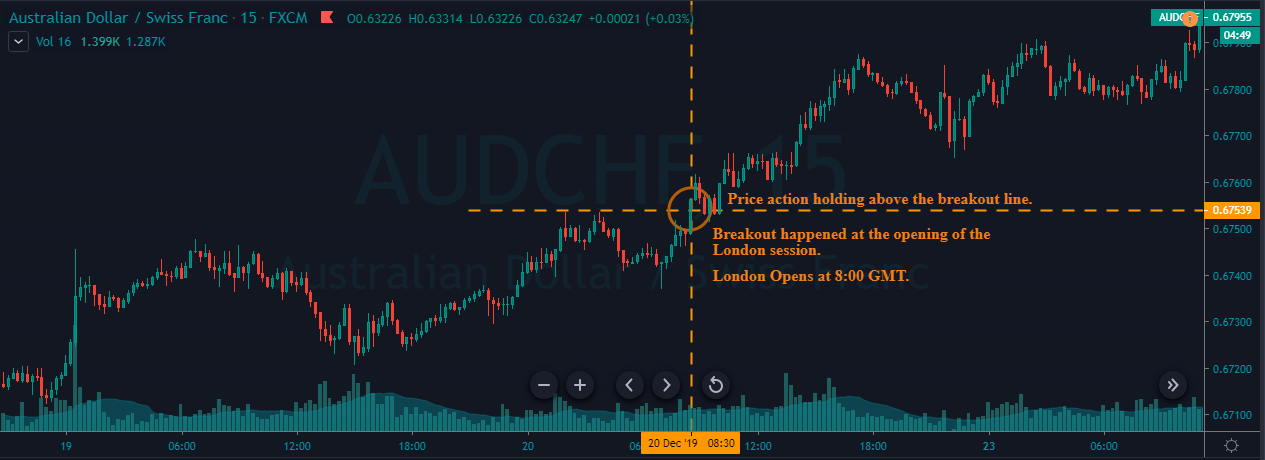

Confirming The Breakout

We can see a breakout happening at the opening of the London session. This indicates that the big players are now ready to move the market. The price action held above the breakout line, indicating that the breakout is real. Going long at this point will be a good idea.

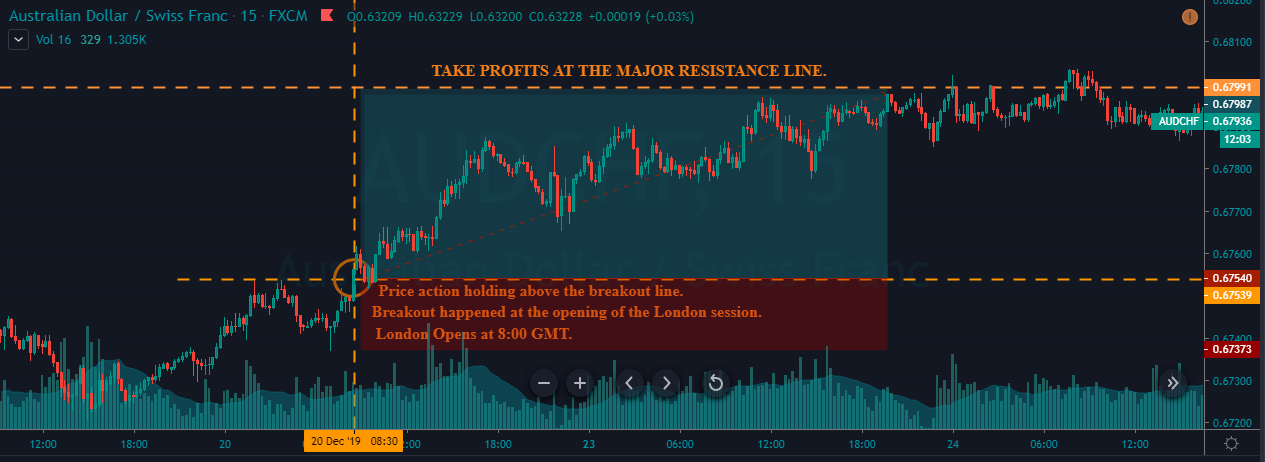

Entry, Stop-Loss & Take-Profit

In the below image, you can see that we have taken a buy position right after the breakout in the London session. The stop-loss is placed just below the recent low, and we chose the higher timeframe’s major resistance area to place our take-profit. A lot of traders believe that if they use this strategy to trade the London session, they must close their positions on the very same day. But that’s a wrong perception as we should be deciding that depending on the market conditions. It is logical to hold your positions until the price reaches our desired take-profit area.

London Breakout + MACD Indicator

In this strategy, we have used the MACD indicator to trade London breakouts. MACD is a celebrity indicator which is popular among most of the professional traders. MACD stands for Moving Average Convergence and Divergence. This indicator consists of two lines; the first one is the MACD line, and another one is known as the second line. MACD is a trend following indicator which is used to identify the overbought and oversold market conditions.

The strategy here is to wait for the breakout to happen right after the opening of the London session. At the time of breakout, check if the MACD indicator is at the oversold area. If yes, it is a clear indication for us to go long. If the MACD is above the zero lines, it is even a greater sign as it indicates that the ongoing trend is strong. Anticipating bullish moves from this point will be a good idea.

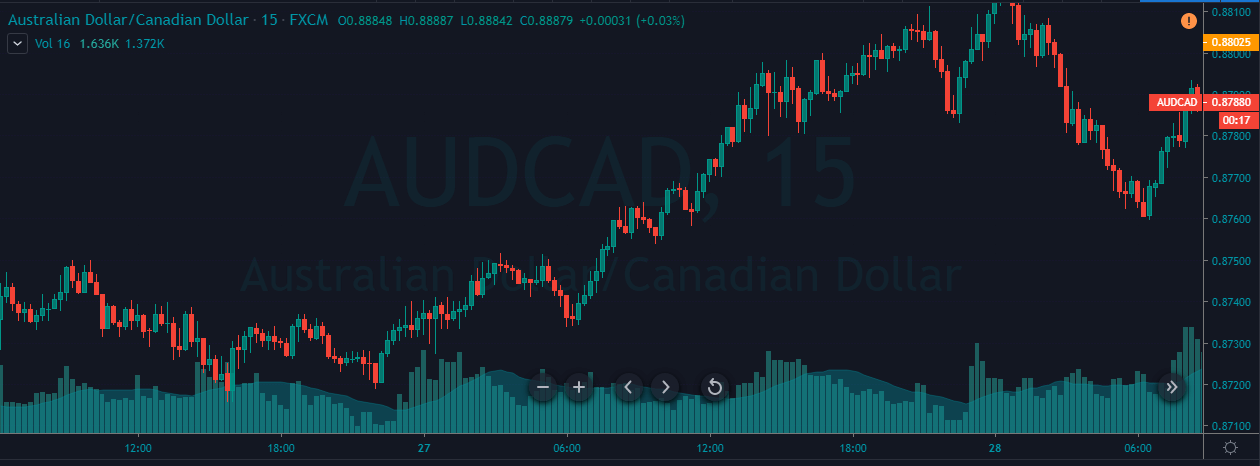

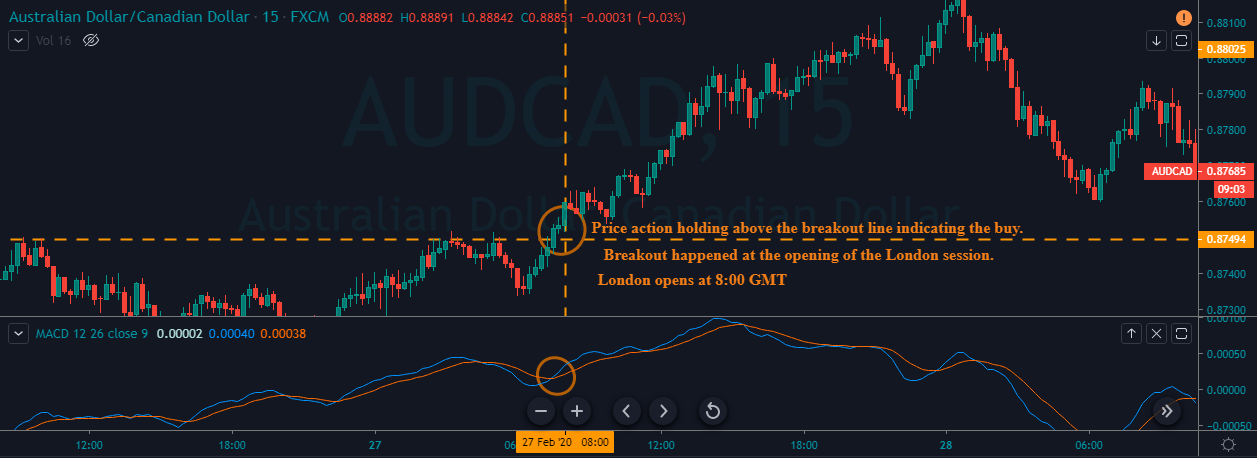

The below price chart represents the AUD/CAD Forex pair, and we can see the market is in an uptrend.

In the below image, it is clear that the MACD lines crossed over precisely when the breakout happened at the London opening. This is a clear indication for us to look out for buy opportunities in this currency pair.

We went long right after the breakout in the London session as it was confirmed by the MACD crossover. We have placed the stop-loss just below the resistance line. We can set the stop-loss order according to our trading style. If you are a confirmation trader, wait for the things to be in your favor to make an entry and use a wider stop-loss. If you are an aggressive trader, the stops below the recent candle are good enough.

If you are a conservative trader, the stops we placed in the below example is good enough. We always suggest you close your positions at the next resistance area. You can follow that process for this strategy as well. Here in this example, we tried to be a bit creative and closed our positions when the MACD indicator gave us an opposite signal. When the MACD indicates that the market is in an overbought condition, it means that the buyers are exhausted now, and it’s time for us to go short. You can see the bearish moment in the market right after we have booked our entire profits.

Conclusion

Both of the strategies mentioned above are simple and easy to use to trade the London market. If you are a beginner, we suggest you practice them first on a demo account. London breakout often gives reasonable risk to reward trades, and most of the trade results can be seen within a few hours. Make sure to follow all the rules of the above strategies to have the edge over the market. All the very best.