Learn How To Trade Forex For FREE!

CAD/JMD Asset Analysis

CAD/JMD is an exotic currency pair. CAD is the Canadian Dollar, and JMD is the Jamaican Dollar. The CAD is the base currency in this pair while the JMD is the quote currency

NZD/AED Asset Analysis

NZD/AED is a currency pair where NZD is the currency of New Zealand. On the other hand, the AED is the currency of the United Arab Emirates (UAE). It is an exotic currency pair where the NZD is the first currency, and the AED is the second currency. Understanding NZD/AED The price of NZDAED represents […]

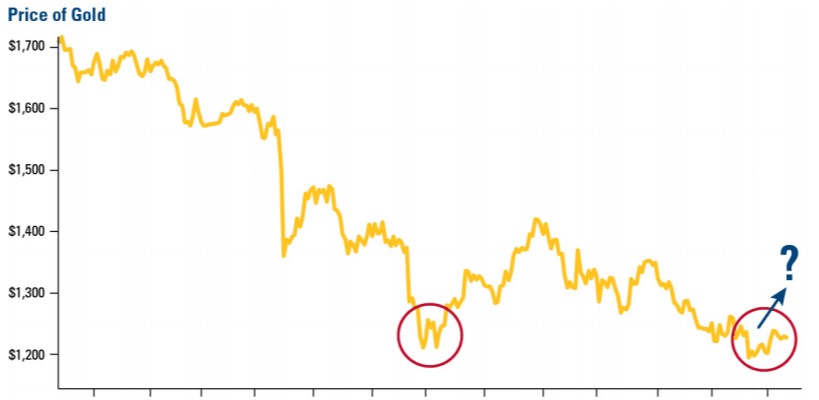

Gold Market Analysis and Structure

If you are operating in the commodity market, you need to have an idea of the structure and dynamics of the supply and demand of the assets. Oil is a typical example, which is rapidly recovering lost positions, thanks to the growth prospects of global demand and the contraction of the surplus in the midst […]

Investing In Silver (the Forex Way)

Many investors wonder how to invest in silver in the most appropriate way since silver has traditionally held up well to inflation and has contributed to the offsetting of investors’ portfolios. When everything else goes wrong, silver becomes one of the best investment alternatives, just like gold. In today’s article, we will analyze the different […]

Trading Strategy For the CAD/JPY Currency Pair

In this article what I want to tell you is one of my strategies that is working well in real life using the CAD/JPY pair. Why this pair? I have chosen this pair as an example but will show you different trading systems using different currency pairs. What is the Strategy Based On? In a […]

The Big Mac Index: How Much Does the USD Really Cost?

The real dollar rate can be defined using the cost of the Big Mac in a particular country. “Burgeconomics” is not an absolutely accurate indicator of monetary incoherence. But this index has been set as a global standard, is included in some economics manuals, and is the subject of academic research. This Big Mac index […]

A Comprehensive Guide to All Forms of Gold Trading

Investors will always try to diversify their investments in order to reduce their risk. Specifically seek the investments of safe haven that have a better when the rest of the market drops. Of these safe investments – treasury bills, Swiss francs, and others, investors think gold is the best. For this reason, you will see […]

Gold As Part of a Diversified Investment Portfolio

Today we’re gonna talk about what diversification means and gold as part of a diversified portfolio. Finally, we will analyze the gold, what has happened in recent months, and what we expect from it in the coming months. If we want to define diversification we could do it as a way to invest in different […]

Forex SignalsSee all

Daily F.X. Analysis, May 05 – Top Trade Setups In Forex – Buckle Up for Seris of U.S. Events!

On the forex front, the ICE U.S. Dollar Index marked a day-low of 98.64 Friday before paring losses to close flat at 99.08. Research firm Markit will publish final readings of April Manufacturing PMI for the Eurozone (33.6 expected), Germany (34.4 expected), France (31.5 expected). The Eurozone Sentix Investor Confidence Index for May will be […]

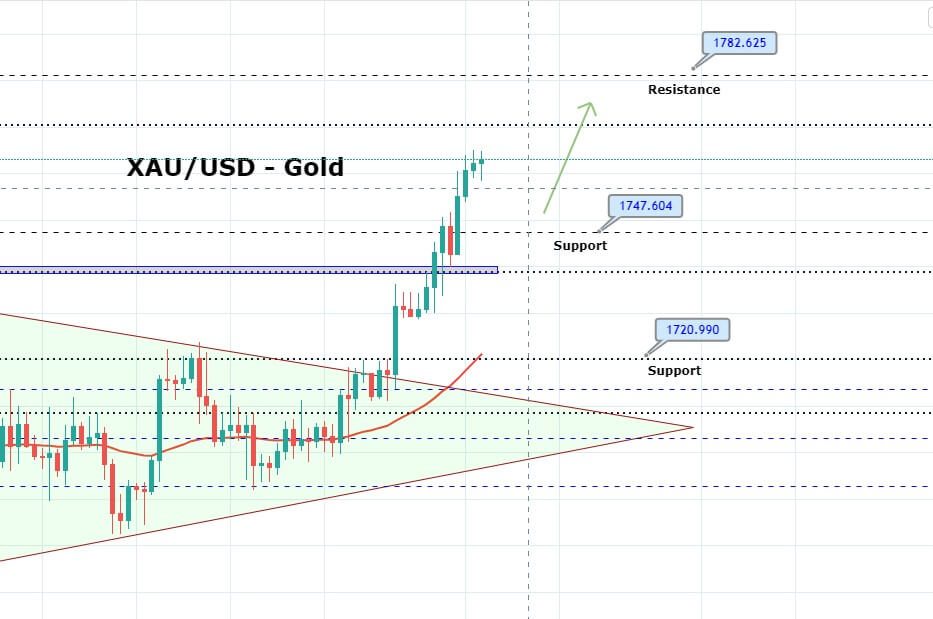

Gold Prices on a Bullish Run – Is It Going after 1,770?

The safe-haven-metal prices extended its 4-day winning streak and rose to the fresh 7.5-year high of $1,760 level since November 2012 while representing 0.90% on the day, although the Federal Reserve’s President Jerome Powell rejected negative rate once again. However, the reason for the gold upticks could be attributed to the renewed tension between the US-China trade tussle. Whereas, the dollar index, which tracks the value of the greenback (gold’s biggest nemesis) against majors, is also sidelined near 100.34. At this moment, the yellow-metal prices are currently trading at 1,761.78 and consolidate in the range between the 1,743.02 – 1,764.73.

CAD/JMD Asset Analysis

CAD/JMD is an exotic currency pair. CAD is the Canadian Dollar, and JMD is the Jamaican Dollar. The CAD is the base currency in this pair while the JMD is the quote currency

Forex EducationSee all

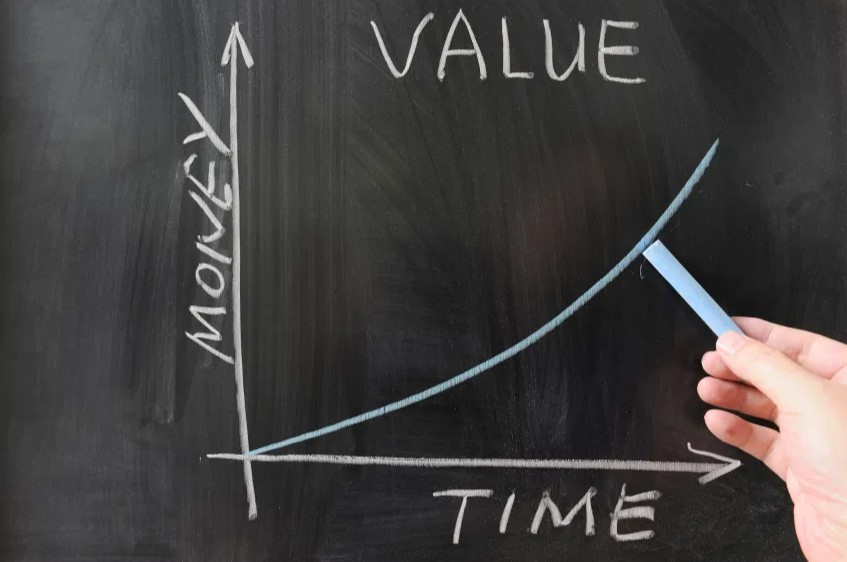

Why Forex Traders Must Value Their Time

All traders at the end of the year always take stock of their own trading activity. There still exists an element that is never taken into account and therefore we tend to forget… How much value do we give to our time? Although it seems obvious, time cannot be “preserved”. It just passes. It is […]

How to Correctly Deal With Forex Losses

For most traders, the toughest aspect of trading in Forex is dealing with financial losses. It’s not just a matter of pain and anguish, but it’s also a latent reality that losses are very often the trigger that drives traders to make their worst mistakes, which can cause even greater losses and start a vicious […]

7 Horrible Mistakes You’re Making With Forex Trading

If we are going to be completely honest, we all make mistakes and when it comes to trading, we have made many, and we are sure that you have too. Some of them are not too bad, some of them though, are pretty horrible and have thrown off our trading quite a bit. If you look back, we are sure that there are some mistakes that you have made in the past, especially when just starting out that you are most likely not too proud of. We are going to be looking at some of the horrible mistakes that we have made and that other trades have made during their forex trading careers.

Forex Trading: Expectations vs. Reality – Part Two

Let’s be honest, we all came into trading thinking that we were going to be rich, that is simply the expectation that a lot of new traders come into trading thinking, they have seen all the advertising spells with the present but often hidden warnings about the number of people who lost money. Due to these adverts and people on social media, people feel that trading is easy and that they will make a lot of money very easily and very quickly Or there are those that know very little about it that see it as gambling or a risk to do. Both of these expectations come from what they see from the outside, yet when we get into the actual facts, things are very different in reality than they are in their expectations. We are going to be looking at some of the differences between the realities and expectations of trading.

Forex Trading: Expectations vs. Reality – Part One

When you tell someone about trading and forex, what do you tell people? Most likely you are telling them all the best things about trading, these good reasons are the reason why you trade in the first place after all. These stories that you are telling other people are what is creating an expectation in them of what trading and forex actually are. If you look anywhere on the internet, there will be people talking about forex and how much you can make, how easy it is, and how life-changing it is, very rarely do you hear horror stories or the opposite feelings. This creates a certain expectation from people outside of the trading circle, expectations that do not really match up to the reality of what trading is and what it involves. We are going to be looking at what some of the realities are when compared to the expectations that a lot of people have and seeing whether the general expectation is right, or if reality is completely different.

Advantages of Forex Trading – Leverage, Liquidity, and Volatility

There are a lot of advantages to trading forex over some of the other methods of trading such as stocks, some of these advantages are the leverage that you can use, the liquidity in the markets, and the volatility that the markets can give. Each of these gives you a huge advantage as a trader […]

How to Correctly Use an Economic Calendar

The Economic News Calendar, also known as the calendar of economic events, plays an important role in the life of every trader and investor in the world, whether this is a minor trader who speculates with a personal account or an operator trading as part of an institutional trading network (institutional operators). An economic calendar […]

Forex Isn’t As Difficult As You Think: Here’s Why…

With all the warning signs that you got all over the place about trading, the little notices that say things like “Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with IC Markets (EU) Ltd. […]

How to Start Investing in Forex

Forex or Forex Trading is a market, also known as OTC (Over-the-counter) and is the largest market in which billions of dollars are executed daily. It’s even bigger than America’s stock markets. But given its OTC nature, no trader can really calculate the correct numbers regarding currency rotation. However, foreign exchange is in fact a […]

Deliberate Practice Trading: What It Is and Why You Should Be Doing It

You would have most likely have been told plenty of times that if you want to be good at something, you will need to practice, practice and practice. The same goes for trading, you will only become truly good at it, or more efficient at it if you put in the work and practice. The […]

How to Balance Your Forex Investment Portfolio

From whom to copy more efficient transactions? From a trader with a high performance 2 months a year, but has a positive balance at the end of the year, or from a trader with a small but stable income throughout the year? Balancing an investment portfolio under the investor’s objectives allows the investor to reduce […]

Forex CourseSee all

199. Effects Of Gold On AUD/USD & USD/CHF Currency Pairs

Introduction Gold is among the most traded commodities globally due to the good intrinsic value of this asset. Considering that Gold is less impacted by uncertain conditions, its prices rise when other economies perform badly and fall when there is an economic boom. Gold impacts AUD/USD and USD/CHF in opposite manners. Price fluctuations in Gold […]

Forex AssetsSee all

CAD/JMD Asset Analysis

CAD/JMD is an exotic currency pair. CAD is the Canadian Dollar, and JMD is the Jamaican Dollar. The CAD is the base currency in this pair while the JMD is the quote currency

AUD/CHF Global Macro Analysis

In this analysis, we will look into endogenous economic factors that influence Australia and Switzerland’s growth. We will analyze factors that affect the fluctuation of the exchange rate of the AUD/CHF forex pair. Ranking Scale Both the endogenous and exogenous factors are ranked on a sliding scale from -10 to +10. The ranking depends on […]

NZD/AED Asset Analysis

NZD/AED is a currency pair where NZD is the currency of New Zealand. On the other hand, the AED is the currency of the United Arab Emirates (UAE). It is an exotic currency pair where the NZD is the first currency, and the AED is the second currency. Understanding NZD/AED The price of NZDAED represents […]

Forex MarketSee all

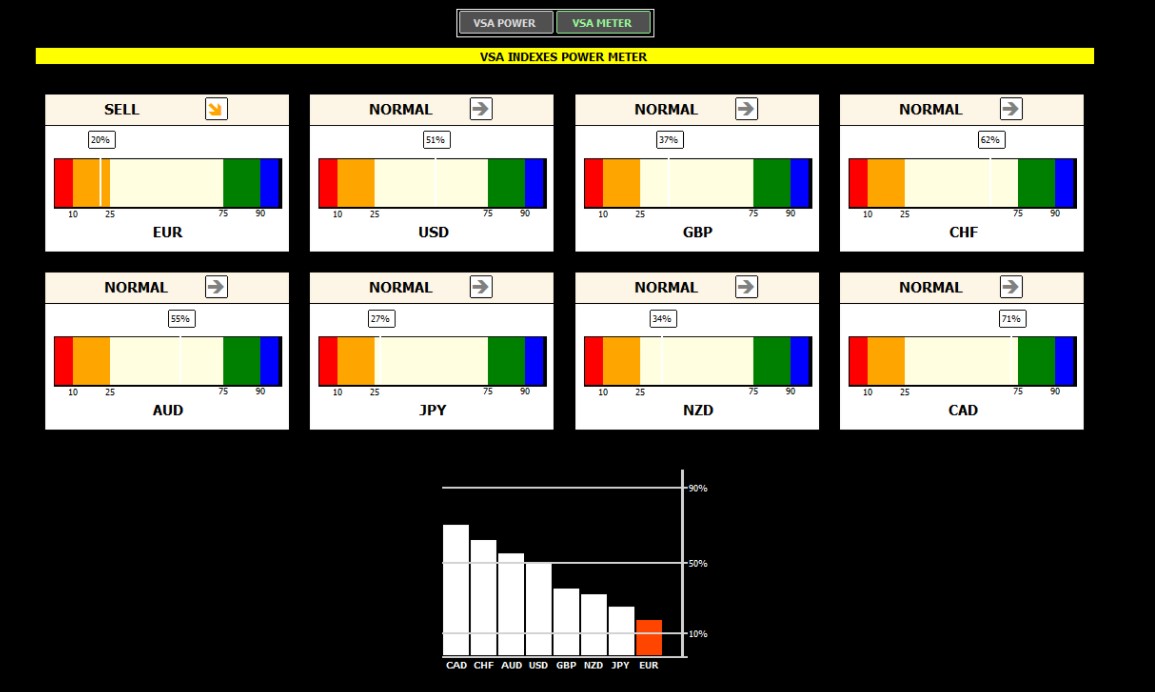

Determining the Strength of the Market by Analyzing the VSA

With this publication, we will look at an incredible method of market analysis based on the volume Volume Spread Analysis (VSA), developed by the famous American financial analyst Tom Williams and published in the book «Master the Markets». This is an unusual view that deals with how market makers manipulate crowd behavior.

Overview of “Dark Pools” (AKA Parallel Markets)

In finance, a «dark pool» is a private market used by its participants to trade in different types of securities. They are basically parallel markets operating outside the most well-known regular markets. Liquidity in these markets is called «dark pool liquidity» (sorry I did not find a suitable translation for the term). The bulk of […]

Forex Vs. Stock Trading: Which Carries More Risk and Why?

Is forex trading riskier than stock trading? And Why? To answer this question we must analyze what is the best market to trade, whether Forex or stocks, and that is what we will try to reveal in this article because a person who is just beginning in order to know the different markets you have […]

How Is COVID-19 Impacting the Forex Market?

I’m not here today to talk about algorithmic trading or systems or tools. I’d like to tell you something that is in the focus of traders in recent days and especially because it is an important issue because it affects the lives of many people. As you know, if it affects people’s lives it affects […]

The Legality of Online Forex Trading in South Africa

If you were to go through any of the major social media platforms and look for things related to Forex, you will most likely find quite a large community of people that are from South Africa. Forex and trading have started to become quite a popular pastime and business opportunity for those living in South […]

ICO´s Are Indeed Risky, But Here’s Why You Shouldn’t Ignore Them…

What will the future of ICOs look like internationally? Without a doubt, ICOs are generating great expectations and I think there is probably an excess of them. Often these are planned too quickly or with a very unclear after business idea. But it is also true that very powerful and interesting projects are coming to […]

Dirty Little Secrets About the Forex Industry

We just adore revealing things that are not talked about in the mainstream media. In our articles series, a trader could notice most of our trading methods are not ordinary. There is a reason for all that. Some could say it is a conspiracy but consider crisp and public proofs on the internet, reporting, news, […]

What’s Holding Back the Forex Industry?

The short answer is well known but the rabbit hole goes deep. It is the same reason we have global economic downturns, each special in its way but with a common enemy. The behavior of all actors linked to the forex industry is guided by many interests. Interests that do not align with individual forex trading. Let’s try to understand the gist since the short answer just turns people away from trading even though forex trading is one of the best ways to attain financial freedom, despite its quirks.

Forex Trading By the Numbers (This Information May Shock You)

For most current traders Forex markets are the privilege they were born into. As the majority of them are below forty–five years of age, they are too young to remember the Bretton Woods Agreement that was set to rebuild the post-World War II economy. This agreement established a system that ensured that each country adopted […]

Investing in China: Opportunity Or the Next Crisis?

In the S. XV, at the time when the so-called Silk Road had its decline, a network of trade routes that from the 1st century B.C. crossed all of Asia to trade goods through territories such as present-day China, Mongolia, Turkey, even Europe, and Africa. At the end of the intermediate period, destination prices were […]

The Functions of the Financial Market

The role of the financial market in a modern civilized society is enormous. Its aim is to mobilize capital, distribute it among industries, control and maintain the reproduction process and improve the efficiency of the overall economic system. The main functions of the financial market, performed by its participants, are as follows: Facilitate efficient relationships […]

The Impact of Supply and Demand In the Forex Market

To become an expert in the field, any tennis player will have to learn how to yield the racket, move across the court, apply different strategies, and prepare mentally for both wins and losses. They will also need to distinguish between different surfaces and how these affect the style of the game, which is all […]

Forex MT4 PlatformSee all

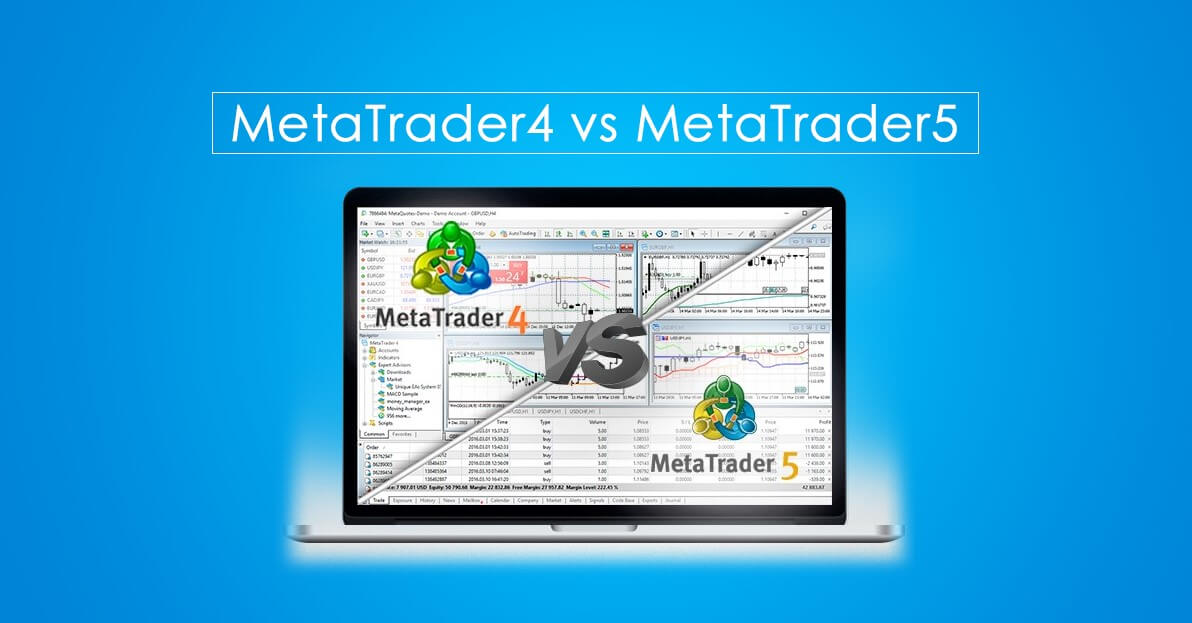

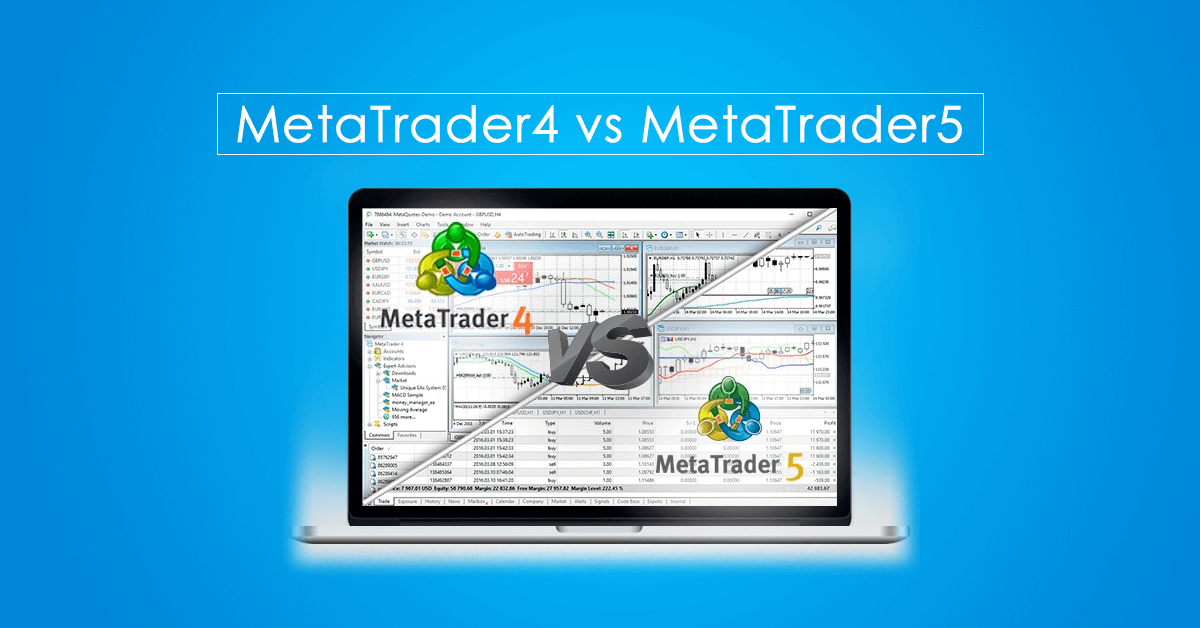

MetaTrader 4 vs MetaTrader 5: An In-Depth Comparison

If you’re a forex trader, chances are that you’ve already heard about MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are the two most popular trading platforms on the market and are among the most common platforms offered by online brokers, especially with MT4. Do know that there are other trading platforms out there, but […]

Forex Trading PlarformsSee all

A Complete Guide to the cTrader Trading Platform

cTrader is one of the biggest competitions to the dominating MetaTrader series of trading platforms, back in 2018 they won the online trading platform of the year award. Created by Spotware Systems Ltd and released back in 2010. It is packed full of features and customisation options. Ctrader has started to be picked up by […]

Overview of the SmartTrader Platform

SmartTrader is an online trading platform that focuses on charting, trading, and social networking. The cloud-based platform supports trading in the forex, stocks, and cryptocurrency markets. SmartTrader also works with a growing list of brokers that currently includes more than 35 options, including some big competitors like Forex.com. Take a look at the SmartTrader platform’s […]

MT4 Vs. MT5 – Which One Should I Use?

Forex traders can choose the trading platform they want to use. However, this choice is interrelated with the choice of the Forex Broker, as not all types of trading platforms are offered by all brokers. In addition, some brokers do not have real compatibility with certain Forex trading platforms, but giving access to them via […]

What to Look For In a Forex Trading Platform

Let’s dedicate this article to speaking about Forex trading platforms. In the market, there are thousands of brokers and platforms, and all promise to be the best. Each may be different in different ways, but what really interests you? What do you ask a trading program to do? Let’s discuss… What is a Trading Platform? […]

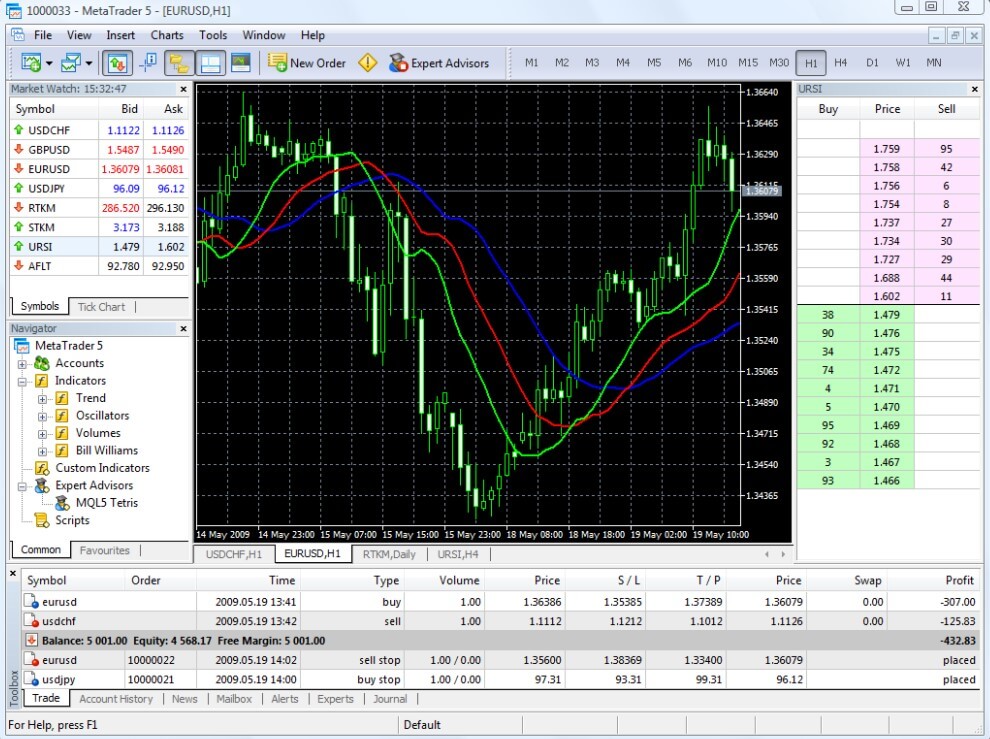

New Trader’s Guide to MetaTrader5

MetaTrader 5 was released back in 2010 as the successor to the hugely popular MetaTrader 4, it has gradually been gaining popularity and is not one of the most used trading platforms available. MetaTrader 5 is slowly being picked up by more and more trading brokers, the majority of which have a white-label version which […]

New Trader’s Guide to MetaTrader4

Many traders out there will be considering MetaTrader 4 as the go-to trading platform, one of the most reliable, flexible, and well-supported trading platforms available. If you have traded with a number of different brokers, you would have surely come across one supporting this platform. The platforms offered by brokers are often customized by the […]

Interactive Brokers Trader Workstation Review

Trader Workstation (TWS) is the flagship trading platform offered by Interactive Brokers, a US-based online trading leviathan. It has a lot of features to recommend it and also some drawbacks in various elements of its functionality. Trader Workstation by Interactive Brokers is a beast in many ways, but are all of them good? Continue reading […]

E*TRADE Trading Platform Review

01E*TRADE has earned a spot on just about every top 5 broker list you can find. The company’s simplistic website is upfront and transparent, outlining their various account types, investment choices, and pricing, along with some sections that were created for new investors. The website’s transparency is a good sign that traders won’t have to […]

Must-Have Forex Trading Platform Features

There are a lot of different trading platforms out there. Many brokers choose to work with popular options like MetaTrader 4 and/or 5, while several others provide their very own platforms. There are also paid commercial options out there that you can choose to use with certain brokers. Before choosing a forex broker, it is […]

NinjaTrader Trading Platform Review

NinjaTrader is a forex, futures, CFD, and equities supporting a trading platform that has been around since 2003. That’s just a couple of years before the ever-popular MetaTrader 4 was released, and 7 years before MT5 came around. If you’ve already begun trading forex, then you’ve likely heard of MT4 and/or MT5. While the aforementioned platforms are popular for many reasons, NinjaTrader does offer some of its own unique features and might deserve more credit with traders. Stay with us to find out what sets this platform apart and whether we’d recommend trading with it.

What is MetaTrader 5?

MetaTrader 5, also known as MT5 for short, was developed and released by MetaQuotes Software in 2010, it was designed as an upgrade to its younger brother MetaTrader 4. The software is now licensed out to a large number of foreign exchange brokers who then, in turn, provide the software to their clients. The client […]

What is MetaTrader 4?

MetaTrader 4, also known as MT4 for short, is one of the world’s leading and most popular electronic trading platforms. It was developed by MetaQuotes Software and first released to the public in 2005. The software is now licensed out to a large number of foreign exchange brokers who then, in turn, provide the software […]

Forex VideosSee all

Beginners – Analysis Feature of MT4 Helps You Fund A Trading Strategy!

https://youtu.be/ngitjajY_io

Forex Trading Algorithms Part 8 Elements Of Computer Languages For EA Design!

https://youtu.be/yZ0Pge3TguU

Forex Fear of Missing Out! (FOMO) Don’t Make This Basic Mistake!

https://youtu.be/H2wlrVrDo4M

Biden Shows His Cards – This Is How The Market Is Preparing To React!

https://youtu.be/IVvDckE_dRg

Market volatility continues into 2021, where next for Cable?

https://youtu.be/V1gF-10QUsw

Forex Trading Algorithms Part 7 Elements Of Computer Languages For EA Design!

https://youtu.be/xXkgQAvWnnI