It’s easy for beginner traders to become overwhelmed, which sadly leads many to give up on trading for good before ever really getting started. This can be avoided when beginners have access to simple, easy-to-follow strategies that aren’t overly technical or risky. Below, we will outline some of the best simple trading strategies for beginners:

- Trailing Stop/Stop Loss Combo Strategy

- Moving Average Crossover Strategy

- Breakout Trading Strategy

- A more detailed 50 Day Breakout Strategy

Trailing Stop/Stop Loss Combo Strategy

This strategy uses stop-loss orders and trailing stops, which ensure that the share will be sold at market price value if it dips to a certain level. Loss-limiting strategies are good for beginners because they can allow traders to get used to trading without risking a larger amount of capital. Trailing stops are also applied through this method to add to the efficiency of the stop loss.

Traders would combine trailing stop and stop loss together and set those limits based on their maximum risk tolerance. For example, you could set the stop loss at 2% below the current trade price and the trailing stop at 2.5% below the price. If the price increases, the trailing stop will surpass the fixed stop loss and render it obsolete. Note that it can be more difficult to use trailing stops with active trades, due to price fluctuations and volatility. You’ll need to study a stock for several days so that you can set a trailing stop value that will accommodate normal price fluctuations and only catch the true pullback of the price.

Moving Average Crossover Strategy

This strategy uses a simple moving average (SMA). SMA is a slower price indicator that looks at older data than what is used by most indicators. Usually, a longer SMA is combined with a shorter one. For example, a 25-day SMA might be combined with a 200-day SMA. Information can be compared on charts to indicate bullish or bearish trends and to provide buy or sell signals.

Moving averages are often used to indicate the overall trend and can be used in combination with a breakout strategy to help do away with signals that don’t match the trend indicated by the moving averages.

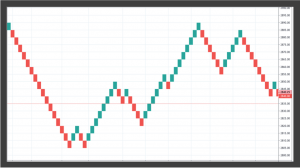

Breakout Trading Strategy

This strategy focuses strongly on trends in the market. Consolidation occurs when the market moves between bands of support and resistance. A breakout occurs when the market moves beyond the boundaries of the consolidation, either to new highs or new lows. A breakout must occur for a new trend to begin; therefore, breakouts are signals that a new trend has started.

Following this strategy is fairly straightforward, which is why we would recommend it to beginners. Of course, risk management is crucial for the strategy to work with limited losses. One of the Breakout strategy’s downsides is that not every breakout signals a new trend.

You’ll also need to get a feel for the type of trend you’re entering:

- A breakout beyond the highest high or the lowest low for a longer period suggests a longer trend.

- A breakout for a short period suggests a short-term trend.

Once you learn to identify trends more quickly, you’ll be able to react more quickly and ride the trend earlier in the curve, although this could lead traders to follow shorter-term trends.

The 50 Day Breakout Trading Strategy

This strategy evolves around momentum, meaning that when prices are moving strongly in one direction, it is likely that things will continue in this direction. Further movement in the direction of the trend is also considered to be far more likely than any movement against the trend.

When using the Breakout Strategy, traders should focus on the pairs EUR/USD and USD/JPY because these pairs have shown the best reliability through research. Traders will also want to use the Average True Range trading indicator. There are a few other key steps to accomplishment with this strategy:

- Monitor the daily chart for the entry signal. A new 50-day high signal that a long trade should be entered, while a low indicates that one should enter a short trade. The trade should be entered immediately once the signal is received.

- Traders should only risk a maximum of 0.25% of their account size per trade. Someone with $2,000 in their account would only risk $5 per trade, which makes this more beginner-friendly.

- Tighter stop losses will help to ensure greater profitability.

- Two days after the trade entry, move the stop loss to break even if the trade is still open. If the market price is worse than the stop loss, you should close the trade at market price.

- Use an exit strategy that is either based on time or using a trailing stop. Exiting after 8 days has shown the best profitability through research.

While some beginners may struggle with the exit strategy, you should remember that a time-based exit of around 5-8 days is profitable. This helps to avoid frustration with making mental judgments as well.