Introduction

XRP/USD is the abbreviation for Ripple against the US Dollar. This pair is used for trading the Ripple cryptocurrency. Also, traders can trade Ripple against other fiat currencies.

Understanding XRP/USD

The value of XRP/USD represents the value of the US Dollar equivalent to one Ripple. It is quoted as 1 XRP per X USD. For example, if the value of XRP/USD is 0.1912, then it can be said that each Ripple is worth 0.1912 US Dollars.

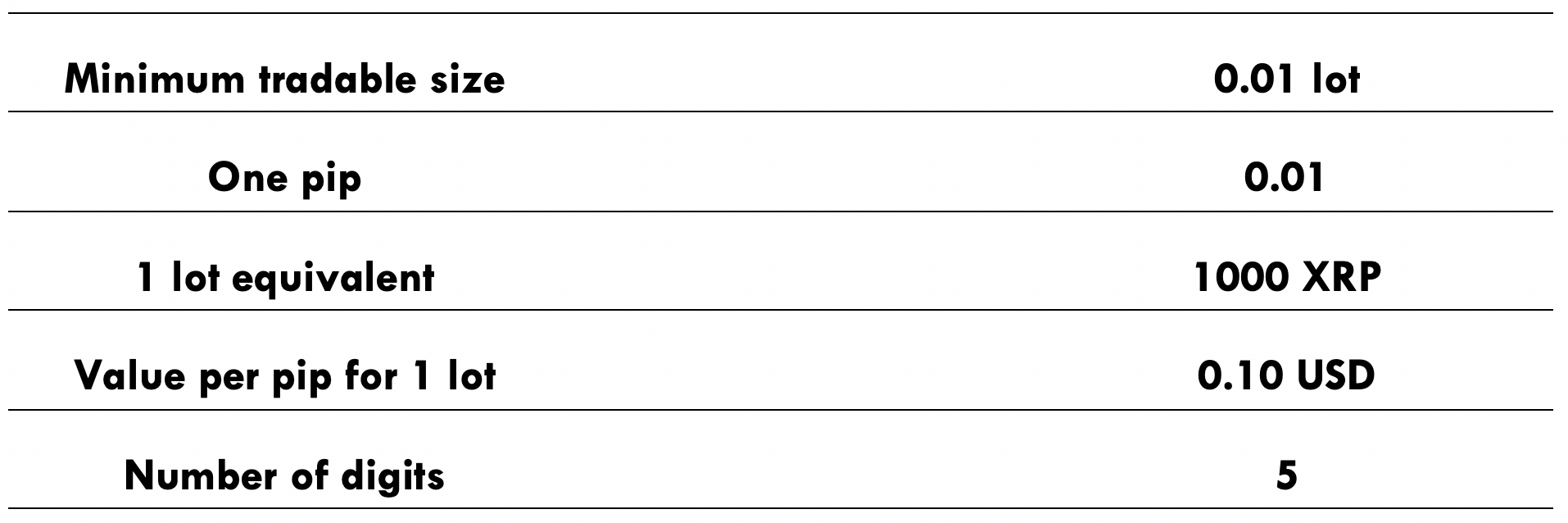

XRP/USD specifications

Spread

Spread is the difference between the bid and the ask price quoted by the brokers. It varies based on the execution model used. Below are the ECN & STP spreads for the XRP/USD pair.

Spread on ECN: 50 pips | Spread on STP: 53 pips

Fee

The fee is the commission that is levied by the brokers on each trade. This fee is only applicable to ECN brokers, not STP brokers.

Slippage

When orders are executed on the ‘market,’ the price requested by the trader is different from the price given by the broker. This can happen either because of high market volatility or broker’s execution speed

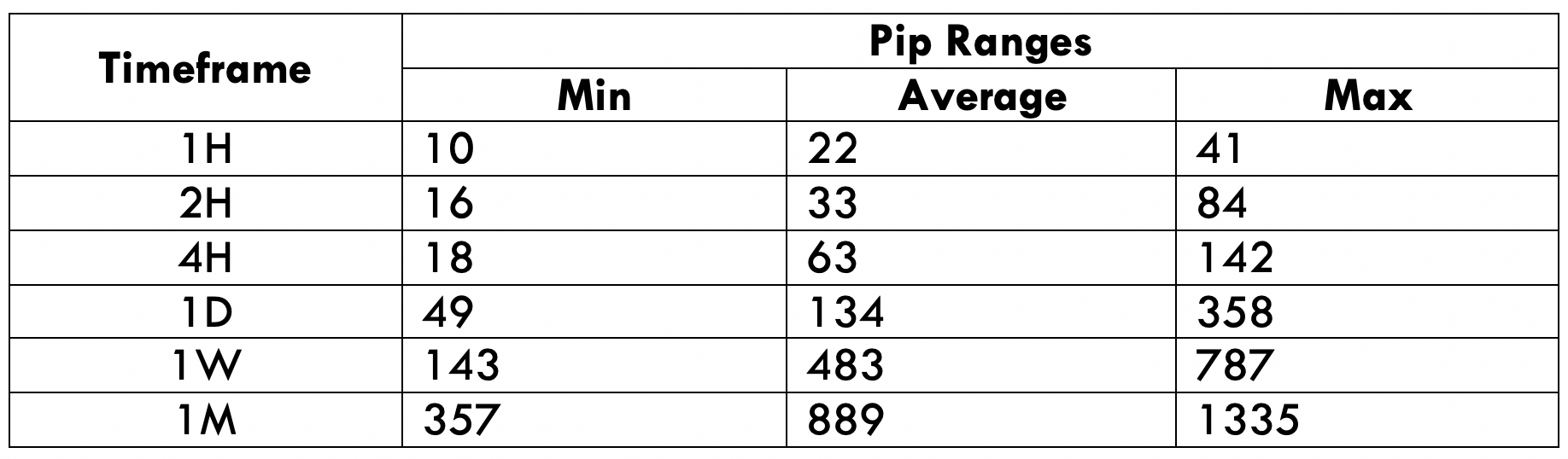

Trading Range in XRP/USD

The minimum, average, and maximum pip movement in XRP/USD are given below. One can use these values to determine the profit/loss they could make in a given timeframe.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

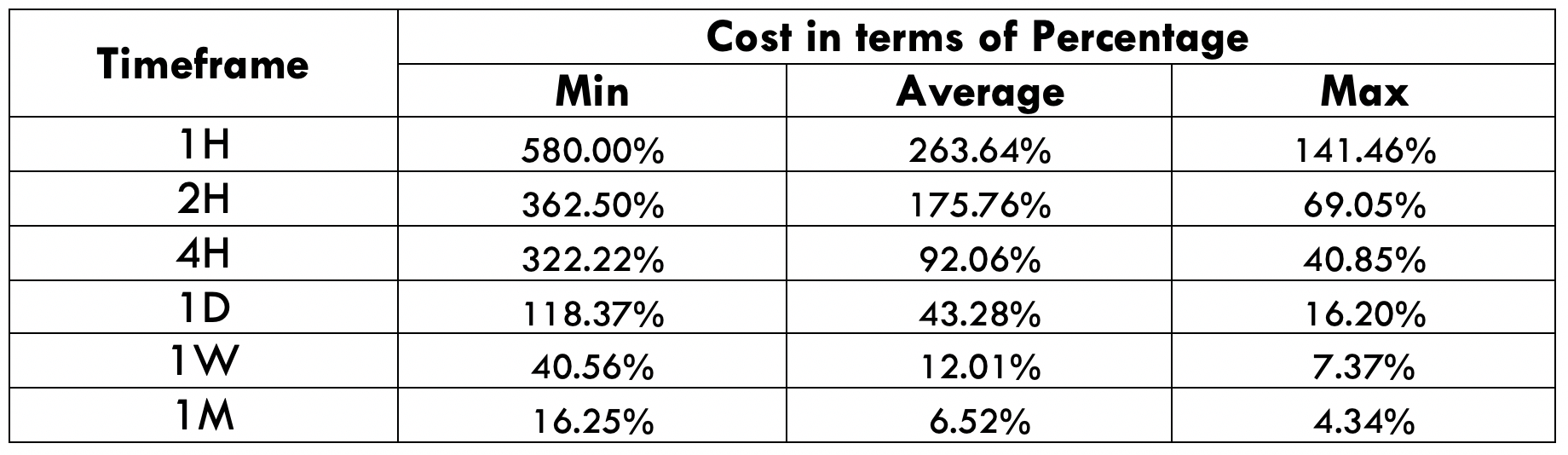

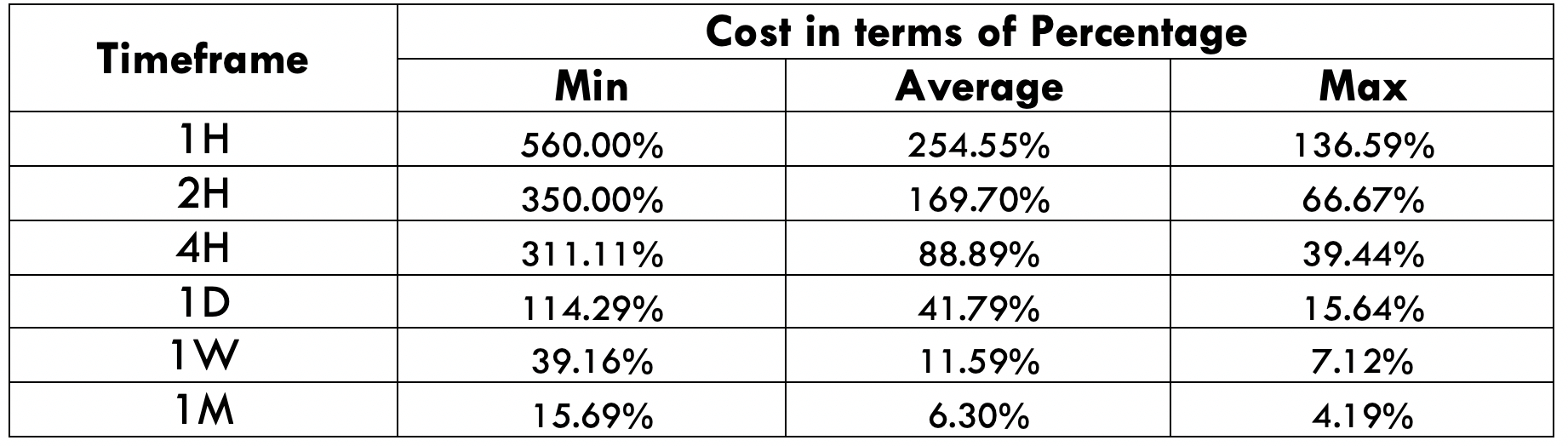

XRP/USD Cost as a Percent of the Trading Range

By applying the volatility values to the total cost of a trade, the variation in the costs for varying volatilities can be determined. Below are two tables representing the same.

ECN Model Account

Spread = 50 | Slippage = 3 |Trading fee = 5

Total cost = Slippage + Spread + Trading Fee = 3 + 50 + 5 = 58

STP Model Account

Spread = 53 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 53 + 0 = 56

Trading the XRP/USD

While trading a pair, there are two factors that must be taken into consideration, namely, volatility and cost.

Volatility

The minimum in the 4H timeframe is 18 pips, while 142 pips are the maximum. And the average stands at 63. So, if a trader wishes to trade the 4H timeframe, then they should make sure that the current volatility is at or above the average volatility. This is because one can make money only when there is movement in the market.

Cost

Cost is not constant but varies as the volatility changes. The cost percentages in the minimum column are the highest compared to the average and maximum columns. This means that the costs are very high for highly volatile markets. Hence, it must be avoided.

The benefit with limit orders

Traders who trade with limit orders have an added benefit than those who trade with market orders. With limit orders, the total cost of the trade does not include the slippage. This hence brings down the cost of the trade to a decent extent.

This concludes the analysis of BCH/USD. We hope you found it interesting and useful. Stay tuned for more such asset analysis. Cheers!