Some beginner traders may not have even heard or dealt with the US dollar Index, but the more invested traders are highly likely to have encountered the term on some media outlet. The US dollar Index, otherwise known under the abbreviations DXY or USDX, can be charted on MT4 on a variety of trading platforms. From the perspective of the forex market, the DXY is often said to be representative of the strength of the United States dollar (USD) due to the fact that it stands against other major currencies.

While traders are still unable to carry out trades on the DXY in the United States, the index is freely traded outside the borders of the country and across the world. Despite the availability of conducting related trades, some prop traders suggest that the ATR might be just too low for it to be a lucrative business endeavor. What is more, those who have extensive experience trading in the forex market claim that any involvement with the DXY may in fact have quite a negative impact on the overall trading of currencies, which may naturally vary from trader to trader.

Nonetheless, besides the difficulties encountered while trading this index, the DXY is still both interesting and important to discuss, especially in terms of the changes that have happened in the past and the ones that have yet to happen. In this article, we will delve deeper into this index implication in forex trading.

The DXY’s history commenced in 1973 when the United States left the gold standard, which further meant that the USD was no longer backed by an equivalent quantity of precious commodities. At the same time, the before-used gold- and silver-stamped banknotes could no longer be exchanged for the corresponding amount of gold and silver. The creation of this index therefore coincided with some key moments in the overall history of the country and its official currency. The value of paper money suddenly decreased and this led to an increase in frustration and fear in a number of people who started to spread concern for future ability to assess the USD’s worth. The idea of making an index directly stemmed from this need and hope that the currency’s value could be determined by comparing it to other world currencies.

Consequently, the currency basket was created and its value, set at 100, depended on the amount of trade carried out with other countries. As stated above, the necessity behind the formation of the DXY essentially originated from the USD no longer being tied to any hard commodities. Today, however, the value of the index changed substantially, especially because the currencies across the world changed and disappeared with time. A great number of the US trades were done with European countries and, as we know, a number of currencies in this continent were merged into the euro (e.g. the Deutsche mark, the French franc, the Italian lira, and the Greek drachma). The spread and the percentage hence changed dramatically and this naturally affected the DXY, which raised concern among the trading community.

Some of the biggest challenges experts claim to have faced in the past is related to the fact that the DXY is generally not calculated by factoring in all the currencies in the world as it was originally conceptualized. While the world and its currencies kept changing, it appears that the rules governing the value of the USD and this index still remained the same. This idea is particularly interesting because the DXY is, as opposed to the common belief, currently determined on the basis of the exchange rates of six world currencies – the Euro (EUR), Japanese yen (JPY), Canadian dollar (CAD), British pound (GBP), Swedish krona (SEK), and Swiss franc (CHF), with the EUR as its greatest component. Based on this information, it is abundantly clear that the ratio does not originate from even distribution across all seven majors, excluding the AUD and the NZD. What is more, the index is heavily reliant on the USD/EUR currency pair, which makes above 50% of the DXY’S value. The weight is then shared between the currencies in the following manner: the EUR: 57.6%, the JPY: 13.6%, the GBP: 11.9%, the CAD: 9.1%, the SEK: 4.2%, and the CHF: 3.6%. Therefore, traders interested in the AUD, NZD, and CNY will likely find little benefit from the USDX.

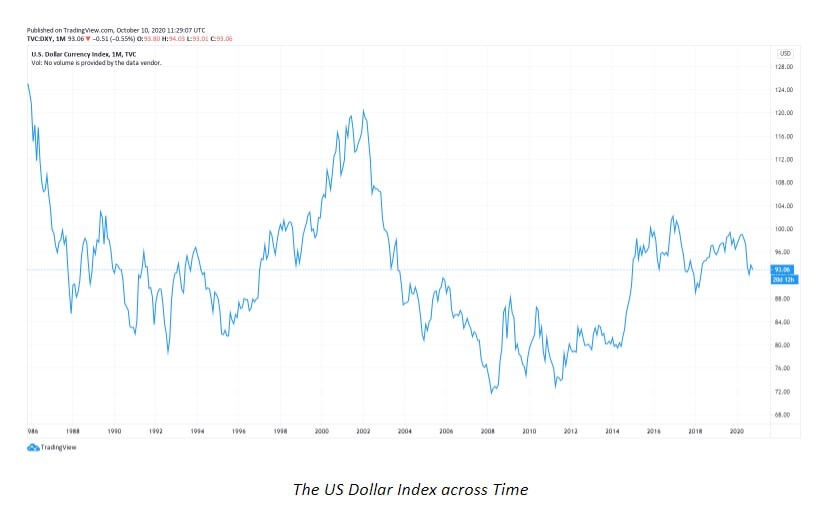

The value which was initially set at 100 would change considerably with time, as you can see from the image below. The DXY would in certain periods appreciate to 120, which only meant that the USD also increased by 20%. At some other points, we can see that the USD depreciated quite a bit, and it is also clear that, as the graph below demonstrates, the current value of the index is standing at just above 90. The mid-80s recorded an all-time high with the unbelievable value of approximately 160, while the lowest point was measured in the midst of the financial crisis in 2007/2008. Interestingly enough, some other events would often affect and propel these drastic shifts, such as the Latin-American crisis that caused the USD’s increase in the 80s. The financial crisis in the US when the USD was quite weak, for example, immediately pushed the oil and gas prices due to the well-known connection between the USD and the price of commodities. The USD was extremely weak and unfavorable at the time and other countries seemed to be booming to the extent that, as some may even remember, the US cab drivers or models desired to be paid in the EUR rather than their homeland currency.

Currency trading is also vastly different from trading stocks owing to the fact that, due to the increase in population and inflation, the stocks inevitably go up in value. This bullish bias however does not exist in the world of currencies, and the DXY directly epitomizes the previously stated difference – although the index was initially set at 100, today it is below its starting point. This (roughly speaking) 7% discrepancy, if compared or 1973, clearly demonstrates how the currency market need not and does not follow the standards or trends of the equities market. Needless to say, trends are also an inherent part of the forex market as well, and traders desire to see the USD increase in value too, yet from the long-term perspective, the value of the USD remains more or less the same as it did several decades ago. Trading currencies is, hence, truly unbiased, unlike stocks.

Also, individuals interested in getting a quote on the USD can for example search for the Dow Jones index, which is based on approximately 30 stocks. Interestingly enough, as stocks are not true objects but prices, people can neither buy them nor always easily find quotes for such matters. Despite the indices/indexes being numerous, some may be increasingly more difficult to find quotes on. Furthermore, since the US regulations forbid trading the DXY in the country, traders can resort to some other legal options that function as an alternative to trading the US dollar index. Some of the common financial derivatives used to trade the US dollar index include the CFDs, futures, and options.

CFD, or contract for difference, is one of the commonly used ways to trade indices, allowing those eager to trade the DXY to profit from price movements. Unlike other trades, the CFD trades typically involve much greater risk, as the price can easily go below zero and even farther, taking down traders’ accounts along with them. As CFDs contain leverage, traders do need to invest in trading psychology and money management skills to be able to weigh out their options and limit the chances of destroying their accounts. Those experienced in trading stocks and indices should also bear in mind that trading CFDs is unique and it is absolutely essential to study and demo trade them thoroughly. Other means of trading the DXY include futures contracts, which serve as a way for companies to offset risk and protect themselves from any future currency exchange rate changes or interest rate changes.

As we discussed above, traders may find it hard to find certain quotes although there are some indices, such as the S&P 500 for example, which are quite easy to access. If you are interested in the DXY, which is essentially a basket or a number derived from other values, you would need to insert the dollar sign before a quote, which signifies that it is an index. Therefore, anyone requesting a Dow Jones industrial average quote would need to put in the dollar sign and INDU. Websites are becoming more and more user friendly, and are becoming easier and easier to use even with respect to the insertion of adequate abbreviations. Real-time quotes are still harder to find in comparison to the delayed ones where interested parties may even need to pay some money.

The DXY is also available as an ETF (Exchange Traded Fund) on the ICE exchange. ETFs track indices, dividing it into shares. In addition, ETFs function similarly to stocks, they do not have a net asset value, and their value fluctuates during the day owing to traders buying and selling activity. Although ETFs resemble stocks, they are not tangible objects but numbers. If a trader is searching for a real-time quote on the USD, he/she can use UUP, a symbol for an ETF, as a substitute for the USD. As a derivative of the DXY, it mimics its behavior, so if one goes up, the other one will follow. The ones interested in stocks who cannot find the S&P 500 index can also use the ETF index under the name of Spiders whose symbol is the in SPY (SPDR), whose movement resembles the S&P 500 as well. Therefore, if traders are looking to buy the DXY, they should know that it is practically impossible because it is an index.

Traders can, however, buy the UUP, which is considered a stock or they can look into futures with regard to index as well. Moreover, those who do not wish to get involved with the UUP can still trade the DXY but would need to do so through its derivatives or futures. This may not be particularly sensible to forex traders, but if any individual feels interested in these trades, they should know that they are in fact buying the percentages of the trades between the USD and other currencies we discussed above.

What is also important to discuss is the changes that have occurred in the past and the ones we are expecting to see in the near future. Firstly, the year of the creation of the DXY is approximately half a century away from the present and the world has changed tremendously since then. We no longer have the currency basked as wide as before, for example, and the concentration is now found in one single currency (the EUR), which everyone finds to be the greatest flaw of the DXY. In addition, trading has completely changed between the US and some companies and countries such as China, Mexico, Brazil, and South Korea. The upcoming changes are still being discussed, especially during times of price dislocation. In 2007, this topic was quite prominent when the DXY was at its lowest, and it appears that the need for change always comes up when there is some distress with the price of the USD.

The DXY is hence quite likely to experience some changes in the future, yet this still should not affect forex traders. The USD is unlikely to change and this only concerns the USD against other currencies. The only value of the DXY is, therefore, found in its ability to reveal its overall performance. In terms of the USD’s general performance, we can easily look into the DXY, but we still lack other similar indices. We still lack a JPY index against the USD, the EUR, the GBP, and other currencies for example. These indices offer a great insight into these baskets which could be utilized to discover the strongest currency. That way we could tell which one is the fastest or which the worst one is, but despite the existing interest, this idea has still not been materialized for some reason.

Although many complain about the uneven distribution of currency percentages of which the DXY is comprised, experienced traders even claim to have tried a number of different approaches and methods to get on top only to realize that, no matter what technical analysis they applied, there found absolutely no gain from struggling with the DXY. For example, although they paid close attention to the type of signals they would receive while choosing which USD trades to trade, they still discovered that too much energy and focus was taken away from making some other profitable trades. That way, those who attempted to make any use of the DXY found that their essential principles of trading were compromised, as they started to pass on good opportunities.

Losses may happen anytime, especially since they are an inherent characteristic of the forex market, but missing out on great opportunities to build one’s account and financial stability are generally considered one of the greatest faux pas in the market. Hence, if any trader is already invested in breaking down the strategy on how to employ the DXY in the best way possible, he/she should also strive to eliminate chances of overseeing prospects of winning. If your involvement with the DXY is taking too much of your time and attention, you should ask yourself if it is worth the effort. Simply put, the claims for changes are many and it is abundantly clear that traders are eager to see an evenly weighted USD Index and the creation of similar indices for other currencies as well.

Still, if you feel that your trading account is currently suffering because of your involvement with the DXY, it may be wise to wait for more prolific times and shift to more lucrative opportunities that the forex market is abundantly offering. If you are eager to keep exploring the DXY and what it can offer in trading, make sure that you invest as much as possible in learning about the different substitutes to standard trading which are legal in the US, employing money and risk management skills.