ReddCoin (RDD)

Market Cap: $195.44M

Circulating Supply: 28.81B RDD

Max Supply: 0 RDD

Volume (24h) $3.62M

RDD/USD = 0.006804

Technical Analysis

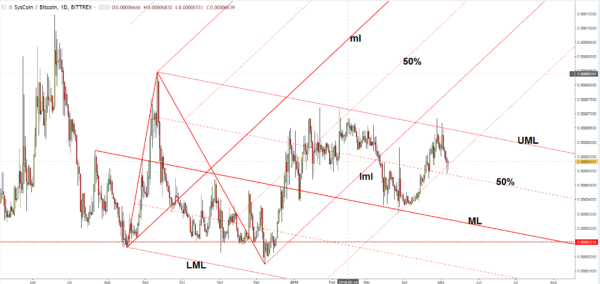

RDD/BTC rallies right now and resumed yesterday’s bullish candle. The rate approaches a very strong dynamic resistance, so it remains to see how it will react. A valid breakout will confirm a further increase in the short term. The rate has shown some oversold signs after the failure to make new lows. It seems that the behaviour has changed, but we still need a confirmation that the rate will increase further.

As you already know, it is very important for the major crypto to increase, and maybe we’ll have an important increase with this pair as well. The last drop was expected and it was natural after another failure to reach and retest the median line (ML) of the sideways pitchfork.

RDD/BTC has found strong support right above the 0.00000076 level and above the 61.8% retracement level. The failure to drop towards the 76.4% level and towards the LML of the sideways pitchfork has attracted the buyers again.

It has also failed to reach the median line (ml) of the minor descending pitchfork signalling a breakout from the descending pitchfork’s body. A valid breakout above the upper median line (uml) should send the rate towards the median line (ML) again.

Conclusion

We can go long after a valid breakout above the upper median line (uml). The first target it will be at the warning line (wl1) and at the ML of the sideways pitchfork. The Stop Loss can be placed below the 0.00000076 level.