EUR/USD Exogenous Analysis

In the exogenous analysis, we’ll analyze the economic fundamentals that impact the Euro-US Dollar exchange rate. For this analysis, we’ll focus on:

- Differences in GDP growth rate

- Trade balance difference

- Interest rate differential

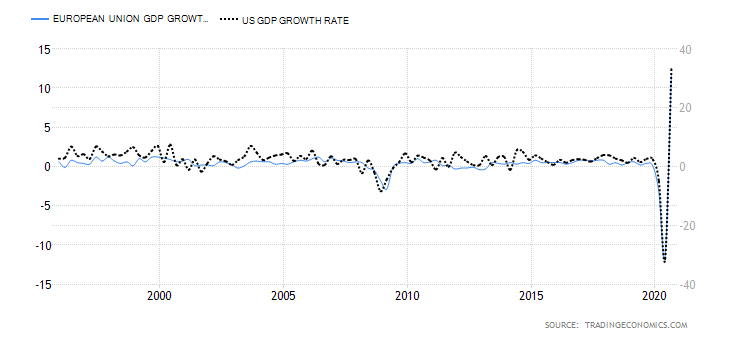

EU and the US GDP Growth Difference

The primary drivers of GDP growth in an economy are domestic demand and international trade. When a country’s exports increase, it means that the demand for its currency also increases, which makes it appreciate.

The US and the EU GDP change are in tandem. In Q3 of 2020, the EU GDP expanded by 11.6%, while that of the US expanded at an annualized rate of 33.1%. Although this change seems much, the US GDP level is still about 3.5% lower than the pre-coronavirus pandemic levels.

Based on the correlation analysis of the GDP differential and the EUR/USD pair changes, we assign a deflationary score of -2. It implies that the difference in GDP growth between the EU and the US will lead to a bearish EUR/USD.

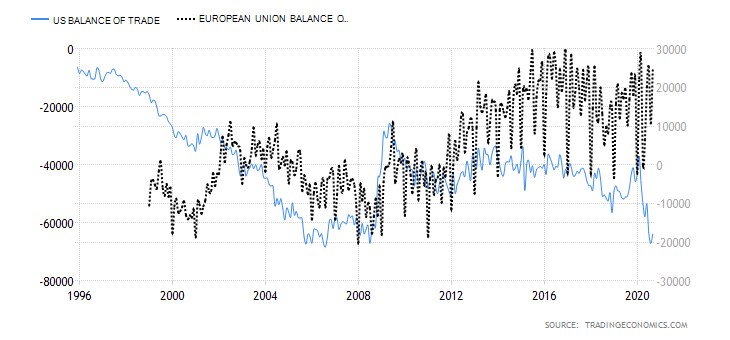

Trade Balance Difference

For each country, the trade balance shows if an economy is running on deficits in international trade. The trade balance is simply the difference between exports and imports. Surplus trade balance happens when an economy exports more than it imports. A negative trade balance means an economy is importing more than it exports.

The EU recorded a trade surplus of €24489.40 million in September 2020, while the US had a $63.9 billion trade deficit in the same period. The trade balance has a high correlation with the exchange rate of the EUR/USD pair. Therefore, we assign it an inflationary score of 7, meaning we expect a widening trade balance between the EU and the US to result in bullish EUR/USD.

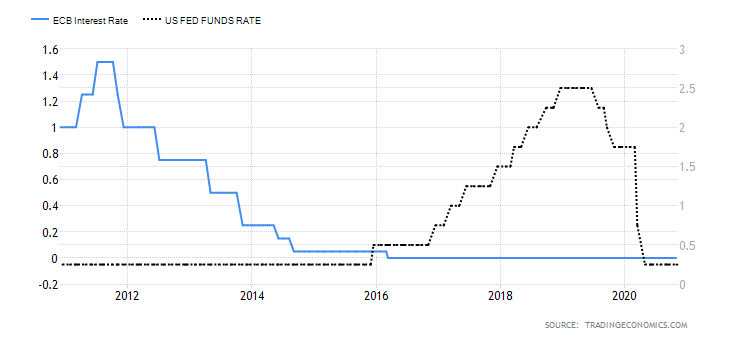

EU and US Interest Rate Differential

This indicator measures the difference between the interest rates in the EU and that in the US. The economy with a higher interest rate will attract more investments from foreigners seeking higher returns.

In the US, the Federal Reserve has kept the interest rate within a range of 0% – 0.25%. In the EU, the ECB interest rate is 0%. Since the interest rate differential between the two economies is low, we do not expect it to impact the EUR/USD exchange rate. Therefore, we assign a deflationary score of -1. That means we expect it to result in a mild bearish trend for the EUR/USD pair.

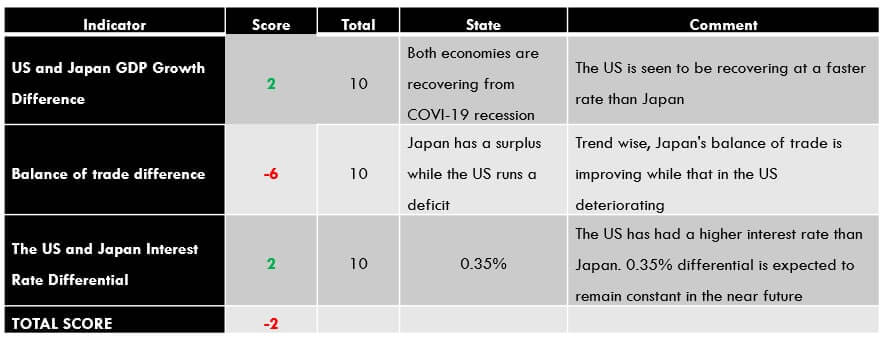

Conclusion

The exogenous analysis of the EUR/USD fundamentals gives an inflationary score of 4. This implies that in 2020, the EUR/USD pair has had a bullish trend. In the short term, this bullish trend is expected to persist.

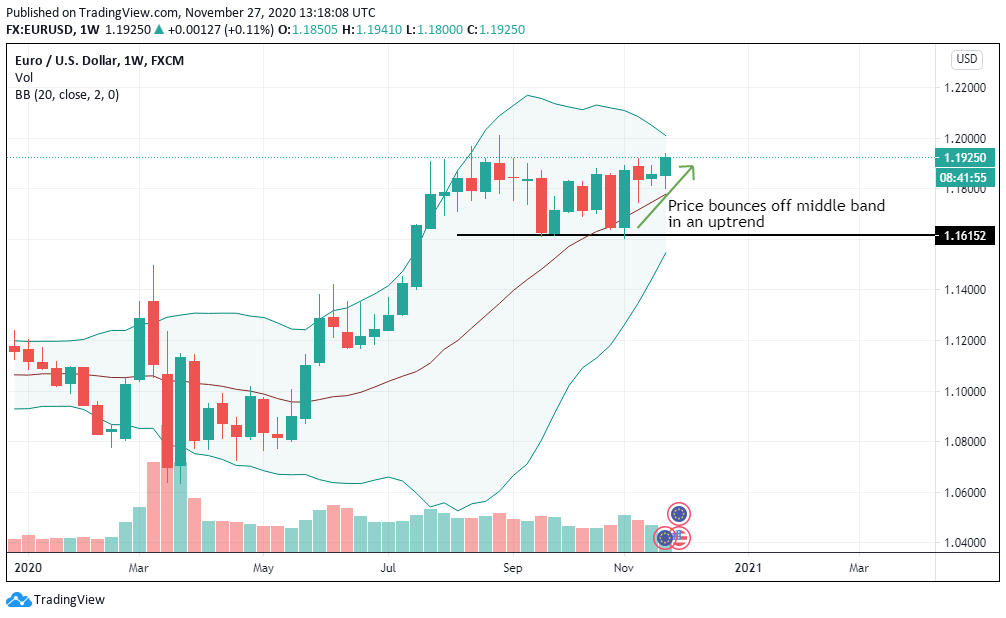

Note that the EUR/USD pair has formed a support level along with the middle Bollinger band. Therefore we can say that our Fundamental analysis is being supported by our Technical Analysis as well. Cheers!