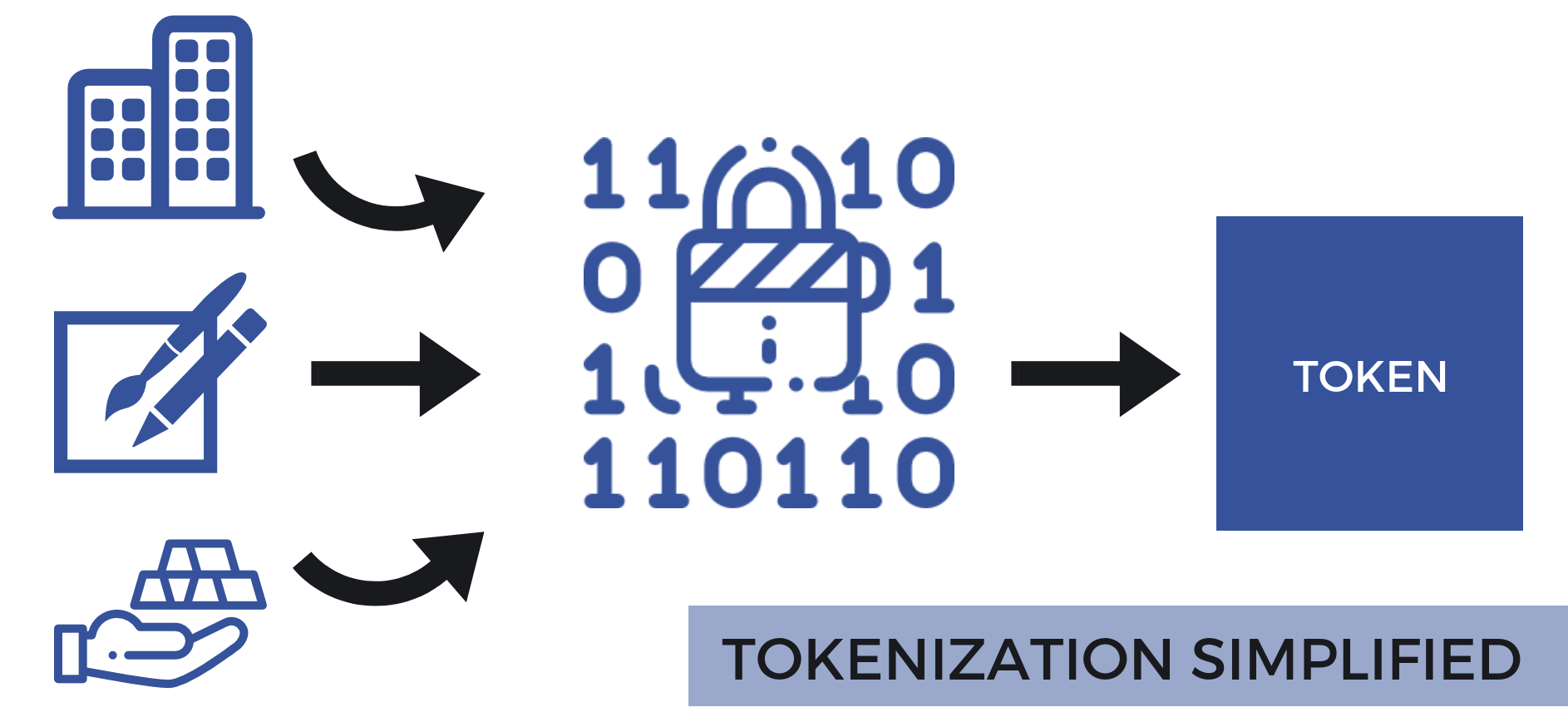

Thanks to blockchain, asset tokenization is now a possibility. This is the process of converting the ownership rights of real-world assets into digital rights on the blockchain. Assets are tokenized to improve their market liquidity, and also to open up your asset to a global market through the power of blockchain.

Several tokenization platforms are scrambling for the spotlight in a bid to become the go-to place for tokenizing assets. Let’s look at some that are hacking the game right now.

#1. Securrency

Founded in 2015 and headquartered in the US, Securrency is a one-stop token issuance platform. It supports token issuing, post-issuance support, and the interoperability of tokens across several blockchain networks.

The platform also came up with the CAT-20 and CAT-721 token standards. Tokens created with this standard can be transferred across blockchain networks (including Stellar, EOS, and Ethereum) and legacy financial systems. This interoperability with several blockchain platforms gives it an edge over other platforms that are only compatible with Ethereum.

Securrency has also embedded customer management applications that customers can utilize to manage investors and token buyers without having to rely on external applications.

The platform has entered into partnerships with fintech companies SharesPost, AX Trading, Entoro, Vertalo, OpenFinance, and SeriesOne.

#2. Securitize

Securitize is a token issuance platform founded in 2017 and based in Tel Aviv. The company raised $12.75 million from Blockchain Capital, Coinbase Ventures, Xpring (Ripple), NXTP, and Global Brain Corporation. Securitize has also partnered with fintech companies Tzero, Blocktrade, OpenFinance, Airswap, ShareSpost, Hyperion, and Bnk to the Future. The platform offers the tokenization of equity, funds, and real estate, and plans to add debt in the future.

The company created the DS Protocol, which generates “DS tokens” that can run on top of the ERC-20 token standard. This means the tokens are only compatible with Ethereum. There’s no mention of compatibility with other blockchain networks.

Securitize tokens can be traded on crypto exchanges as well as be hosted on clientele systems. The platform has a record registry that supports KYC details, a regulations compliance layer, and a communication protocol that notifies investors of industry trends.

Some of Securitize’s clients have been Blockchain Capital, SpiceVC, Augmate, 22x Fund, and Science Blockchain.

#3. TokenSoft

TokenSoft is another trusted token issuance platform that features a ton of functionalities. It’s been funded by investors such as eVentures, Base10, Coinbase Ventures, and Fidelity Ventures. The company has partnered with several other platforms, both in blockchain and fintech, such as OpenFinance, Stellar, Hyperledger, R3 Corda, and Tierion, to enhance its service delivery capabilities to customers.

Services offered include token issuance and distribution, payment of dividends, trading of issued tokens, post-token issuance support, and digital asset custody solutions.

TokenSoft developed the ERC-104 standard that enables token issuers to manage investor whitelists and investor limits, and issue tokens globally. Some of the clients that have used TokenSoft for token issuance include Andra Capital, Hedera Hashgraph, and the Tezos Foundation.

#5. Polymath

Polymath is a security token issuance platform based out of Toronto and founded in 2017. The platform has partnered with various industry players in finance, legal, custody, and escrow such as SelfKey, IdentityMind, OpenFinance, Pegasus Fintech, Vertalo, Blocktrade, Prime Trust, Monarch Wallet, Netcoins, Genesis Block, Tokenizo, Athena Blockchain, Blocktrade, Prime Trust, Glyph, Cassels Brock, Aird & Berlis, and Messner Reeves LLP to provide the highest level of customer experience to users.

Polymath features a token marketplace, a token studio for token creation and issuance, and token compatibility with the Ethereum network. On the Polymath Token Studio, token issuers can customize and launch their own security token offering (STOs), and still be able to select a Know Your Customer (KYC) and anti-money laundering (AML) service provider of their choice.

Examples of companies that have issued security tokens via Polymath include Corl, 7PASS, MintHealth, IPwe, and BlockEstate.

#6. Harbor

Founded in 2017, Harbor is a tokenization platform based in San Francisco. The company is led by individuals with a ton of experience, including former PayPal COO David Sacks, who is also the founder of Yammer, Craft Ventures, and Zenefits. The company managed to raise over $38 million from VC firms Founders Fund, Pantera Capital, Fifth Wall, Kindred Spirits, Andreessen Horowitz, Valor Capital Ventures, Future Perfect, and more.

Through integration with BitGo, Harbor facilitates investor onboarding through KYC/AML procedures, accreditation, tax forms, e.t.c.

Harbor supports an ERC-20 token known as R-Token that ensures supported ERC-20 wallets or exchanges are compatible with the necessary requirements for trading. It also uses an Oracle feature to act as the go-between for peer-to-peer token transfers and exchanges.

#7. Swarm

Swarm is an ”open infrastructure for digital securities.” The company has partnered with several companies such as OpenFinance, Maker, Tron, Security Token Network, Jaxx, Mercury, Copper, MVP Workshop, Monarch, Standard Consensus, Glyph, Blockpass and STOCheck to avail the best services to clients and other platform users.

It uses the SEC20 protocol that facilitates the creation and issuance of security tokens. Swarm allows users to tokenize all manner of assets, including real estate, renewable energy, agriculture, tech companies, cryptocurrency hedge funds, and so on. Swarm makes it easy to manage, transfer, and trade tokens.

Other supported functions include STO fundraising and post-issuance and support such as token redemption and the issuing of dividends to clients. Swarm features the Market Access Protocol (MAP), a protocol that supports token interoperability between various players, including issuers, investors, exchanges, and qualification providers.

Swarm allows users to purchase security tokens with either of several supported cryptocurrencies, which include a native token called Swarm (SWM), BTC, ETH, BNB, DAI, MKR, XLM, XRP, TRX, ADA and DASH.

#8. Tokeny

Tokeny is a Europe-based tokenization platform founded in 2017. The company serves over 180 jurisdictions and has had $27 billion worth of assets tokenized so far.

Tokeny allows for the issuance, management, and transfer of tokens. Properties such as individual, company and government assets, business equity, investment funds, and even goods and services can all be tokenized on the platform.

The platform features a cloud-based T-REX (Tokens for Regulated Exchanges) that allows investors to manage securitized assets such as by paying and receiving dividends and carrying out audits. T-REX also offers interoperability with crypto wallets, exchanges, and identity providers. It also allows clients to issue and transfer assets globally.

Some of Tokeny’s past clients include Black Manta, Property Token, Lition, Bakari, Mash, Vivo Play, Key Pasco, Neovate, Block Port, and b40Lux.