Many traders will agree with me that one of the most difficult things in Forex trading is the placement of Stop Loss and the levels of take-off. Much of the educational material for learning foreign exchange is focused on how to find the right spot to place an operation.

While it is true that the entry point is very important, the management of a good trade -that is, the good use of the Stop Loss and the levels of profit taking, changing these levels appropriately as the operation progresses- is equally important. It is quite possible that, even if you get the tickets right, you will lose money in general. Assuming you have a good entry strategy, how can you exploit it to the fullest? Is there a better or more dynamic methodology than just placing a Stop Loss and profit-taking levels and forgetting? There is, although this may be a challenge as the “place and forget” methods are psychologically easier to implement.

This is as important as the analysis one would make before opening a position. In this article, we present a brief guide on how to make the placement of the Stop Loss and the levels of making profits.

Stop Loss (SL) or stops is defined as an order you say or send to your Broker telling you to limit losses in an open position (or trade). Taking profit (TP) or target price is an order you say or send to your Broker, informing you to close your position or trade when the price reaches a specified price level on the profit. The right place for the Stop Loss and the profit-taking levels are of a static nature. In other words, orders are activated (and their operation is closed) when a security value reaches a specified price level.

Dynamic Stop Loss

It is a good idea to never operate without a hard Stop Loss, for example, that is properly registered on your broker’s platform for execution unless very small position sizes. This is an essential point for controlling risk in Forex operations. Imagine the Trade without a shutdown, which could potentially drain your entire capital. Similarly, imagine that you don’t trade without a target price, which basically exposes your entire account’s equity to market fluctuations.

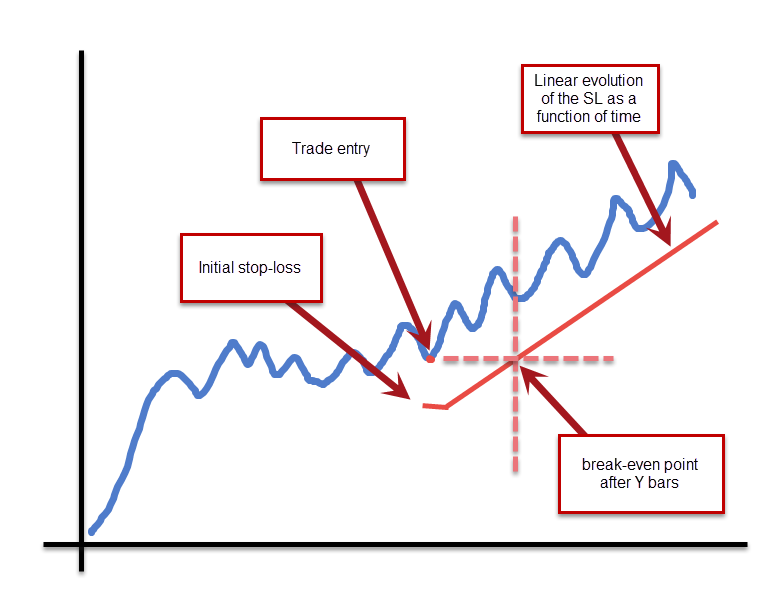

The Stop Loss can be dynamic, as a way to ensure profits in a transaction that progresses in a profitable way. However, the Stop Loss should be moved only in the direction of reducing losses or blocking profits. This way, a trade with good performance will end up giving benefits. This is of course an excellent way to leave an operation ends with a “natural death,” rather than aiming for profit goals that can be very difficult to predict.

The Stop Loss can be dynamic, as a way to ensure profits in a transaction that progresses in a profitable way. However, the Stop Loss should be moved only in the direction of reducing losses or blocking profits. This way, a trade with good performance will end up giving benefits. This is of course an excellent way to leave an operation ends with a “natural death,” rather than aiming for profit goals that can be very difficult to predict.

An example of a dynamic stop loss is the Trailing Stop. This can be placed on a certain number of pips or based on the average measure of volatility. This last option is the best. Another example would be to move the Stop Loss level periodically so that it is ahead of the main maximum or minimum or other technical indications. The advantage of this is that the operation is kept alive as long as it performs well. When a long operation begins to break through the key support levels, then this type of Stop Loss is hit and ends the operation. This method is a way to let the winners run and stop the losers in their tracks.

Dynamic Profit Taking (Take Profit)

First of all, it is worth asking why you should use Take Profit in Forex. Many traders usually use them instead of moving the Stop Loss and letting the operation end up that way, for the sole reason that the latter method means they always give up a little floating profit. But why cut a short winner? You might think that the price will be directed only at X level but, what if it actually goes ahead? If you list your last hundred operations, I will almost guarantee that you will see that the use of some kind of Stop Mapping would have generated more profits than even your wisest Take Profit command application. Of course, if your style of negotiation is very short-term, profit-taking orders make more sense. However, if you let winning operations run for days, weeks, or even months, then taking profit really does nothing but exacerbate your fear and greed.

There is a possible compromise. You may want to use dynamic pickups set in locations relatively far from the current price, which could be reached by, for example, a sudden news spike. This could get you some nice benefit at the peak, and allow you to re-enter at a better price when the turbulence passes. This is the most suitable use of Hard Take Profit commands within “non-scalping” negotiating styles.

There is a possible compromise. You may want to use dynamic pickups set in locations relatively far from the current price, which could be reached by, for example, a sudden news spike. This could get you some nice benefit at the peak, and allow you to re-enter at a better price when the turbulence passes. This is the most suitable use of Hard Take Profit commands within “non-scalping” negotiating styles.

You can also use the soft profit taking levels if you manage to see the price make a good end long candle. Such candles can often be good points for quick departures and reentry as described above. Note, however, that this tactic requires real skill and experience to be used in Forex markets, being a dangerous path for novice traders.

The Trading of Darwin

Charles Darwin’s theory of evolution suggests that the fittest elements within a species are more likely to survive. We can all see this when we plant plants in a garden. Usually, the baby plants that look stronger and taller are the ones that eventually become the best specimens. Skilled gardeners will remove diseased and weak plants and leave the strong ones to grow and harvest when they begin to die. Profitable forex trading is known as “Darwin trading” can be achieved in exactly the same way, by using a combination of soft and dynamic stop loss plus take-profit orders to effect pruning and harvesting, cutting down losers, and letting the winners keep running. A Stop Loss that results in profits can be called a take-profit order when you think about it.

Case Study

In Darwinist operations, the strongest operations survive, and the weakest artists are sacrificed. We can show how you can improve results using “Darwin trading” techniques using the last three years of the EUR/USD currency pair as a case study.

Long operations began when a fast exponential moving average crossed a slow simple moving average in the hourly graph, considering that all the higher time frames were also aligned (up to and including the weekly time period). An initial hard Stop Loss equal to the 20-day Average True Range was used.

The results of the tests were very positive: of a total of 573 operations, 53.40% reached a profit equal to the hard stop loss and 25.65% reached a profit equal to five times the hard stop loss, before arriving at the hard stop loss. These results clearly show why it is much more profitable to let the winning operations run.

Now, let’s analyze the number of operations that showed benefit 2 hours after entry. Only 48.31 percent of operations fit this category. However, if you look at all the operations that finally hit five times the hard stop loss, you see that 57.44% of these operations made a profit 2 hours after the entry. Five times the average real range is well beyond the average two-hour volatility, so there is an impulse factor.