General Overview

Daily Crypto News Updates

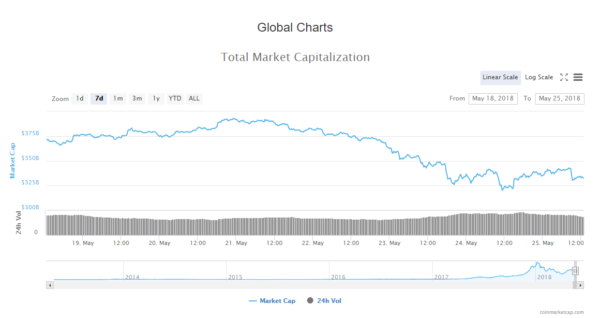

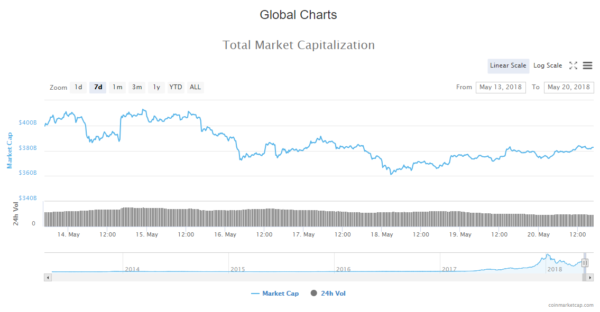

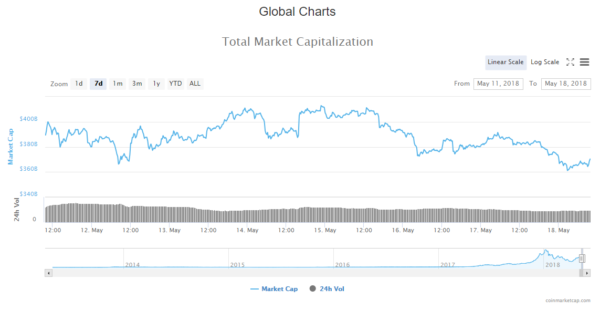

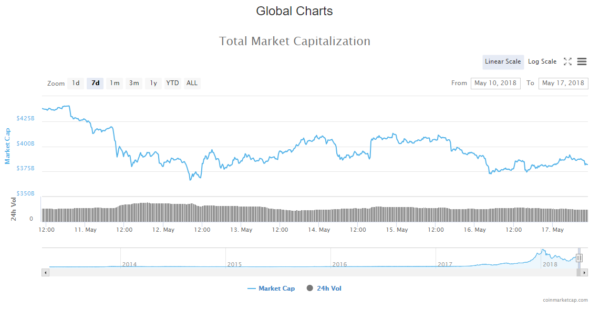

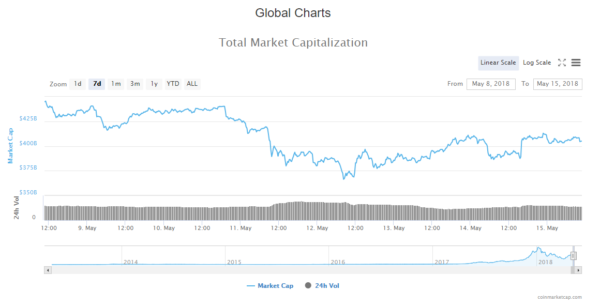

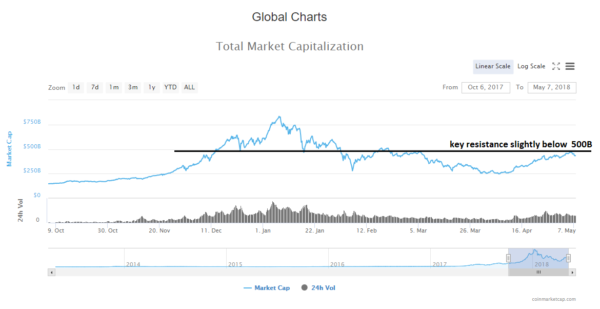

Market Cap: $334,350,848,700

24h Vol: $18,412,644,843

BTC Dominance: 38.2%

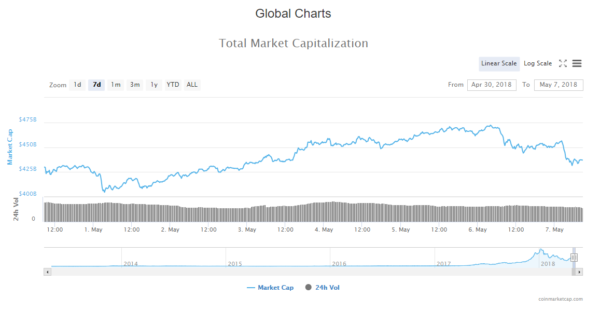

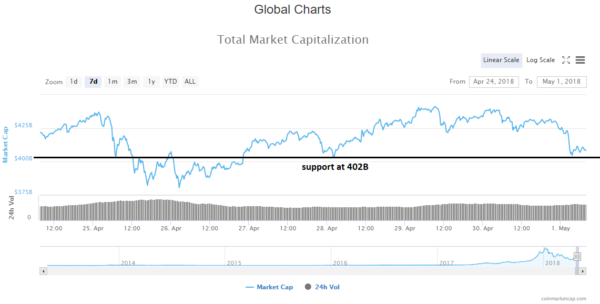

In the last 24 hours, market capitalisation has been rising, from yesterdays low at 320,1B to 342,74B and then fell back to 332,666B where it is currently sitting.

The market is in green, with biggest gainers among top 100: Mixin +24%, CyberMiles 16%, Bitcoin Private 21%, Eos 11.6%.

Daily Crypto News

Top stories that came out in the last 24 hours are the following:

German Bank and Steel Conglomerate Execute Forex Transaction via Blockchain

German bank Commerzbank and steel company Thyssenkrupp have completed a €500,000 pilot transaction of a forex (FX) forward on a blockchain, reported Cointelegraph auf Deutsch May 24.

Singapore Fires Compliance Warning at 8 Crypto Exchanges, Orders an ICO to Halt Sales

Singapore’s central bank said today, May 24, that it had issued a warning to eight cryptocurrency exchanges over securities compliance and ordered an ICO to stop issuing tokens.

Russia’s Largest Bank to Pilot First Official ICO

Russian bank Sberbank CIB and the National Settlement Depository (NRD) will pilot the country’s first official Initial Coin Offering (ICO) using the Bank of Russia’s regulatory sandbox, ForkLog reports today, May 24.

South Africa’s Central Bank Calls Crypto ‘Cyber-Tokens’, Not Currency

The South African Reserve Bank, the central bank of the Republic, has chosen to call digital currencies “cyber-tokens” because they “don’t meet the requirements of money,” Bloomberg reported May 24.

Source: cointelegraph.com

Analysis

From yesterday’s open, the price of Bitcoin has decreased by 0.8% coming from 7574$ to 7510$ where it is currently.

Looking at the daily chart, we can see that support baseline was respected and that yesterday’s candle closed above the support line, leaving a wick below it. Today’s candle is red and its back on the levels of yesterdays opening, as the price is retesting the support.

Zooming into the hourly chart, we can see the interaction with the baseline support. The price bounced quickly but was repealed by the wedge support line which now serves as resistance.

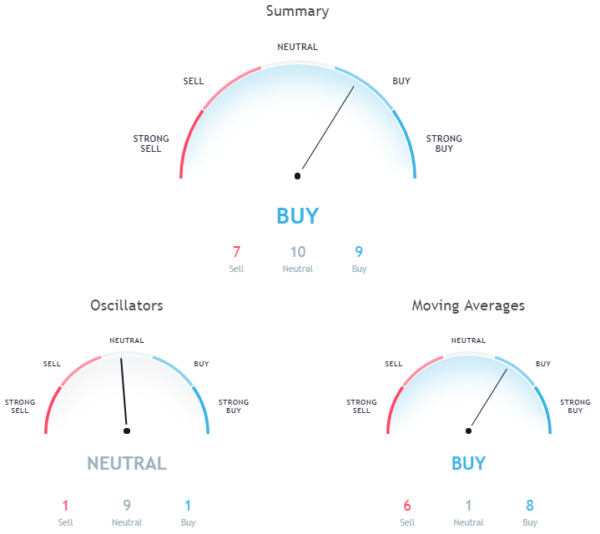

Market sentiment

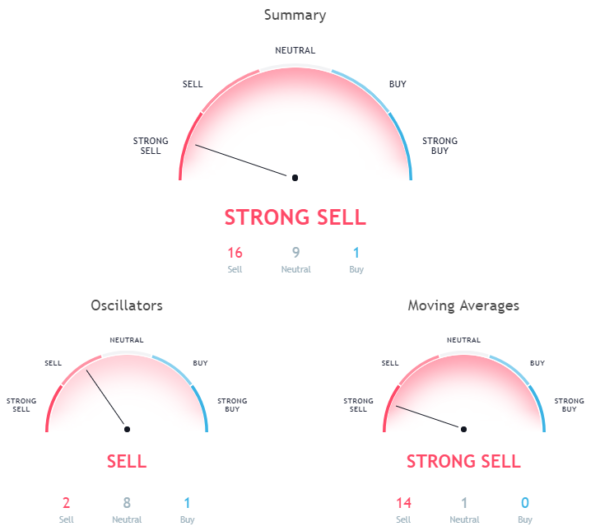

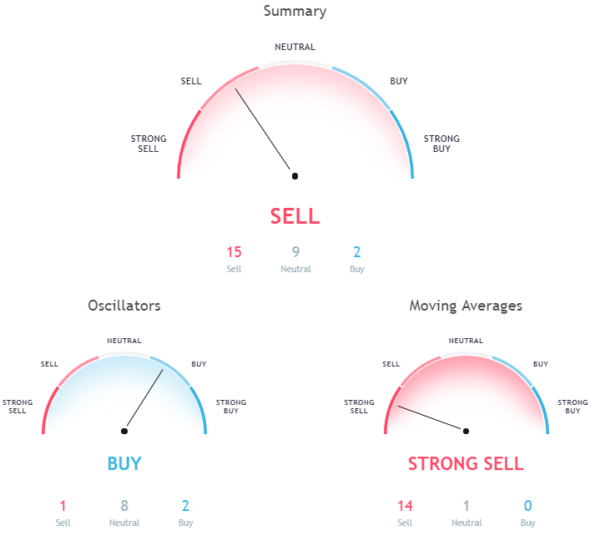

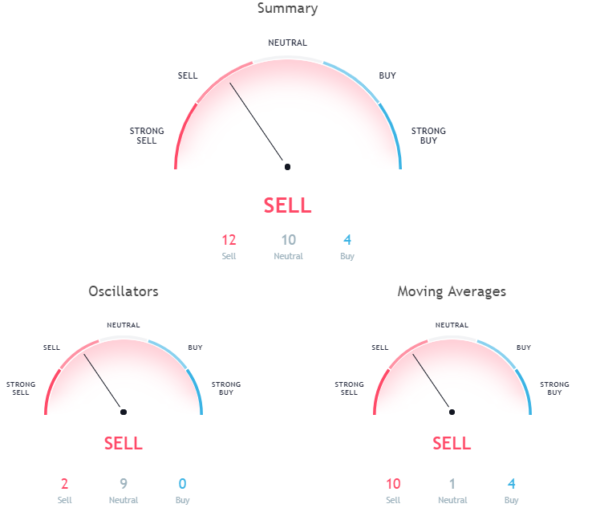

- Bitcoin hourly chart technicals signal a sell.

- Oscillators are neutral, and moving averages signal a sell.

Pivot points

S3 6582.5 S2 7052.3 S1 7314.5 P 7522.2 R1 7784.4 R2 7992.0 R3 8461.8

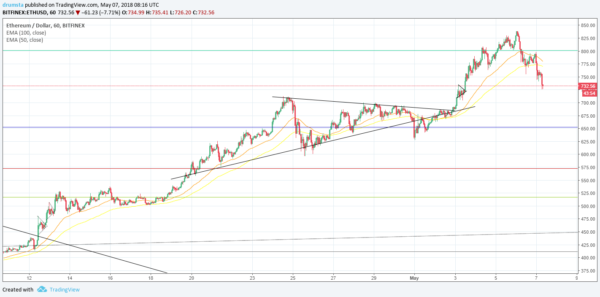

ETH/USD

From yesterday’s open the price of Ethereum has increased by 3.34% coming from 588$ to 605$ where it is currently.

Looking at the daily chart, we can see that after the price spiked down to the first support, it went back up above the 0.382 Fibonacci level and is currently a doji candle with wicks from both sides. As you can see the current candle’s high is at the levels of a prior range support which now serves as resistance.

Zooming into an hourly chart we can see the interaction with the support line, and that even on the hourly chart there was a quick spike down. We can see some sideways movement as the price action is bouncing up and down between the range in which it is currently.

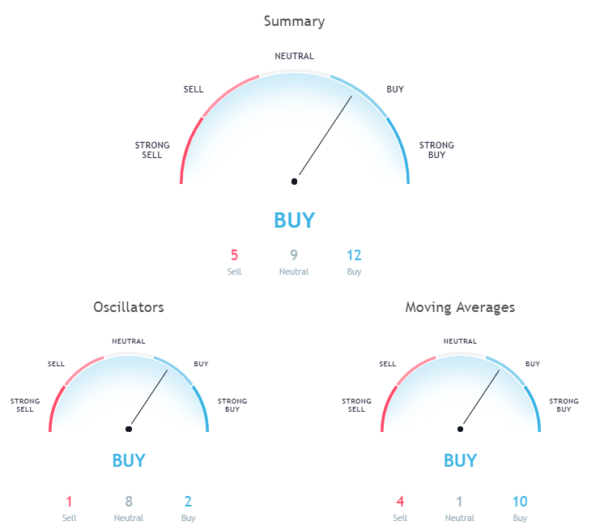

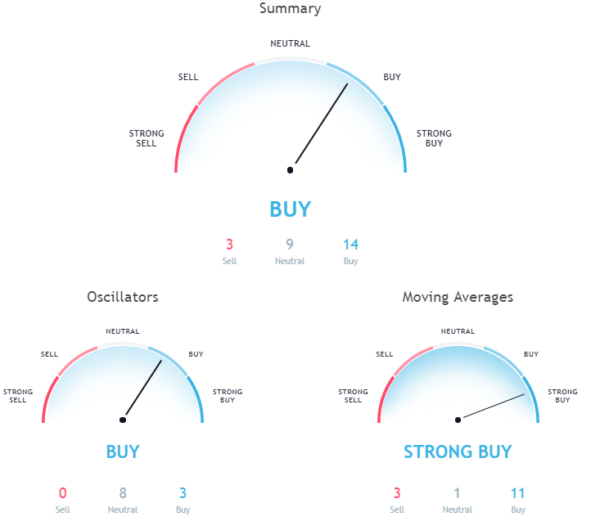

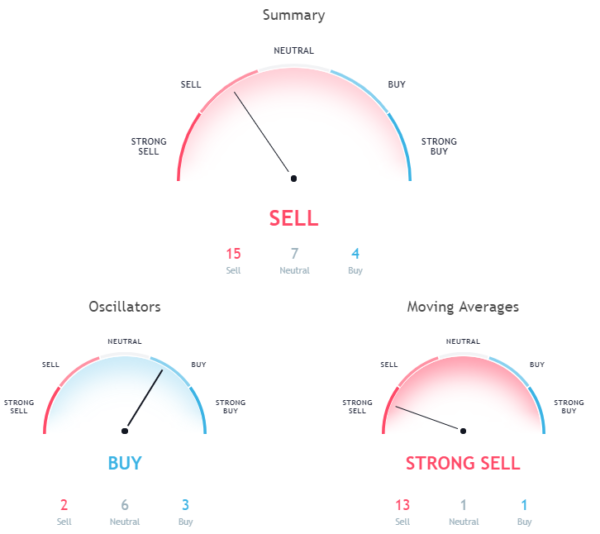

Market sentiment

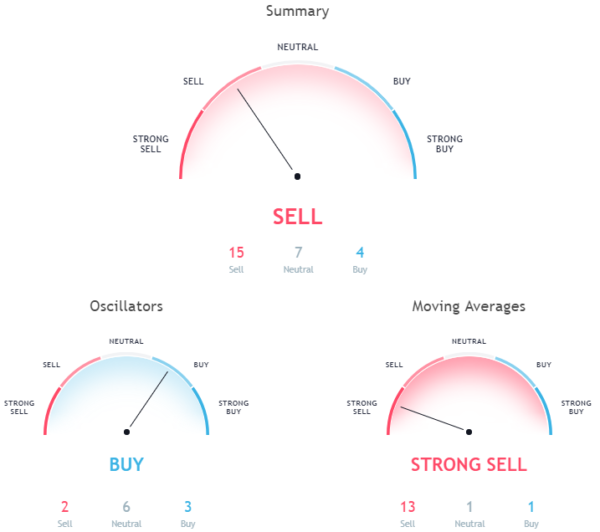

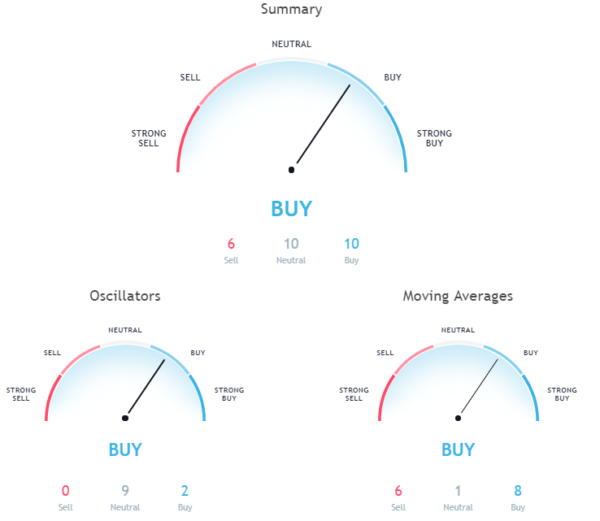

- Ethereum hourly chart technicals signal a buy.

- Oscillators are on buy, and moving averages are signalling a buy.

Pivot points

S3 443.64 S2 513.55 S1 558.03 P 583.46 R1 627.94 R2 653.37 R3 723.28

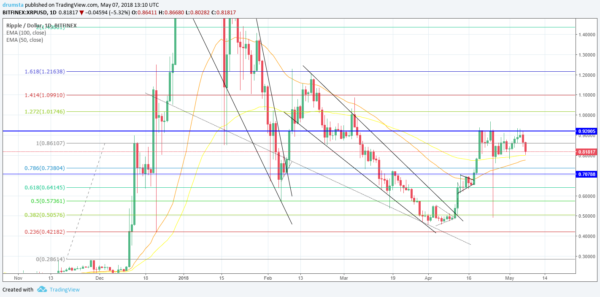

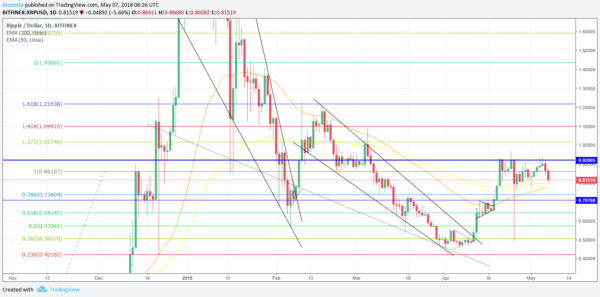

XRP/USD

From yesterday’s open, the price of Ripple has increased by 2.46% from 0.6$ to 0.617$ where it is currently.

Looking at the daily chart, we can see that the price failed to exceed the 0.236 Fibonacci retracement level which serves as resistance, and as soon as the price hit it, it has retraced to the levels of prior range support.

Zooming on the hourly chart, we can see the interaction with the 0.236 Fibo level clearly. The price struggled to go beyond it but failed to keep up the momentum. As it entered the seller’s territory, the selling has begun.

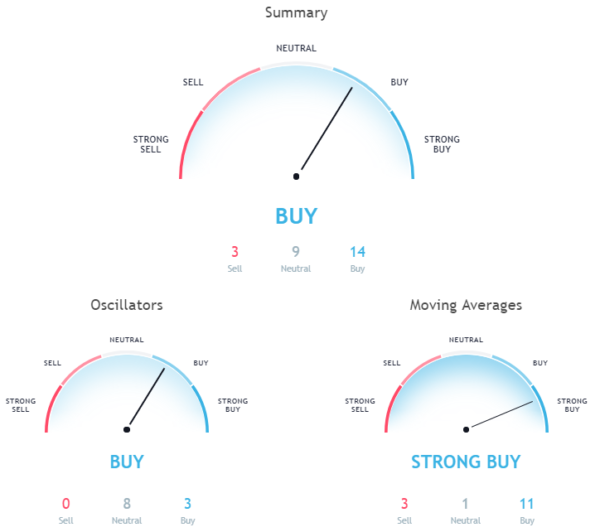

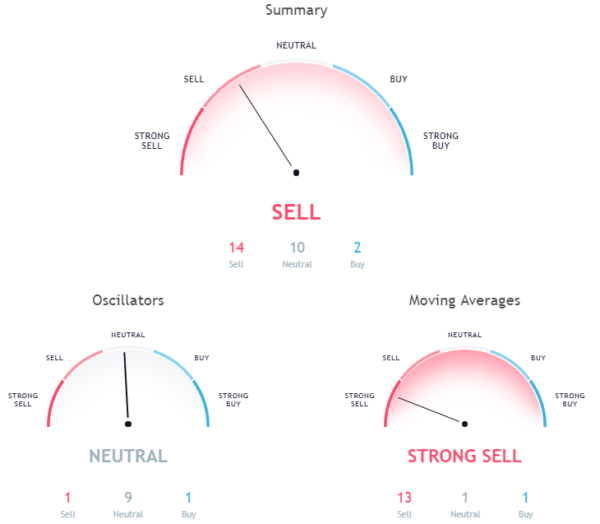

Market sentiment

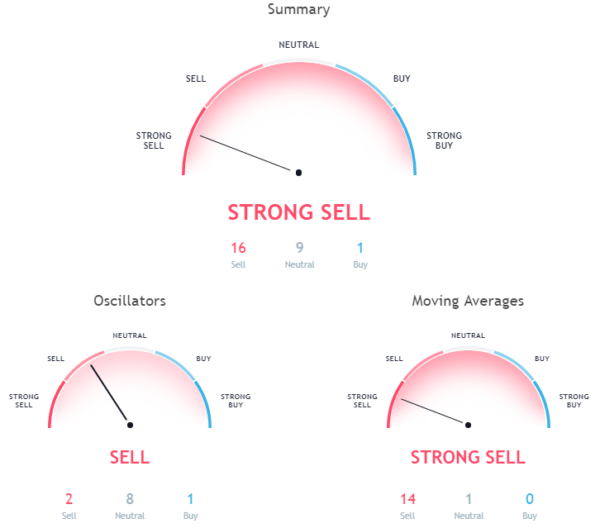

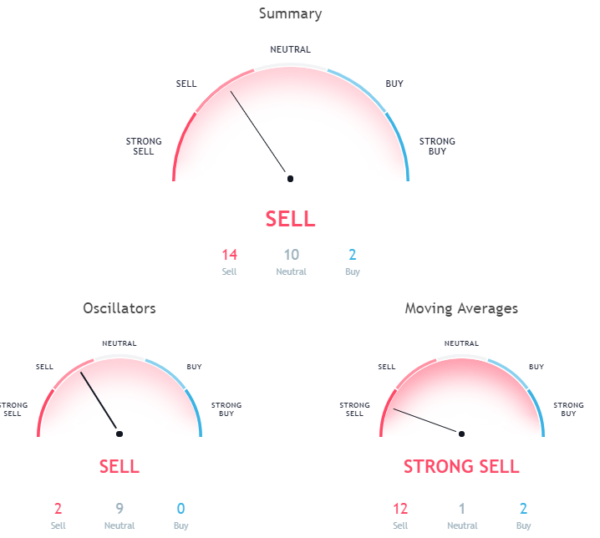

- Ripple is still in the sell zone.

- Oscillators are on neutral, and moving averages signal a strong sell.

Pivot points

S3 0.48865 S2 0.55127 S1 0.59016 P 0.61389 R1 0.65278 R2 0.67651 R3 0.73913

Conclusion

Daily Crypto News Update: As we have seen yesterday, a strong momentum by the drop in price and the first interaction with the support levels, we are now seeing a reaction in a form of a quick bounce. Because the prices of three major cryptos are now back on the support levels of a prior range which now serve as resistance, we are either going to see buyers coming in a pushing the prices higher, which would mean that the correction has ended and that we are in for new highs, or the second and more probable scenario in which the prices enter seller’s territory and we are in for another low.

Pivot points:

Pivot points:

Pivot points:

Pivot points:

The current market sentiment for Ripple is positive, meaning 87,88% of 66 mentions in total are positive.

The current market sentiment for Ripple is positive, meaning 87,88% of 66 mentions in total are positive.

Pivot points:

Pivot points:

Overall, hourly

Overall, hourly

The current sentiment is positive, meaning 75% of 64 mentions in total are positive.

The current sentiment is positive, meaning 75% of 64 mentions in total are positive.

Overall, hourly chart signals a sell.

Overall, hourly chart signals a sell.