This is an ECN type broker doing business since 2005 under the “by traders for traders” motto. FXOpen is transparent with its history, stating major advances for each year, the readers will have a better picture of what they do, how, and what are their concerns. Their business domains cover the Australian branch from FXOpen.com.au and FXOpen.co.uk for the UK, while fxopen.com is from Saint Kitts and Nevis, Carribean country without any regulation.

The UK and Australian domains have FCA and ASIC licenses respectively. To cover the lack of regulation for the Nevis domain, the broker turned to “The Financial Commission” group, a neutral 3rd party committee organization that features a list of brokers’ reputation and also a Compensation Fund. The Compensation Fund acts as an insurance policy for members’ clients. FXOpen pays to be a member of this organization but we are not sure if it could be a substitute for the ASIC or FCA.

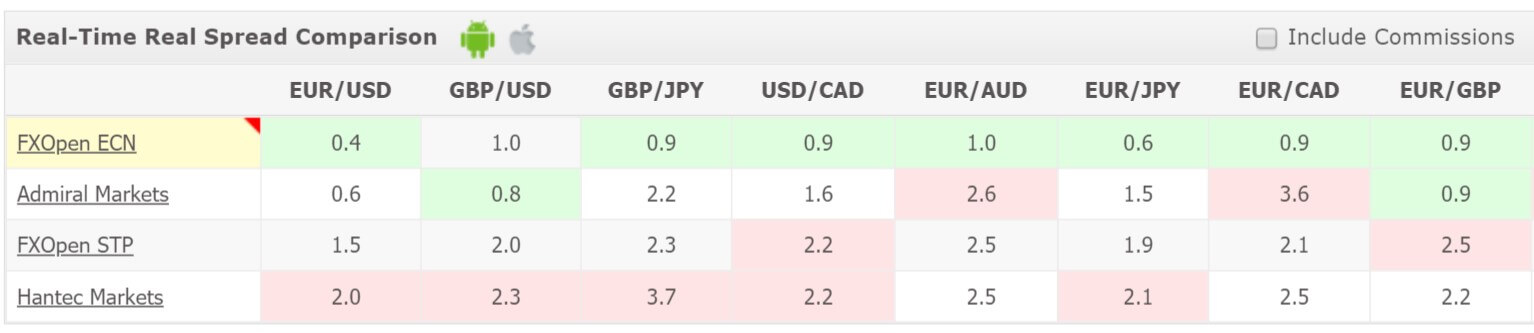

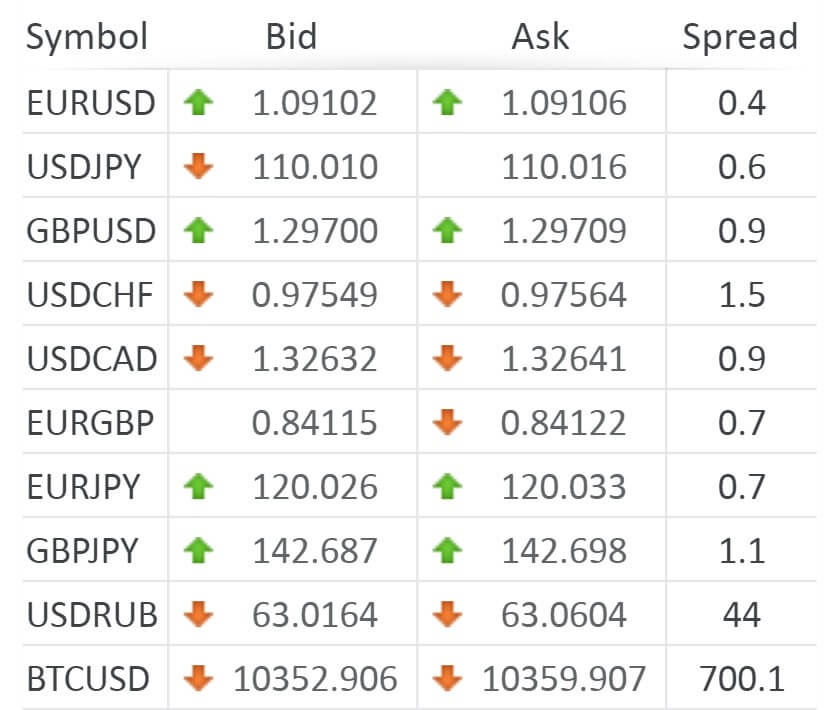

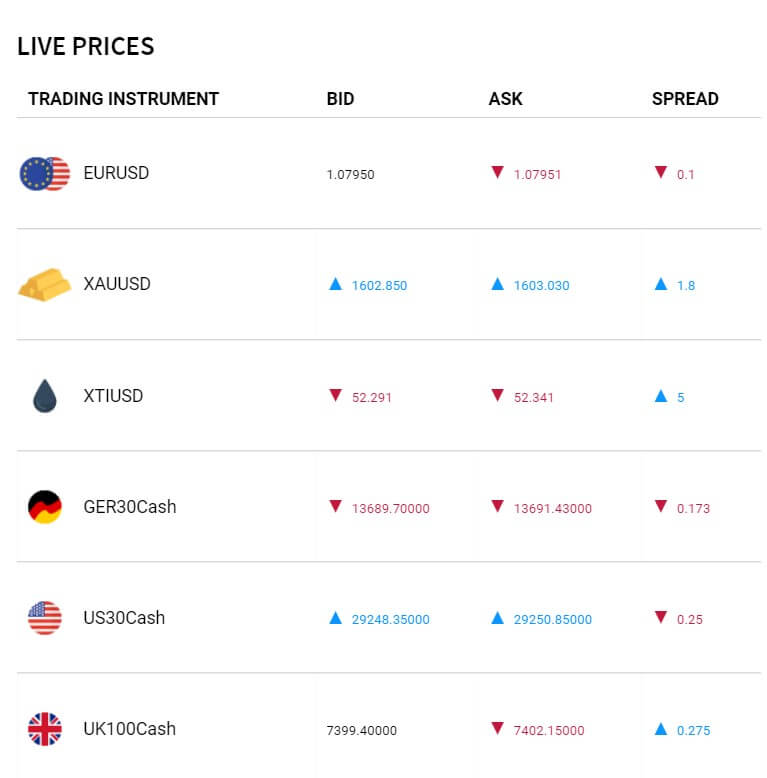

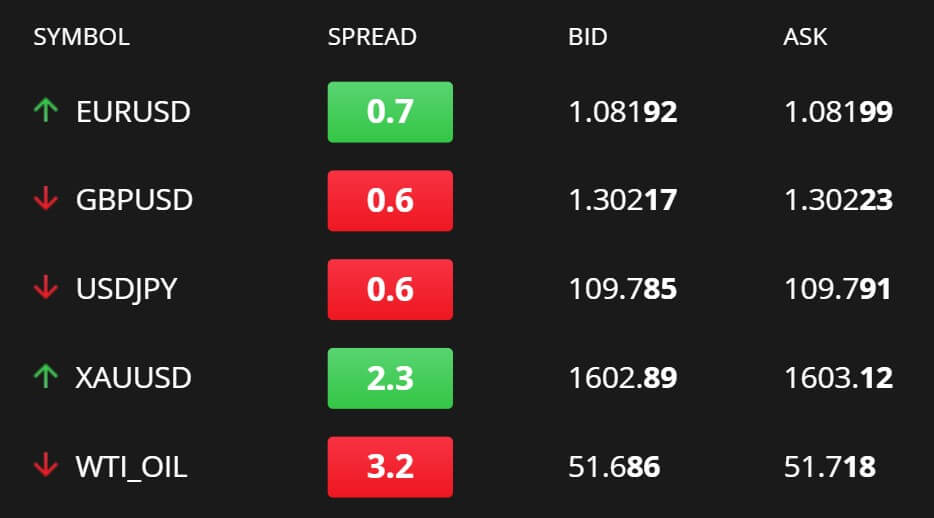

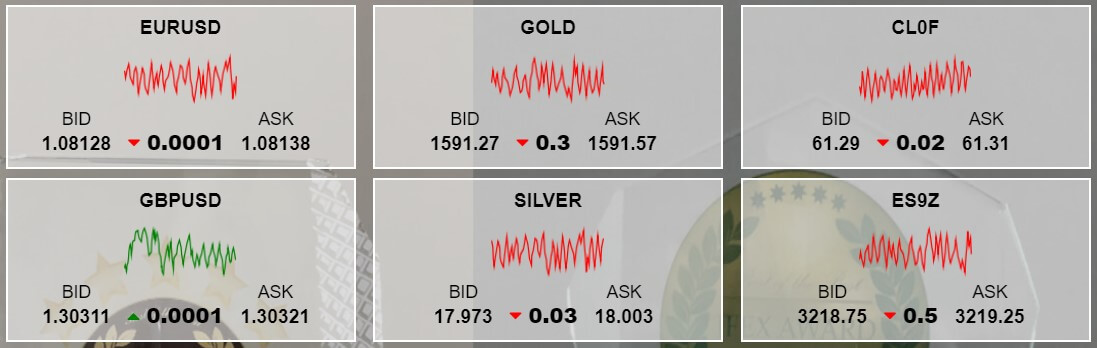

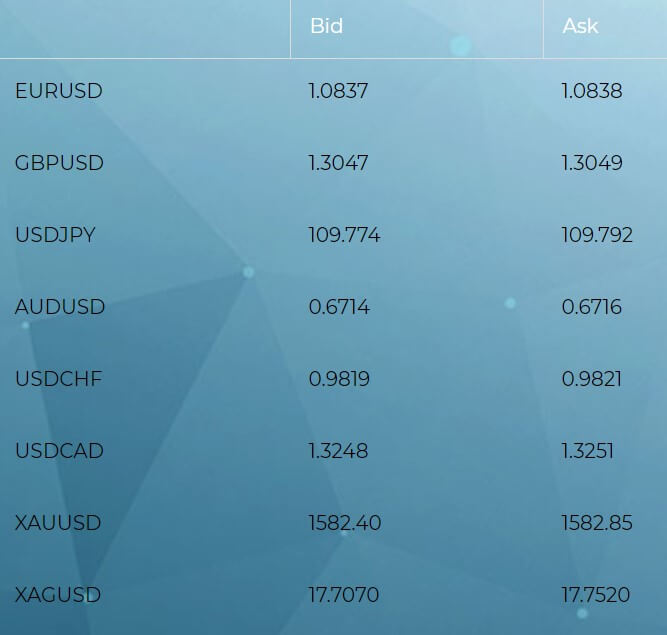

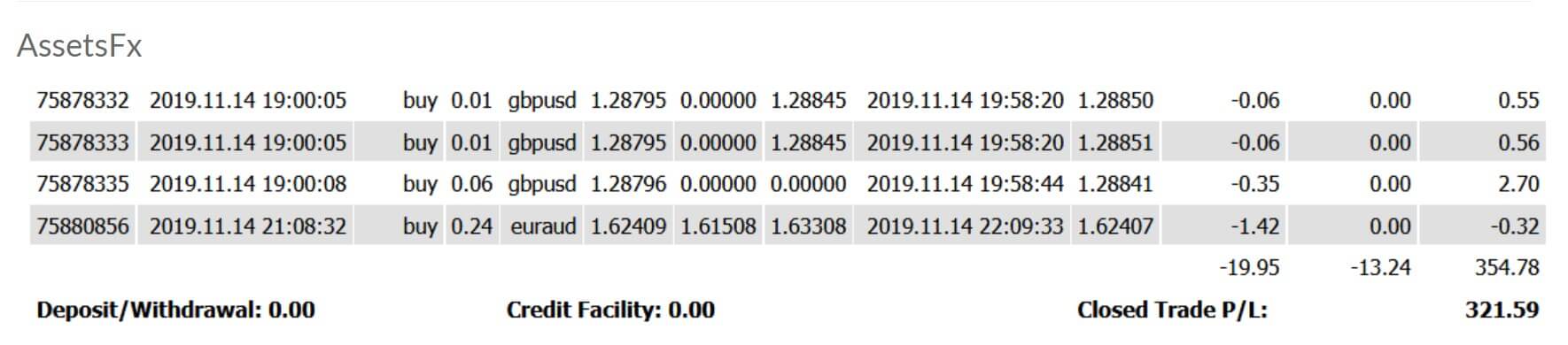

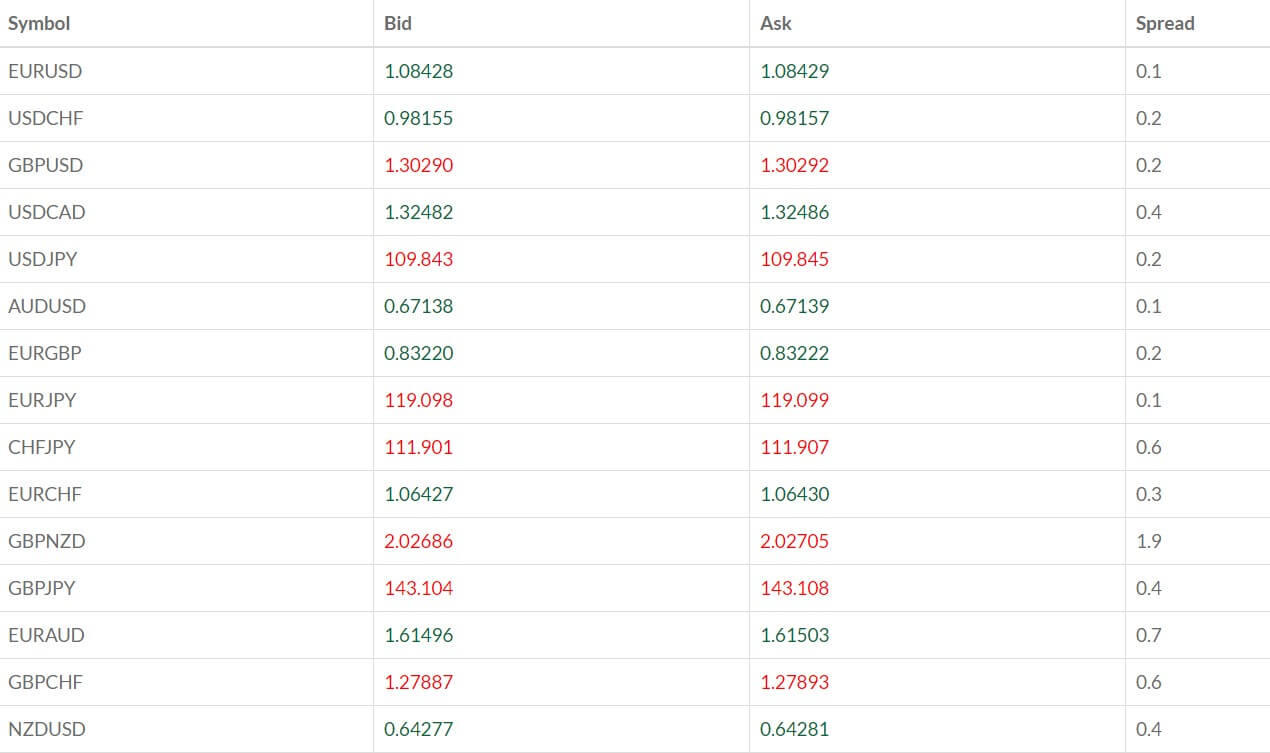

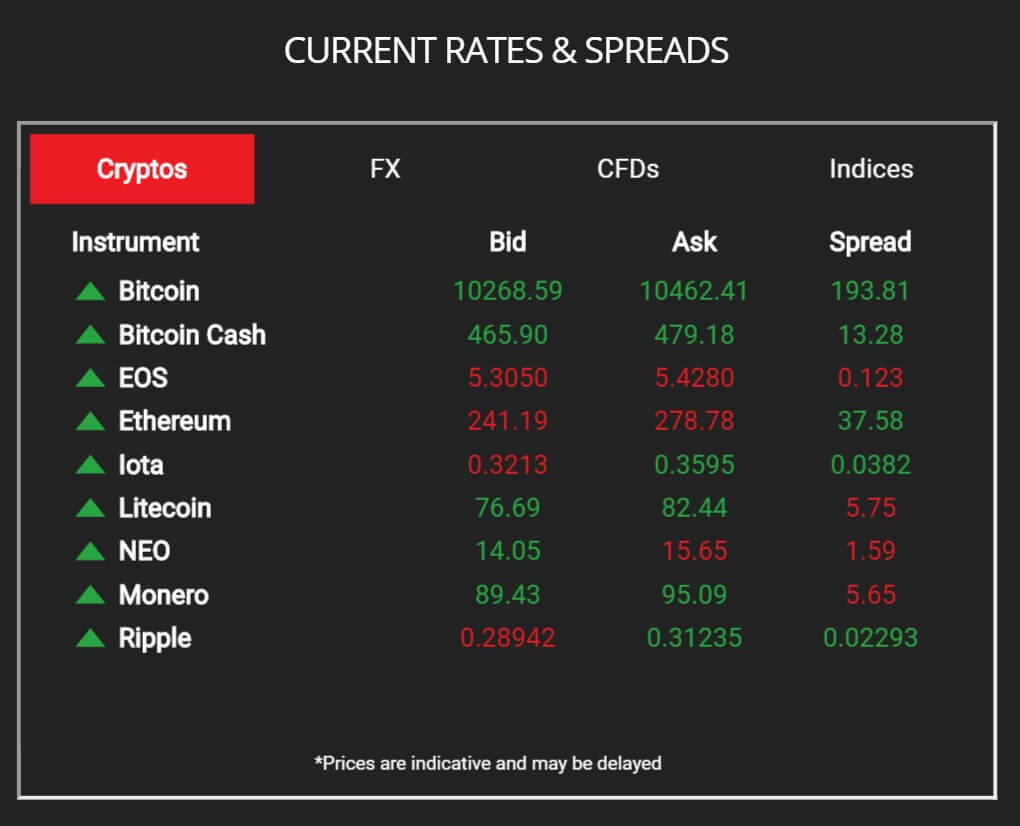

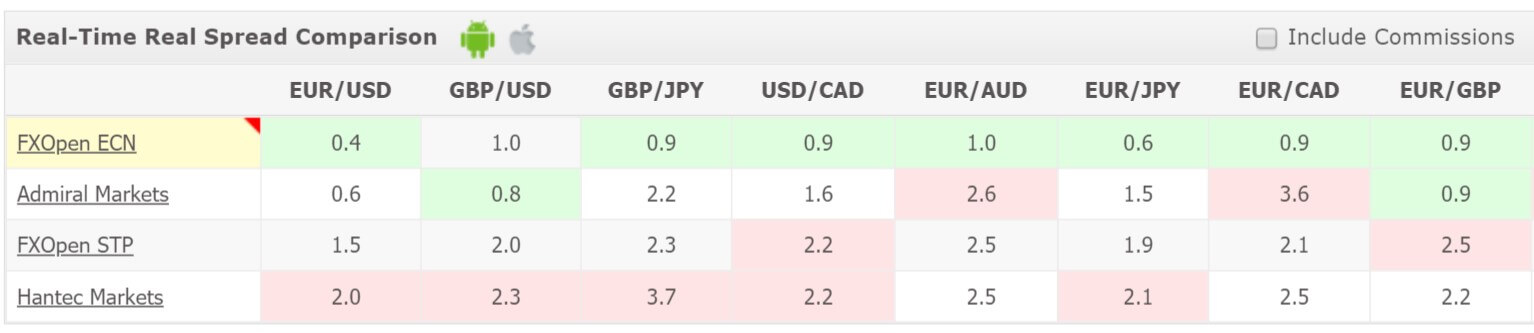

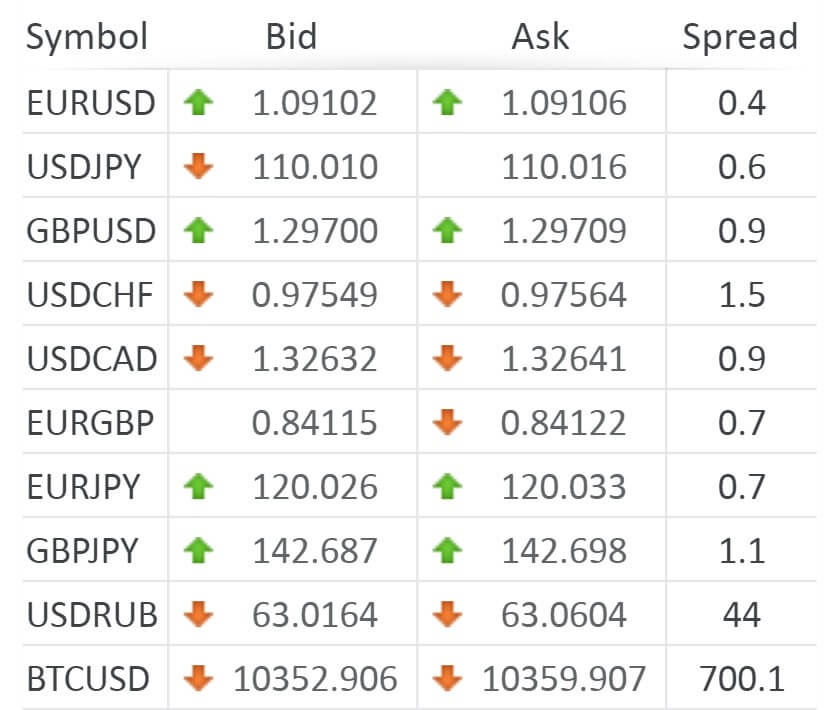

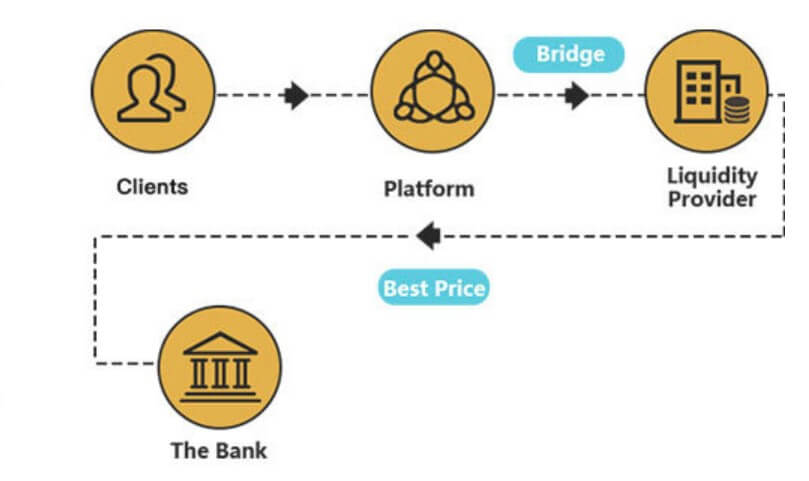

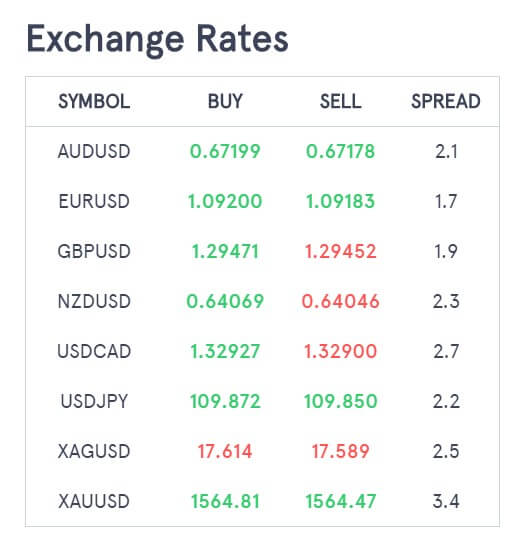

There are also other differences, one notable is that FXOpen does not offer negative balance protection, unlike their FCA regulated branch. The website is simplistic full of information related to trading. The homepage will showcase FXOpen business model visual, Quotes Table with the live spreads information, and a real-time spreads comparison table with other brokers – a featured feed from myfxbook.com. This is a good sign of transparency and good marketing mix as other legitimate party information is used for promotion.

The broker’s main selling points are low spreads, diversified account types, low minimum deposit, their PAMM, and crypto trading. Ratings the broker has received on the benchmark sites are mixed. However, it is notable that FXOpen responds to negative opinions with good arguments and openness for resolution. This FXOpen review will provide insight into how good their services are by sections.

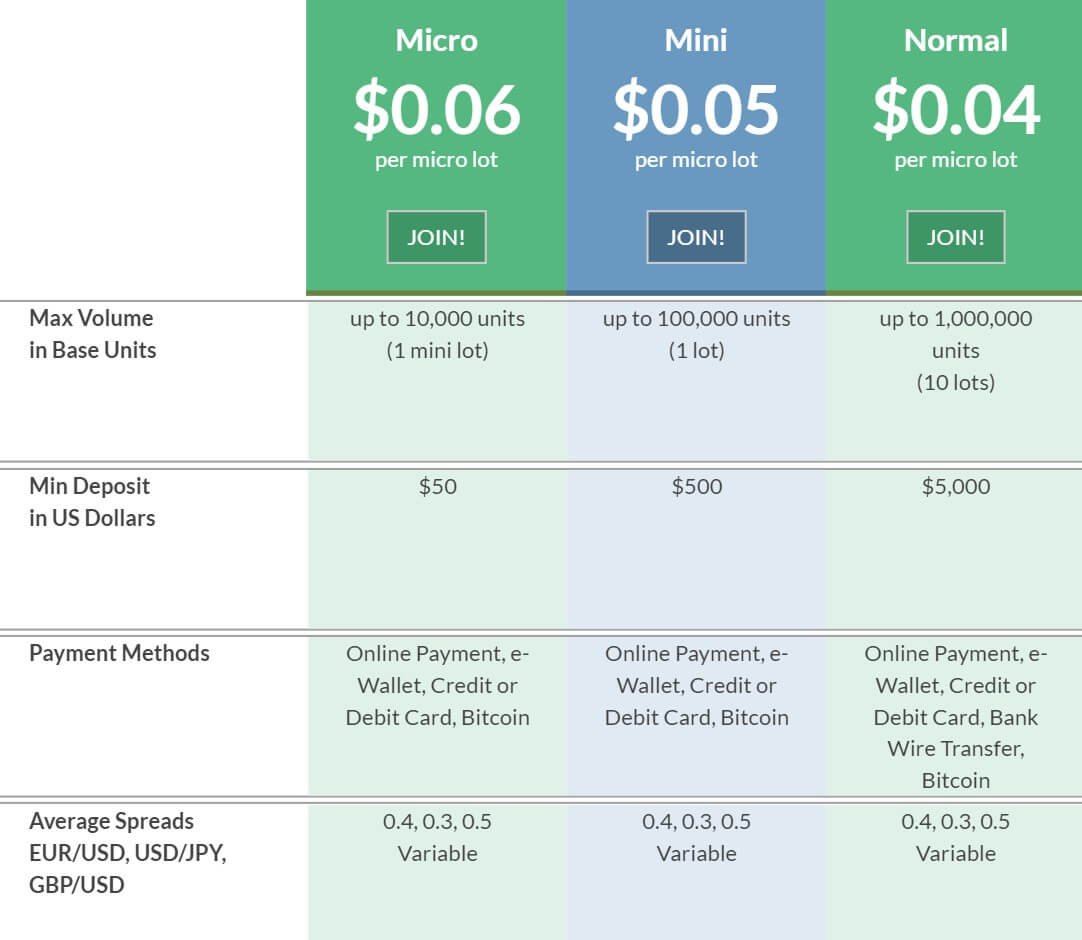

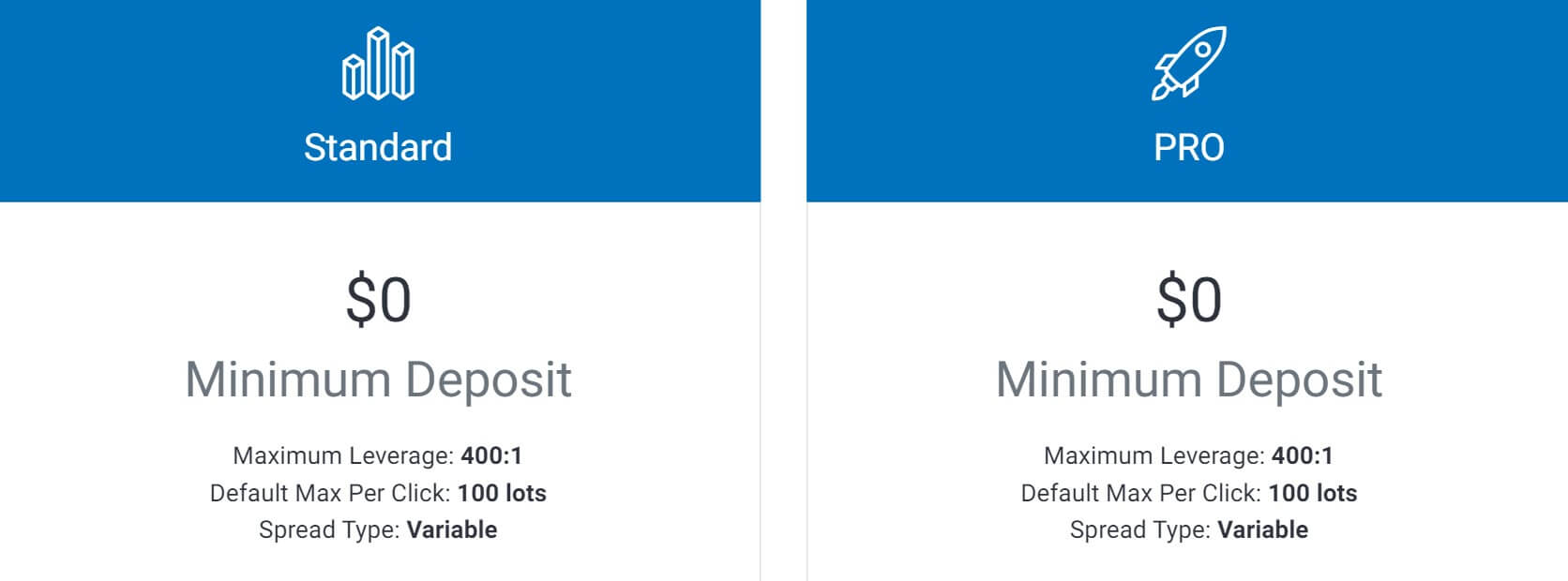

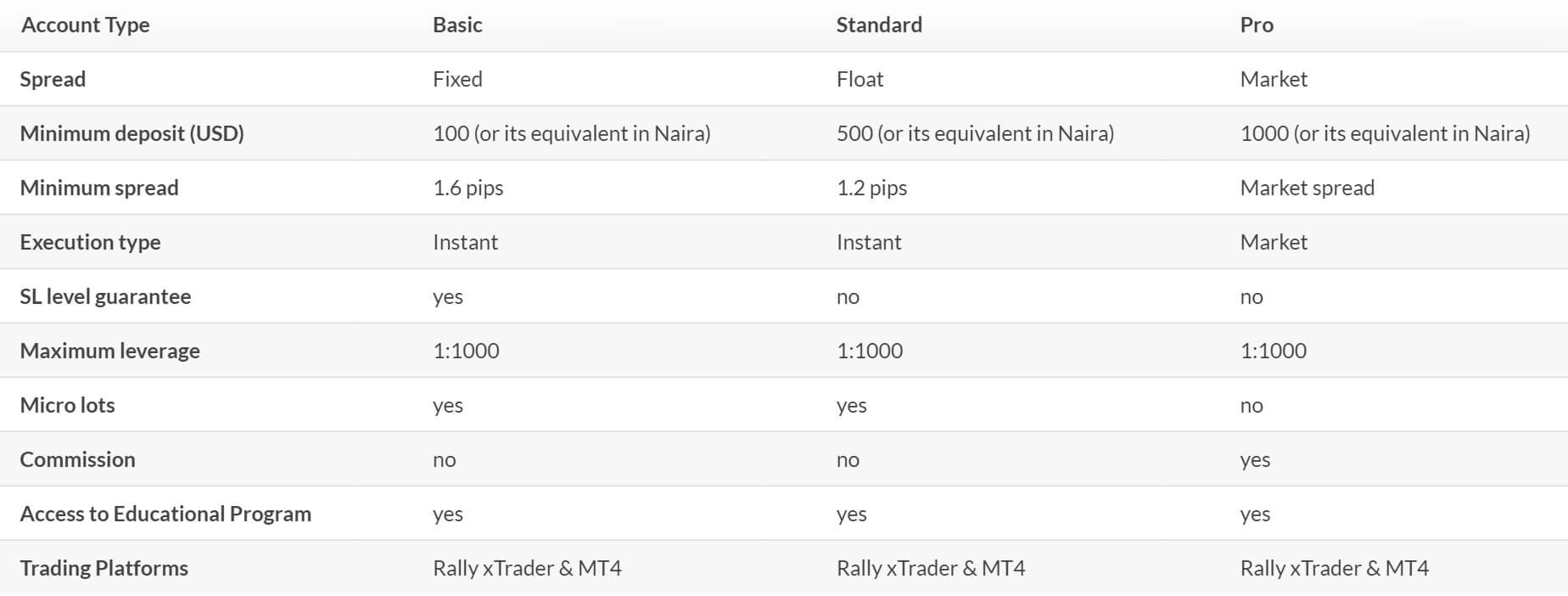

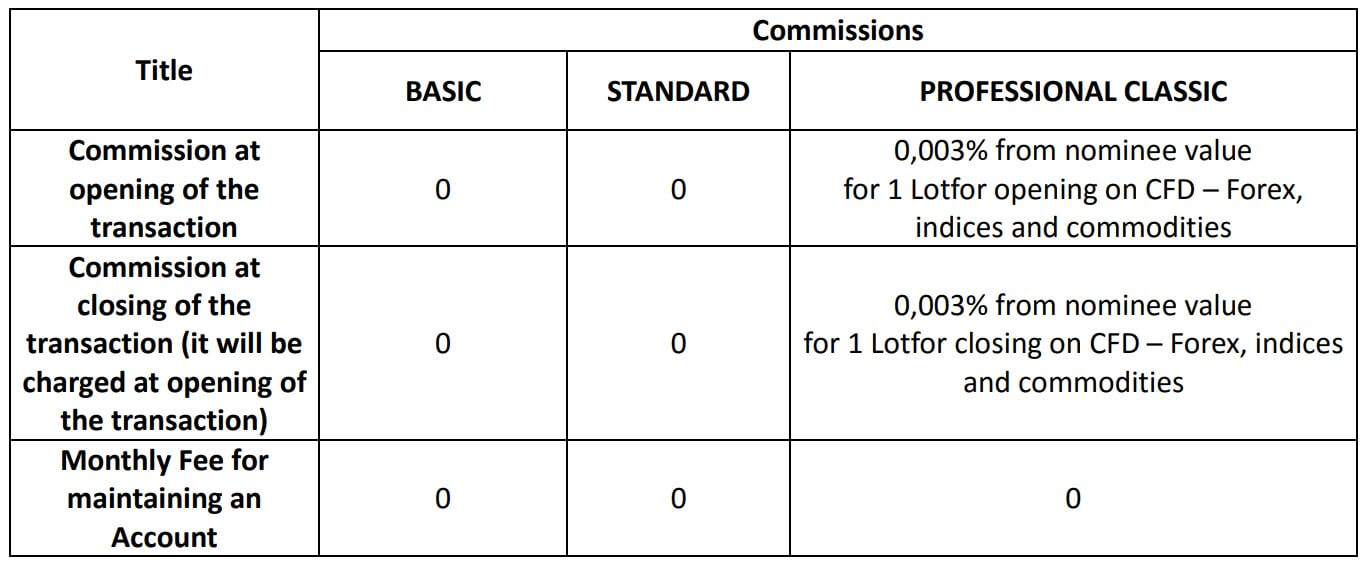

Account Types

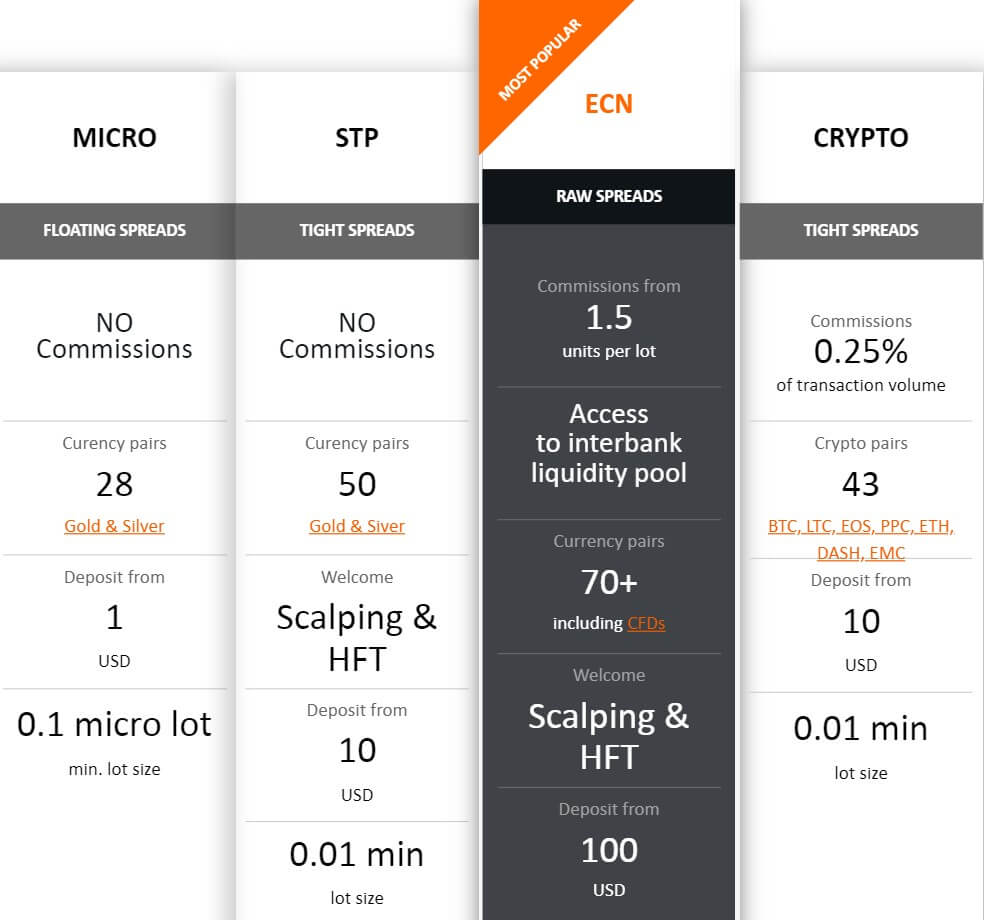

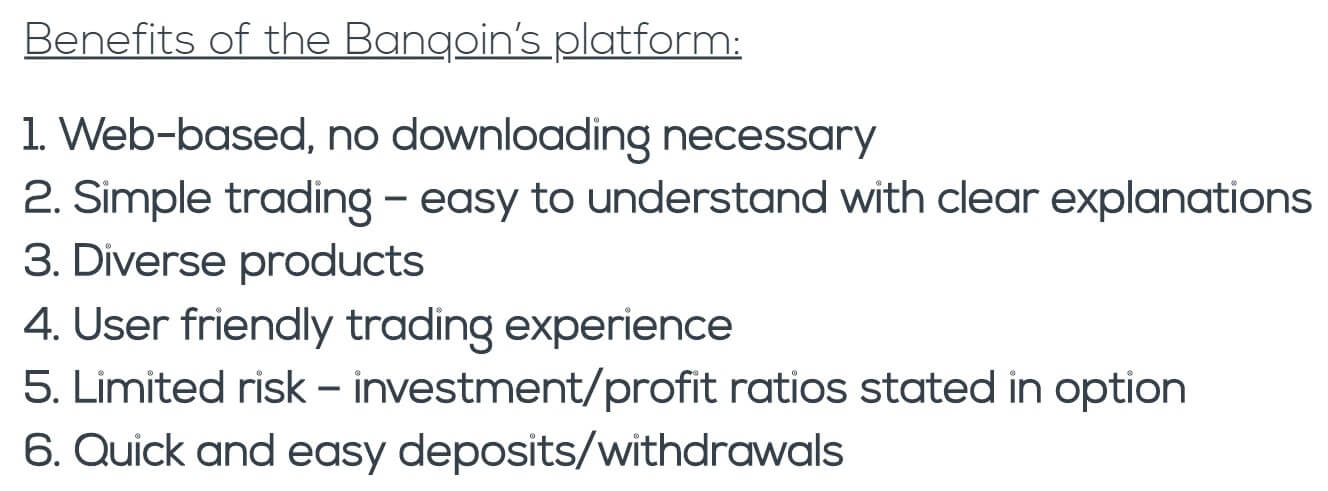

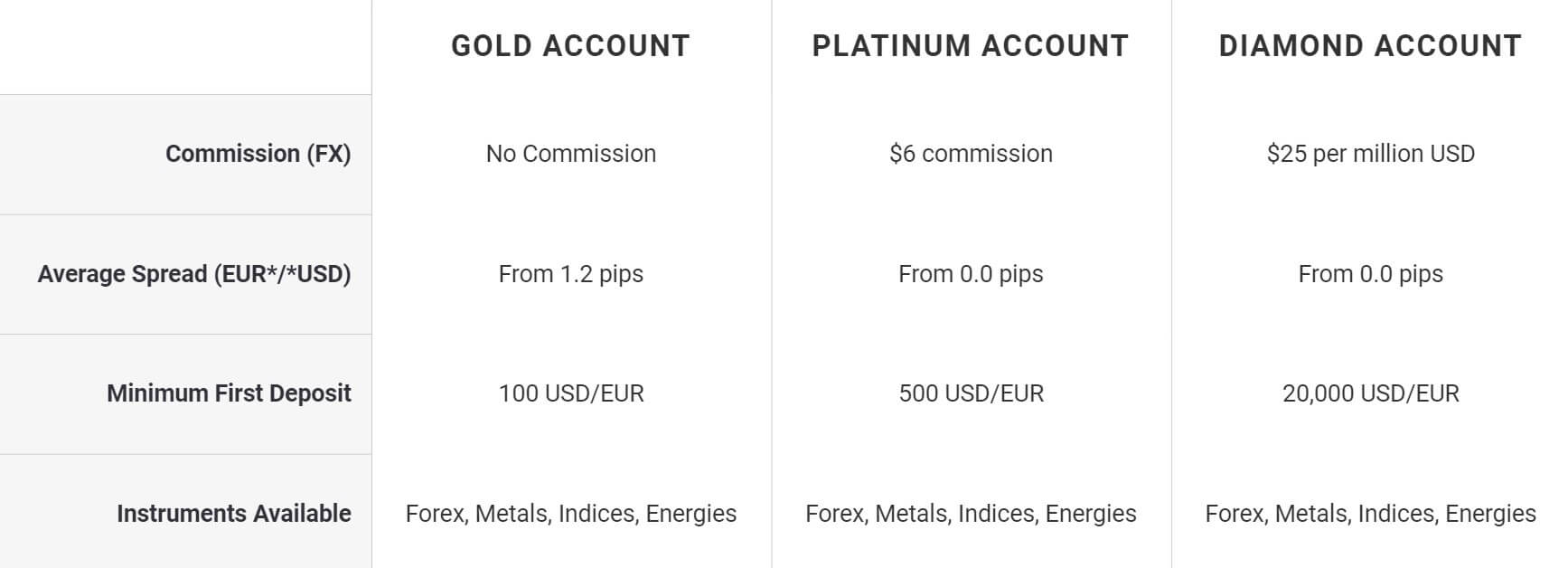

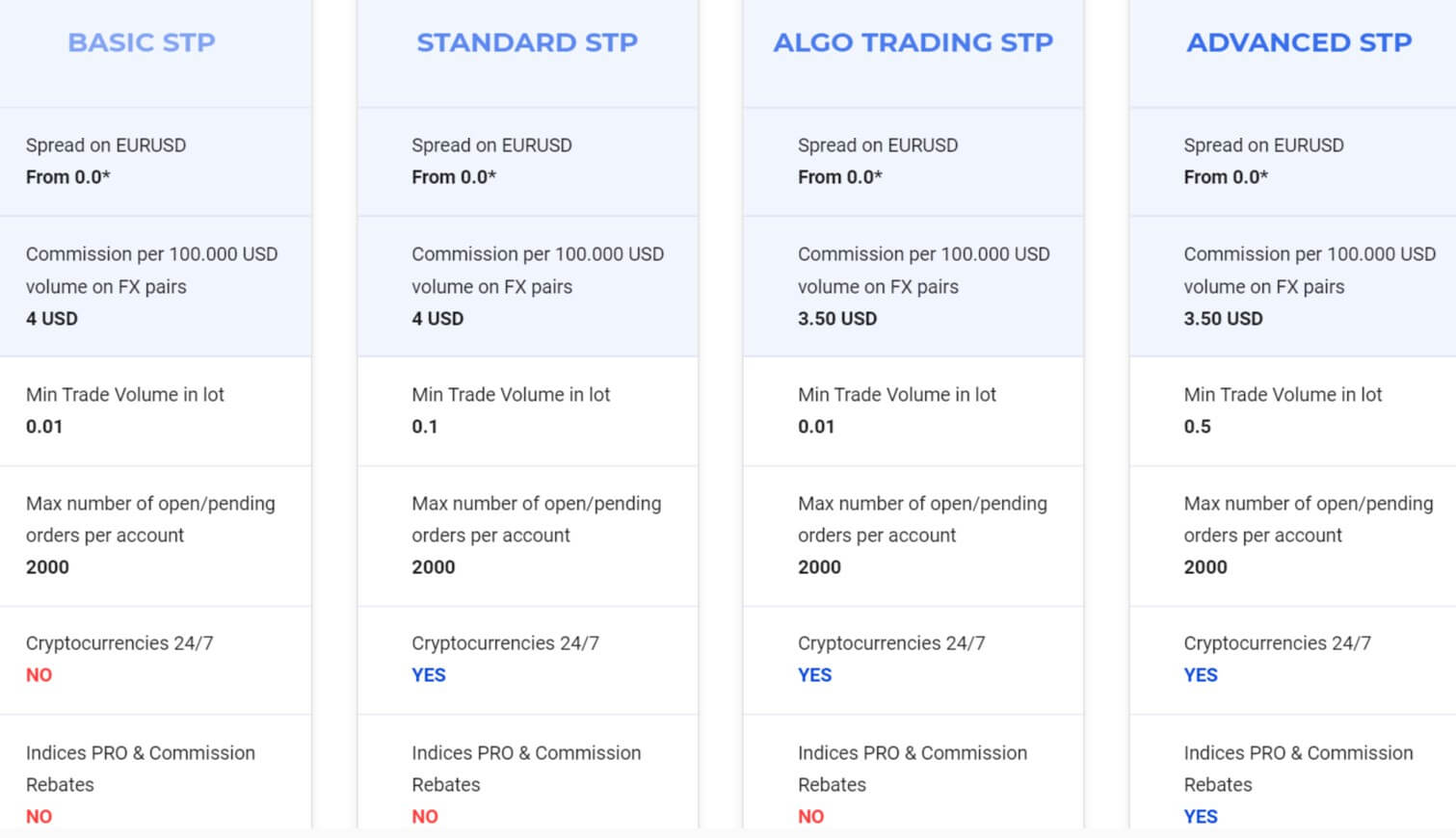

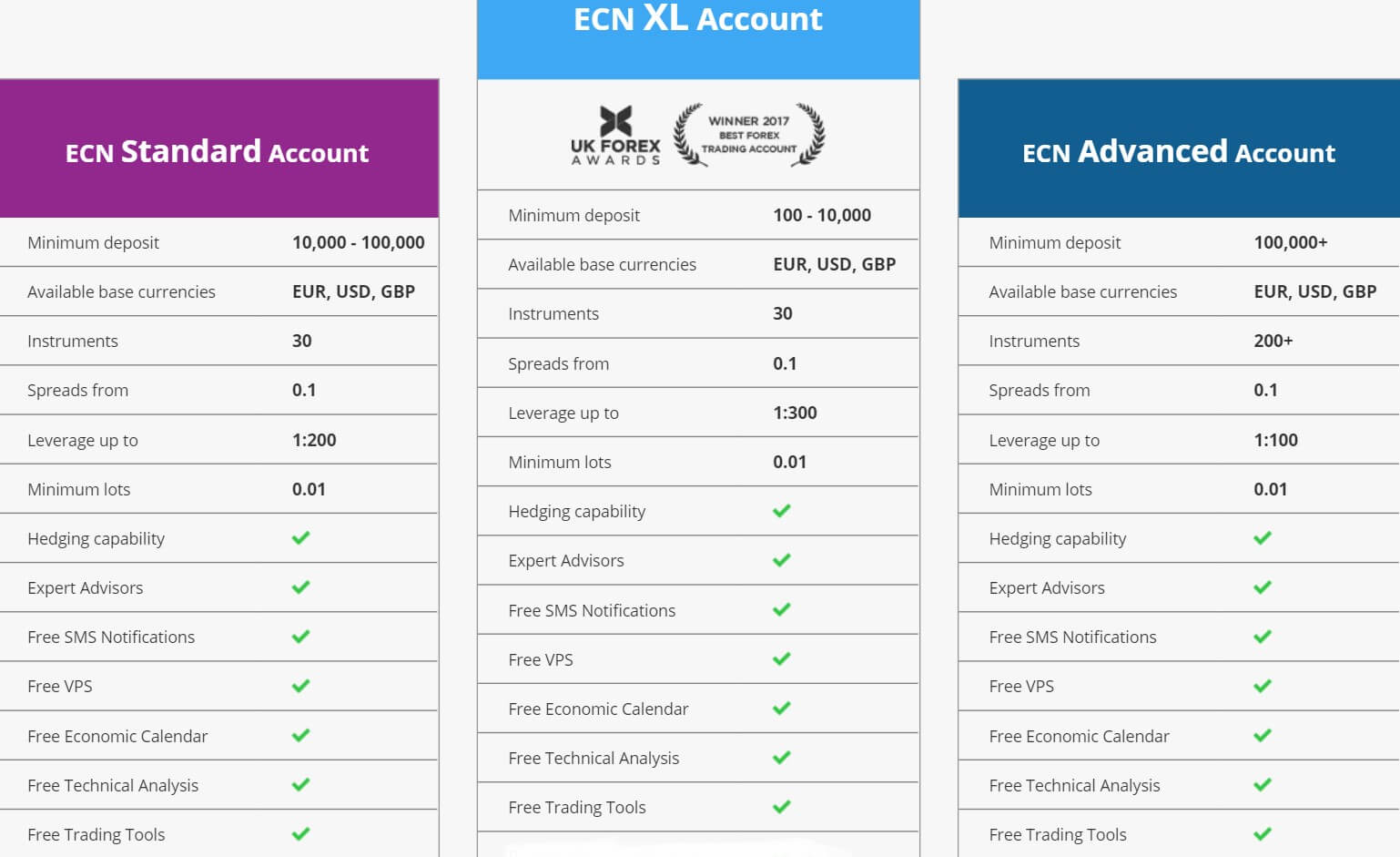

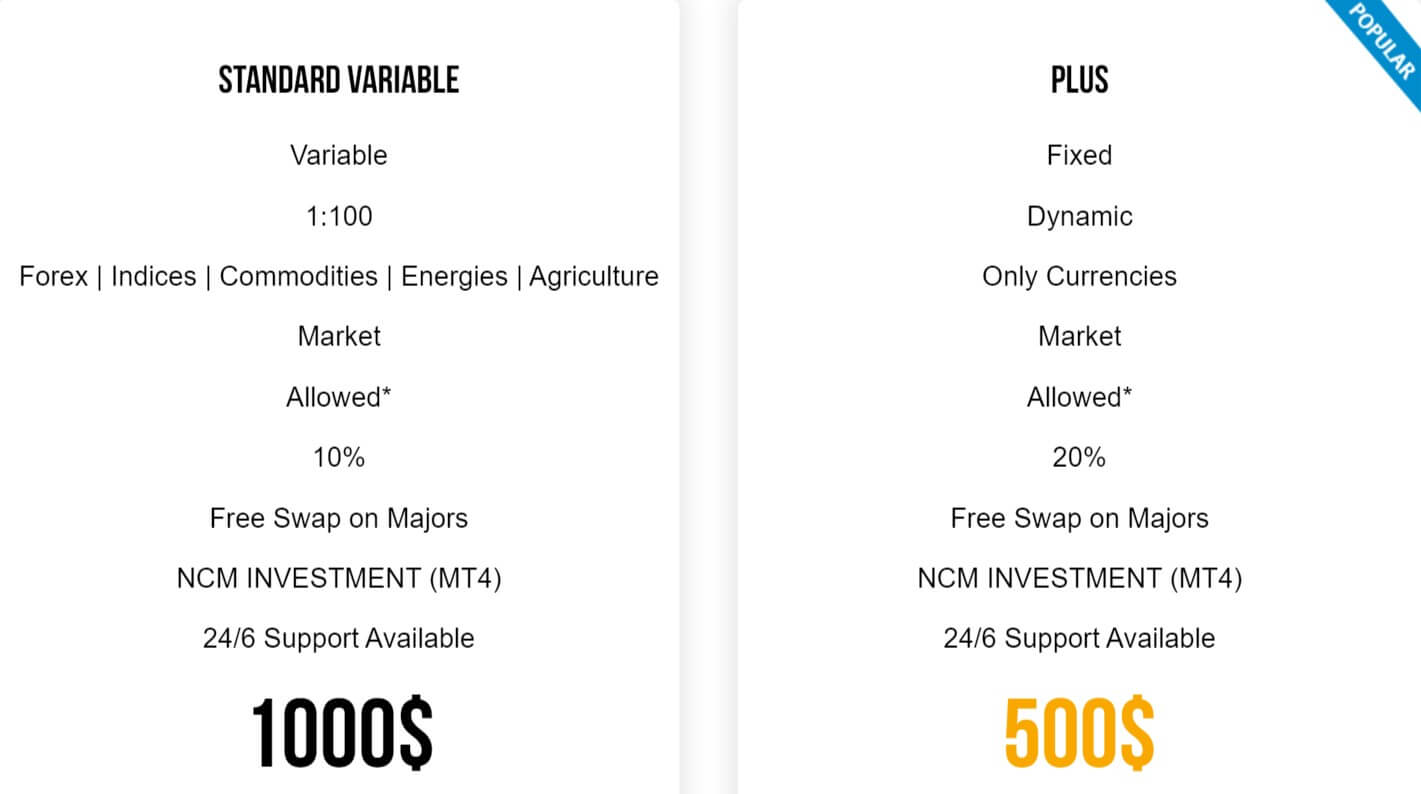

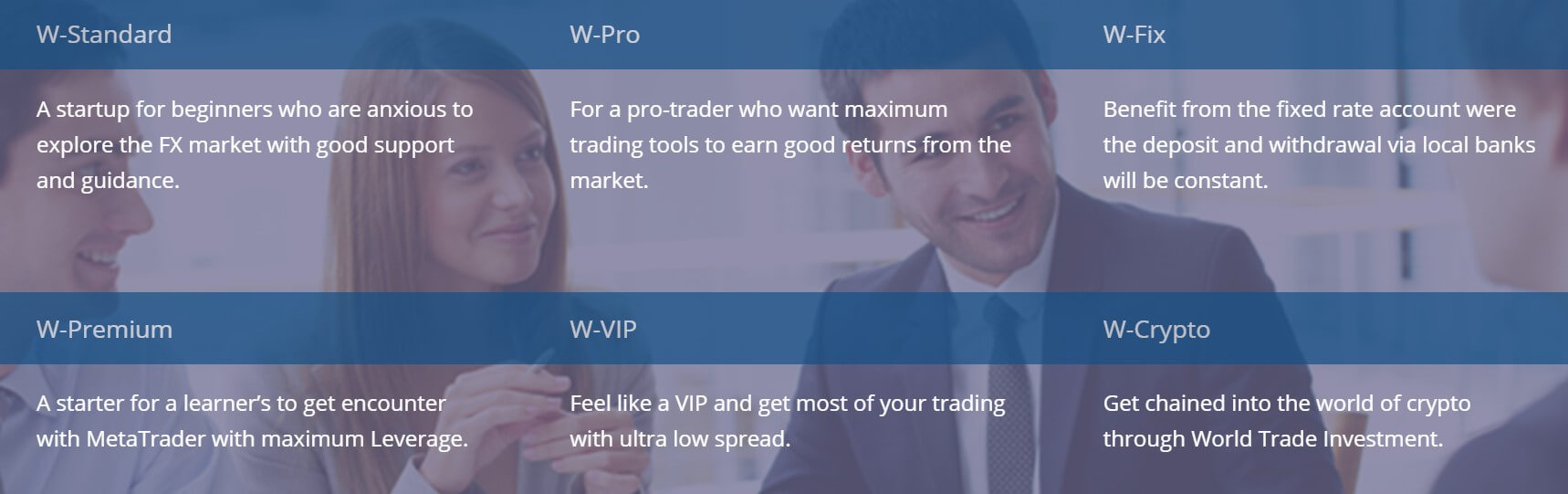

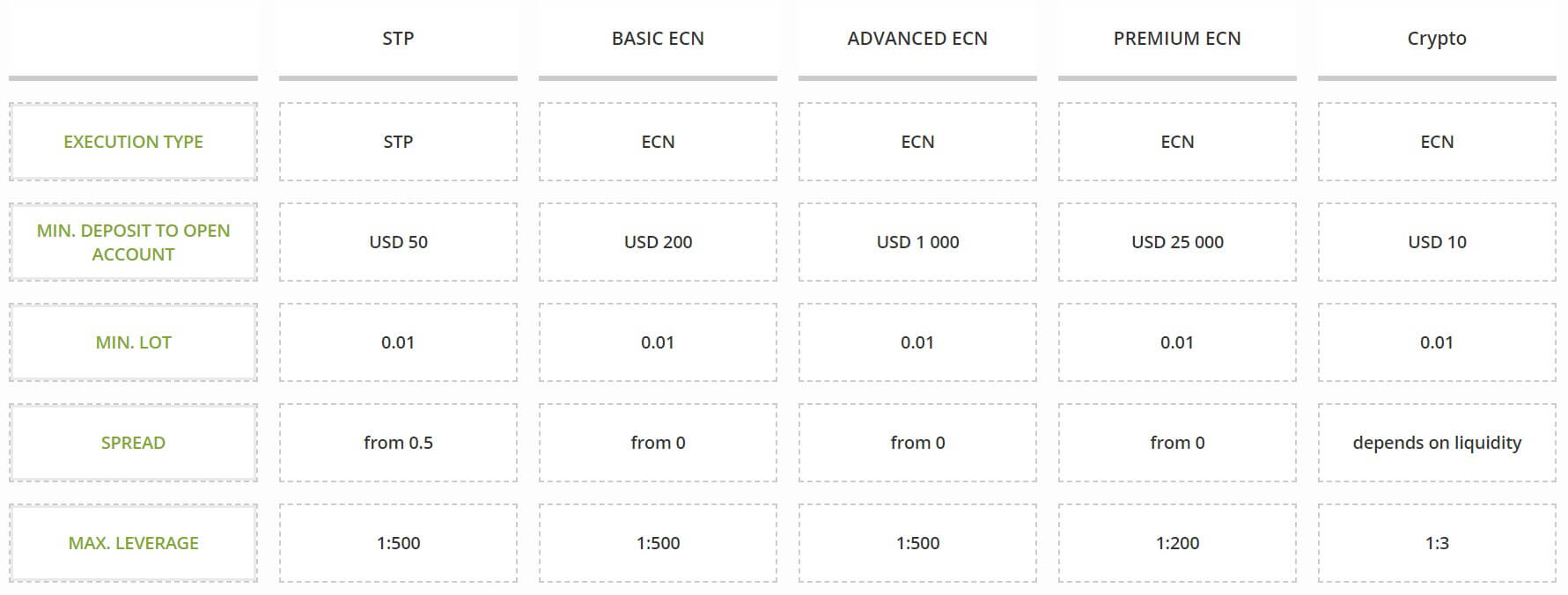

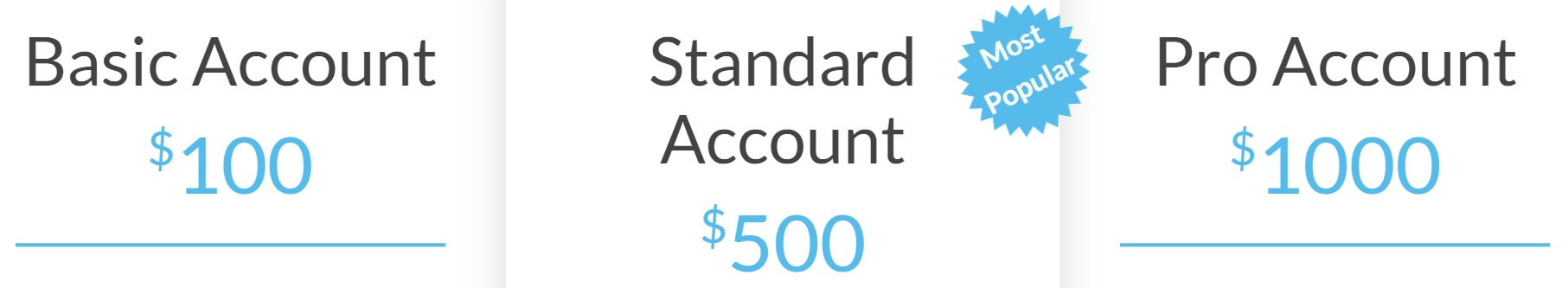

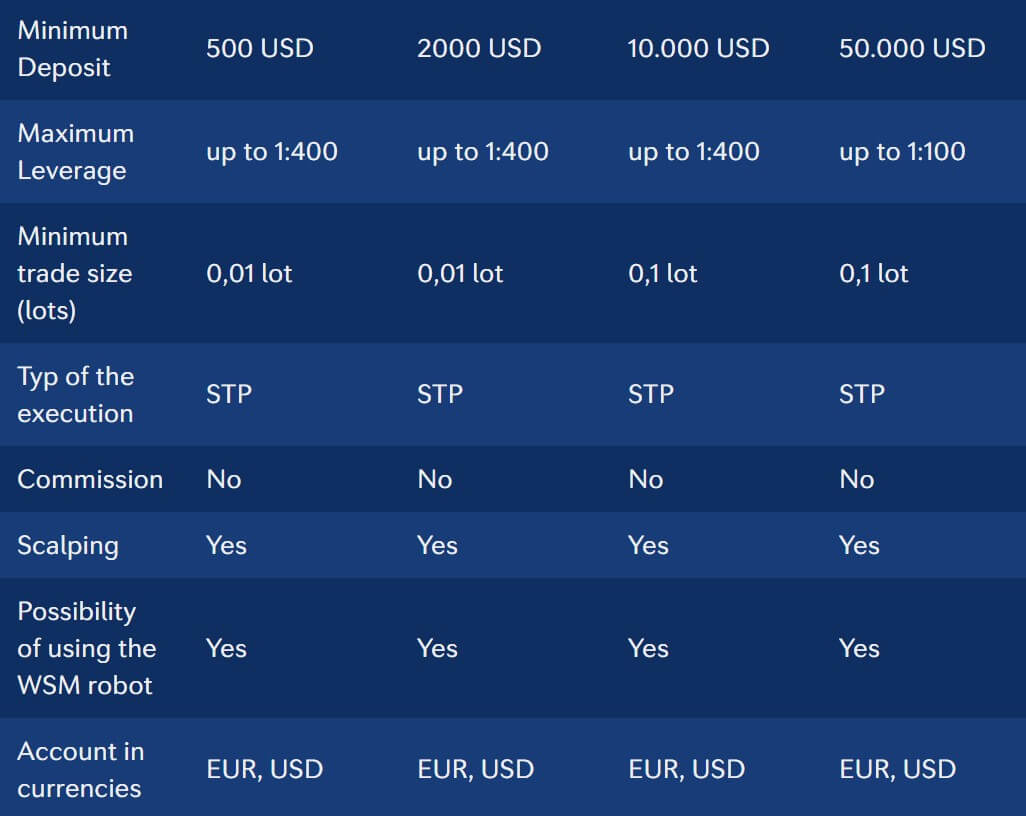

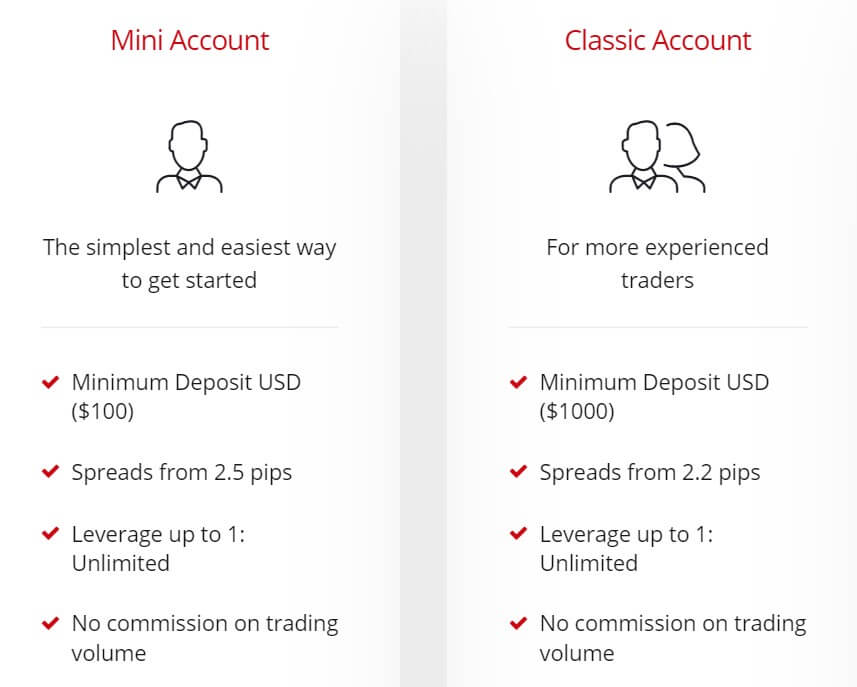

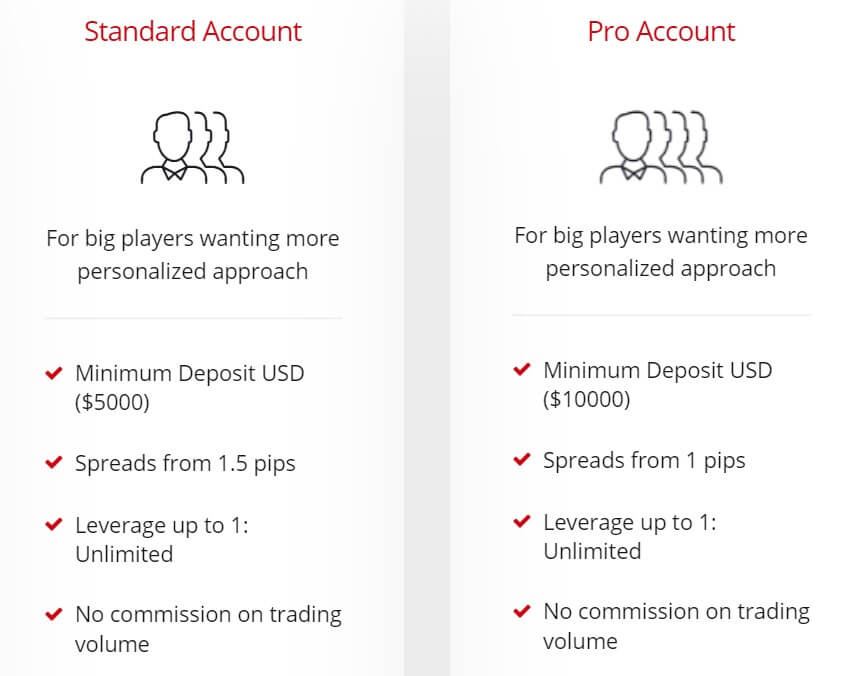

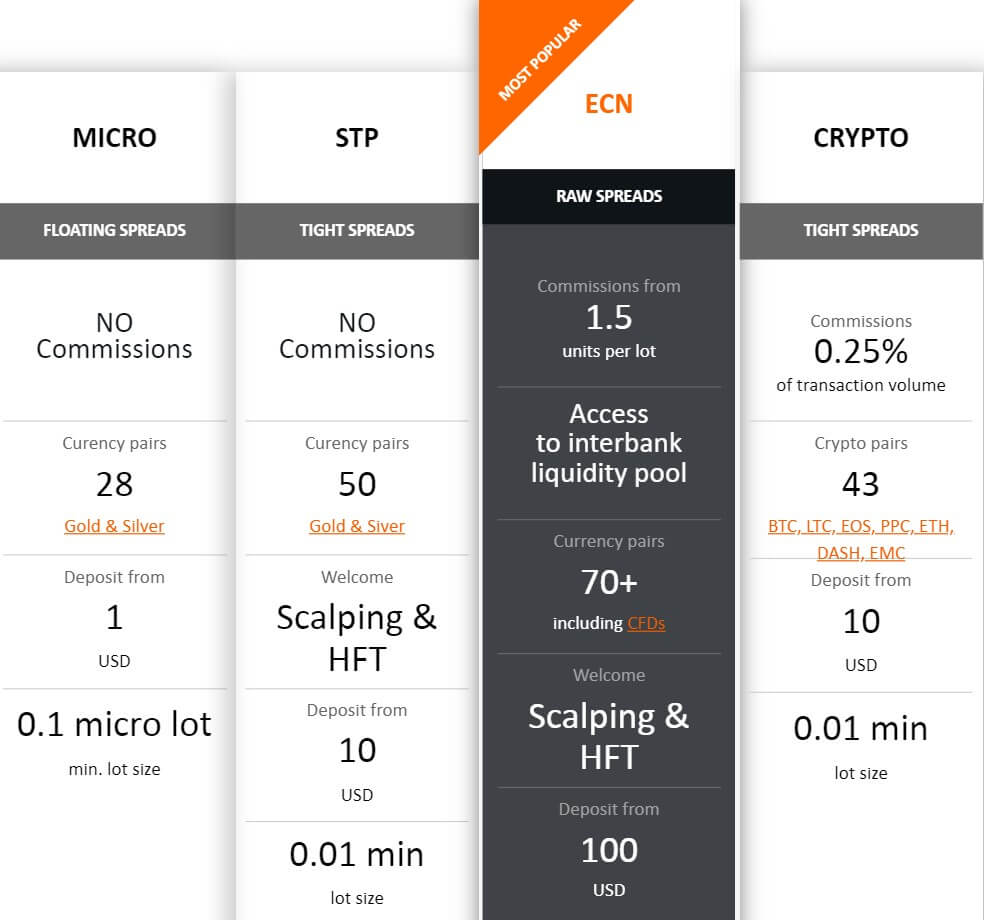

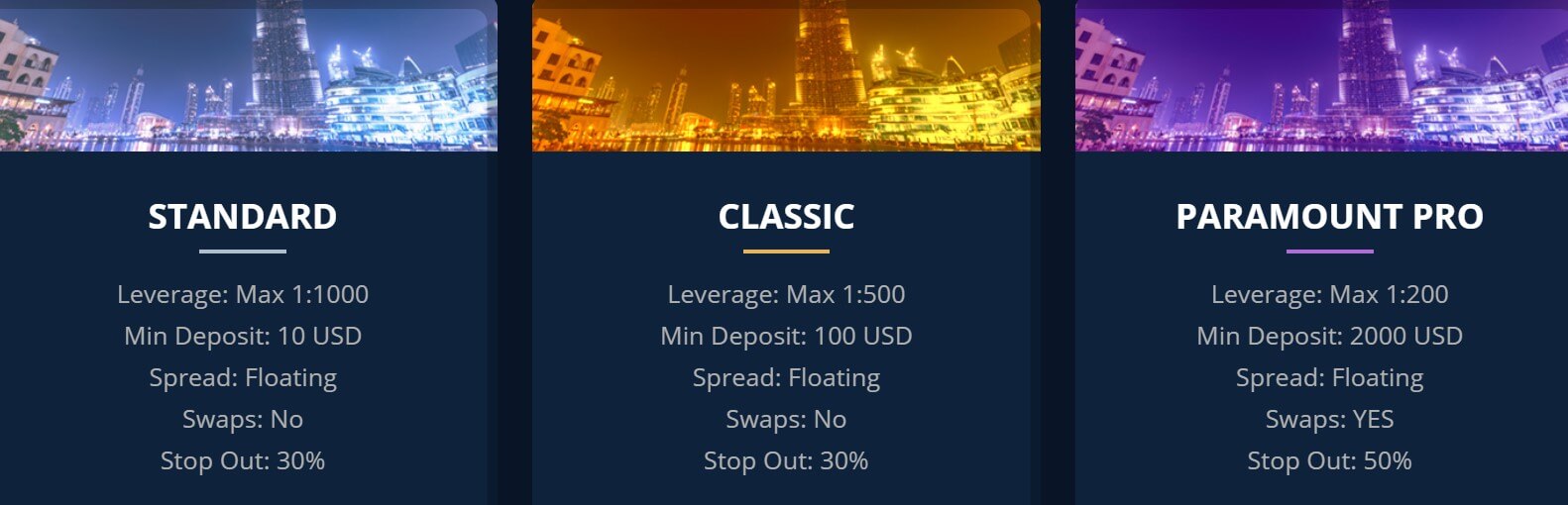

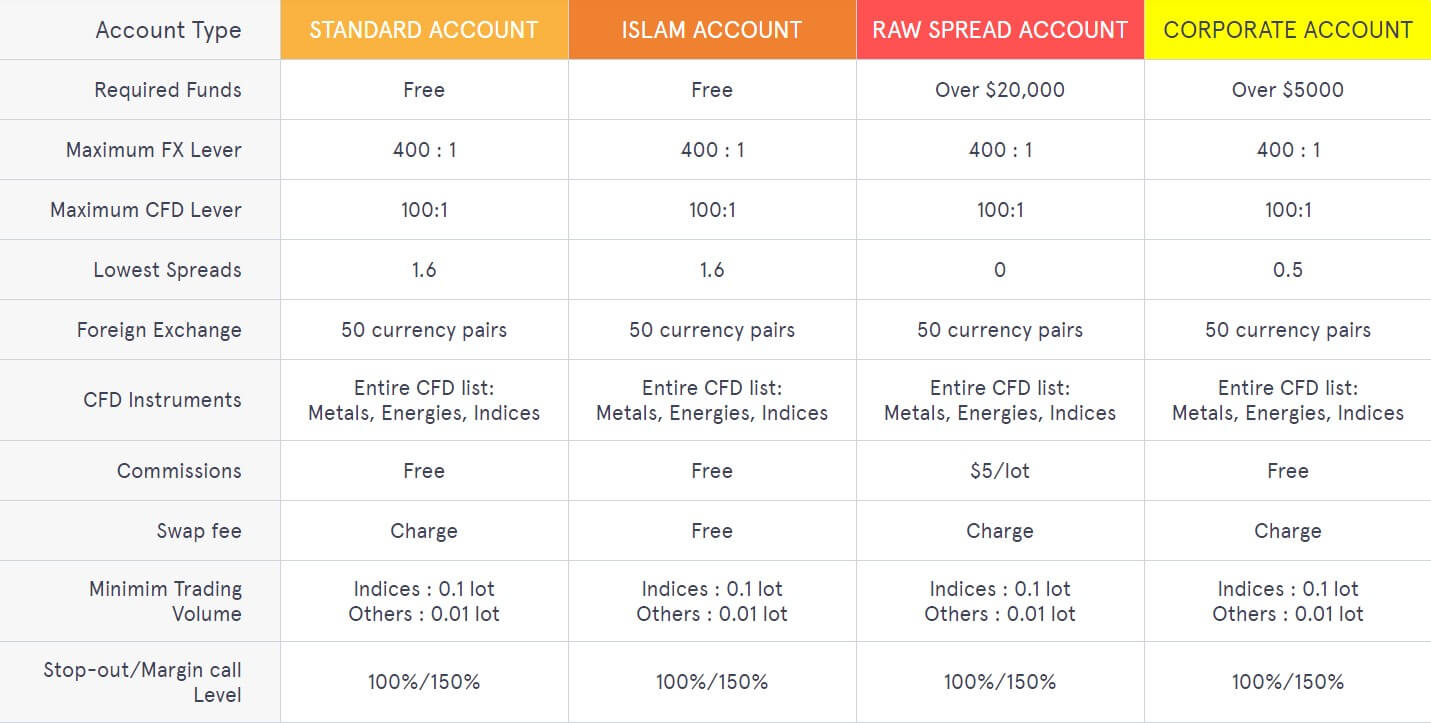

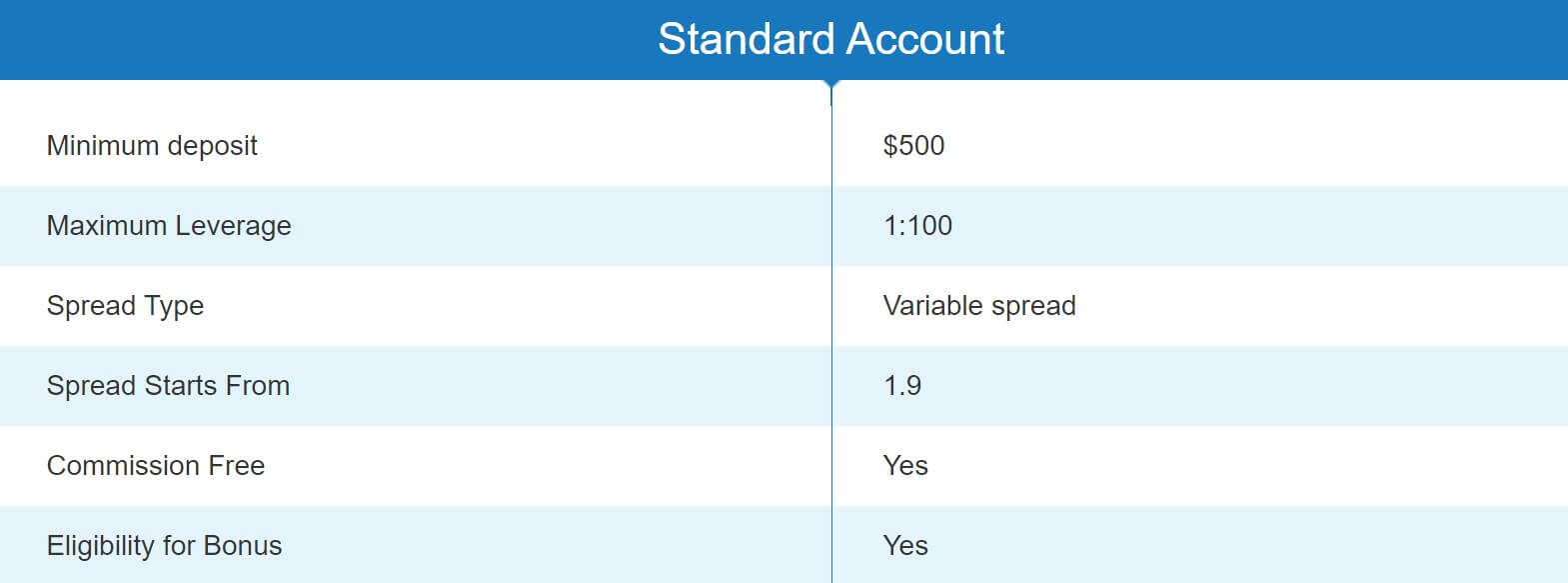

FXOpen offers 4 account types that are not diversified by minimum deposits requirements and scaling benefits but towards the trading style and financial capabilities.

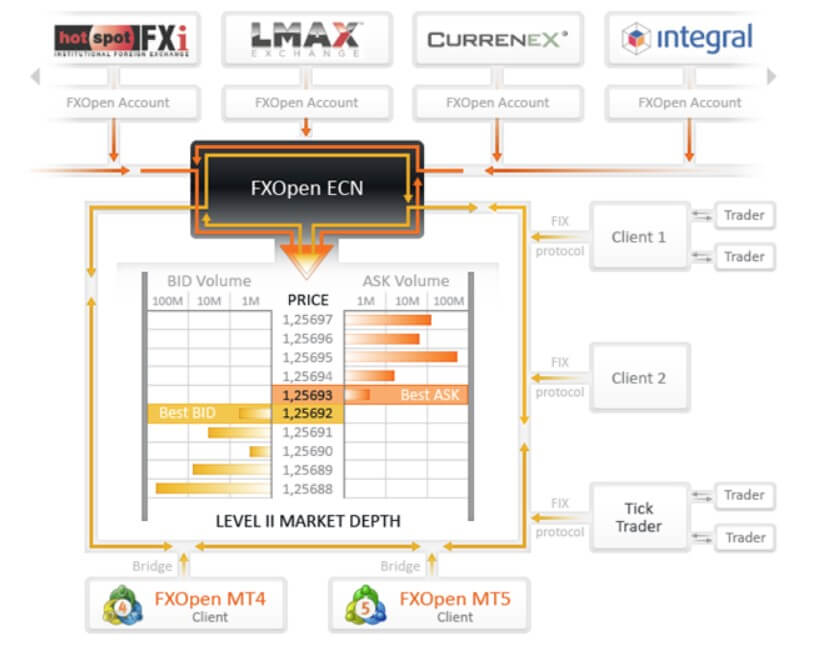

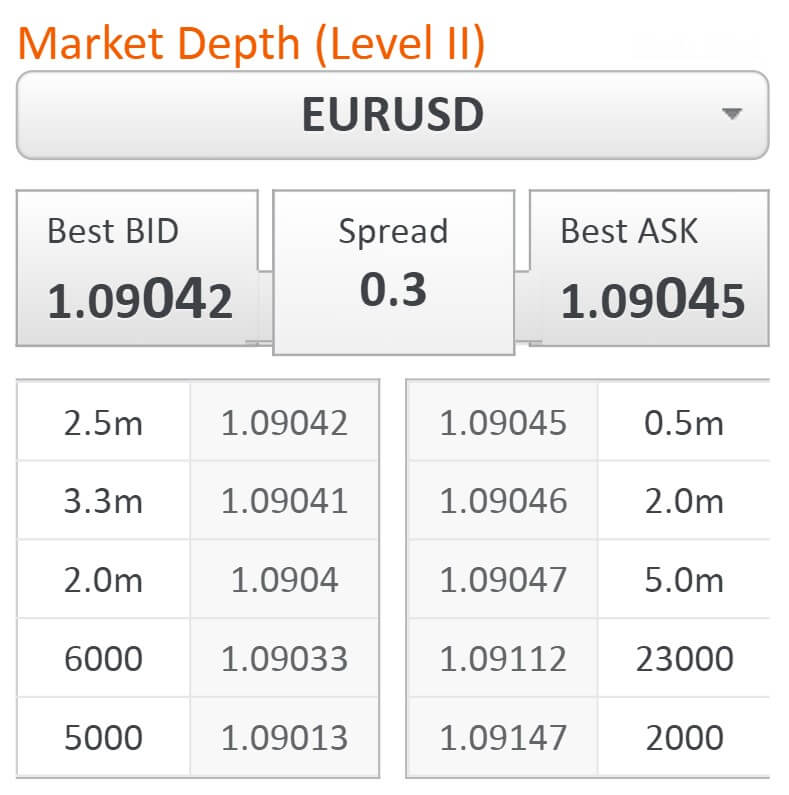

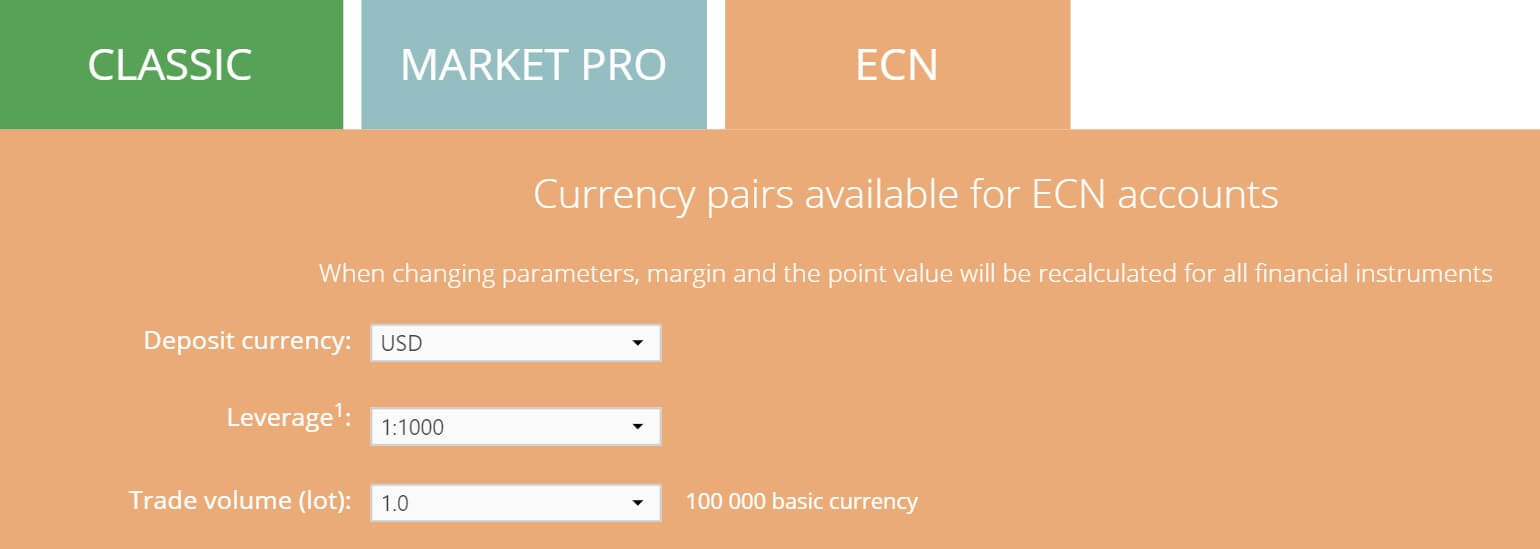

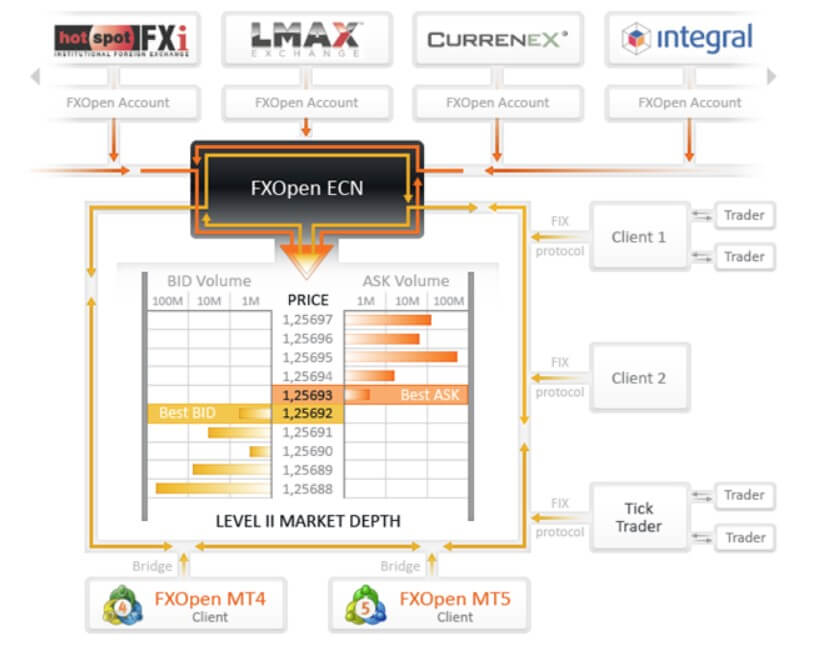

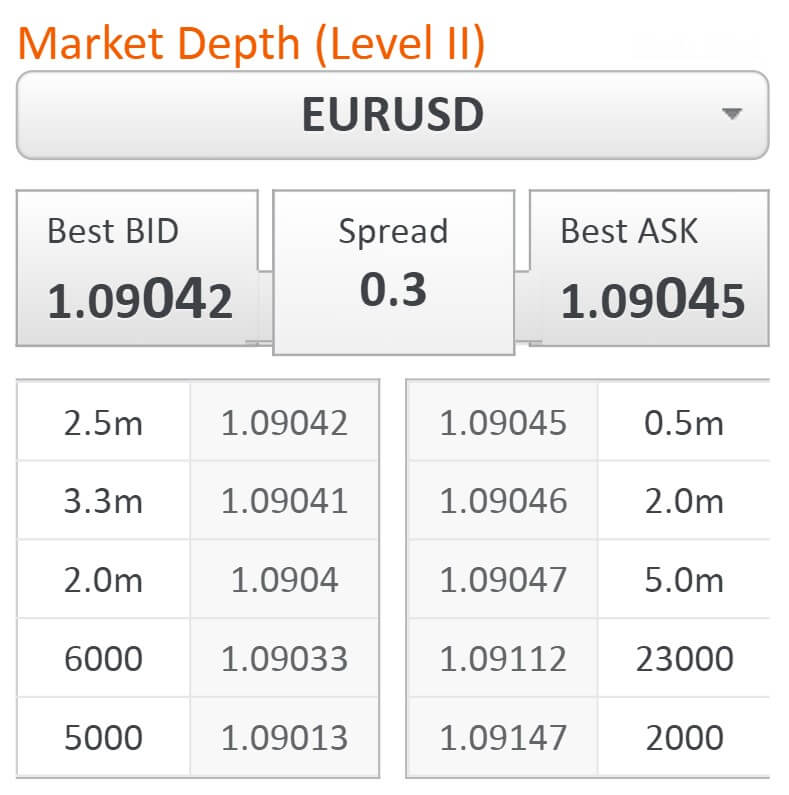

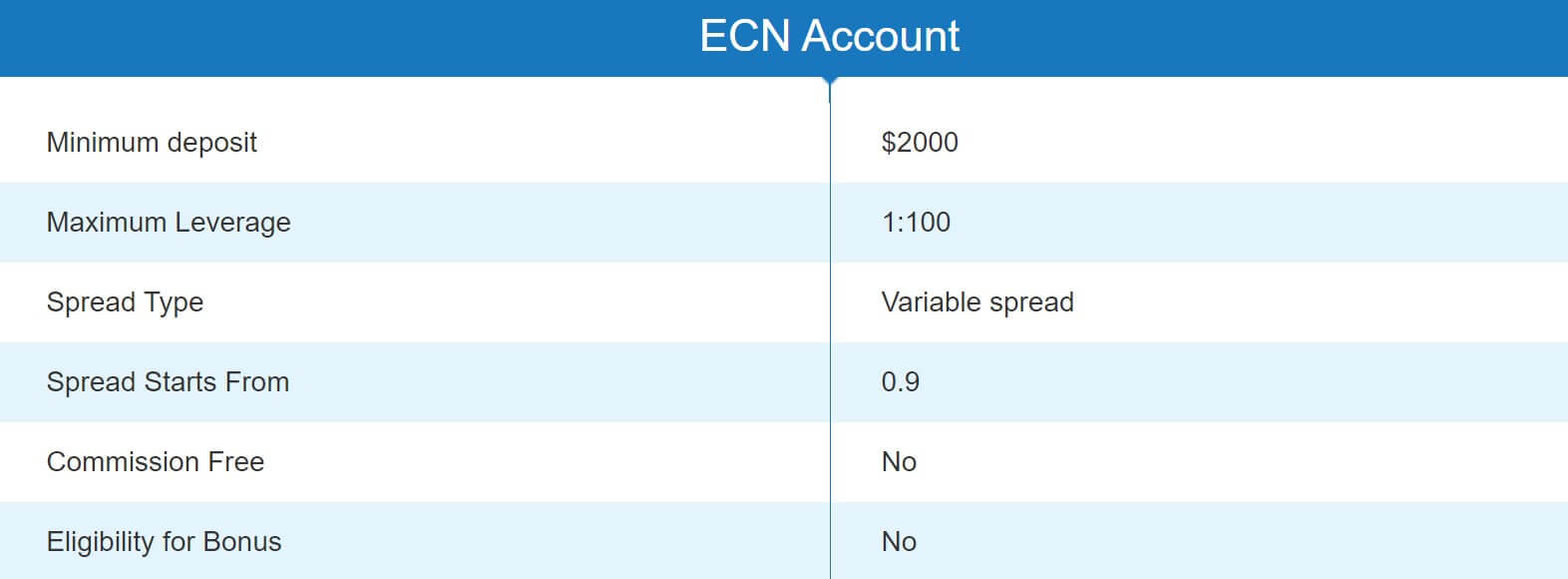

ECN Account is FXOpen’s main account that features aggregating liquidity technology, therefore it should provide tight spreads, great execution time and liquidity. Each participant acts as a liquidity provider and Level 2 Market depth is available.

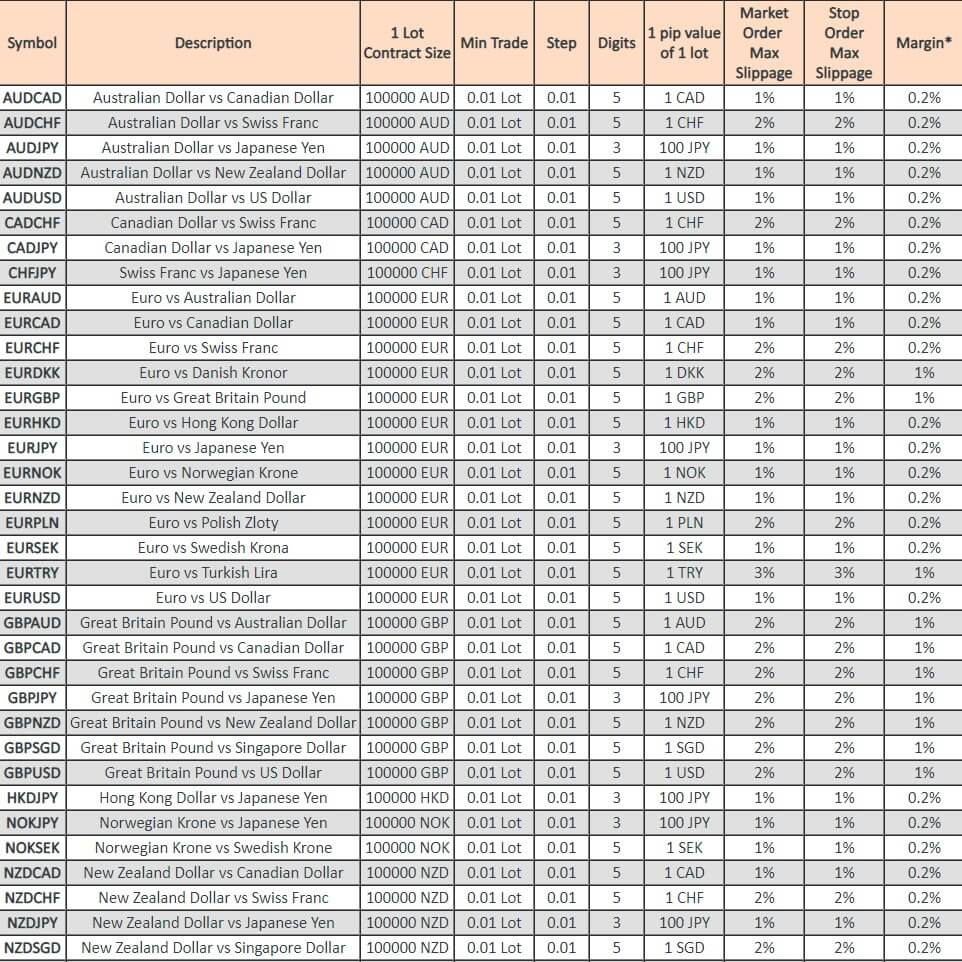

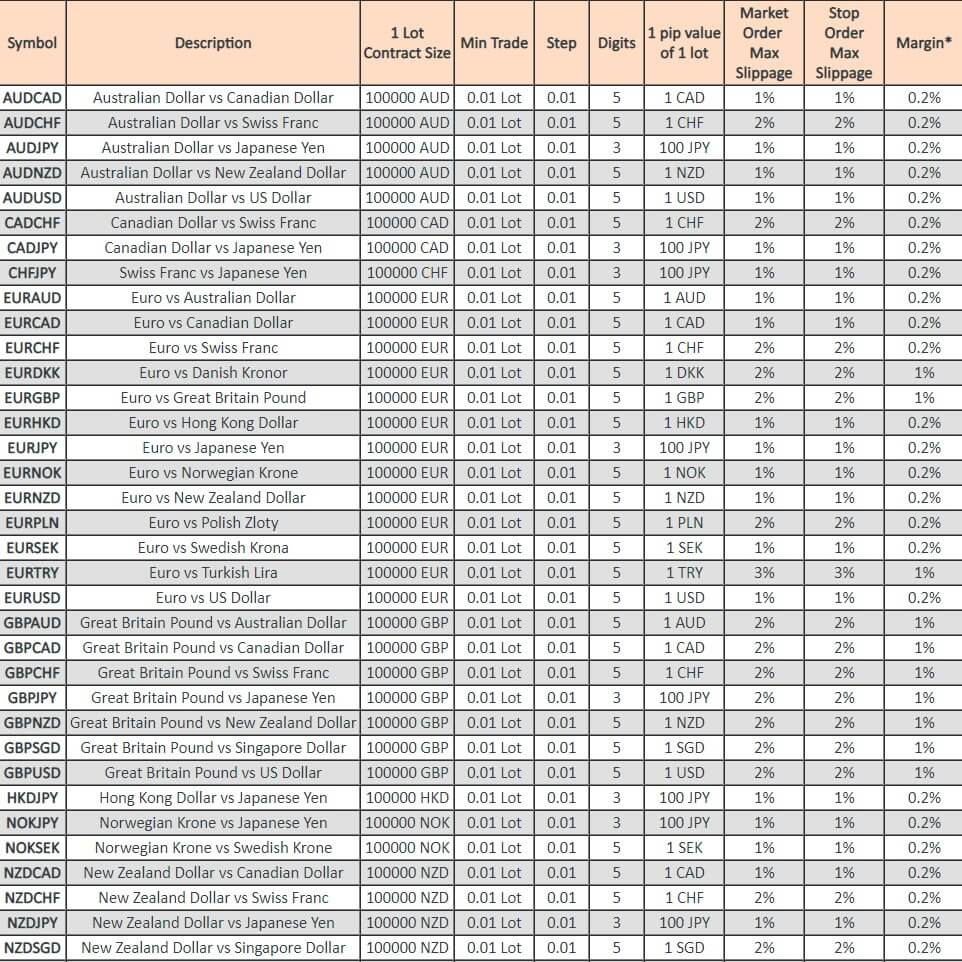

ECN Account is an NDD type without any limitations to the trading style. Account currencies available are USD, AUD, CHF, EUR, GBP, JPY, RUB, SGD, milliBTC (0.001 BTC), and GLD. GLD is a unique Gold unit are represents 0.001 troy ounces of Gold that can be used for account currency. Having Gold as a base gives traders the ability to have a haven from market crashes, special hedging, and hold an asset that has undisputable intrinsic value. Note that the account will not have actual Gold backed up, just a representation of Gold. The account specification table is very detailed, more than what we usually see with other brokers.

ECN Account is an NDD type without any limitations to the trading style. Account currencies available are USD, AUD, CHF, EUR, GBP, JPY, RUB, SGD, milliBTC (0.001 BTC), and GLD. GLD is a unique Gold unit are represents 0.001 troy ounces of Gold that can be used for account currency. Having Gold as a base gives traders the ability to have a haven from market crashes, special hedging, and hold an asset that has undisputable intrinsic value. Note that the account will not have actual Gold backed up, just a representation of Gold. The account specification table is very detailed, more than what we usually see with other brokers.

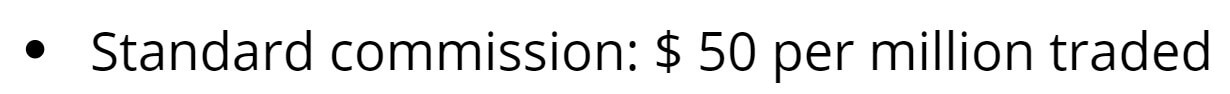

ECN account has a commission charged, although it is one of the lower amounts in the industry. Furthermore, the amount may vary depending on the volume and also if you open an account through an affiliate. FXOpen recommends this account type for scalper trading strategies and experienced traders. There are more than 70 tradeable instruments according to the FXOpen website.

STP Account is a no commission variant of ECN Account with a lower initial deposit requirement. The commission is integrated into the spread. Account currency can be in USD, EUR, GBP, JPY, RUB, CHF, and Gold. GLD is used as base currency the same way as the ECN Account. No limitations are set and the trader will have more than 50 tradeable instruments as stated, under the same liquidity conditions as the ECN type. STP Account also has more tolerable Margin Call and Stop Out levels. STP Account does not list crypto assets and some other commodities for trading, only the ECN Account has all assets available.

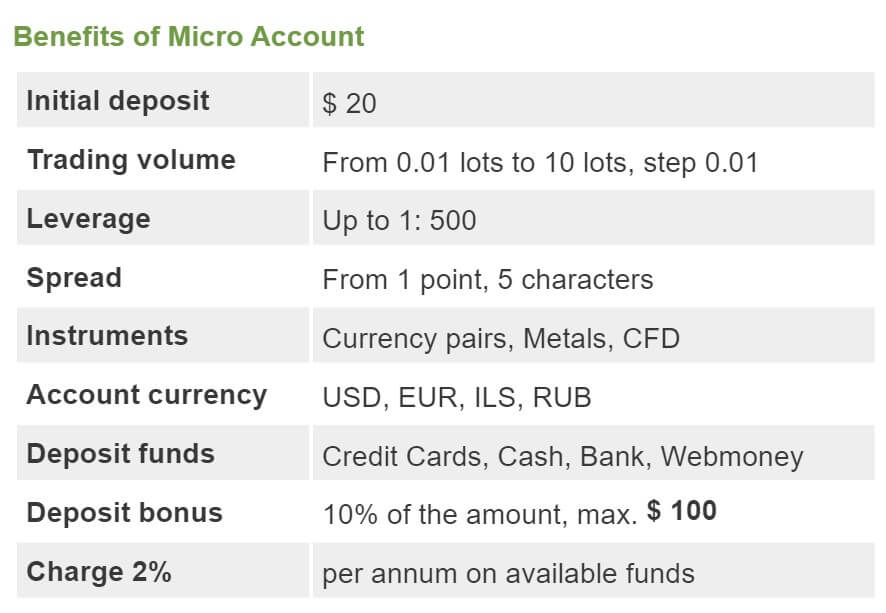

Micro Account is scaled down to cents instead of regular USD and is designed for low capital traders. The initial deposit amount is minimal, Margin Call and Stop outs are even lower then STP but they share the same trading conditions. There are 28 currency pairs, Gold and Silver available for trading only. Demo account for Micro is not available, it acts almost like a demo with real, low-value capital. Some other restrictions apply to trade styles. News trading and scalping are not allowed and Level 2 market depth is unavailable. No commissions are charged but the leverage will be reduced once the balance exceeds $3000.

Crypto Account is dedicated to cryptocurrencies trading with a leverage of 1:3. The broker uses the same ECN aggregation technology for better liquidity as with other accounts. Conditions are very well presented, almost all the information that we were interested in is stated. Account currency can be in USD, EUR, GBP, RUB, JPY, Bitcoin (mBTC), Litecoin, Ethereum, and Dash. This ability to have cryptocurrency is very convenient for those who do not want to have any intermediaries for their financial transactions. The commissions are charged and are scaled to trading volume.

There is a total of 43 trading instruments with BTC, ETH, BCH, EOS, Ripple, Monero, ETH, LTC, etc. No bonuses are available for this account type. Traders will have no trading style restrictions. Also, you will enjoy 24/7 crypto trading. More info on trading assets and costs for each account type in the following sections.

Islamic account is available but the swaps are just integrated into commission equal to the Swap rate of the particular currency pair.

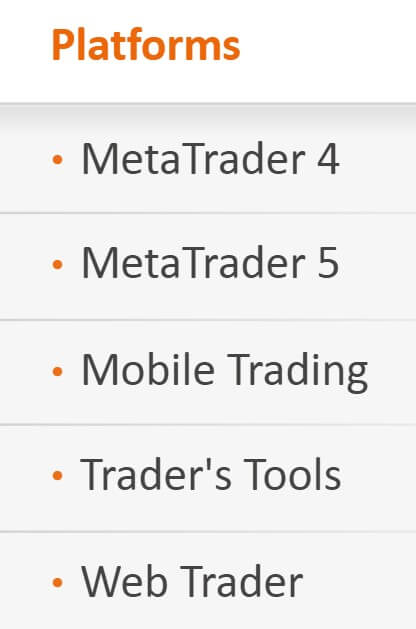

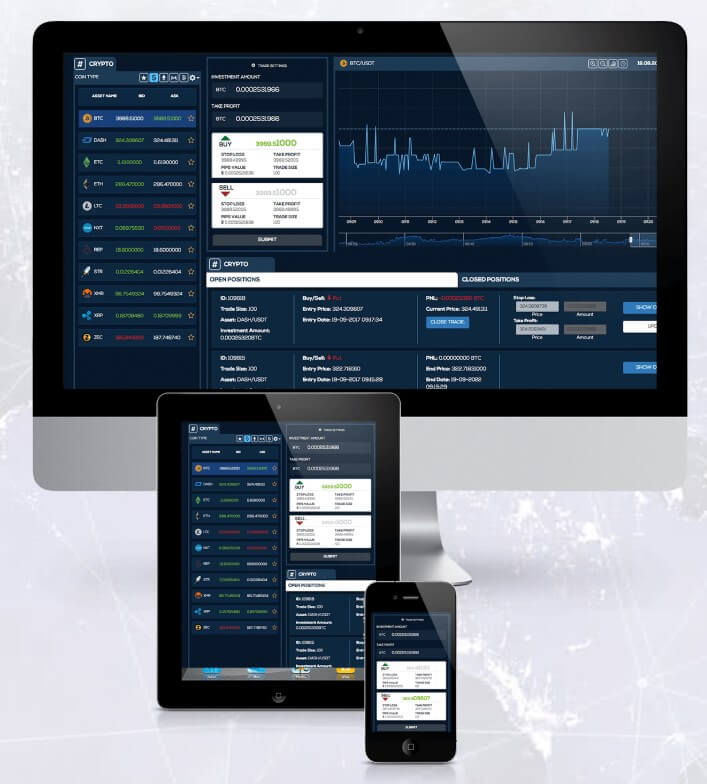

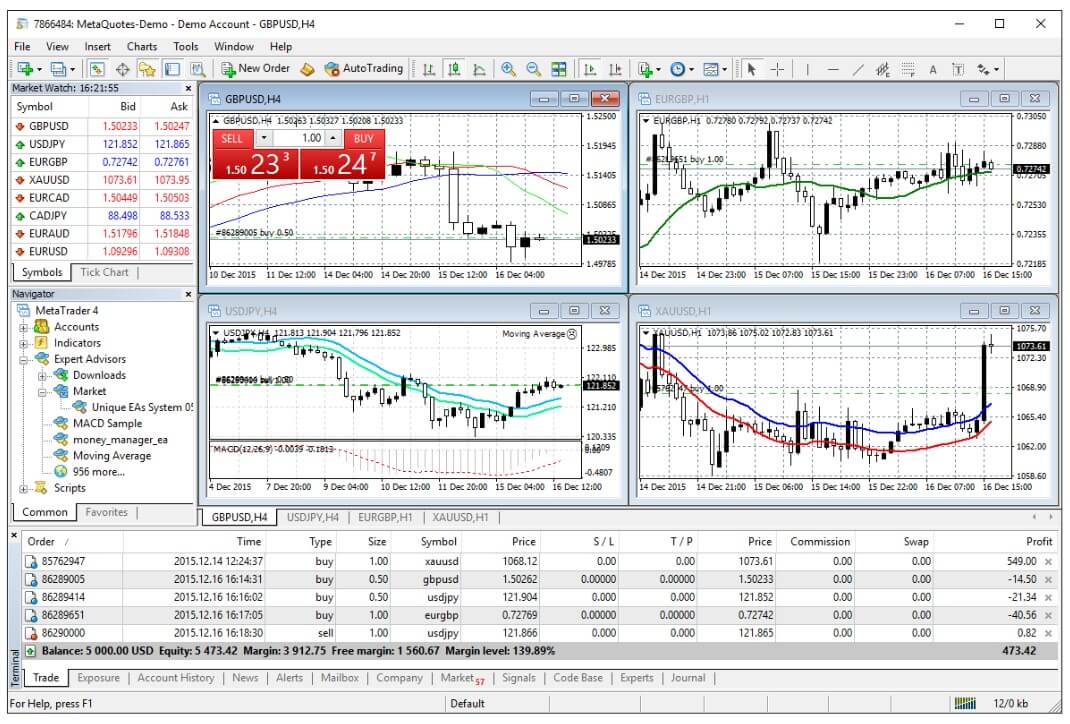

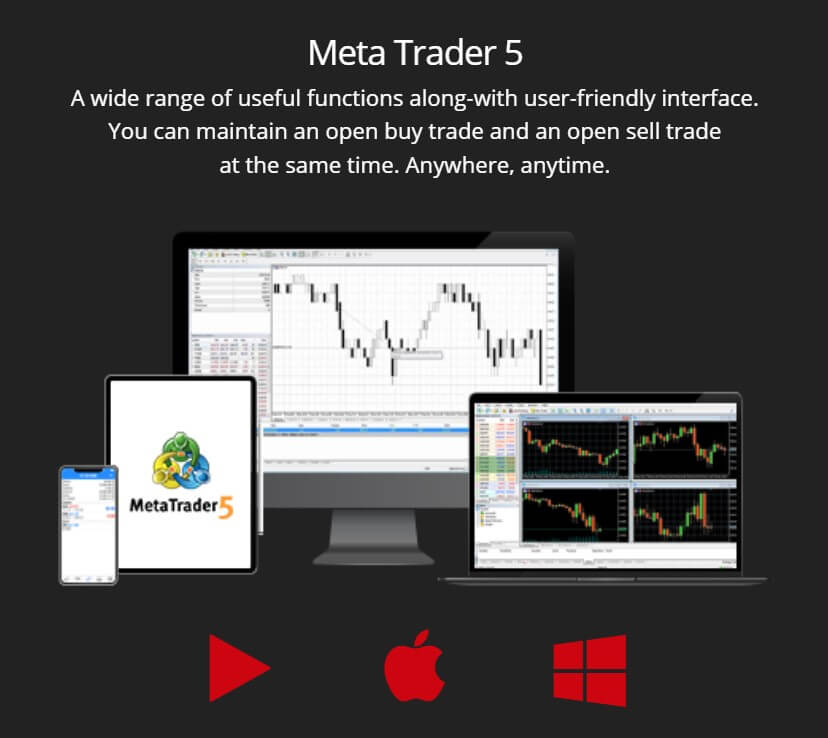

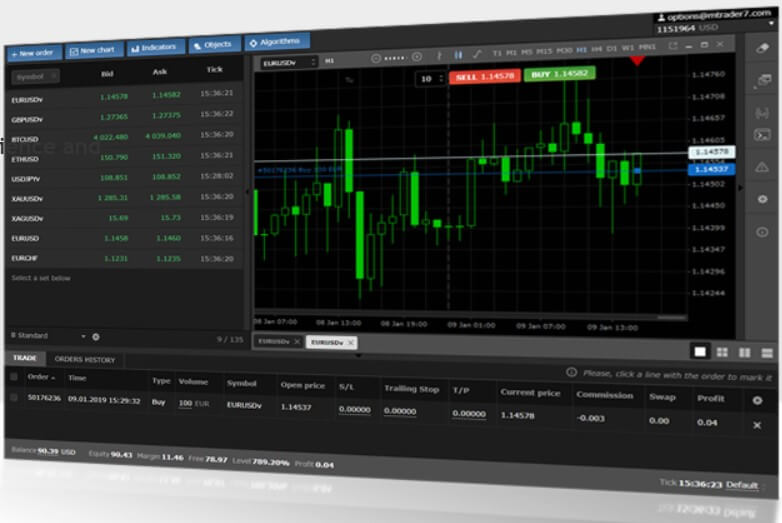

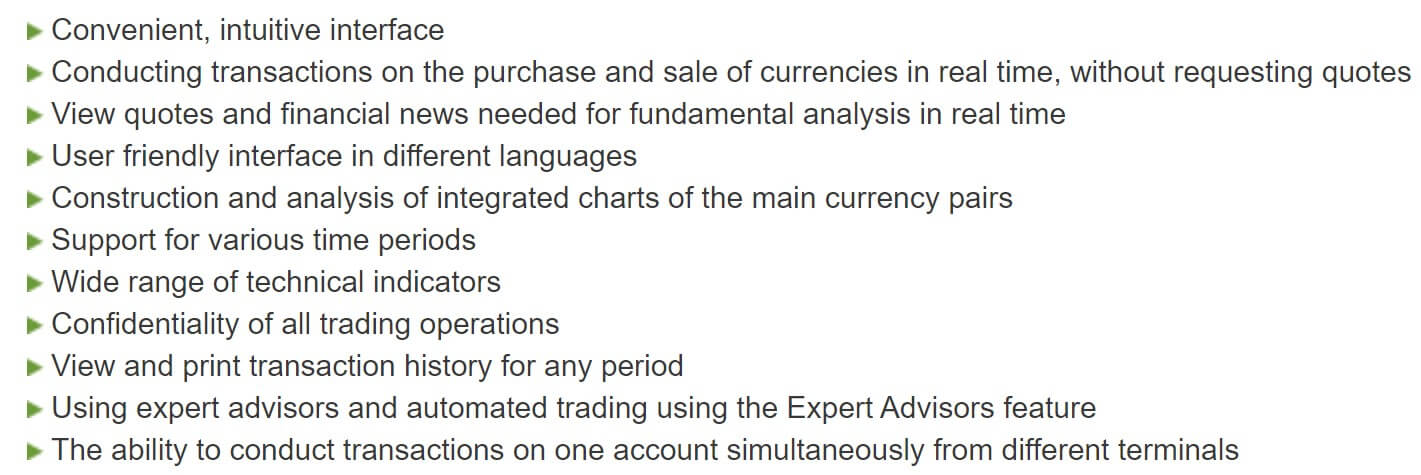

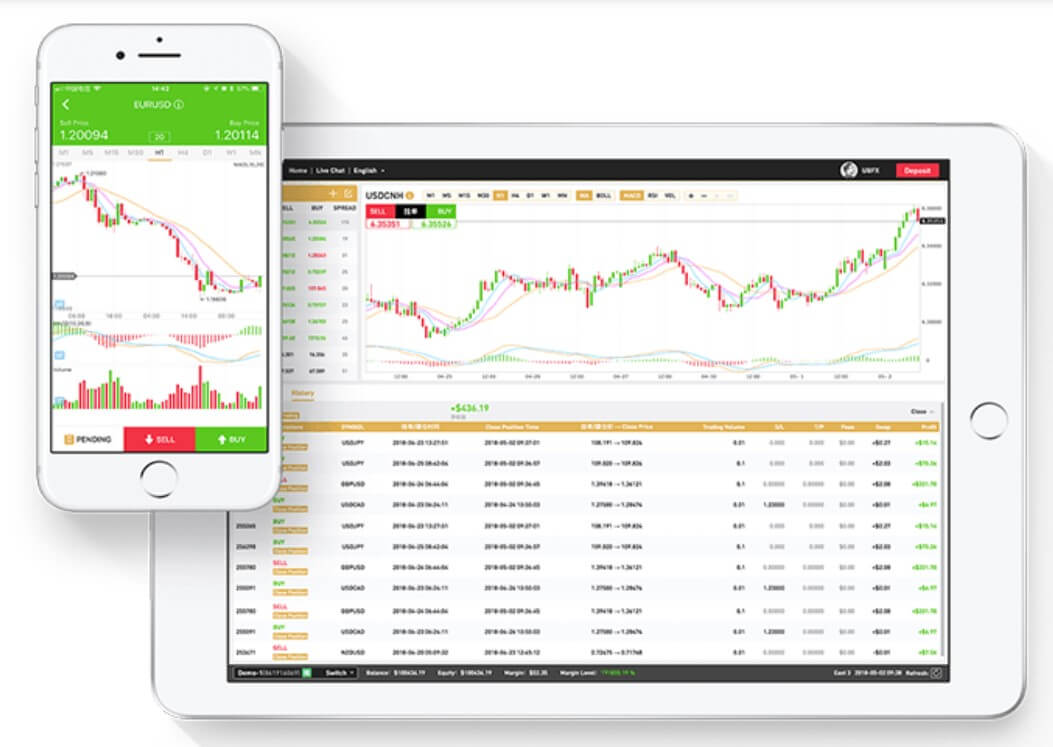

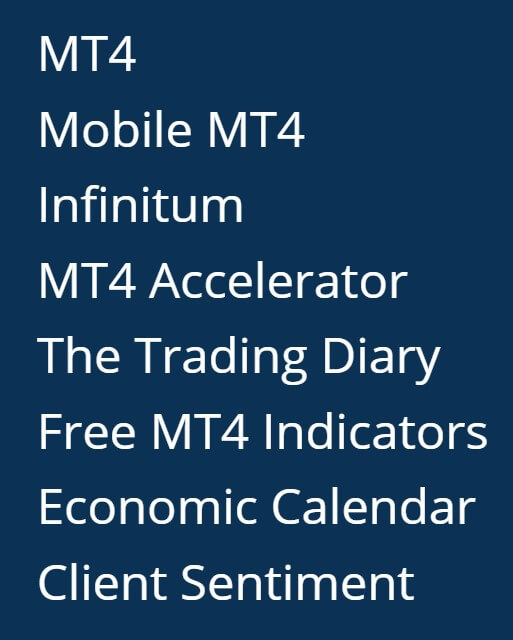

Platforms

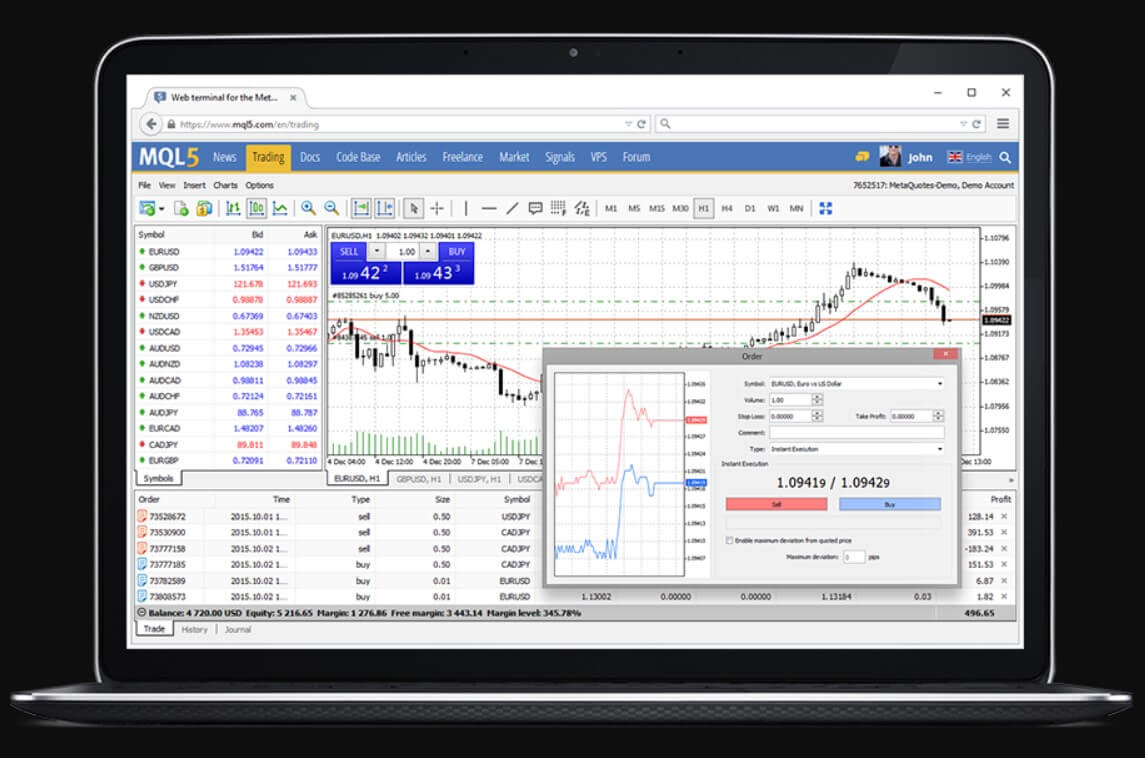

FXOpen launched the MetaTrader 5 platform for the ECN accounts in 2018 and also holds former licenses for the MetaTrader 4 platform. Both are available for computers running on Windows and Mac operating systems as well as for the mobile devices running on Android and iOS. Web access MT4 or is available without any need for installation or download. The MT4 platform has different modifications for the ECN and the STP or Micro accounts. So traders will have two versions to download.

FXOpen launched the MetaTrader 5 platform for the ECN accounts in 2018 and also holds former licenses for the MetaTrader 4 platform. Both are available for computers running on Windows and Mac operating systems as well as for the mobile devices running on Android and iOS. Web access MT4 or is available without any need for installation or download. The MT4 platform has different modifications for the ECN and the STP or Micro accounts. So traders will have two versions to download.

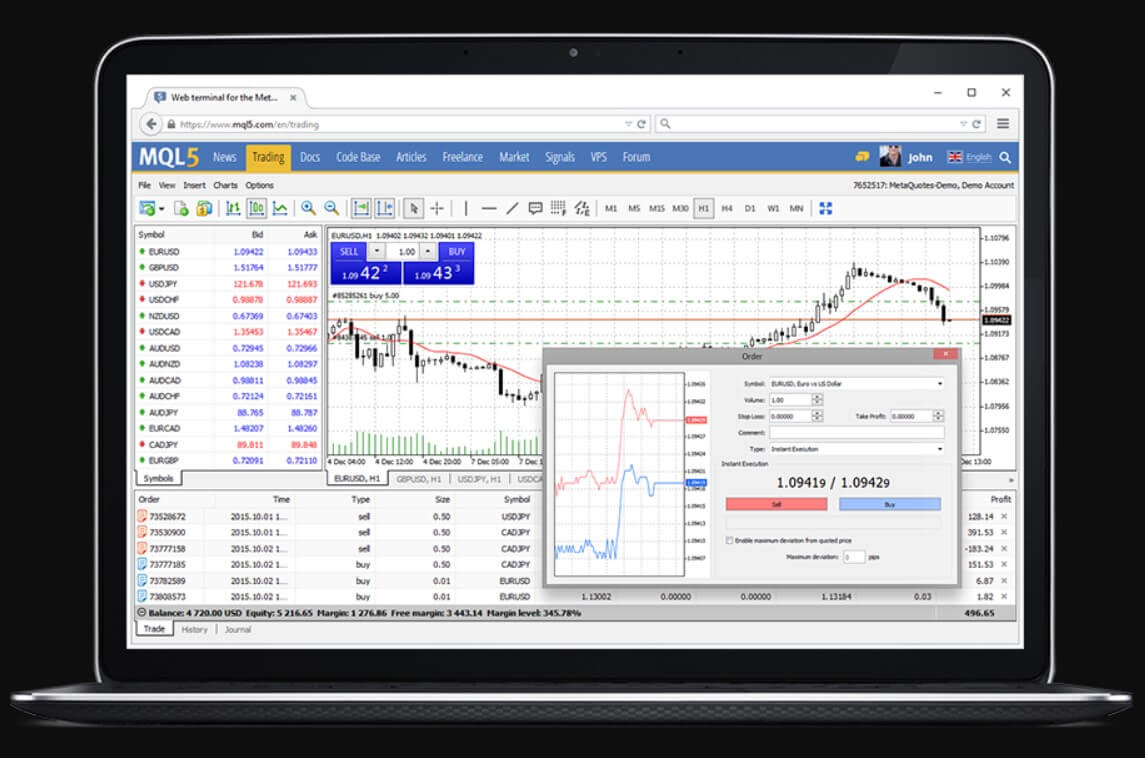

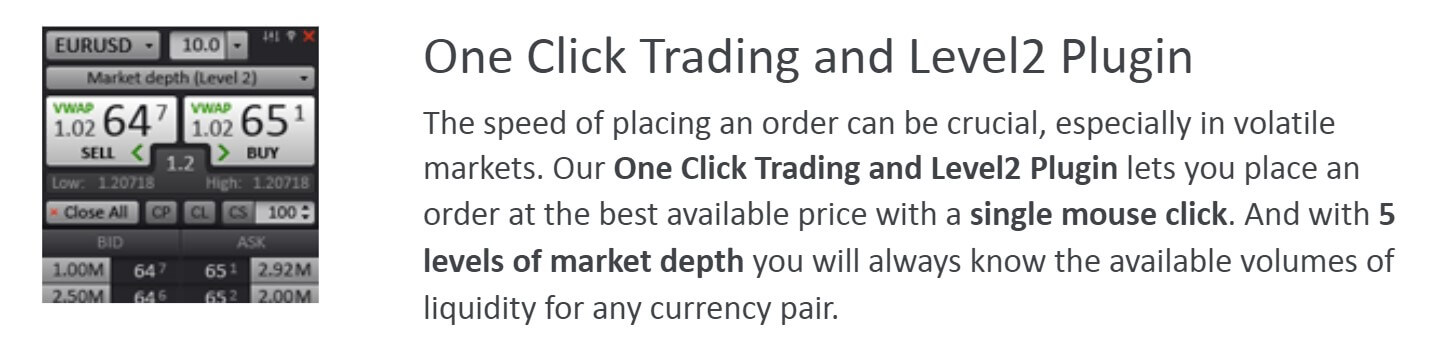

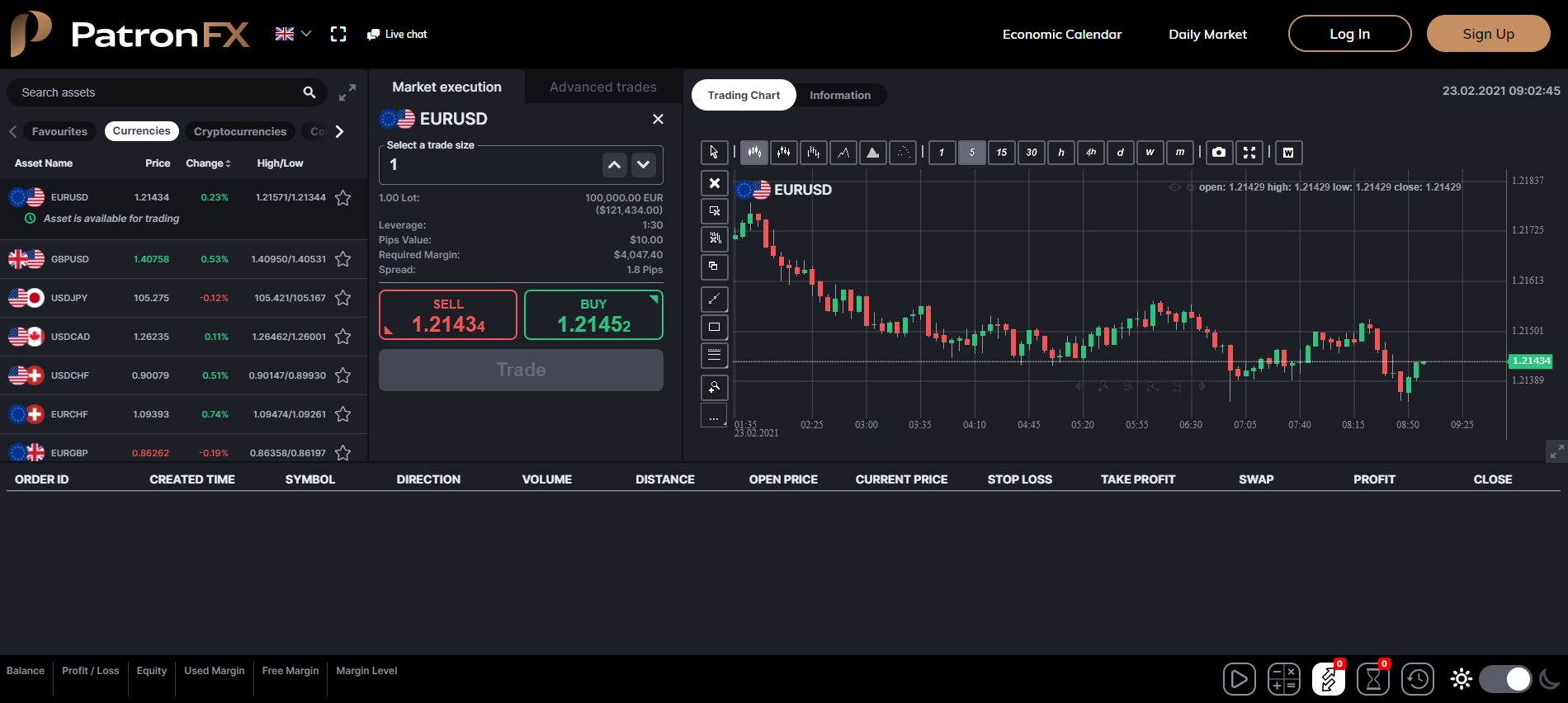

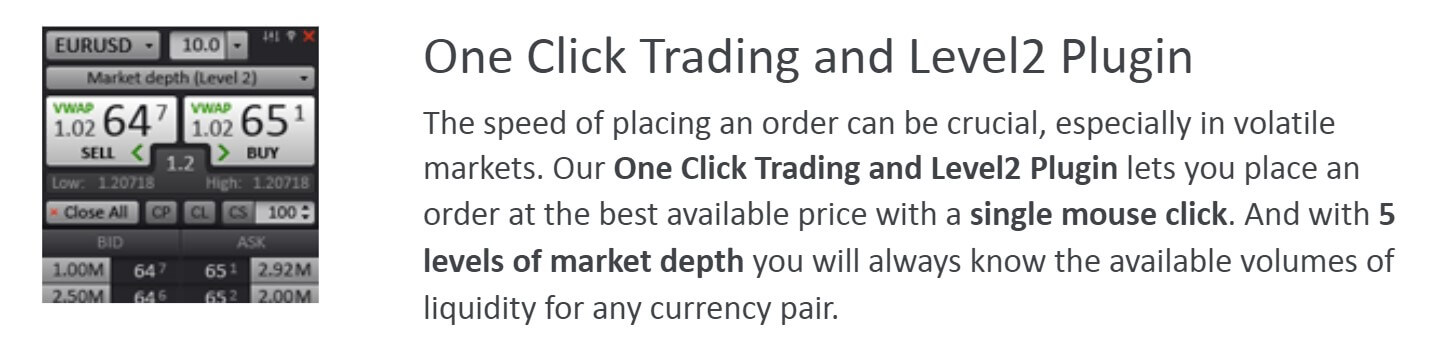

The MT4 platform will show 2 FXOpen servers to select, Live and Demo, both having around 50ms ping. The main four charts will resemble default settings but FXOpen wants to showcase their crypto assets trading for the ECN Account type. So, apart from two major Forex currency pairs on the H4 timeframe, there are also BTC/USD and LTC/USD. One-click trading is only enabled on the EUR/USD chart. Of course, One-click trading can be enabled but not for cryptocurrencies as we have experienced in the MT4. The reason is that to trade crypto, you need to have Crypto type Account. FXOpen has separately offered “One-click trading and Level 2 plugin” developed by Soft-FX. This tool acts as an Expert Advisor that is can be installed like any other program.

A few settings have to be enabled in the MT4 before the tool can be applied to charts. The plugin is well designed with several useful options for trading. Traders can see the spread, Bid and Ask price, Level 2 structure in quantity or lots. Orders type selection, Stop Loss and Take Profit boxes are available with the addition of partial closing, aggregated ordering options, volume-weighted average price mode and more. The tool package comes with the custom complementary indicator that will show the Level 2 histogram orders on-chart. Tools like this add unique value to traders and are rare to see. FXOpen provides a very good installation and Usage Guides for this tool.

The platform client is updated to the latest version and it is registered for the FXOpen Investments Inc. in Panama City, Panama. This address is not the same as the one registered for contact on the FXOpen website. There are no additional templates or custom indicators included in the default installation. The symbols are grouped into several groups, too many in our opinion and many of them contain one asset. Still, traders will understand the classification. There are also groups containing the Ask and Average prices for the many instruments, these are indicative only but opens a different aspect of trading.

The instrument specification window is showing enough trading conditions data. Open positions have swaps and commissions columns that accurately represent trading costs. The execution times range from 240ms to 280ms with an average of 263ms. Deviations are not extreme and under normal conditions are rare.

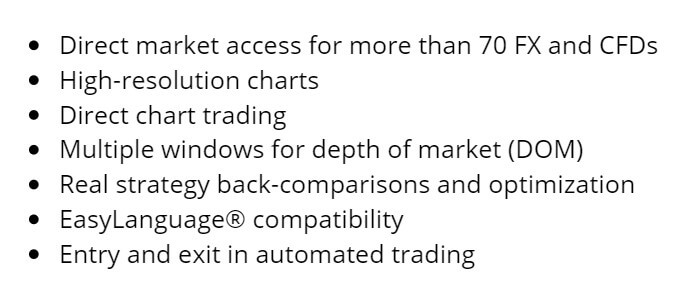

Metatrader 5 platform is available only for ECN Account type traders. The EU server has a bit slower ping rate of 55ms compared to the MT4. The client is updated to the latest version and is registered to FXOpen Investments Inc. in Panama City. The default startup template is not modified, it is by default settings with 4 major forex currency pairs set on H1 timeframe. This time cryptocurrencies are not presented on charts. Symbols list is similar to the MT4 but better, as there is no unnecessary grouping. Instruments Specification shows all the trading conditions including the commission in percentage terms per lot. The execution times are better than with MT4 and are about 60ms without deviations, one of the fastest execution times in the industry. Market depth Level 2 quotes are available.

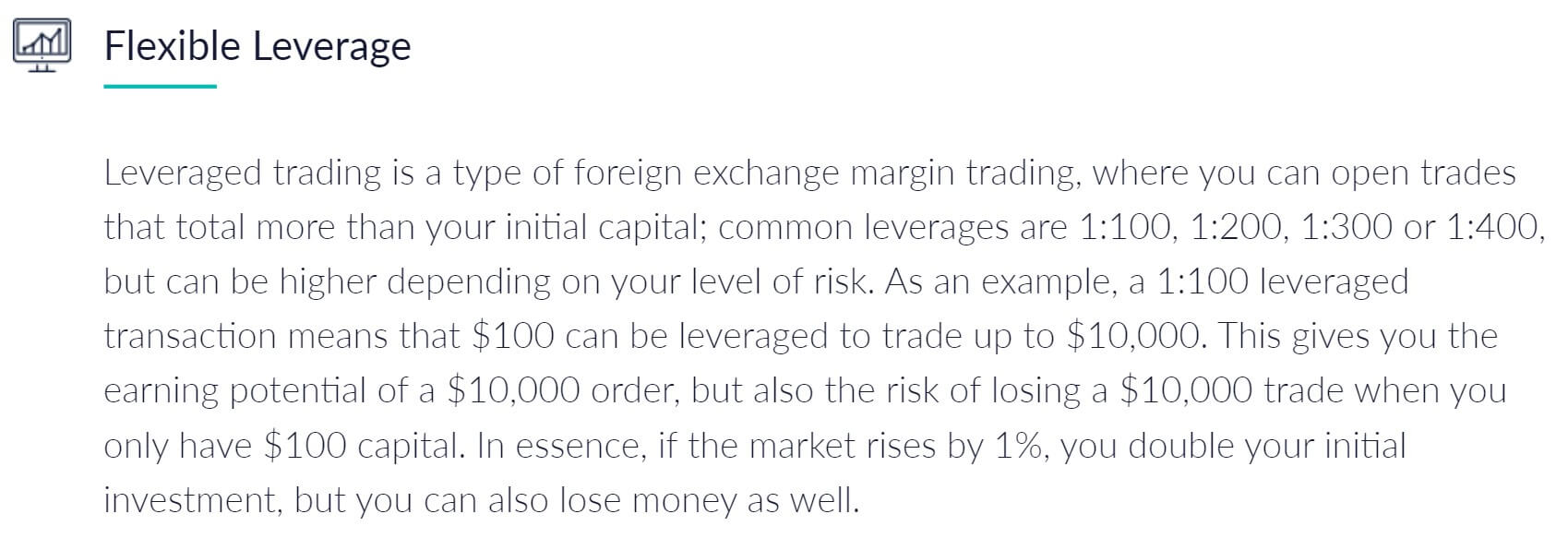

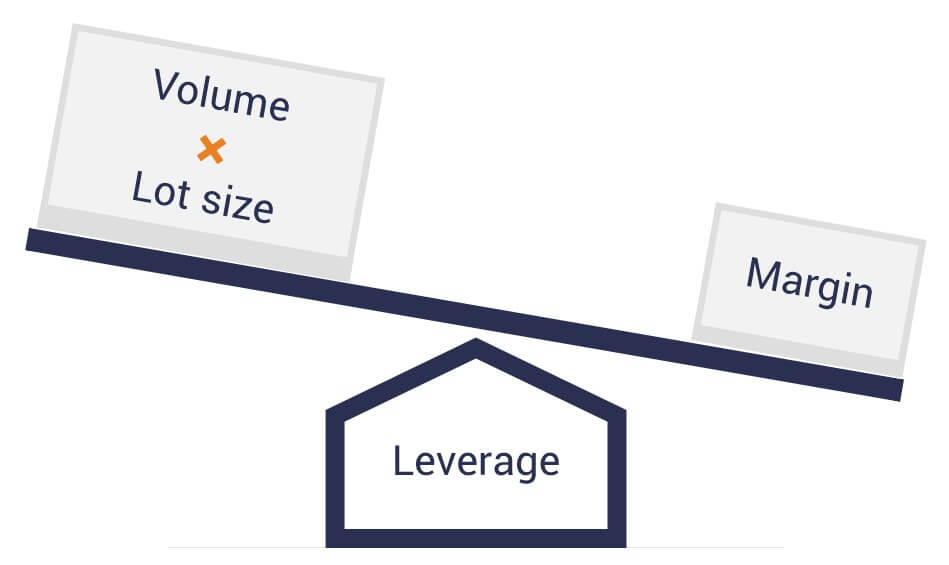

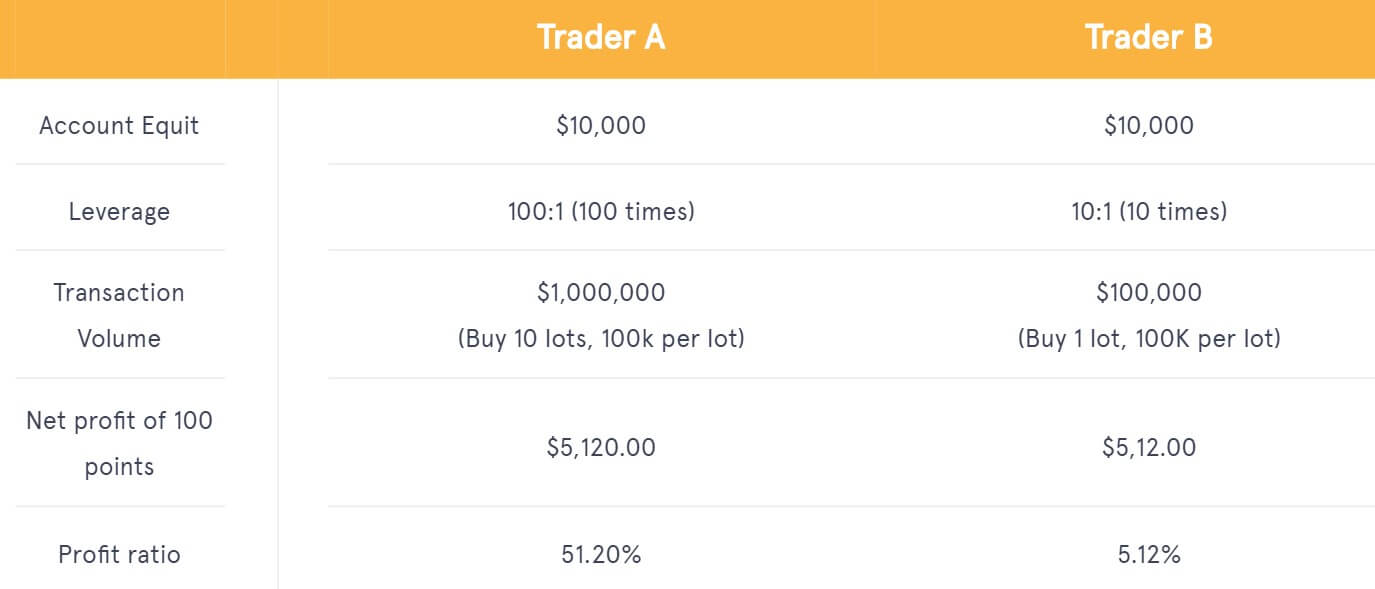

Leverage

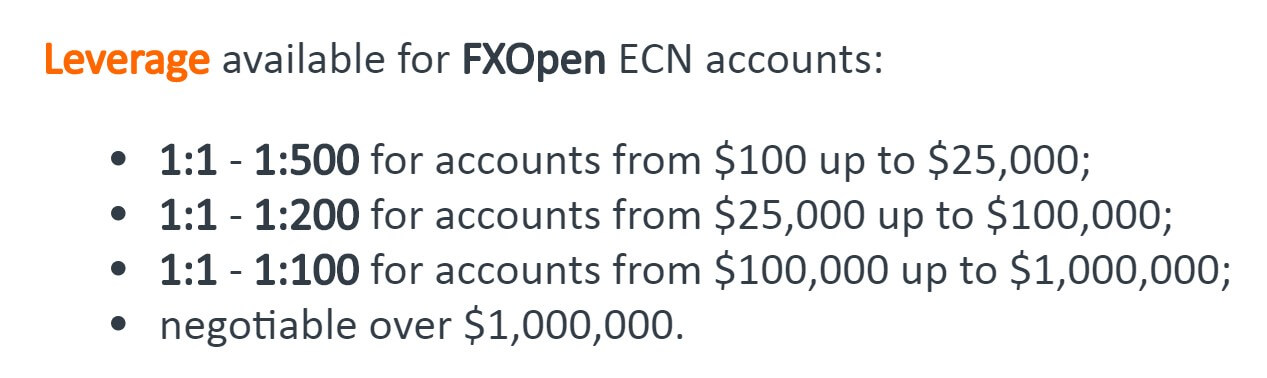

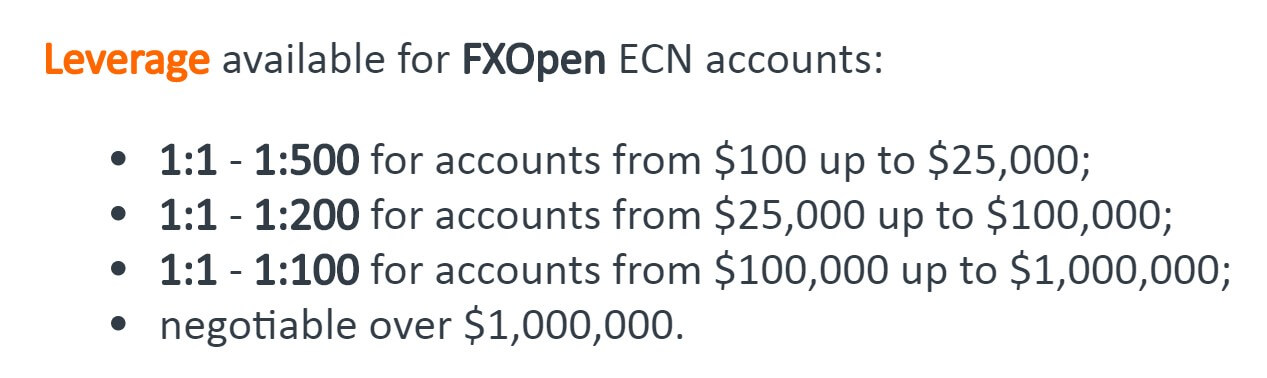

The leverage will be dependant on the FXOpen domain traders are registered to. EU regulations do not allow leverage above 1:30 unless traders are classified as Professionals. ASIC regulated domain will have leverage up to 1:500 for the Standard ECN Account.

The leverage level also depends on the account type. ECN accounts leverage is up to 1:500 and it is also scaled to balance size. Therefore, traders with a balance up to $25,000 can have 1:500 maximum, from $25,000 up to $100,000 – 1:200 and up to $1,000,000 is 1:100. FXOpen is open for leverage negotiation for sizes above 1 million.

The leverage level is changeable by notifying the broker. For some instruments, the maximum leverage is lowered, such as for exotics and volatile currency pairs. These are all GBP based pairs, EUR/DKK, EUR/GBP, EUR/TRY, USD/TRY and USD/HKD with a maximum leverage of 1:100. Gold and Silver remain at 1:500, which is not common. Oils are at 1:50 and Natural Gas 1:25. Indexes leverage go from 1:50 to 1:100.

The STP Account has 1:500 leverage for all assets except for the GBP related currency pairs that have 1:100. For the Micro account, the leverage is 1:500 maximum. Once the balance of a Micro account exceeds $3000, the leverage will be decreased 100x (for example: from 1:500 down to 1:5). The leverage specifications of this account published on the FXOpen website is not consistent with the main account presentation table, but we have confirmed that the leverage is 1:500 maximum. The Crypto Account has the leverage of 1:33 maximum for all trading assets, which are all and only cryptocurrencies.

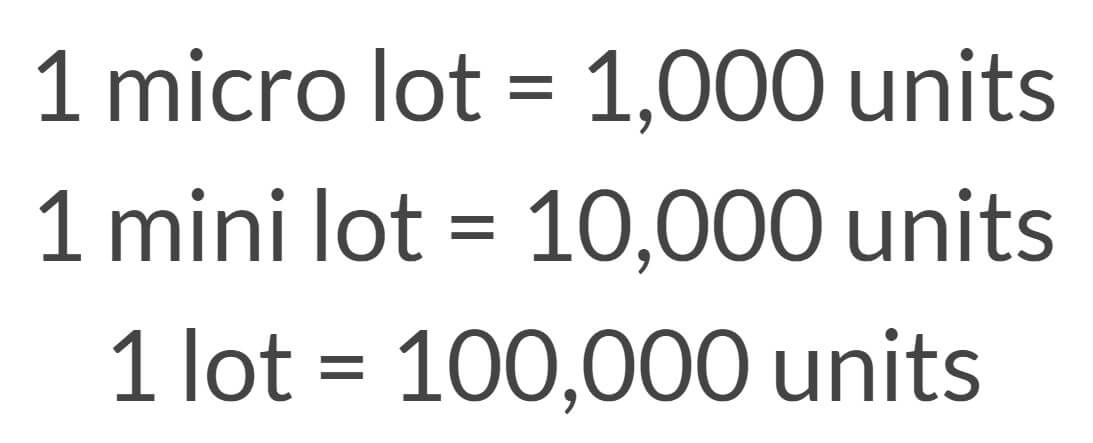

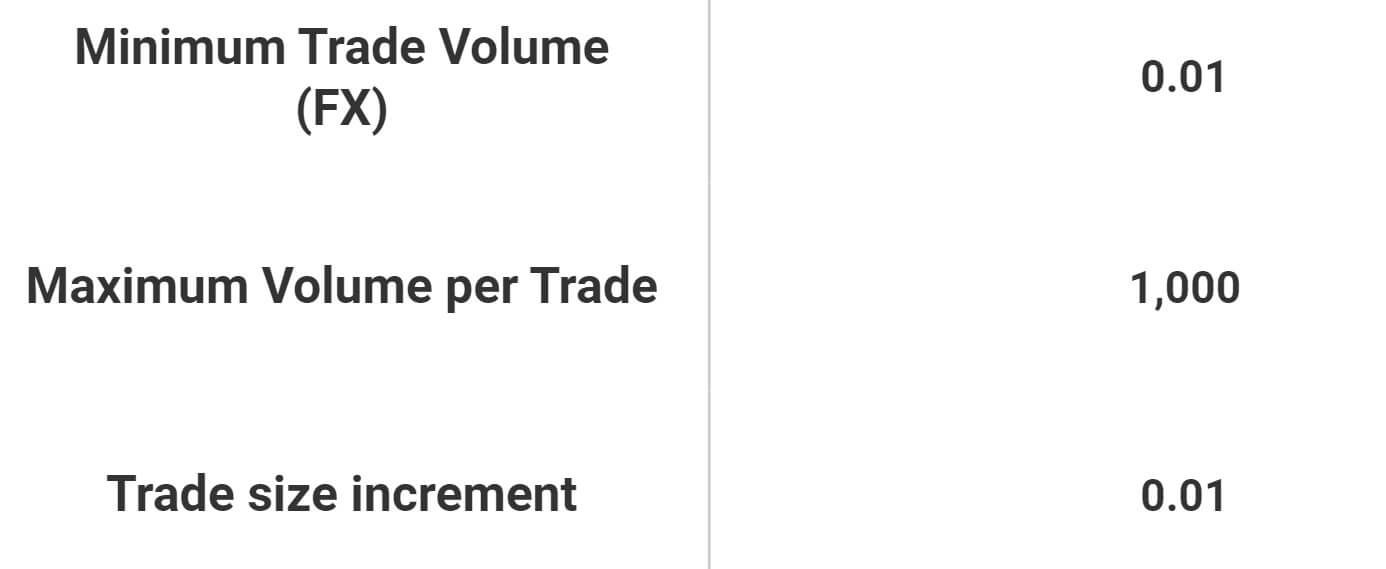

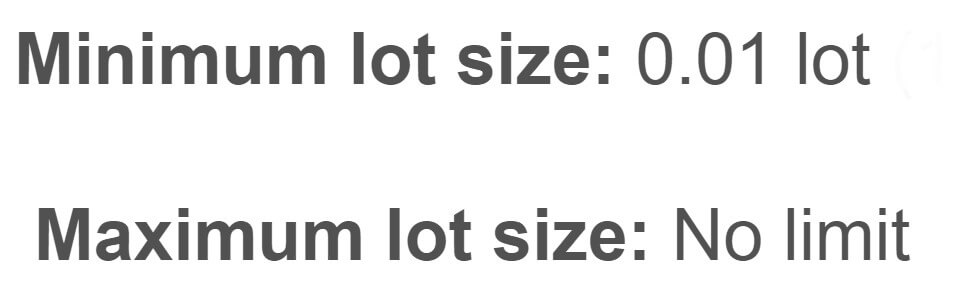

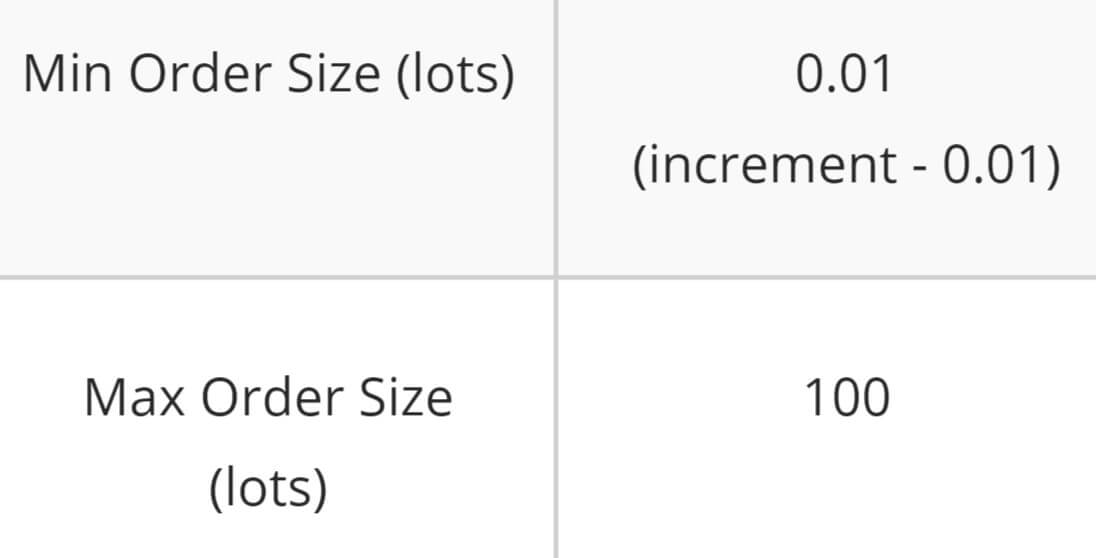

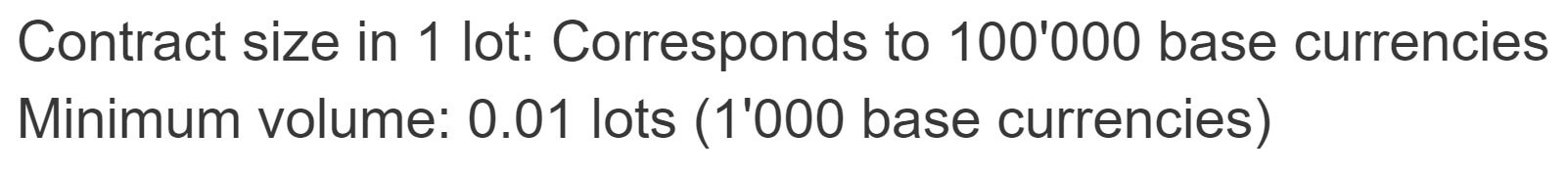

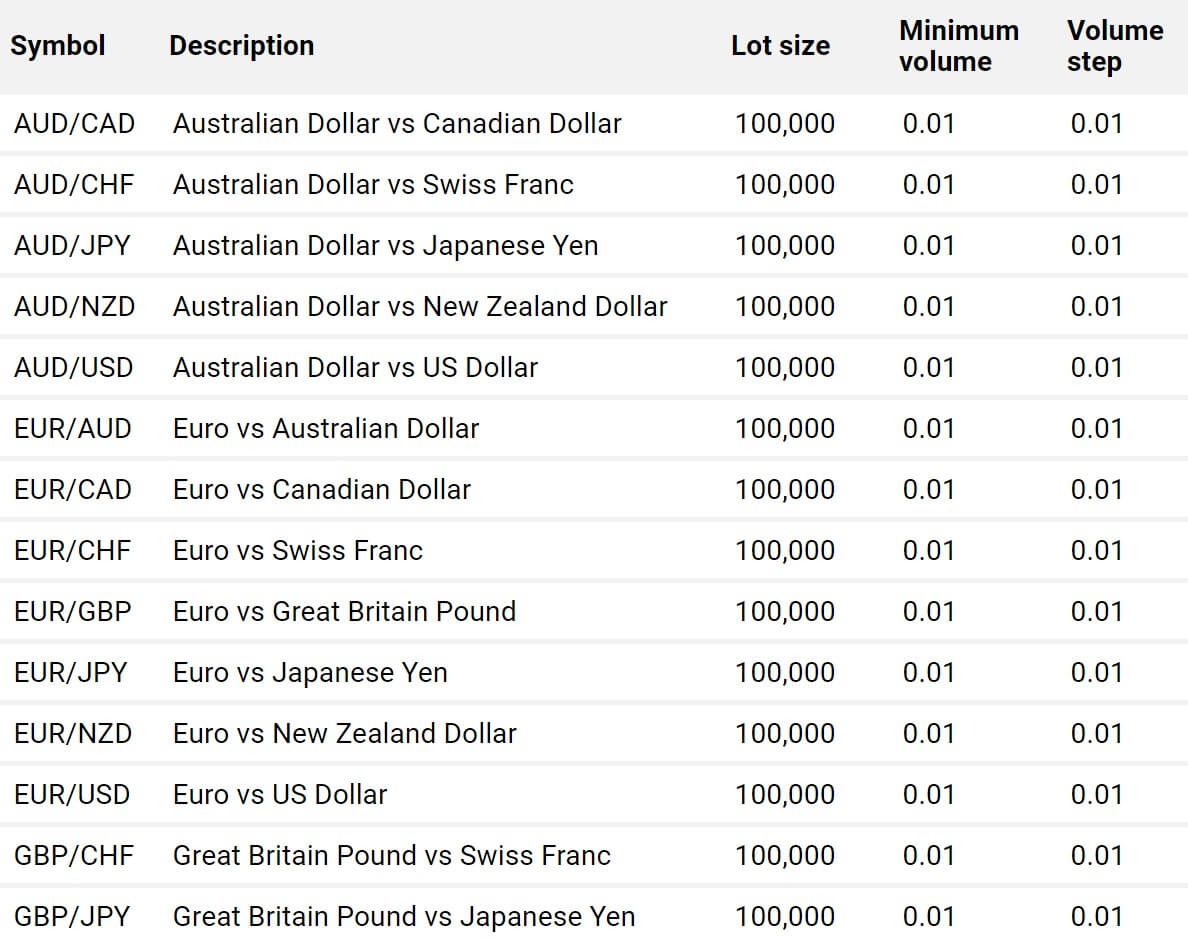

Trade Sizes

FXOpen uses micro-lot sizes on all accounts or 0.01 lots (1000 units). The maximum trade size is not limited as stated, what we have noticed in the specifications from the MT4 is 1000 lots. Additional steps are also 0.01 lots allowing traders to be precise when allocating more trades. This is also convenient using the One-click trading and Level 2 plugin with more options for trading orders. Stops level is set to 0 for all forex pairs, meaning no limits where you put your Stop Loss or Take Profit orders. We haven’t noticed any Stops levels for other account types too.

For Indexes, the minimum trading size volume is 0.1 lots, Oil types retain 0.01 lots minimum, and Natural Gas is set to 0.1 lots. For cryptocurrencies, trade sizes vary and are scaled to the coin value. Bitcoin minimum trade size is 0.01 lots with steps in micro-lots too. But, Litecoin’s minimum trade size is 0.1 lots and allowing additional trade steps in micro-lots. The same trade size conditions are for other low values coins like Ethereum. For some, the minimum trade size can go up to 10 lots as these contracts contain only one, low-value crypto.

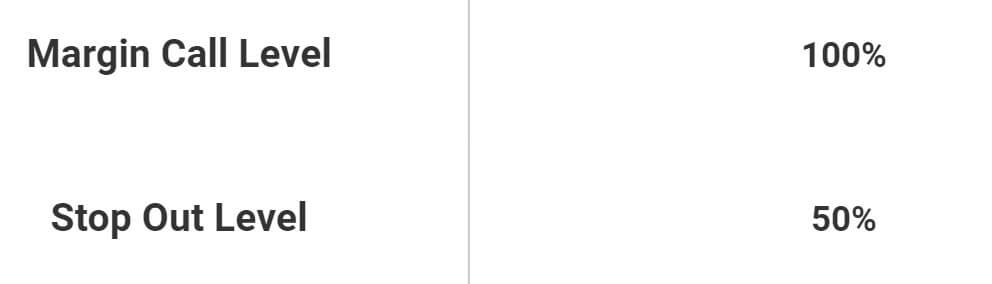

There are differences regarding the Margin Call and Stop Out across the account types. ECN Account has this set to 100% Margin Call and 50% Stop Out, STP Account is set to 50% and 30% and Micro to 20% and 10% Stop Out. Margin Call for Crypto Account is 30% and 15% Stop Out.

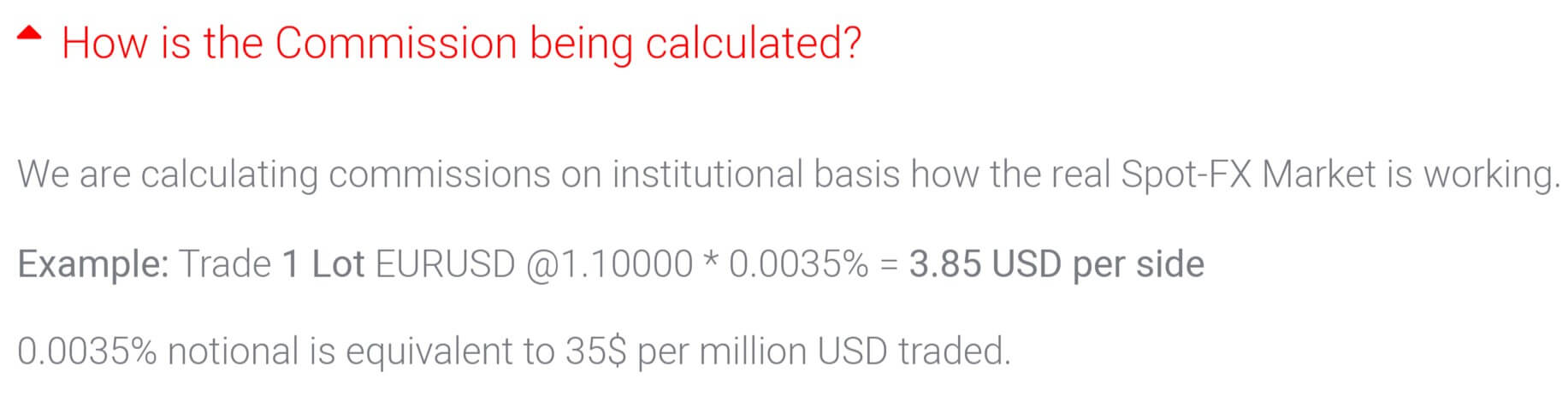

Trading Costs

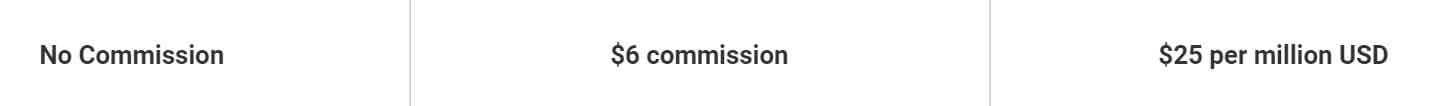

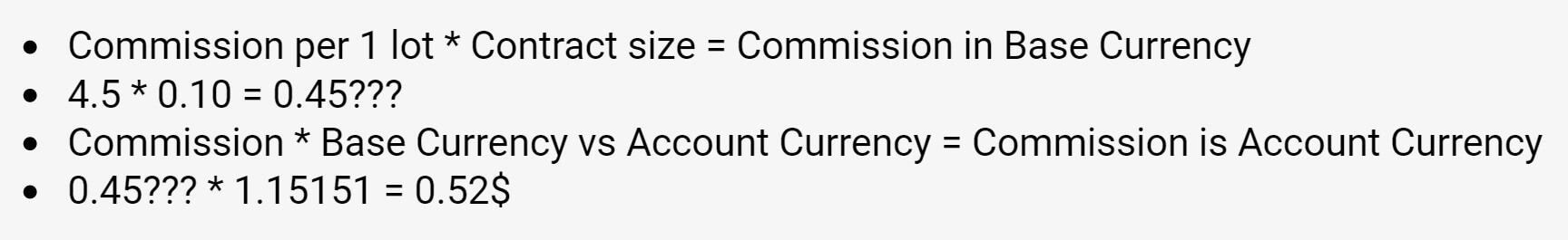

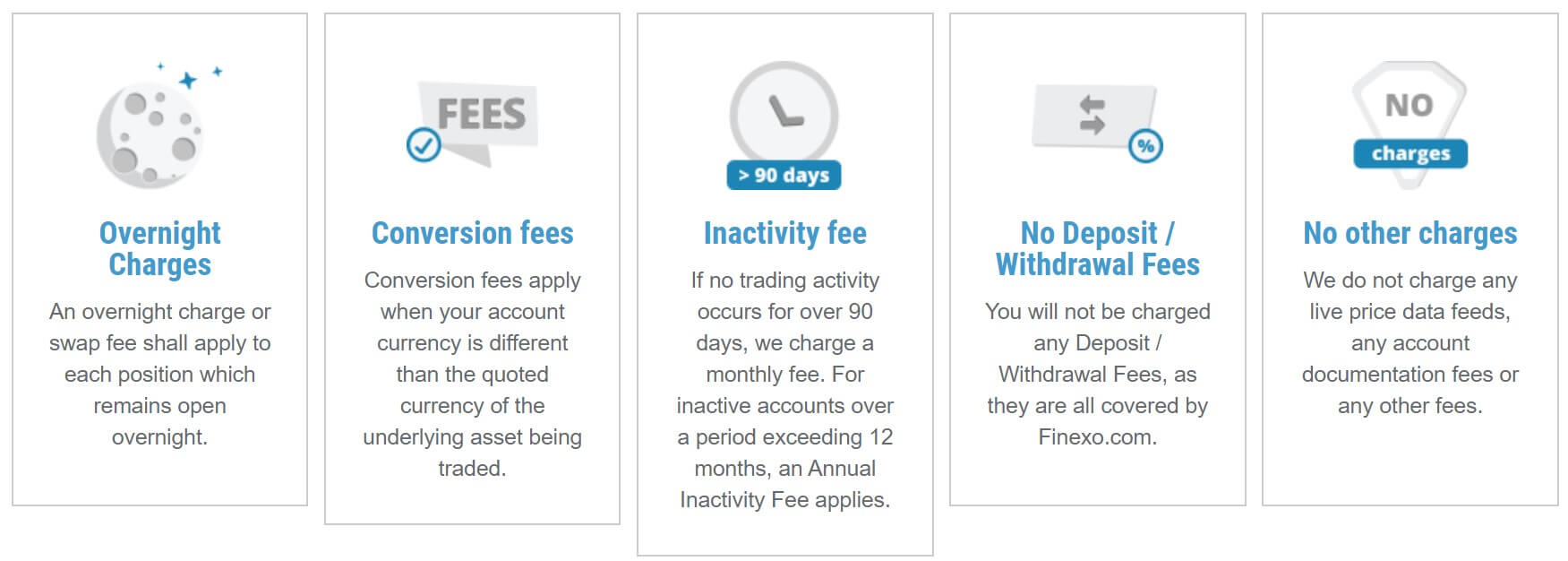

FXOpen has a somewhat complicated commission fee structure. It is affected by the trading volume and the equity size. Bigger the equity, less the commission but also trading volume can further decrease it. The complete structure is published online. For ECN MT4/MT5 Accounts, the commission can be from $10 per lot traded to 3$ – if a trader reaches more than 250,000,000 units of trading volume without breaching the $1000 equity. For Equities more than $1,000, the commission is further reduced from $5 to $3, and from $25,001 equity, it is $3.6 to $3.

Any equity above $250,000 has $3 commission per lot traded regardless of the trade volume. Index commission is in pips and ranges from 0.16 to 4 pips depending on the Index. Other base currencies are not converted, so a commission of $5 is €5 if the account is in EUR. STP Account does not have commissions as they are integrated into the spreads.

Inactivity fees are charged by FXOpen. A trading account is deemed inactive if there are no open trades, transfers or deposits more than 90 days. Inactive accounts will be charged 10 USD each month. Whatsmore, if you want to start trading again you will have to pay a reactivation fee of $50. The broker recommends if you plan to cease trading to transfer all funds to FXOpen eWallet where they can stay indefinitely.

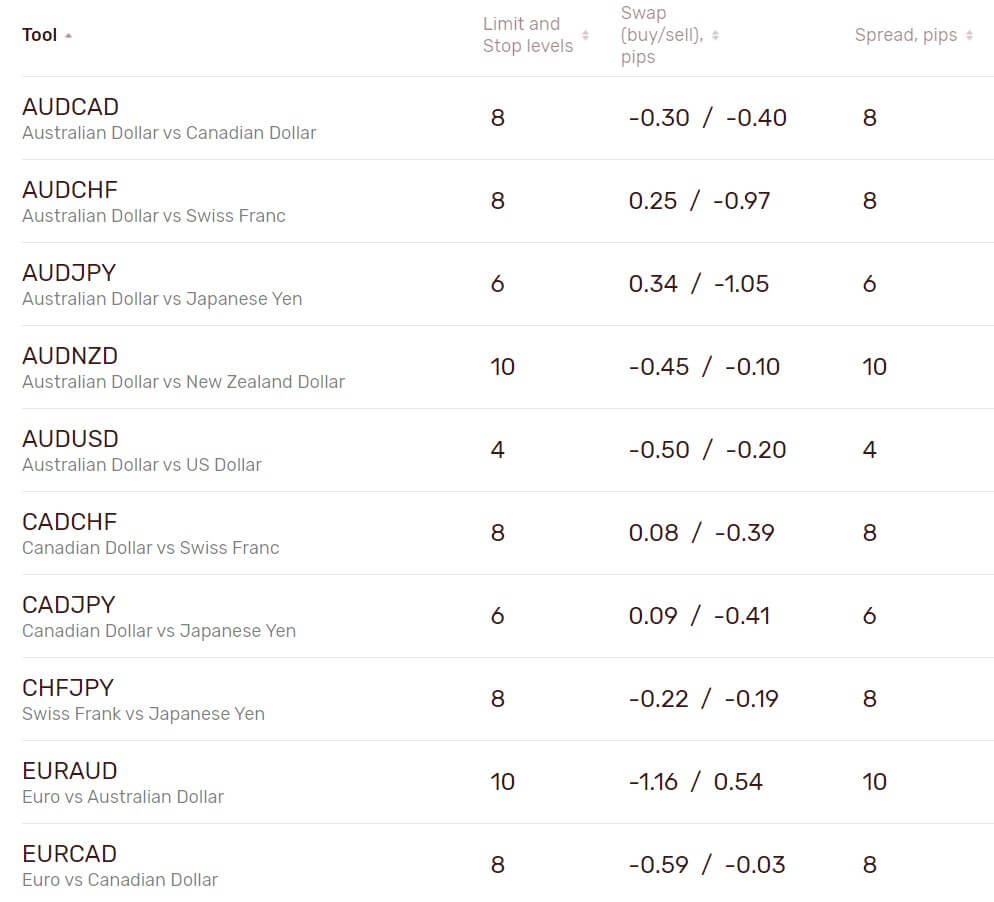

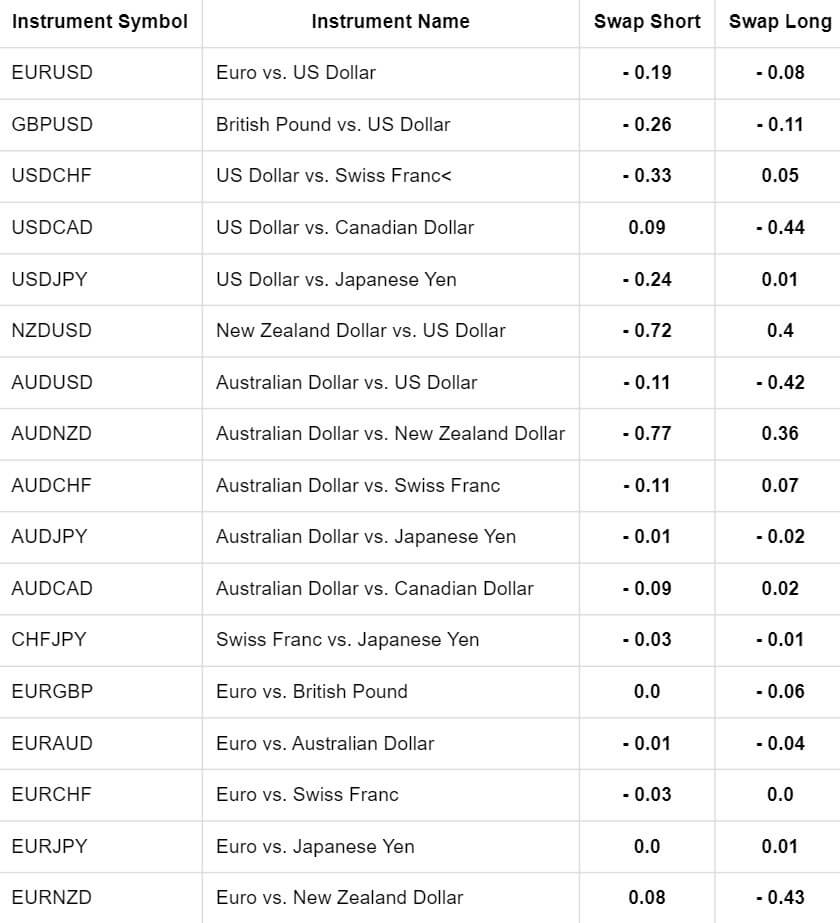

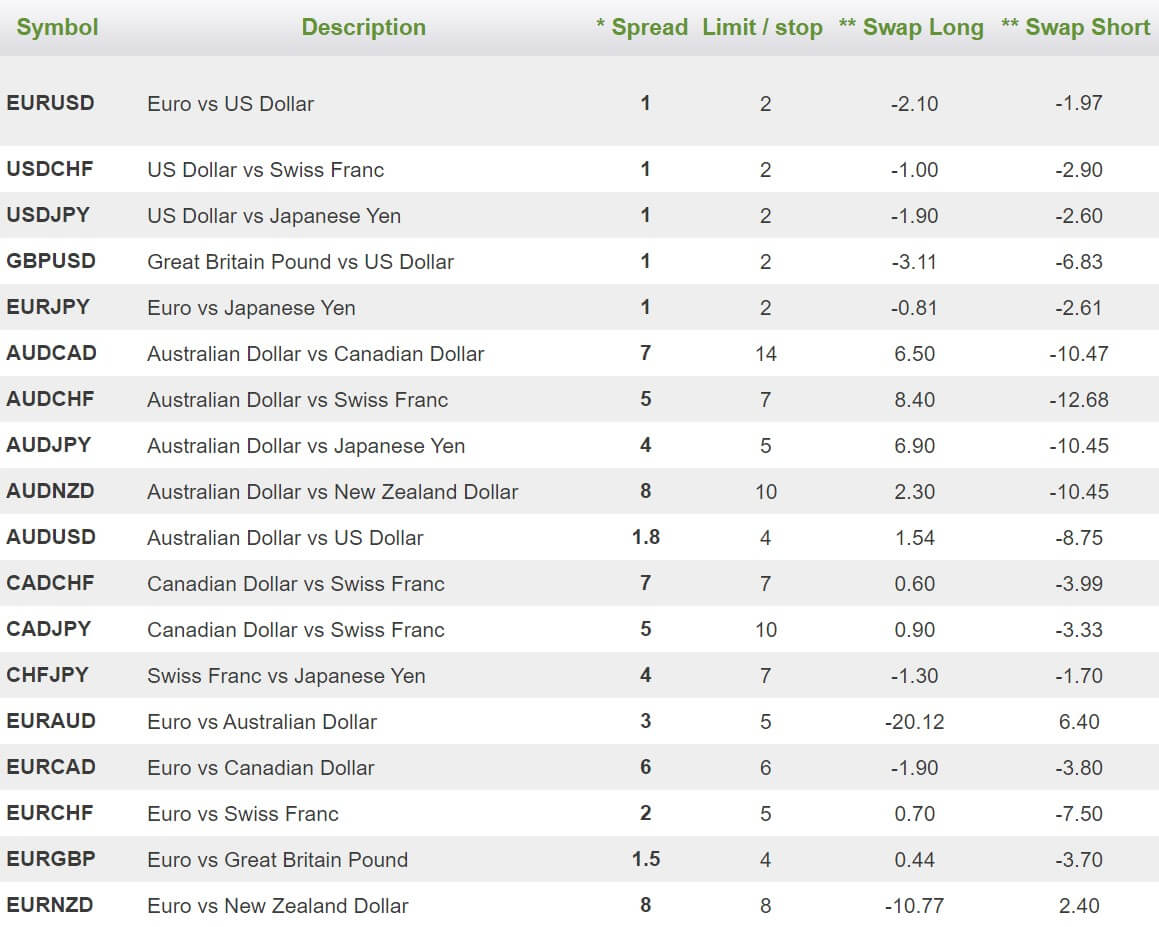

Swaps are low with frequent positive figures on one side. They are calculated in points for Forex and tripled on Wednesdays. EUR/USD pair has a positive on the short side 3.6 and -9.6 points on the long. USD/JPY has 2.3 on long and -8.2 points on short, GBP/USD -0.8 short and -7.5 long, and AUD/USD with -4.7 points on long and -0.3 points on the short side. Other, more moving currency pairs have increased swaps but not to extremes.

GBP/NZD has -8.4 points on long and -5.1 points short, EUR/TRY -291 on long and 160 short, GBP/SGD -11.8 long and -2.5 short, SGD/JPY 3.67 long and -5.85 short and so on. The biggest swap is for the USD/MXN with -423.7 points on the long side and 156.3 on the short. USD/RUB has a low swap compared to other brokers with -175.5 points for long and 1.3 points on the short side. Gold swap is not unusual with -15.7 points on the long and a positive 0.6 points on the short.

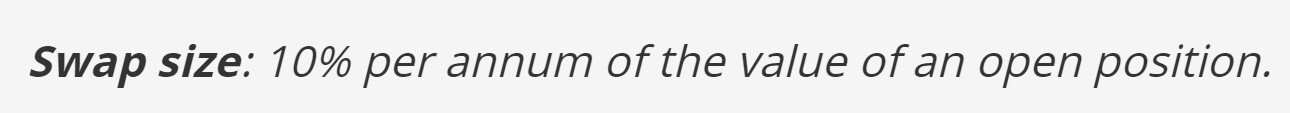

Moving on to the Crypto Account swaps and commissions. Swaps are calculated in percentage terms per annum and tripled on Wednesdays. For all crypto assets, it is -10% on both trade sides. The commission charged is 1% per lot traded and it is applied to all crypto instruments although it is affected by the trading volume.

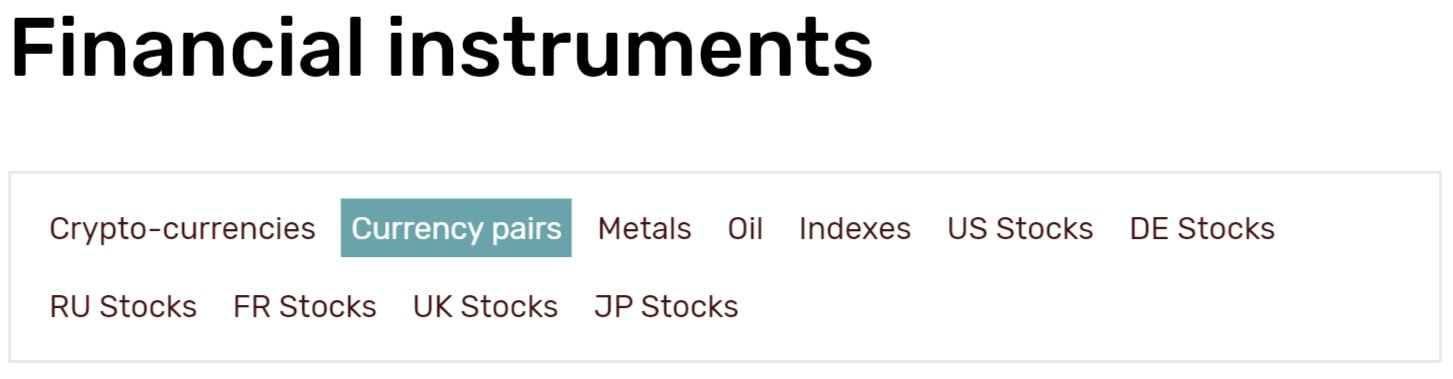

Assets

FXOpen has separated cryptocurrencies into their Crypto Account, and the STP Account does not hold all assets from the ECN Account. We will present what assets are present in each of the account types. Starting with the Crypto Account the broker states 43 tradeable assets related to cryptocurrencies only. We have counted a total of 32 in the MT4. Note that the number of cryptos is lower as single crypto has multiple quoted variations, thus increasing the total number of instruments.

Bitcoin is available against EUR, USD, CNH, JPY, and RUB. Bitcoin is also used on the quote side for other cryptos, for example, BCH/BTC, LTC/BTC and so on. Counting only cryptos available there are Bitcoin, Litecoin, Ethereum, NameCoin, PeerCoin, DASH, Emercoin, and Ripple. One of particulars of FXOpen’s crypto offer are rarities like DSH/CNH, EMC/BTC, PPC/BTC, NMC/BTC, ETH/CNH, ETH/RUB, LTC/JPY, BTC/RUB, BTC/JPY, BTC/CNH and more.

Chinese Offshore Yuan and Ruble are present as a quote for most cryptocurrencies, showing signs of broker focus on the Asian markets where cryptocurrencies are most popular. In 2018 the broker states that they have included Bitcoin Cash, Ethereum Classic, EOS, Monero, NEO, IOTA, OMNI, etc. We have not found these in the MT4 platform except for the BCH.

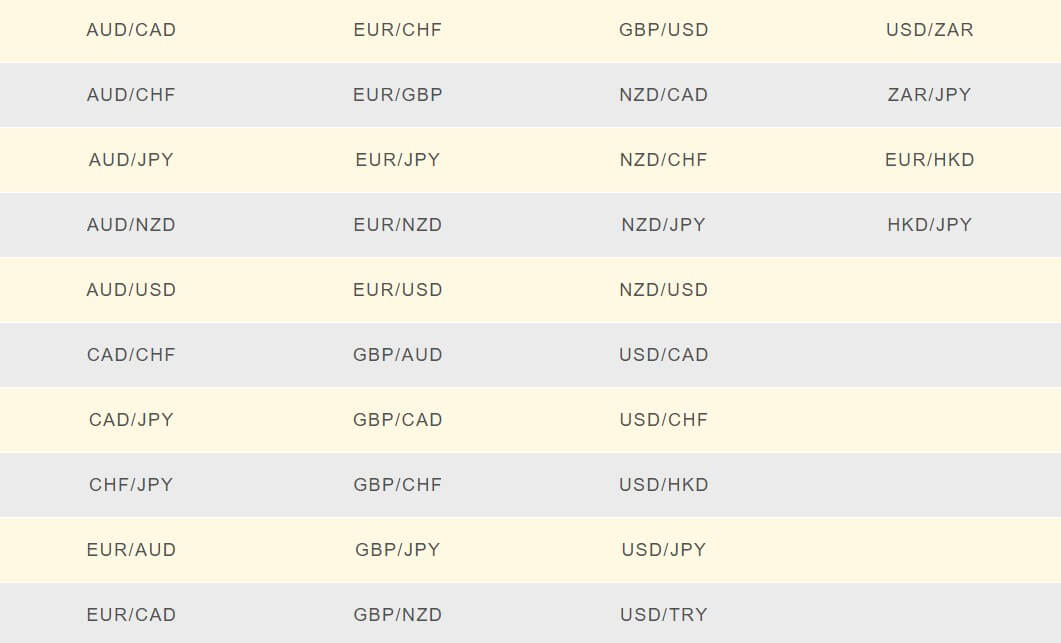

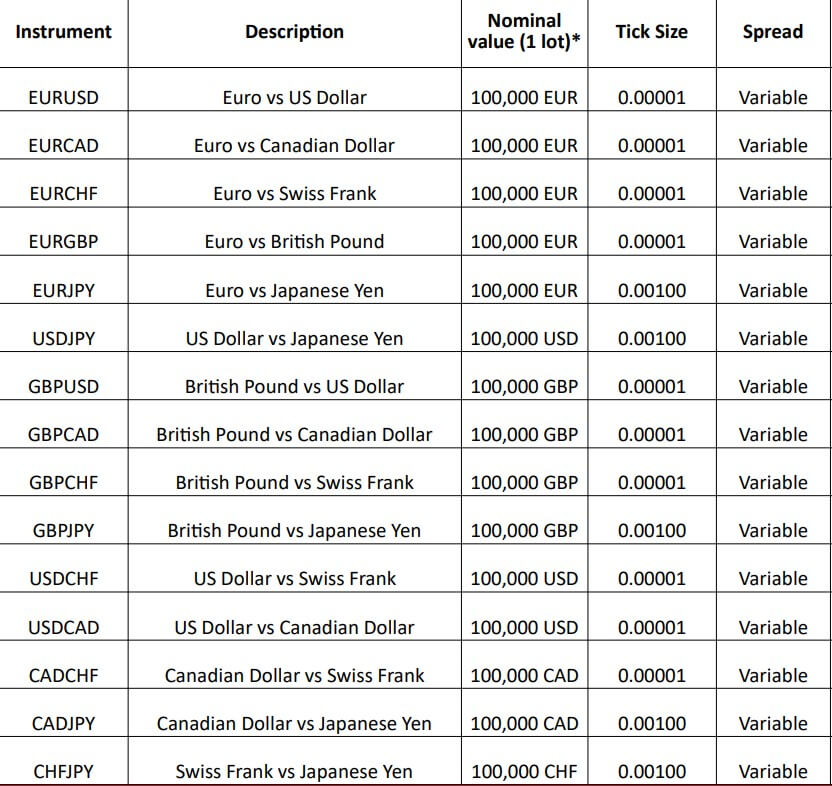

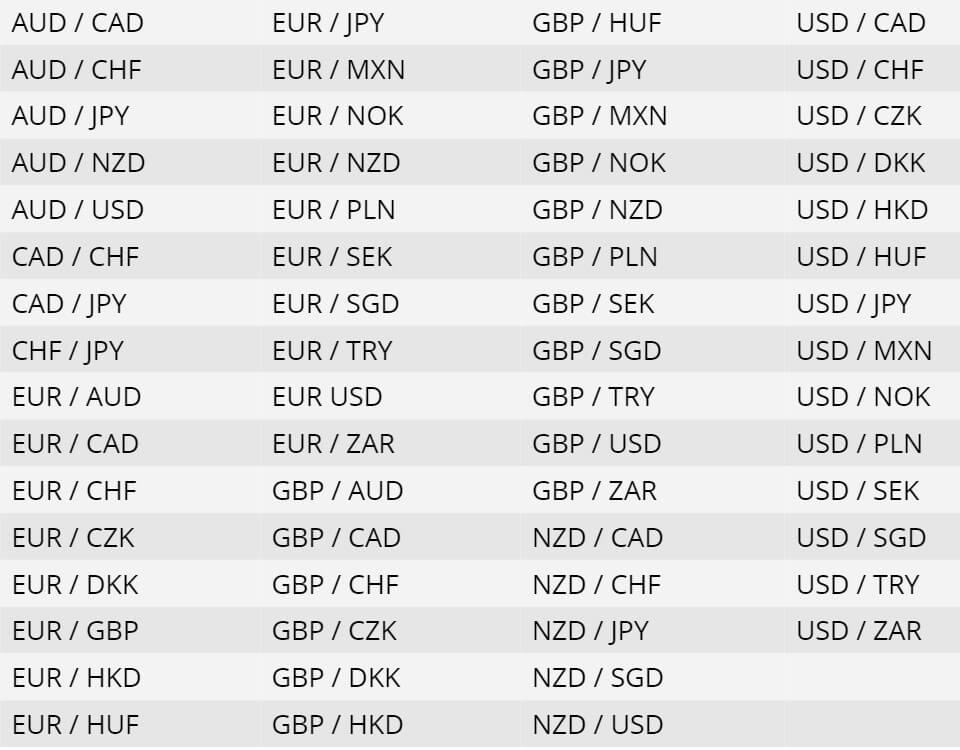

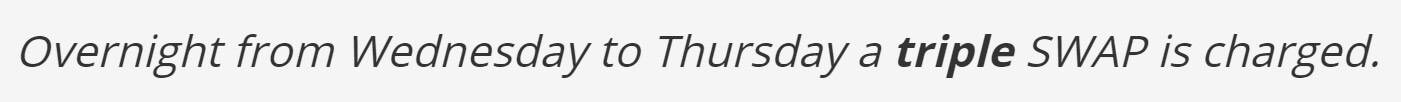

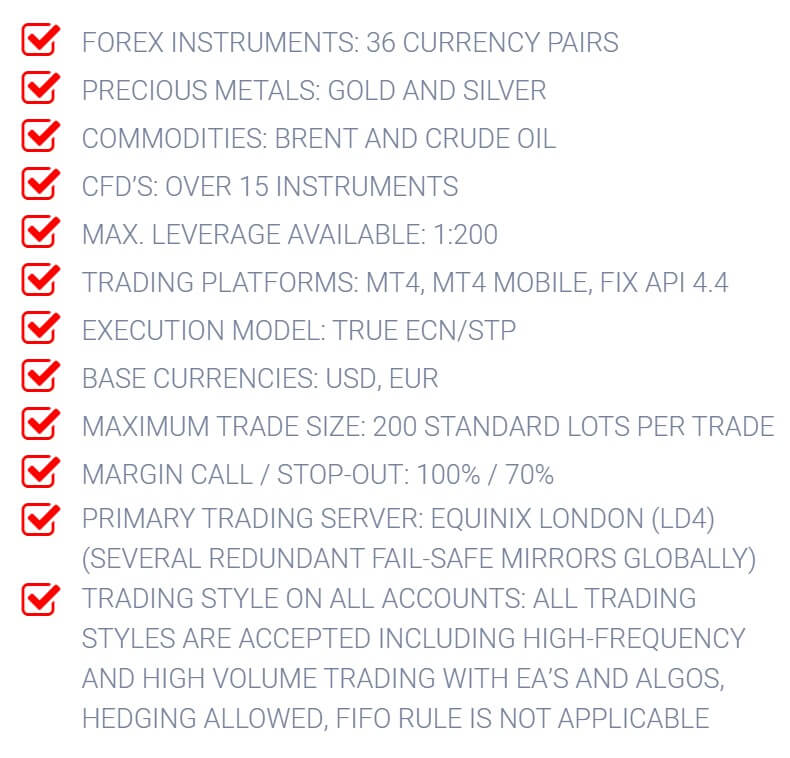

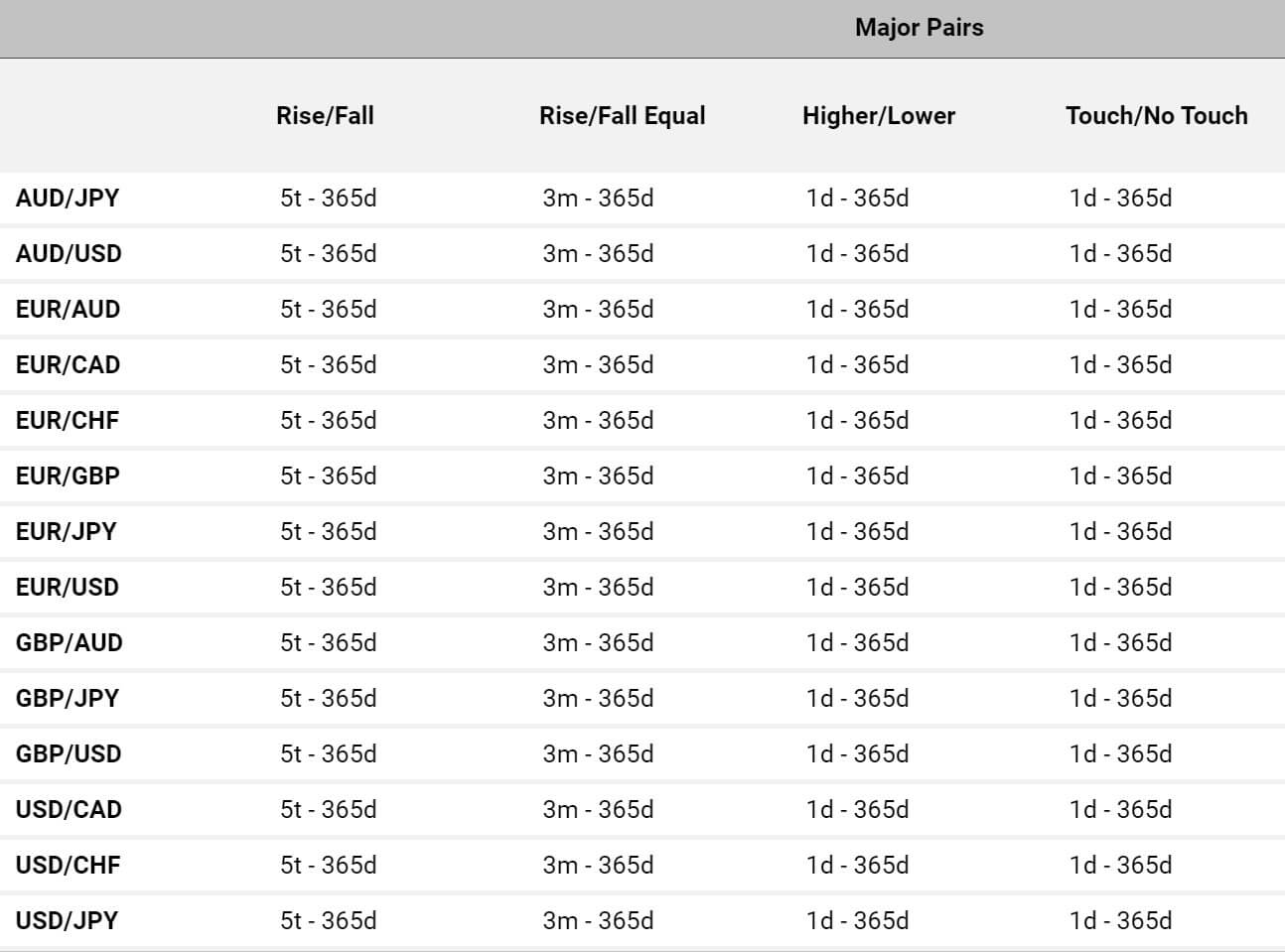

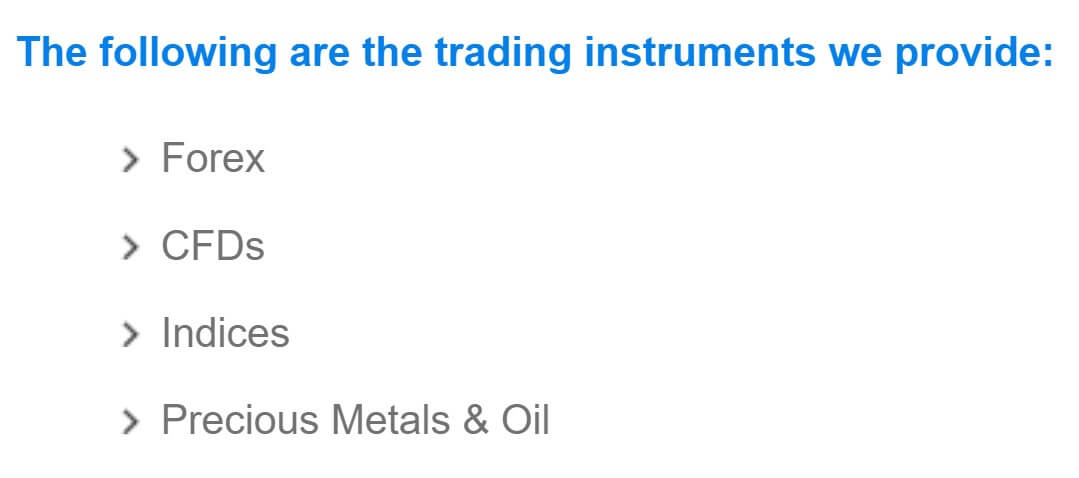

ECN Account holds more than 70 instruments available to trade and is the most complete offer. categories covered are Forex, Commodities, Indices, and Precious Metals. Forex offer is very good with a total of 50 currency pairs. All majors and minors are listed with some additional combos like GBP/SGD, and HKD/JPY. Other notable and rare pairs are EUR/HKD, EUR/PLN, EUR/TRY, NOK/JPY, USD/MXN, USD/RUB, USD/CNH, and USD/TRY.

Commodities range is limited to two Oil types, spot Brent and WTI with the addition of Natural Gas. Indexes offer is good enough with a total of 13 total assets. FXOpen offers mini Index for S&P500, Wall Street 30, Germany 30, and NASDAQ. Others offered are France 40, Europe 50, Australia 200, UK 100, Japan 25, and Wall Street 50. There are only two precious metals for trading, as usual, Gold and Silver.

STP Account does not feature Indexes, Commodities or Crypto. It is focused on the Forex and two metals, Gold and Silver. The forex range contains the same 50 instruments as for the ECN Account. The Micro account has a limited Forex offer to 28 pairs and also offers Gold and Silver. The Forex range does not feature exotics and is limited to majors and minor currency pairs.

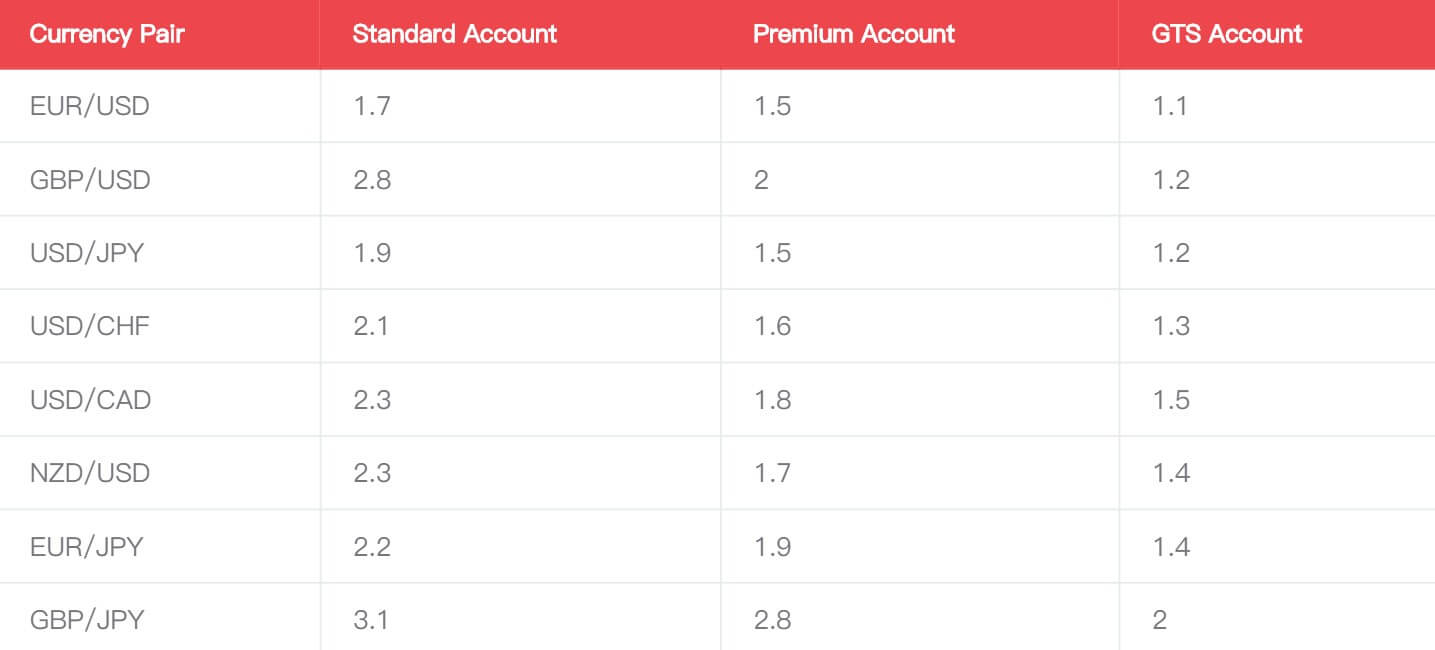

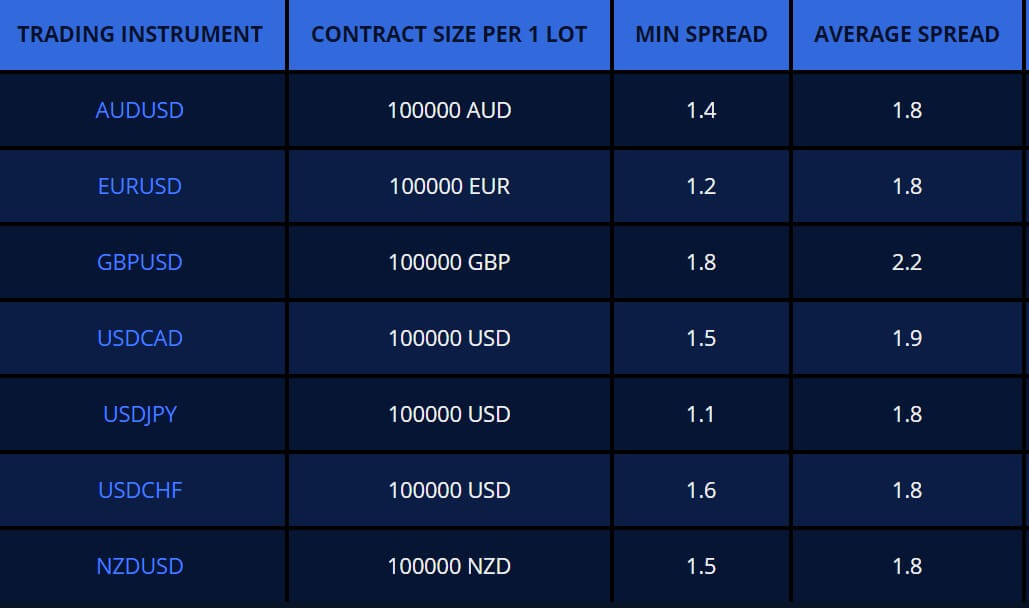

Spreads

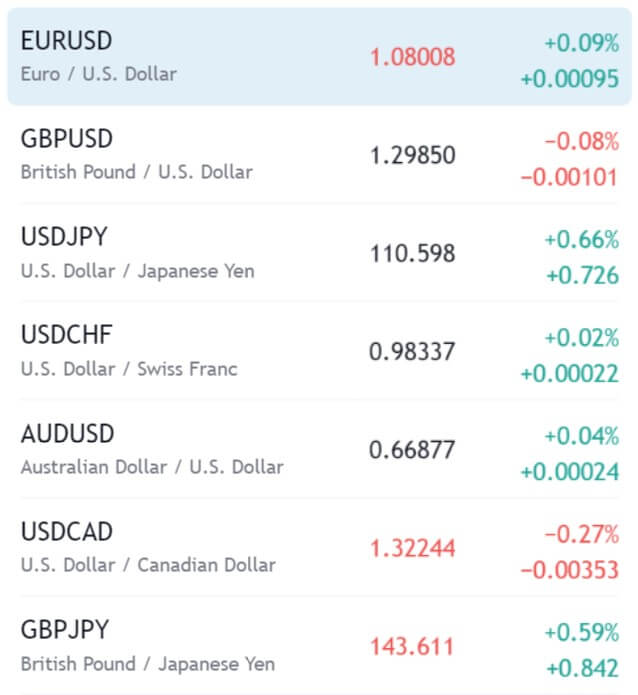

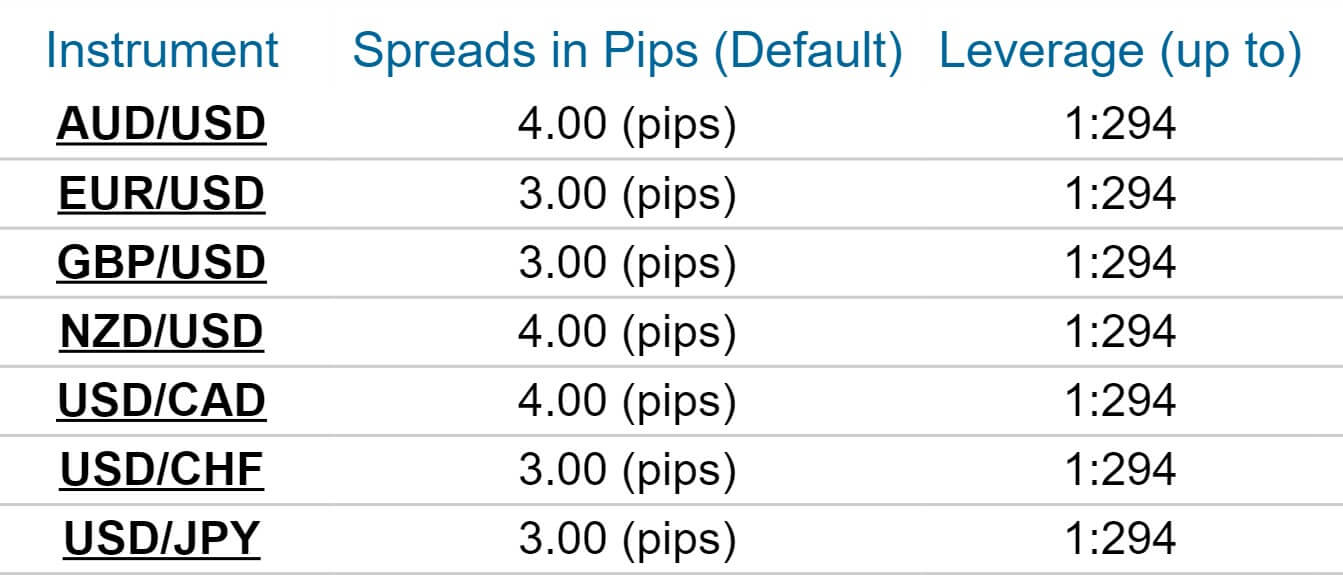

FXOpen offers floating spreads on all of its accounts. The broker promotes the famous “from 0 pips” line. During our readings the Crypto Account BTC/USD spread is $7.4, BTC/EUR €5.2. XRP/USD spread was 233 points and Litecoin/USD – 28100 points. Forex ECN Account spreads are not 0 pips on any asset at any time during our testing.

The lowest spreads are 1.2 pips for the EUR/USD, 1.5 pips for HKD/JPY, 2.2 pips for EUR/GBP 2.3 pips for USD/JPY and 2.5 pips for AUD/USD. It is surprising to see HKD/JPY on this list.

Other forex instruments spreads are marginally higher, notably higher are AUD/CHF with 48 points, EUR/CHF at 60 points, EUR/NZD at 62, EUR/JPY at 40, GBP/AUD at 67, GBP/NZD at 184 and USD/CHF at 63 points. The exotics spreads are also good enough with USD/CNH at 80 points, USD/RUB at 518 points, EUR/NOK at 3081- which is also nominally the highest Forex spread, EUR/TRY at 1751, and USD/PLN at 375 points. Spot Gold spread is competitive with 45 pips. Bothe Oil types have around 14 points floating spread.

STP Account should have higher spreads since the commission is added to them. Starting with the EUR/USD at 2 pips, 8 points markup compared to the ECN Account, HKD/JPY is 38 points, EUR/GBP is also 38 points, USD/JPY 33 and AUD/USD has 30 points spread. AUD/CHF rises to 75 points, EUR/CHF at 74 points, EUR/NZD at 84, EUR/JPY at 47 – just 7 points more, GBP/AUD – 104, GBP/NZD at 200, and USD/CHF at 66, just 3 points higher. According to this comparison, we could say the spreads are about 30% wider than with the ECN Account but not in all cases. Spot Gold has 61 pips spread and Silver 38.

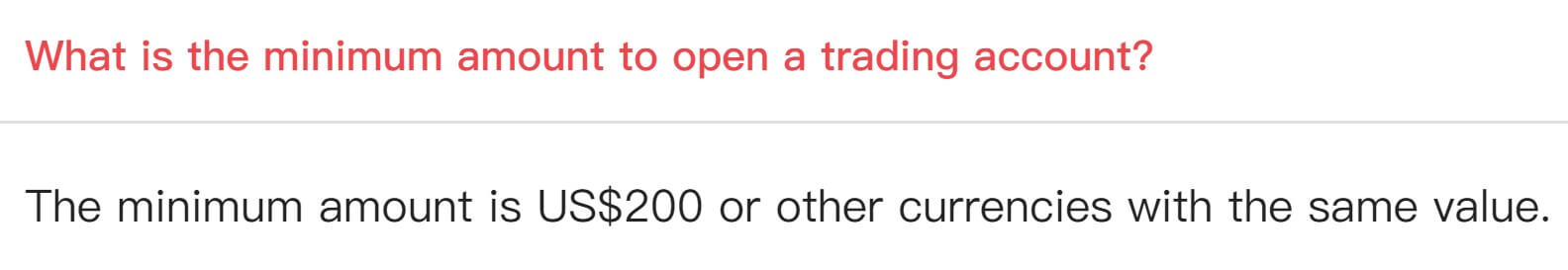

Minimum Deposit

The minimum deposits requirement starts from $1 for the Micro Account or cent account as often called. For the STP Account, you will need to deposit at least $10 and for the ECN $100. Crypto Account requires $10 or equivalent.

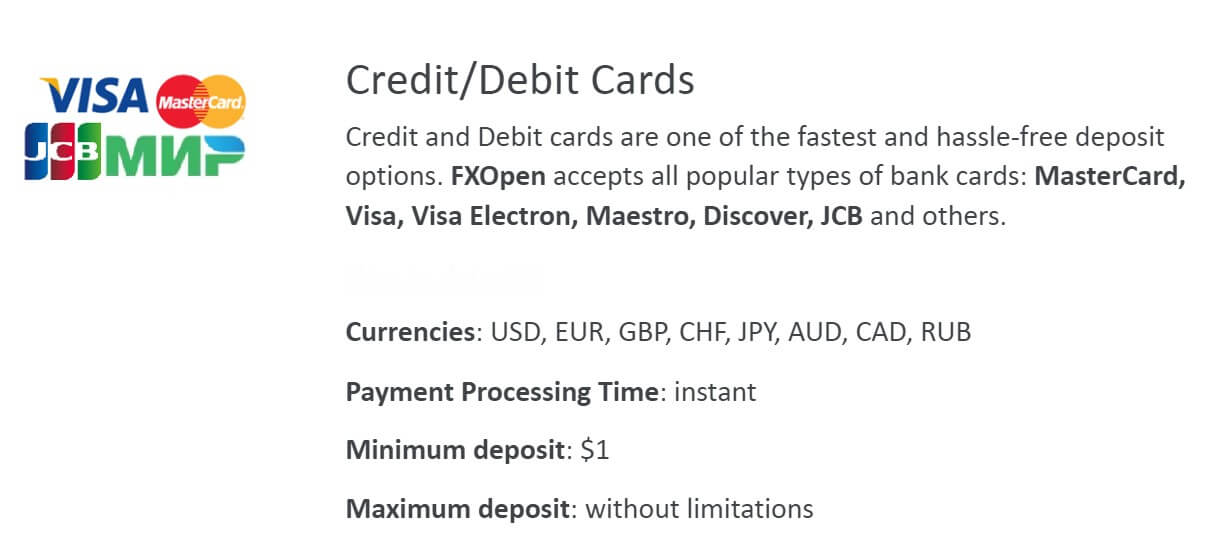

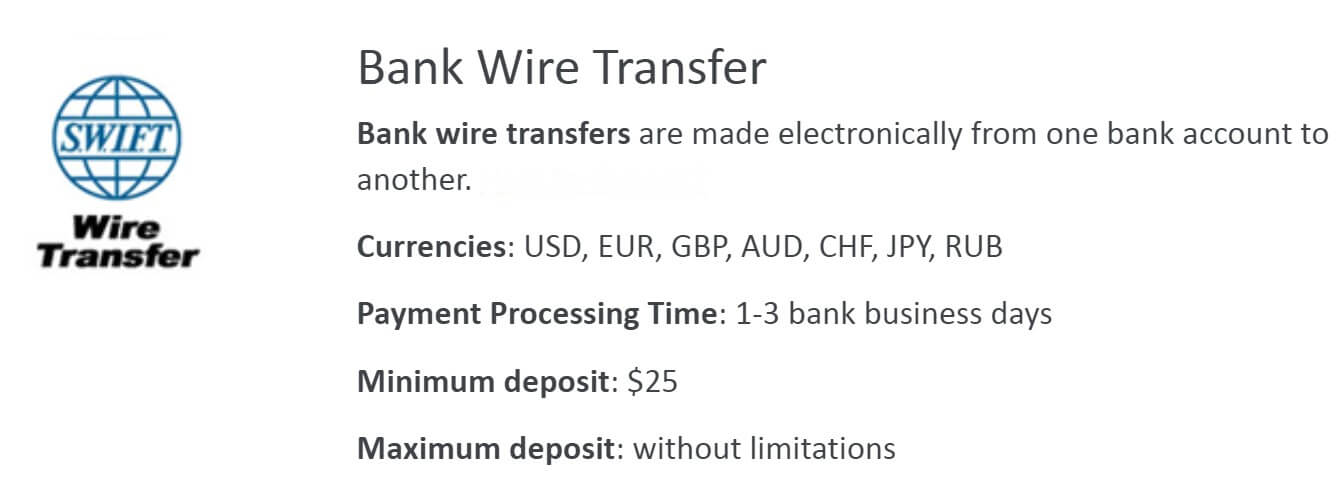

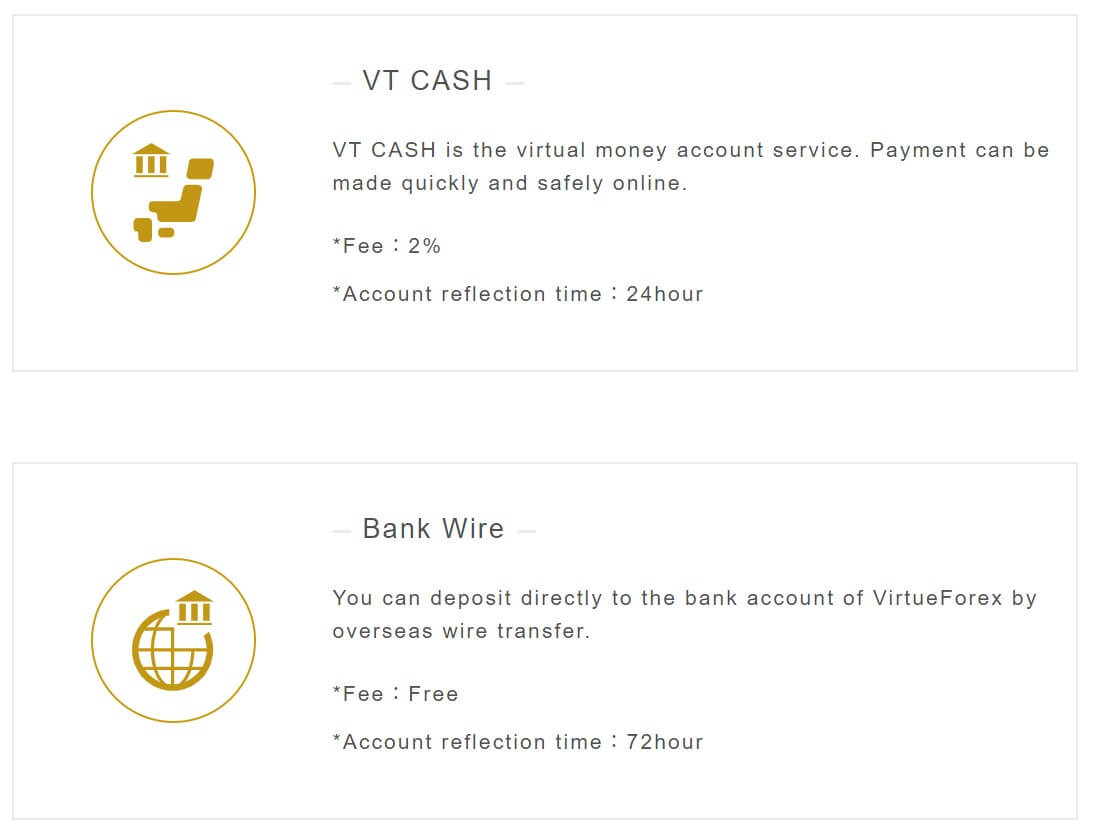

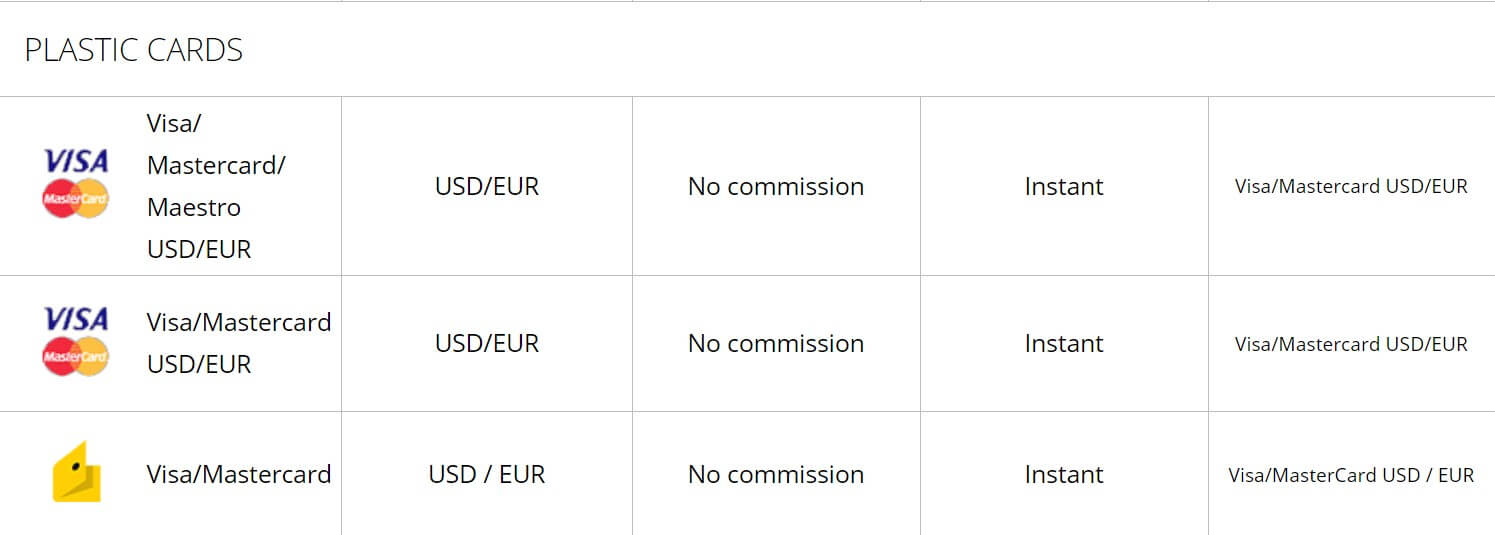

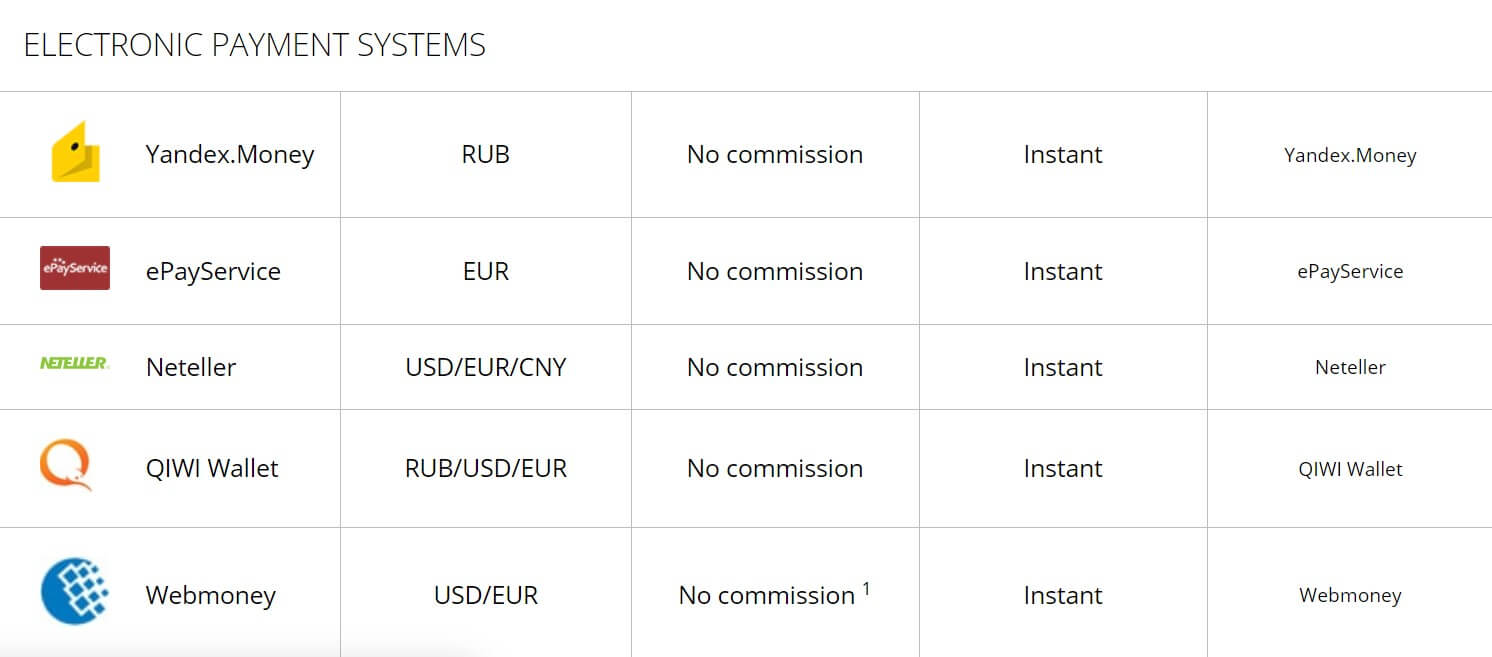

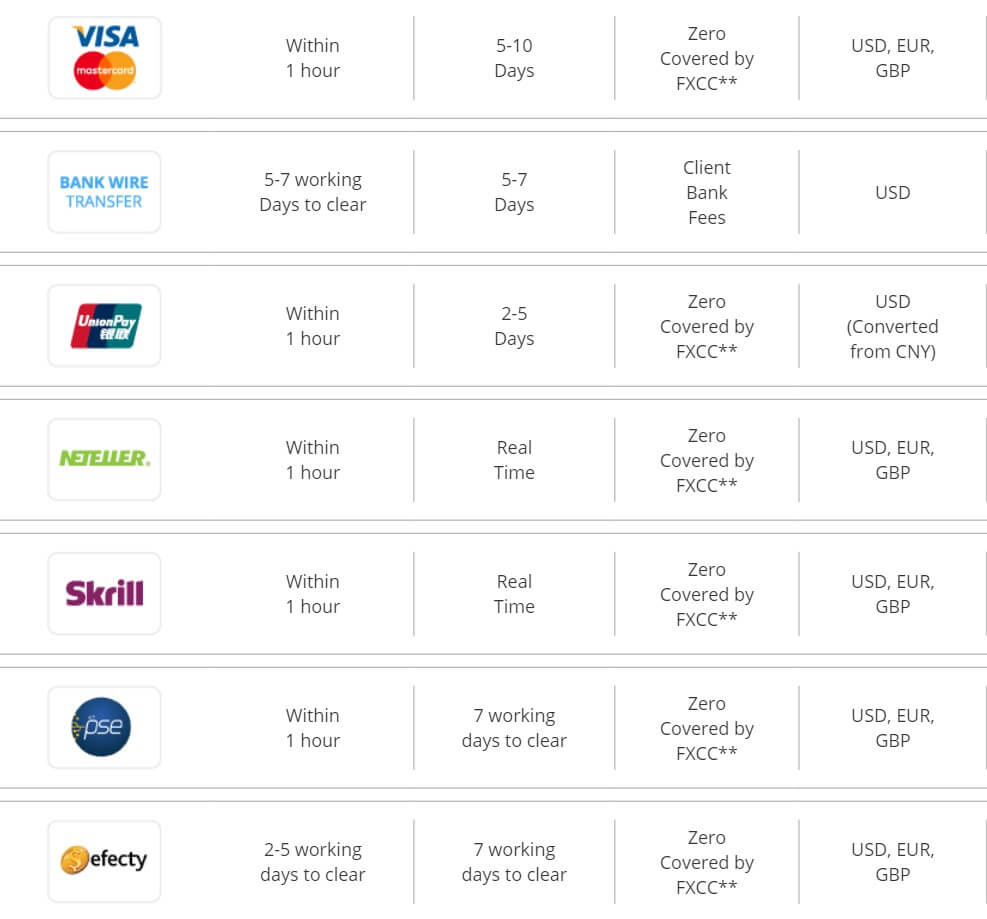

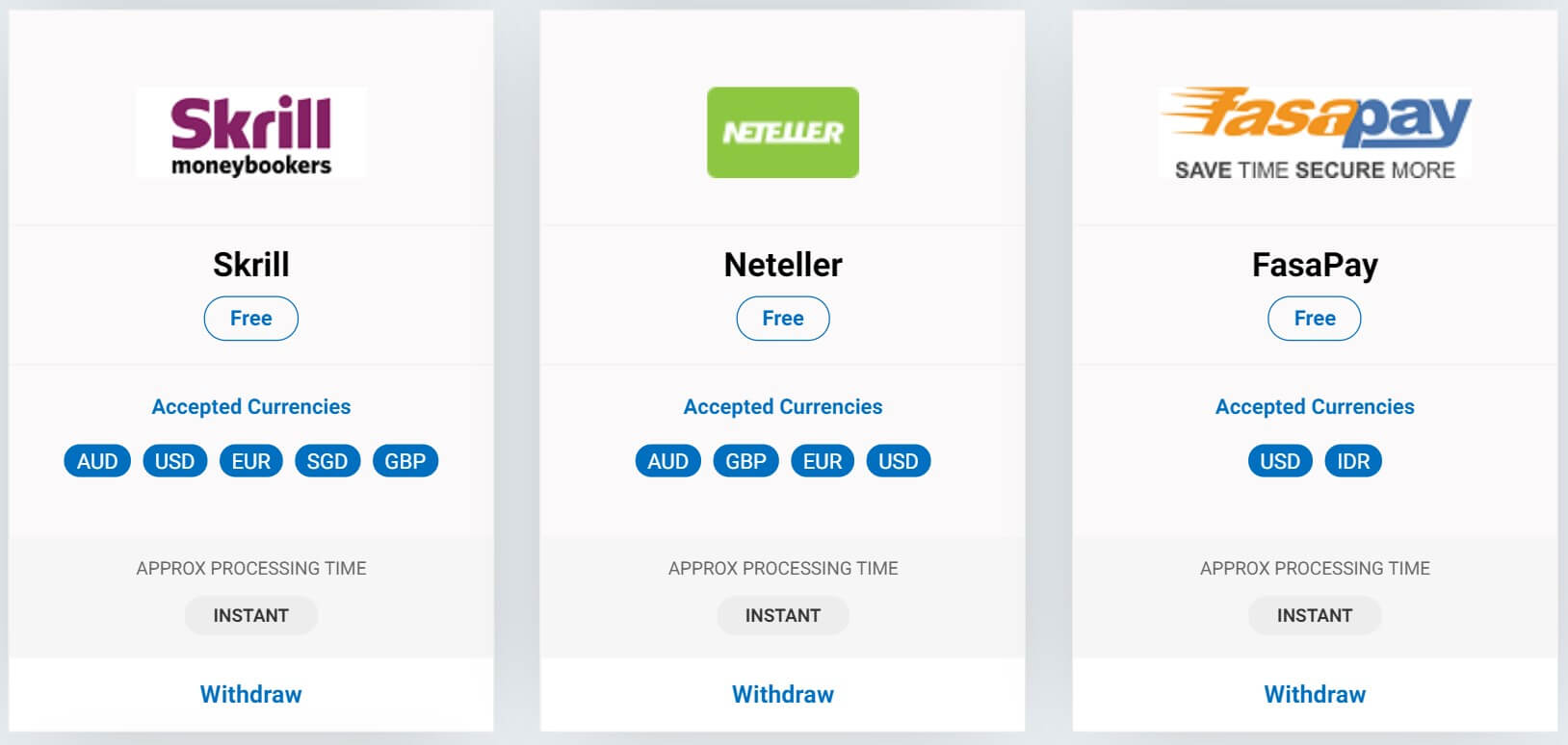

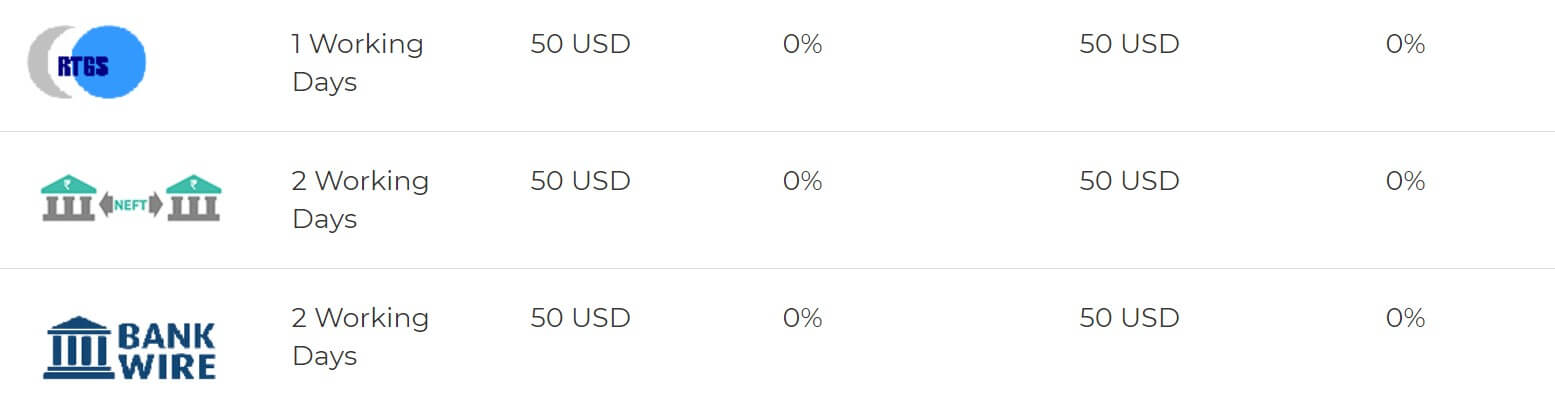

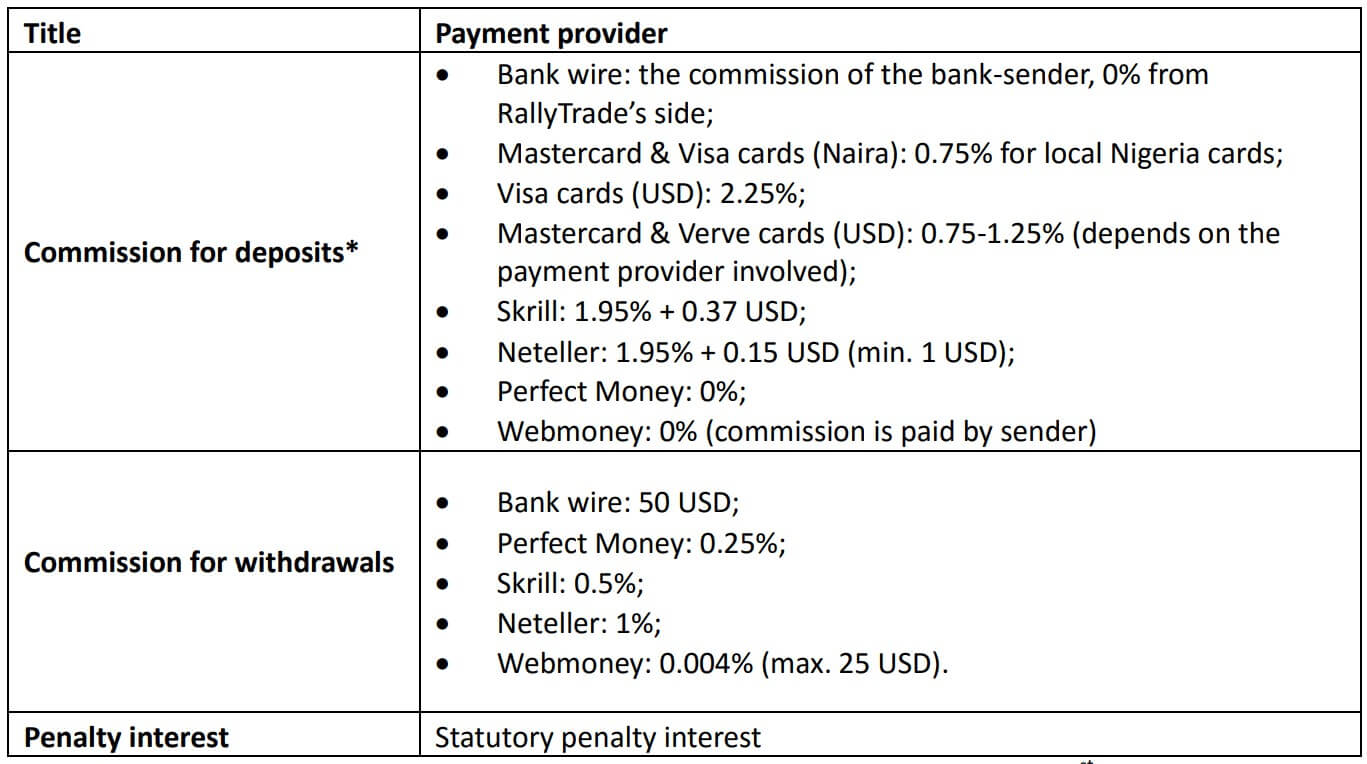

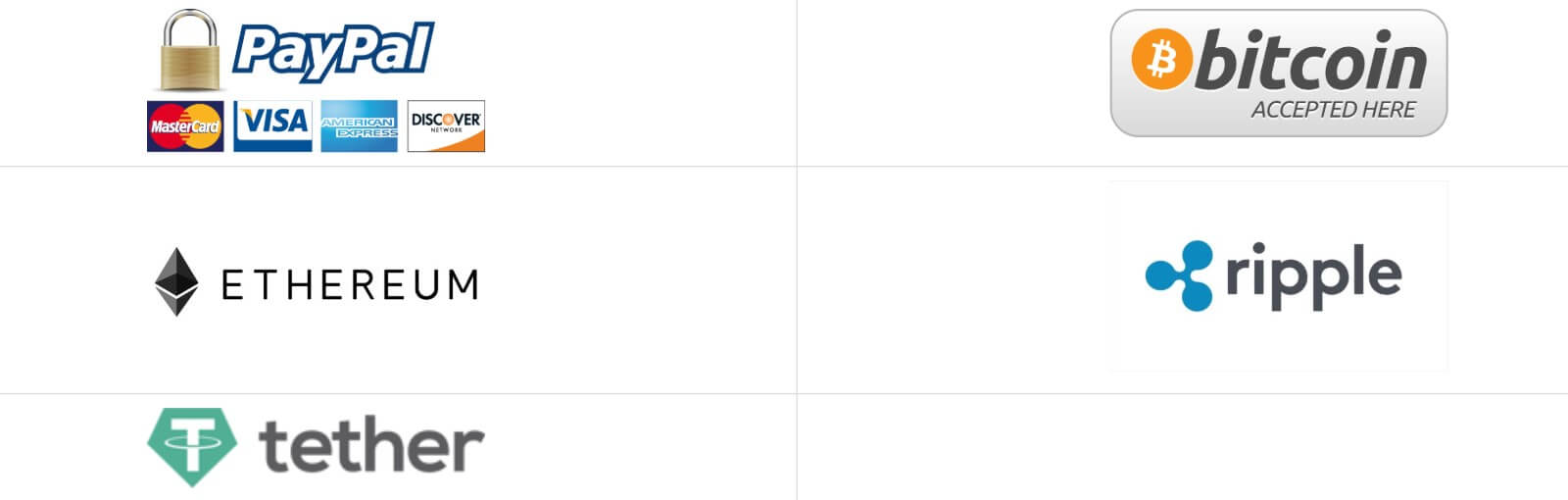

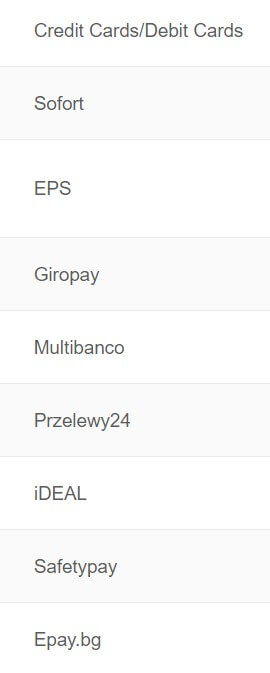

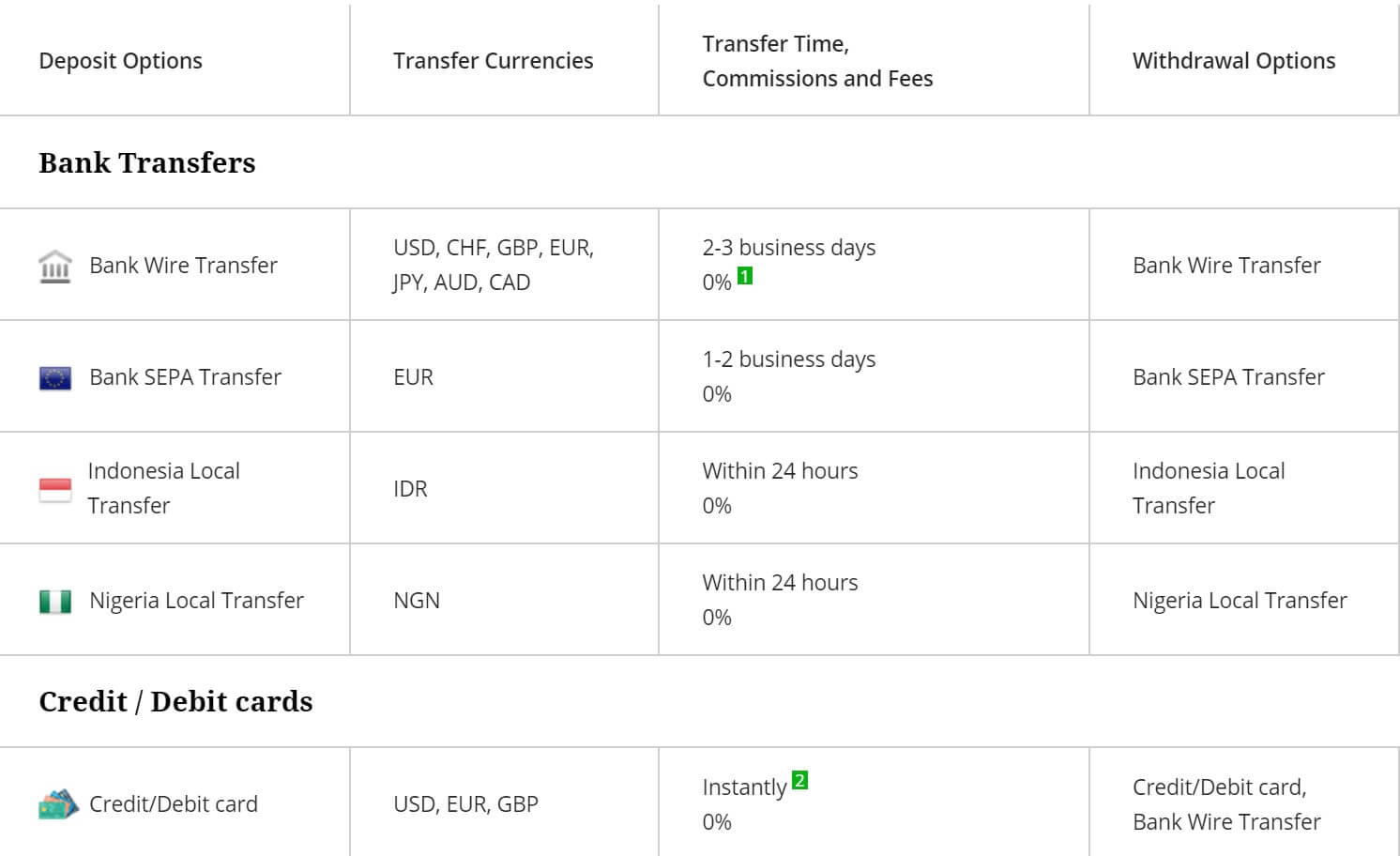

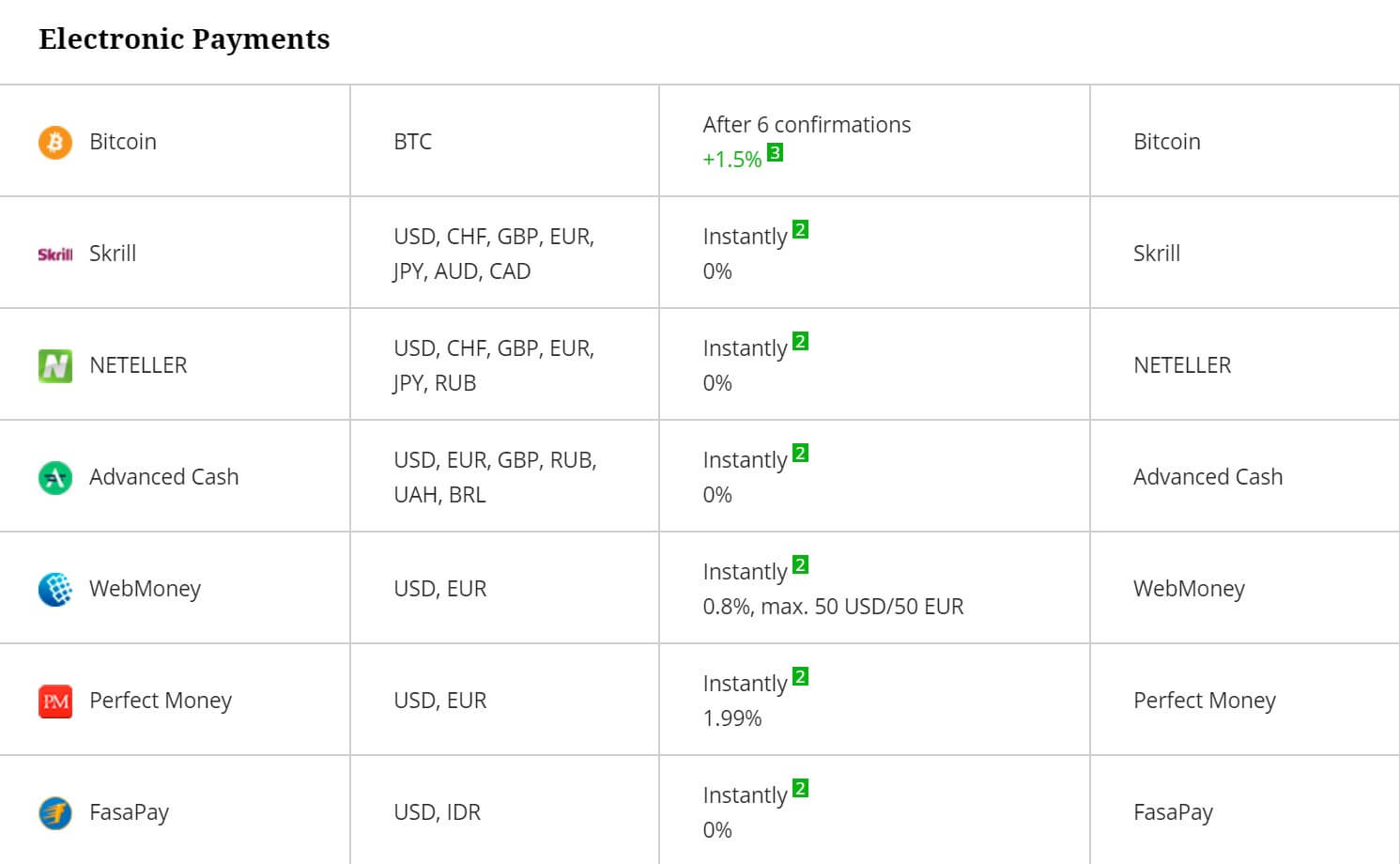

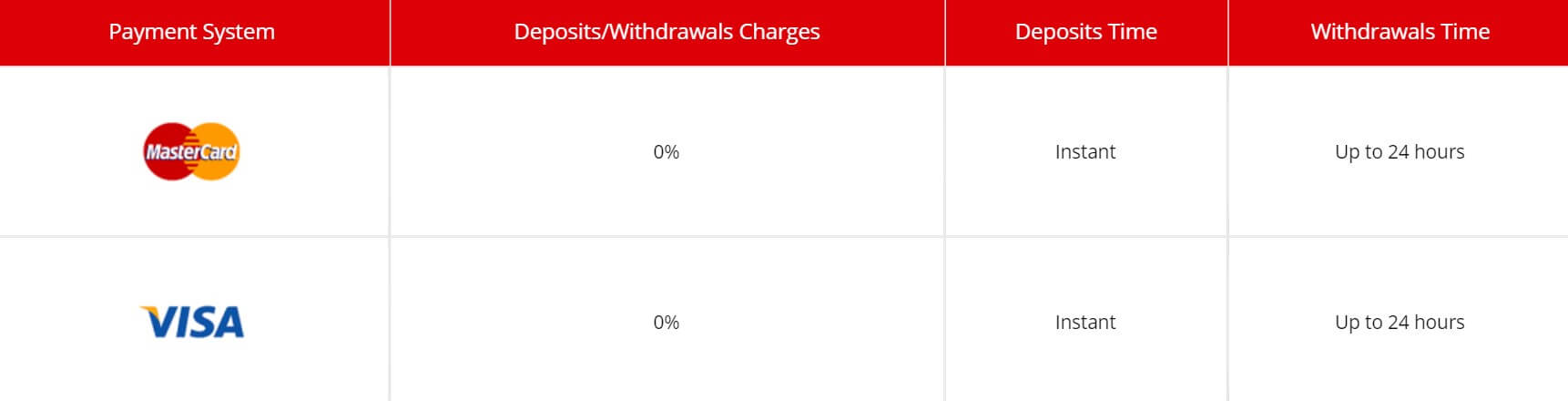

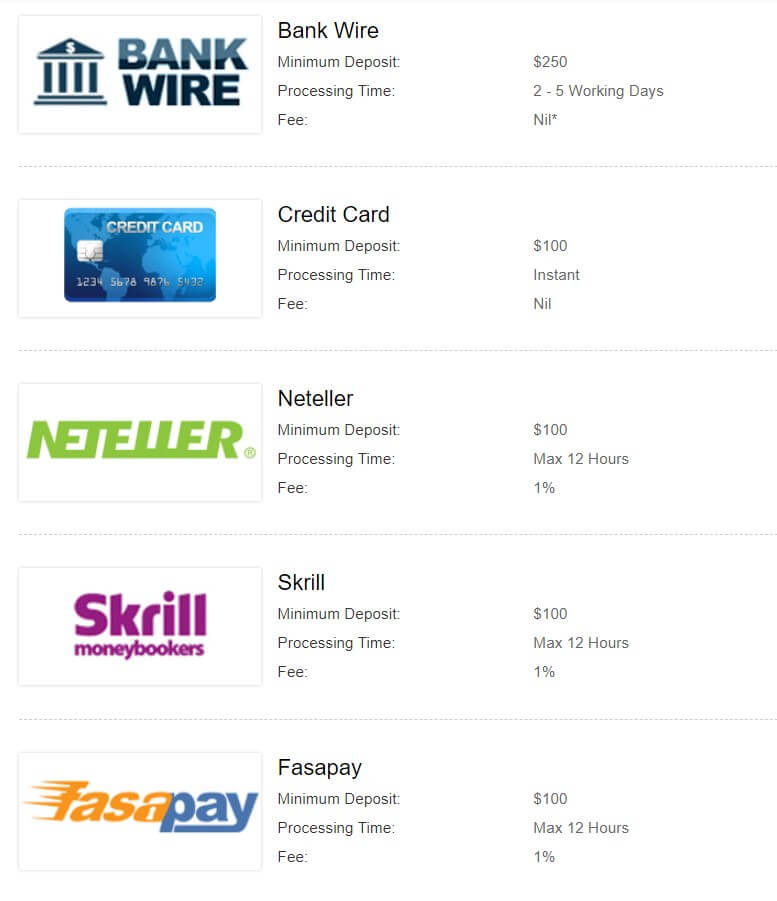

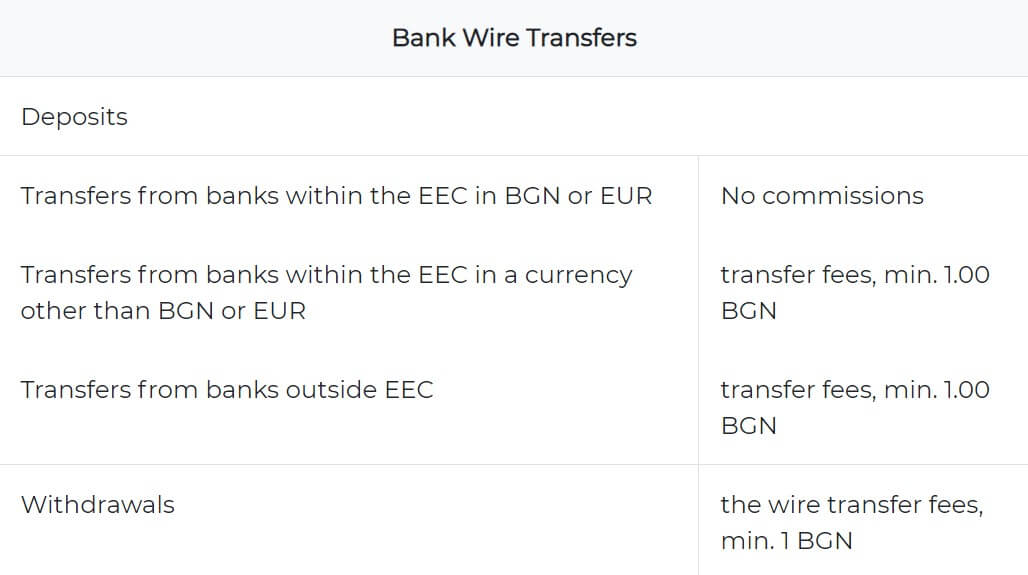

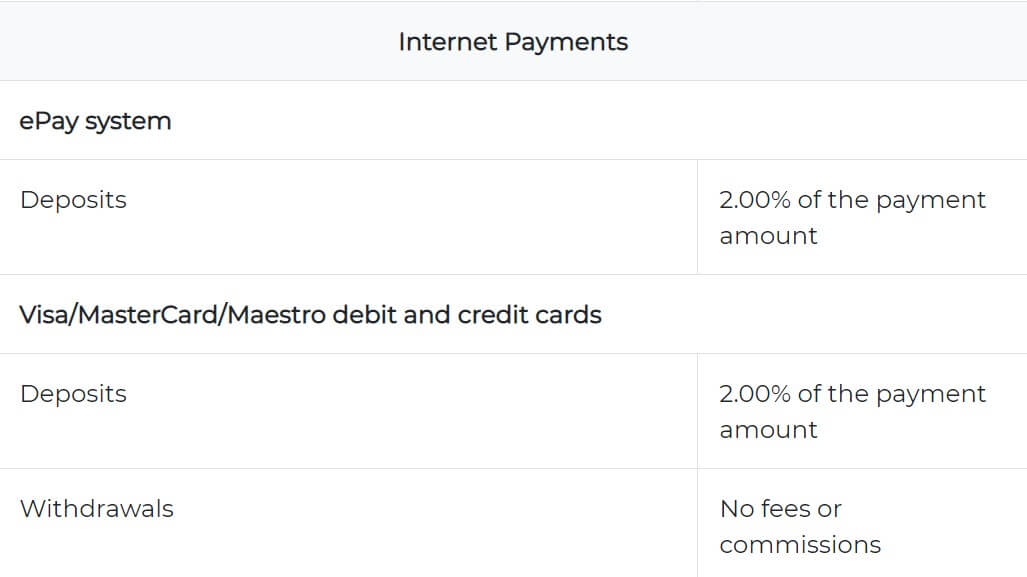

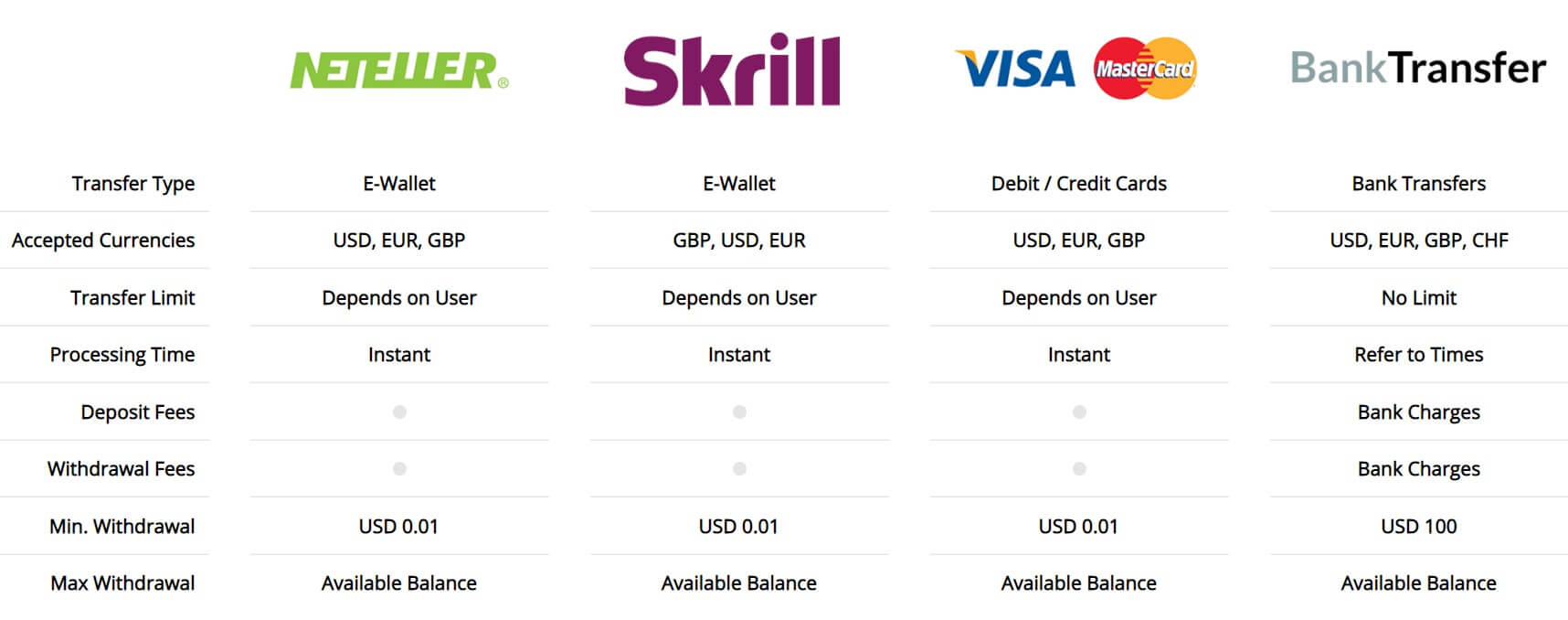

Deposit Methods & Costs

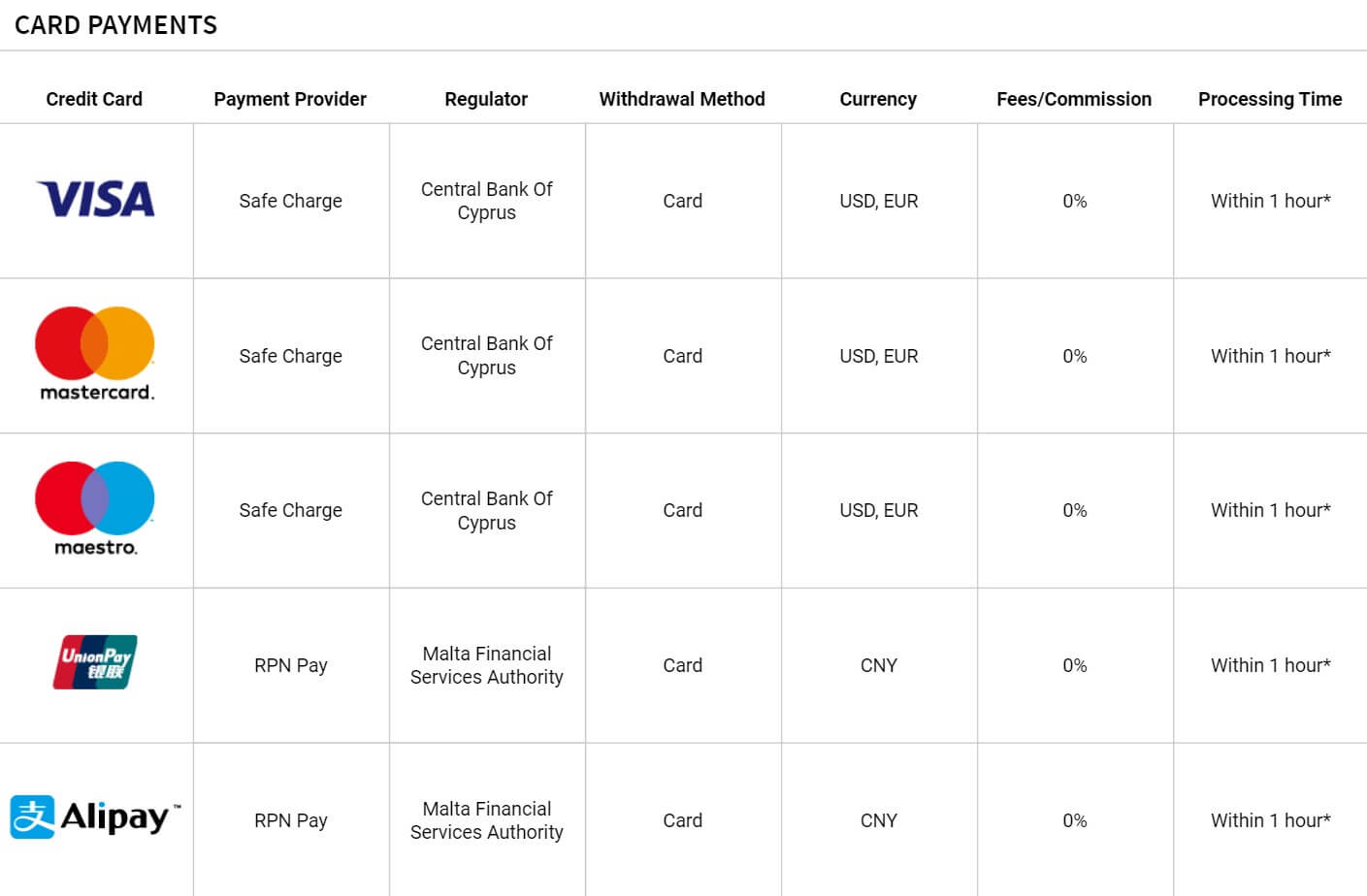

FXOpen has many deposit channels, some of which may not be available to all. One is certain, cryptocurrency deposit is available to all. The broker allows Bitcoin, Litecoin, Ethereum, Emercoin, and Tether deposits. FXOpen’s eWallet is the main account where all financial transactions are done. Channels for deposits by electronic wallets are Netteler (in AUD, EUR, GBP, RUB, SGD, and USD), Skrill (in AUD, CAD, CHF, EUR, GBP, JPY, and USD), WebMoney (EUR and USD), QIWI Wallet (in EUR, RUB, USD), FasaPay (in IDR, and USD), Yandex.Money (only RUB), and IntellectMoney (only Ruble). Standard Bank operation deposits are available as SEPA transfers, PayToday (THB only), Wire transfer and local deposits.

Instant local bank transfers are available in RUB only by Alfa-click. Credit/Debit Cards are accepted with the addition of China UnionPay. Prepaid cards, vouchers, and Paysafe are also accepted. Note that Tether is a US Dollar-pegged cryptocurrency, that lets traders deposit and withdraw in USD and EUR equivalents using the Blockchain technology.

Wire and SEPA transfers have a minimum of 25 EUR/USD while local transfers have a minimum of $1. Other deposit methods also require very low amounts for transfer.

Alfa-click has a 7% deposit commission, local bank transfers have from 3.2%+USD 0.29 for USD deposits and 2.5%+EUR 0.29 for EUR deposits (or equivalent in another currency). Credit Cards will be charged from 2.5% + EUR 0.29. China UnionPay commission for deposits is from 2.5%.

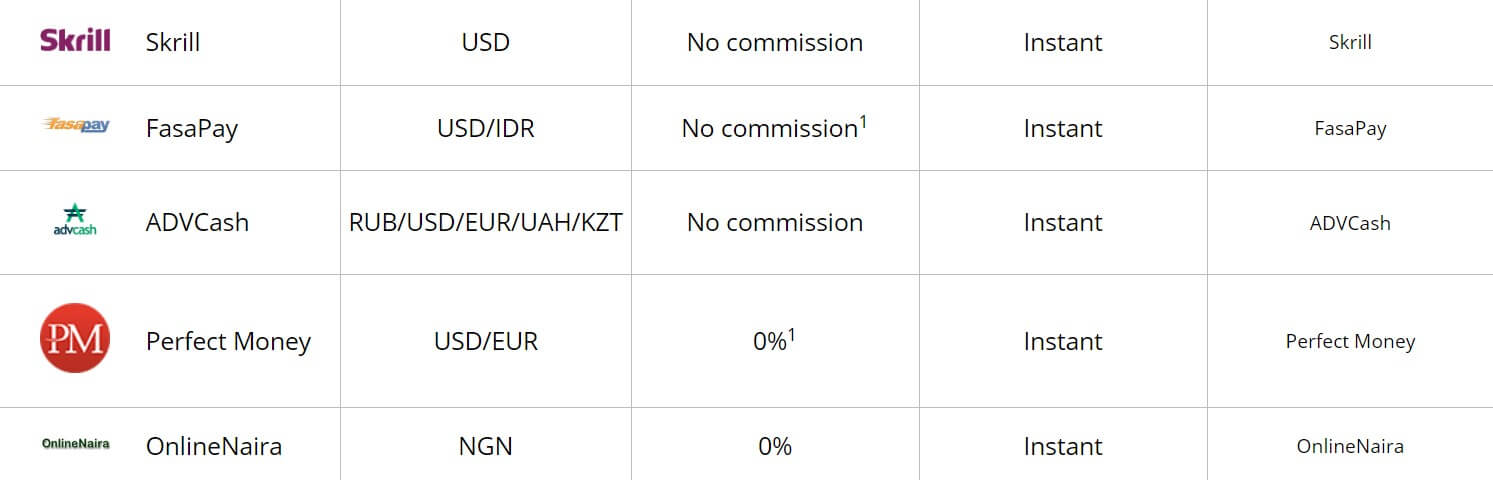

As for eWallets, commission for deposits is 1% for WebMoney, 3.2%+USD 0.29 (2.5%+EUR 0.29 for EUR deposits) or equivalent in another currency (min EUR 1.29 or equivalent for transfer between Skrill accounts). QIWI Wallet has a high commission for deposits of 6% as well as Yandex Money with 7%. Neteller deposit commission is 2.5% + 0.29 (commission equivalent for all currencies). The IntellectMoney deposit commission is from 3%. FasaPaay will not charge any commission for deposits. Prepaid cards do not have any costs except for Paysafe – 8.25%.

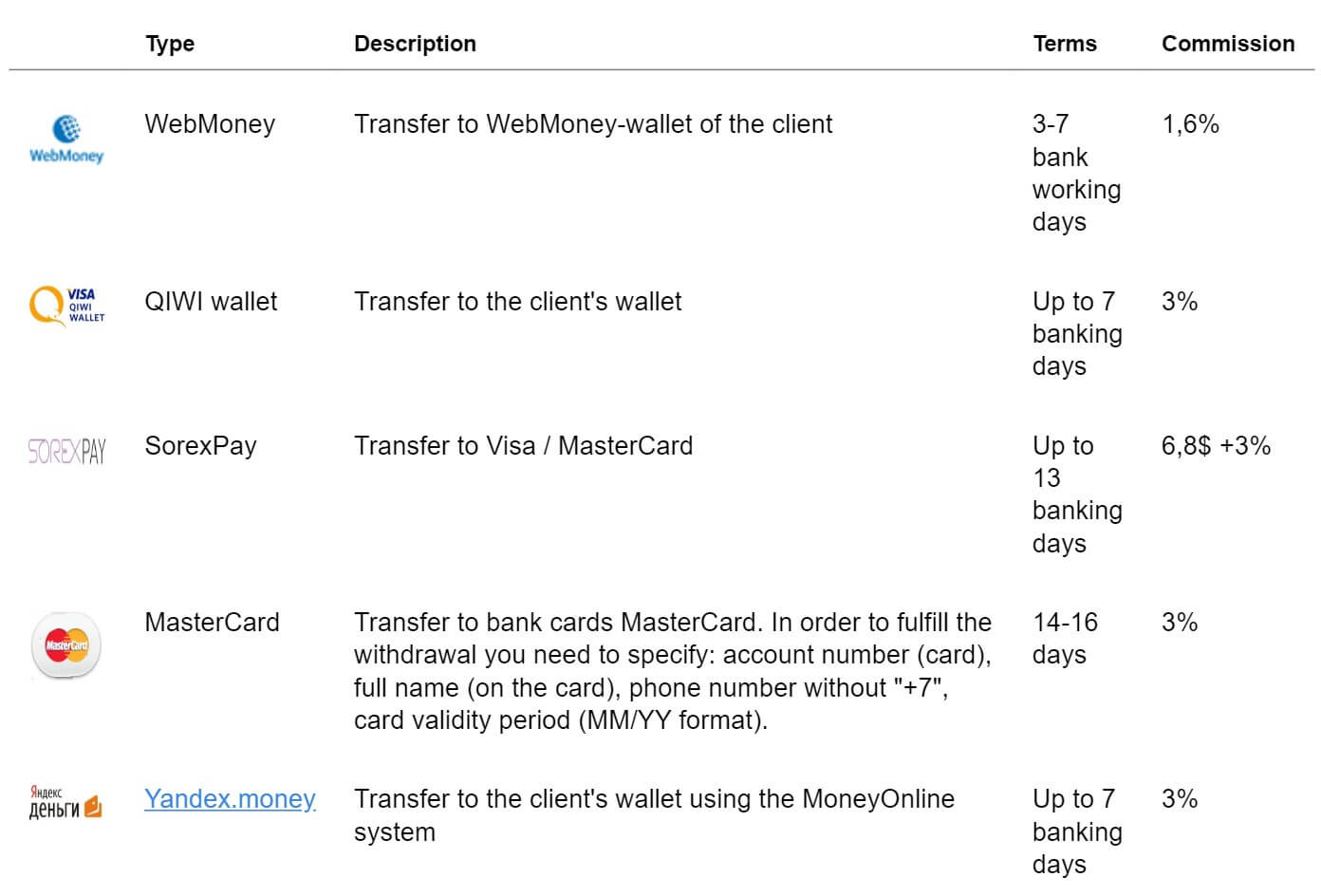

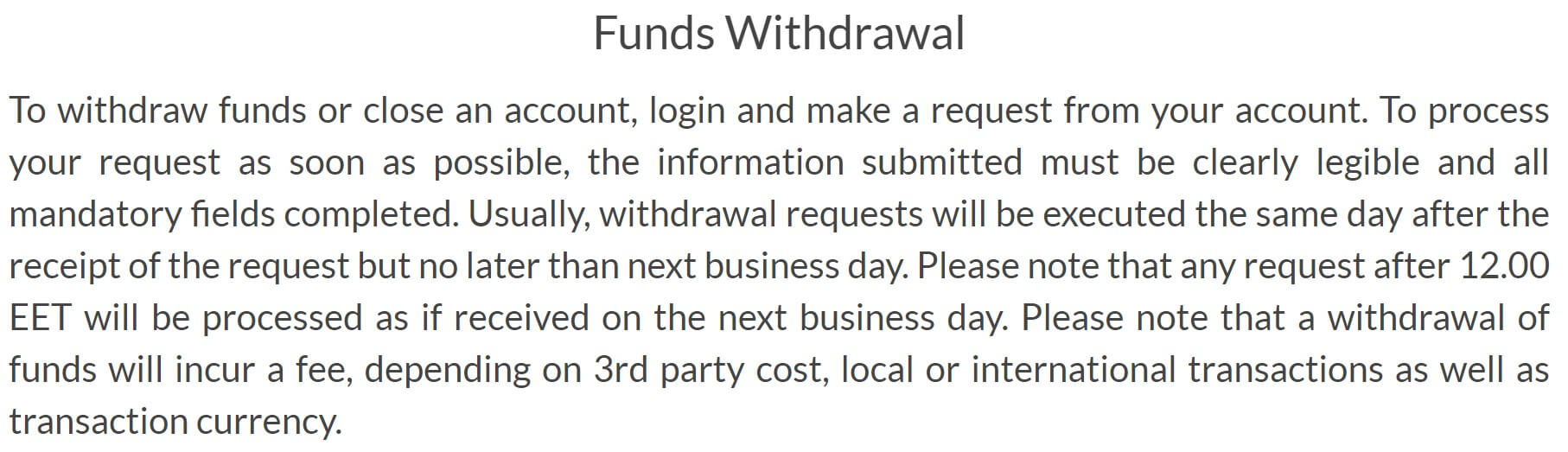

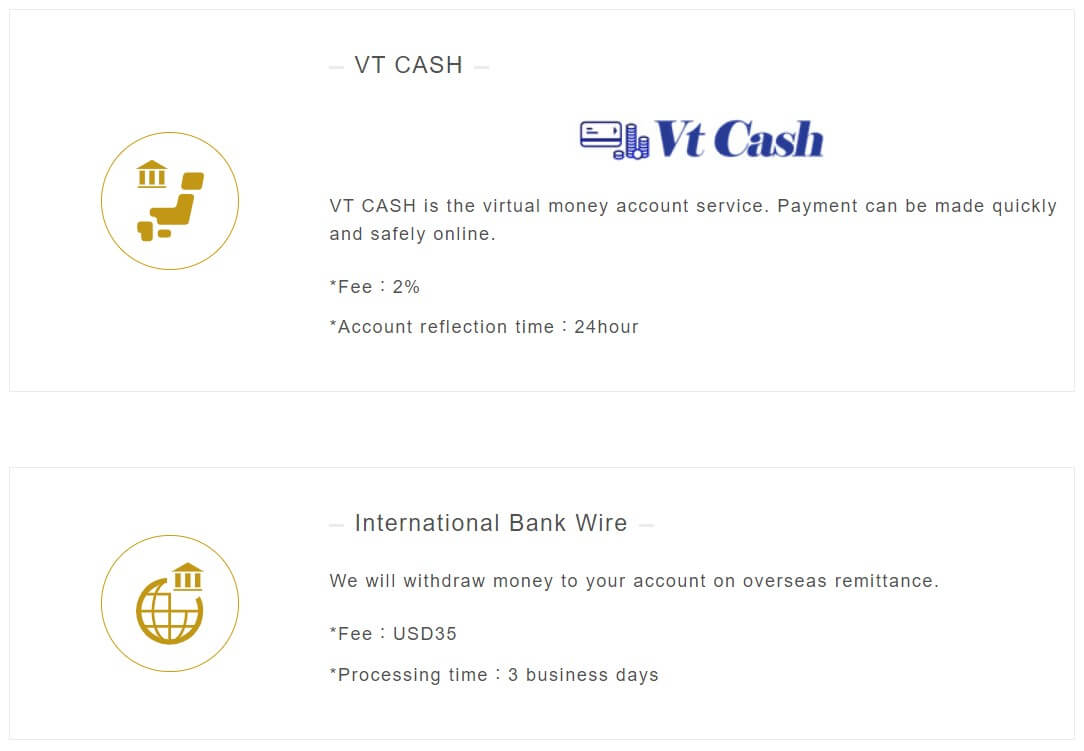

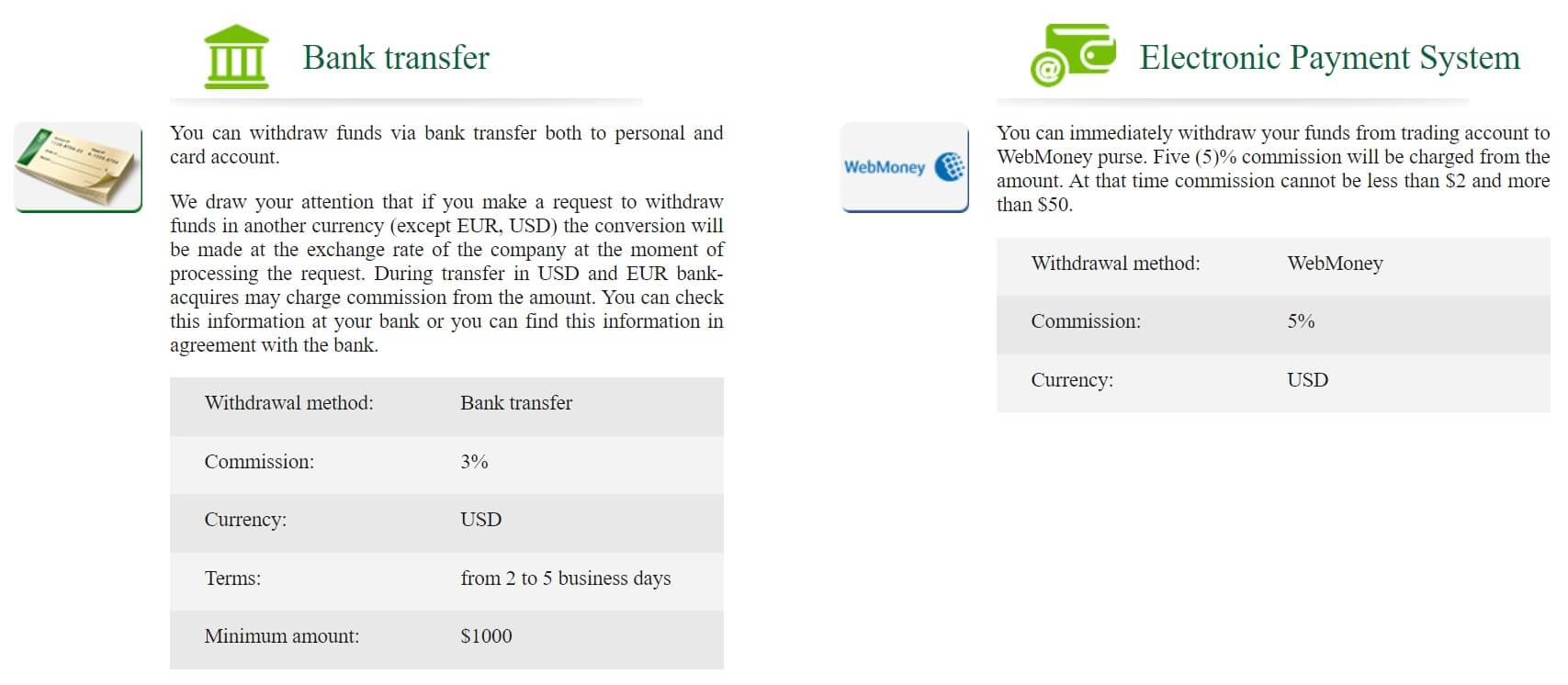

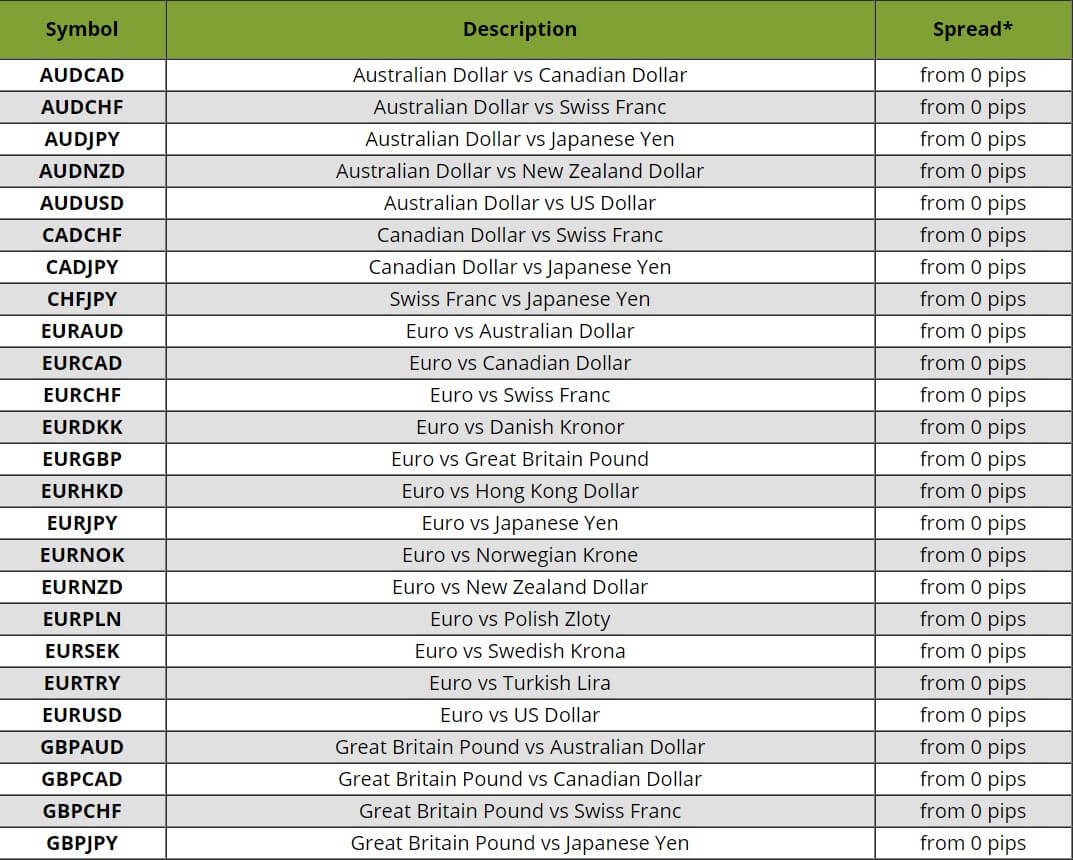

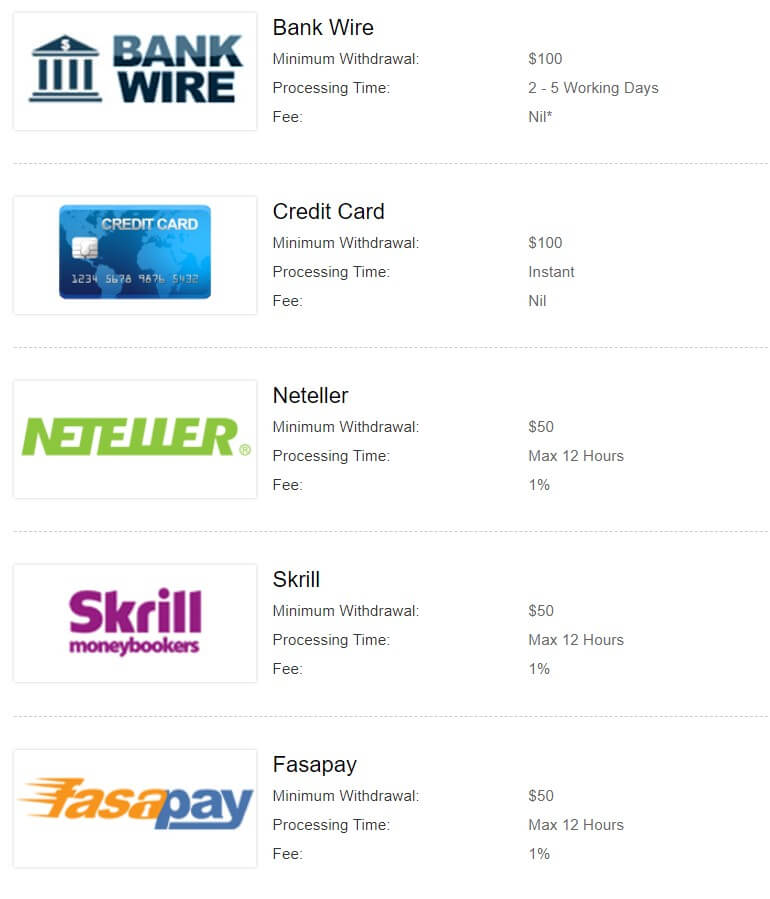

Withdrawal Methods & Costs

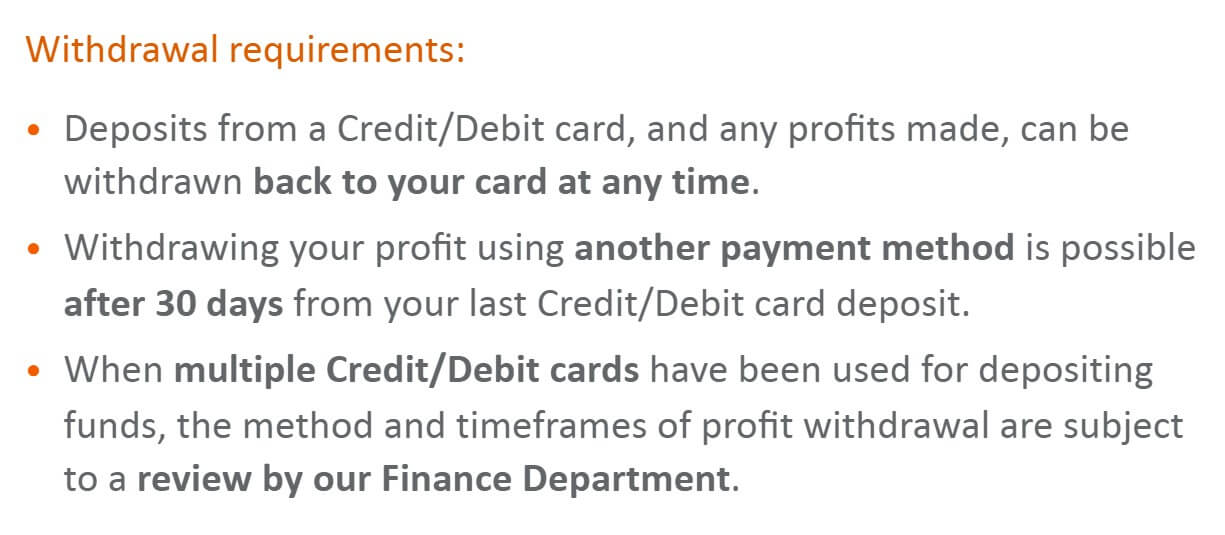

Withdrawal methods are almost as numerous as with deposits but there are certain restrictions. Bank Wire transfers have a minimum of $100, local transfers minimal amounts are changeable, Cards have a minimum of EUR 8 or USD 10 and $2000 maximum, while other methods have small minimum amounts required.

Unfortunately, FXOpen has fees for withdrawals. Costs related to Bank Transfers are from 15 EUR/ 45 USD/ 1500 RUB/ 35 GBP/ 45 CHF/ 65 AUD/ 5000 JPY and for SEPA is from EUR 15. Skrill commission is 1% (max $0.68) and Credit Cards 2.5%+USD 3.5 for USD, 2.5% + EUR 3.5 for EUR and 2.5%+RUB 50 for RUB withdrawals. The commission may vary depending on the card-issuing country and amount of payment. China UnionPay commission is from 2% but not less than 10 CNY (RMB). WebMoney withdrawal commission is USD 0,8% (max $50), EUR 0,8% (max €50, min. 1.29).

Yandex Money will ask for 1% of the withdrawal amount while Netteler does not have any costs for withdrawals. Perfect Money does not have affordable deposits but is friendly when it comes to withdrawals with 0.5%. FasaPay will also charge 0.5%.commission. QIWI withdrawal fee depends on the currency, for RUB – 1%, for EUR – 0%, and for USD – 1%.

If you request a withdrawal before meeting the requirements of the minimum notional trading volume, your account may be subject to a fee of 2.5 to 8.25% depending on which deposit option you used.

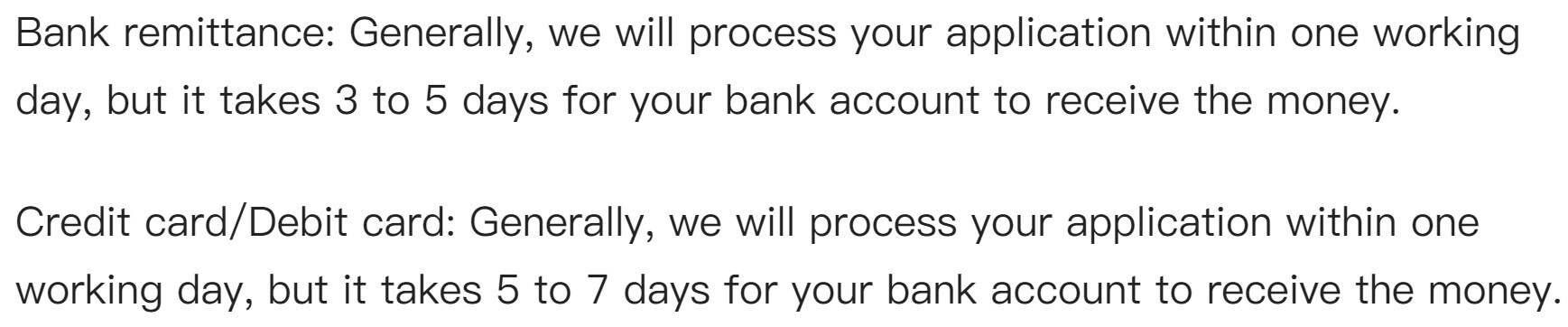

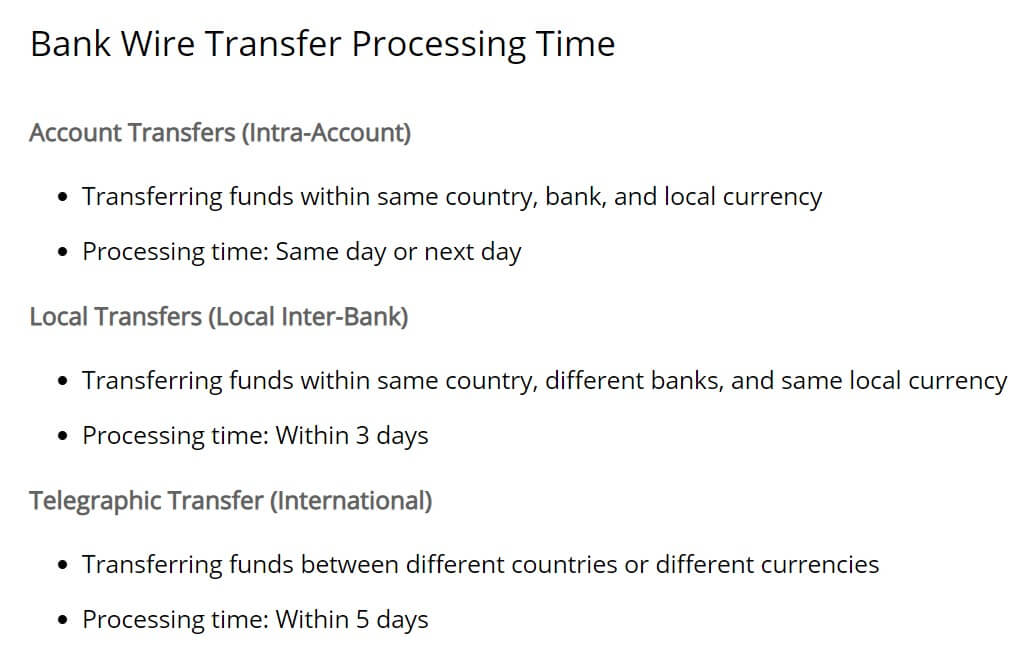

Withdrawal Processing & Wait Time

Withdrawals are done through the FXOpen portal. For Wire transfers, the processing time is from 1 to 3 days, local transfers are up to 3 days and Card withdrawals are made in 1 day. EWallets also require only 1 day to finish.

FXOpen issues a PIN code upon registration that needs to be entered every time a financial transaction is made. 2-step verification measure is applied so you will have to have your mobile device ready. You can check the status of your withdrawal at the Operation Summary page in My FXOpen personal area.

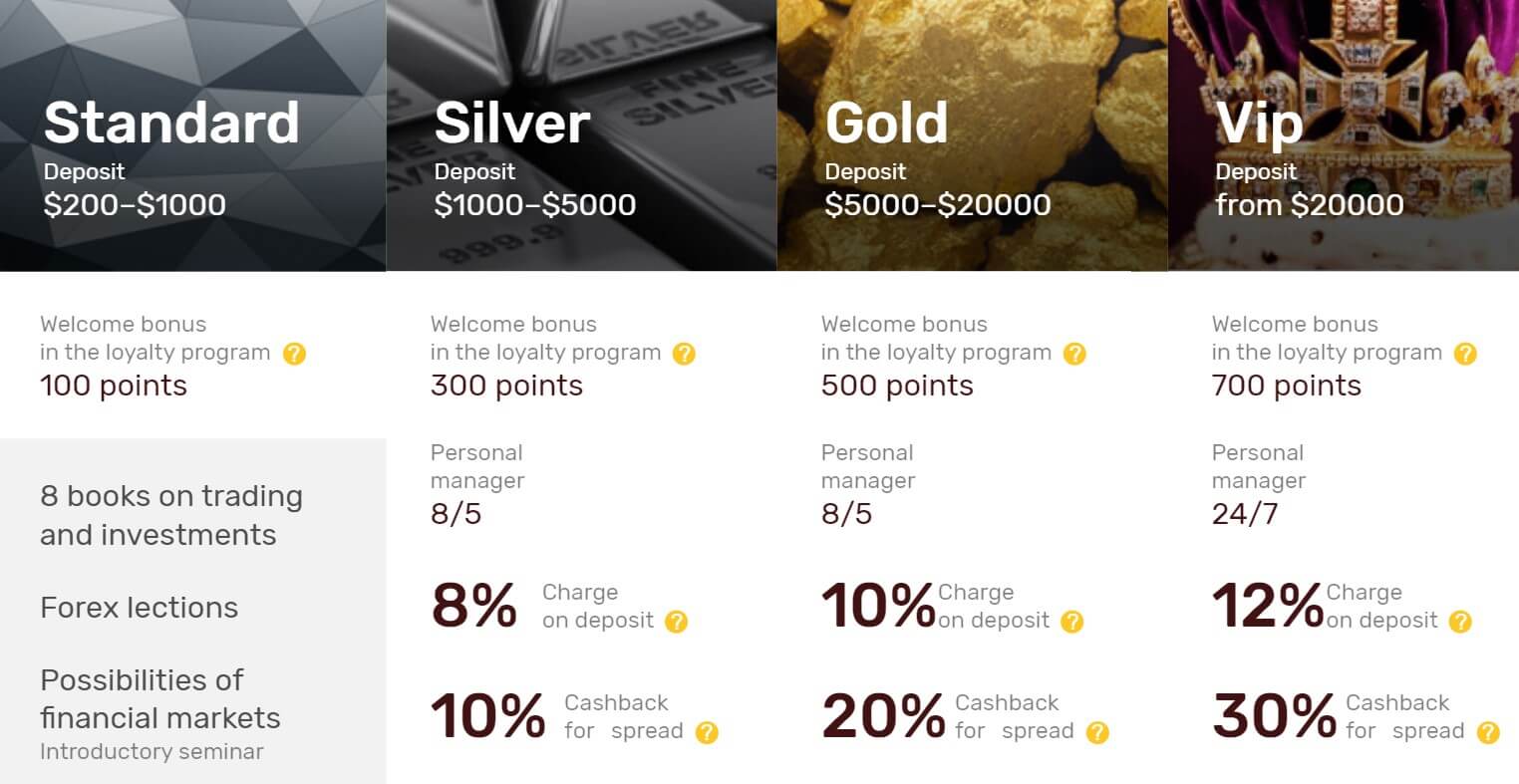

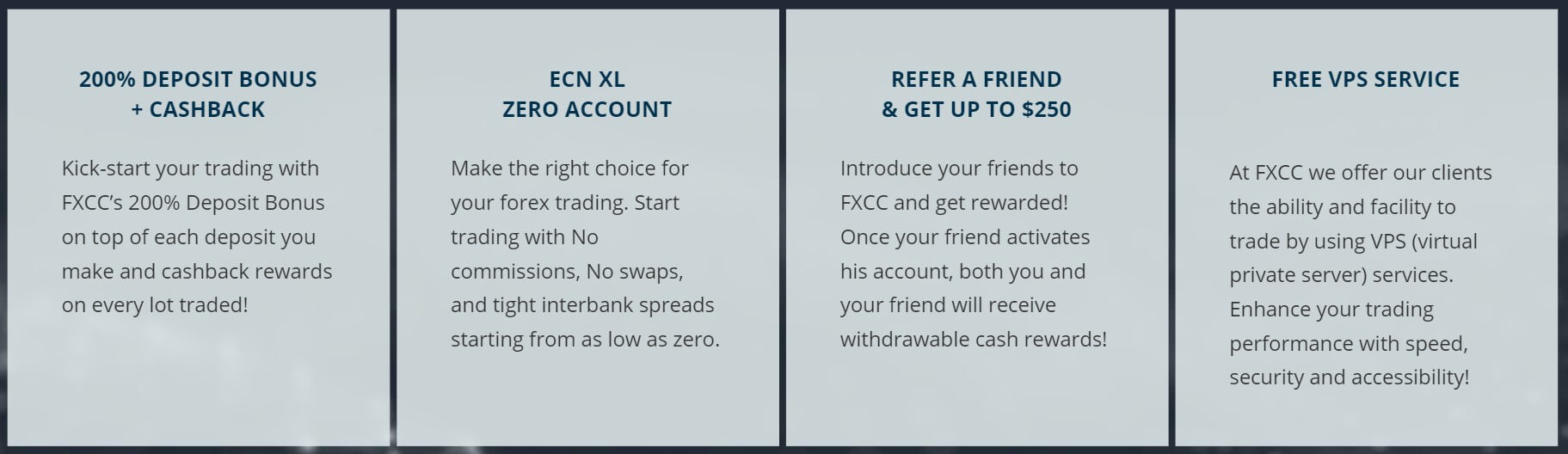

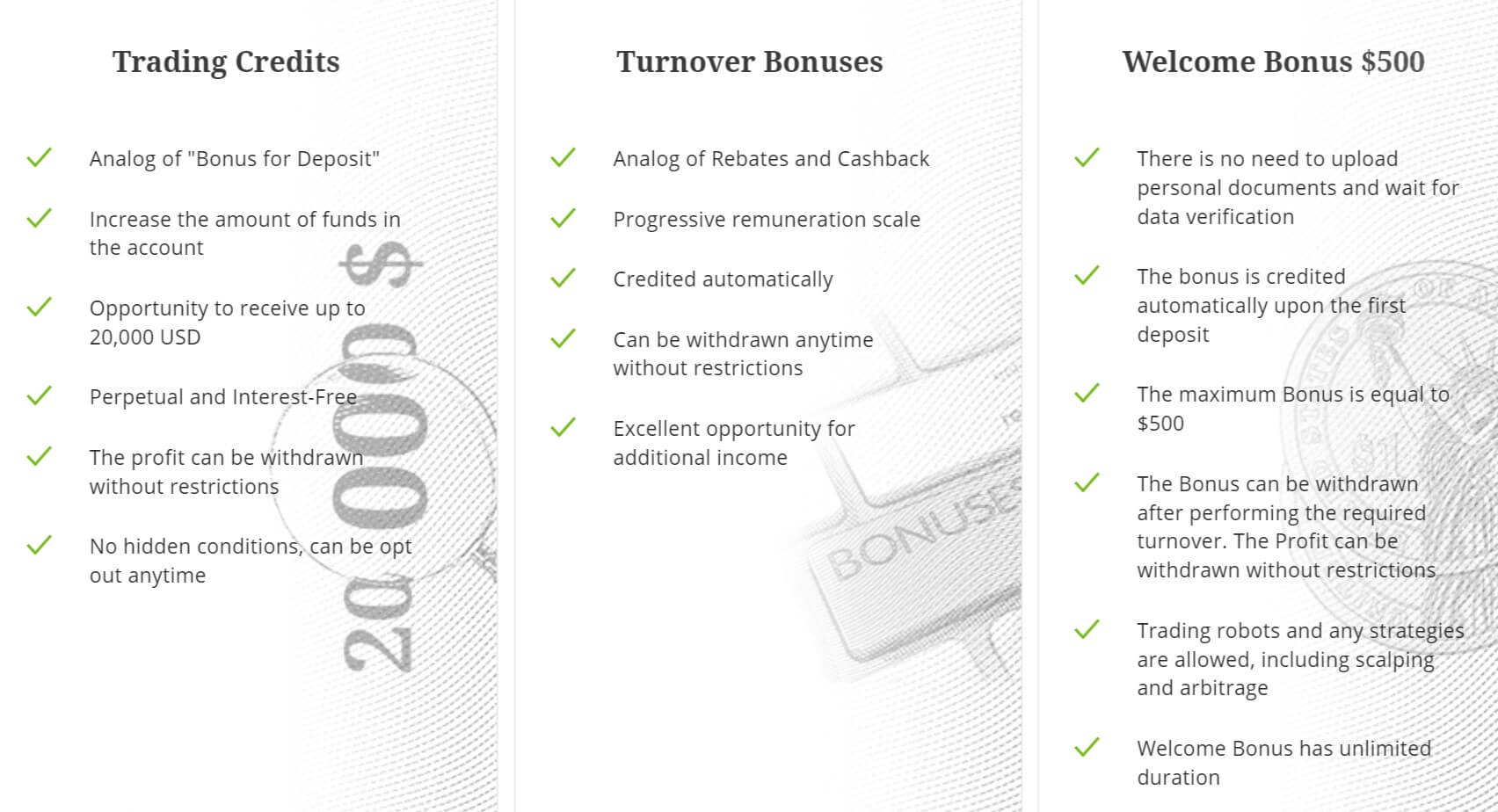

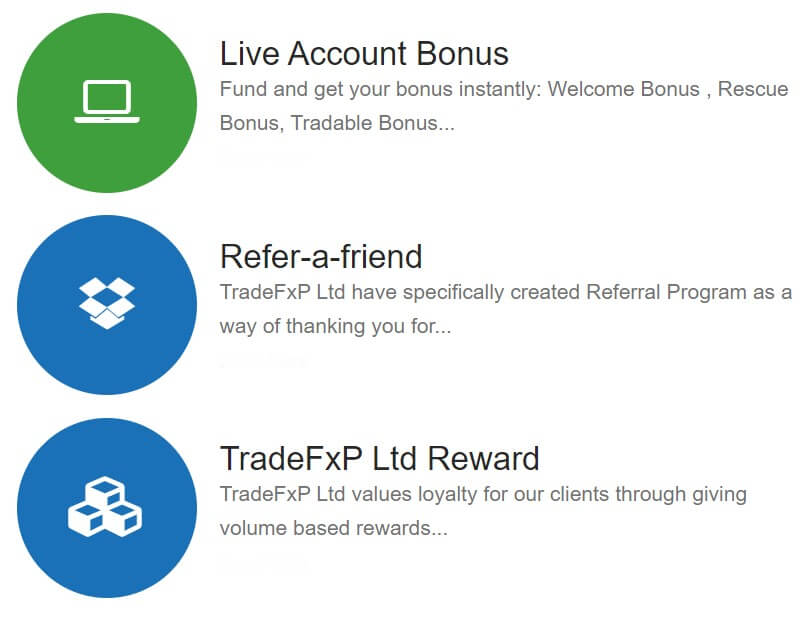

Bonuses & Promotions

FXOpen has several promotions ready at the moment of writing of this review.

No Deposit Bonus for STP accounts is a non-withdrawable bonus amount received once registration is verified to level 2 and an STP Account is opened. Any profits are withdrawable after the required volume of 2 lots. This bonus means you can start with $1 and trade like you have $11. For some, this opportunity has almost no downsides ($1) and a very open and positive upside.

The Welcome Bonus is a small addon bonus for Micro Accounts that is withdrawable after 100 traded micro-lots. After traders open a Micro Account and get level 1 verification level they will receive $1 on top of their Micro Account balance.

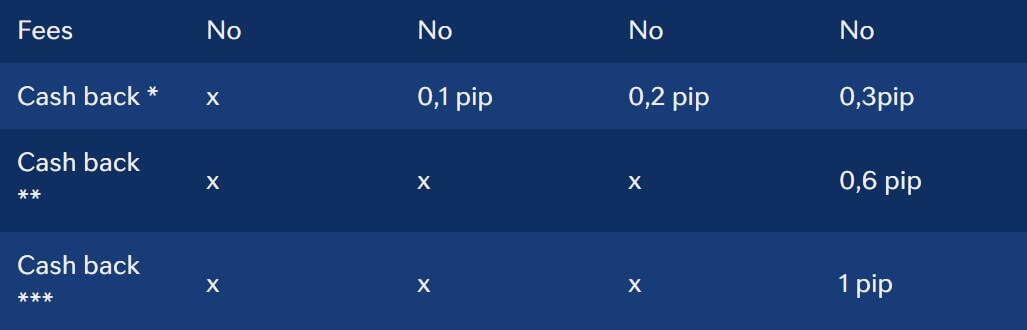

FXOpen also has a Cashback program. It is based on the used margin and is available for all account types, ECN, STP, Crypto, Micro, PAMM ECN, PAMM STP. The minimum cashback is $5, and the maximum is $1,000. Per trade $100 is the maximum. According to the broker formula the cashback is calculated, as the used margin increases, the cashback amount will decrease. Starting cashback up to 150% of the Standard commission per trade. Cashback is fully automated, the funds are credited to the client’s Commission account and can be used immediately.

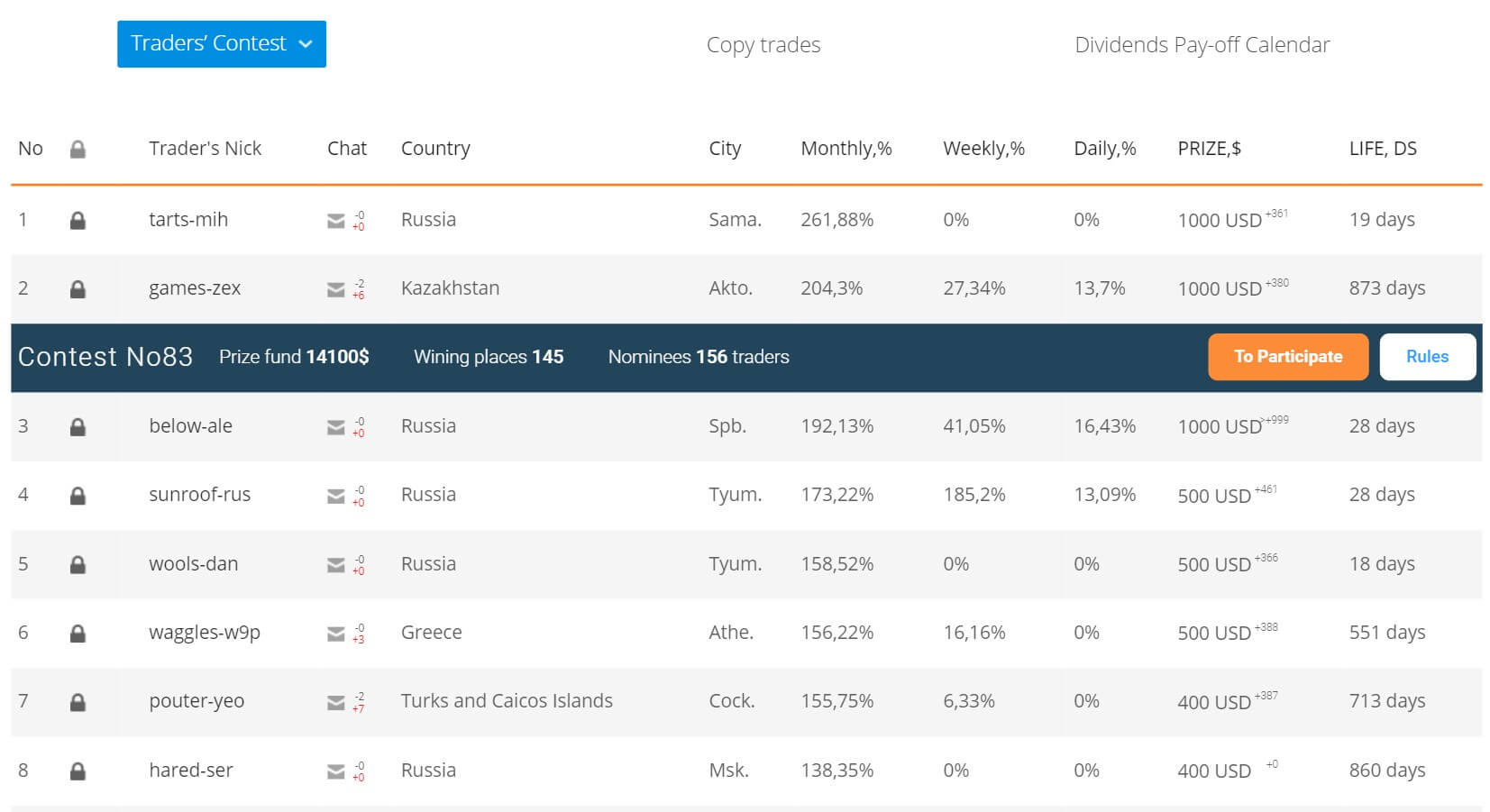

ForexCup Trading Contest Bonus is a reward for the contest FXOpen organizes for the STP demo accounts. The ranking is made according to the profit made for a certain period and the bonus is usually 1% of that amount. You can withdraw or transfer the bonus to another account. Limitations may apply depending on a particular ForexCup contest.

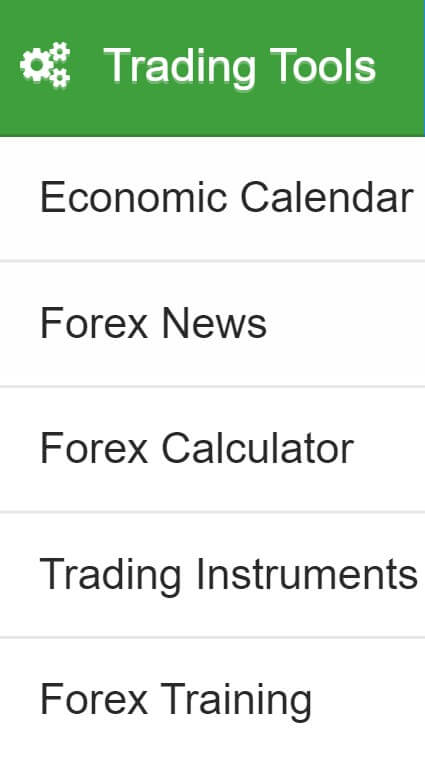

Educational & Trading Tools

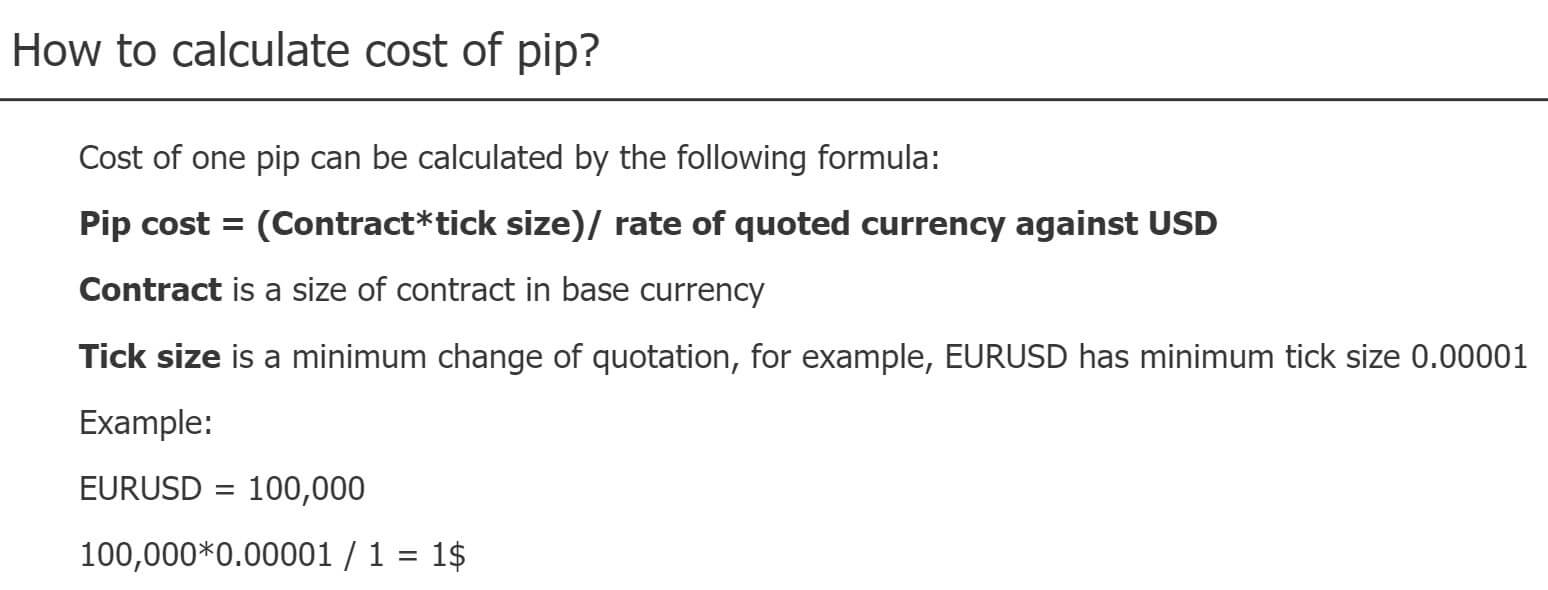

Aside from the mentioned One Click Trading and Level2 Plugin, FXOpen offers a few less advanced tools. These are Margin and Pip Value Calculator, Currency Exchange Rates and Commission Calculator. The description of how to use one and why is very good. Note that these tools are only for live trading accounts.

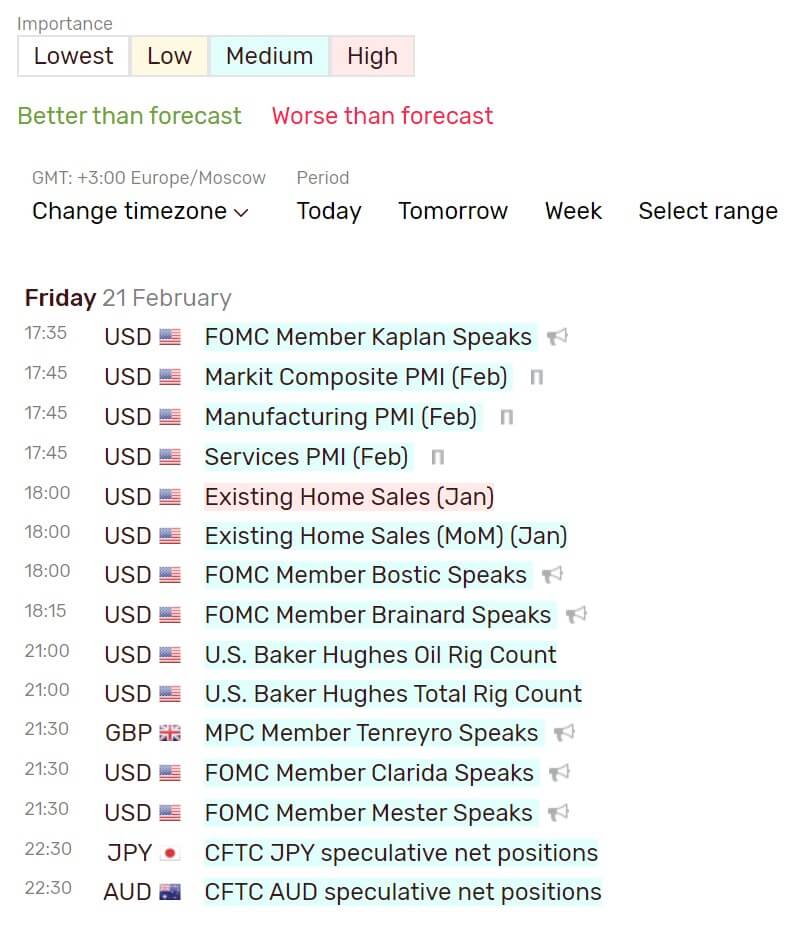

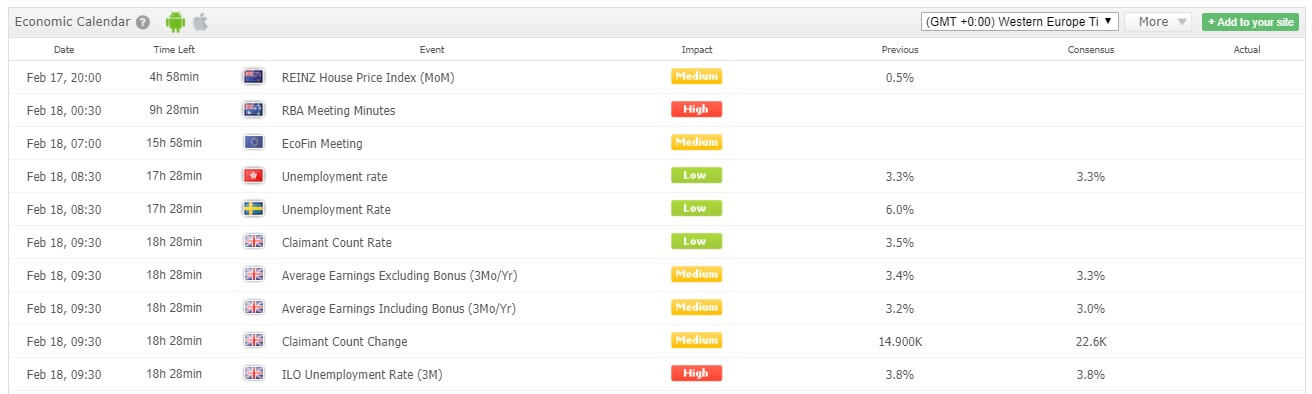

FXOpen Economic Calendar is not packed with features. It is mostly presented as a list with event names, impact meter, and the figures related. There is no way to filter any criteria. Clicking on ht event name will open the fxstreet.com website.

The broker is friendly to Zulutrade and Myfxbook automated trading service as well as VPS. For those not familiar, these are the most popular mirror automated trading websites that can be linked with the FXOpen account.

The educational section of FXOpen is not as developed as with some other bigger brokers, but what is impressive is the FXOpen blog. The blog is not as easily visible or promoted on the FXOpen website. About Forex page is mostly basic and meant for beginners that need to understand how to trade. Some marketing is involved but the page is not designed to be a substitute for real education. Market News and Market Analysis sections are very good and the news is mostly from the FXstreet portal. It is updated and filled with solid fundamental information.

Although we would like to have more diversified sources. Market Analysis is connected to the FXOpen blog area. There is a lot of interesting analysis, regularly updated. Each analysis is structured with visuals but some popular technical indicators, Fibonacci levels, and practices used may not be appropriate for certain currency pairs or similar assets. Still, the articles are good enough to instill attention to these points.

At a glance, the FXOpen blog section is full of useful material in different areas, like Cryptocurrencies, Brokers, Strategies, General Trading and so on. It is a definitive source for knowledge and information other, large brokers do not have.

Customer Service

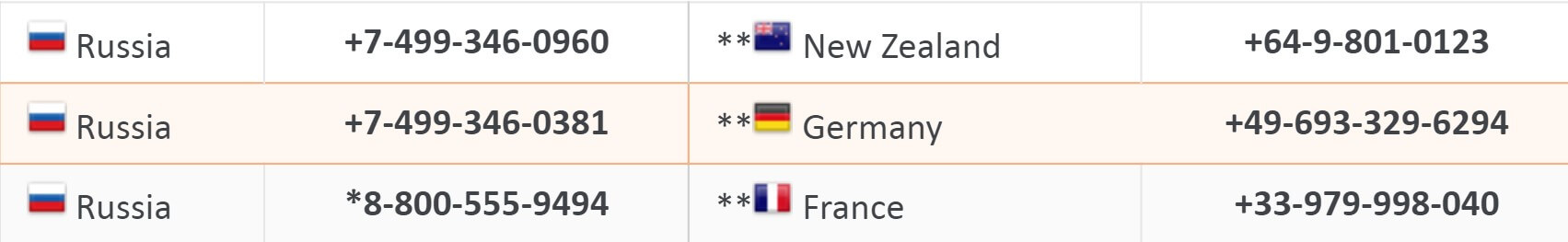

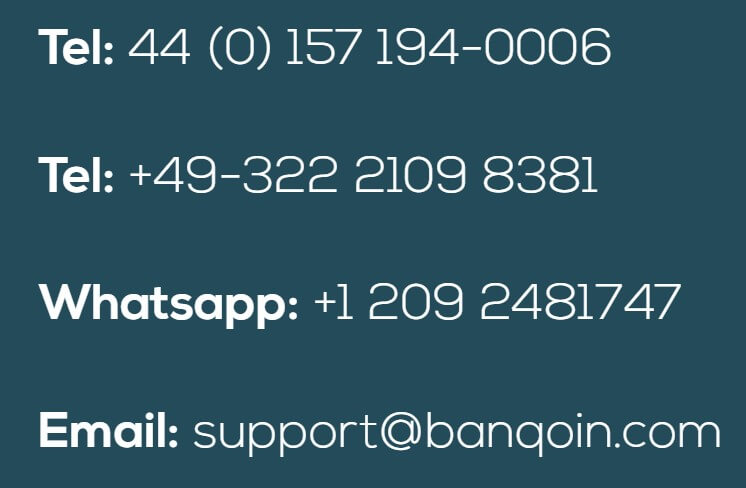

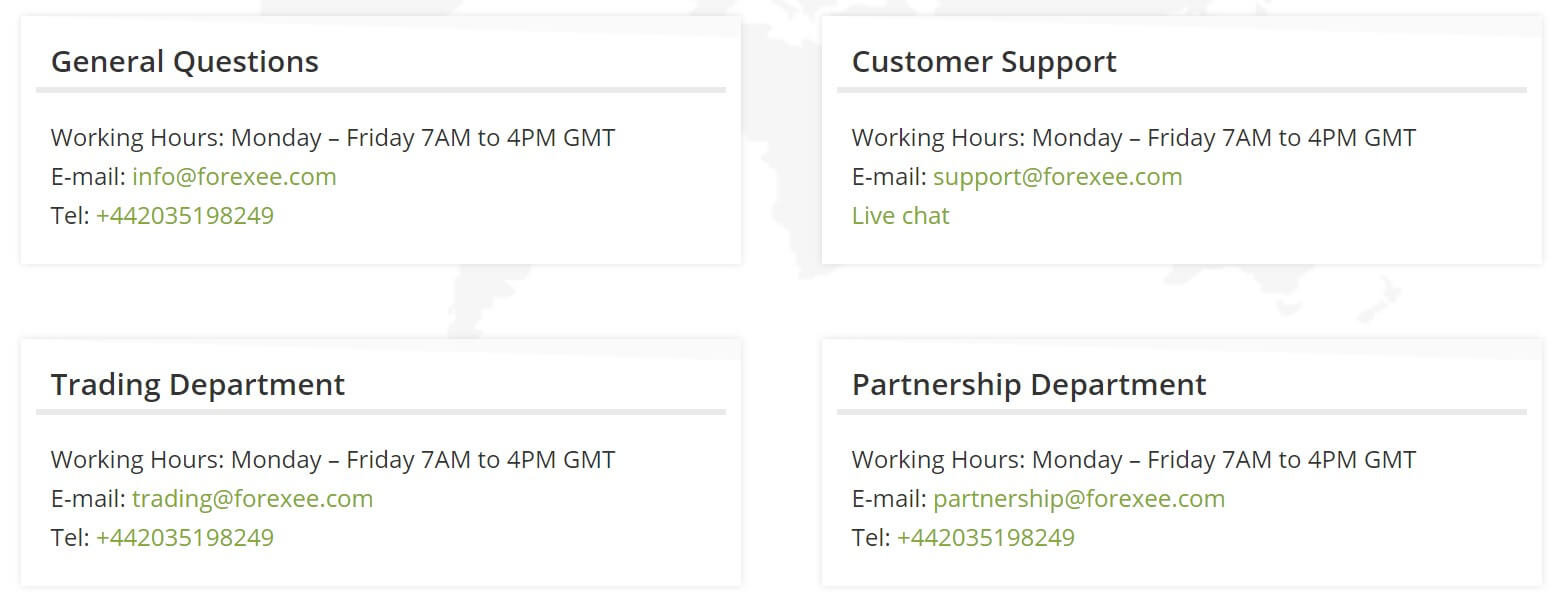

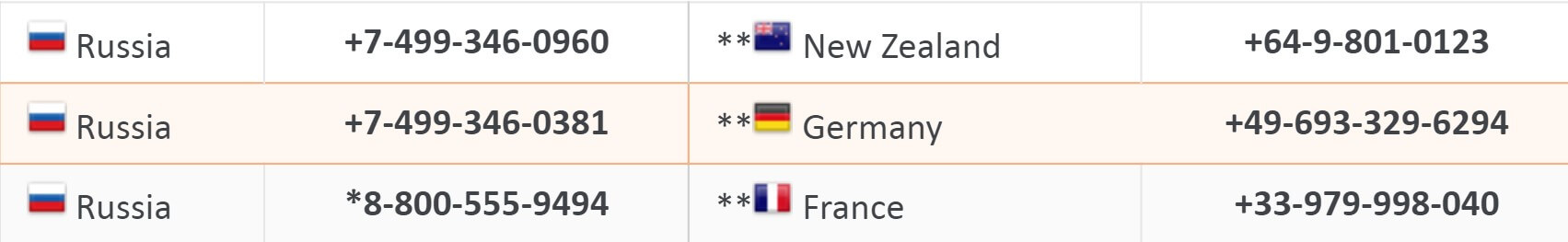

Customer service is available 24/7 and chat service is 24/5. There are several support branches across the world zones and languages. Clicking on the chat cloud button will show many channels FXOpne can be reached. There is a Facebook messenger, WhatsApp, Telegram, Twitter, Skype, Viber, Line, and WeChat. The customer service representatives are not oriented to sales pitches and a very neutral. There is almost no waiting time to reach them and most of the answers are direct unless there is a negative answer behind. Still, none of them are conflicting with the actual conditions.

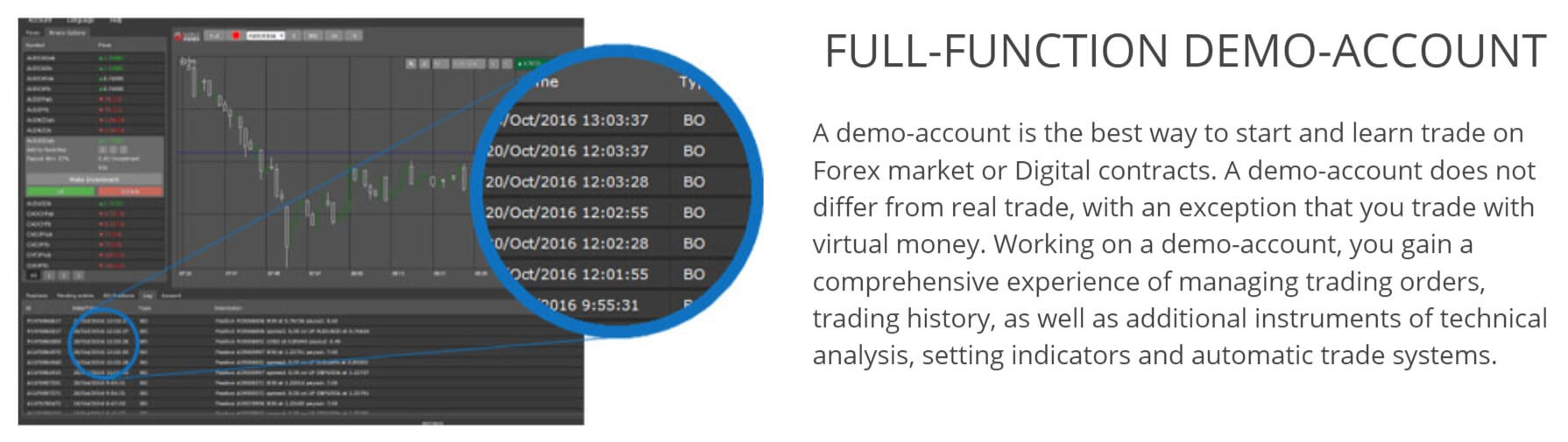

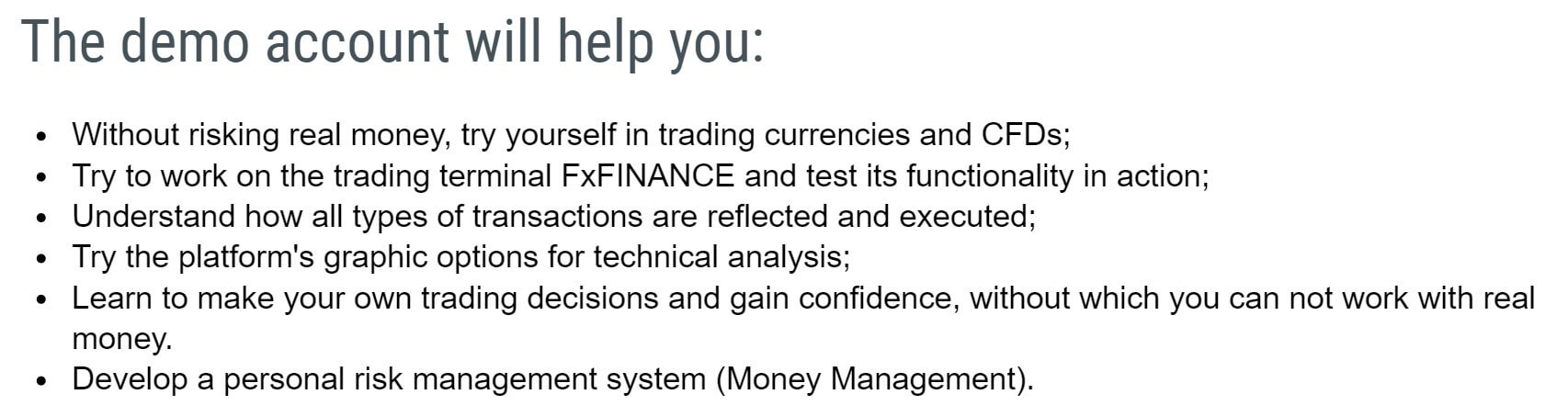

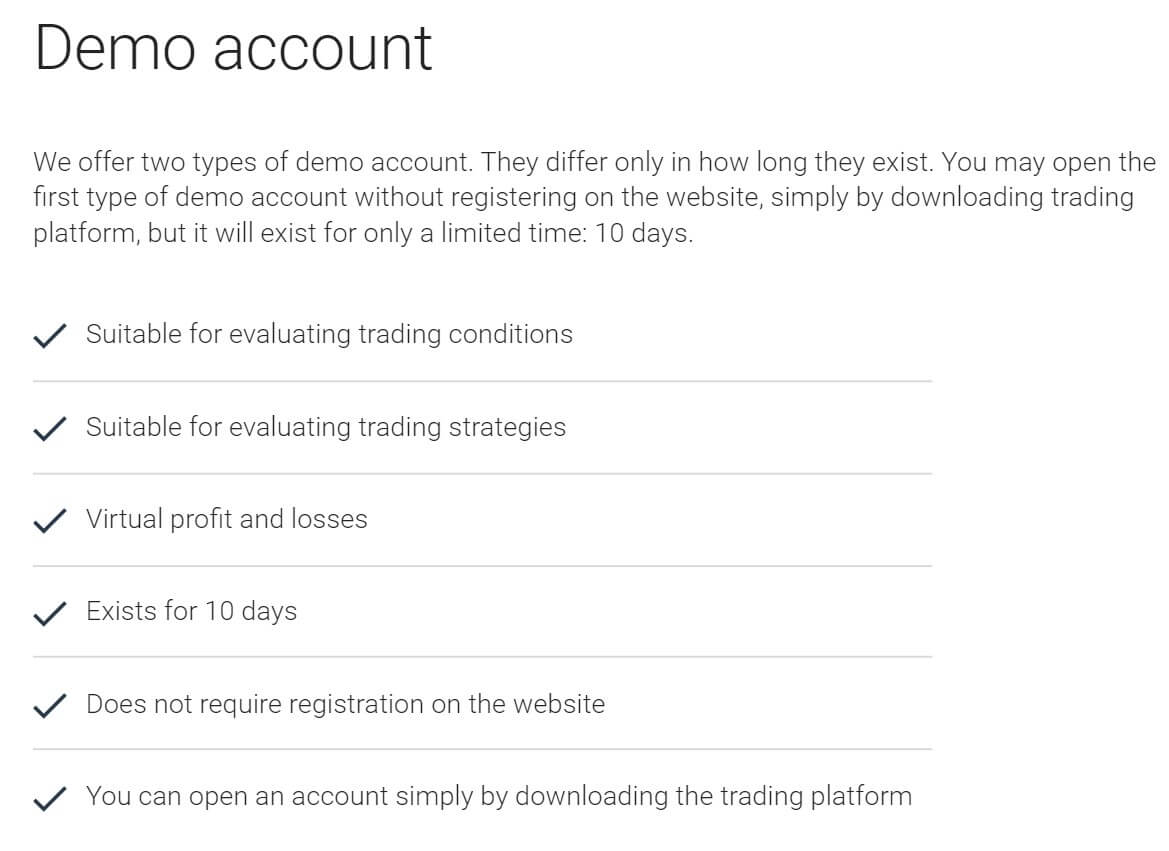

Demo Account

The demo accounts are unlimited according to the broker. You can open a demo for Crypto, ECN and the STP Account. All of them have actual costs included and represent live trading conditions. To open a demo is easy and also can be done directly through the MT4 or MT5 platform.

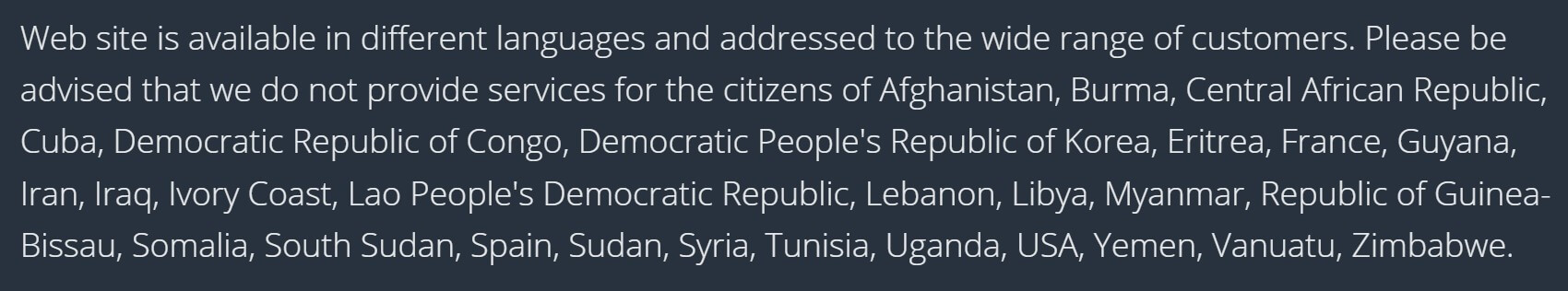

Countries Accepted

According to the FXOpen published list in February 2019, these are the countries restricted to service (fxopen.com domain): Aland Islands, Austria, Belgium, Brazil, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, French Guyana, Germany, Gibraltar, Greece, Guadeloupe, Guernsey, Hong Kong, Hungary, Ireland, Italy, Japan, Latvia, Liechtenstein, Lithuania, Luxembourg, Malaysia, Malta, Martinique, Mauritius, Mayotte, Netherlands, Norway, Poland, Portugal, Reunion, Romania, Slovakia, Slovenia, Spain, Svalbard and Jan Mayen, Sweden, United Kingdom, and United States.

Conclusion

This section of the FXOpen review will address some issues that may be of concern to some traders. This broker does not have weak points except maybe the fees associated with the withdrawals. All other aspects are well developed. The broker is transparent and presents very good and useful information to traders in all aspects. Rating on some benchmark sites is mixed but they could be from traders that do not follow the ethical way of trading as many are attracted to no deposit bonuses and low entry barriers to start trading. Not to mention easy cryptocurrency transactions, one of FXOpen trademarks as a cryptocurrency-focused broker.

What traders should pay attention to are some reports that the broker can utilize measures to profitable traders where their profits are not justified and canceled, but this is unconfirmed. On some other popular review websites, FXOpen stands very positive, especially by Russian clients. FXOpen has not received any bad publicity or fines except for the $140,000 fine for offering services to US residents in 2012.

Trade Sizes

Trade Sizes

On the broker’s website says that the process times are 30 minutes, which we find speedy processing compared to most brokers if this is true. Even the withdrawals ordered on weekends will still be processed in 30 minutes. The waiting times are the usual, if the withdrawal is by bank transfer the time until your money appears in your account is 1 to 5 days. For withdrawals made using electronic and cryptocurrency media, you may have the withdrawal process completed on the same day.

On the broker’s website says that the process times are 30 minutes, which we find speedy processing compared to most brokers if this is true. Even the withdrawals ordered on weekends will still be processed in 30 minutes. The waiting times are the usual, if the withdrawal is by bank transfer the time until your money appears in your account is 1 to 5 days. For withdrawals made using electronic and cryptocurrency media, you may have the withdrawal process completed on the same day. WorldForex has a promotion now consisting of a 100% deposit bonus. If the deposit amount is higher than 100 USD it also offers a free VPS server. Usually, this type of bonus is not removable; instead, what you do is increase your margin so you can trade with more volume. Profits made with bonus capital are usually refundable. As always, we recommend reading the terms and conditions surrounding bonuses prior to accepting one.

WorldForex has a promotion now consisting of a 100% deposit bonus. If the deposit amount is higher than 100 USD it also offers a free VPS server. Usually, this type of bonus is not removable; instead, what you do is increase your margin so you can trade with more volume. Profits made with bonus capital are usually refundable. As always, we recommend reading the terms and conditions surrounding bonuses prior to accepting one.

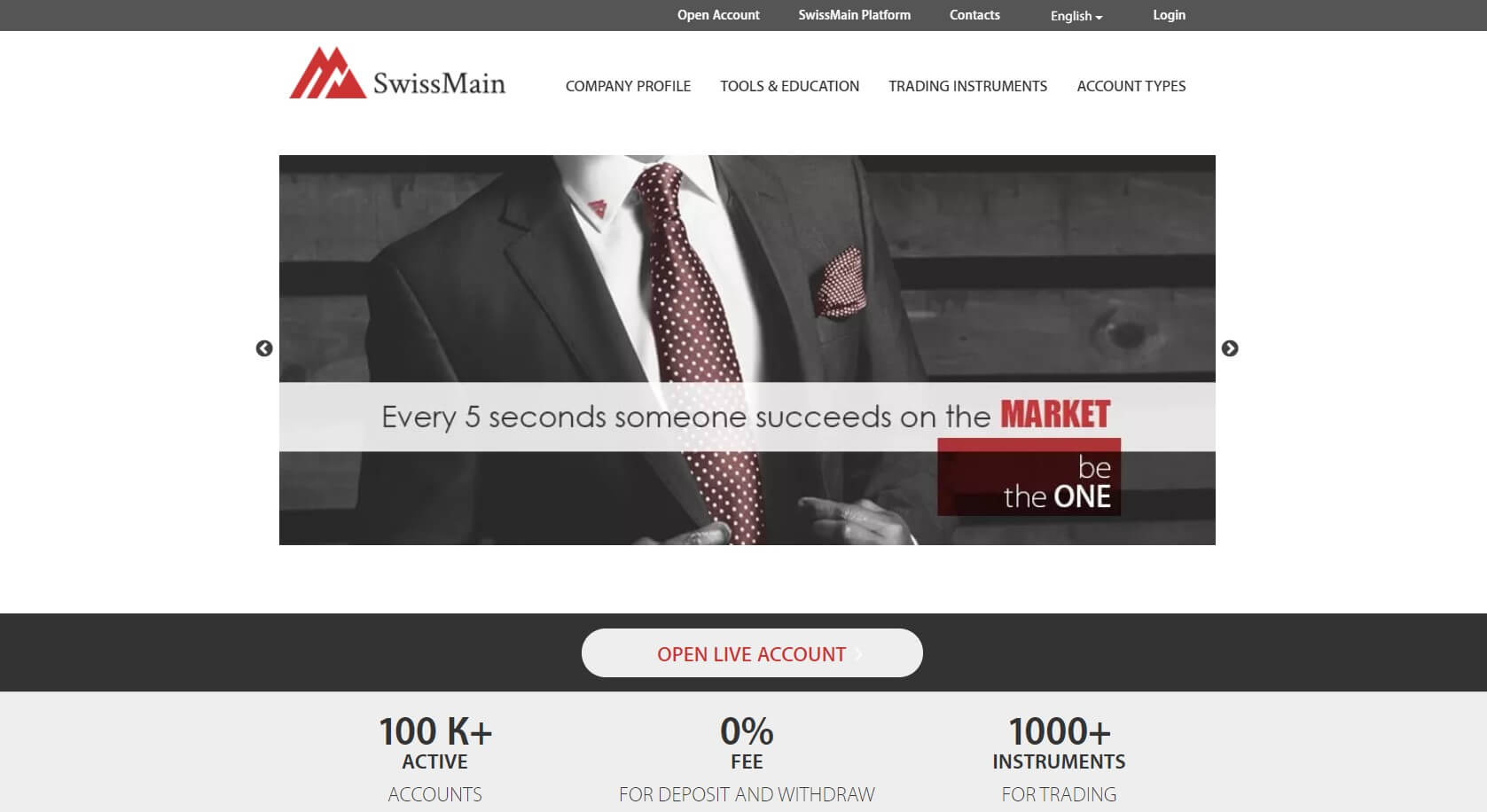

Swissmain is a broker with which you can access and trade more than 1,000 total assets in the financial market. They make available major currency pairs, commodities, indices, and stocks, and even

Swissmain is a broker with which you can access and trade more than 1,000 total assets in the financial market. They make available major currency pairs, commodities, indices, and stocks, and even

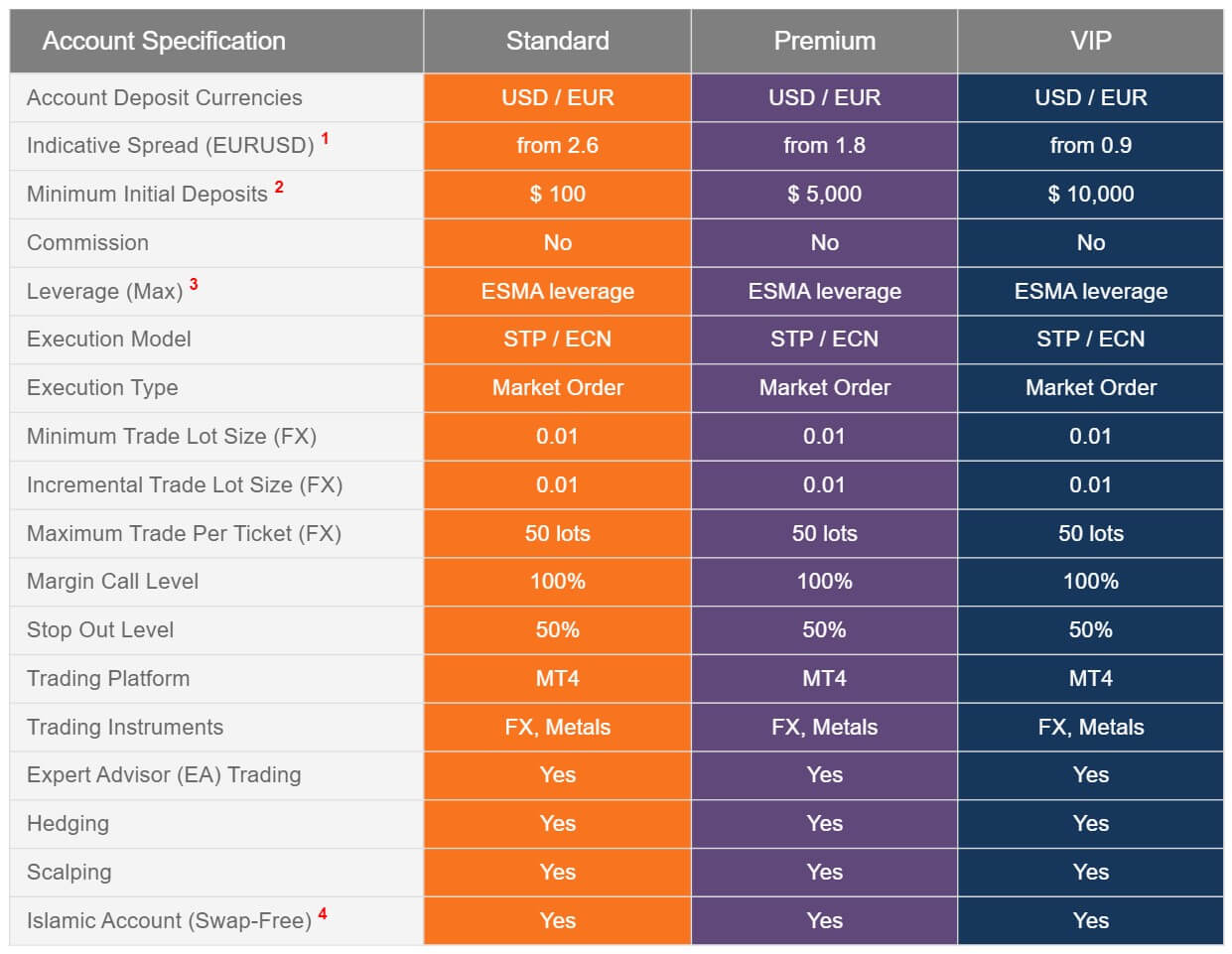

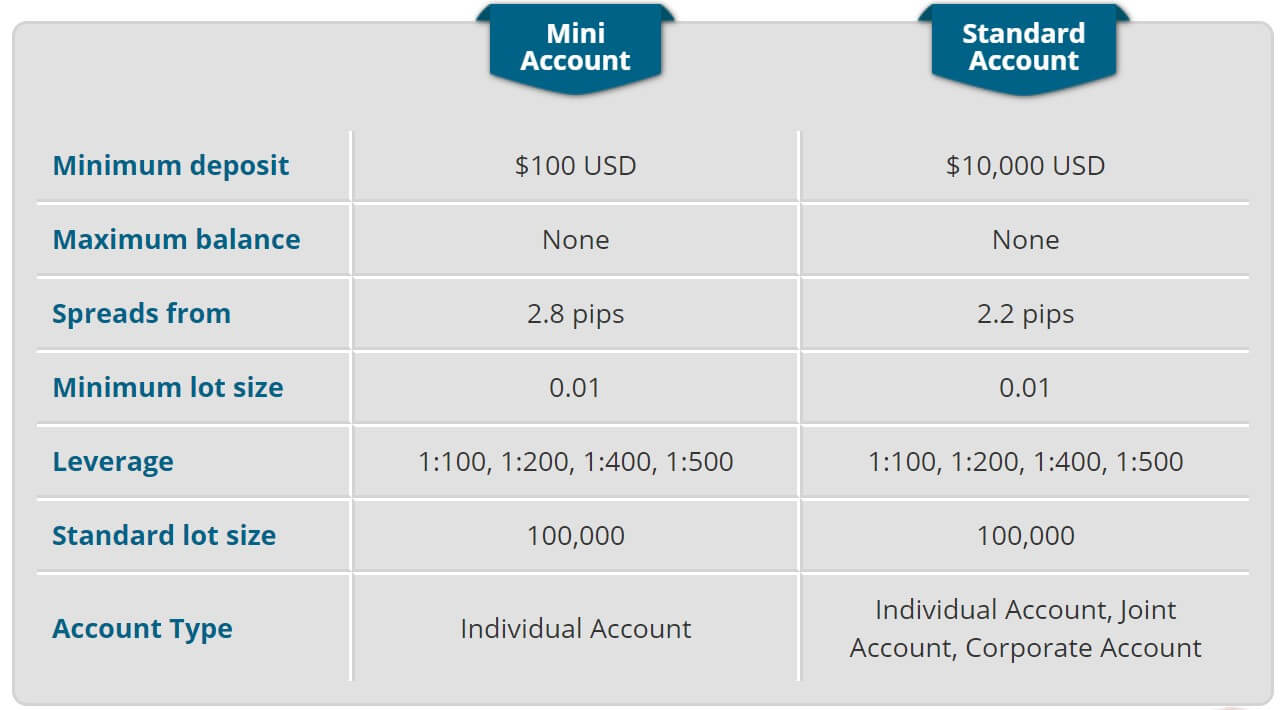

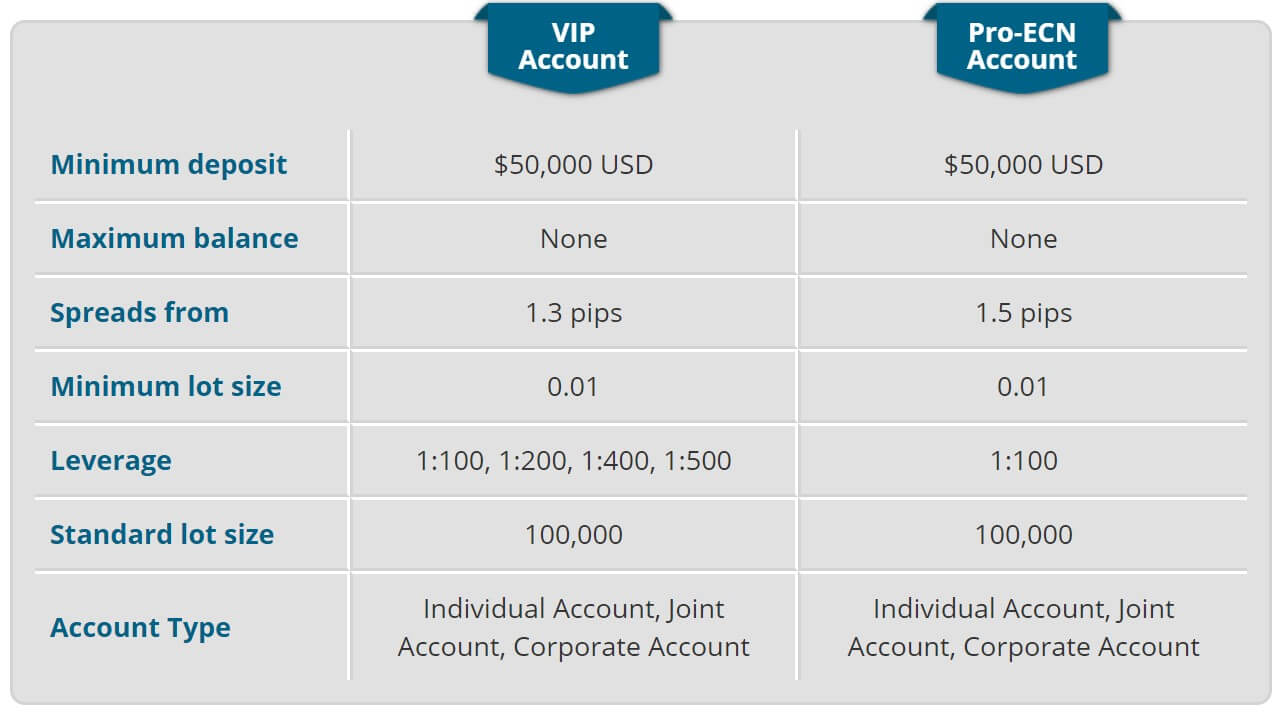

Nico FX is a reasonably well-regulated currency broker, with CySec, FCA and Bafin licenses. The firm is offering online trading on 46 currency pairs and precious metal CFDs. It uses the MT4 platform, which is a good thing. The spreads of this broker are quite contradictory, as there is a huge difference between the spreads offered in your basic account, 2.6 pips in EUR/USD, and 0.9 pips in your VIP account. The minimum deposits to open a trading account with this broker are also very disparate, from USD 100 in the base account to USD 10,000 in your VIP account, which is where the best trading conditions are offered.

Nico FX is a reasonably well-regulated currency broker, with CySec, FCA and Bafin licenses. The firm is offering online trading on 46 currency pairs and precious metal CFDs. It uses the MT4 platform, which is a good thing. The spreads of this broker are quite contradictory, as there is a huge difference between the spreads offered in your basic account, 2.6 pips in EUR/USD, and 0.9 pips in your VIP account. The minimum deposits to open a trading account with this broker are also very disparate, from USD 100 in the base account to USD 10,000 in your VIP account, which is where the best trading conditions are offered.

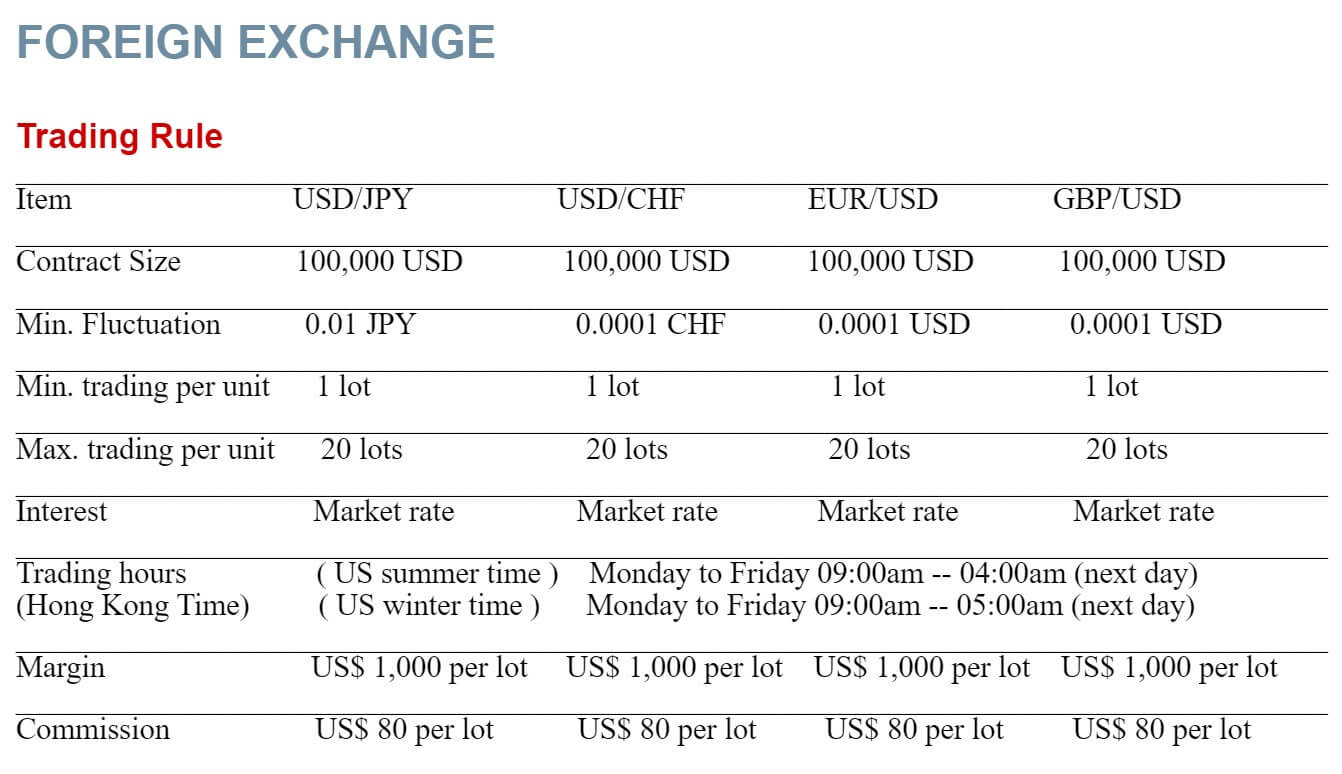

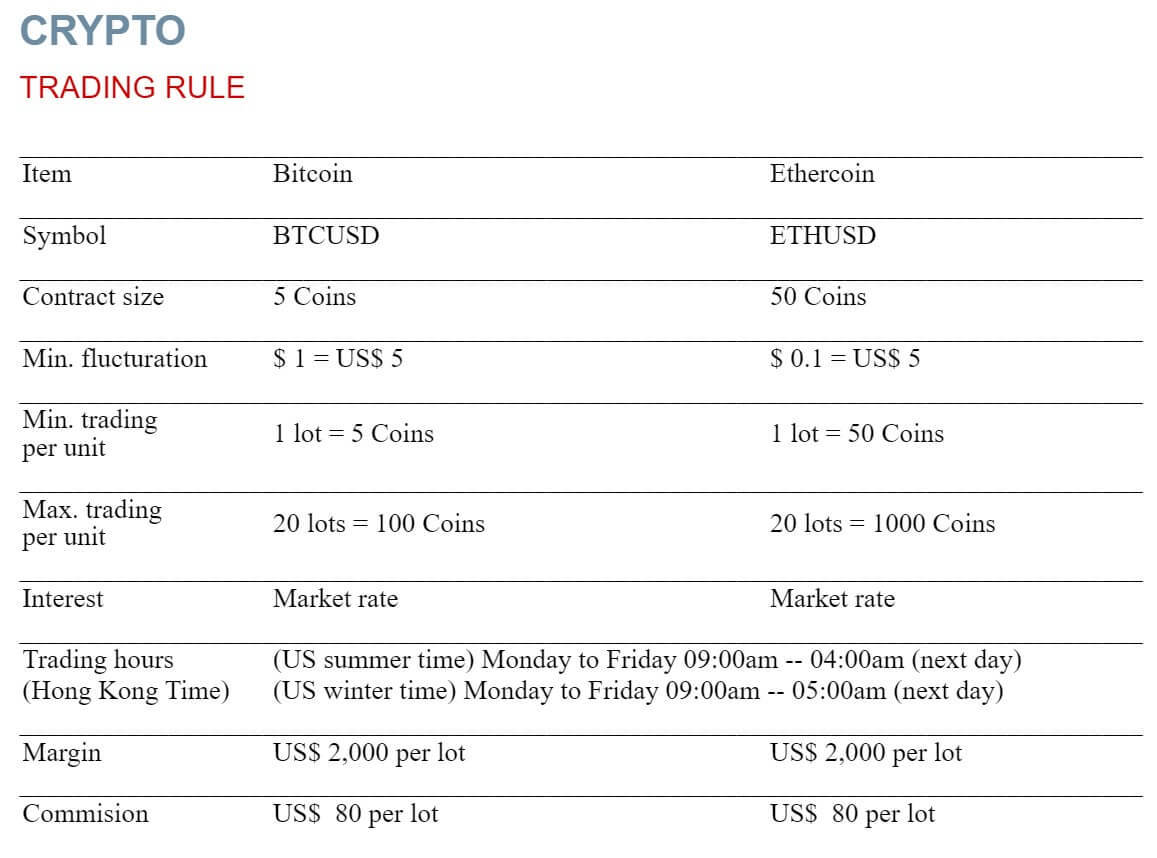

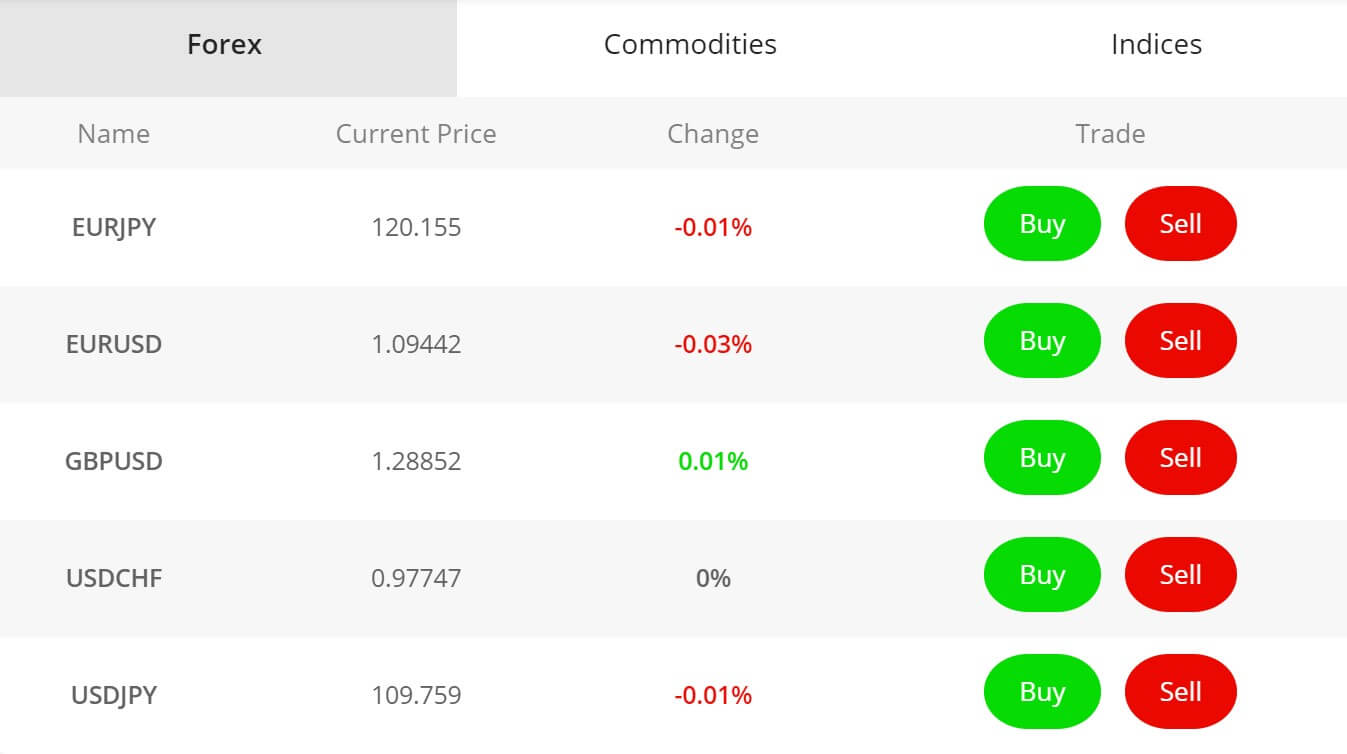

Forex: Just four different pairs are mentioned on the forex page, these are USDJPY, USDCHF, EURUSD, and GBPUSD. We would hope that there would be more to trade but unfortunately, we do not know for sure.

Forex: Just four different pairs are mentioned on the forex page, these are USDJPY, USDCHF, EURUSD, and GBPUSD. We would hope that there would be more to trade but unfortunately, we do not know for sure.

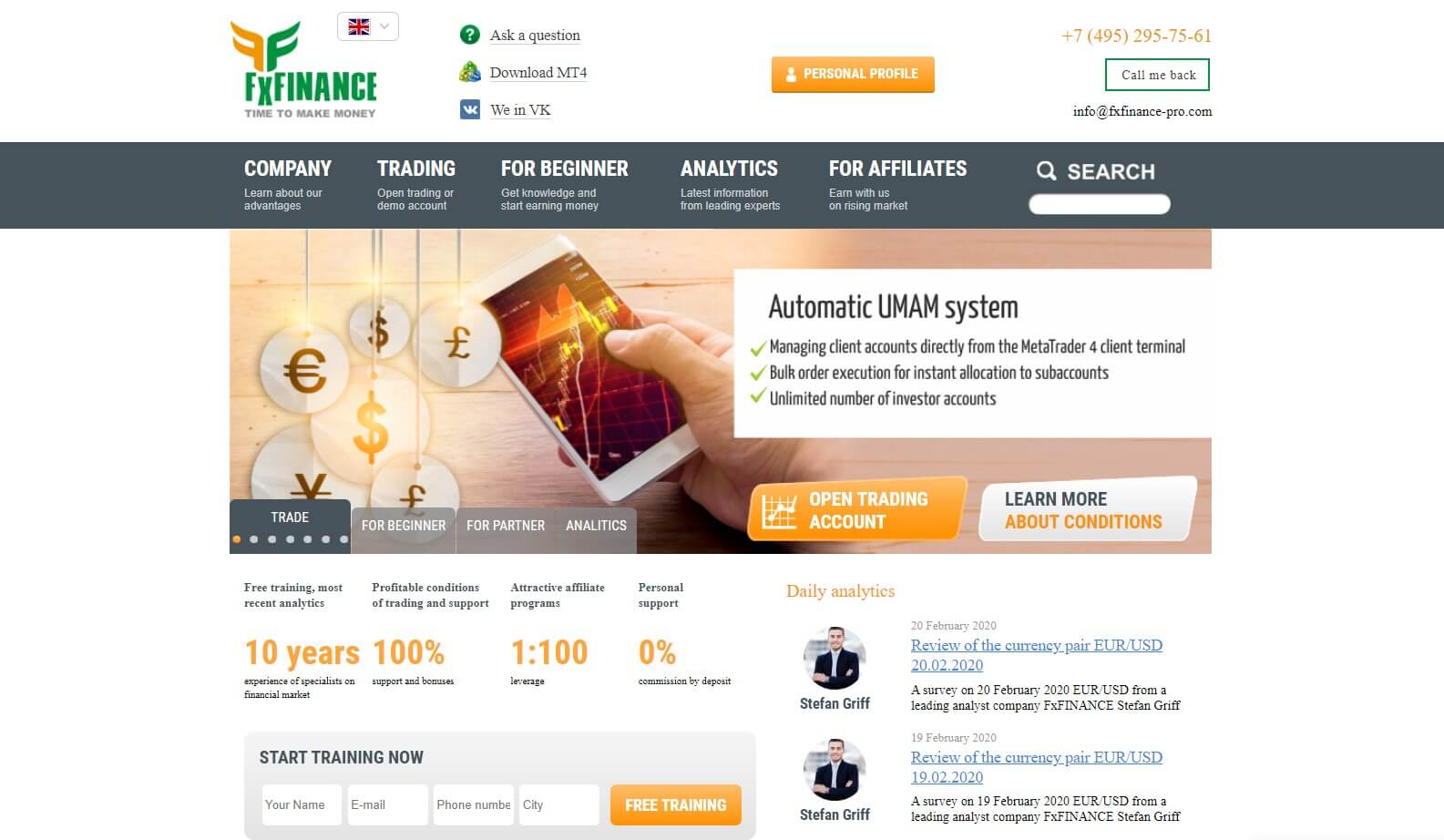

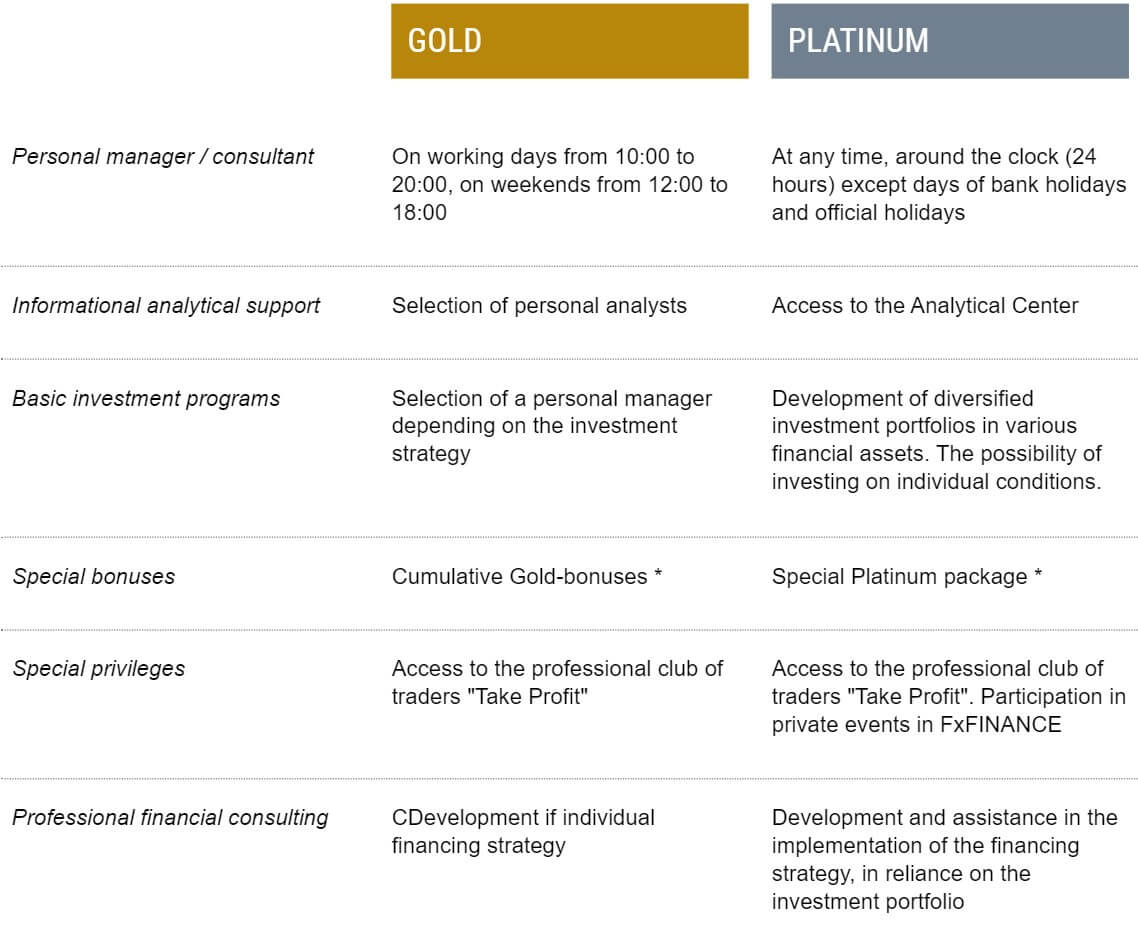

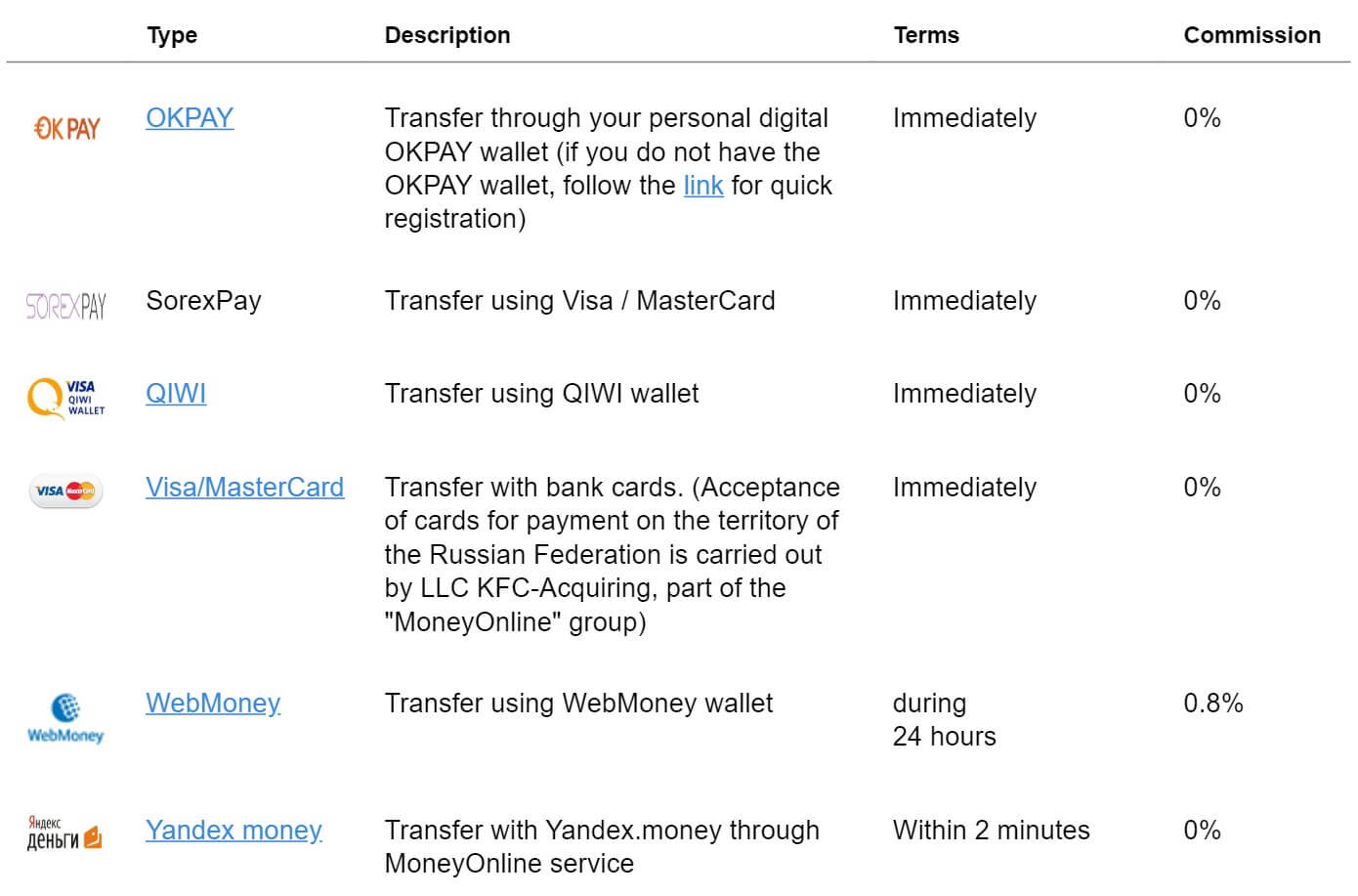

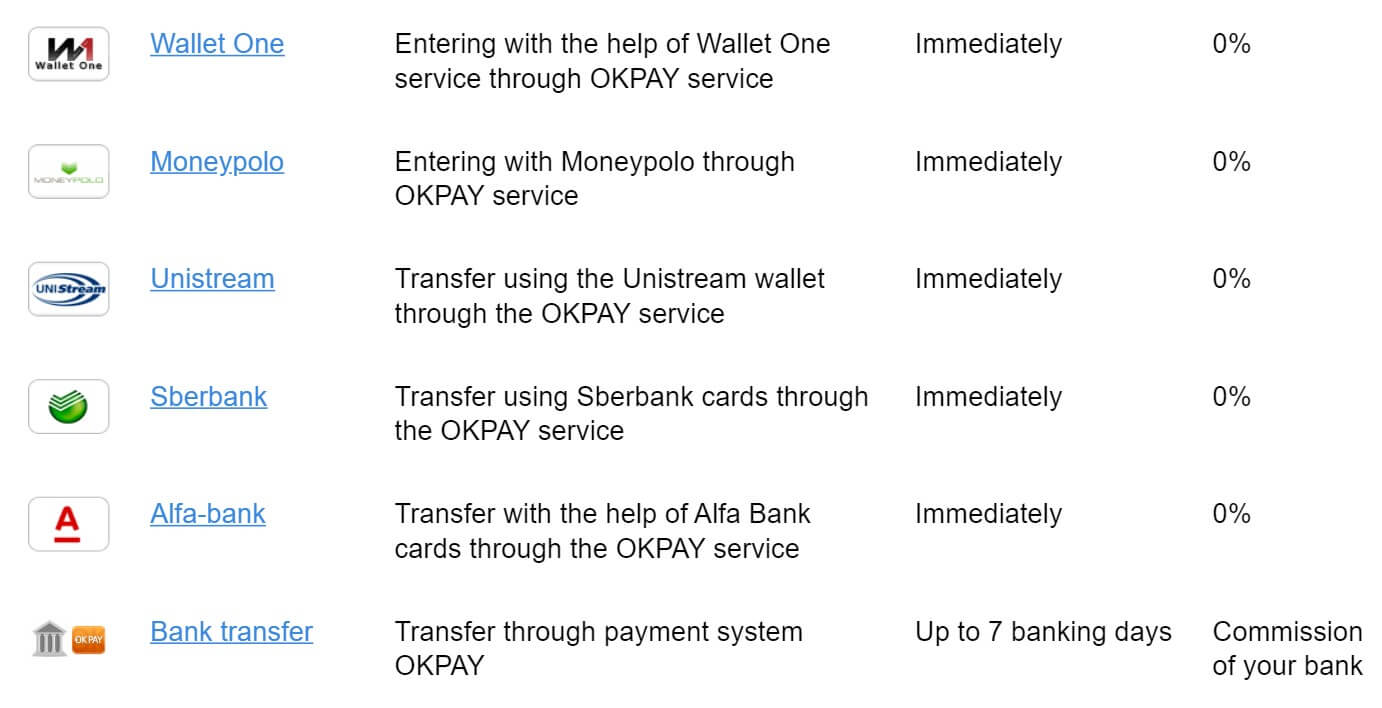

FXFinance is a foreign exchange broker based in Cyprus. They claim that by combining first-class specialists, the best training programs, trading services, and profitable tools under the brand of FxFINANCE Group of Companies, they have made work on financial markets truly fascinating, with brilliant prospects for everyone. We will be using this review to delve into the website and services on offer to see how they fare against other competition and to see if they are the right broker for you to use.

FXFinance is a foreign exchange broker based in Cyprus. They claim that by combining first-class specialists, the best training programs, trading services, and profitable tools under the brand of FxFINANCE Group of Companies, they have made work on financial markets truly fascinating, with brilliant prospects for everyone. We will be using this review to delve into the website and services on offer to see how they fare against other competition and to see if they are the right broker for you to use.

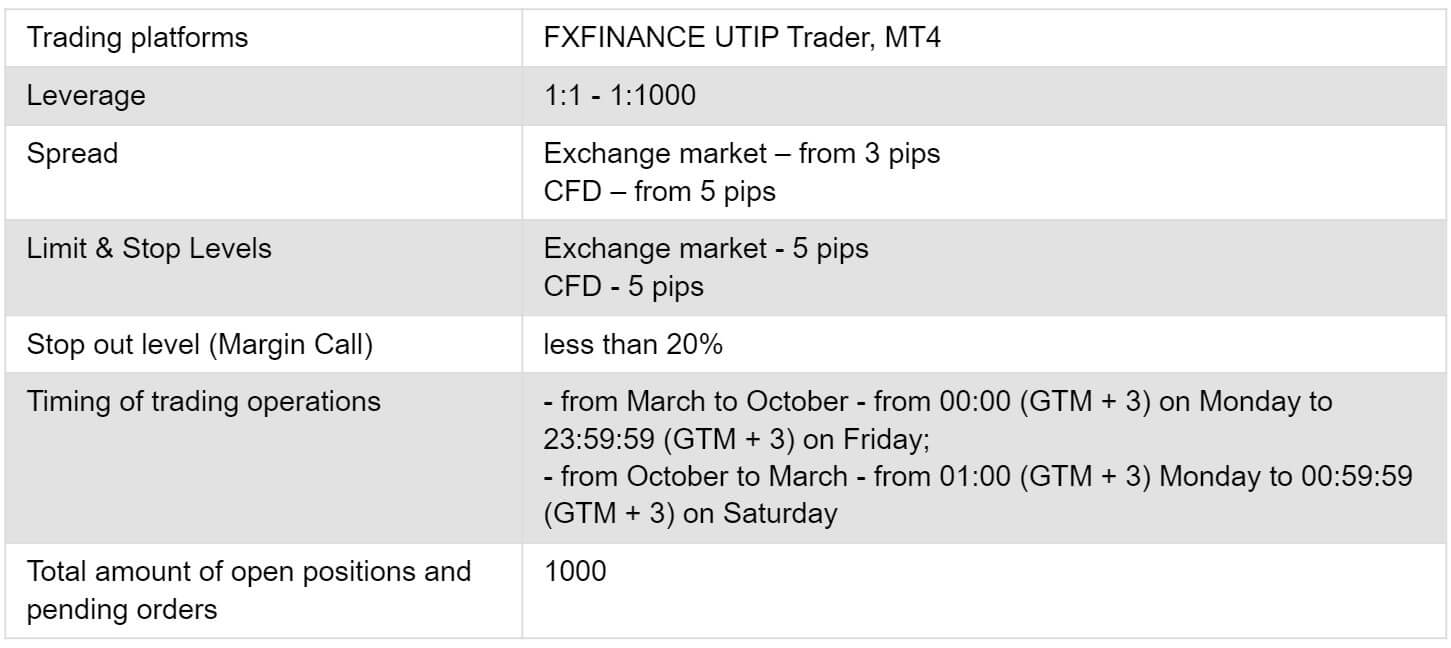

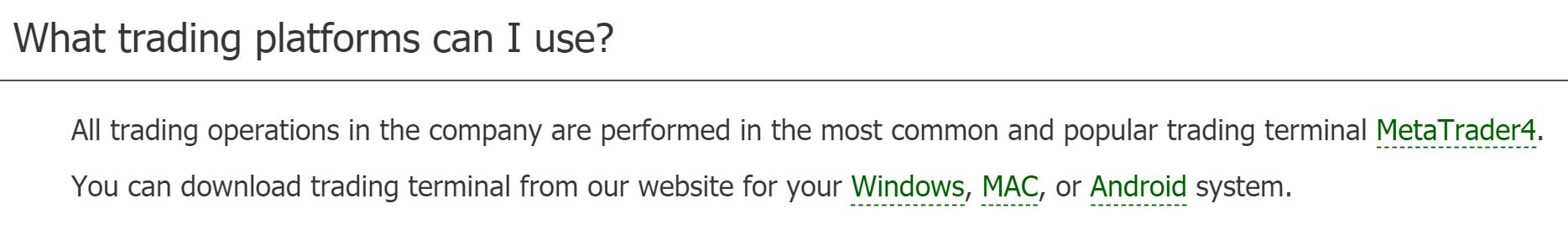

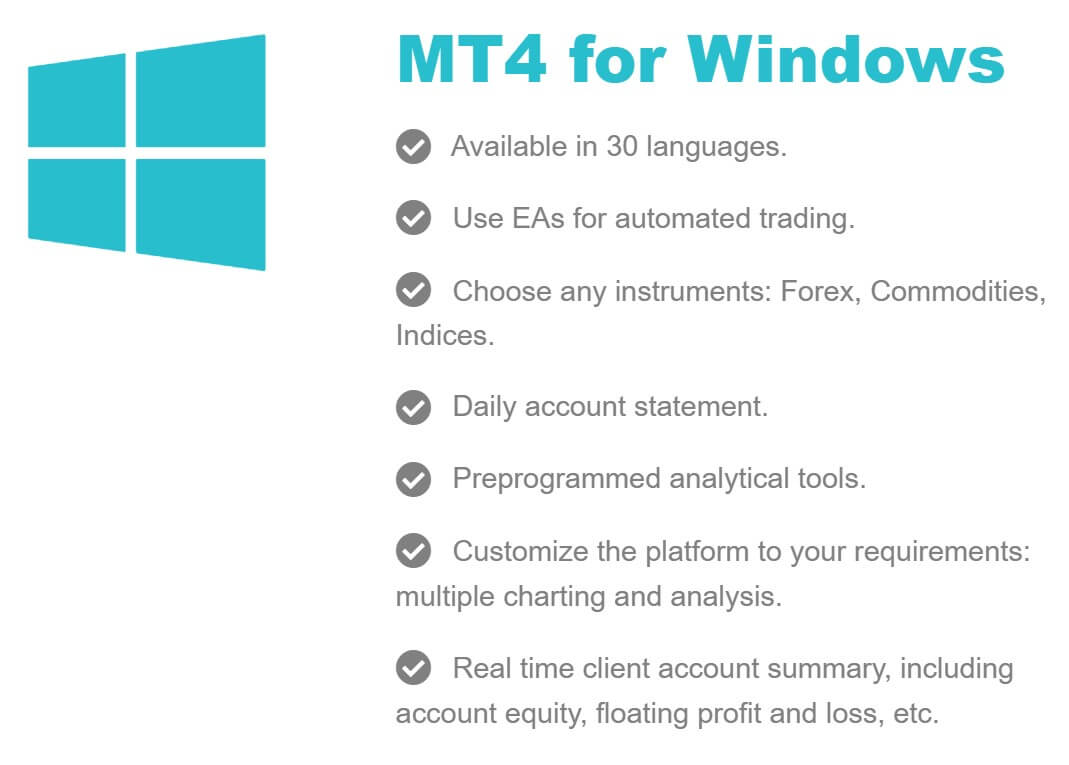

While the account section indicates more than one platform is available, the trading platform section of the site only mentioned MetaTrader 4 so we believe that this is the only platform currently available. MT4 is offered for both Windows and iOS-based systems, as well as for Android devices. The system requirements for each are provided on the broker’s website, as are download links for each of the versions. There are certainly no problems to report here, as MetaTrader 4 has been viewed by most to be the top platform in the world for over a decade now. Even with MT5 having been released several years ago, many FX traders still opt to use MT4 for their trading needs.

While the account section indicates more than one platform is available, the trading platform section of the site only mentioned MetaTrader 4 so we believe that this is the only platform currently available. MT4 is offered for both Windows and iOS-based systems, as well as for Android devices. The system requirements for each are provided on the broker’s website, as are download links for each of the versions. There are certainly no problems to report here, as MetaTrader 4 has been viewed by most to be the top platform in the world for over a decade now. Even with MT5 having been released several years ago, many FX traders still opt to use MT4 for their trading needs.

UniTrader: UniTrader represents a new generation of trading platforms that were designed and built as an easy and logical instrument for active traders looking for an edge. It offers features like live streaming rates, easy order management, trading history, live trading, detailed account information, news streams and SquawkBow, real-time tradable charts, open position information and instrument subscriptions.

UniTrader: UniTrader represents a new generation of trading platforms that were designed and built as an easy and logical instrument for active traders looking for an edge. It offers features like live streaming rates, easy order management, trading history, live trading, detailed account information, news streams and SquawkBow, real-time tradable charts, open position information and instrument subscriptions.

There are a few different bonuses currently running, we have outlined two of them so you can get an idea of the sort of things that are on offer. Please visit the Forex Player website for information regarding additional promotions and bonuses.

There are a few different bonuses currently running, we have outlined two of them so you can get an idea of the sort of things that are on offer. Please visit the Forex Player website for information regarding additional promotions and bonuses.

Leverage

Leverage

OneTrade allows traders to choose from a few different trading platforms, including our personal favorite MetaTrader 4 on a browser, PC, Android, and iOS devices, the OneTrade WebTrader, which also supports copy trading, and the Social Trading investment platform. MT4 is known for its powerful reliability, along with a vast array of built-in features that make the platform easy to use and navigate.

OneTrade allows traders to choose from a few different trading platforms, including our personal favorite MetaTrader 4 on a browser, PC, Android, and iOS devices, the OneTrade WebTrader, which also supports copy trading, and the Social Trading investment platform. MT4 is known for its powerful reliability, along with a vast array of built-in features that make the platform easy to use and navigate. Leverage

Leverage Trade Sizes

Trade Sizes

One advantage that Aplus Trader does provide would be the provision of access to the world-famous trading platform, MetaTrader 4. The platform is highly praised by beginner and professional traders alike and can be found among the available platforms supported by most

One advantage that Aplus Trader does provide would be the provision of access to the world-famous trading platform, MetaTrader 4. The platform is highly praised by beginner and professional traders alike and can be found among the available platforms supported by most  Aplus Trader is not consistent when describing their available leverage options. One section of the website states that caps go up to an impressive 1:1000, while the trading conditions actually list a 1:400 leverage cap. Either way, the leverage cap does appear to be extremely flexible, although we aren’t happy with the fact that Aplus is once again providing inconsistent information. There is a significant difference between the two options and traders that are looking for specific caps may not be able to make a decision without better supporting information.

Aplus Trader is not consistent when describing their available leverage options. One section of the website states that caps go up to an impressive 1:1000, while the trading conditions actually list a 1:400 leverage cap. Either way, the leverage cap does appear to be extremely flexible, although we aren’t happy with the fact that Aplus is once again providing inconsistent information. There is a significant difference between the two options and traders that are looking for specific caps may not be able to make a decision without better supporting information.

The broker’s website provides inconsistent information about spreads. On the homepage, spreads from 0.1 pip are advertised, yet the broker also lists starting spreads from 0.5 pips under their trading conditions. Once one actually opens an account, they will find that spreads are nearly five times higher than advertised options, at around 2.4 pips on EURUSD. That amount is also 1 pip higher than the industry average 1.5

The broker’s website provides inconsistent information about spreads. On the homepage, spreads from 0.1 pip are advertised, yet the broker also lists starting spreads from 0.5 pips under their trading conditions. Once one actually opens an account, they will find that spreads are nearly five times higher than advertised options, at around 2.4 pips on EURUSD. That amount is also 1 pip higher than the industry average 1.5  Oddly enough, Aplus does not mention its minimum deposit requirement anywhere on the website. It’s possible that the broker may base these amounts on the chosen deposit method, but there’s really no way of knowing until one prepares to make a deposit. If options fall into an average range, we would see minimum requirements from $1 to around $250, which is on the higher end of things. Based on what we know, Aplus is offering spreads that are high even for a Mini/Micro/Cent account type. Elsewhere, those types of accounts go for $100 or less. If Aplus is asking for more than that, then traders would be better off opening an account through another broker.

Oddly enough, Aplus does not mention its minimum deposit requirement anywhere on the website. It’s possible that the broker may base these amounts on the chosen deposit method, but there’s really no way of knowing until one prepares to make a deposit. If options fall into an average range, we would see minimum requirements from $1 to around $250, which is on the higher end of things. Based on what we know, Aplus is offering spreads that are high even for a Mini/Micro/Cent account type. Elsewhere, those types of accounts go for $100 or less. If Aplus is asking for more than that, then traders would be better off opening an account through another broker. As we mentioned, the broker doesn’t tell us much about their funding methods. Assuming that Aplus follows standard anti-money laundering practices, withdrawals would likely be processed back to the original bank account, card, or e-wallet that was used to fund the account. Typically, profits are returned to bank wire. The broker advertises an advantage in the form of fee-free withdrawals. Elsewhere, we’ve seen fees of 3%, 4%, and even higher, sometimes charged in addition to deposit fees, so this would definitely be one of the few advantages we’ve seen so far.

As we mentioned, the broker doesn’t tell us much about their funding methods. Assuming that Aplus follows standard anti-money laundering practices, withdrawals would likely be processed back to the original bank account, card, or e-wallet that was used to fund the account. Typically, profits are returned to bank wire. The broker advertises an advantage in the form of fee-free withdrawals. Elsewhere, we’ve seen fees of 3%, 4%, and even higher, sometimes charged in addition to deposit fees, so this would definitely be one of the few advantages we’ve seen so far.

Aplus Trader seems very dedicated to providing beginners with all of the tools that they would need to be successful, and the company has even won awards for having the best educational program in 2013, 2014, 2015, and 2016. The program teaches the pitfalls and roadblocks of trading, provides practical tips & tricks from pros, explains terminology, and basically explains everything from a beginner-friendly approach. Apps can be accessed from the “Trading Tools” section of the website and include an economic calendar and multiple calculators. Educational resources, on the other hand, cannot be accessed until one actually opens an account. Forcing one to make a deposit in order to access educational material is not ideal, since most brokers have those options available directly.

Aplus Trader seems very dedicated to providing beginners with all of the tools that they would need to be successful, and the company has even won awards for having the best educational program in 2013, 2014, 2015, and 2016. The program teaches the pitfalls and roadblocks of trading, provides practical tips & tricks from pros, explains terminology, and basically explains everything from a beginner-friendly approach. Apps can be accessed from the “Trading Tools” section of the website and include an economic calendar and multiple calculators. Educational resources, on the other hand, cannot be accessed until one actually opens an account. Forcing one to make a deposit in order to access educational material is not ideal, since most brokers have those options available directly. Support is available 24 hours a day, from 5 pm EST Sunday until 4 pm EST Friday. The quickest contact methods include phone, Skype, and Whatsapp. Traders can also fill out a contact form on the website, request a callback, or email support directly. Aplus seems to make contacting support fairly convenient, although the addition of weekend support and LiveChat would offer the ultimate convenience to clients. We’ve provided the available contact details below.

Support is available 24 hours a day, from 5 pm EST Sunday until 4 pm EST Friday. The quickest contact methods include phone, Skype, and Whatsapp. Traders can also fill out a contact form on the website, request a callback, or email support directly. Aplus seems to make contacting support fairly convenient, although the addition of weekend support and LiveChat would offer the ultimate convenience to clients. We’ve provided the available contact details below.

MetaTrader 4 is available to download for Windows, Mac, and Linux operating systems. Also offered for mobile devices running on iOS and Android. The web-accessible MT4 platform is not offered so visitors will have to download the installation packages and install the platforms to see the trading conditions.

MetaTrader 4 is available to download for Windows, Mac, and Linux operating systems. Also offered for mobile devices running on iOS and Android. The web-accessible MT4 platform is not offered so visitors will have to download the installation packages and install the platforms to see the trading conditions.

Live Market News contains a very good introduction for beginners on how to interpret the news. The feed is updated hourly and arranged as a grid. Most of the news comes from Reuters or Investing.com, it is not the work of the broker staff. Therefore, clients will have to digest the information on their own.

Live Market News contains a very good introduction for beginners on how to interpret the news. The feed is updated hourly and arranged as a grid. Most of the news comes from Reuters or Investing.com, it is not the work of the broker staff. Therefore, clients will have to digest the information on their own. Learn part of the main menu holds video tutorials, trading guides, glossary and trading FAQ. Video Tutorials are numerous with over 60 lessons on topics such as Indicators, Trading Psychology, Trading Strategies, MT4, Market Analysis and so on. They are not long and have good explanations but as such do not have any depth.

Learn part of the main menu holds video tutorials, trading guides, glossary and trading FAQ. Video Tutorials are numerous with over 60 lessons on topics such as Indicators, Trading Psychology, Trading Strategies, MT4, Market Analysis and so on. They are not long and have good explanations but as such do not have any depth.

The drawback is there are no Cryptocurrencies. Starting with forex, there are 182 total assets, 140 of them are forwards contracts and 42 are on spot. This is almost the full Forex range one can find. Let’s just say you can find exotics pairs such as CHF/TRY, AUD/ZAR, SGD/CNH, USD/AED, GBP/ILS, JPY/HKG, PLN/DKK, and many more extremes.

The drawback is there are no Cryptocurrencies. Starting with forex, there are 182 total assets, 140 of them are forwards contracts and 42 are on spot. This is almost the full Forex range one can find. Let’s just say you can find exotics pairs such as CHF/TRY, AUD/ZAR, SGD/CNH, USD/AED, GBP/ILS, JPY/HKG, PLN/DKK, and many more extremes.

The Newsfeed is updated regularly and currently only comes from NewsEdge Spanish LATAM. They are only available in Spanish without any way to translate. If non-Spanish speaking traders what to use this, they can utilize any translating service as the articles are not longer than one page.

The Newsfeed is updated regularly and currently only comes from NewsEdge Spanish LATAM. They are only available in Spanish without any way to translate. If non-Spanish speaking traders what to use this, they can utilize any translating service as the articles are not longer than one page.

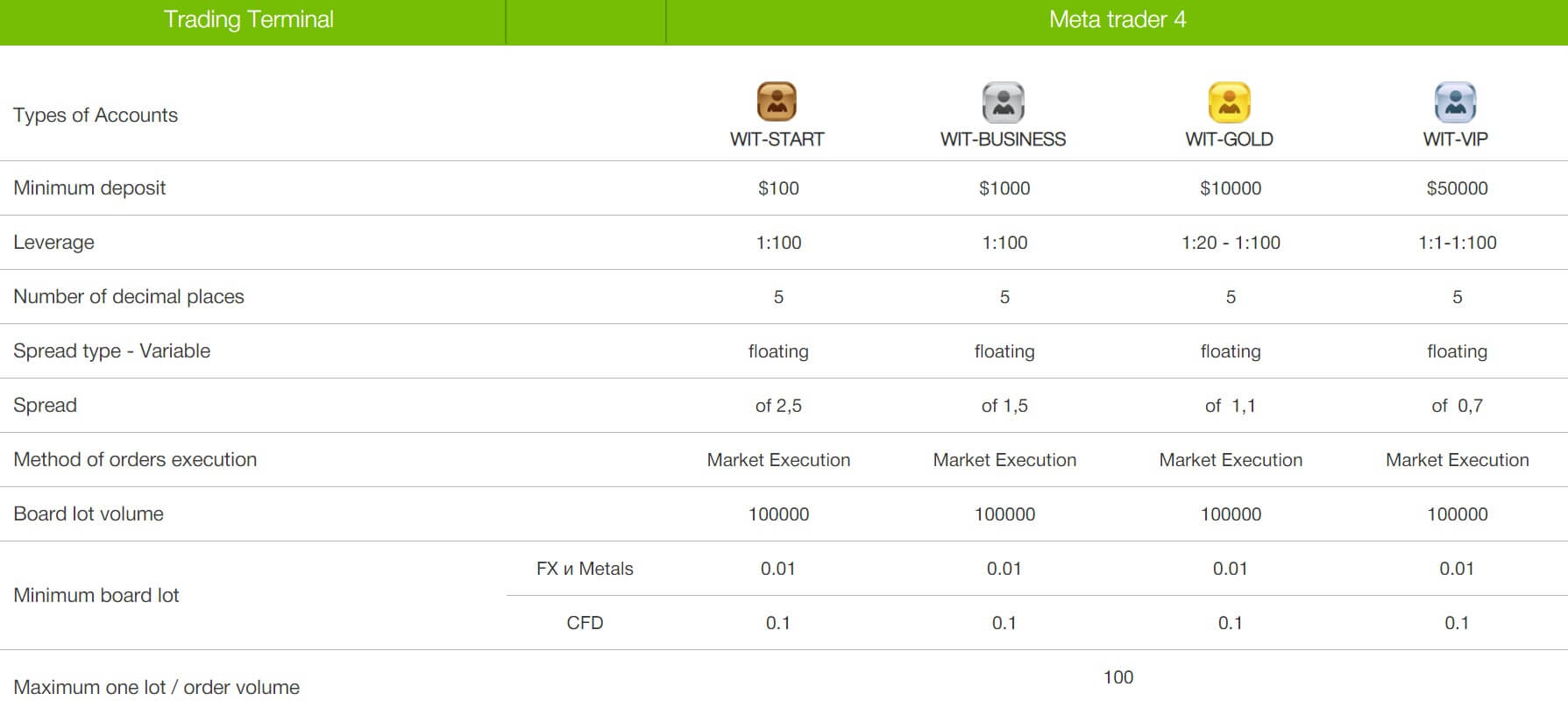

Gann Markets offers 4 account types. Actually, on the broker’s website, they give very little information on each of them. We did manage to gather that the account titles are as follows:

Gann Markets offers 4 account types. Actually, on the broker’s website, they give very little information on each of them. We did manage to gather that the account titles are as follows:

The leverage that Gann Markets applies to all its accounts is 1:400. Currently, such high leverage levels can only be seen in unregulated brokers such as Gann Markets or Australian licensed brokers, as Australia is the last major regulatory center where

The leverage that Gann Markets applies to all its accounts is 1:400. Currently, such high leverage levels can only be seen in unregulated brokers such as Gann Markets or Australian licensed brokers, as Australia is the last major regulatory center where  We have not been able to inform ourselves about the trade sizes, but we assume that if we can open an account with 100 USD, it is normal that the minimum size of the trade is 0.01 lots (micro lot). Smaller trade sizes are the best way in which to control spending while learning

We have not been able to inform ourselves about the trade sizes, but we assume that if we can open an account with 100 USD, it is normal that the minimum size of the trade is 0.01 lots (micro lot). Smaller trade sizes are the best way in which to control spending while learning  Gann Markets offers its customers a good variety of trading assets, including more than 40 currency pairs, many of which are minor or exotic pairs such as USDZAR, USDSEK, USDPLN, USDNOK, USDMXN, USDDKK, USDSGD, USDTRY, as well as various CFDs, from precious metals such as gold, silver, platinum, and palladium to oil, natural gas, and 7 stock indices. Overall, the number of assets and variety should be more than enough to please any trader.

Gann Markets offers its customers a good variety of trading assets, including more than 40 currency pairs, many of which are minor or exotic pairs such as USDZAR, USDSEK, USDPLN, USDNOK, USDMXN, USDDKK, USDSGD, USDTRY, as well as various CFDs, from precious metals such as gold, silver, platinum, and palladium to oil, natural gas, and 7 stock indices. Overall, the number of assets and variety should be more than enough to please any trader. You can start trading with only $100 USD in the fixed account and floating account. While there are brokers who do accept less (some even as low as $1), one-hundred dollars is quite reasonable. The truth of the matter is, while you may be able to deposit only $1 elsewhere, it would be virtually impossible to enter into an FX trade with that amount of money.

You can start trading with only $100 USD in the fixed account and floating account. While there are brokers who do accept less (some even as low as $1), one-hundred dollars is quite reasonable. The truth of the matter is, while you may be able to deposit only $1 elsewhere, it would be virtually impossible to enter into an FX trade with that amount of money.

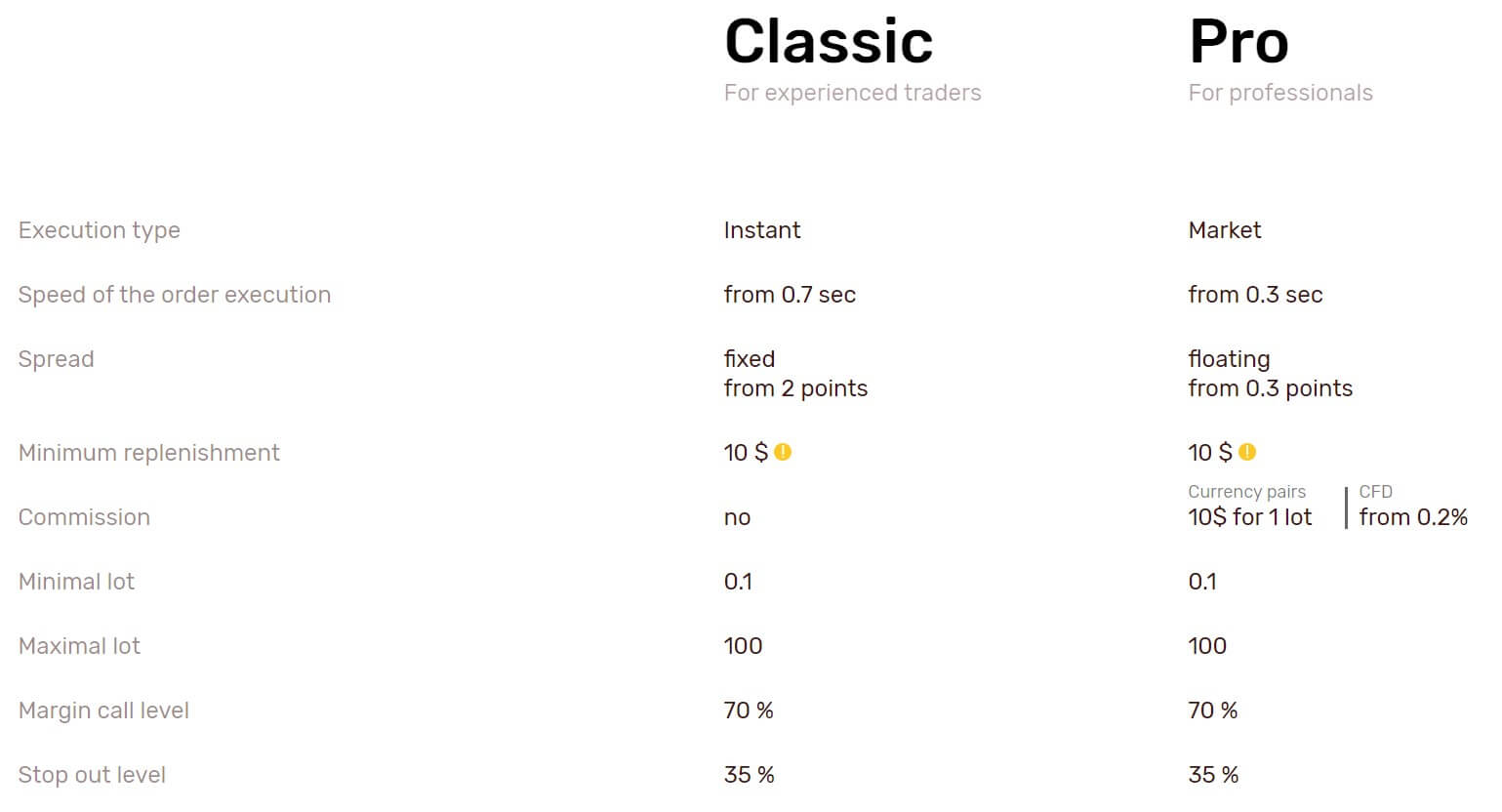

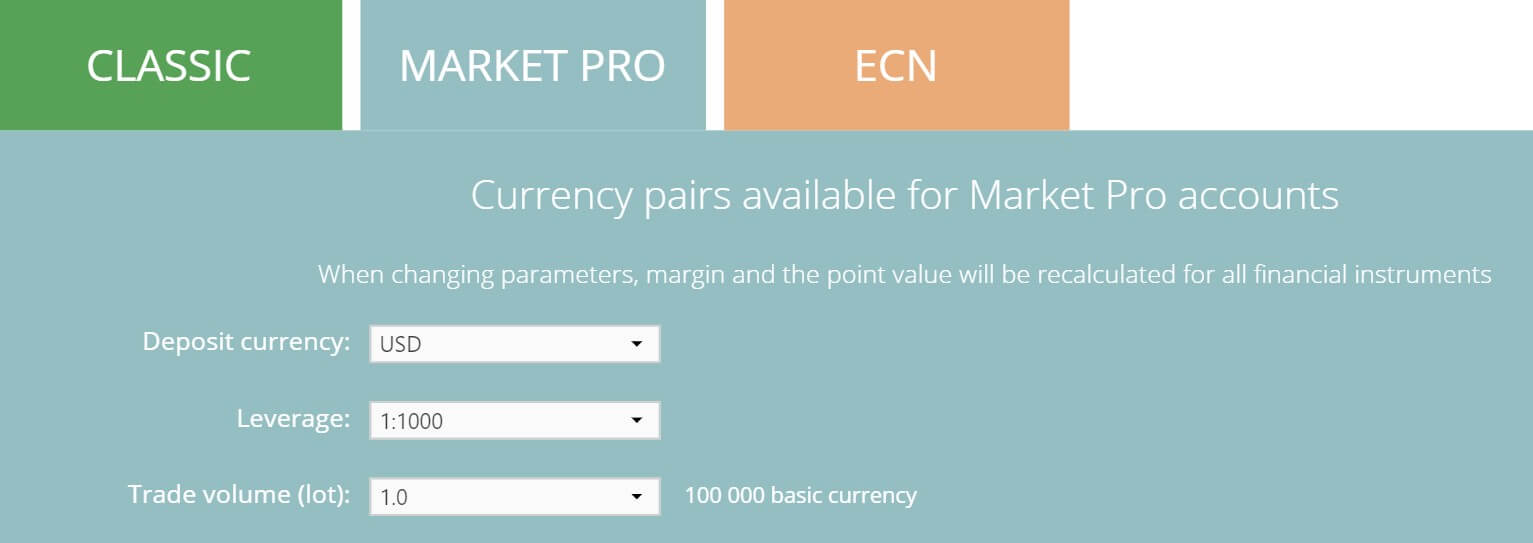

While not 100% sure, it looks like the Classic account can be leveraged up to 1:2000 while the Market Pro and ECN accounts can be leveraged up to 1:1000. Both of these figures are too high and you should avoid going over 1:500 as the risk factor increases drastically as you go up. Leverage can be selected when opening up ana account and you can get it changed by contacting the customer service team with the request to change it.

While not 100% sure, it looks like the Classic account can be leveraged up to 1:2000 while the Market Pro and ECN accounts can be leveraged up to 1:1000. Both of these figures are too high and you should avoid going over 1:500 as the risk factor increases drastically as you go up. Leverage can be selected when opening up ana account and you can get it changed by contacting the customer service team with the request to change it. As is often the case when a broker offers multiple types of accounts, Fresh Forex’s trade size requirements vary by account. Even so, trade sizes start from 0.01 lots on all three account types and then climb in increments of 0.01 lots. The Classic Account has a maximum trade size limit of 20 lots. The Market Pro Account maximum is 100 lots and the

As is often the case when a broker offers multiple types of accounts, Fresh Forex’s trade size requirements vary by account. Even so, trade sizes start from 0.01 lots on all three account types and then climb in increments of 0.01 lots. The Classic Account has a maximum trade size limit of 20 lots. The Market Pro Account maximum is 100 lots and the  The different account types shave different spreads, the Classic account ahs spread starting at 2 pips and they are fixed, while the Market Pro account has an average spread starting from 1.3 pips which are variable and the ECN account has a starting spread as low as 0 pips. Fixed spreads mean they do not change no matter what happens in the markets while variable spreads will get larger and smaller depending on the amount of volatility in the markets.

The different account types shave different spreads, the Classic account ahs spread starting at 2 pips and they are fixed, while the Market Pro account has an average spread starting from 1.3 pips which are variable and the ECN account has a starting spread as low as 0 pips. Fixed spreads mean they do not change no matter what happens in the markets while variable spreads will get larger and smaller depending on the amount of volatility in the markets.

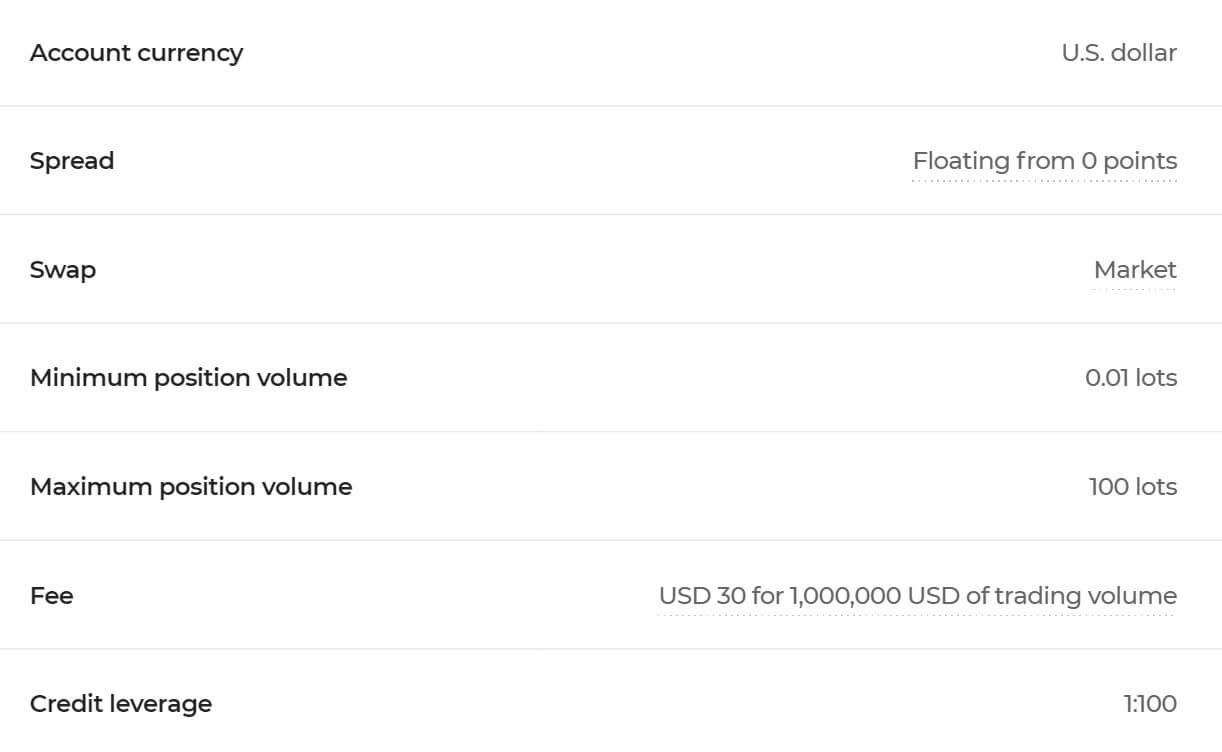

Quineex’s leverage is one of its downsides. Account-holders only get 100:1 in buying power, without the option of increasing it in the future. To put that into perspective, many brokers may give you up to 500:1, although 200:1 or 300:1 is a more common leverage rate in the industry. Nonetheless, fixed, non-changing leverage still has some advantages. First, it makes your trading experience more predictable.

Quineex’s leverage is one of its downsides. Account-holders only get 100:1 in buying power, without the option of increasing it in the future. To put that into perspective, many brokers may give you up to 500:1, although 200:1 or 300:1 is a more common leverage rate in the industry. Nonetheless, fixed, non-changing leverage still has some advantages. First, it makes your trading experience more predictable. Since there is no minimum deposit, funding your account with enough money to buy 0.01 lots or 1,000 in the base currency (the smallest trade size that Quineex permits) would suffice. This includes leverage. For example, if you deposit $10, your 100:1 buying power enables you to buy or short-sell $1,000 worth of forex pairs, which meets Quineex’s minimum

Since there is no minimum deposit, funding your account with enough money to buy 0.01 lots or 1,000 in the base currency (the smallest trade size that Quineex permits) would suffice. This includes leverage. For example, if you deposit $10, your 100:1 buying power enables you to buy or short-sell $1,000 worth of forex pairs, which meets Quineex’s minimum  Commissions are $3 on each lot that you trade. You incur this fee when you open a position. It is also charged upon closing it. In other words, a fully closed round-trip trade would cost $6 per lot. When taking a step back, we can notice that Quineex’s commissions are about average, particularly in comparison to other brokerage firms.

Commissions are $3 on each lot that you trade. You incur this fee when you open a position. It is also charged upon closing it. In other words, a fully closed round-trip trade would cost $6 per lot. When taking a step back, we can notice that Quineex’s commissions are about average, particularly in comparison to other brokerage firms.

If a trader chooses to open an account with Quineex, the average spread on the EUR.USD (which is the most liquid

If a trader chooses to open an account with Quineex, the average spread on the EUR.USD (which is the most liquid

To clarify, ‘High’ priority announcements tend to be followed by strong market reactions; ‘Low’ priority ones are less relevant and don’t have a very noticeable impact on prices; and ‘Medium’ events are in between the former two. Quineex also has a currency conversion calculator, which allows you to view the live/current price based on your selected lot size and the exchanged forex pair.

To clarify, ‘High’ priority announcements tend to be followed by strong market reactions; ‘Low’ priority ones are less relevant and don’t have a very noticeable impact on prices; and ‘Medium’ events are in between the former two. Quineex also has a currency conversion calculator, which allows you to view the live/current price based on your selected lot size and the exchanged forex pair.

Moreover, this broker will not charge you any fees when you transfer money (both in and out of your account) through one of their various transaction methods. Not only that, but both deposits and withdrawals are instantly processed. Quineex also offers two demo accounts that cater to different traders’ needs. The temporary one serves those who want to learn about the MT4 platform, while the permanent demo (the Trial Account) is especially suitable for beginners.

Moreover, this broker will not charge you any fees when you transfer money (both in and out of your account) through one of their various transaction methods. Not only that, but both deposits and withdrawals are instantly processed. Quineex also offers two demo accounts that cater to different traders’ needs. The temporary one serves those who want to learn about the MT4 platform, while the permanent demo (the Trial Account) is especially suitable for beginners.

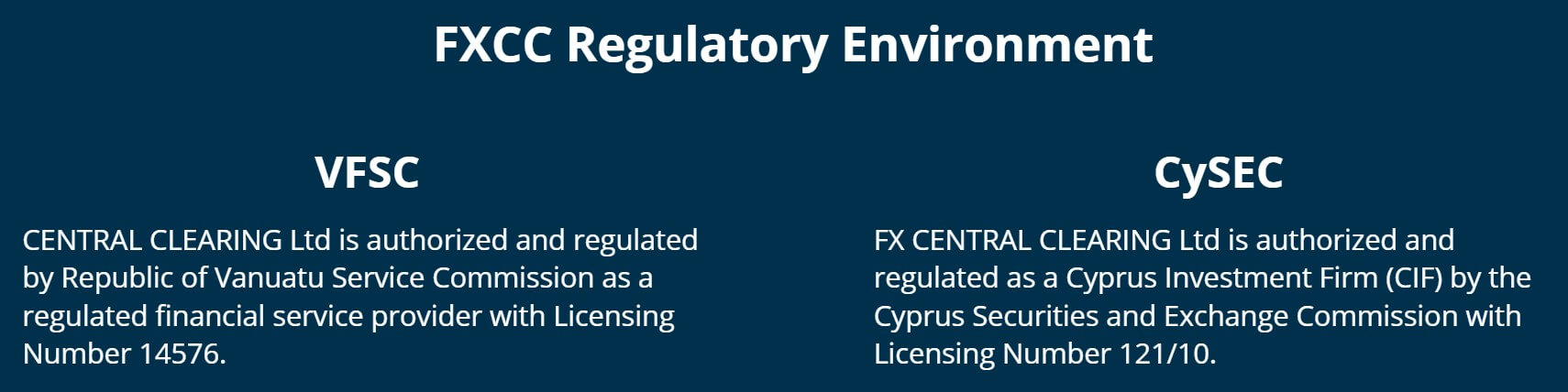

Like most brokers, FXCC is compatible with the award-winning and popular Metatrader 4 (MT4). This platform is the preferred choice of the most experienced traders, and also of beginners. The platform is equipped with a series of technical indicators, an advanced graphical package, and a wide range of Expert Advisors (EA), as well as several options for backtesting for EAS, which will allow you to evaluate your strategies. The platform is available in desktop and mobile versions for use on smartphones and tablets. FXCC customers are offered a multi-account management solution through MetaTrader 4 MultiTerminal, which is an integrated part of the MT4 package.

Like most brokers, FXCC is compatible with the award-winning and popular Metatrader 4 (MT4). This platform is the preferred choice of the most experienced traders, and also of beginners. The platform is equipped with a series of technical indicators, an advanced graphical package, and a wide range of Expert Advisors (EA), as well as several options for backtesting for EAS, which will allow you to evaluate your strategies. The platform is available in desktop and mobile versions for use on smartphones and tablets. FXCC customers are offered a multi-account management solution through MetaTrader 4 MultiTerminal, which is an integrated part of the MT4 package. Trade Sizes

Trade Sizes

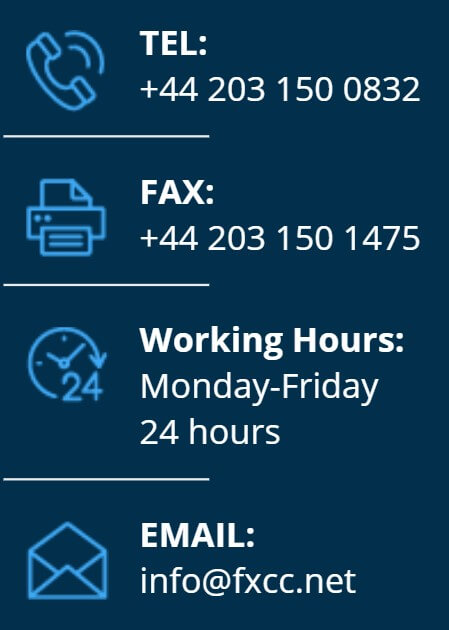

To get in touch with FXCC’s customer service, we have several options. We can get in touch, by phone, by email, through a contact form on the web, a live chat available 24 hours and call service. When entering your personal data and your phone, the broker contacts you.

To get in touch with FXCC’s customer service, we have several options. We can get in touch, by phone, by email, through a contact form on the web, a live chat available 24 hours and call service. When entering your personal data and your phone, the broker contacts you.

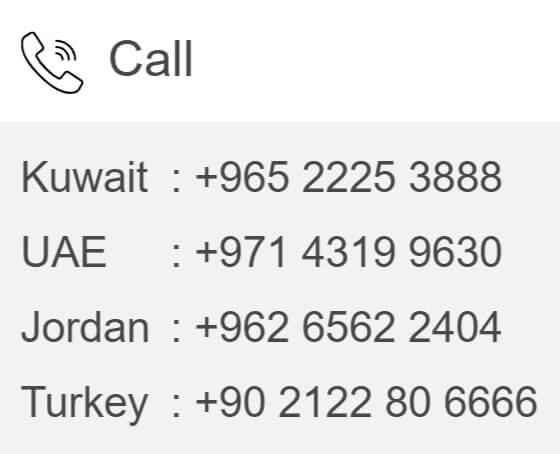

Kuwait Headquarters:

Kuwait Headquarters: NCM Investment (HQ) is regulated by Capital Markets Authority, Kuwait under license No: AP / 2019 / 0003 & AP / 2017 / 0009 | LEI No. 2 1 3 8 0 0 1 6 3 E L E M N K Q Z I 7 7

NCM Investment (HQ) is regulated by Capital Markets Authority, Kuwait under license No: AP / 2019 / 0003 & AP / 2017 / 0009 | LEI No. 2 1 3 8 0 0 1 6 3 E L E M N K Q Z I 7 7

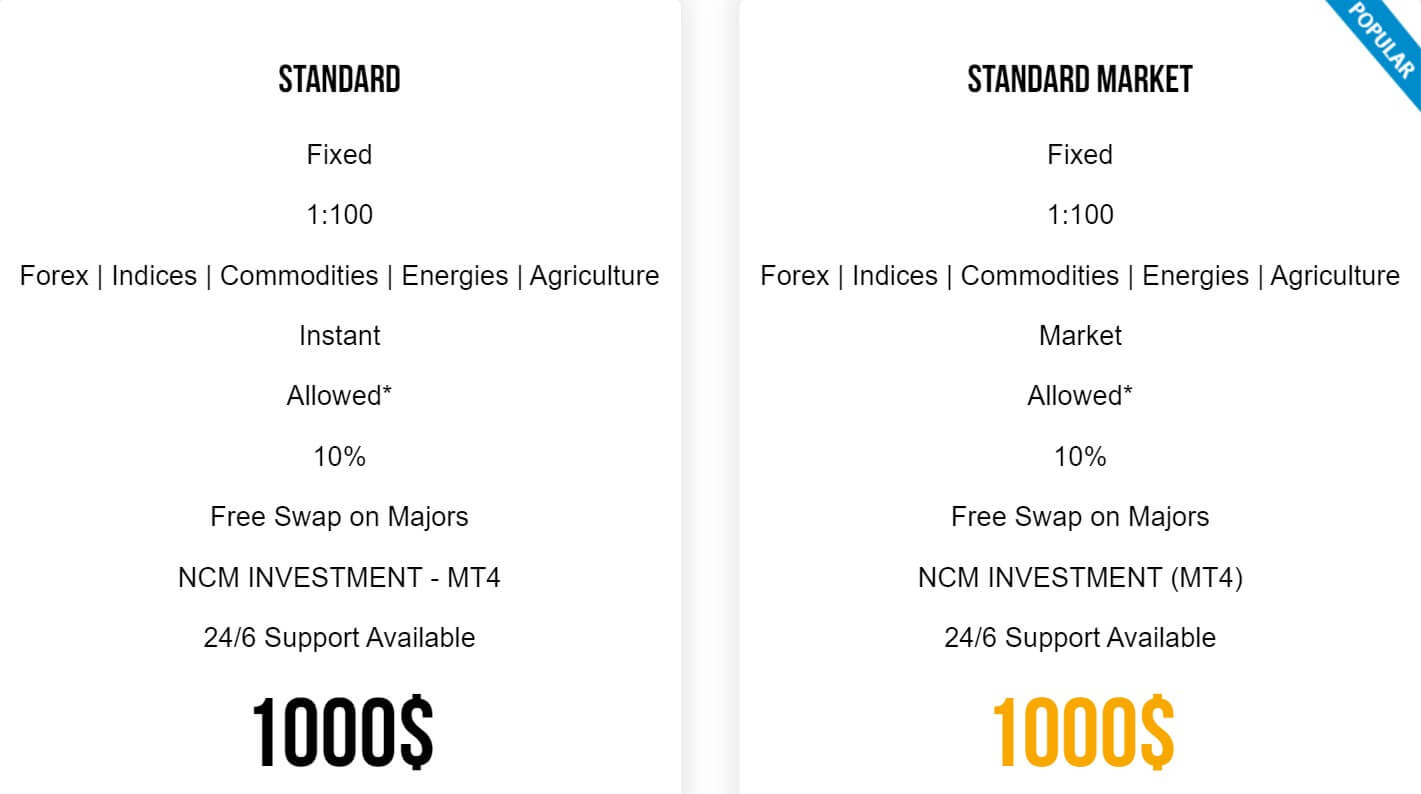

Customers can apply for leverage of up to 1:500 on Forex. Trading

Customers can apply for leverage of up to 1:500 on Forex. Trading

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CADSGD, CHFJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNOK, GBPNZD, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, SGDJPY, USDCAD, USDCHF, USDHKD, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD, and USDTRY

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CADSGD, CHFJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNOK, GBPNZD, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, SGDJPY, USDCAD, USDCHF, USDHKD, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD, and USDTRY

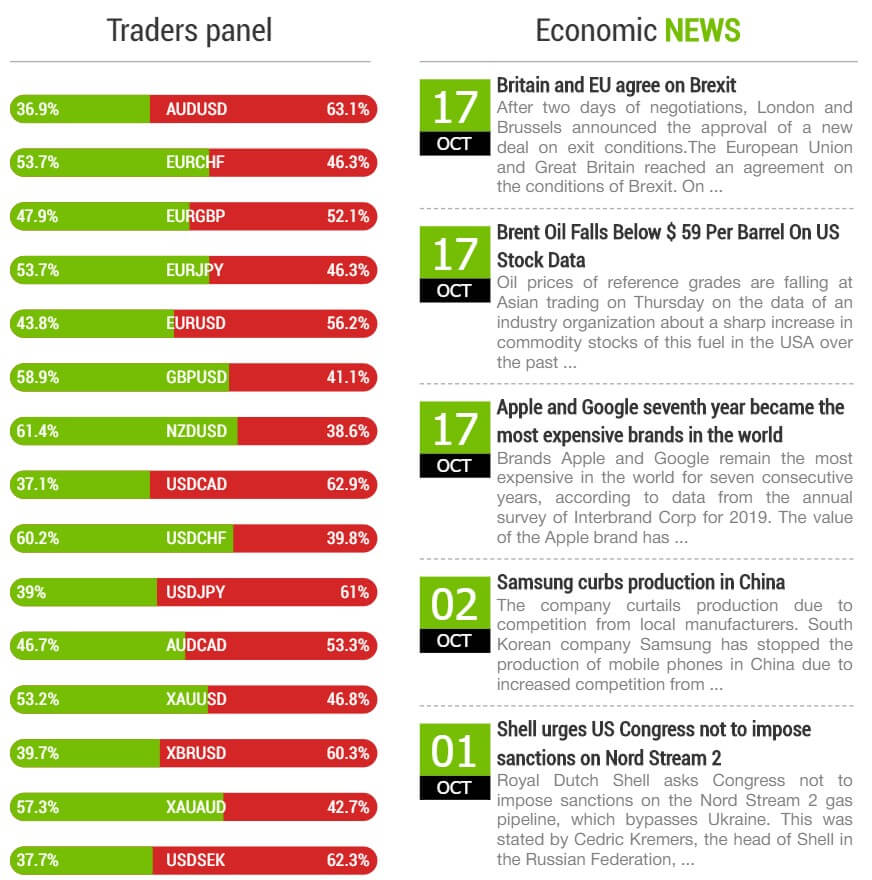

An economic news box, which we’ve seen updates.

An economic news box, which we’ve seen updates.

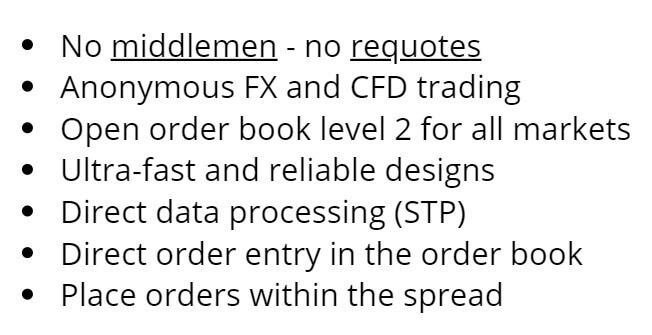

Multicharts: With Multicharts, Swissdirekt traders can access the LMAX Exchange directly from the graphics. Multicharts is a professional graphics technology specially designed for

Multicharts: With Multicharts, Swissdirekt traders can access the LMAX Exchange directly from the graphics. Multicharts is a professional graphics technology specially designed for

Again the broker does not give information about what the deposit methods are to deposit money into your accounts. It is prevalent for brokers to accept bank transfers and credit or debit card payments, including some electronic payment systems. If any trader wishes to trade with this broker, he will need to contact customer service for deposit methods.

Again the broker does not give information about what the deposit methods are to deposit money into your accounts. It is prevalent for brokers to accept bank transfers and credit or debit card payments, including some electronic payment systems. If any trader wishes to trade with this broker, he will need to contact customer service for deposit methods.

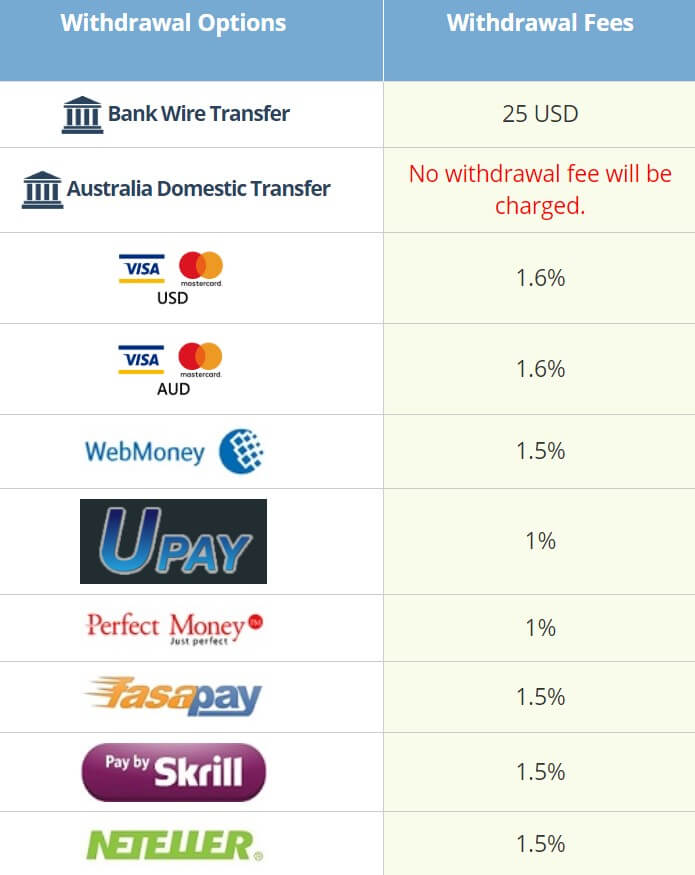

In accordance with their regulation, the broker has a few boundaries set in place when it comes to withdrawing funds. Clients who have made a deposit via card must withdraw the amount of their deposit back to that same card within 180 days of the initial deposit. Withdrawal of additional funds that exceed the initial deposit amount can be made via separate payment methods. Also, an extra 3% charge will be applied to any withdrawals of more than $3,000 USD made through e-wallets (WebMoney, PerfectMoney, Skrill, Neteller, Vogue Pay, Vietnam Online Banking). The only fee-free method would be Australian Domestic Bank Wire; however, regular Bank Wires will be charged fees. All applicable fees have been listed below.

In accordance with their regulation, the broker has a few boundaries set in place when it comes to withdrawing funds. Clients who have made a deposit via card must withdraw the amount of their deposit back to that same card within 180 days of the initial deposit. Withdrawal of additional funds that exceed the initial deposit amount can be made via separate payment methods. Also, an extra 3% charge will be applied to any withdrawals of more than $3,000 USD made through e-wallets (WebMoney, PerfectMoney, Skrill, Neteller, Vogue Pay, Vietnam Online Banking). The only fee-free method would be Australian Domestic Bank Wire; however, regular Bank Wires will be charged fees. All applicable fees have been listed below. All withdrawals are processed by the finance team within 24-48 hours. The broker doesn’t go into further detail as to whether it would take a longer amount of time to actually receive the withdrawal. In the case of Bank Wire Transfers, it would be best to expect it to possibly take 3-5 business days, especially for international transfers. This is based on the fact that banks tend to have a longer waiting period before funds are credited. Hopefully, all funds would be available within a day or two.

All withdrawals are processed by the finance team within 24-48 hours. The broker doesn’t go into further detail as to whether it would take a longer amount of time to actually receive the withdrawal. In the case of Bank Wire Transfers, it would be best to expect it to possibly take 3-5 business days, especially for international transfers. This is based on the fact that banks tend to have a longer waiting period before funds are credited. Hopefully, all funds would be available within a day or two.

This broker seems to understand the importance of educating their clients, based on the fact that the website has devoted an entire section to an “Education Centre”. The category is made up of an FX Blog, Trading Guide (Book), USGFX TradersClub, Webinars & Seminars, Forex Exhibition, Forex Contest, Forex Seminar, Everything About

This broker seems to understand the importance of educating their clients, based on the fact that the website has devoted an entire section to an “Education Centre”. The category is made up of an FX Blog, Trading Guide (Book), USGFX TradersClub, Webinars & Seminars, Forex Exhibition, Forex Contest, Forex Seminar, Everything About

WTI profits through spreads and overnight interest charges, or swap fees. One advantage of choosing

WTI profits through spreads and overnight interest charges, or swap fees. One advantage of choosing

Leverage

Leverage

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFHUF, CHFJPY, CHFPLN, EURAUD, EURCAD, EURCHF, EURCZK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURRON, EURSEK, EURTRY, EURUSD, GBPAUD, FBPCAD, GBPOCHF, GBPJPY, GBPNZD, GBPPLN, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDBRL, USDCAD, USDCHF, USDCLP, USDCZK, USDHUF, USDJPY, USDMXN, USDNOK, USDPLN, USDRON, USDSEK, USDTRY, USDZAR.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFHUF, CHFJPY, CHFPLN, EURAUD, EURCAD, EURCHF, EURCZK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURRON, EURSEK, EURTRY, EURUSD, GBPAUD, FBPCAD, GBPOCHF, GBPJPY, GBPNZD, GBPPLN, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDBRL, USDCAD, USDCHF, USDCLP, USDCZK, USDHUF, USDJPY, USDMXN, USDNOK, USDPLN, USDRON, USDSEK, USDTRY, USDZAR.

Educational & Trading Tools

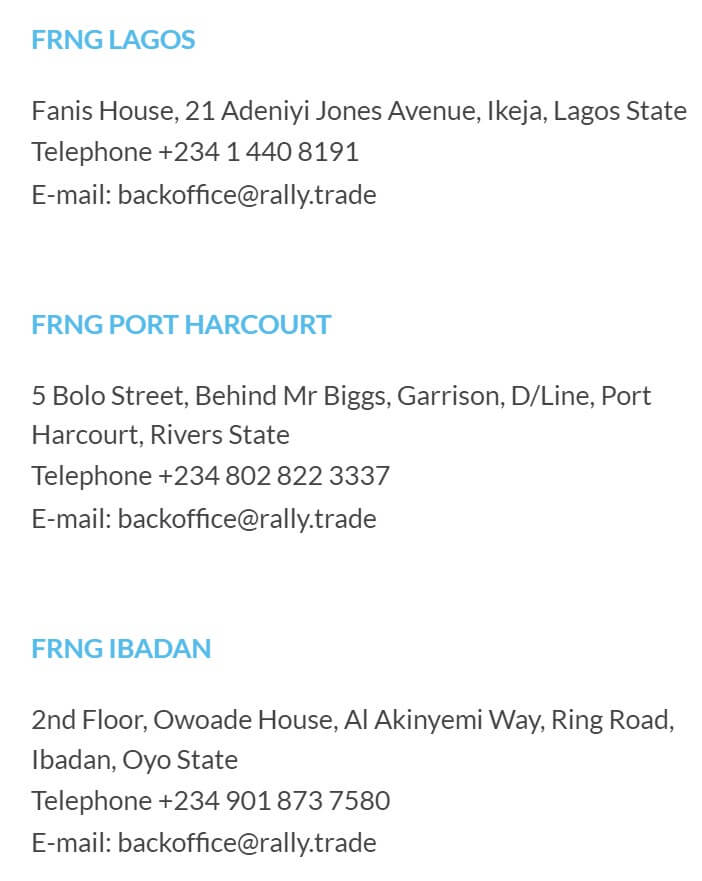

Educational & Trading Tools FRNG Lagos:

FRNG Lagos:

Deposit Methods & Costs

Deposit Methods & Costs

The broker’s customer service team can be contacted through LiveChat, email, or phone. Agents are in the office from 22:00 GMT on Sunday evening through Friday afternoon at 22:00 GMT. Although we were initially happy to see the instant contact option LiveChat available on the website, there weren’t any agents online when we attempted to start a chat. This was during business hours, so it seems as though support agents can’t be counted on to always be online when they’re supposed to be. In the broker’s defense, the chat does ask for an email address and allow one to type in their problem to receive a response once an agent does come online, but this doesn’t really provide more convenience than simply emailing support in the first place. We’ve provided contact details below and LiveChat can be accessed from the bottom right corner of the website.

The broker’s customer service team can be contacted through LiveChat, email, or phone. Agents are in the office from 22:00 GMT on Sunday evening through Friday afternoon at 22:00 GMT. Although we were initially happy to see the instant contact option LiveChat available on the website, there weren’t any agents online when we attempted to start a chat. This was during business hours, so it seems as though support agents can’t be counted on to always be online when they’re supposed to be. In the broker’s defense, the chat does ask for an email address and allow one to type in their problem to receive a response once an agent does come online, but this doesn’t really provide more convenience than simply emailing support in the first place. We’ve provided contact details below and LiveChat can be accessed from the bottom right corner of the website.

This broker exclusively supports the successor of the world’s most popular trading platform MT4, MetaTrader 5. The newer version basically aims to provide more features, while keeping the older platform’s convenient and navigable interface. MT5 also comes with more languages, timeframes, and a built-in economic calendar. The platform is available for download on PC, iOS, Android devices, or accessible through the online WebTrader.

This broker exclusively supports the successor of the world’s most popular trading platform MT4, MetaTrader 5. The newer version basically aims to provide more features, while keeping the older platform’s convenient and navigable interface. MT5 also comes with more languages, timeframes, and a built-in economic calendar. The platform is available for download on PC, iOS, Android devices, or accessible through the online WebTrader.

CDFX is an online broker with an asset portfolio that includes currency pairs and metals. The broker requires a $5,000 deposit and only offers two main account types, Standard and Islamic. Considering that the deposit requirement is so high, we would expect to see spreads that start lower than the broker’s 1.5 pip offer, even with a lack of commission fees. You’ll find an average leverage cap of up to 1:300 on the broker’s Standard account, while Islamic account holders are allowed a leverage option of up to 1:500.

CDFX is an online broker with an asset portfolio that includes currency pairs and metals. The broker requires a $5,000 deposit and only offers two main account types, Standard and Islamic. Considering that the deposit requirement is so high, we would expect to see spreads that start lower than the broker’s 1.5 pip offer, even with a lack of commission fees. You’ll find an average leverage cap of up to 1:300 on the broker’s Standard account, while Islamic account holders are allowed a leverage option of up to 1:500.

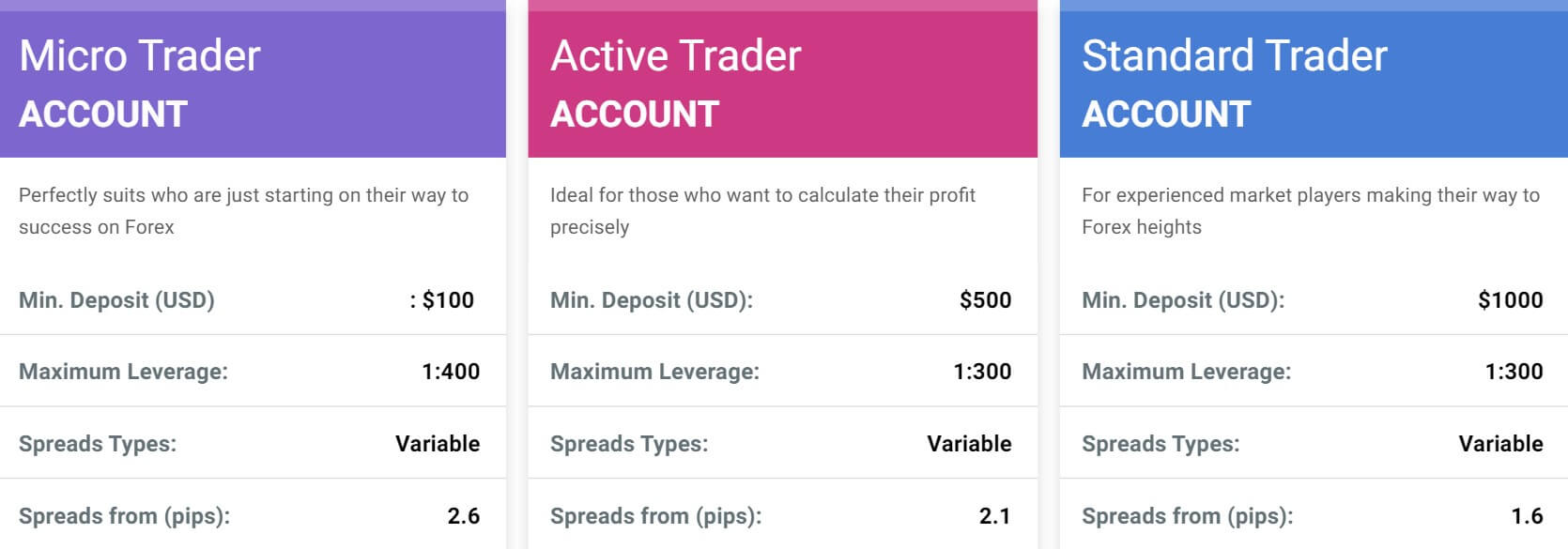

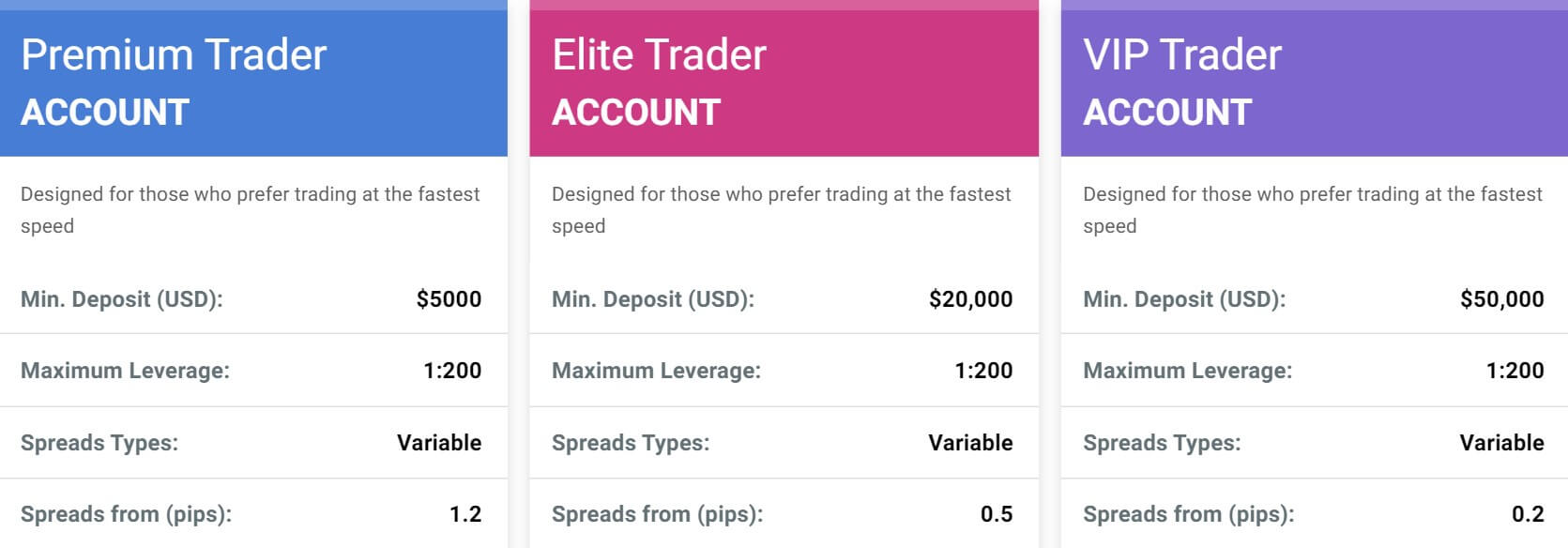

The Micro account allows a more flexible leverage choice of up to 1:400, while the Active Trader and Standard accounts both lower the cap slightly to 1:300. These options hold up to many other broker’s offers and allow for a good amount of flexibility. On the accounts that hold larger balances, the leverage options are decreased to a lower 1:200 cap on the Premium, Elite, and

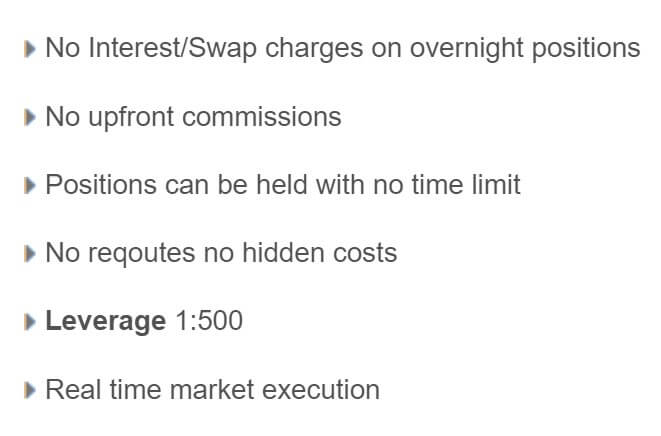

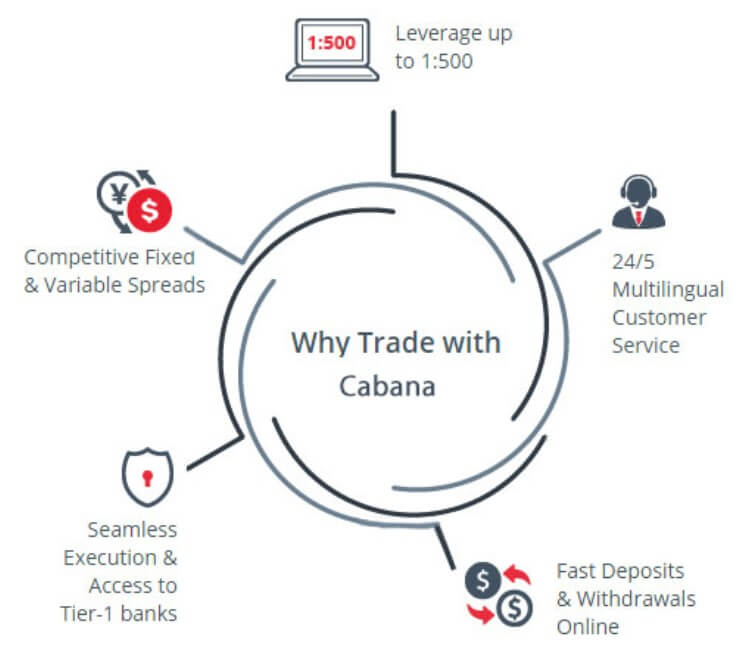

The Micro account allows a more flexible leverage choice of up to 1:400, while the Active Trader and Standard accounts both lower the cap slightly to 1:300. These options hold up to many other broker’s offers and allow for a good amount of flexibility. On the accounts that hold larger balances, the leverage options are decreased to a lower 1:200 cap on the Premium, Elite, and  Cabana Capitals advertises the minimum spreads for each account type, but we don’t get to see a more detailed product page that would allow us to compare how high options could actually go. If at all possible, we would definitely recommend making the $1K deposit to open a Standard account, due to the fact that spreads on the more affordable account types are well above average. To be exact spreads start from 2.6 pips on the Micro account and 2.1 pips on the Active Trader account. The higher than average spreads will certainly put traders that can’t afford a better account type at a disadvantage.

Cabana Capitals advertises the minimum spreads for each account type, but we don’t get to see a more detailed product page that would allow us to compare how high options could actually go. If at all possible, we would definitely recommend making the $1K deposit to open a Standard account, due to the fact that spreads on the more affordable account types are well above average. To be exact spreads start from 2.6 pips on the Micro account and 2.1 pips on the Active Trader account. The higher than average spreads will certainly put traders that can’t afford a better account type at a disadvantage.

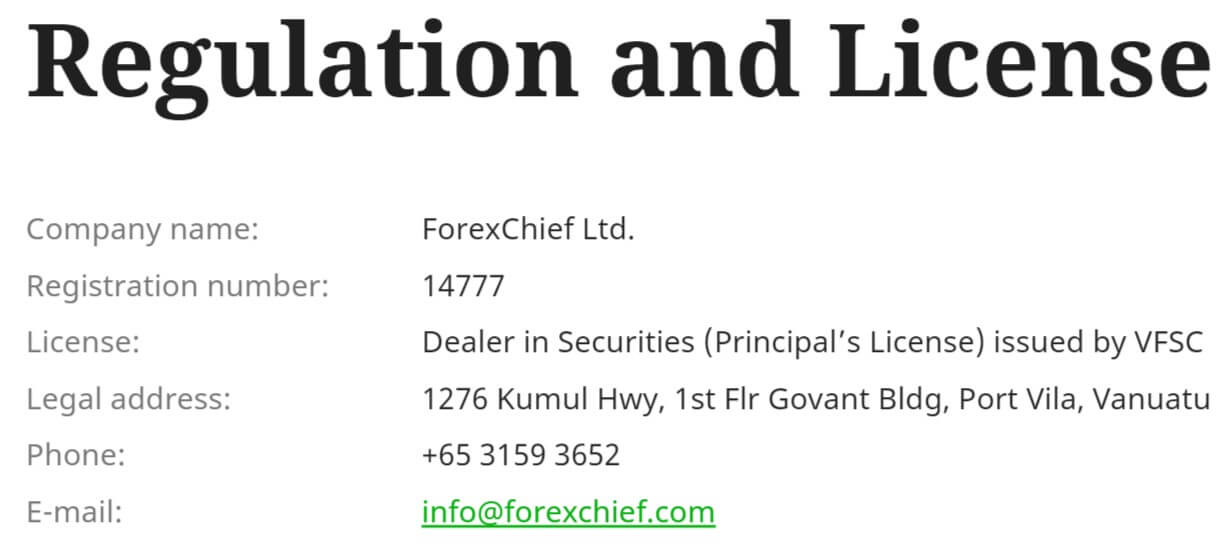

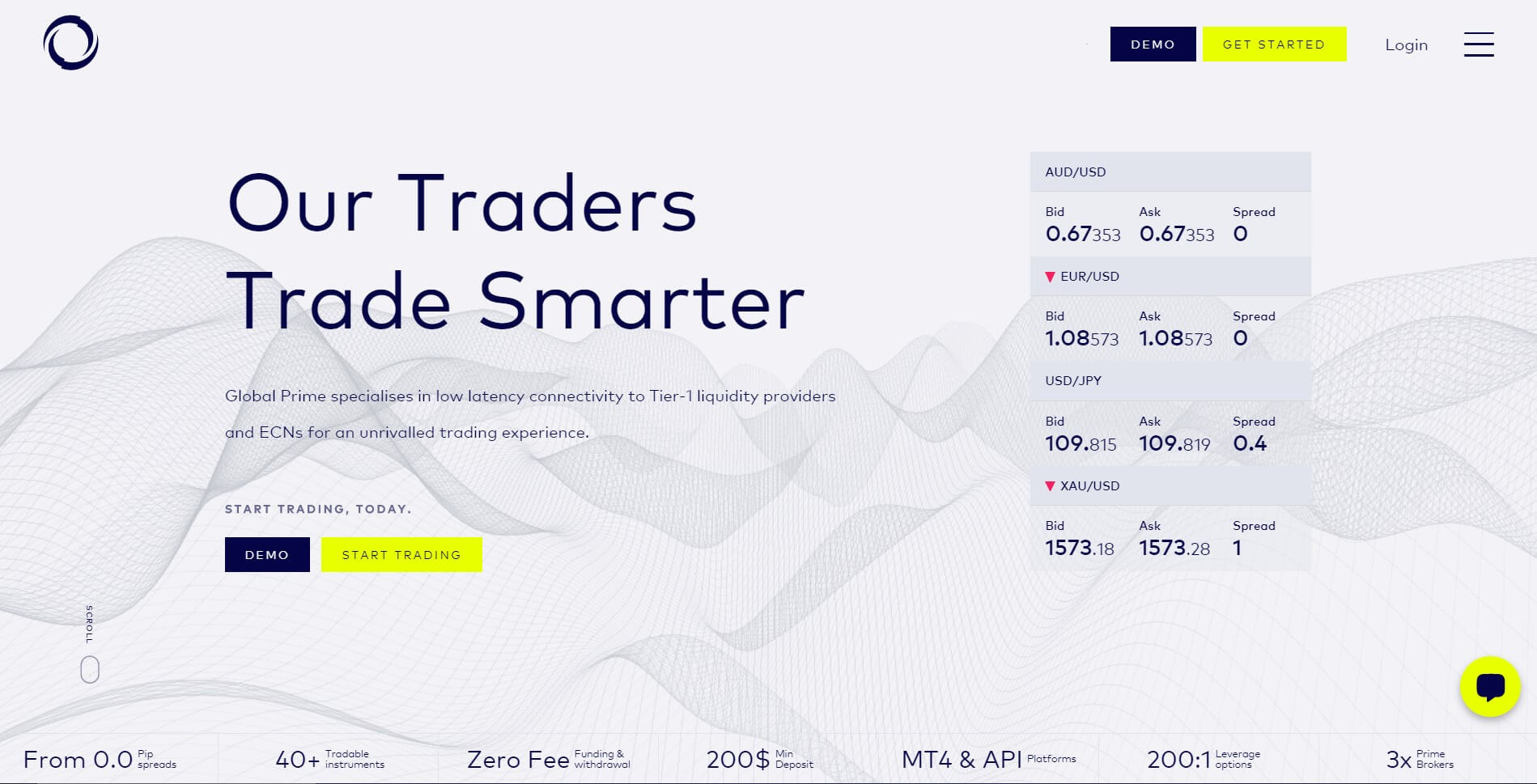

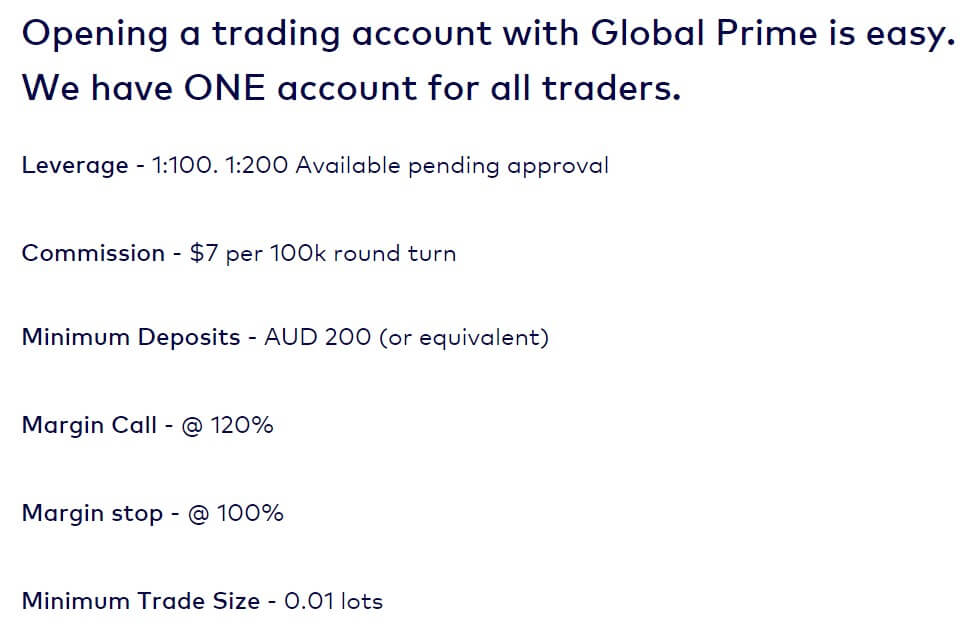

Forex Chief supports the world’s favorite trading platform MetaTrader 4, alongside its popular successor MetaTrader 5. Each account is available in an MT4 or MT5 version, so traders would simply need to select the account based on the platform version they would prefer. Comparing both options is difficult since MT4 and MT5 are both powerful trading platforms that come with multiple built-in features. We suppose that it could be argued that MT5 provides more options since it comes equipped with 21 timeframes, vs MT4’s 9 timeframes, plus 8 more technical indicators, and 13 more drawing tools, including the Fibonacci studies and Elliot Wave drawing tools.

Forex Chief supports the world’s favorite trading platform MetaTrader 4, alongside its popular successor MetaTrader 5. Each account is available in an MT4 or MT5 version, so traders would simply need to select the account based on the platform version they would prefer. Comparing both options is difficult since MT4 and MT5 are both powerful trading platforms that come with multiple built-in features. We suppose that it could be argued that MT5 provides more options since it comes equipped with 21 timeframes, vs MT4’s 9 timeframes, plus 8 more technical indicators, and 13 more drawing tools, including the Fibonacci studies and Elliot Wave drawing tools.

Under the “Market Insights” section of the website, traders will find the following options;

Under the “Market Insights” section of the website, traders will find the following options;

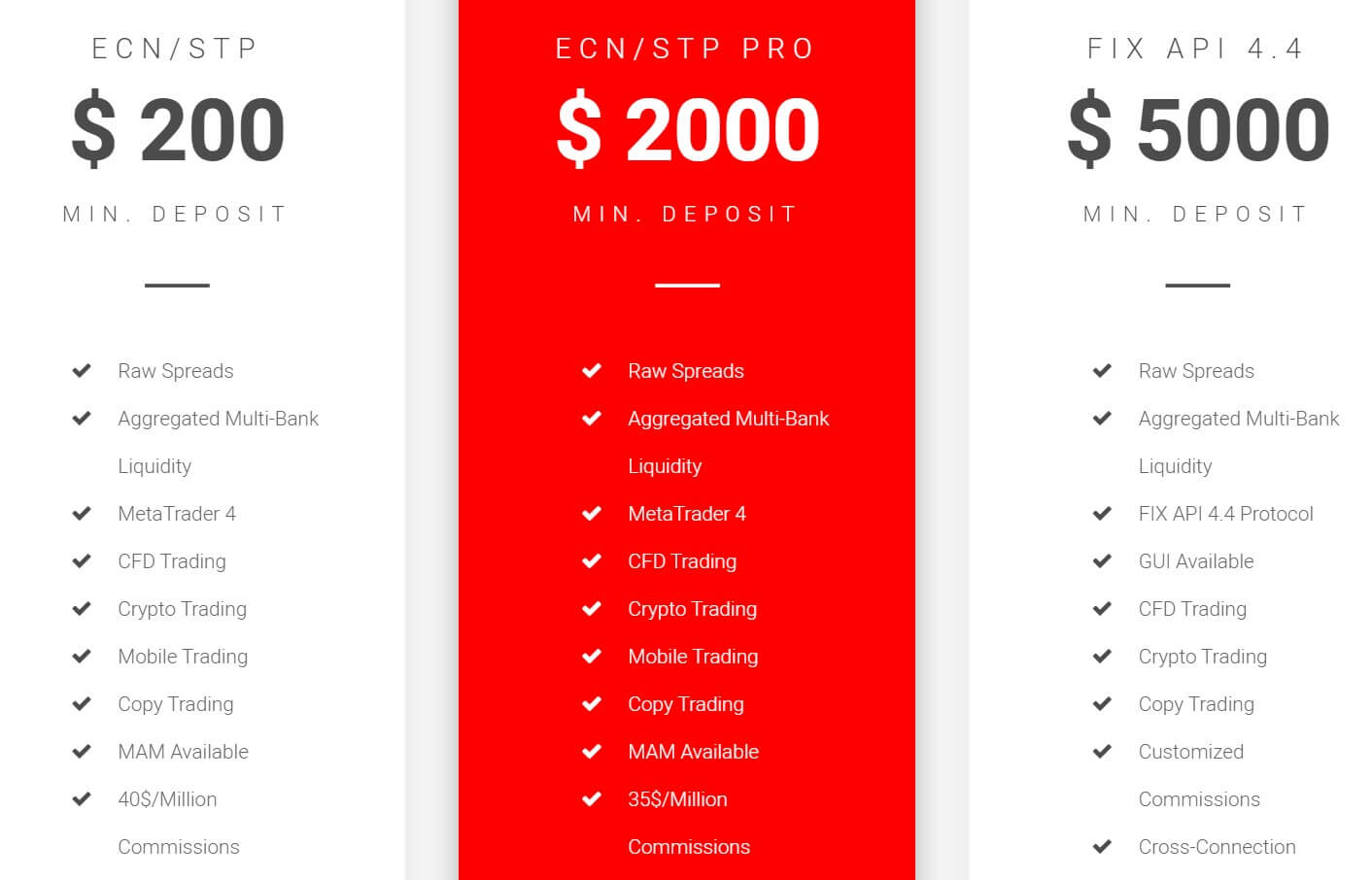

Accepted deposit methods include bank wire transfer, credit/debit card, Neteller, and Bitcoin. Note that deposits are only accepted if the name on the sending account matches the client’s name on the trading account. Charges that may apply to bank wire transfers include a transaction fee (from the bank that starts the transaction), an intermediary fee (if your bank does not have a direct connection with the recipient bank), and/or a receiving bank fee. TegasFX does not charge fees on Neteller from their side, but the payment provider does charge a 3.9% fee. It takes 1-3 business days to process wire transfers, 1 business day to process card and Neteller deposits, and Bitcoin deposits are processed instantly.

Accepted deposit methods include bank wire transfer, credit/debit card, Neteller, and Bitcoin. Note that deposits are only accepted if the name on the sending account matches the client’s name on the trading account. Charges that may apply to bank wire transfers include a transaction fee (from the bank that starts the transaction), an intermediary fee (if your bank does not have a direct connection with the recipient bank), and/or a receiving bank fee. TegasFX does not charge fees on Neteller from their side, but the payment provider does charge a 3.9% fee. It takes 1-3 business days to process wire transfers, 1 business day to process card and Neteller deposits, and Bitcoin deposits are processed instantly.

The Leverage is adjusted to balance and certain assets. IMS FX excel table states leverage up to 1:500 for the Standard Account and Precious metals at 1:100 fixed. We have confirmed this in the MT4 platform, even the

The Leverage is adjusted to balance and certain assets. IMS FX excel table states leverage up to 1:500 for the Standard Account and Precious metals at 1:100 fixed. We have confirmed this in the MT4 platform, even the

The broker promotes unlimited leverage for all account types on the website, although what we see in the Members Area are different values. For the Mini and Classic Account the

The broker promotes unlimited leverage for all account types on the website, although what we see in the Members Area are different values. For the Mini and Classic Account the

In the MT5 platform, we have encountered Forex, Precious Metals on spot and as futures, Index futures, currency futures, and Oil futures CFD. Forex range is average with 32 total currency pairs. In this class, Dollar Index is also included although it is indicative only and closed for trading. All majors and crosses are listed. Exotics are limited to a few pairs, they are USD/TRY, USD/CNH, and USD/ZAR. In addition to these, there are also futures on the Euro, GBP, NZD and so on.

In the MT5 platform, we have encountered Forex, Precious Metals on spot and as futures, Index futures, currency futures, and Oil futures CFD. Forex range is average with 32 total currency pairs. In this class, Dollar Index is also included although it is indicative only and closed for trading. All majors and crosses are listed. Exotics are limited to a few pairs, they are USD/TRY, USD/CNH, and USD/ZAR. In addition to these, there are also futures on the Euro, GBP, NZD and so on. Fast FX has inconsistent statements on the website and in the Members Area about the spreads. They are a floating type for certain. We will use all sources and present what is actually in the MT5 platform.

Fast FX has inconsistent statements on the website and in the Members Area about the spreads. They are a floating type for certain. We will use all sources and present what is actually in the MT5 platform.