Introduction

In the previous crypto guides, we have understood what a cryptocurrency wallet is, and its essential purpose. We have also understood the types of crypto wallets and ranked them in terms of security. In this article, let’s see how they are classified.

Quick Recap

As we know, storing cryptocurrencies essentially means storing the corresponding ‘Private Key’ of the crypto coin. Anyone with that key can have control over the respective cryptos. So it is vital to store the private keys in a safe and secure place. Cryptocurrency wallets serve this purpose. There are many types of wallets, and all these types are classified into Hot Wallets & Cold Wallets.

🔴 Hot Wallets

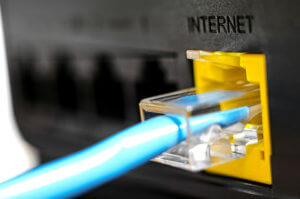

Wallets that are directly connected to the internet are known as Hot wallets. This means the private keys of a coin are stored in a computer, smartphone, or tablet with an internet connection. This kind of wallet is user-friendly and pretty seamless to use as your private keys can be easily accessible to authorize a transaction.

Having said that, hot wallets are not that secure as they are vulnerable to computer hacks. With the advent of technology, there are many hackers out there who can steal private keys despite being stored securely.

🔵 Cold Wallets

In this storage, the private keys are saved on an electronic device not connected to the internet. Even if the key is noted down on a piece of paper and stored it securely, it can be considered as cold storage. It is less convenient to use cold wallets as it is difficult to access your private keys. But these wallets are way too safer the hot wallets.

Which type of wallet is best for me?

Well, it depends on the volume and frequency of the transactions you make. Hot storage is recommended for those users who transact cryptos regularly. Even then, make sure not to store a huge amount of cryptos in hot storage. For typical investors, who are planning to hold their large sum of cryptos for long, they should consider cold storage as it is way too secure.

Personal vs. Hosted Wallets

There are different credible wallet service providers in the market. These providers will take the responsibility of storing your cryptocurrencies. Again, there are personal wallet service providers and hosted wallet service providers. The personal wallet providers are those companies that provide software to store private keys. They do not handle the private keys of their users in any way.

But hosted wallet service providers store the private keys of their users in secured servers. It is always recommended to use a personal wallet over a hosted wallet if you are handling a significant amount of cryptos. Having said that, hosted wallets are way too convenient as transactions can be processed swiftly here due to the ready availability of private keys.

It is essential to take a lot of precautions while storing your cryptos. Let us know if you have any questions in the comments below. Cheers.