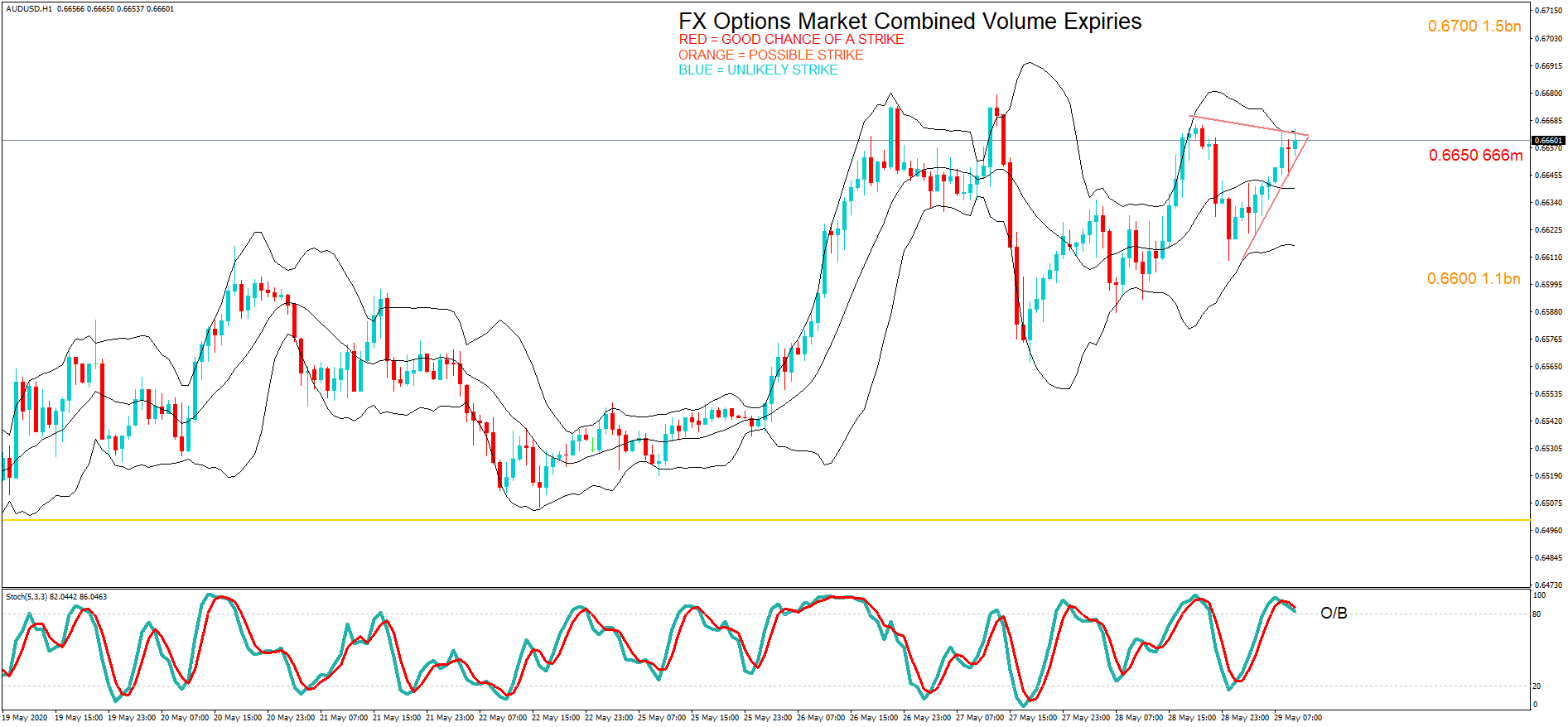

Thank you for visiting the Forex Academy FX Options market combined volume expiries section. Each day, where available, we will bring you notable maturities in FX Options of amounts of $100 million-plus, and where these large combined maturities at specified currency exchange rates often have a magnetic effect on price action, especially in the hours leading to their maturities, which happens daily at 10.00 AM Eastern time. This is because the big institutional players hedge their positions accordingly. Each option expiry should be considered ‘in-play’ with a good chance of a strike if labelled in red, still in play and a possible strike if labelled in orange and ‘out of play’ and an unlikely strike if labelled in blue, with regard to the likelihood of price action meeting the strike price at maturity.

……………………………………………………………………………………………………………………..

FX option expiries for June 1 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

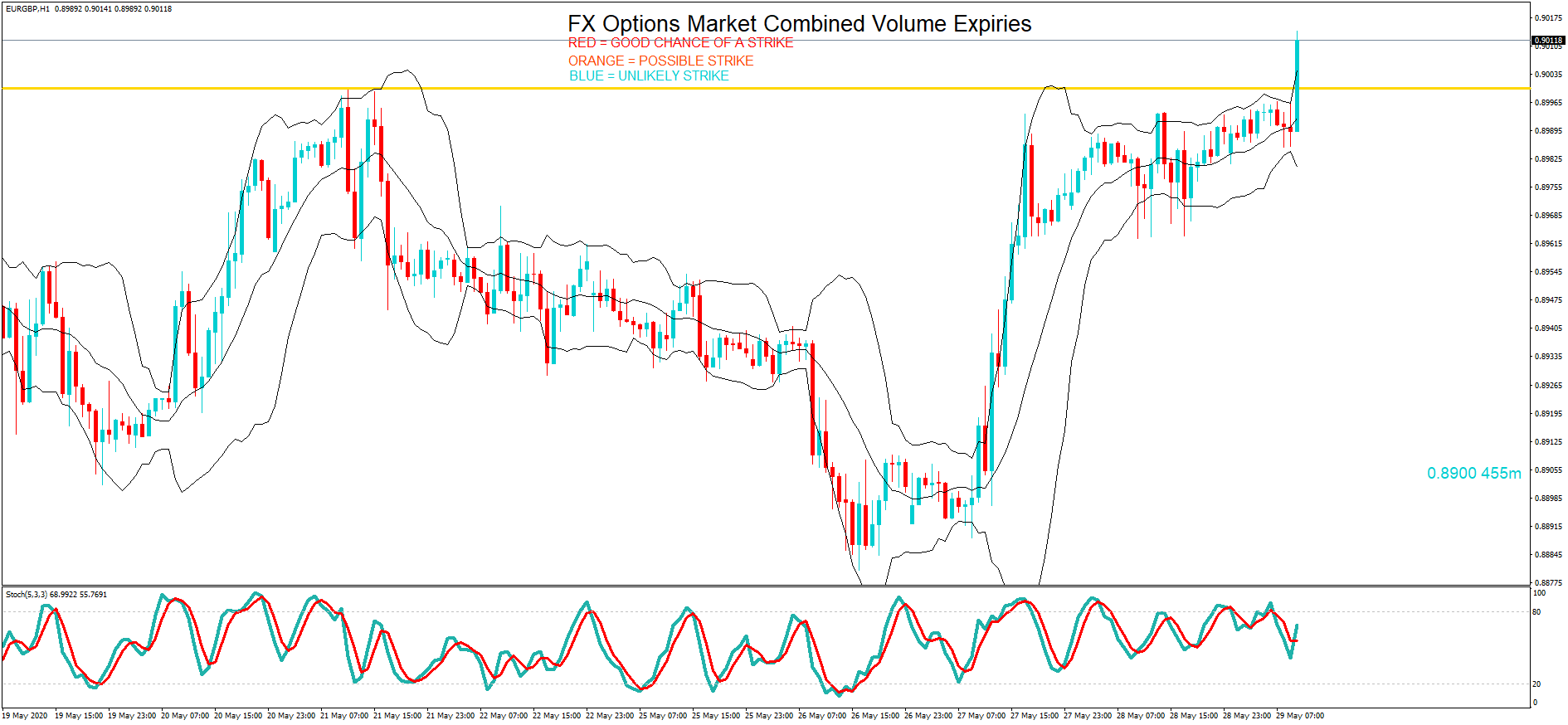

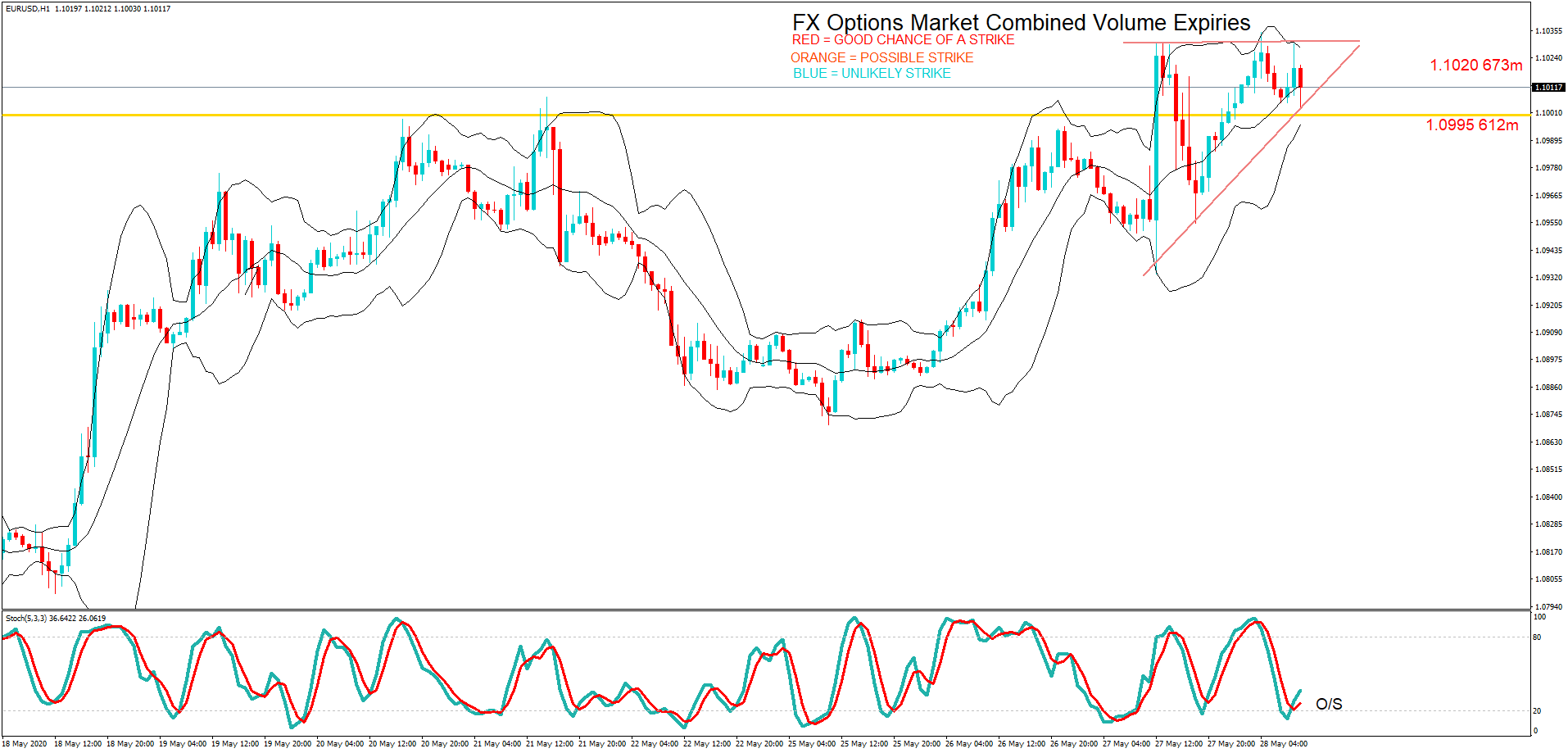

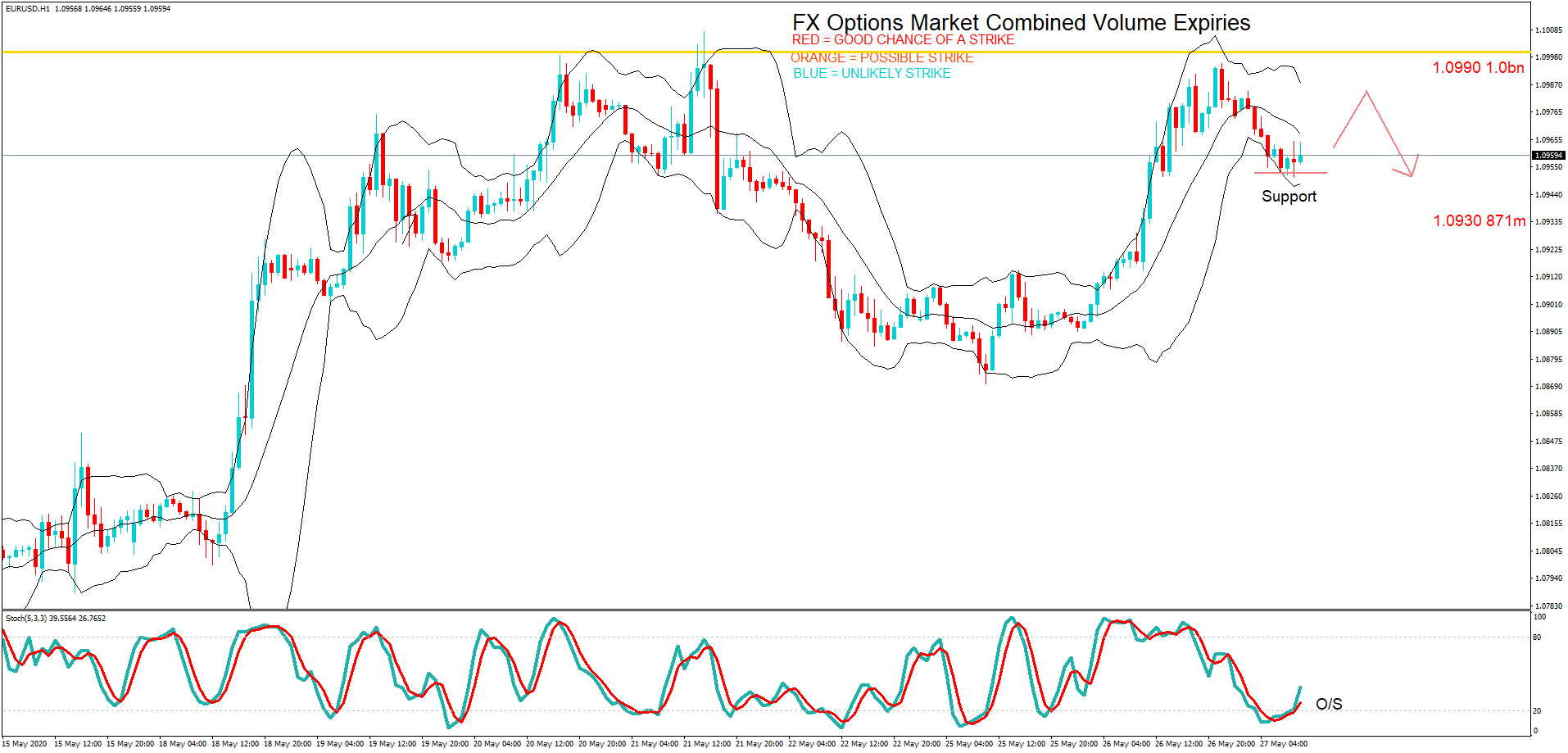

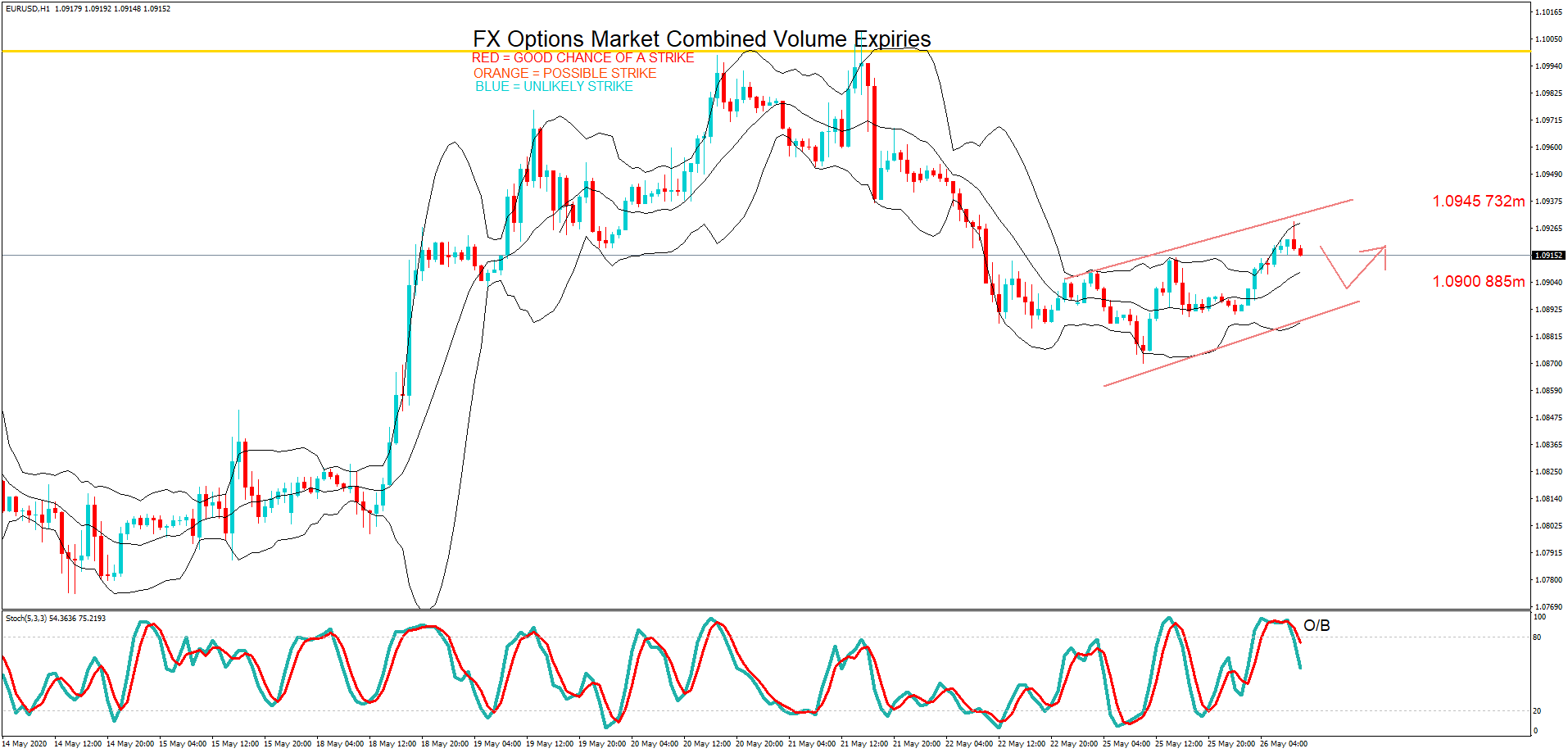

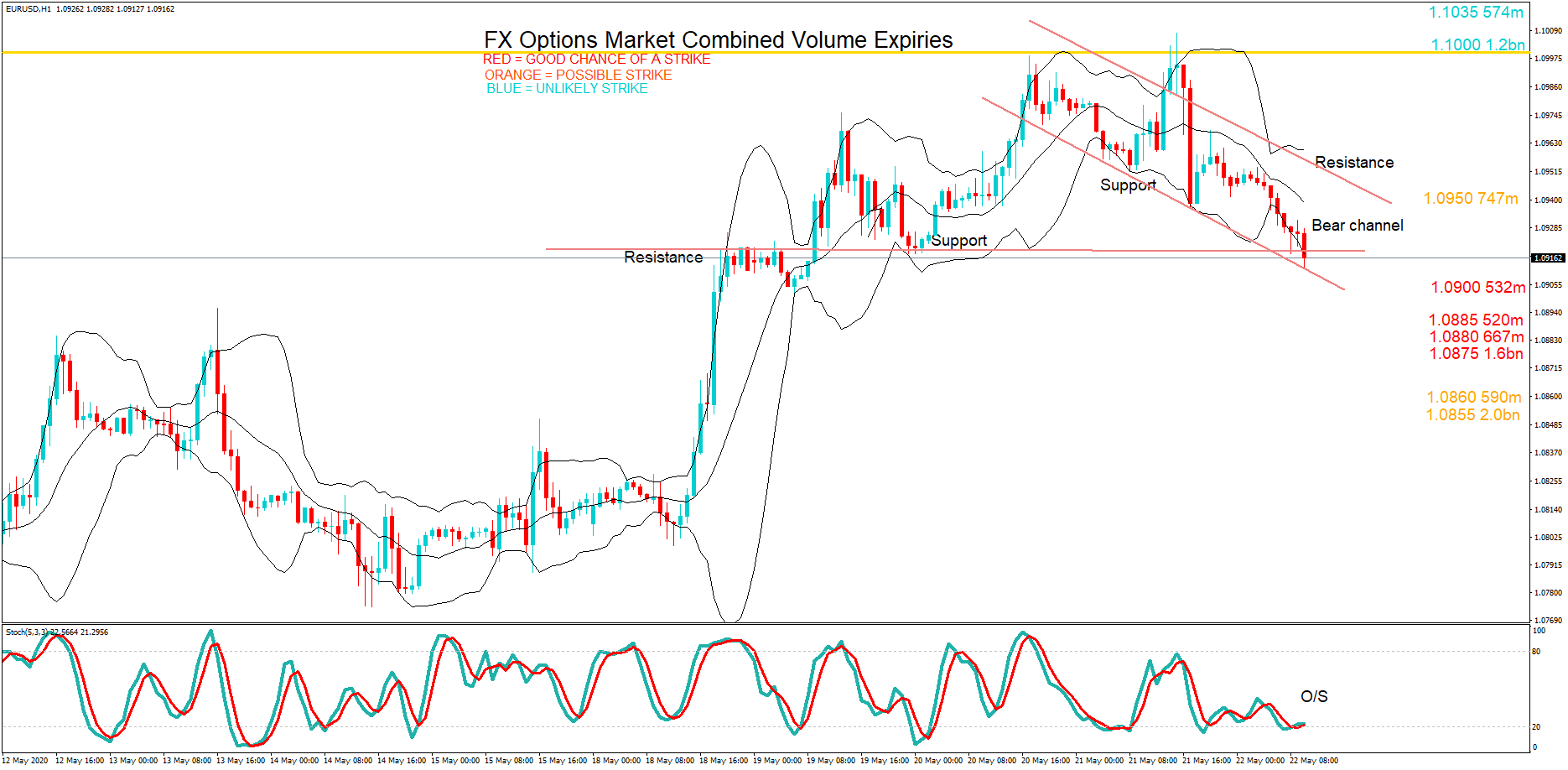

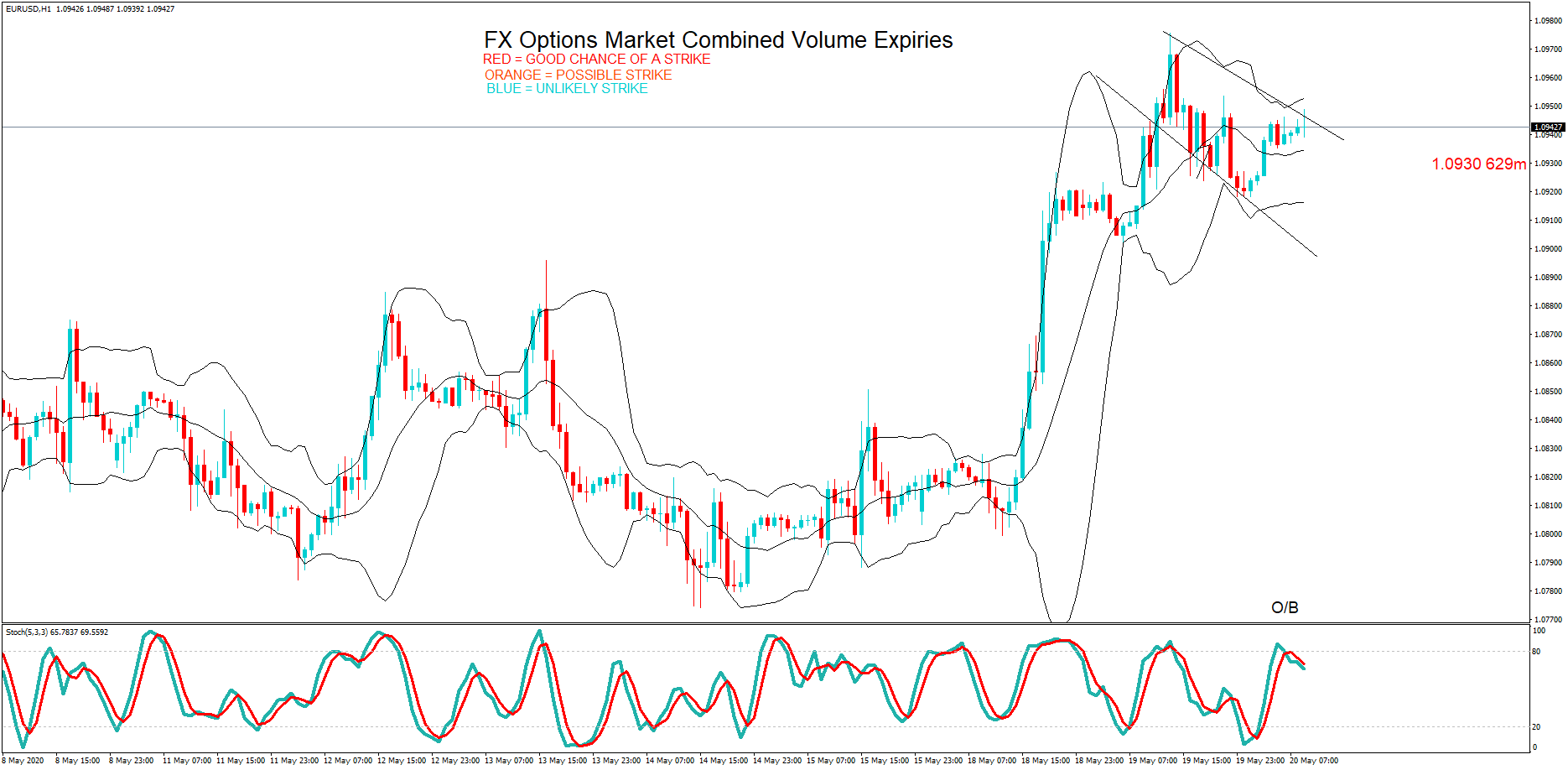

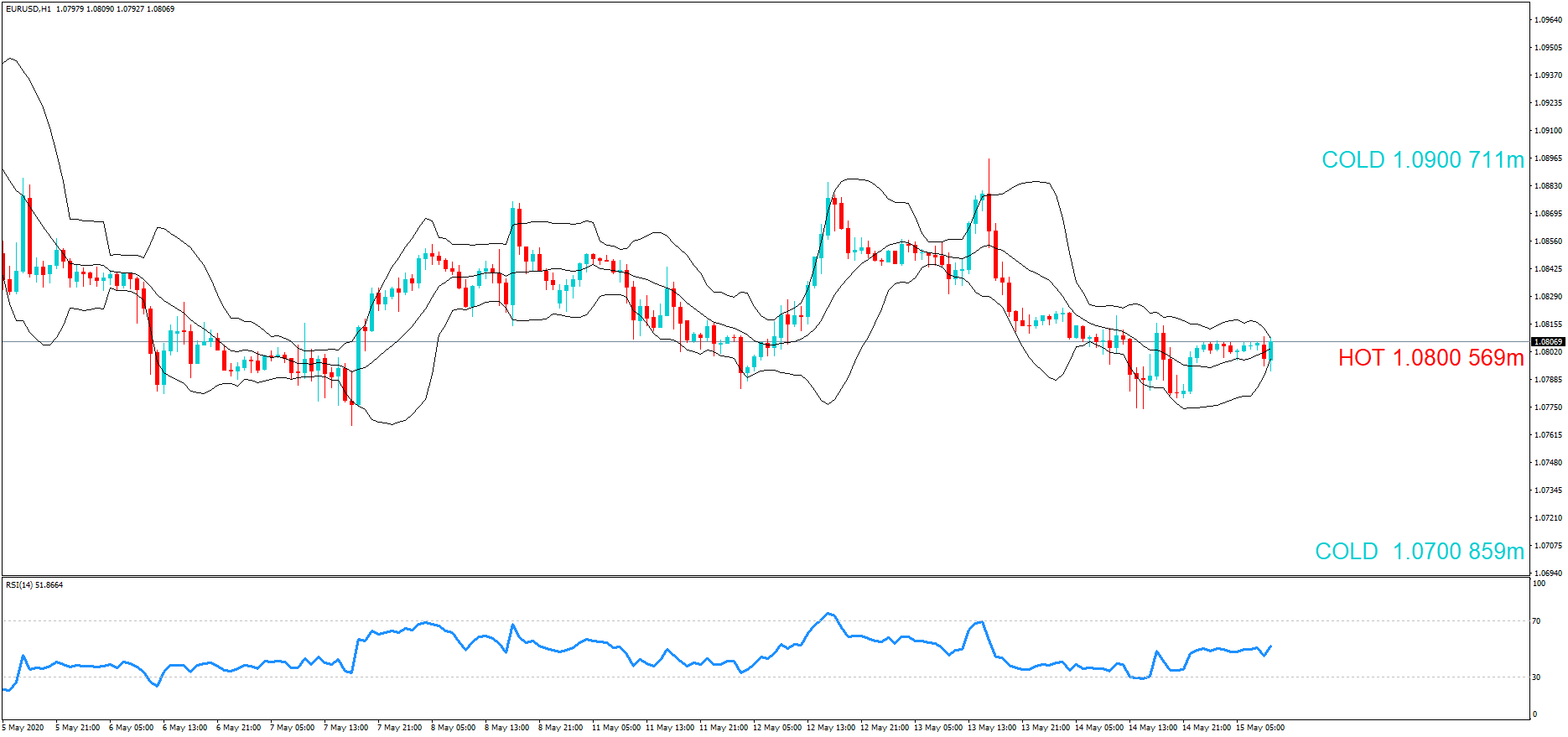

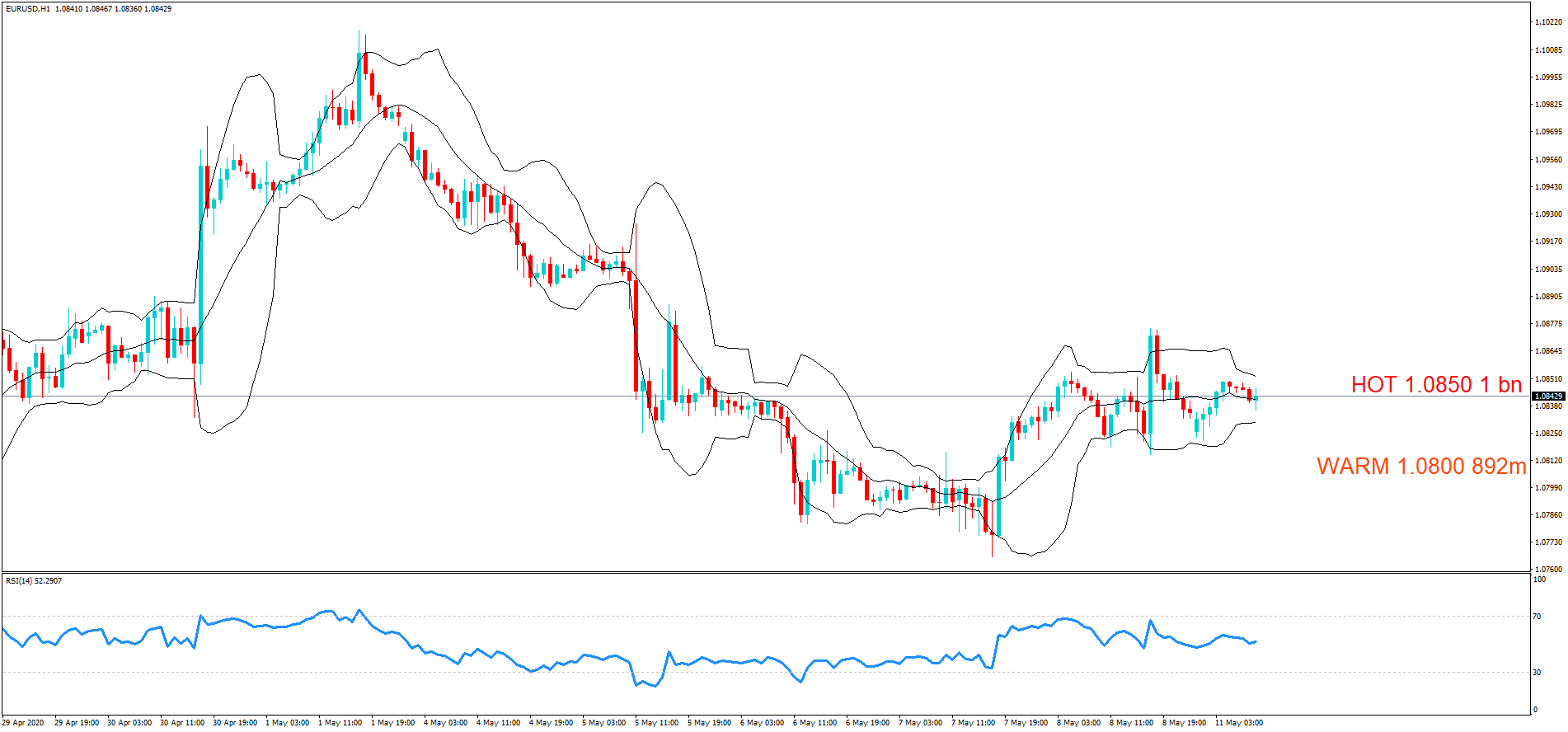

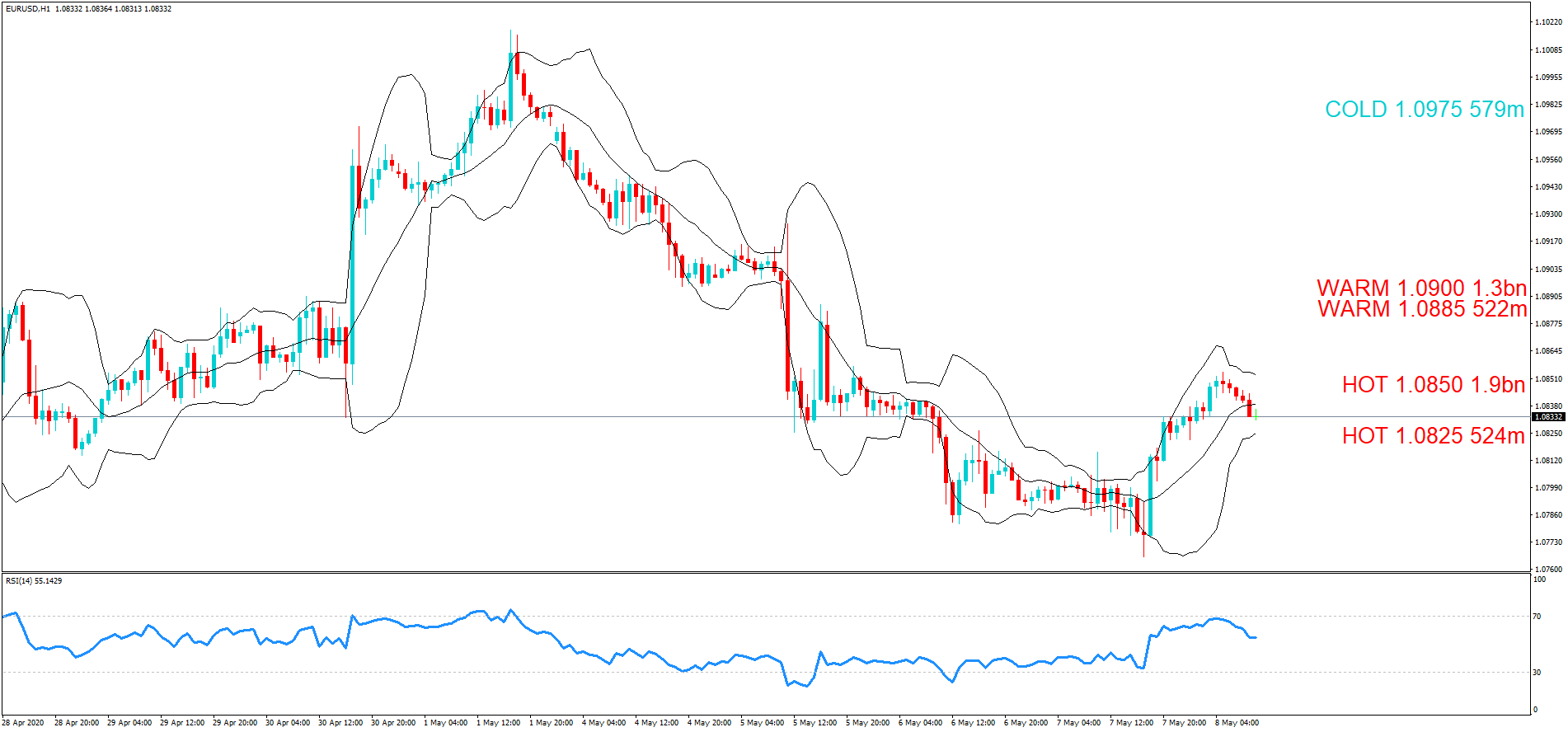

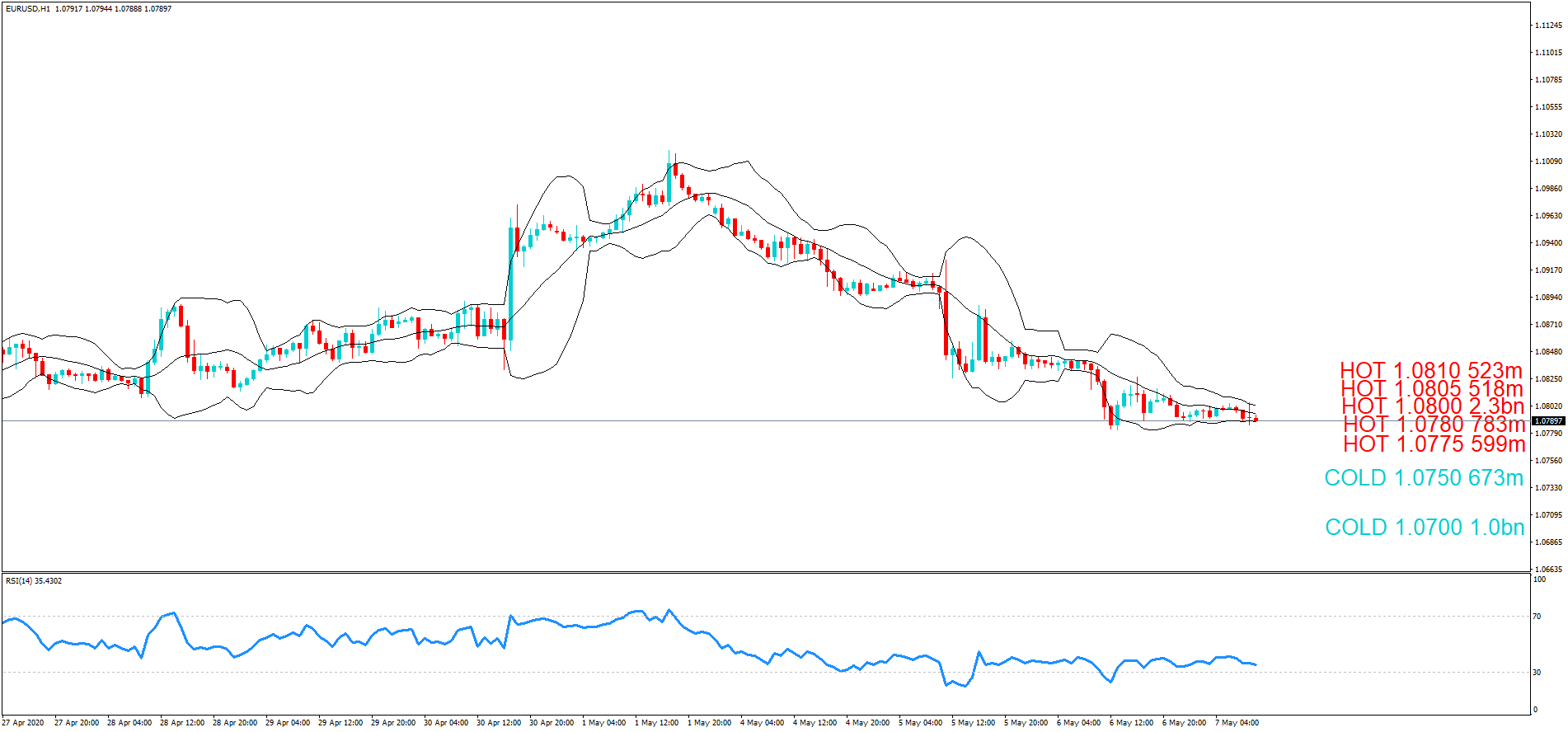

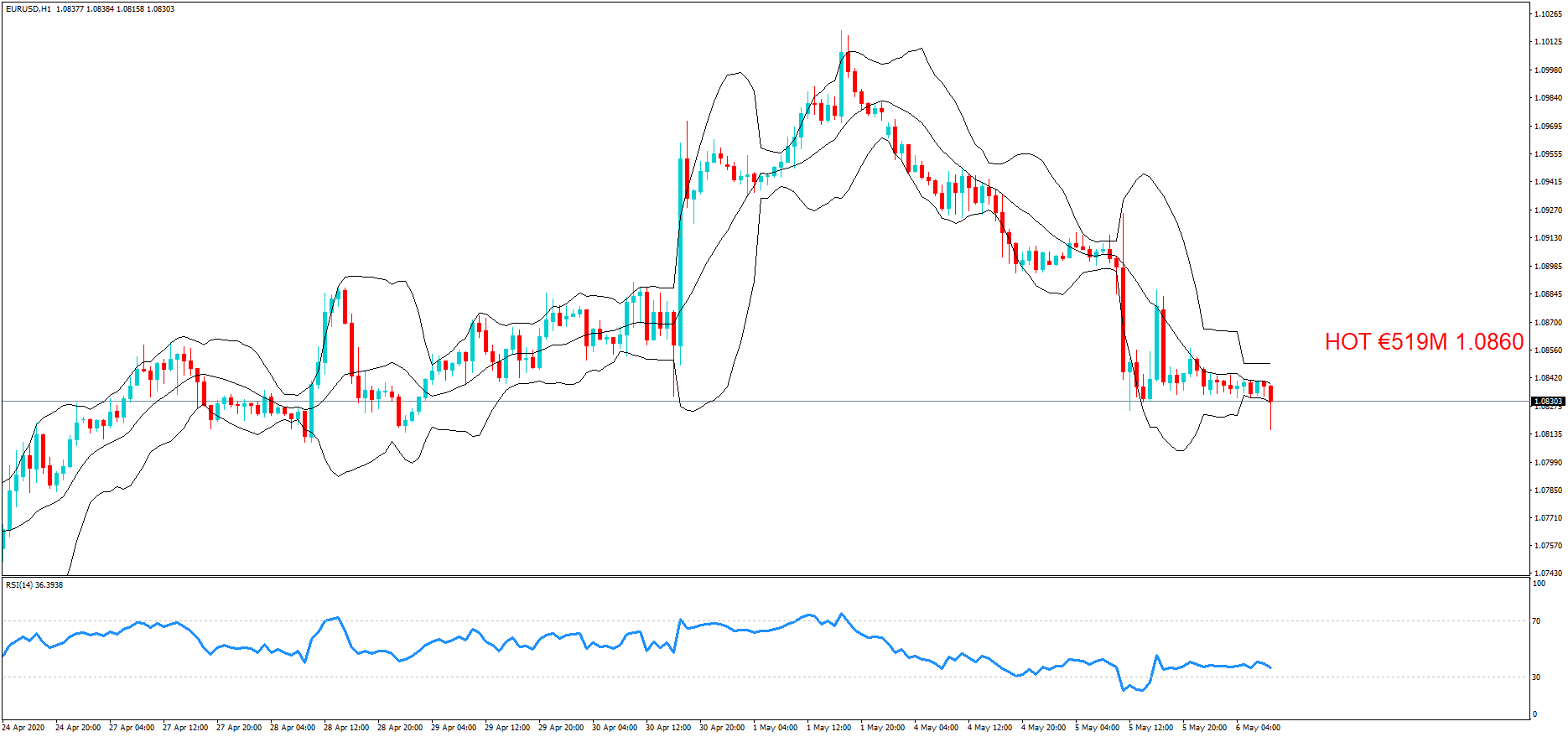

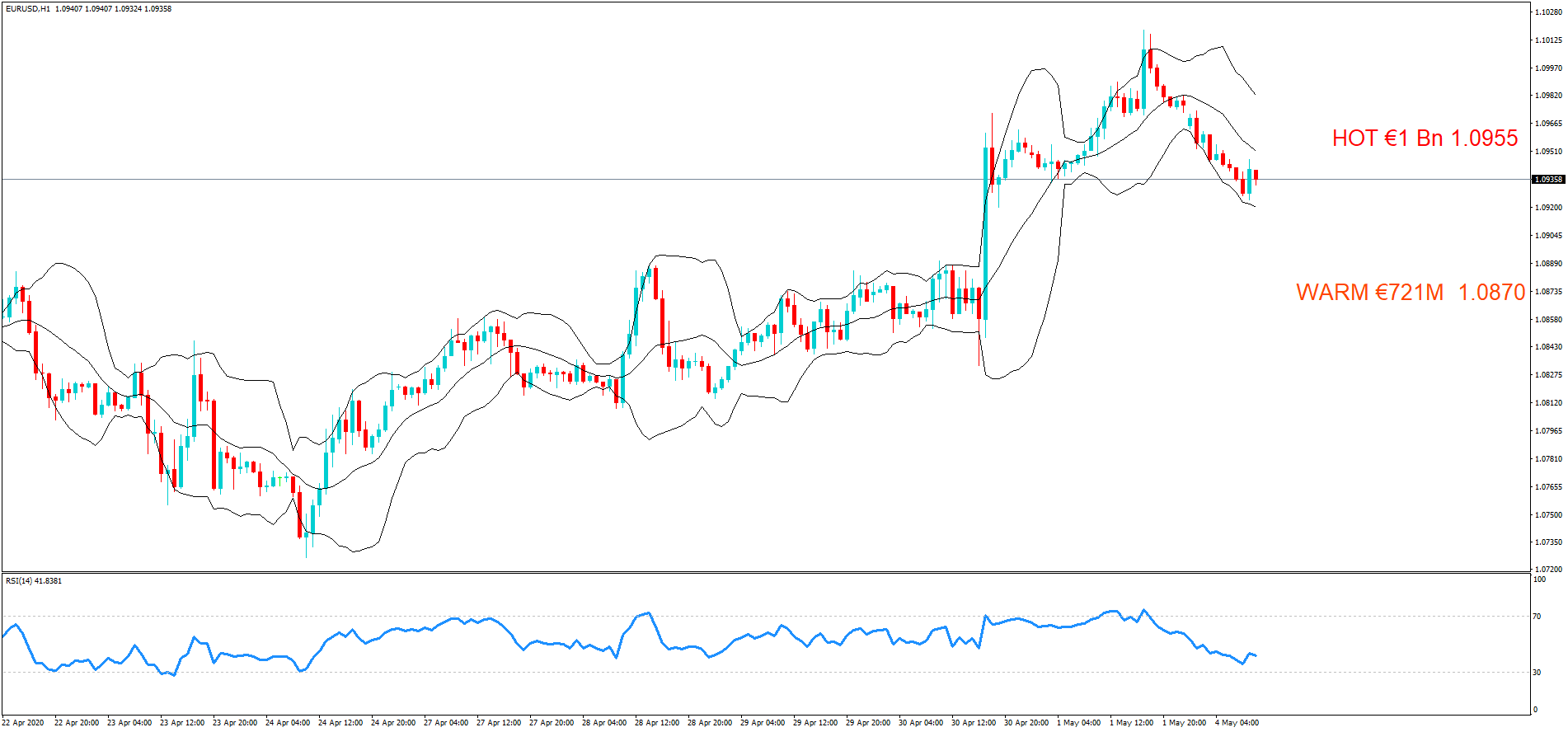

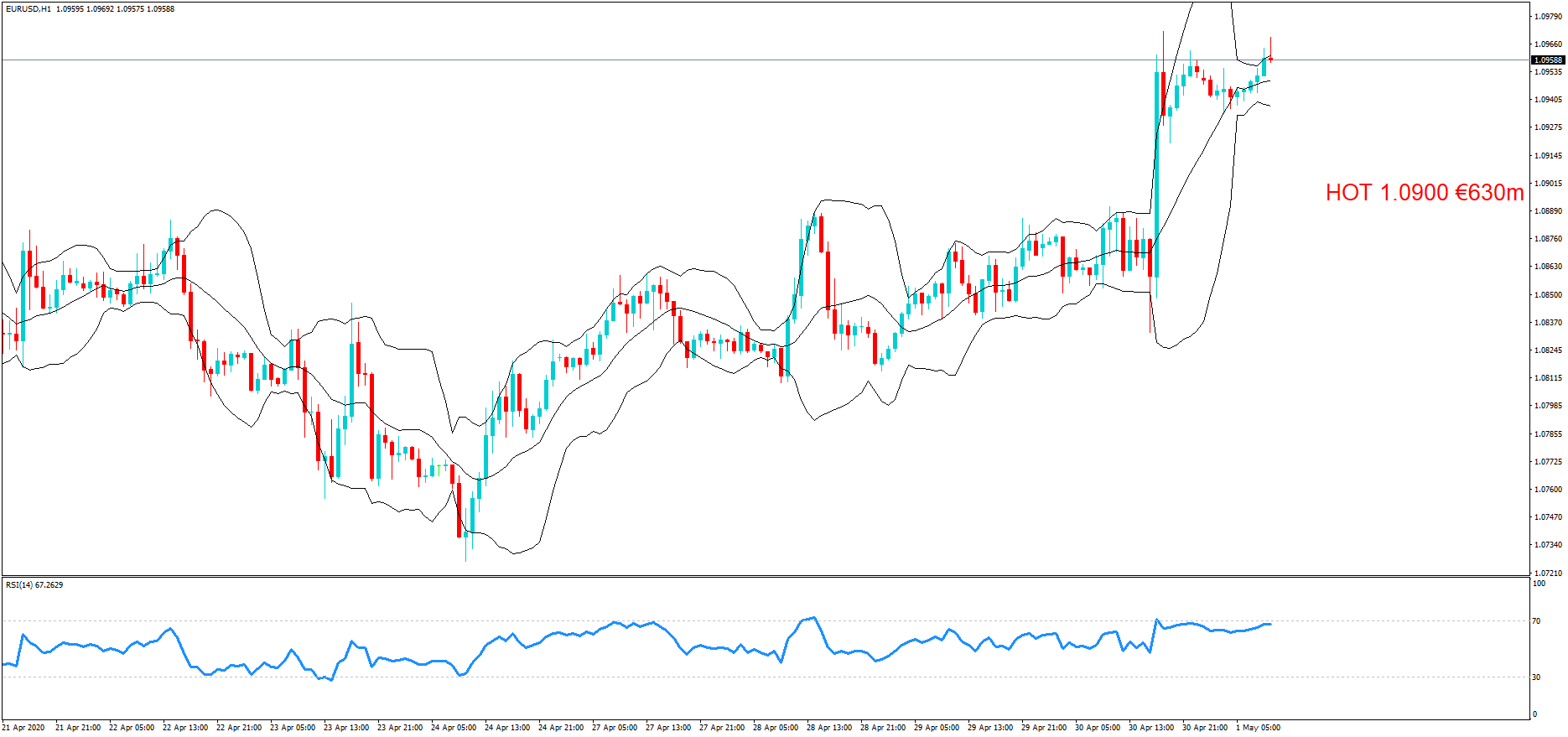

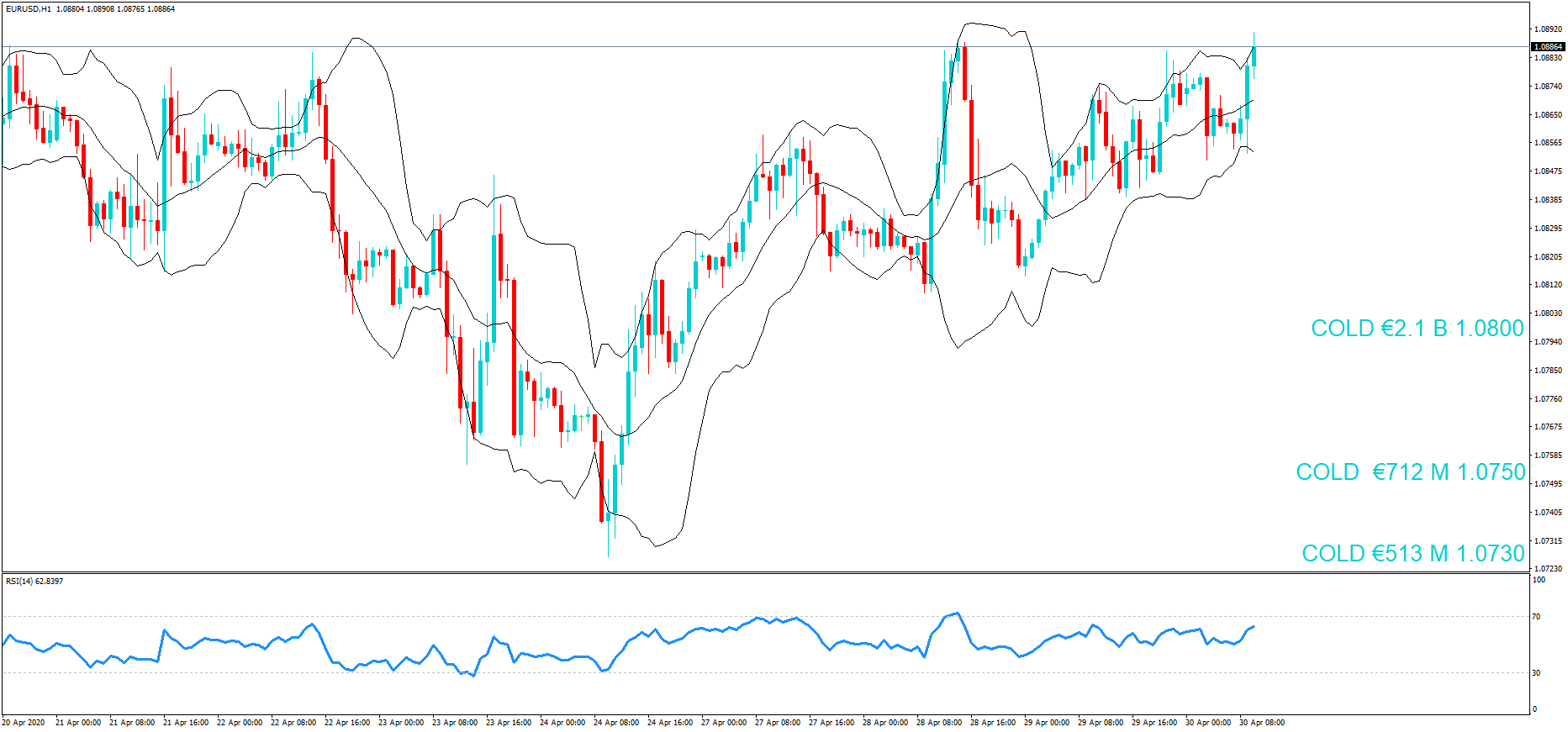

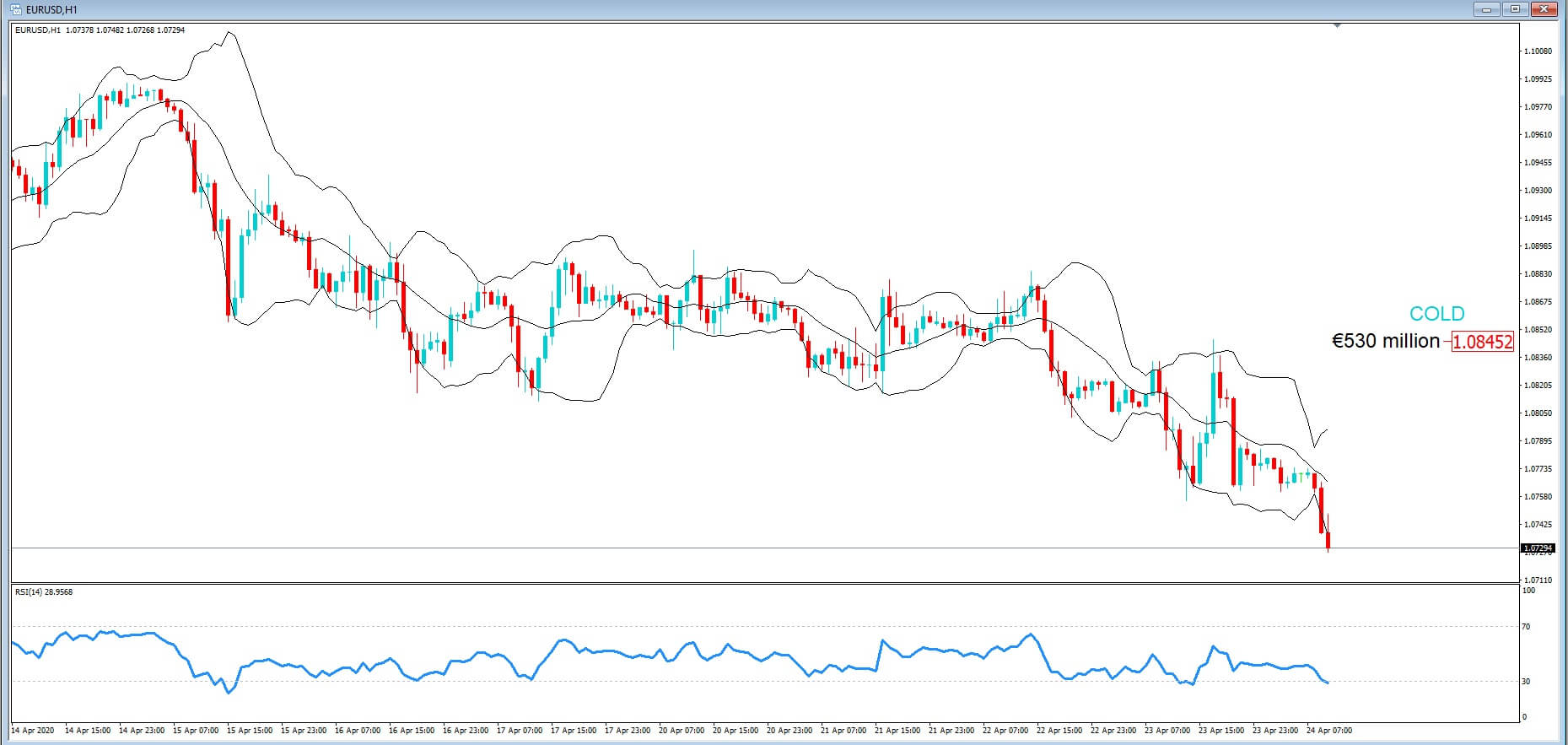

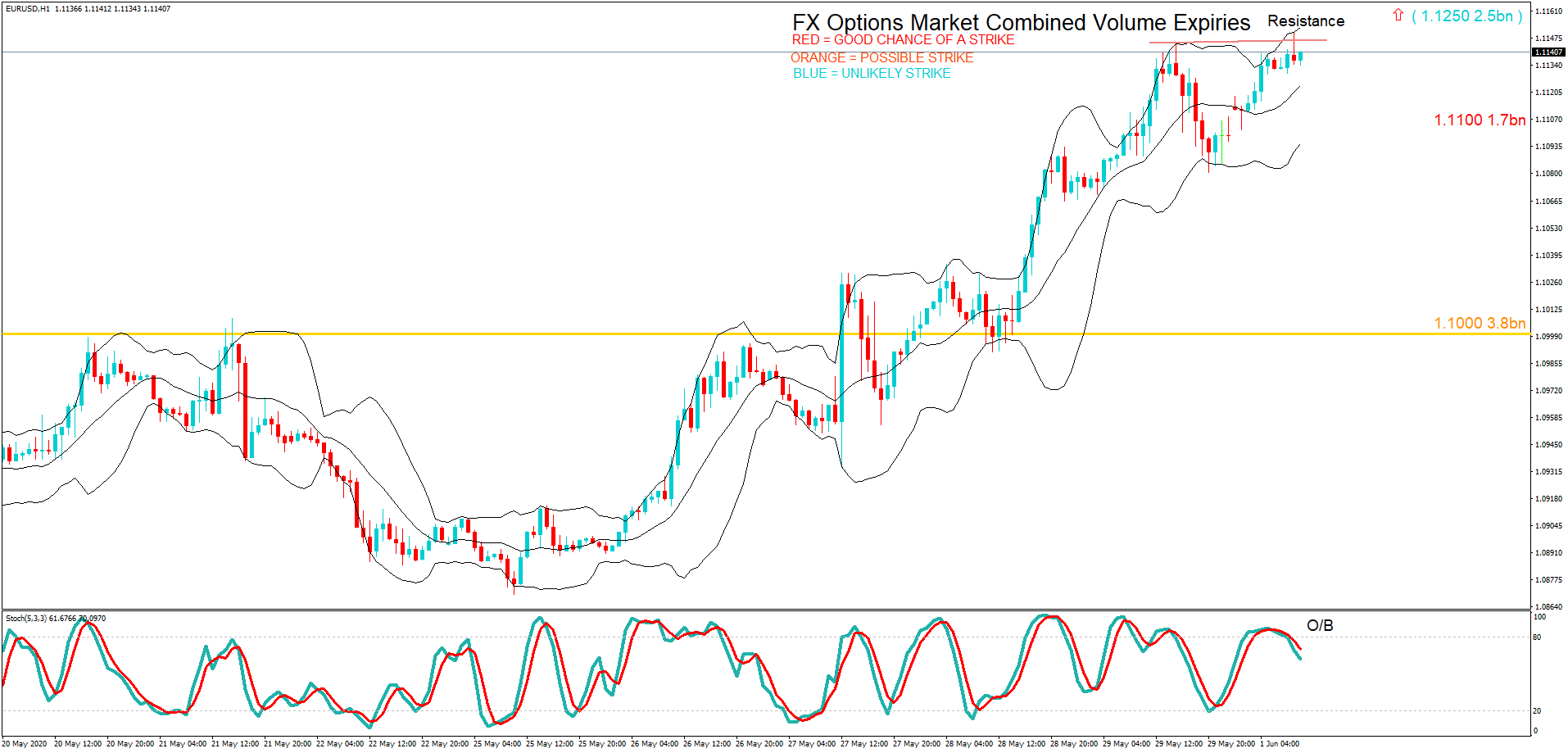

– EUR/USD: EUR amounts

- 1.1000 3.8bn

- 1.1100 1.7bn

- 1.1250 2.5bn

EURUSD pair is overbought on the one hour chart and showing signs of running out of steam to the upside with a double top formation and with Markit PMI’s and US data out before the New York cut. The 1.1100 maturity is very much in play. The 1.1000 maturity should not be discounted due to its massive size.

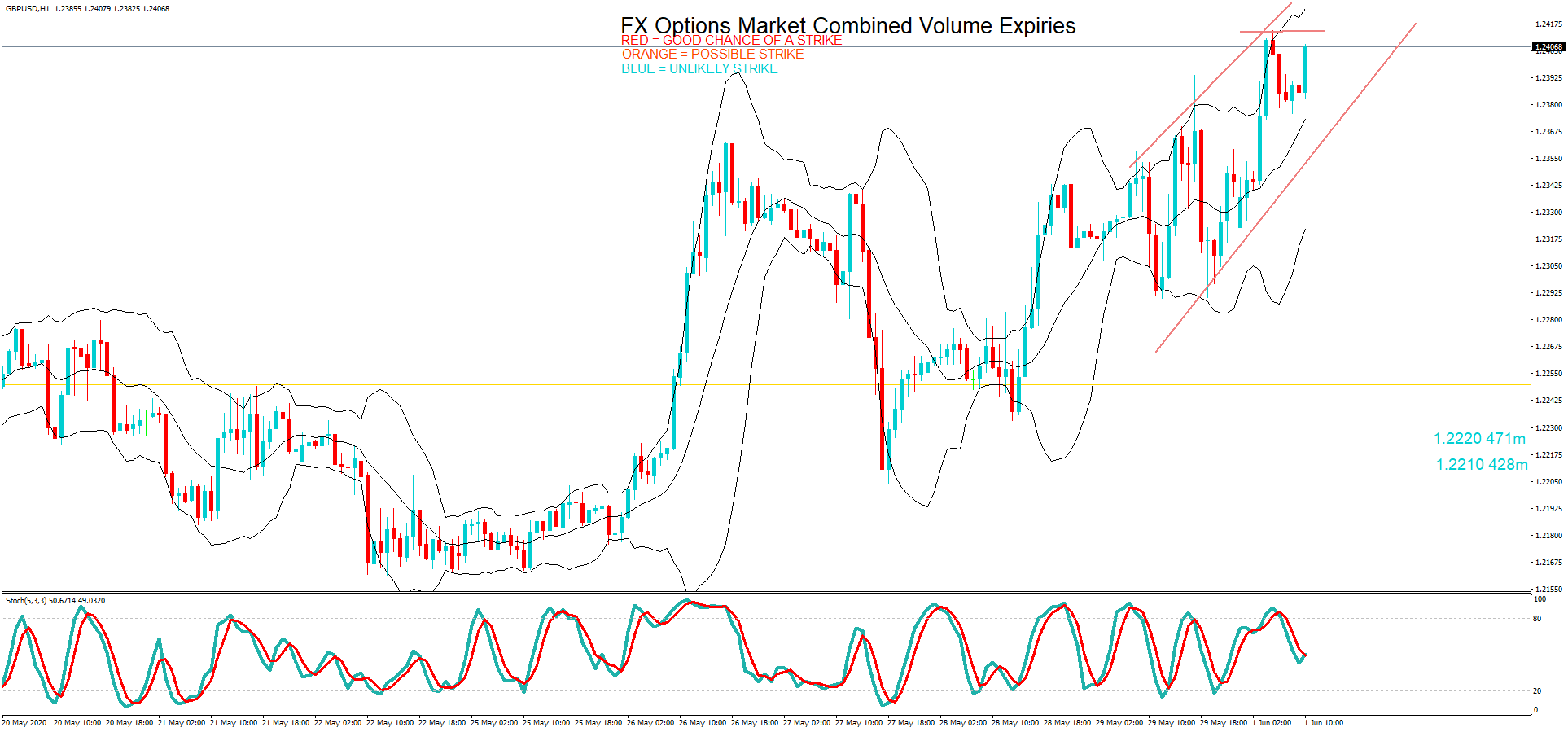

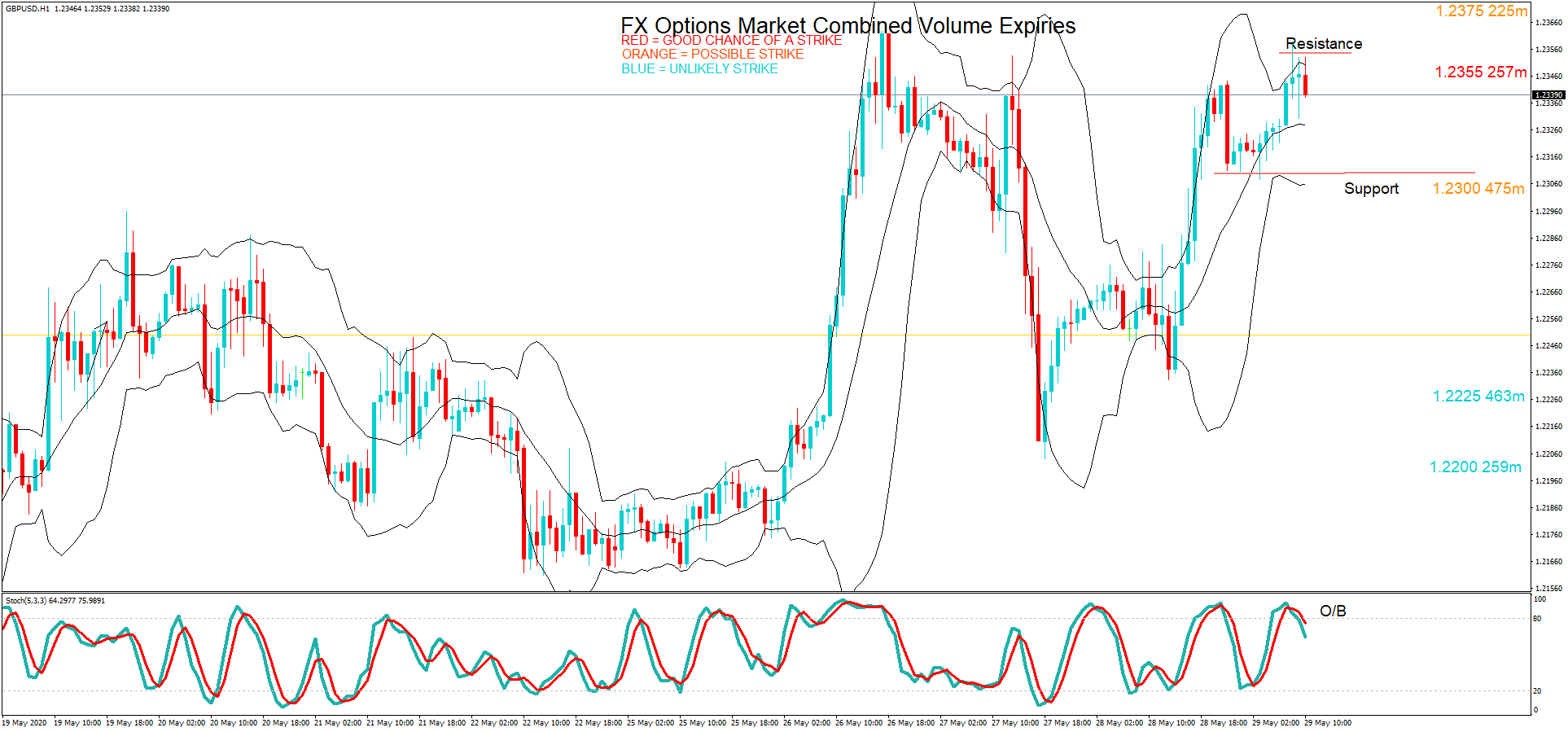

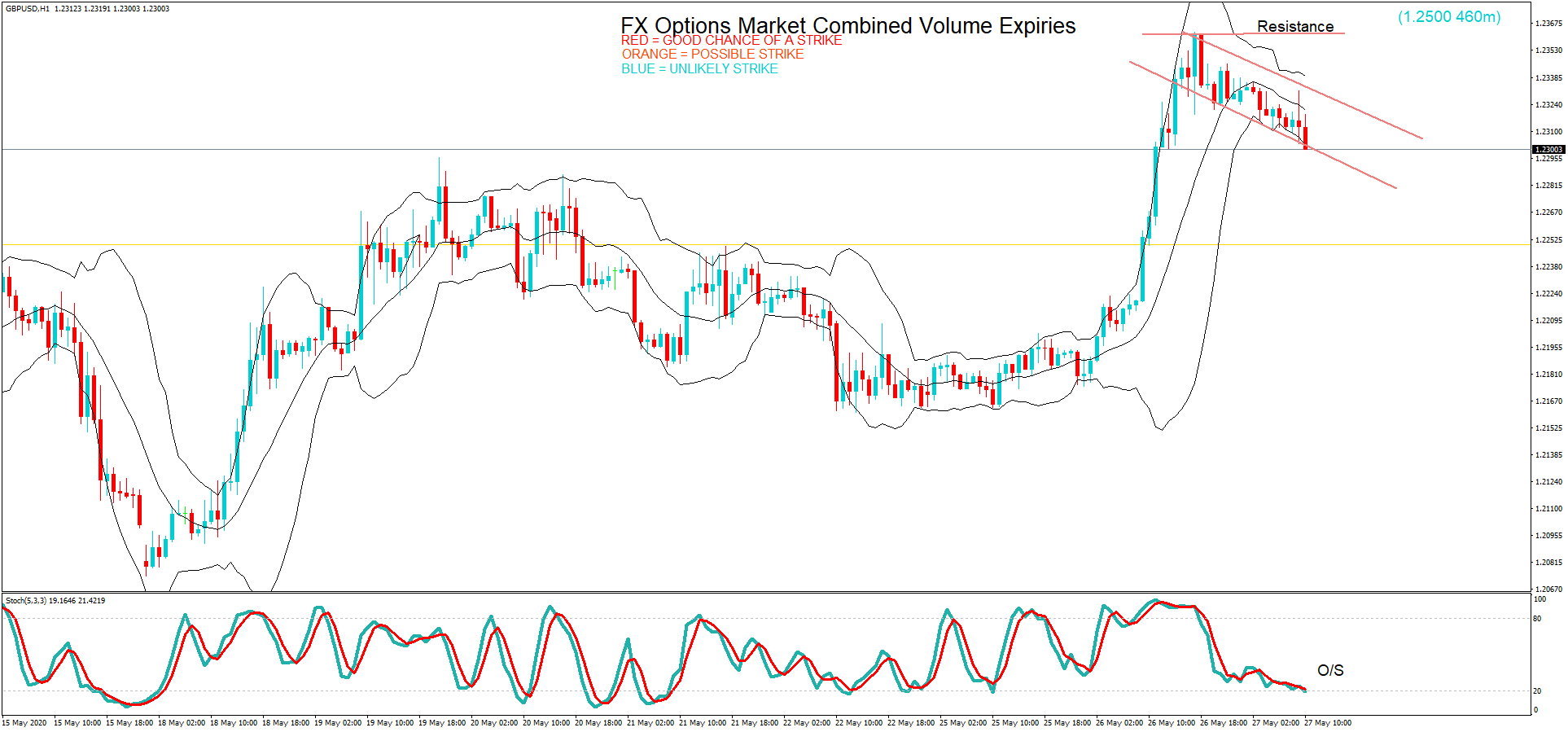

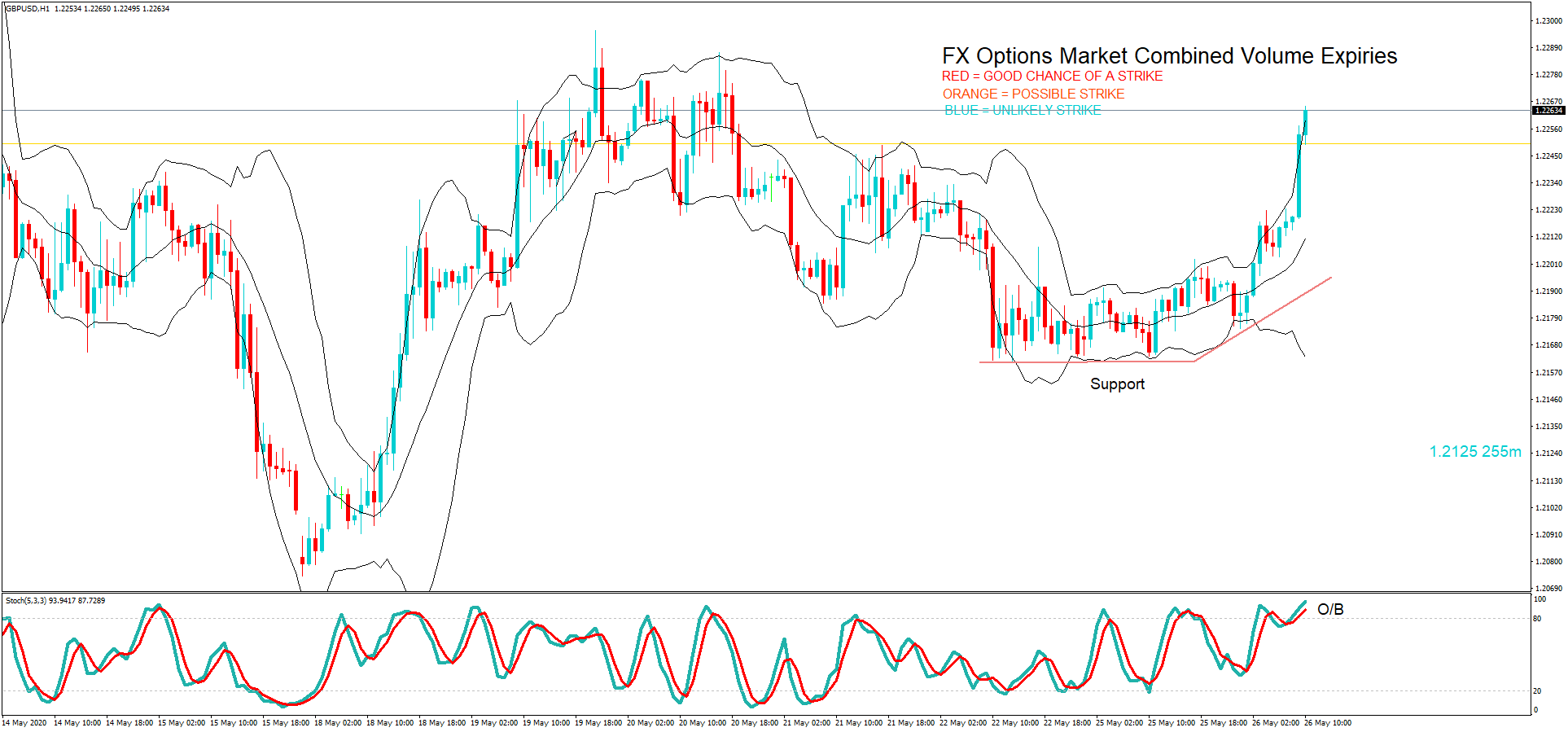

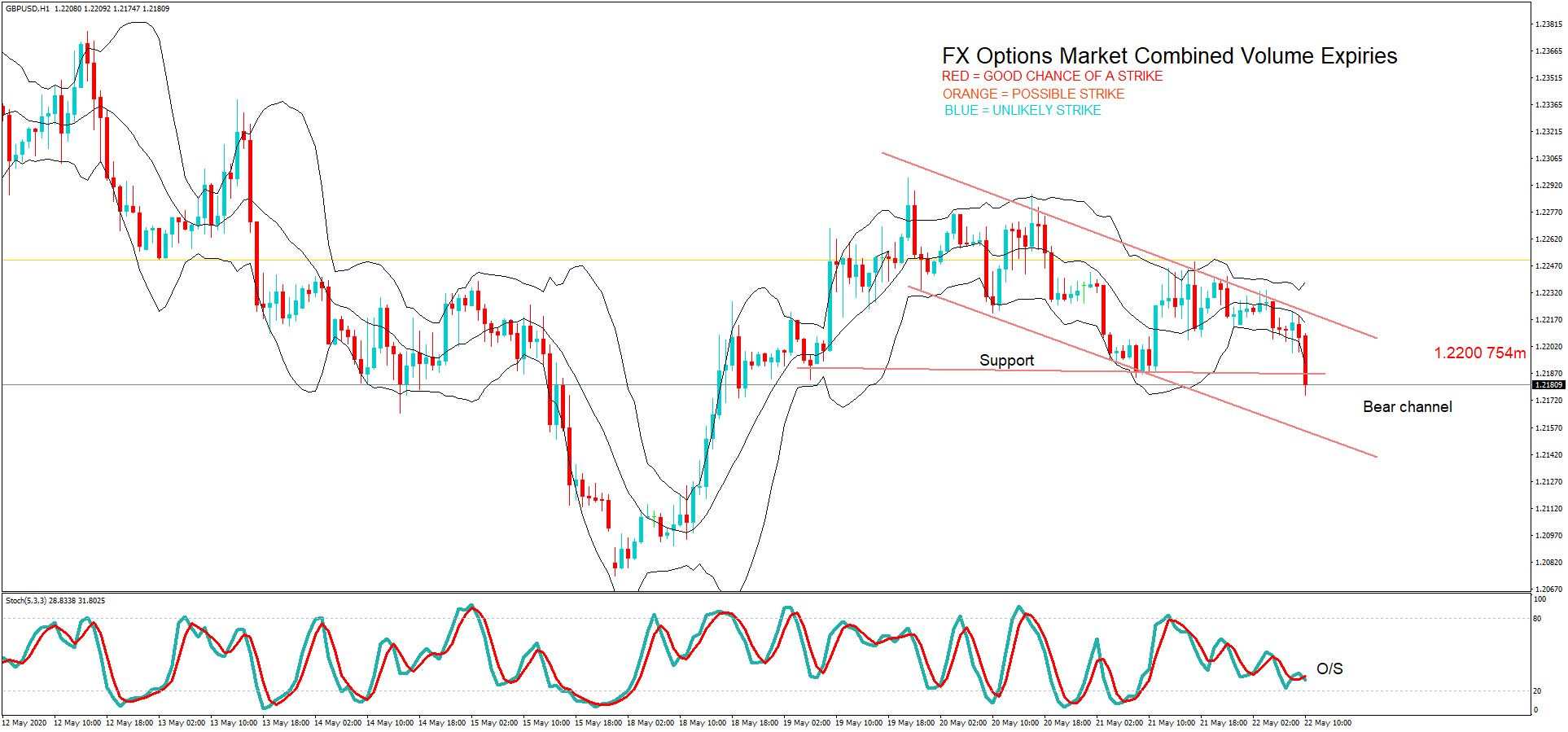

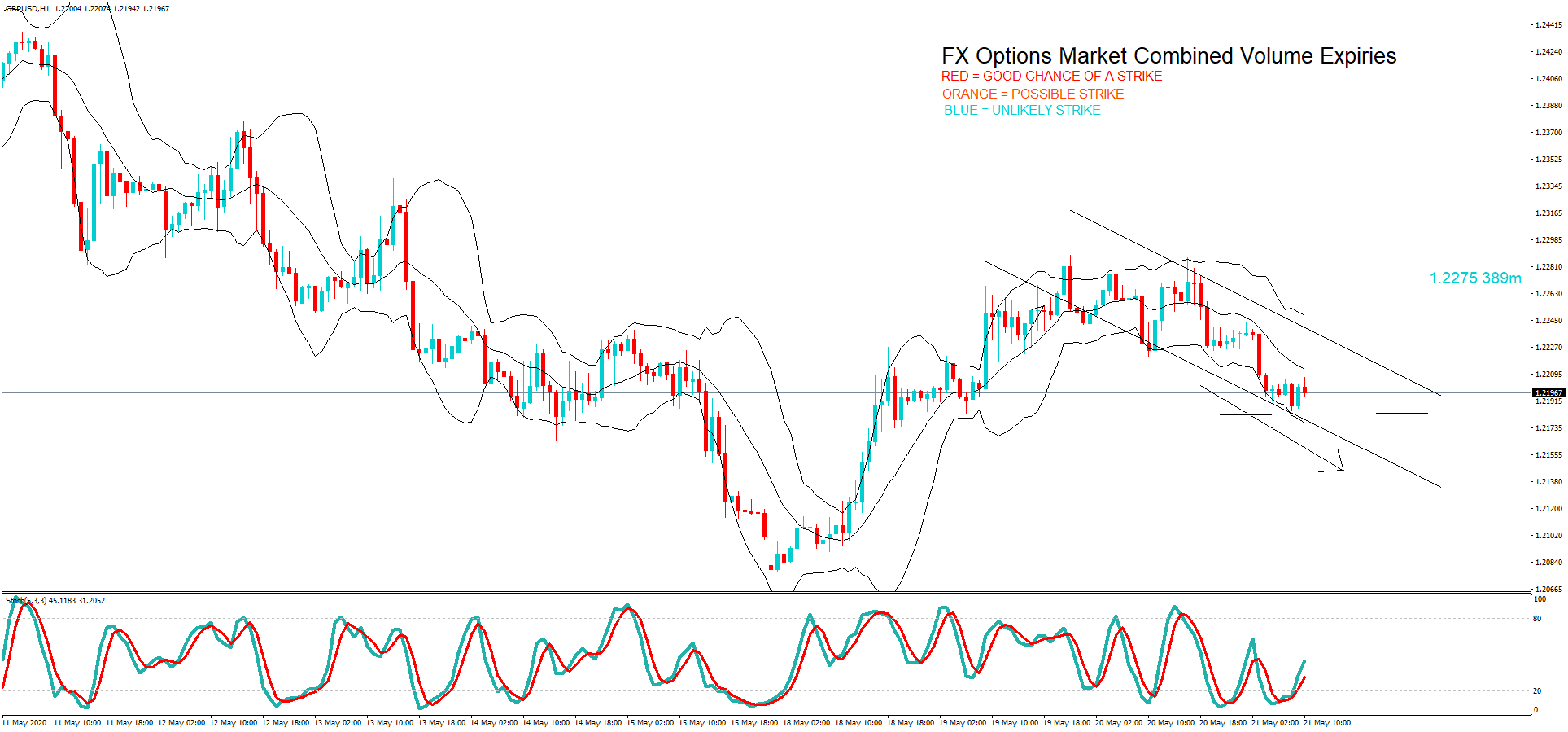

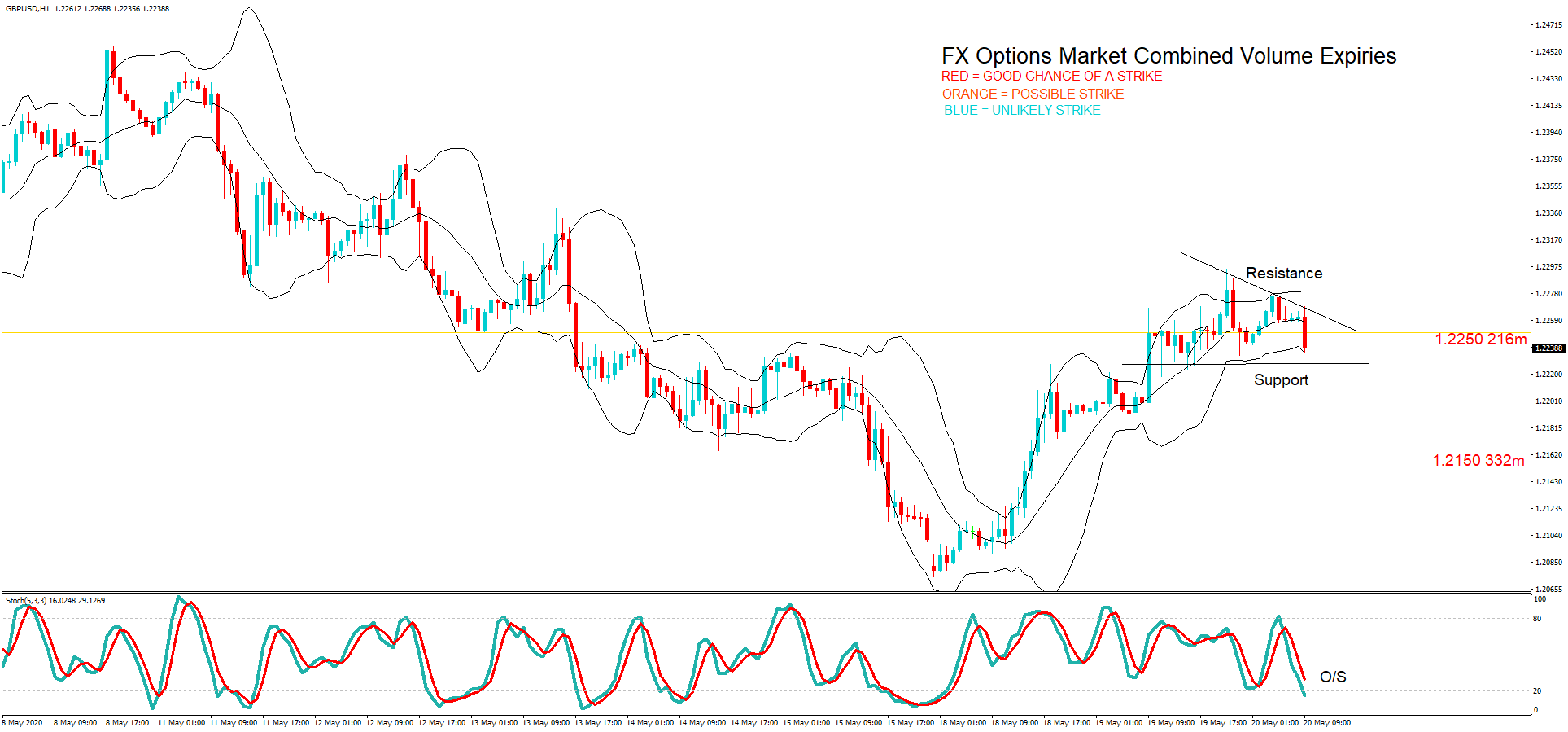

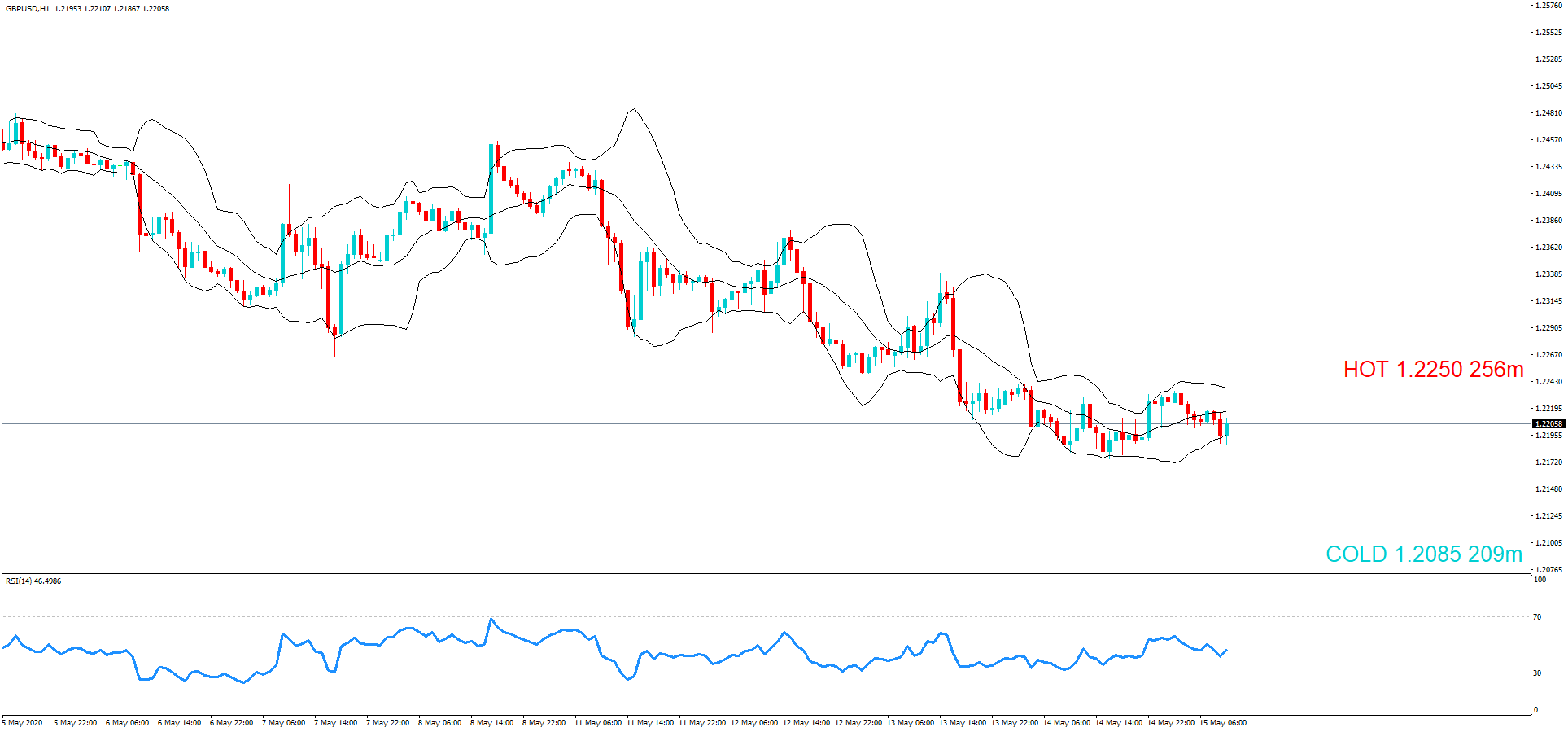

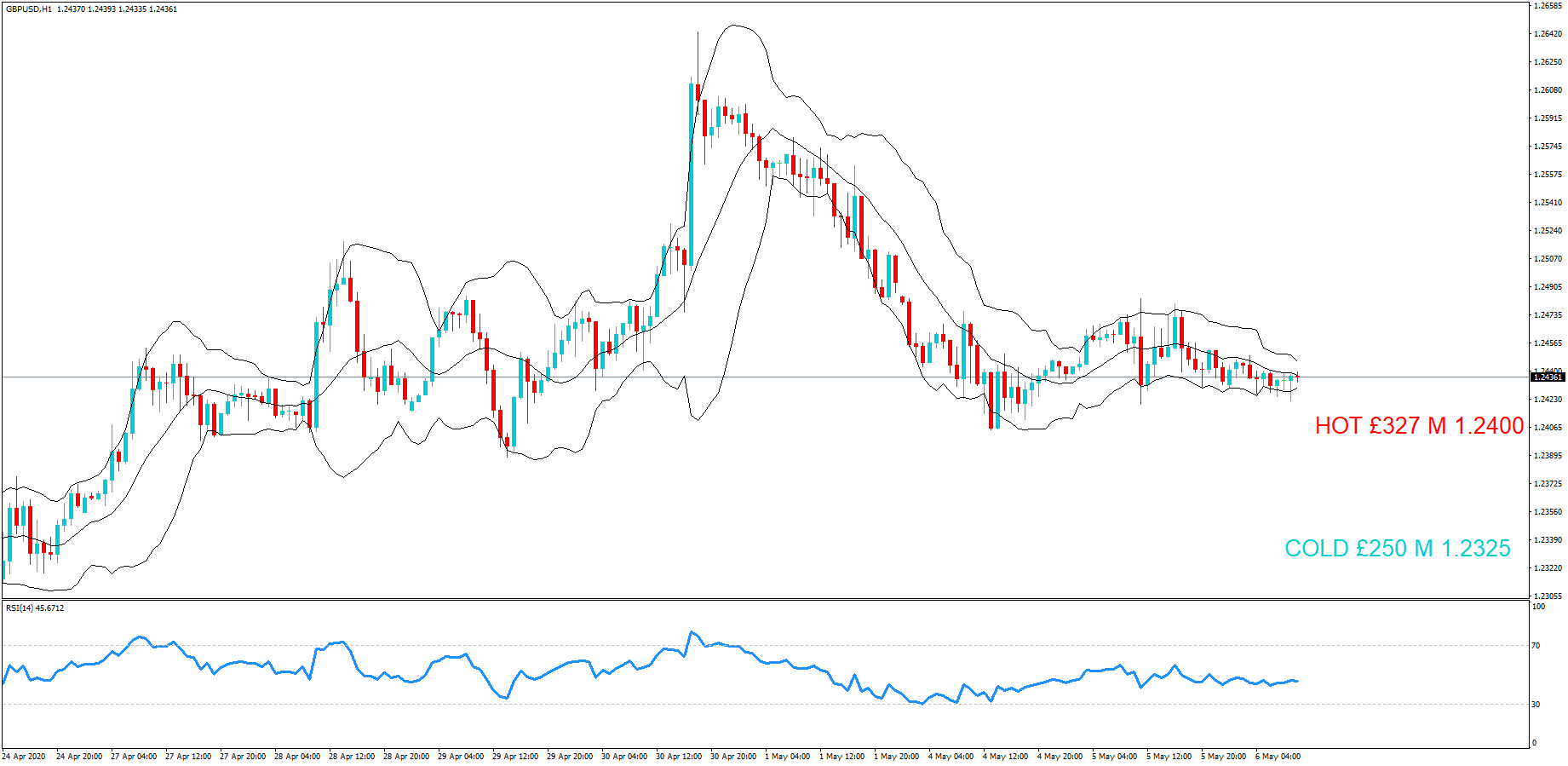

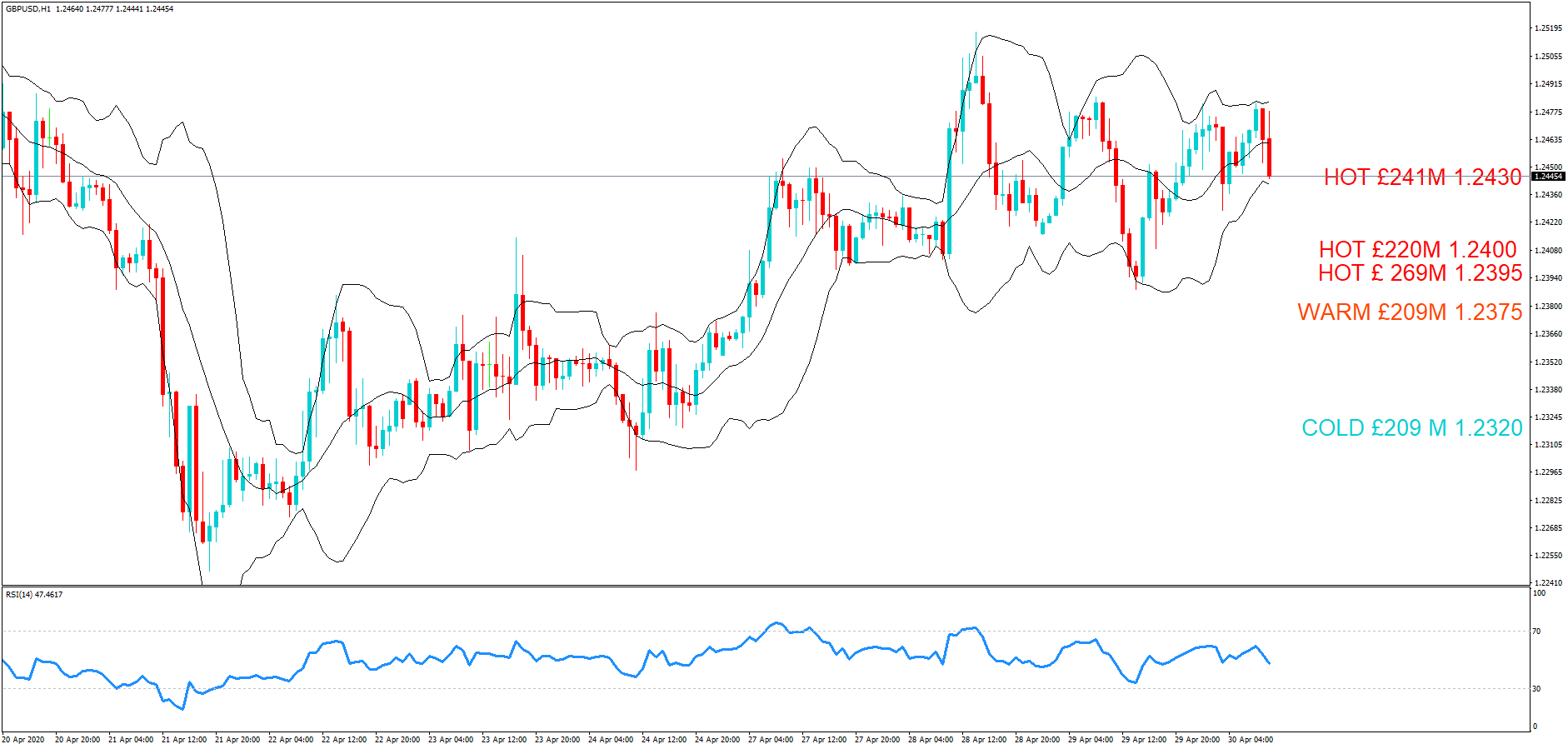

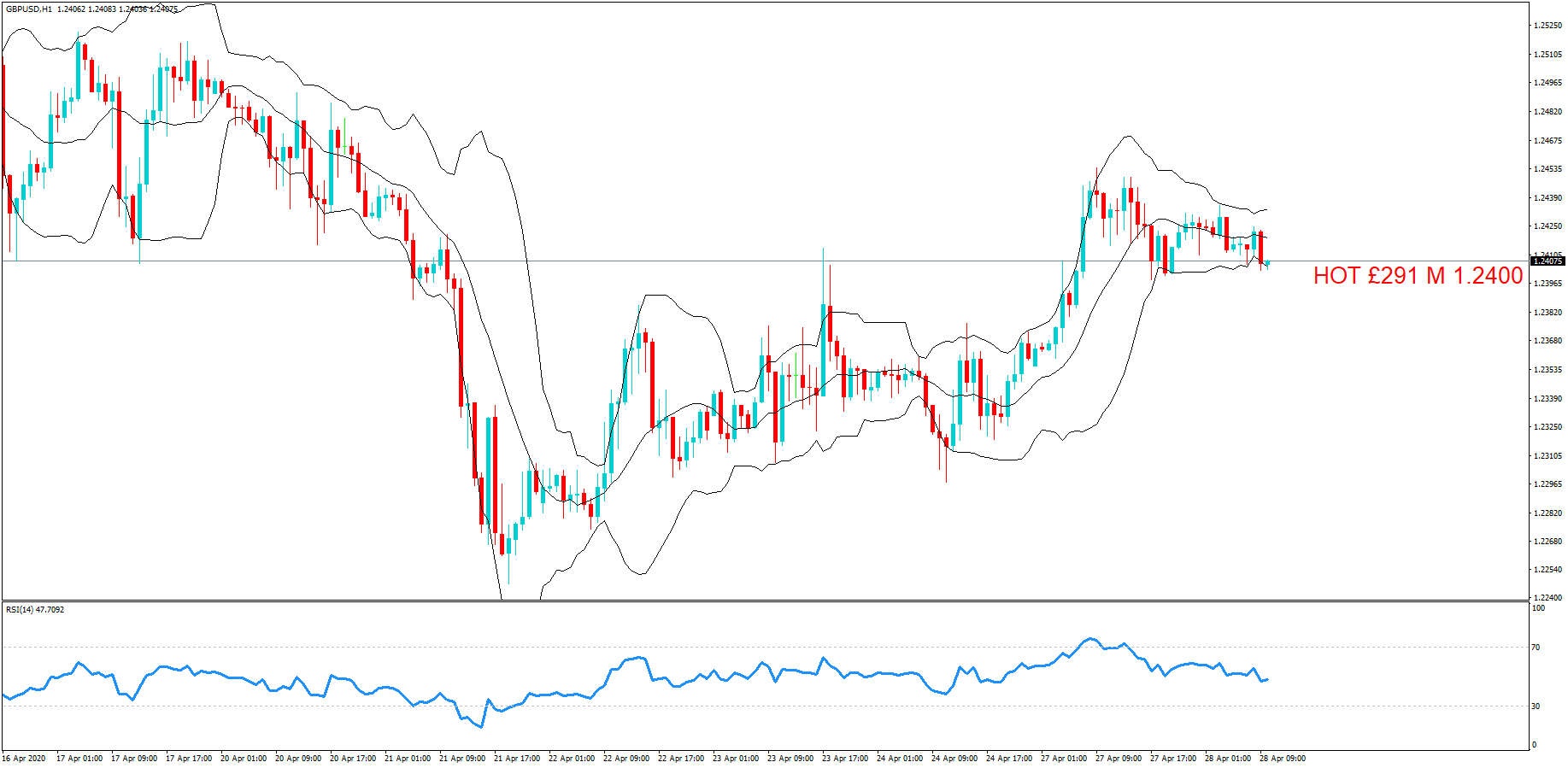

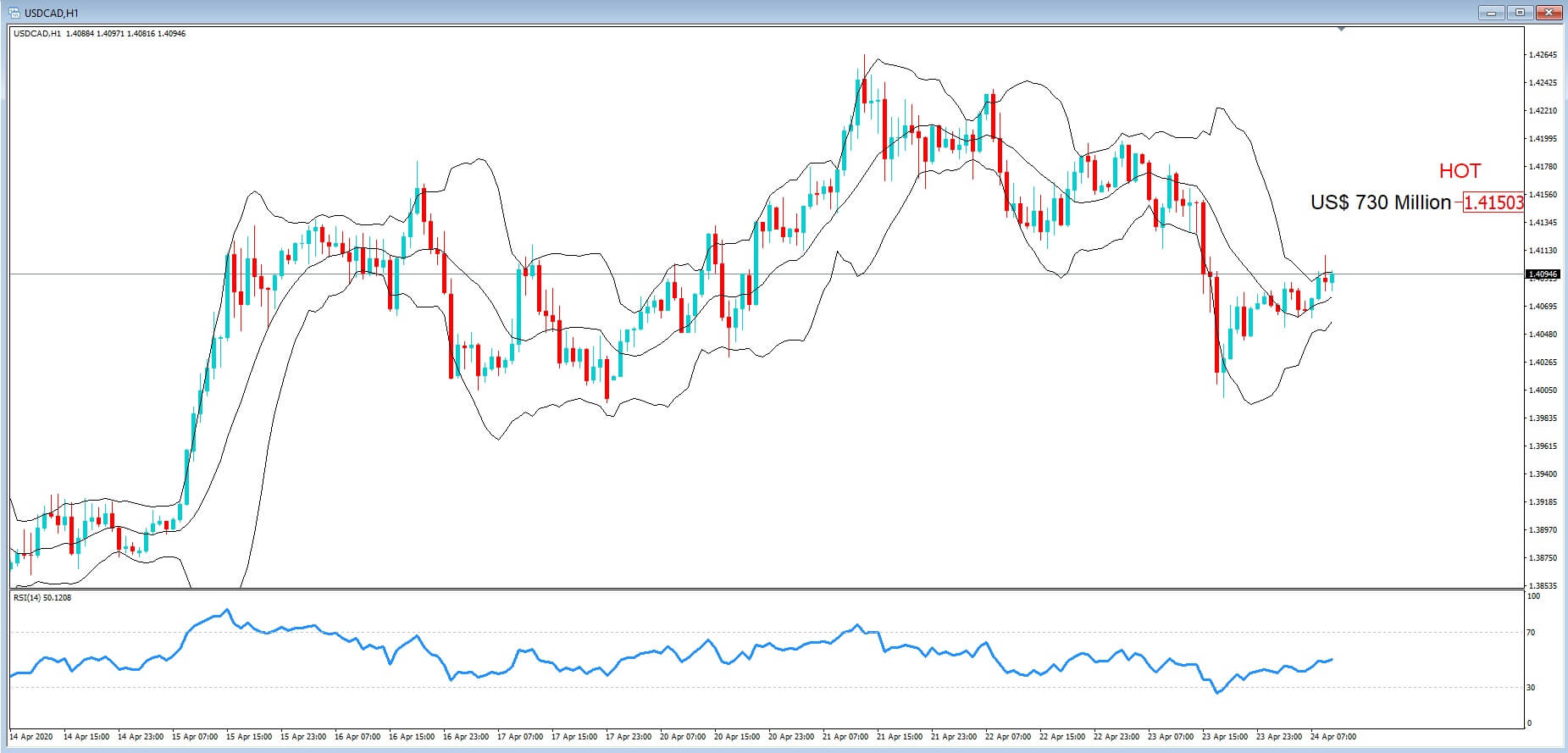

– GBP/USD: GBP amounts

- 1.2210 428m

- 1.2220 471m

GBPUSD pair is approaching an area of resistance but moving in an upward channel. The 2 maturities look to be out of play. UK and US data out later.

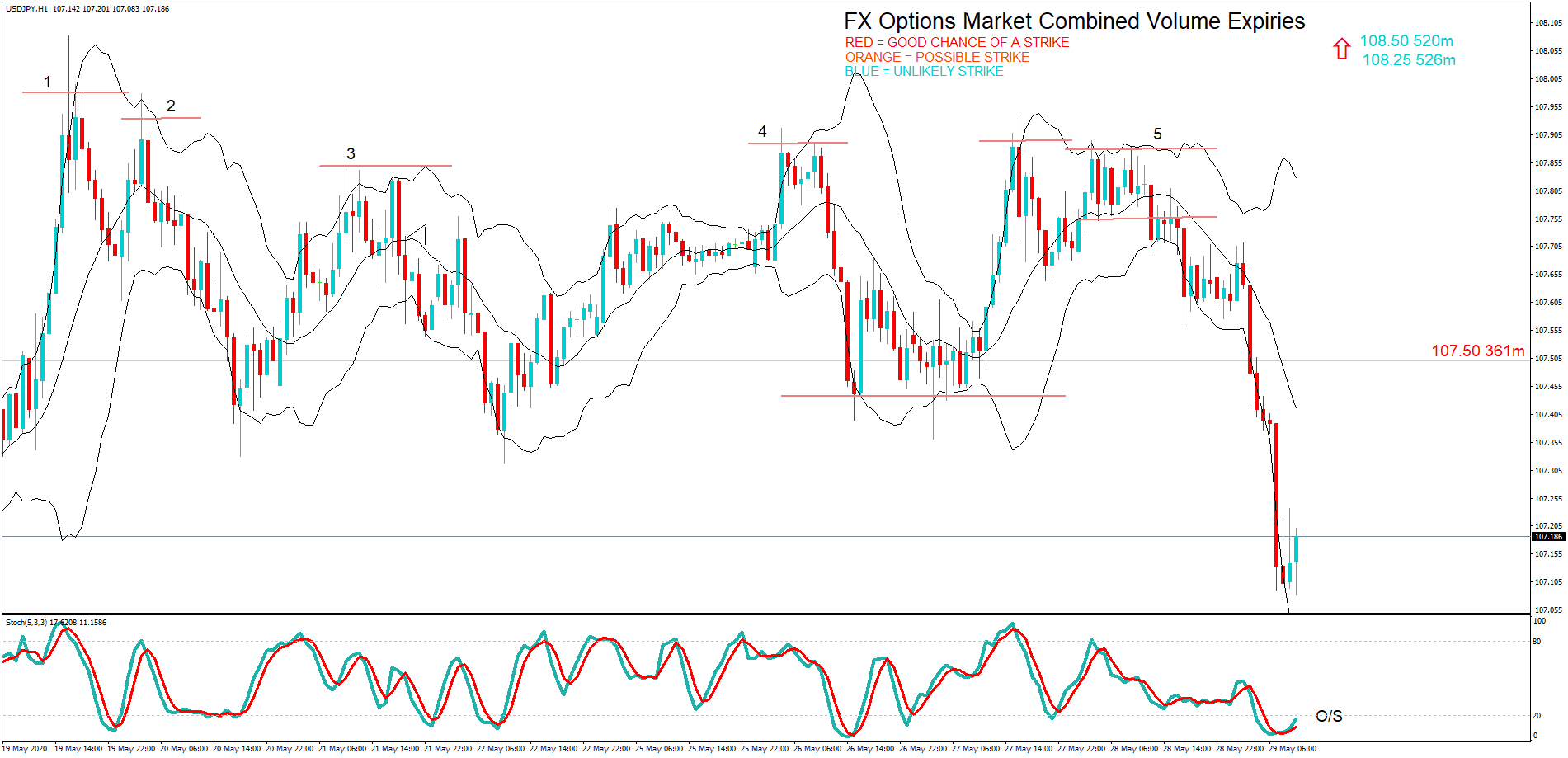

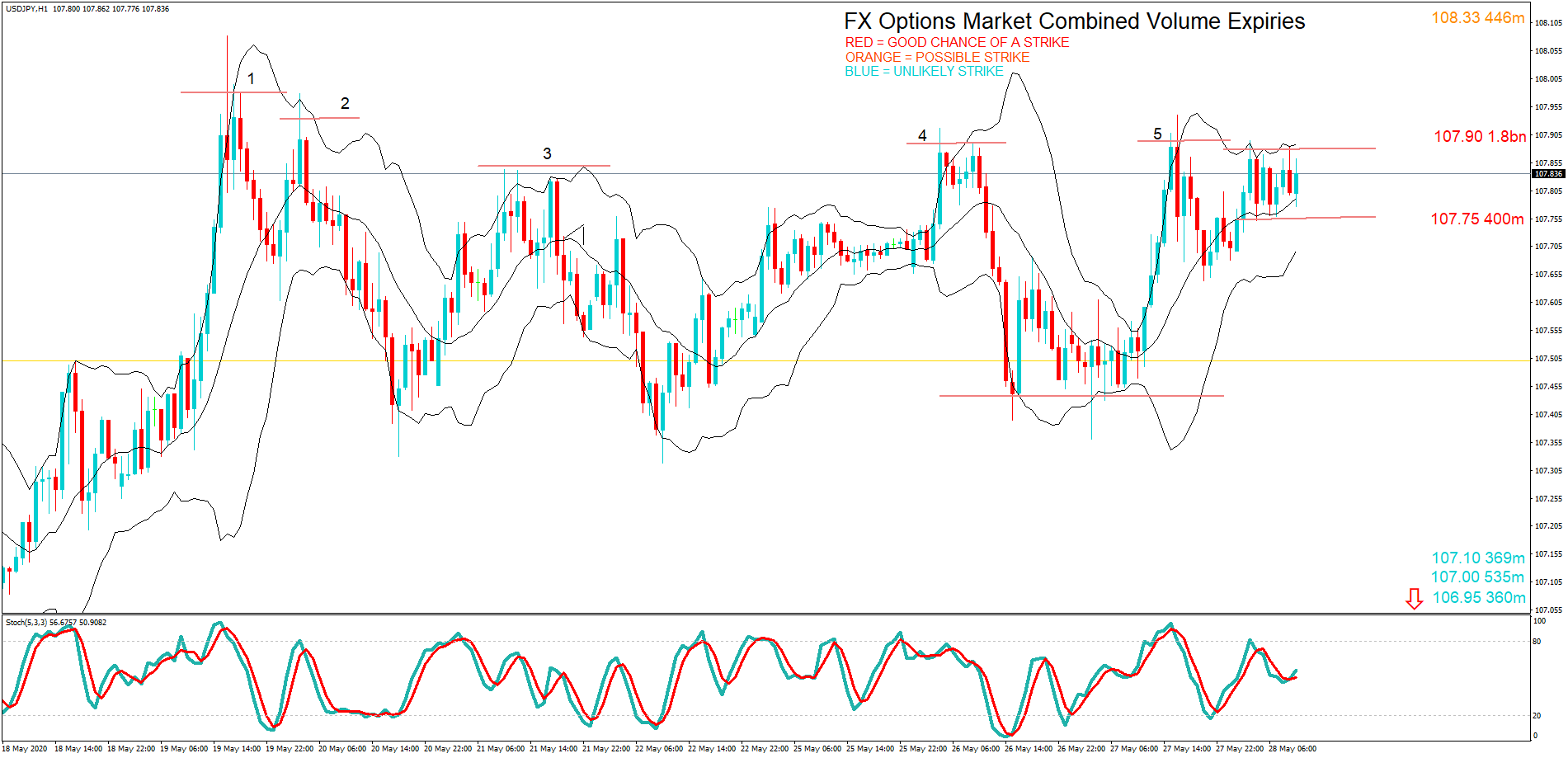

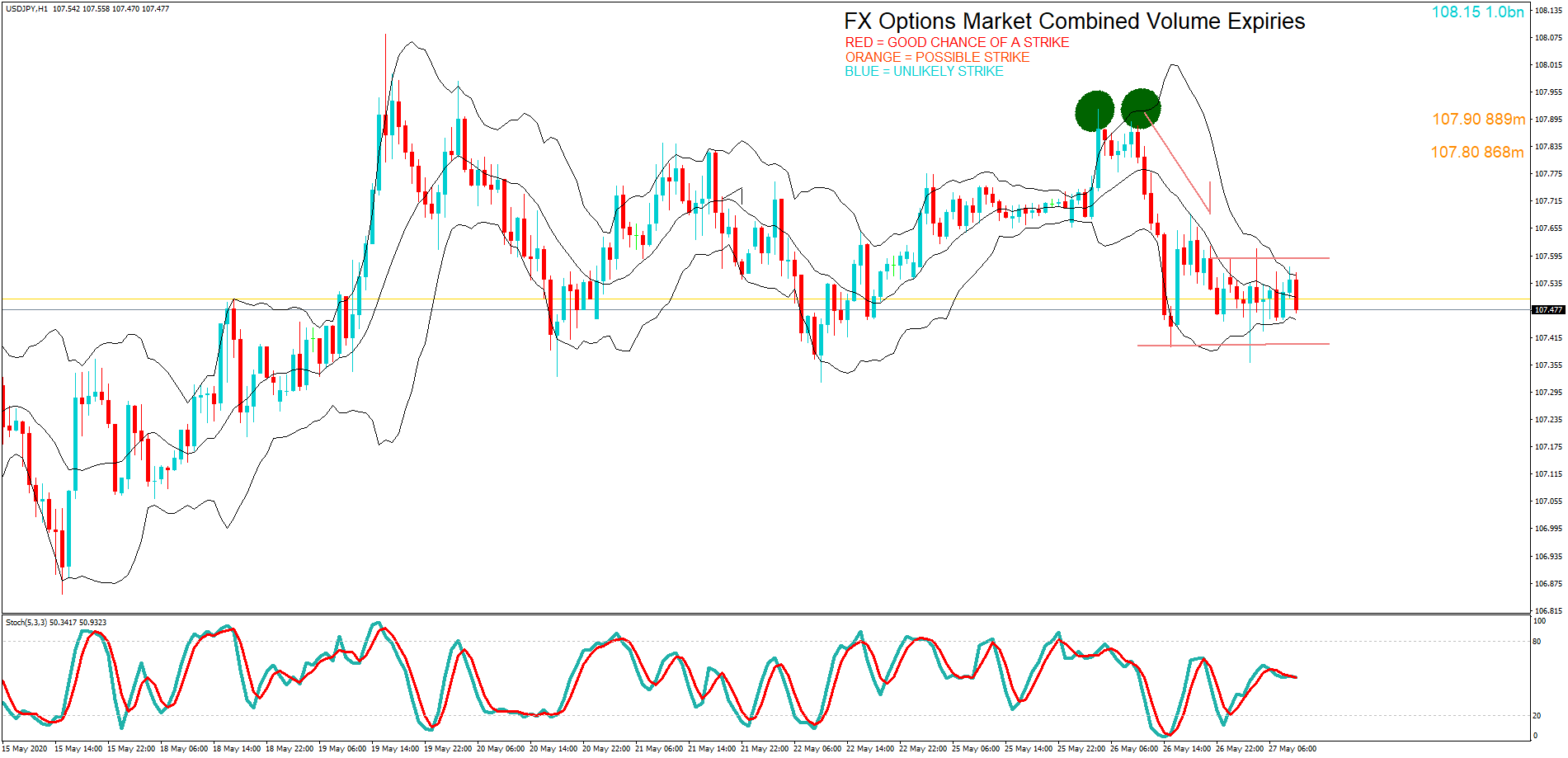

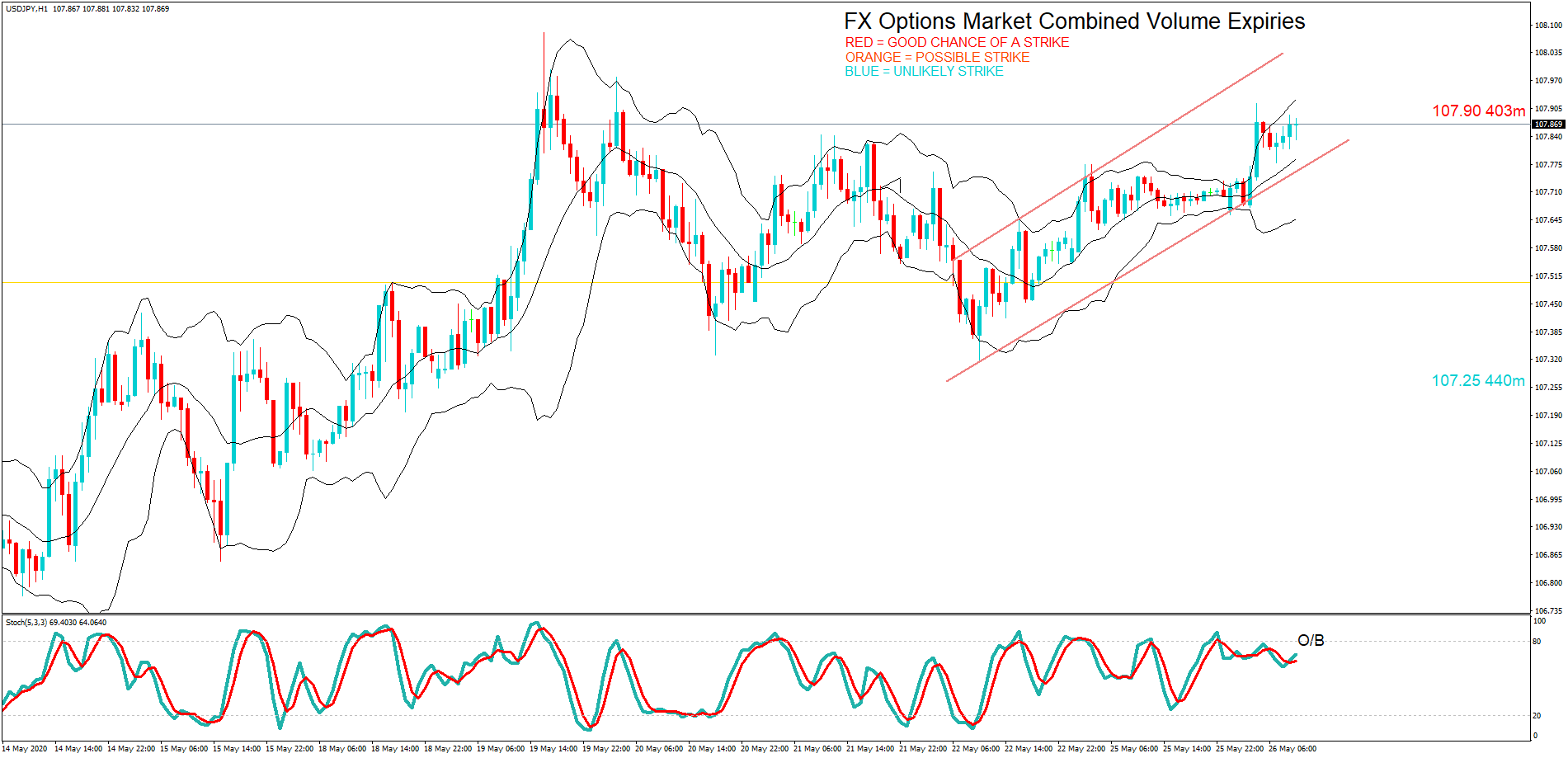

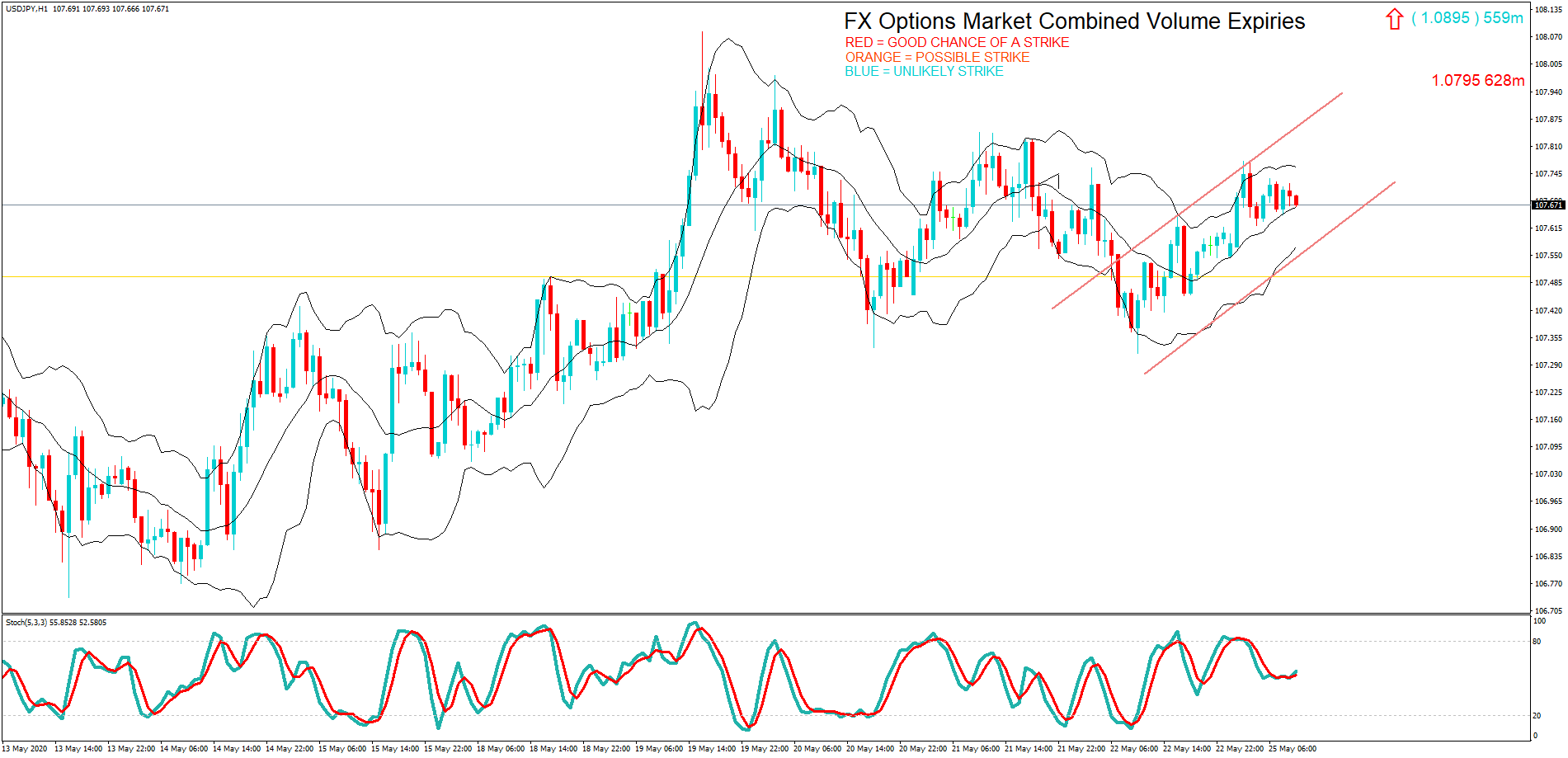

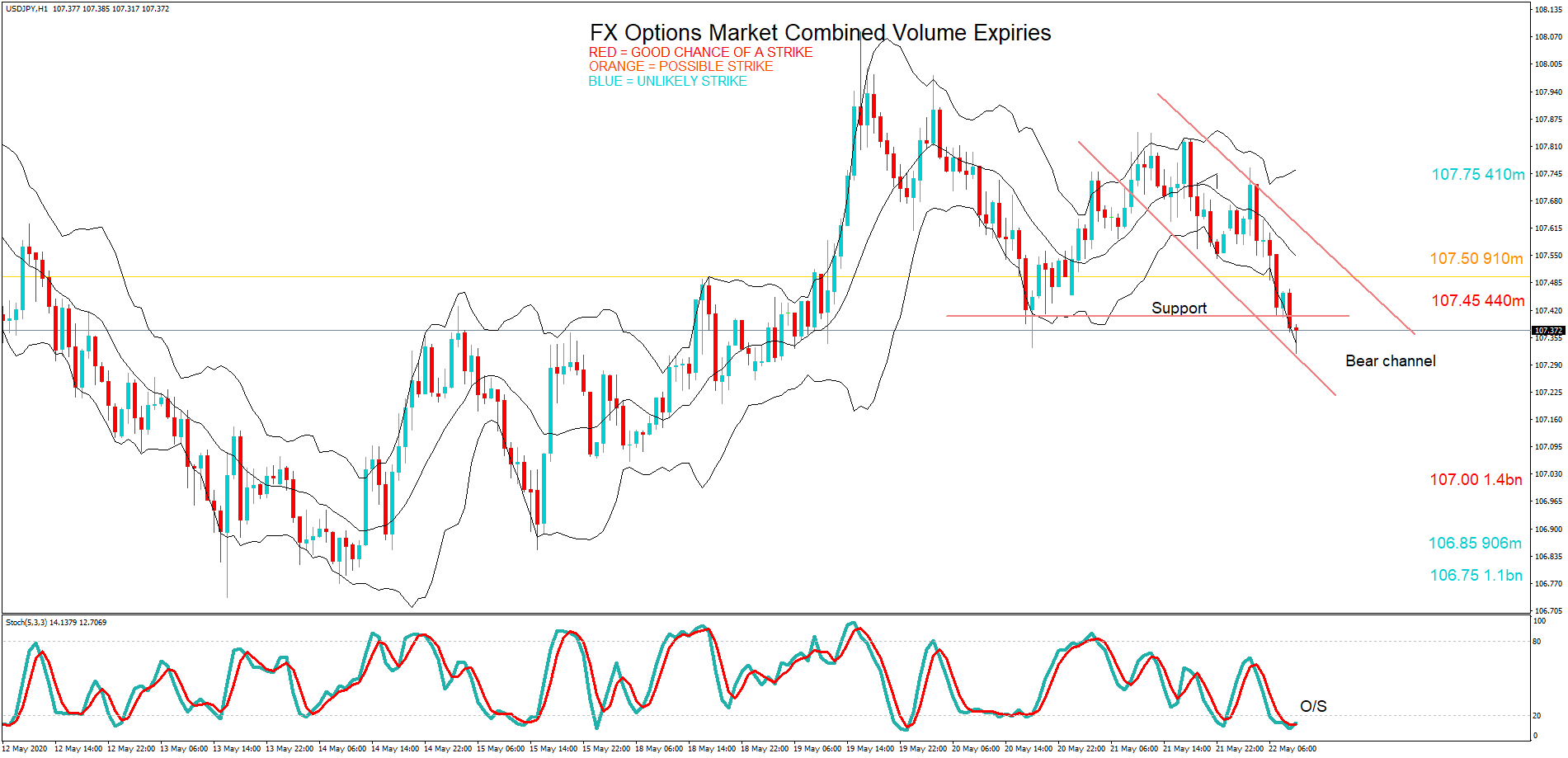

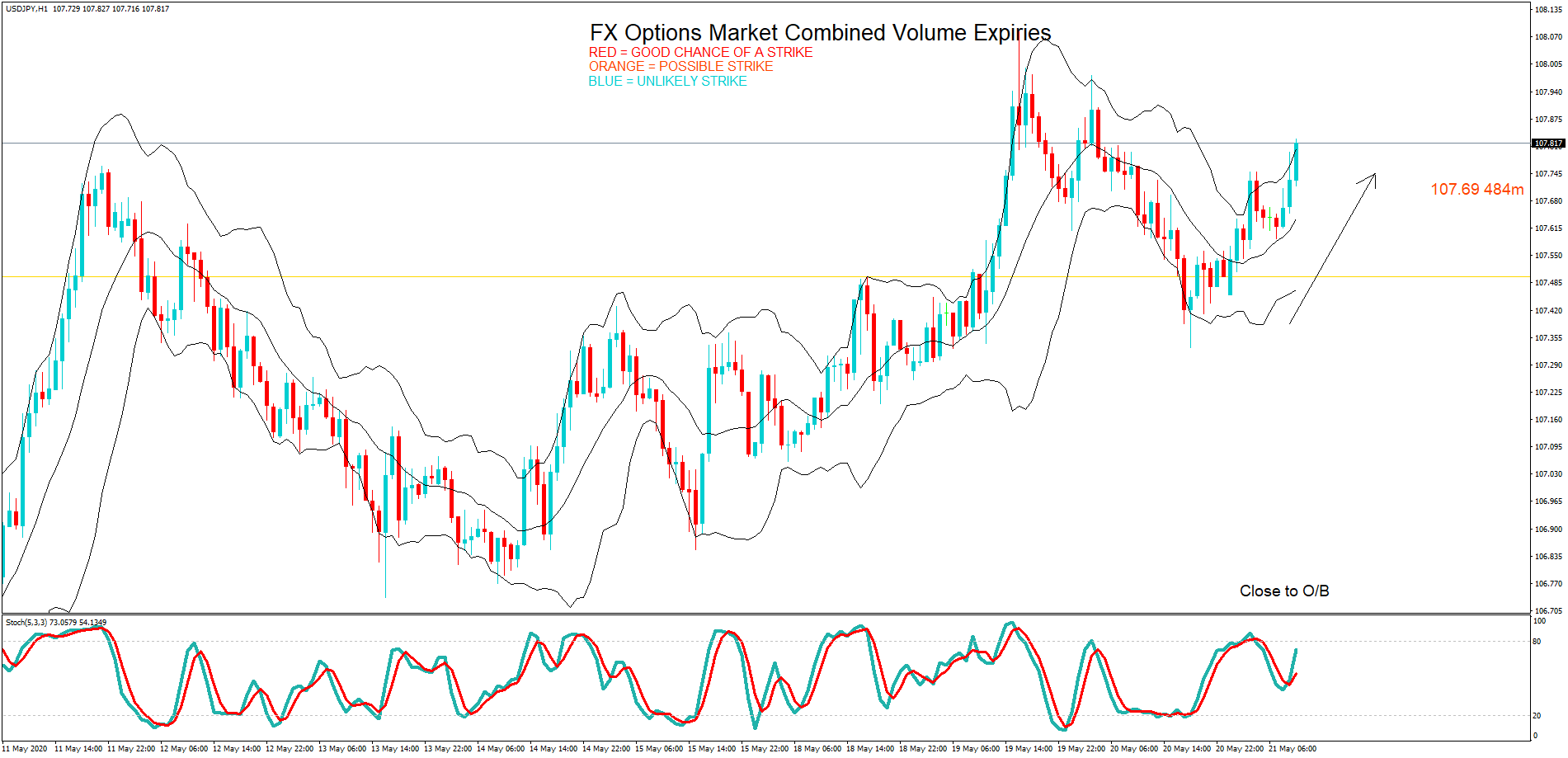

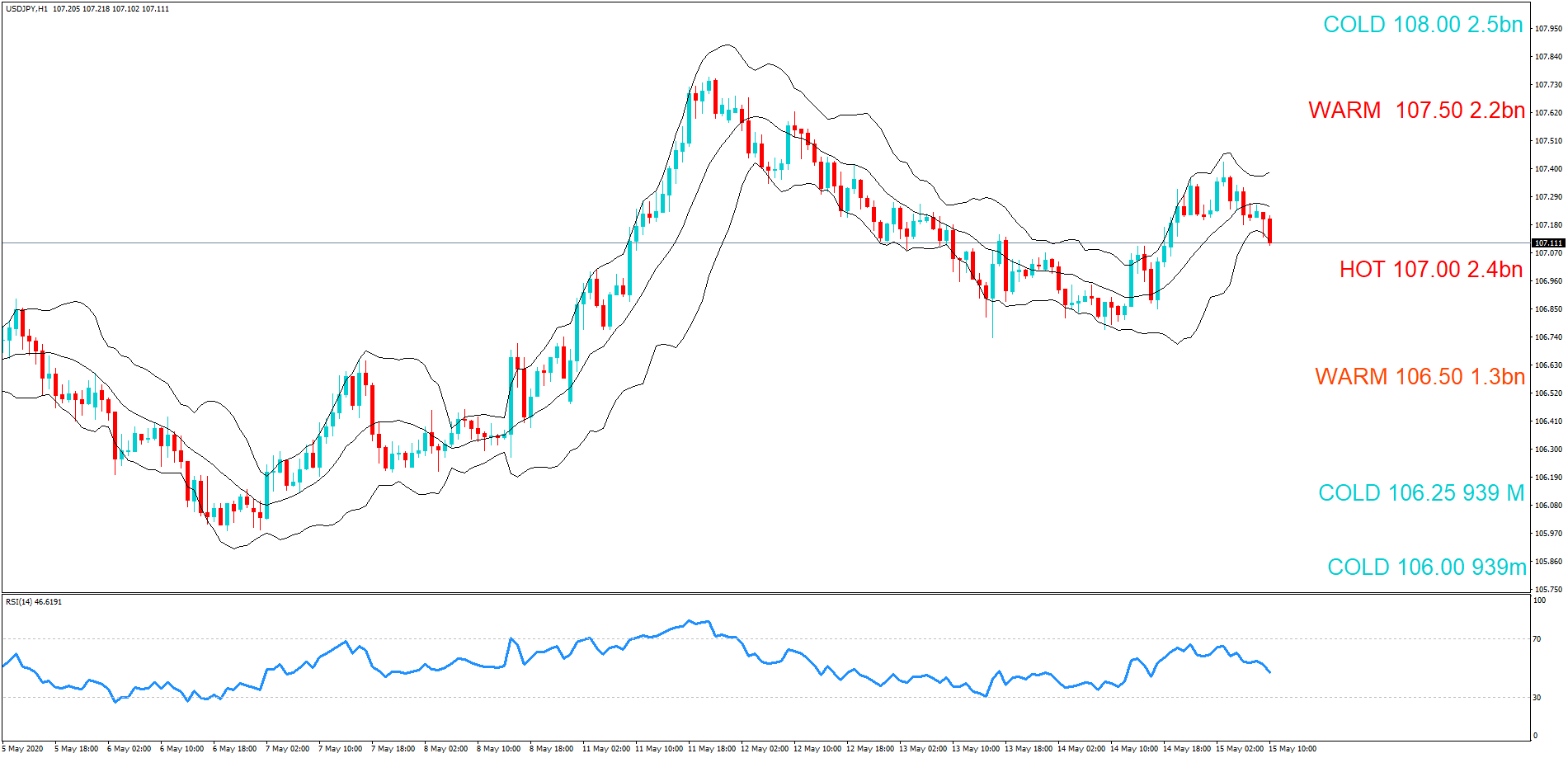

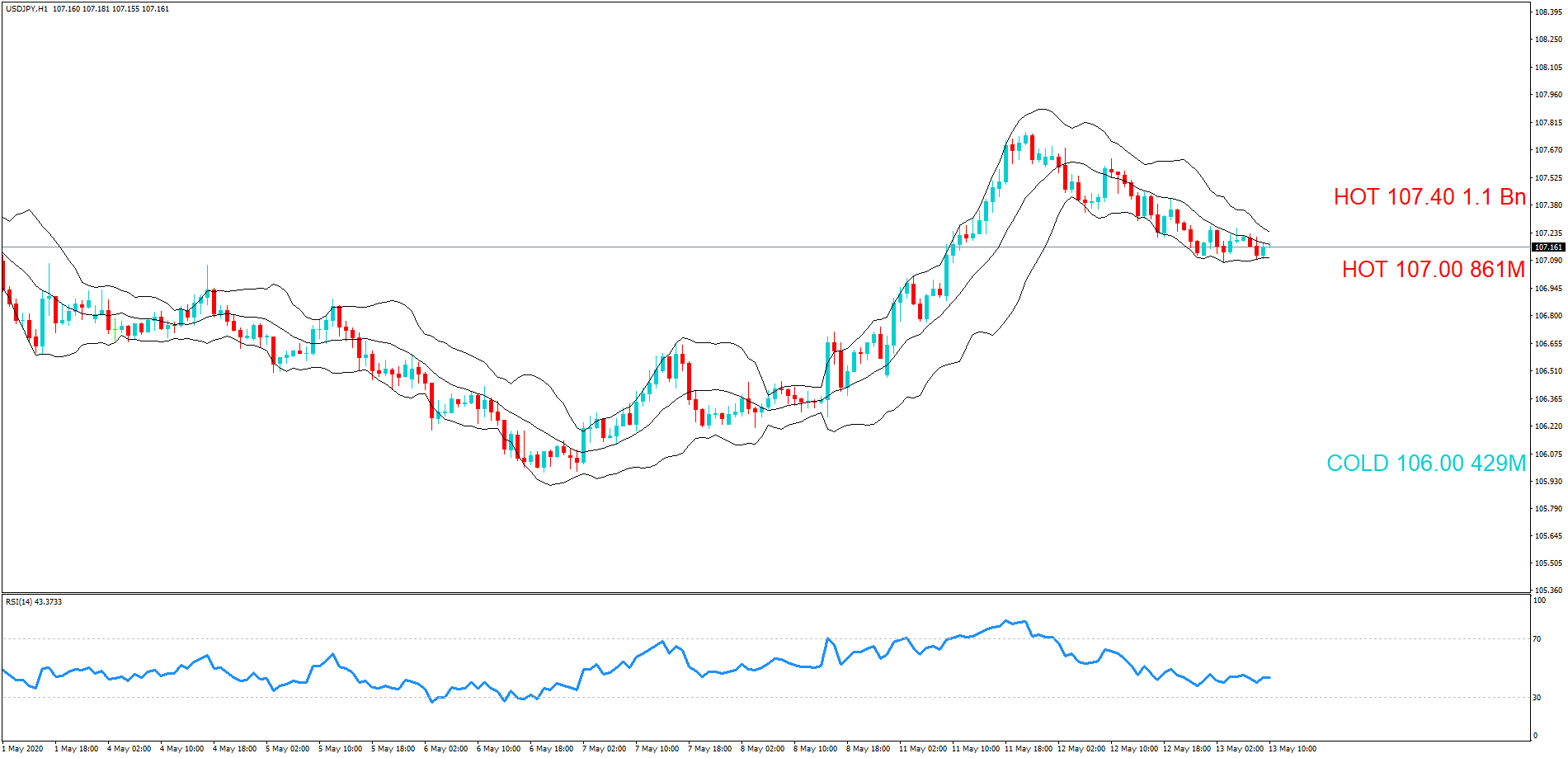

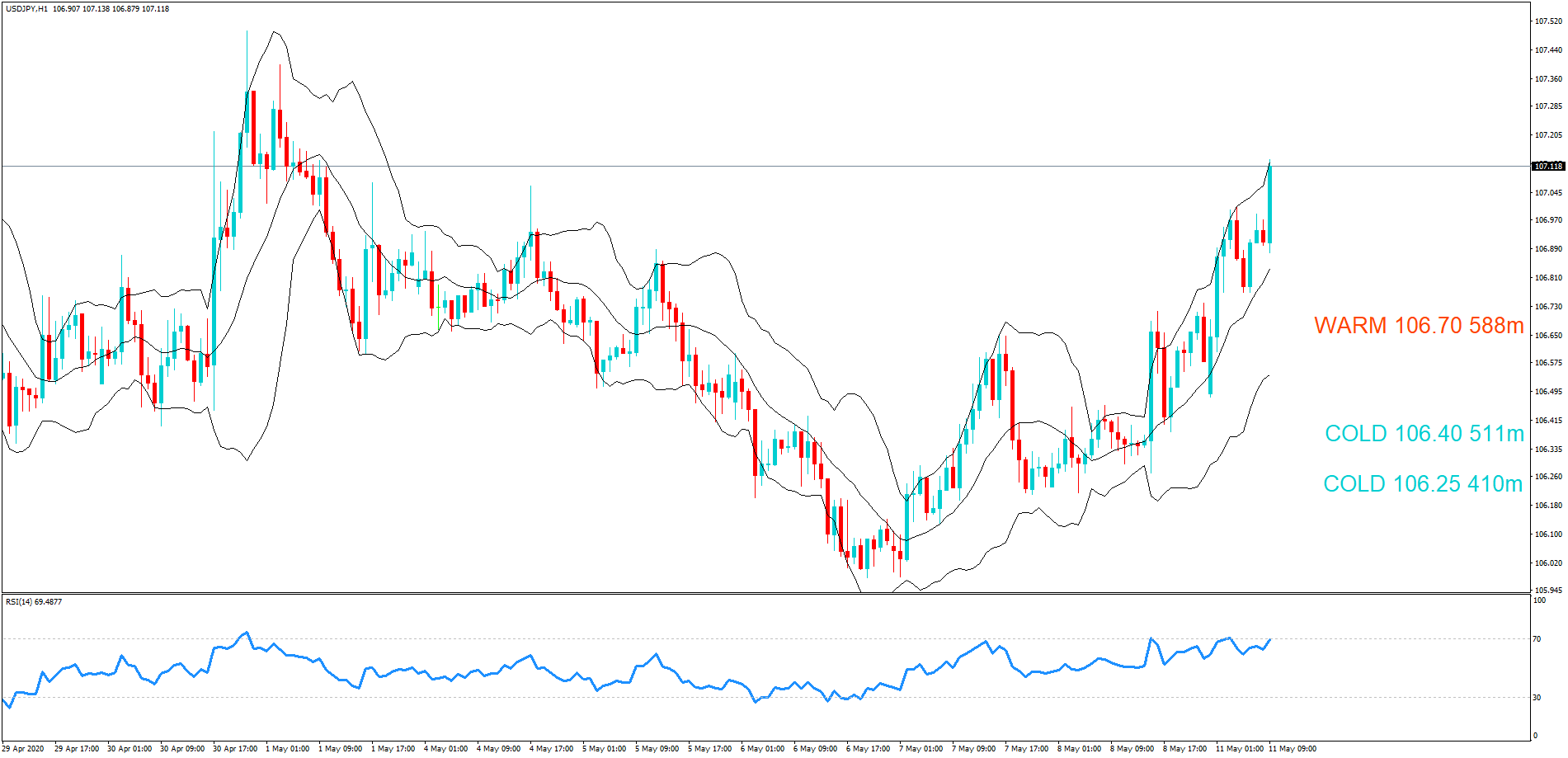

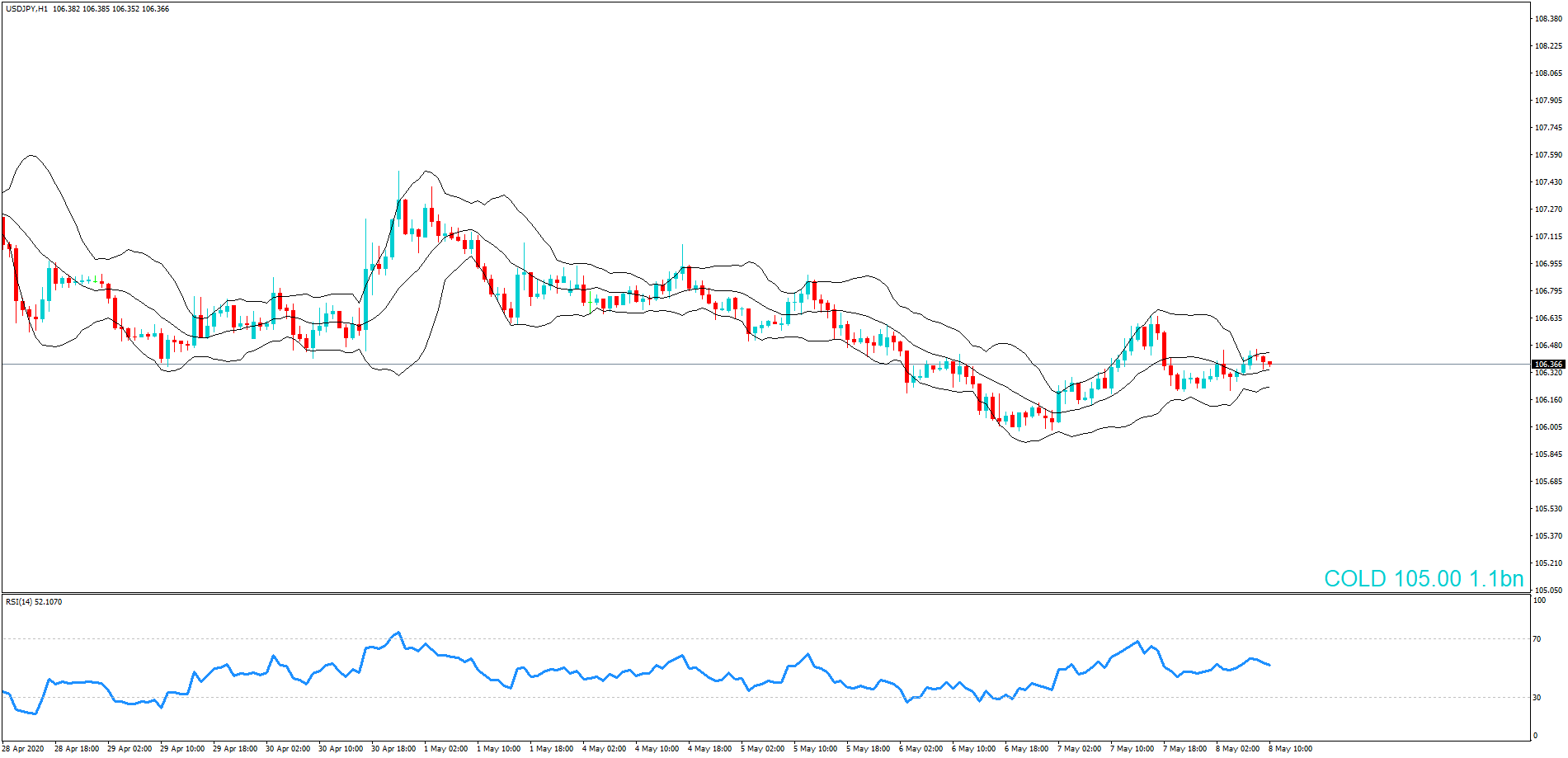

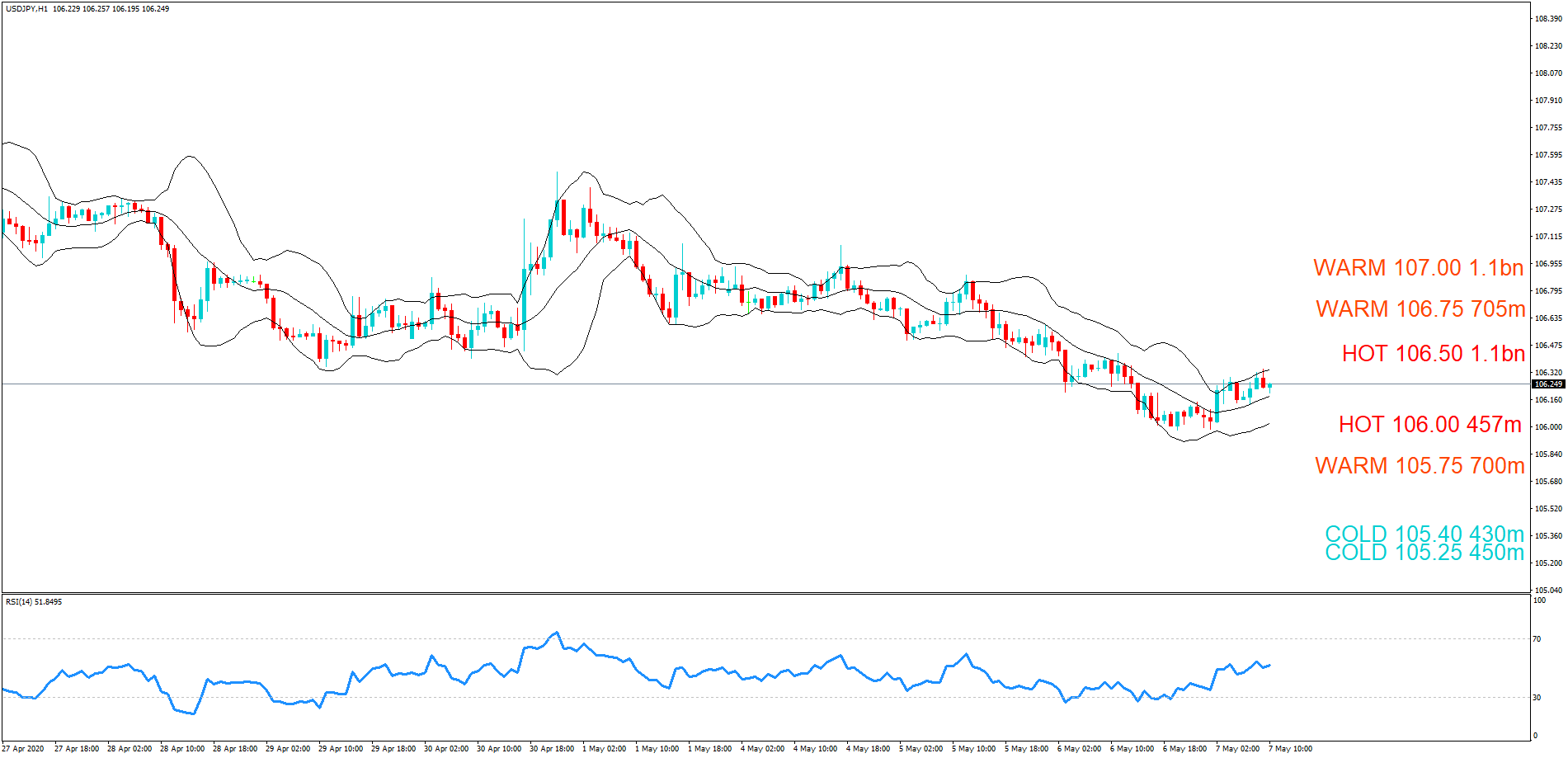

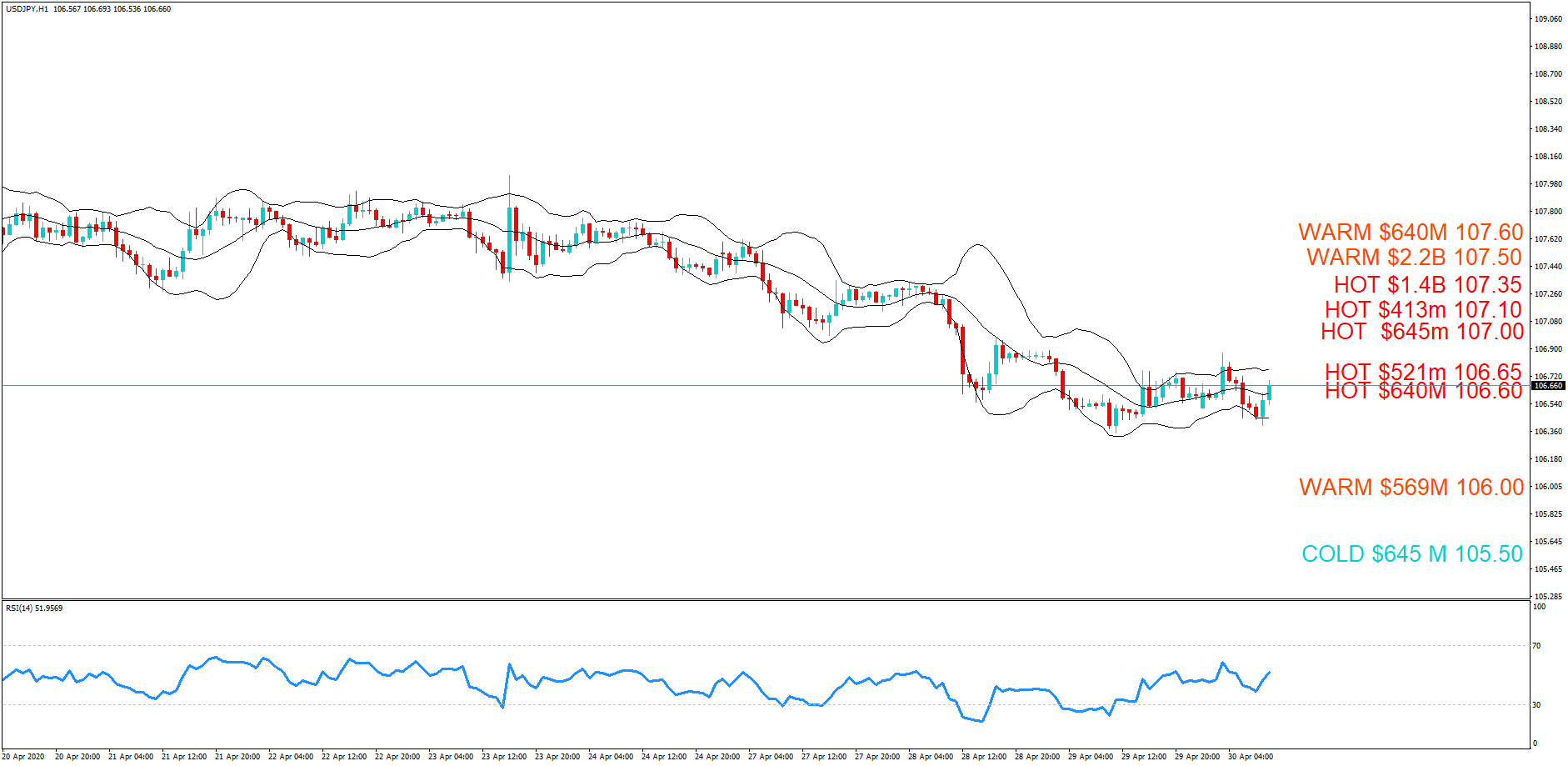

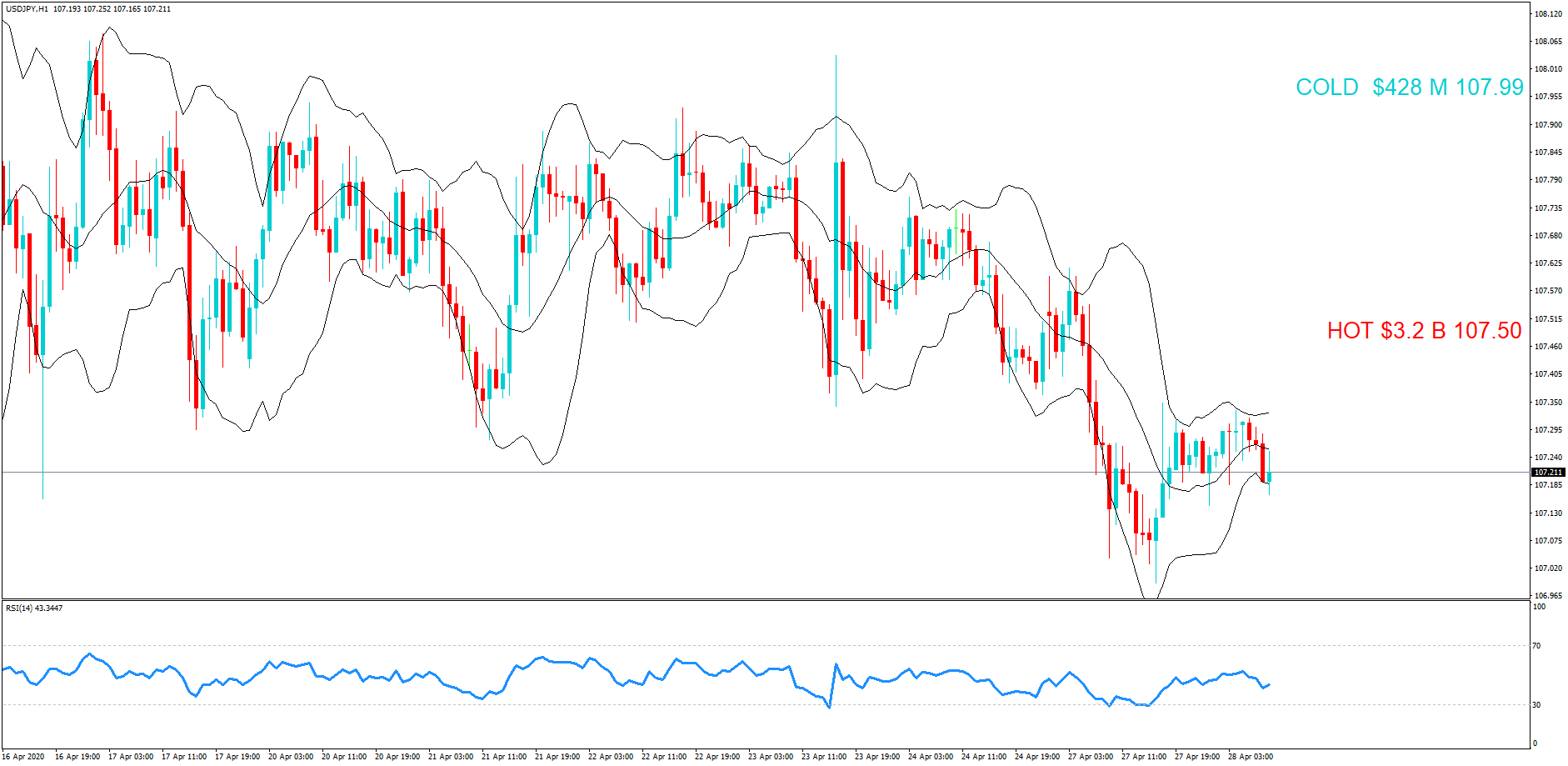

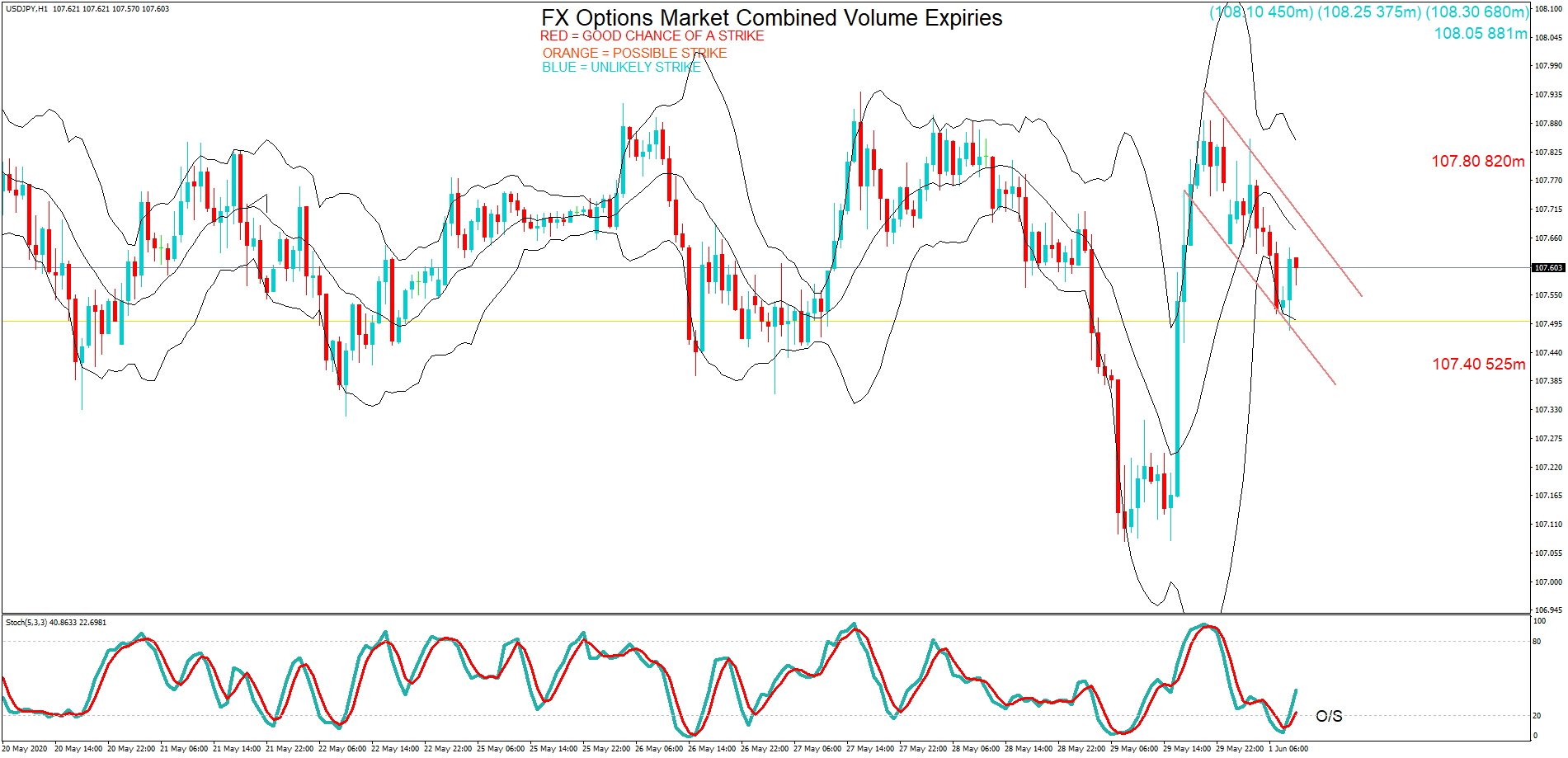

– USD/JPY: USD amounts

- 107.40 525m

- 107.80 820m

- 108.05 881m

- 108.10 450m

- 108.25 375m

- 108.30 680m

USDJPY pair is in a bear channel but oversold on our one hour chart. The 107.40 maturity looks to be the most likely candidate for a strike. Look out for US PMI data later.

………………………………………………………………………………………………………………………..

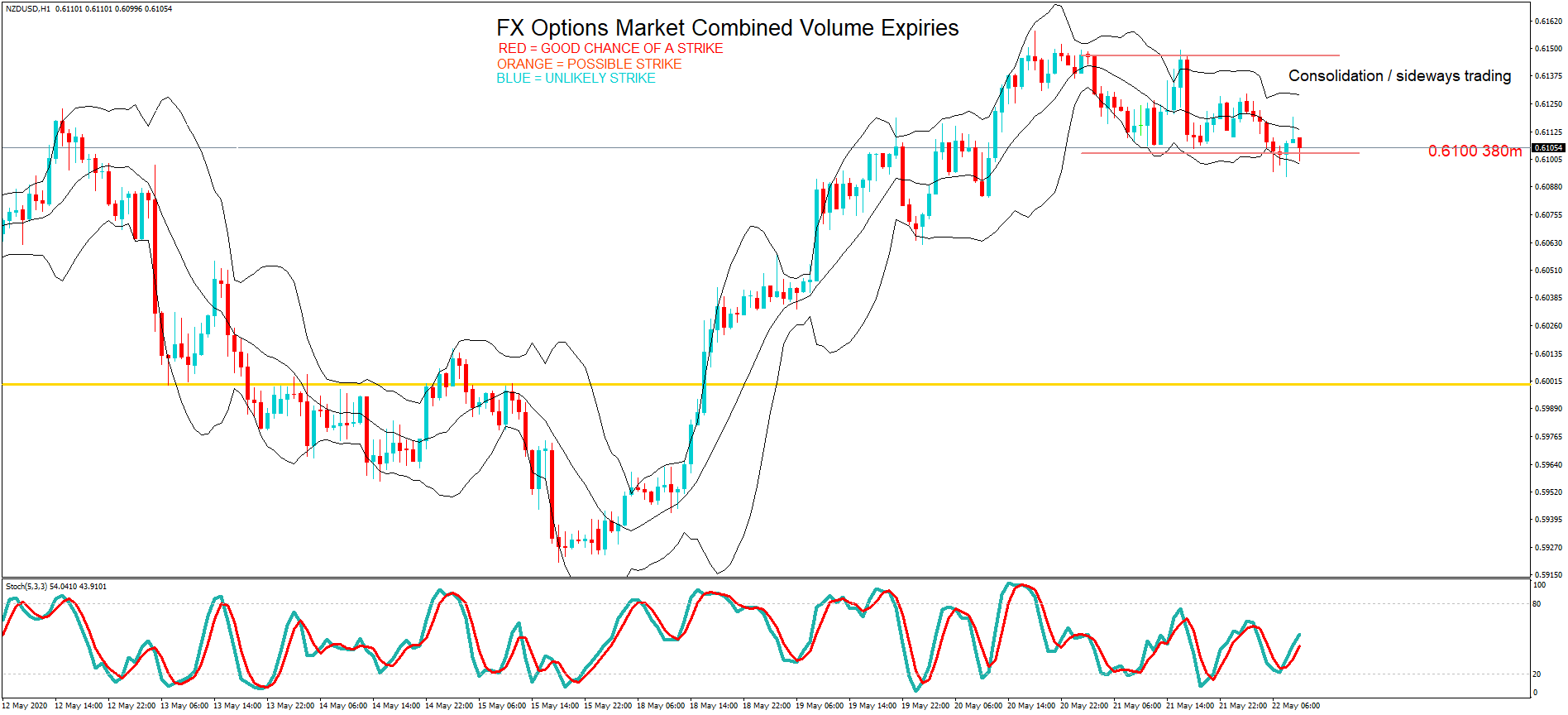

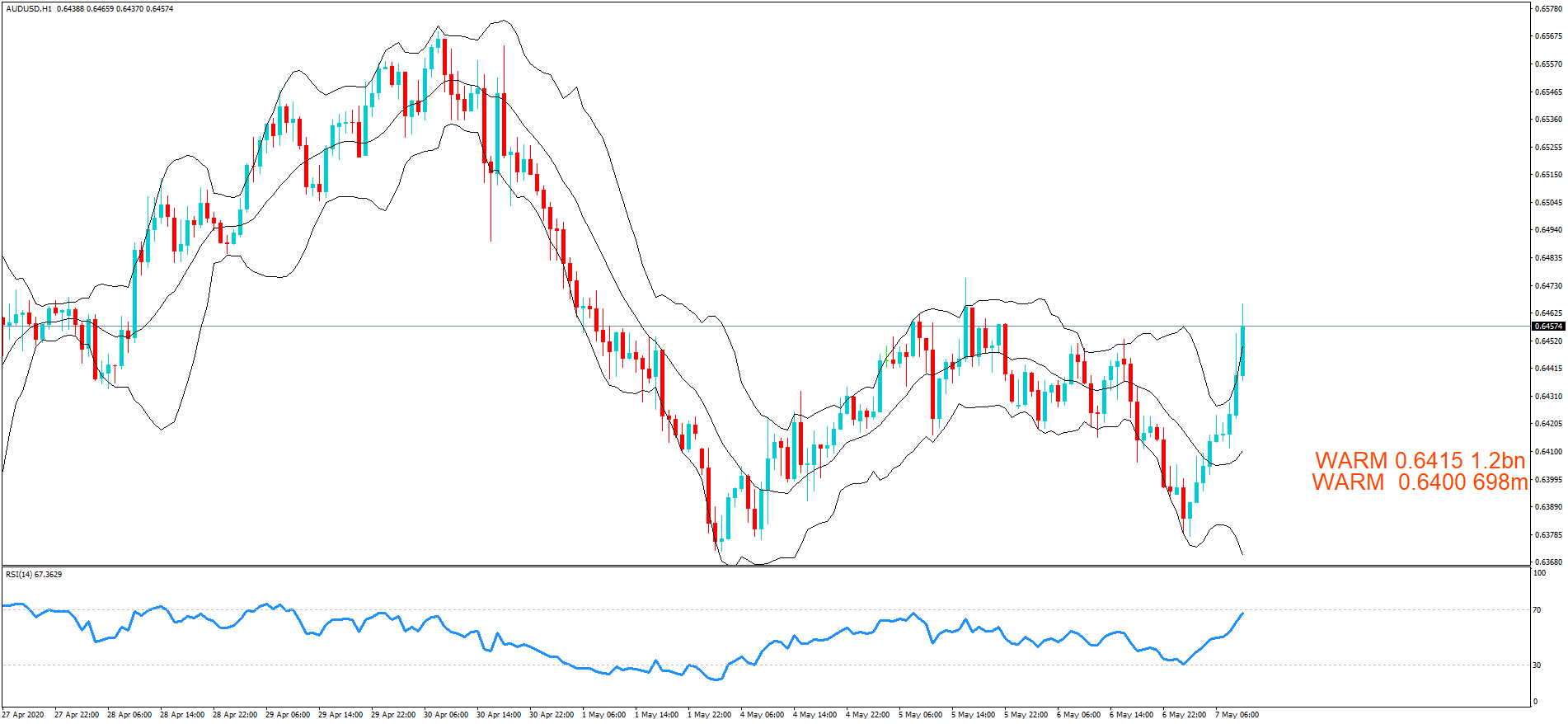

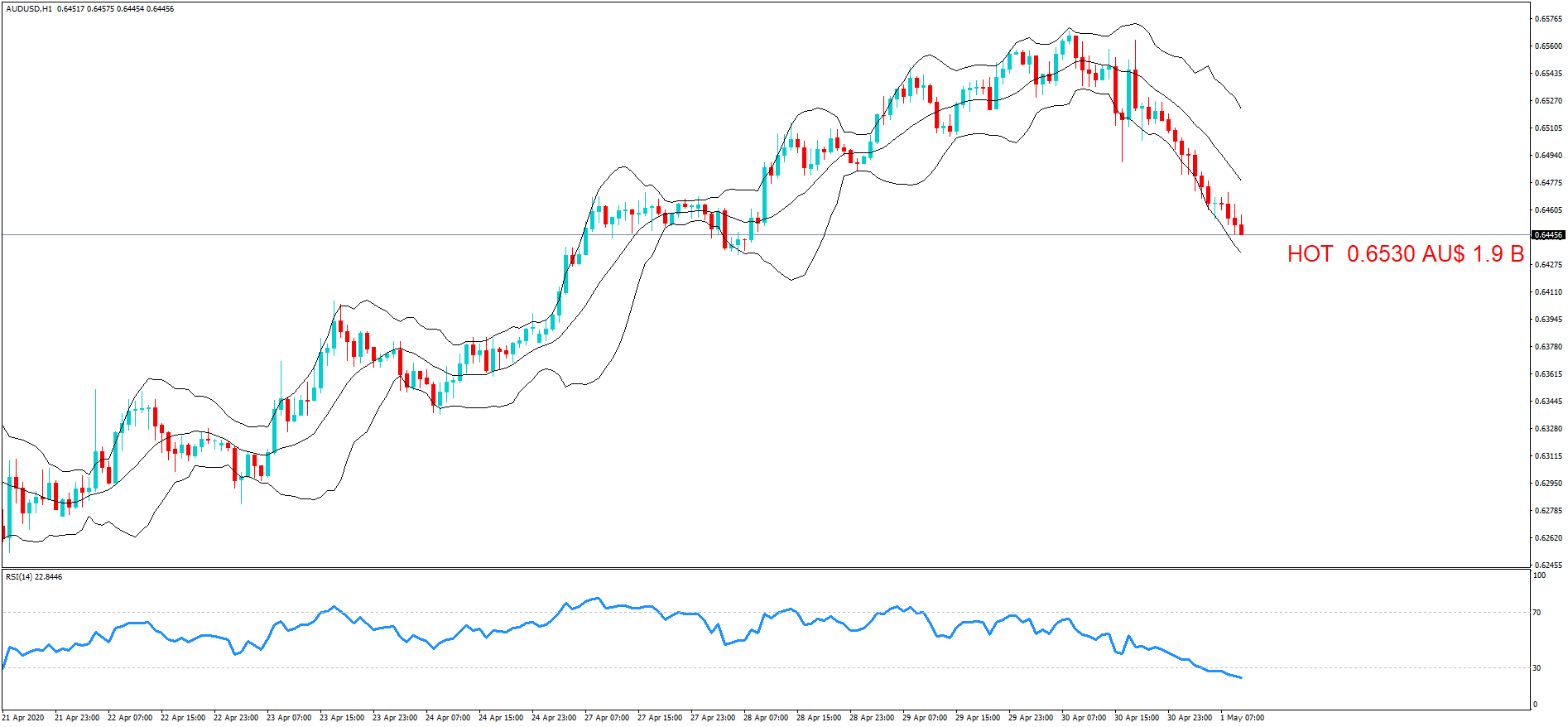

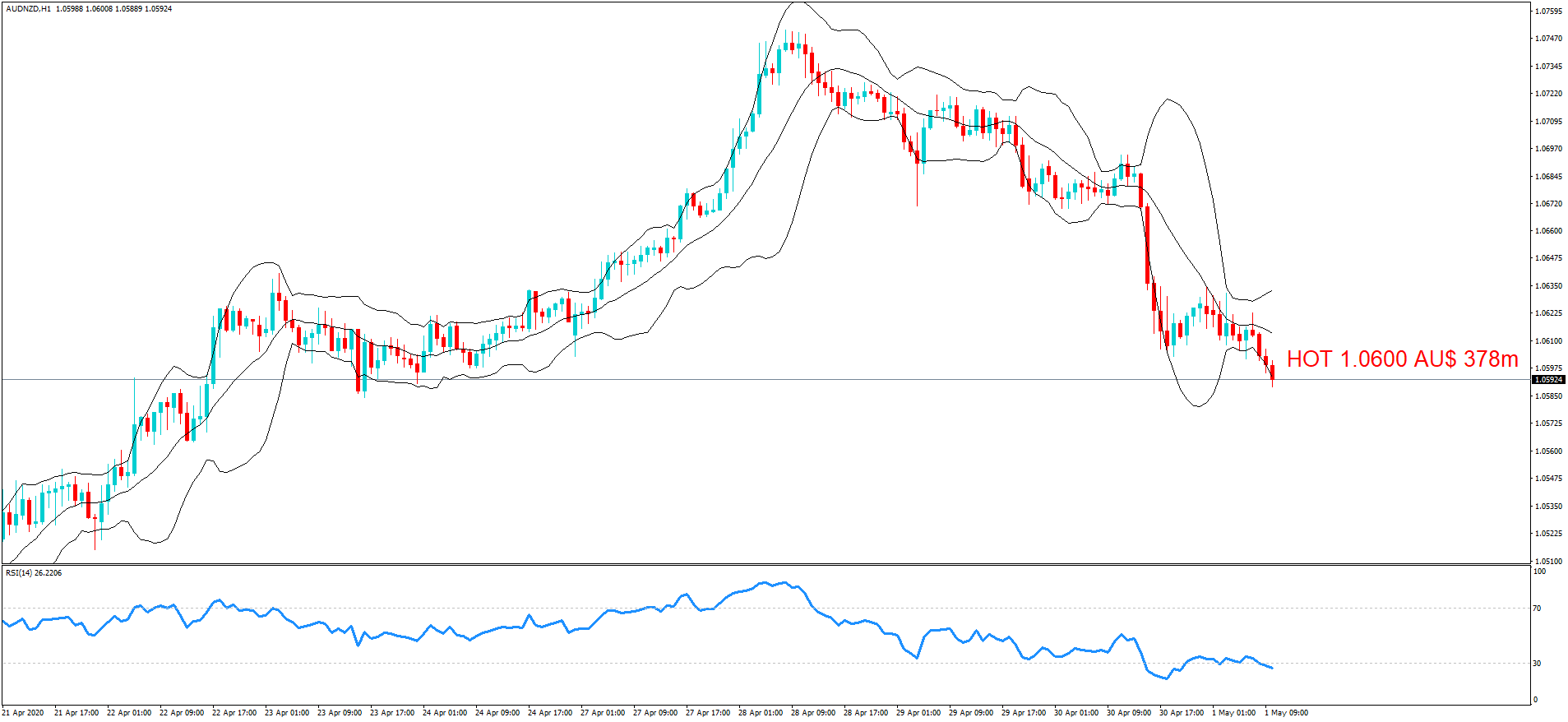

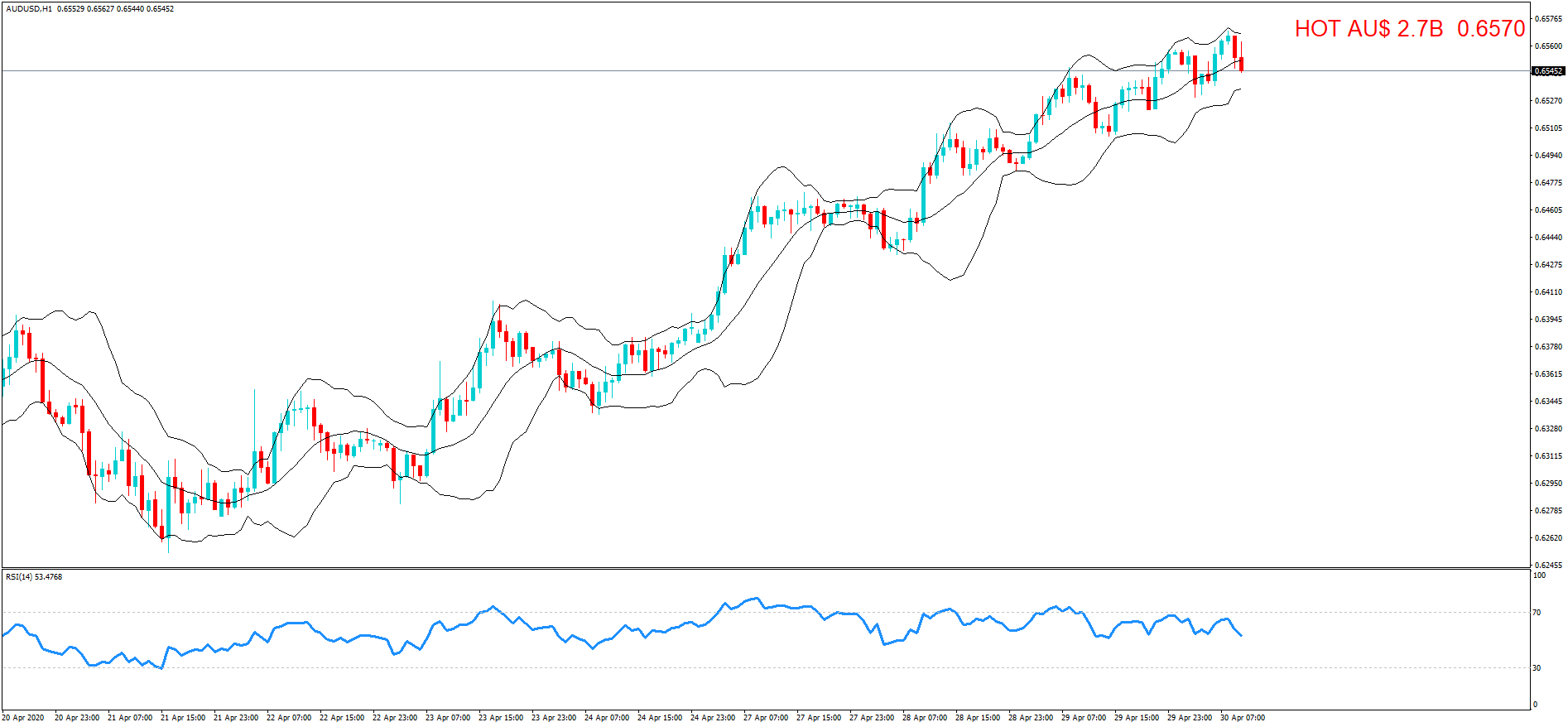

As you can see on the charts we have also plotted the expiration levels at the various exchange rate maturities and we have also labelled in red, orange and blue. Therefore, if you see option expiry exchange rates labelled in red these should be considered in-play, because we believe there is a greater chance of the expiry maturing at these levels based on technical analysis at the time of writing. There is still a lesser possibility of a strike if they are in orange and so these are ‘in-play’ too. However, if we have labelled them in blue, they should be considered ‘not in-play’ and therefore price action would be unlikely to reach these levels, which are often referred to as Strikes, at the time of the 10 AM New York cut.

Our technical analysis is based on exchange rates which may be several hours earlier in the day and may not reflect price action at the time of the maturities. Also, we have not factored in economic data releases or keynote speeches by policymakers, or potential market volatility leading up to the cut.

Although we have added some technical analysis we suggest you take the levels and plot them onto your own trading charts and incorporate the information into your own trading methodology in order to use the information to your advantage.

Remember the higher the amount, the larger the gravitational pull towards the exchange rate maturity at 10:00 AM Eastern time.

If you want to learn how forex option expiries affect price action in the spot FX market see our educational article by clicking here: https://bit.ly/2VR2Nji

DISCLAIMER: Please note that this information is for educational purposes. Also, the maturities will look more or less likely to become a strike at 10 AM NY time due to exchange rate fluctuations resulting in a different perspective with regard to technical analysis, and also due to upcoming economic data releases for the associated pairs.