Nessfx is a forex and CFD broker on indices, commodities, and metals, offering pure NDD execution on two different trading platforms, MT4 and Sirix. The broker’s Non-Dealing Desk (NDD) or no trading table, offer access to the interbank market without passing orders through a trading table as in the case of a Market Maker. In this NESSfx review, we’ll find out exactly what this broker has to offer so that you can decide if they are a good fit for you.

With the real NDD brokers, there are no recotizations in the orders and no additional pause during the confirmation of the order. This particular feature allows the performance of transactions without any type of transaction at the time when important market news is made known. NDD brokers earn their earnings either by collecting a transaction fee (based on trading volume) or by increasing the spread over quotations, in which case Forex transactions are free of commissions.

The trademark was initially operated by Lionsman Capital Markets Ltd. (currently working the binary options brand Optionweb ); however, the company waived its CIF license and obviously sold its business to Fxnet Ltd. The latter is a Cyprus investment firm, licensed by Cyprus Securities and the Exchange Commission (Cysec), and also operates the Fxnet and Rynki brokers.

Licensed Cysec brokers must have at least €730,000 to prove their financial solvency, and keep client funds in segregated accounts, as well as report to the Commission regularly, and also meet many other requirements. However, in exchange, they are allowed to operate throughout the EU under the MIFID rules and are covered by an insolvency clearing system so that they can secure their client funds (up to €20,000). Also, Nessfx claims to offer its customers negative balance protection.

The broker’s website is available in the following languages: English, Spanish, Polish, French, German, Italian, Bulgarian, and Czechoslovak.

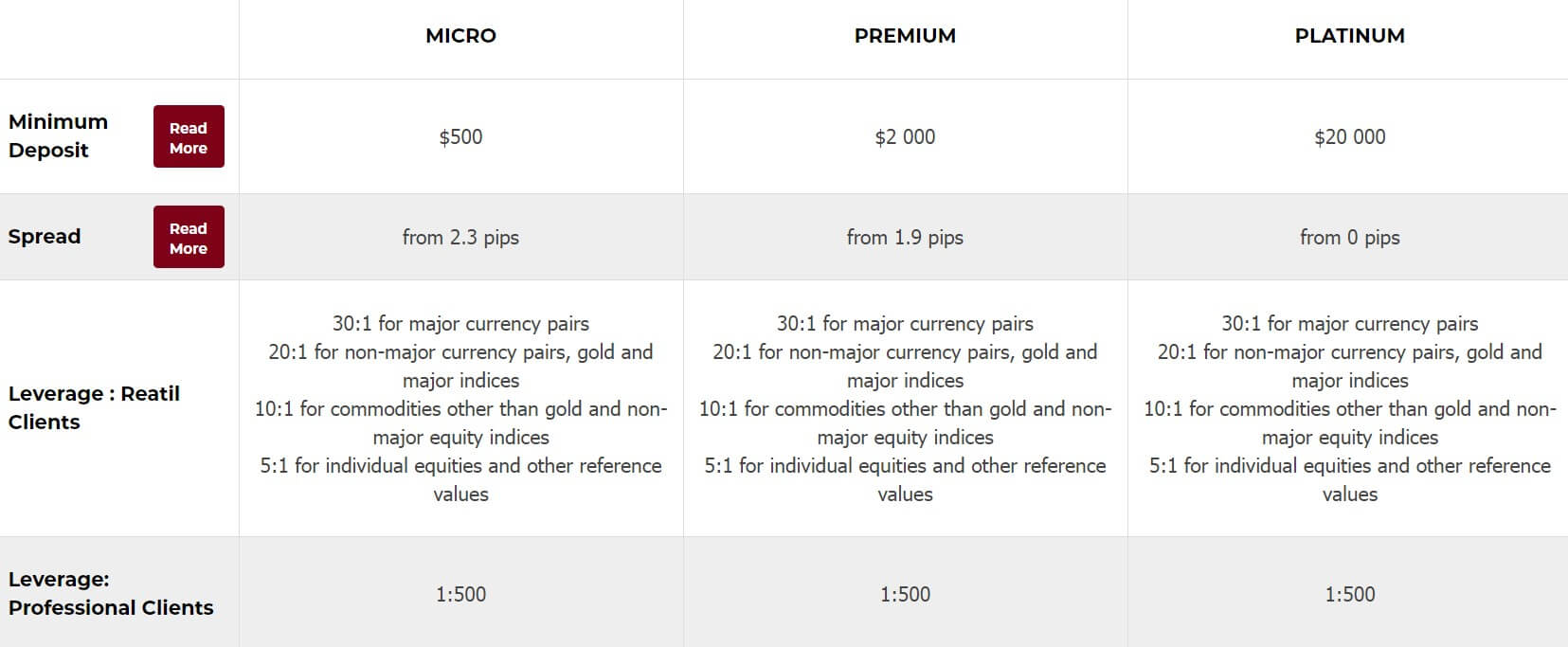

ACCOUNT TYPES

As you can see, Nessfx offers its customers 3 options of account types, depending on the minimum deposit. With this broker, customers can choose between two trading platforms: Sirix and Metatrader 4, fixed or variable spreads, and benefit from their pure execution of NDD and in addition to the exemption of commissions for trading in Micro and Premium accounts (the platinum account does have commissions).

Premium account holders are offered tighter spreads, an individual trading coach, and accelerated withdrawal processing within 48 business hours, while Platinum can get guaranteed automatic withdrawals.

The broker offers the possibility of opening Islamic accounts. Only the Micro account can become Islamic, and a holder cannot be a holder of Islamic accounts and standard accounts. Remember that Islamic accounts are exempt from the cost of Swap, this is to comply with Sharia law.

PLATFORMS

Nessfx is compatible with the Metatrader4 trading platform (MT4), available both in its desktop version for Windows and Mac and in mobile versions for use on smartphones and tablets. The broker also offers the Sirix platform as an alternative, although we like the MT4 much better.

Nessfx is compatible with the Metatrader4 trading platform (MT4), available both in its desktop version for Windows and Mac and in mobile versions for use on smartphones and tablets. The broker also offers the Sirix platform as an alternative, although we like the MT4 much better.

NESSfx allows you to access global financial markets through the ever-popular Metatrader4 (MT4). This is a reliable option as it offers incredible potential for advanced graphics, a lot of custom technical indicators, which can be found, tested, and purchased on the MQL market. Also. There are automated trading systems, called expert advisors (Eas).

The Sirix platform is equipped with advanced integrated indicators and advanced graphics options. Charts can be displayed in several time periods, and traders can add their own lines, measurements, and annotations. It also allows users to view and copy trades from other traders. Sirix available with this broker desktop version for computers, a web version, and mobile versions for smartphones and tablets.

Besides, some additional services, such as forex signals and social trading are also available with Nessfx.

LEVERAGE

Leverage will be different depending on the asset traded. This is the detail of the leverages offered by Nessfx:

- 30:1 for major currency pairs.

- 20:1 for non-main currency pairs, gold, and major stock indices.

- 10:1 for non-gold commodities and non-main stock indices.

- 5:1 for individual equity securities (stocks).

- The broker offers professional traders maximum leverage of up to 500:1.

This broker uses the leverage recommended by the ESMA. Remember that high leverage offers opportunities to make big profits with a relatively small deposit. However, we recommend traders to be careful when using it, as increased leverage also implies a higher risk of losses, which may even exceed the initial investment.

TRADE SIZES

Trade sizes are different depending on the account. For the micro account, you can trade with trade sizes of 0.01 lots (micro lot), but in the Premium and Platinum accounts, the minimum trade size is 0.10 lost (mini lot).

TRADING COSTS

The trading costs in the micro and premium accounts are basically determined by the spread since these accounts have no trading fees. The platinum account has the lowest spreads, but it does have a trading fee that we haven’t been able to find out for lack of information.

Another expense to consider is the Swap, a cost that you will have with all the brokers unless you have an Islamic account that lacks them. The Swap is any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

The cost of the swap is not considered in the Islamic accounts as they are designed to comply with Sharia law.

ASSETS

Below are some of the assets available to trade:

Forex: EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD, USD/CHF, EUR/GBP, EUR/CHF, NZD/USD, EUR/JPY, GBP/JPY, EUR/AUD, EUR/CAD, EUR/NZD, and many more.

Metals: XAG USD, XAU USD, XPD USD, XPT USD, and Copper.

Commodities: BRT USD, NGAS, USOil1000, Cocoa, Corn, Cotton, Sugar, Coffee, and Wheat.

Indices: Amsterdam 25, CAC 40, China 50, DAX 30, DOW 30, DXY, EURSTOXX 50, FTSE 100, Italy 40, MICEX 50, NAS 100, NIKKEI 225, Spain 35, SPX 500, VIXX, and WIG20.

SPREADS

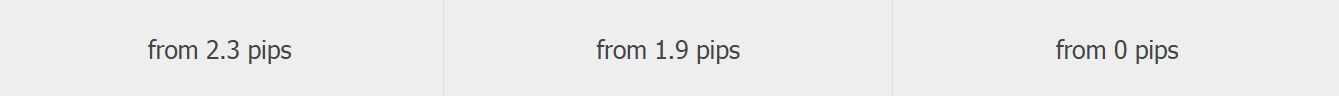

NessFx does offer different spreads in conjunction with different account types. These are shown below.

Nessfx offers to trade without commissions on two of its accounts (micro account and premium account); however, their spreads are high, as they amount to 2.3 pips and 1.9 pips in EUR / USD, respectively.

In fact, the best spreads offered by this broker are in the Platinum account, but to access this account you need an initial minimum deposit of 20,000 USD, an amount within reach of very few. Also, in the platinum account, the broker charges a commission for each lot traded, although that data is not reported on the website, and we have not been able to find out.

For comparison purposes, the average spreads of most brokers in the accounts without commissions amount to 1.2 pips in EUR/USD, while those of the account type without spread, with an average of 0.6 pips in EUR/USD, involve a commission of USD 5 per standard lot traded.

MINIMUM DEPOSIT

To open an account with Nessfx, traders must invest a minimum of $500 by opening a micro account. Such a minimum initial quantity is considered to be a little high compared to the average of the industry. Other brokers based in Cyprus can be found, which require a significantly lower initial deposit and similar commercial terms.

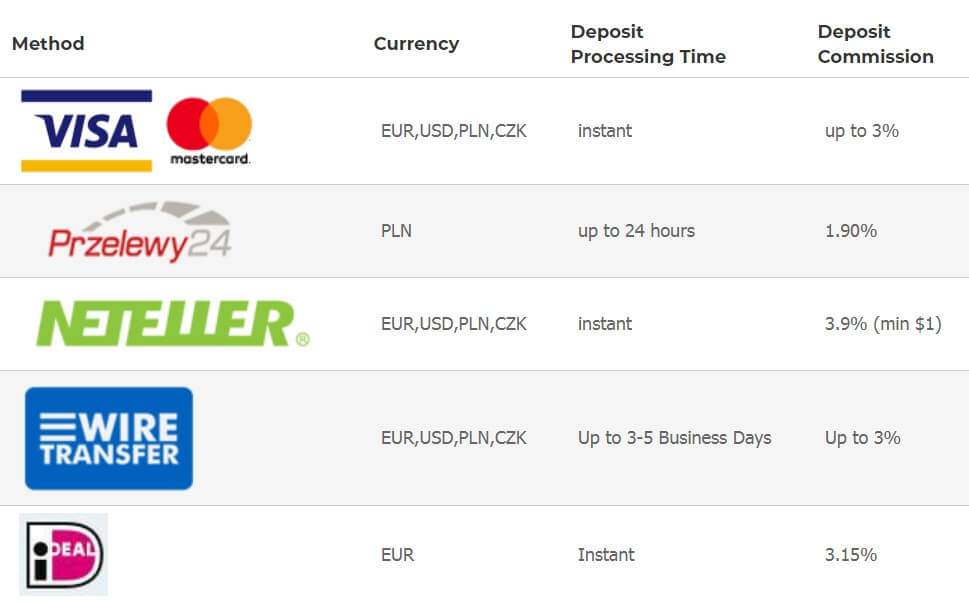

DEPOSIT METHODS & COSTS

Nessfx offers its customers a wide variety of deposit methods. Here is a table with the available methods, accepted currencies, waiting times, and associated costs:

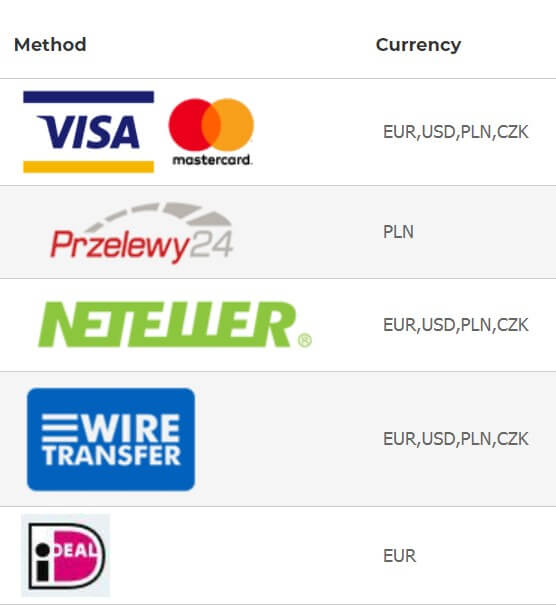

WITHDRAWAL METHODS & COSTS & WAIT TIME

Same methods we have for deposits for withdrawals. Here is the table with the waiting times and the costs of making a withdrawal depending on the method used:

BONUSES & PROMOTIONS

We have not found any bonuses or promotions available with this broker at present. Nor have we found on the Nessfx website that they have an affiliate program or Introducing Broker (IB).

EDUCATIONAL & TRADING TOOLS

Nessfx has a section where it has a F.A.Q. on trading, which is like a kind of glossary with the most basic terms that every trader should know. It doesn’t seem a little basic but it’s the correct content.

As tools of interest to the trader, in the same section, the broker offers an economic calendar, which we always say is a fundamental tool for every trader as it reports the most important daily events and which can affect the assets we are trading.

CUSTOMER SERVICE

To contact Nessfx customer service we have 4 possibilities, telephone, email, web contact form, and a live chat available from Monday to Friday during market hours. These are the contact details of this broker:

- Office: 4 Theklas Lysioti St, Harmony House, Office 31, 3rd Floor, 3030 Cyprus

- Email: [email protected]

- Phone: +357 25 022 870

DEMO ACCOUNT

A Demo account can benefit the trader in 2 ways:

– Practicing commercial techniques

– Learning the different tools of the platform.

It is widespread for traders to open a Demo account before depositing money into a real account. It is also essential to know that the Demo account retains the same live prices and market conditions, simulating the exposure in a real account.

Fortunately, Nessfx provides a free demo account to its customers. To obtain the demo account, we must fill out a form with our data, then we will receive an SMS with a pin code, and we from our customer area must configure the account to our liking in order to start trading with it with virtual money.

COUNTRIES ACCEPTED

This broker has geographical restrictions in a good number of countries, as reported in his legal documents. The list of countries that will not be able to open an account with Nessfx is Belgium, Turkey, Russia, Japan, Canada, British Columbia (Canada), Quebec (Canada), Saskatchewan (Canada), and the United States of America.

CONCLUSION

Nessfx is a well regulated Forex and CFDs broker. The trading conditions it offers are not the best on the market as the spreads offered are a little high. It has two trading platforms to choose from for its customers, such as the popular MT4 and Sirix.

The initial deposits required are high, even for the most basic account (500 USD), and to aspire to better spreads you have to make high disbursements, 2000 USD in the Premium account and 20,000 USD in the Platinum account. On the positive side, we have a variety of deposit methods available, and that the customer has the possibility to open a Demo account before depositing their actual funds into a live account.

To summarize the above, let’s show the advantages and disadvantages we have found in this broker:

Advantages

- Well regulated, licensed Cysec 182/12.

- Scope of payment methods.

- Has accounts without commissions

- Choice of platforms, MT4, or Sirix

- Forex signals and social trading available

Disadvantages

- High commissions on deposits and withdrawals

- High spreads