MXC Forex is an offshore broker founded in 2015. This broker offers assets to trade as Forex, Commodities, Metals, and Cryptocurrency, all through the famous MT4 platform. The broker claims to have client accounts segregated and separated from the broker’s management accounts, which if true gives us more confidence in MXC Forex.

The company behind the trademark MXC is MX CAPITAL FINANCIAL LIMITED, a company that is registered in Labuan, Malaysia (LL12478). The website reports that MX CAPITAL FINANCIAL LIMITED is regulated by the Labuan Financial Services Authority (LFSA). LFSA requires financial services companies to comply with certain capital requirements and procedures such as risk management, staff training, accounting, and auditing.

Let us not forget that Malaysia is a popular tax haven country and that the regulation of its country is not as strict as the FCA O Cysec.

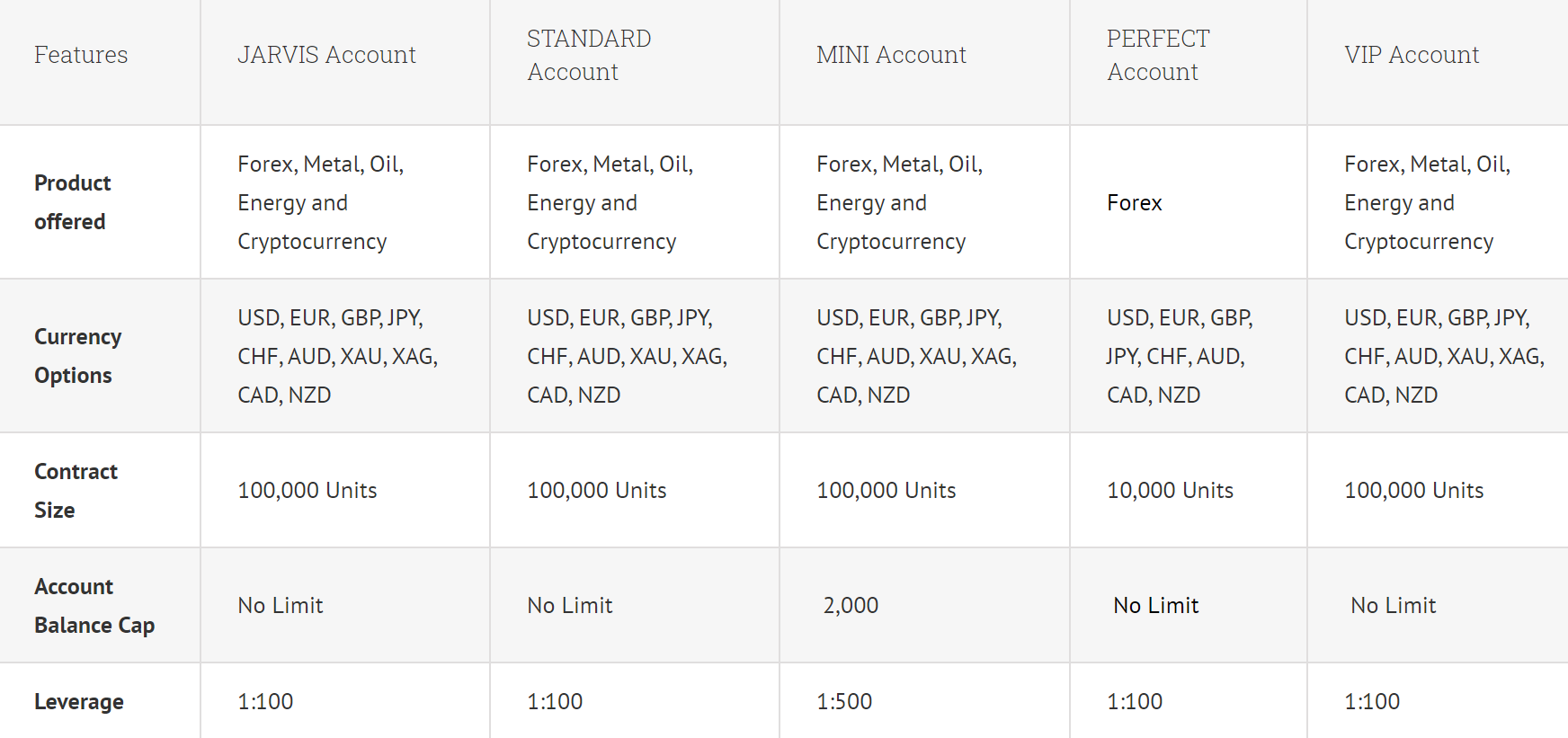

ACCOUNT TYPES

MXC Forex offers 7 different accounts to choose from, according to the requirements of its clients. They are called, Gold Account, Wise Account, Jarvis Account, Standard Account, Mini Account, Perfect Account, and VIP Account.

Here we show you the differences and characteristics of some of them,

- JARVIS Account

Products offered: Forex, Metal, Oil, Energy, and Cryptocurrency. Currency Options, USD, EUR, GBP, JPY, CHF, AUD, XAU, XAG, CAD, and NZD. Account Balance Cap, No Limit. Leverage 1:100. Spreads, As Low as 2.0 Pips. Commission, Yes. Minimum Trade, 0.01 Lot. Max Position, 100 Lots.

- STANDARD Account

Products offered: Forex, Metal, Oil, Energy, and Cryptocurrency. Currency Options, USD, EUR, GBP, JPY, CHF, AUD, XAU, XAG, CAD, and NZD. Account Balance Cap, No Limit. Leverage 1:100. Spreads, As Low as 2.0 Pips. Commission, No. Minimum Trade, 0.01 Lot. Max Position, 100 Lots.

- MINI Account

Products offered: Forex, Metal, Oil, Energy, and Cryptocurrency. Currency Options, USD, EUR, GBP, JPY, CHF, AUD, XAU, XAG, CAD, and NZD. Account Balance Cap, 2000 USD. Leverage 1:500. Spreads, As Low as 0.3 Pips. Commission, Yes. Minimum Trade, 0.01 Lot. Max Position, 3 Lots.

- PERFECT Account

Products offered: Forex only. Currency Options, USD, EUR, GBP, JPY, CHF, AUD, XAU, XAG, CAD, and NZD. Account Balance Cap, 2000 USD. Leverage 1:100. Spreads, As Low as 2 Pips. Commission, No. Minimum Trade, 0.05 Lot. Max Position, 100 Lots.

- VIP Account

Products offered: Forex, Metal, Oil, Energy, and Cryptocurrency. Currency Options, USD, EUR, GBP, JPY, CHF, AUD, XAU, XAG, CAD, and NZD. Account Balance Cap, 2000 USD. Leverage 1:100. Spreads, As Low as 1,5 Pips. Commission, No. Minimum Trade, 0.05 Lot. Max Position, 100 Lots.

PLATFORMS

The trading platform used by this broker is MT4. MXC Forex offers its customers, as we have already said, the most famous application in the Forex industry. We will have the MT4 desktop version and also the mobile plication for use on tablets and smartphones.

MT4 is a well-equipped working tool that allows you to operate in financial markets (Forex, CFD, and Futures). It provides its users with many tools and resources to analyze the prices of financial assets, conduct business transactions and create and use automated software (Expert Advisors).

Also, MXC Forex customers have access to the Mirror Trader Platform, for copy trading, and the latest version of Tradency, Robox. The famous Autochartist technical analysis reports are also available to MXC broker customers.

LEVERAGE

MXC Forex offers leverage up to levels of 1:500, this is considered high leverage. But really, many brokers offer leverage of 1:500. We just have to keep in mind that using high leverage levels means a higher risk of loss. And even if this broker offers high leverage, the customer can, from his investor portal, adjust leverage to levels of 1:100 or 1:200 if he desires.

TRADE SIZES

The minimum trade size depends on the customer’s account but ranges from 0.01 to 0.05 micro-lots.

TRADING COSTS

Some accounts like the Jarvis account or the mini account have commissions, but unfortunately, the broker does not report the amount of them. Where we will always have an expense is in night financing if we leave open trades overnight. This is a small interest that varies according to the currency and can be negative or positive.

ASSETS

With MXC Broker you can trade assets such as Forex, Commodities, Metals, and Cryptocurrency. We do not have information about how many currency pairs there are, how many commodities, metals, or cryptocurrencies. We would have liked to know the variety of assets available, but that information does not appear on the broker’s website

SPREADS

SPREADS

The variable spreads offered by MXC Forex are above average, starting from 1.5 pips. In the market, other offshore brokers offer spreads averaging 1.2 pips on their accounts without commissions.

MINIMUM DEPOSIT

The broker does not clearly report the minimum deposit required to open an account. We only have information on the minimum deposits required in the different deposit methods.

DEPOSIT METHODS & COSTS

MXC Forex Broker offers its clients a wide variety of deposit methods, here we list what they are:

- Mastercard: Minimum Amount, 5 USD. Maximum Amount, 1.000 USD, Transaction Cost, 4%. Processing Time, Instant.

- Bitcoin: Minimum Amount. , NA. Maximum Amount, NA, Transaction Cost, 5%. Processing Time, Instant.

- Local Depositor: Minimum Amount, 10 USD. Maximum Amount, 10.000 USD, Transaction Cost, No. Processing Time, Within 1 working day.

- Bank Transfer: Minimum Amount, 5.000 USD. Maximum Amount, 100.000 USD, Transaction Cost, 10 USD + Bank Charges. Processing Time, Within 3 – 5 working days.

- Neteller: Minimum Amount, 10 USD. Maximum Amount, 5.000 USD, Transaction Cost, 5% (Min. 1.00 USD) + 0.29 USD. Processing Time, Instant.

- Skrill: Minimum Amount, 10 USD. Maximum Amount, 5.000 USD, Transaction Cost, 5% (Min. 1.00 USD). Processing Time, Instant.

- WeChat Pay: Minimum Amount, 10 CNY. Maximum Amount, 5.000 CNY, Transaction Cost, 2%. Processing Time, Instant.

- UnionPay Mobile: Minimum Amount, 10 CNY. Maximum Amount, 2.000 CNY, Transaction Cost, 2%. Processing Time, Instant.

- UnionPay Desktop: Minimum Amount, 10 CNY. Maximum Amount, 100.000 USD, Transaction Cost, 2%. Processing Time, Instant.

- Alipay: Minimum Amount, 10 CNY. Maximum Amount, 5.000 CNY, Transaction Cost, 2%. Processing Time, Instant.

- FasaPay: Minimum Amount, 10 USD. Maximum Amount, 5.000 USD, Transaction Cost, NO. Processing Time, Instant.

- Paypal: Minimum Amount, 5 USD. Maximum Amount, 1.000 USD, Transaction Cost, 4%. Processing Time, Instant.

- Perfect Money: Minimum Amount, 1 USD. Maximum Amount, 1.000 USD, Transaction Cost, 3%. Processing Time, Instant.

WITHDRAWAL METHODS & COSTS & WAIT TIME

MXC Forex broker also offers a wide variety of methods to make your withdrawals. Here we detail the methods, the commissions applied, and the waiting times:

- Mastercard. Minimum Amount, 20 USD. Maximum Amount, 1.000 USD. Transaction Cost, 4%. Processing Time, Within 1 working day.

- Bank Transfer. Minimum Amount, 1.500 USD. Maximum Amount, unspecified. Transaction Cost, Varies depending on bank charges. Processing Time, Within 1 – 5 working days.

- Local Depositor. Minimum Amount, 20 USD. Maximum Amount, 10.000 USD. Transaction Cost, NO. Processing Time, Depends on Local Depositor availability.

- Bitcoin. Minimum Amount, NA. Maximum Amount, NA. Transaction Cost, 5%. Processing Time, Instant.

- Neteller. Minimum Amount, 20 USD. Maximum Amount, 5.000 USD. Transaction Cost, 2% (Min. 1.00 USD). Processing Time, Within 1 working day.

- Skrill. Minimum Amount, 20 USD. Maximum Amount, 5.000 USD. Transaction Cost, 1% + 0.29 EUR. Processing Time, Within 1 working day.

- RPNpay. Minimum Amount, 100 CNY. Maximum Amount, 100.000 CNY. Transaction Cost, 0.5% (min CNY 30 fee). Processing Time, Within 1 working day.

- Fasapay. Minimum Amount, 20 USD. Maximum Amount, 100.000 USD. Transaction Cost, 0.5%. Processing Time, Within 1 working day.

- PayPal. Minimum Amount, 20 USD. Maximum Amount, 1.000 USD. Transaction Cost, 4%. Processing Time, Within 1 working day.

- Perfect Money. Minimum Amount, 20 USD. Maximum Amount, 1.000 USD. Transaction Cost, 3%. Processing Time, Within 1 working day.

BONUSES & PROMOTIONS

This broker does not have any Bonuses or promotions currently available. MXC Forex broker also has an Introducing Broker program. Basically, if a customer succeeds in making new clients for this broker, he will be rewarded with commissions that are generated by operating them.

EDUCATIONAL & TRADING TOOLS

MXC Forex broker has a small educational area where some of the basic forex concepts that every trader should know are detailed:

What is Forex?, Who trades Forex?, How can I trade Forex?, Understanding Forex prices, Understanding currency pairs, Introduction to margin, Contract sizes, Majors and currencies pairs revisited, Approaches to trading the market, and Basic concept and additional Strategies.

It also has a FAQ with answers related to Forex and the relationship with the broker. And an academy called Mxcacademy in the web domain https://www.mxcacademy.com/ , which at the time of this review was not operational.

Trading Tools: It has a trading tool comparator such as mirror trader, tradeworks, dubips, echofin… etc. It also has an updated economic calendar, a link to download the Mirror Trader application, and another link to download and use Qyptech, which is an Expert Advisor (EA).

CUSTOMER SERVICE

MXC Forex broker has several methods of contact, such as phone, email, and live chat, plus an informed physical address. They are as follows:

MX Capital Financial Limited: 14th Floor, Main Office Tower, Financial Park Labuan Complex, Jalan Merdeka, 87000 Labuan F.T., Malaysia

Phone number: +6087599257

Email: [email protected]

DEMO ACCOUNT

We have not seen the broker offer a demo account, at least we could not find any information. This gives us a bad impression, as a demo account allows new traders to test trading conditions and test strategies before risking their own money. Any serious broker should include a download link to a demo account on their website.

COUNTRIES ACCEPTED

MXC Broker does not report in the legal documents available on its website any list of countries that are not accepted by the broker.

CONCLUSION

To conclude, trading with an offshore broker is unwise, although it must be said that many offshore brokers are reliable and do not cause any problems to their clients. However, if we can choose, it is better to invest your money in a licensed broker in the UK, Cyprus, or Australia, where traders have more protection and watchful regulators supervise their operations.

MXC Forex has online trading services available for its clients in Forex and CFD, however, trading margins are high. Worst of all, the company has poor regulation.

Here are the advantages and disadvantages of MXC Forex:

Advantages: MT4 available, copy trading option, some accounts have no commissions. High leverage is available.

Disadvantages: No European regulation, high spreads.