The market you are in is experiencing capital outflows, that is what is going on. Pull up your plan B. You noticed how the market has changed. It may not be trending as unusual and the opportunities have been scarce for a while. What do you do now?

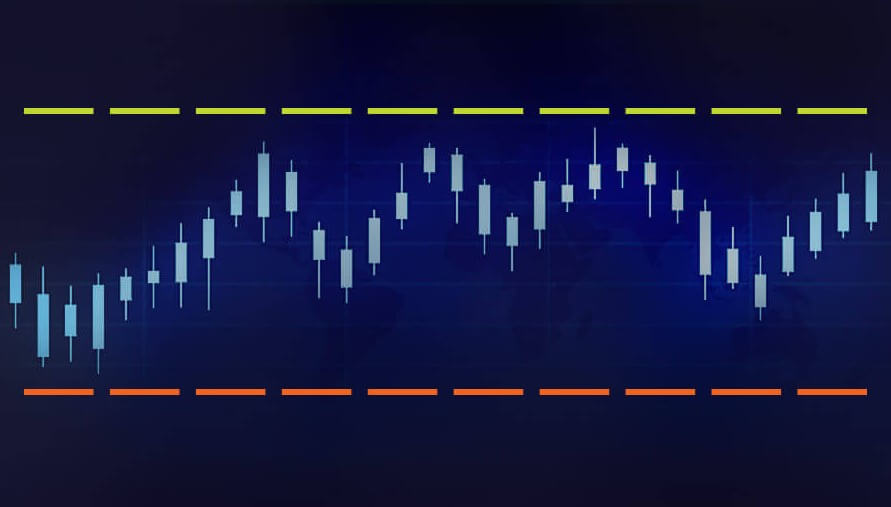

First, we need to acknowledge that the market never remains exactly the same. Sometimes the market will trend for a while after which we may see equally long (or longer) periods of consolidation. In fact, the market can be so devoid of any action that you may wonder if you are ever going to get a trade opportunity that is not a fake breakout.

From time to time, we will not be able to see any definitive upward or downward movement and the prices may not get to make your take profit targets, making traders insecure about the overall market direction.

From time to time, we will not be able to see any definitive upward or downward movement and the prices may not get to make your take profit targets, making traders insecure about the overall market direction.

So, how do you know that you are in a dead market?

Even though we can determine market volume with the help of ATR, ADX, and Bollinger Bands, among other tools, the $EVZ volatility index has proved to be extremely useful and easy to use. When you open the full chart, you will be able to see a number under the heading “Euro FX VIX.”

Even though we can determine market volume with the help of ATR, ADX, and Bollinger Bands, among other tools, the $EVZ volatility index has proved to be extremely useful and easy to use. When you open the full chart, you will be able to see a number under the heading “Euro FX VIX.”

If this number is lower than seven (7), for example, this means that volume and volatility are low. Also, the lower the $EVZ index is, the lower the chance of winning a trend following trade is as well.

If we need volume to trade effectively, how should we then approach long market dry spells?

There are a few ways to deal with unfavorable markets. First of all, dead markets are not the markets we want to trade, especially as beginners. However, we can still be productive! As a beginner trader, you are probably developing your system and trying to see if your tools are giving you valid information on the market.

There are a few ways to deal with unfavorable markets. First of all, dead markets are not the markets we want to trade, especially as beginners. However, we can still be productive! As a beginner trader, you are probably developing your system and trying to see if your tools are giving you valid information on the market.

If you are backtesting or forward testing your system, you should be getting a clear sign not to engage in trading at the moment. If you are still getting signals that it is ok to proceed, you need to change the volume/volatility indicator you are using.

Still, low volume/volatility is a normal part of market oscillations, as these constantly fluctuate. Even if you are getting a lot of losing trades, do not get discouraged. Your time will come.

Still, low volume/volatility is a normal part of market oscillations, as these constantly fluctuate. Even if you are getting a lot of losing trades, do not get discouraged. Your time will come.

You may be wondering if you can still trade despite sideways market movements, and the answer is…

…YES and NO.

You should not trade at this time because the price direction guesswork is extremely hard to get right and you can easily lose a lot of money. If you aren’t getting any signals, there is no reason for you to push it. Just stay put.

You should not trade at this time because the price direction guesswork is extremely hard to get right and you can easily lose a lot of money. If you aren’t getting any signals, there is no reason for you to push it. Just stay put.

If you are, however, getting signals to enter a few trades please choose wisely! For example, forex traders may not want to trade pairs whose currencies are heavily monitored by big banking institutions. Any strange news event will also be a reason strong enough to avoid certain currency pairs altogether at this time.

Also, be careful with your money management!

We cannot scale out when the market is unresponsive. Therefore, we should in such cases take the entire trade-off at the first take-profit point. While we may be getting wins that are smaller than usual, we know that these are safer wins after all. It is far better to have minor wins than major losses. Even if the trade you exited seems to be heading somewhere, do not be regretful. Cut your take profit targets.

We cannot scale out when the market is unresponsive. Therefore, we should in such cases take the entire trade-off at the first take-profit point. While we may be getting wins that are smaller than usual, we know that these are safer wins after all. It is far better to have minor wins than major losses. Even if the trade you exited seems to be heading somewhere, do not be regretful. Cut your take profit targets.

If the market happens to be extremely low in volume and volatility, you should also manage your risk differently!

We usually cannot have a standard 2% risk on trades encumbered by sideways market movement. Reduce your risk to 1%, for example, if you see that the $EVZ index is reaching incredible lows, like in 2019.

We usually cannot have a standard 2% risk on trades encumbered by sideways market movement. Reduce your risk to 1%, for example, if you see that the $EVZ index is reaching incredible lows, like in 2019.

What you can also do in times like these is use a smaller time frame to pick up your wins more easily. Again, dead markets do not necessitate that you forsake your daily time frame by default, but it can be a good opportunity for you to see if there are any changes between different time frames.

This is a reminder not to forget the power of your mind!

If you are not prepared mentally or emotionally, your account will suffer no matter the conditions. If you start panicking the first moment you spot any sideways market movement, the likelihood of you making a good decision will start to decrease exponentially.

If you are not prepared mentally or emotionally, your account will suffer no matter the conditions. If you start panicking the first moment you spot any sideways market movement, the likelihood of you making a good decision will start to decrease exponentially.

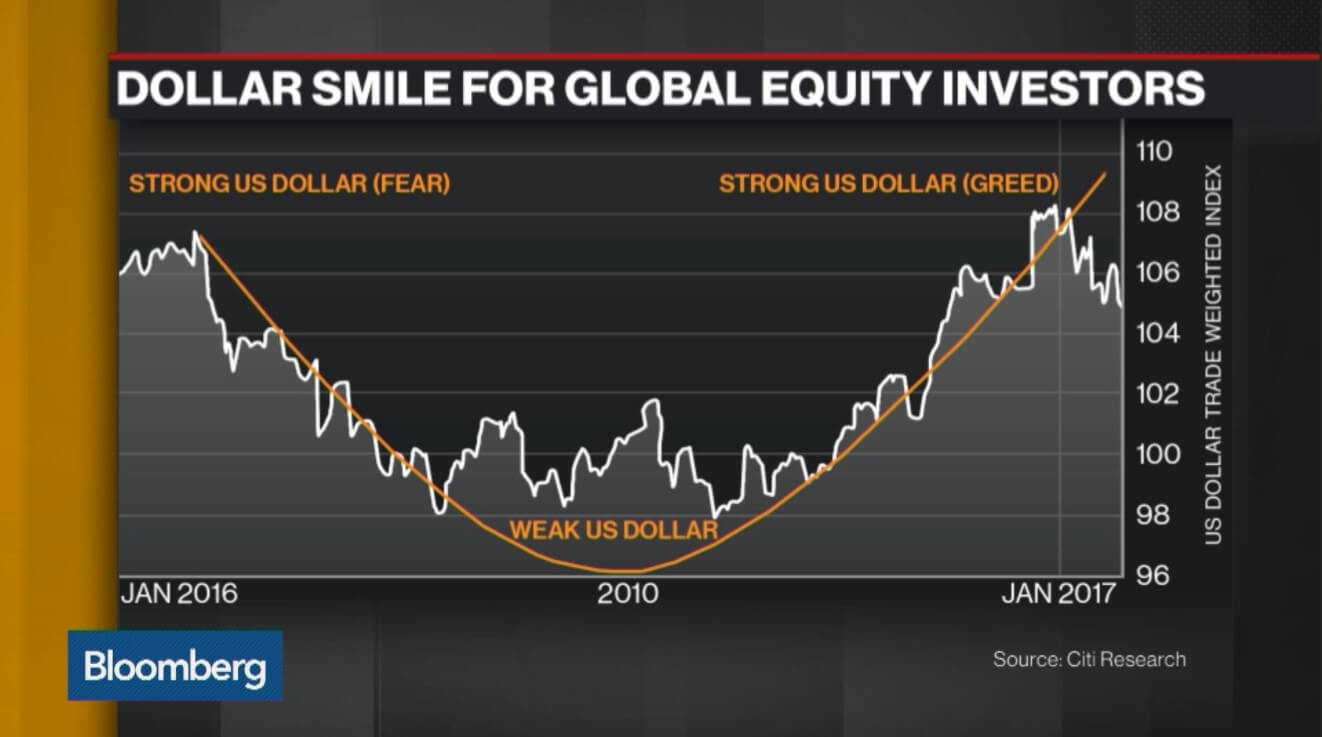

There is also a major prejudice concerning market volume and volatility. What we need is balance – in the market and in our approach to it. Therefore, if we enter trades with high volatility or volume, we are also adding unnecessary risk, which can be detrimental to our accounts.

Looking for an ideal trading scenario to start trading is as futile as is failing to recognize the potential of dead markets. When we are faced with the saturation of sideways market movements, we should perceive the market as our fertile land. It is those moments that give us perfect room for improving our systems. Reflect on your past trades and decisions, and see what you can do better. Focus your attention on your trading and test, test, test. If you find a strategy that is working well in these conditions, this is your plan B, switch to it.

Looking for an ideal trading scenario to start trading is as futile as is failing to recognize the potential of dead markets. When we are faced with the saturation of sideways market movements, we should perceive the market as our fertile land. It is those moments that give us perfect room for improving our systems. Reflect on your past trades and decisions, and see what you can do better. Focus your attention on your trading and test, test, test. If you find a strategy that is working well in these conditions, this is your plan B, switch to it.

Unfavorable market conditions affect us all. Do not think that experts are making a ton of money under any circumstances. You may have even had plans to leave your current job and turn to trading only, but now is not the time. Make no rash decisions, keep all of your sources of income active, and just wait for everything to go back to normal. Even when it does, you may still need a few months or years for everything to work out as you planned.

Unfavorable market conditions affect us all. Do not think that experts are making a ton of money under any circumstances. You may have even had plans to leave your current job and turn to trading only, but now is not the time. Make no rash decisions, keep all of your sources of income active, and just wait for everything to go back to normal. Even when it does, you may still need a few months or years for everything to work out as you planned.

What happens when the market finally comes back to us?

Well, no matter how well-developed your system is, most volume indicators cannot record the first big move as quickly as it occurs. So, now that you know that it isn’t your fault, do not give in to any doubts or regrets and just move on.

Well, no matter how well-developed your system is, most volume indicators cannot record the first big move as quickly as it occurs. So, now that you know that it isn’t your fault, do not give in to any doubts or regrets and just move on.

Finally, there is no way for you to “trick the system” and evade the sideway market movements. It is a perfect time to develop a strategy that can work in dead markets, it will stay with you when the markets are dead again. Do not go looking for a volume indicator that would tell you what you want to hear. Instead of feeling sorrowful about your fate, look where you have the power to initiate change. Trading is not about making wins only. Protecting your account and making smart money is far more important.