Introduction

In the world of trading, the order types are identical, irrespective of the market you’re trading. The type of the ‘Order’ refers to how you wish to enter or exit a trade. If you’re new to the world of trading, you might only know two order types – Buy and Sell. But there are other order types that serve different purposes, and improve the way you trade. In this lesson, we will be discussing some of the most used orders in the forex market.

Types of Orders

There are about four order types widely used by traders. These are

- Market Order

- Limit Entry Order (Buy Limit, Sell Limit)

- Stop Entry Order (Buy Stop, Sell Stop)

- Stop Loss Order

Apart from the above, there are other orders that are exclusively offered by specific brokers like ‘Trailing Stop-Loss’ and ‘Profit Booking Order’ but in this article, we shall confine only to these four types.

Understanding the Bid and Ask prices

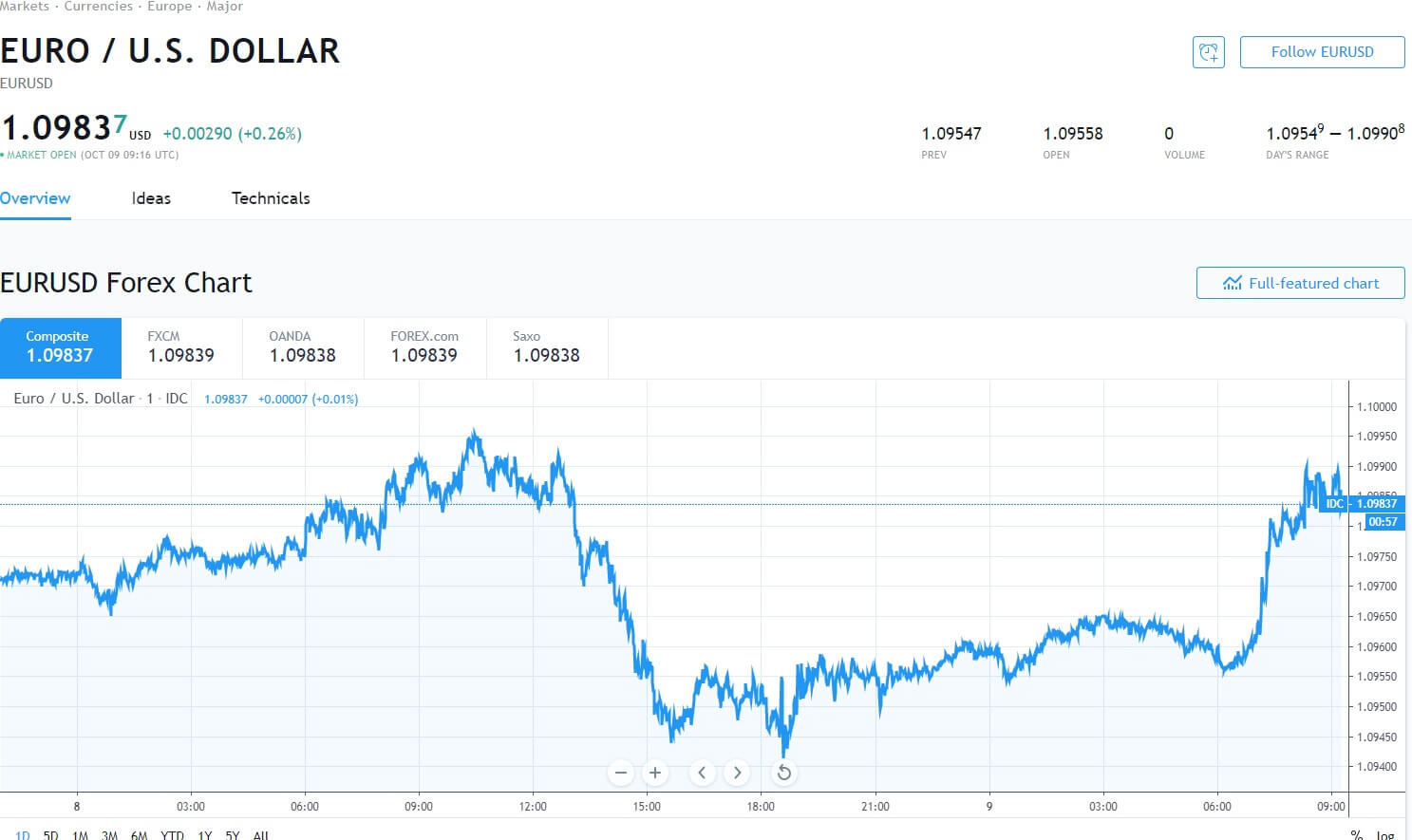

Let us first discuss these two terms as they form the base for understanding the order types.

Bid price

The bid price is the price at which the broker is willing to buy the currency pair from you. So, when you short sell a currency pair, you will be executed at the bid price.

Ask price

Ask price is the price at which the broker is willing to sell the currency pair to you. So, if you go long (buy) on a currency pair, you will be filled at the ask price.

With this under consideration, let us continue our discussion on different order types.

Market Order

This is the most basic form of order. In a market order, you get filled at the current market price. It is basically the best price available in the market to buy/sell a currency pair.

For example, let’s say the bid price of EURUSD is 1.2150, and the ask price is 1.2152. Now, if you execute a market buy order on this one, you will get filled at the ask price, i.e., at 1.2152. Similarly, if you go short on this pair, you will get filed at 1.2150.

Market orders are fast. A trader uses that order to enter a marker no matter what. That speed and fill guarantee comes at the cost of the slippage is the market has moved from the instant the trader pulls the trigger to when the order is filled.

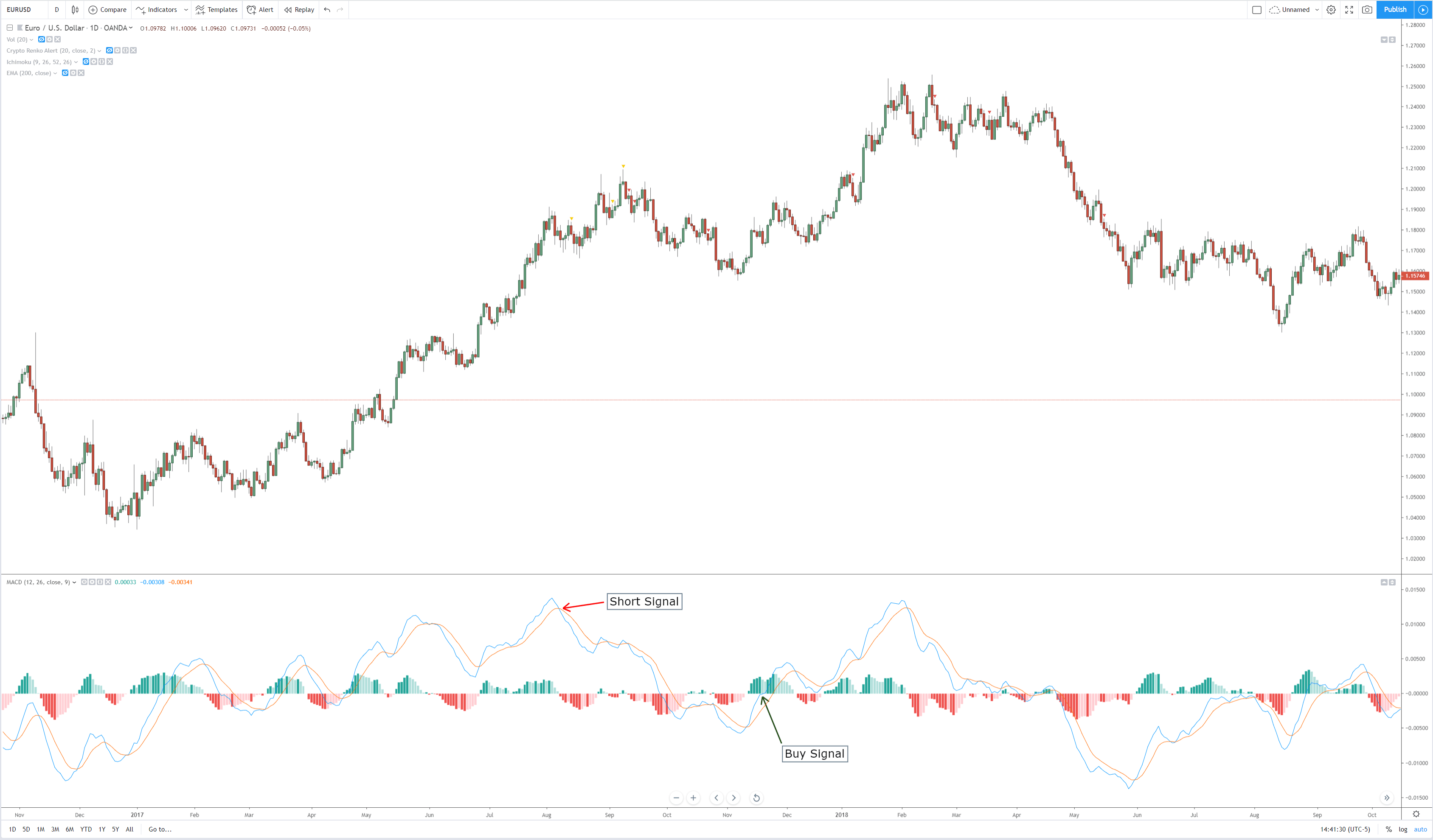

Limit Entry Order

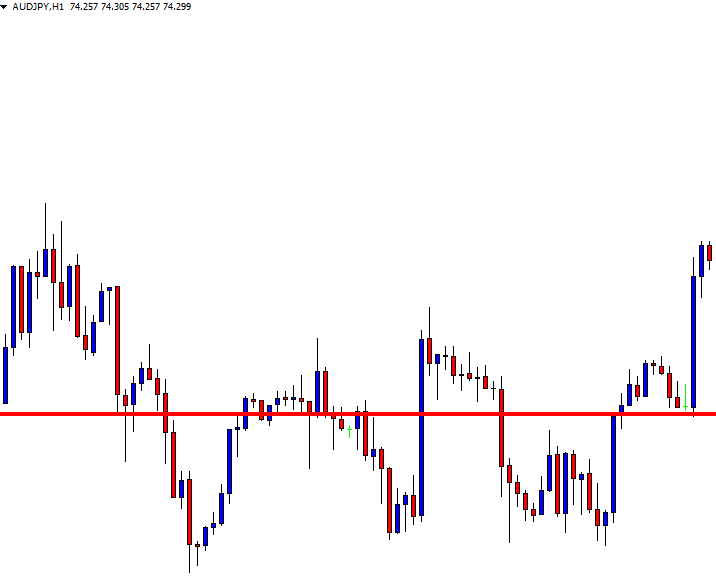

Limit entry order is an order where a buy order is placed less than the current market price, and a sell order is placed above the current market price.

For example, let’s say the current market price of AUDUSD is 0.6750. Now, if you want to buy it at 0.6725, you will have to place a Buy Limit order at this price. And if you want to short it at 0.6790, you will need to place a Sell Limit order at this price.

Limit orders can be used as entry or as exit orders.

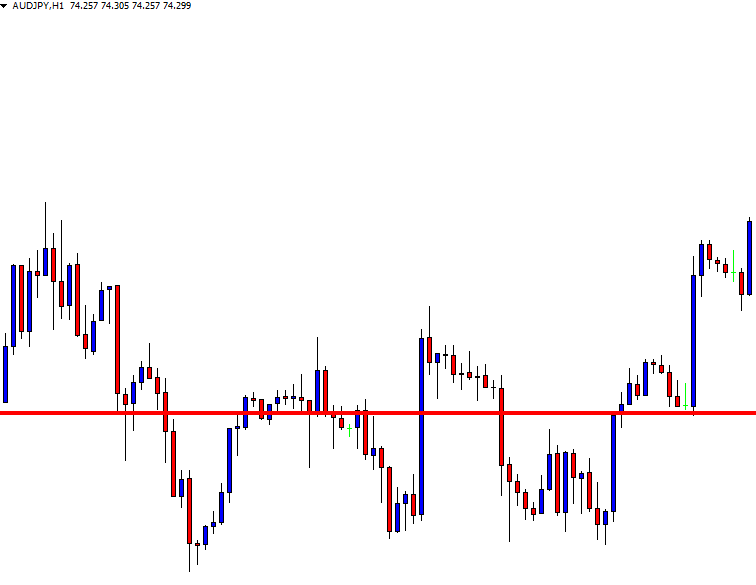

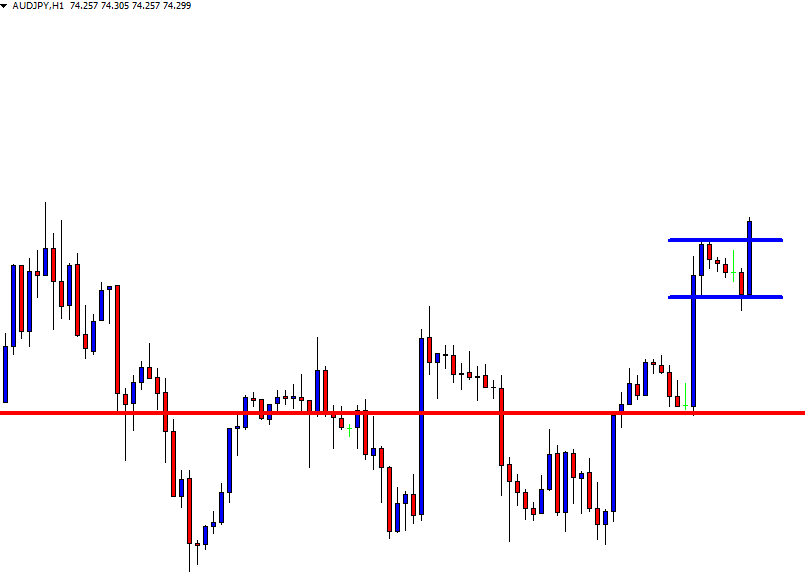

As entry orders, you are applying the logic of buy low and sell high (on short-sell limit orders). A limit order is handy to spot a support area while the price moves back and get filled as the price approaches support.

As exit orders, they are handy to take profits. You place a limit to sell at your profit-taking level on long trades and you place a buy limit order at your profit target level on short trades.

Stop Entry Order

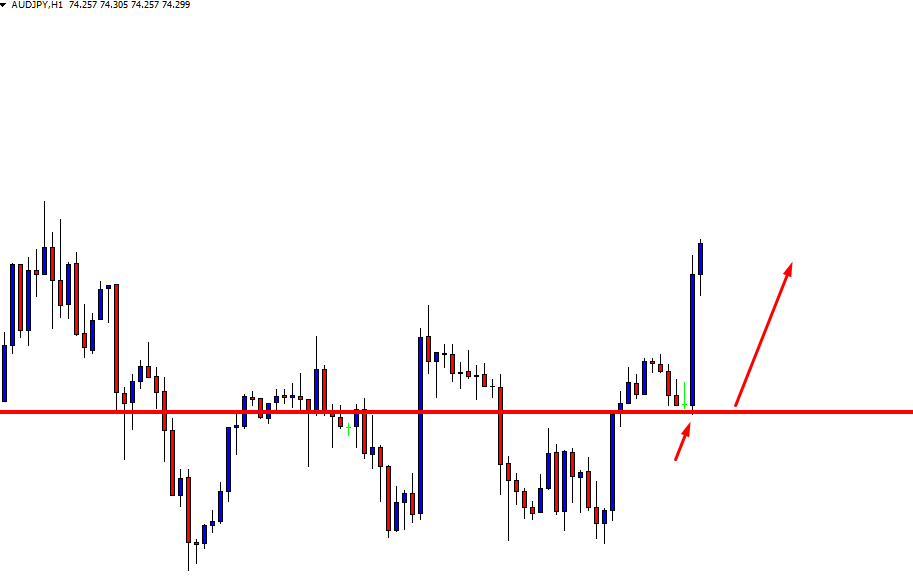

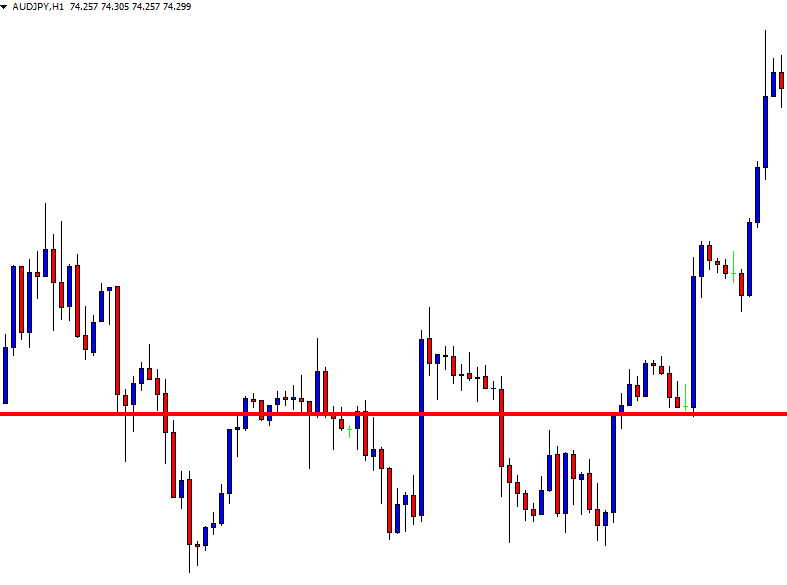

A stop entry order is the reverse of a limit entry order. Here, you can place a buy order above the current market price and a short sell order below the current market price.

For example, let’s say the current market price of GBPJPY 1.6570. Now, if you think the market will head up only if the price breaks above 1.6590, you must place a Buy Stop at the price you wish to buy. So, when the price goes up to 1.6590, your buy order will be executed.

Stop-Loss Order

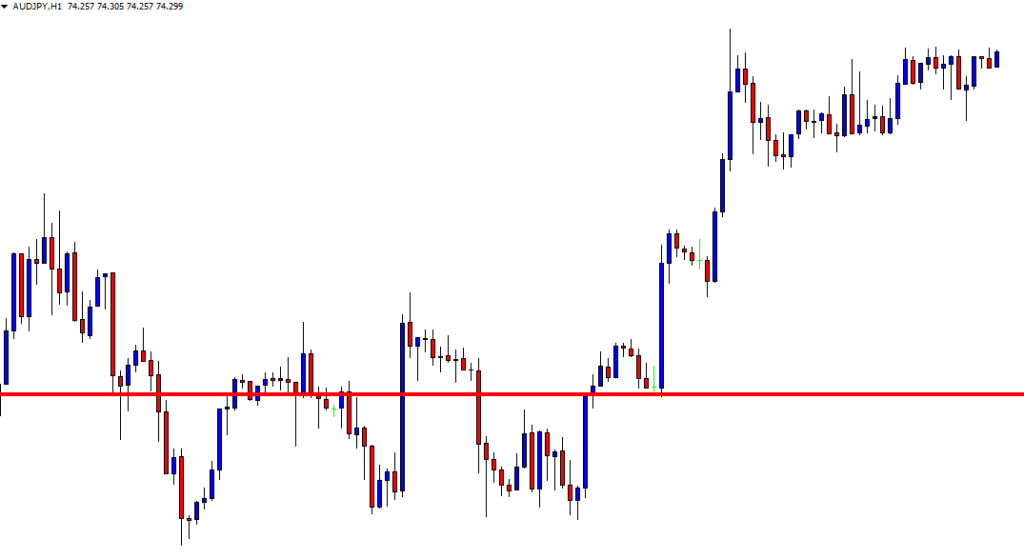

A stop-loss order is special order for closing a trade. This order is placed against the price at which you bought/sold the currency pair. This is done to avoid further losses from trade. Since this order ‘stops’ the losses, it is called a ‘stop-loss’ order.

For example, let’s say you bought a currency pair at 1.1320. Now, for this trade, if you place a stop-loss at 1.1250, the positions will be closed when the market touches this price, hence, protecting you from further losses.

This completes the lesson on basic order types in the forex market. We will discuss the more premium broker specific orders in our future lessons. For now, take the below quiz and check what you have learned the concepts right.

[wp_quiz id=”45527″]