What’s this about trading robots? Do they work? Are robots bad? Many questions are those that usually roll in the head when you hear the word “robot”. In the article I write today, I will try to expose what is this about Forex robots and everything that affects them, as well as some myths and realities. Let’s discuss…

How Do Forex Robots Work?

Before you start talking about how they work, do you know what a Forex robot is? A robot is nothing more or less than a few lines of code with clear rules of entry and exit to the market that are executed automatically. All this applied to the Forex market would simply be an automated strategy that buys and sells in the currency market. They are also called EA (Expert Advisor).

When I told you what it is, I explained how they work. But hey, can you make money with robots, or are they a scam? The performance or results of these automated strategies will depend on these previous strategies and their supervision, so if they are not profitable from the start, no matter how much they are automated they will not be. But if the strategy that is programmed is good, the result may be better.

Key Advantages

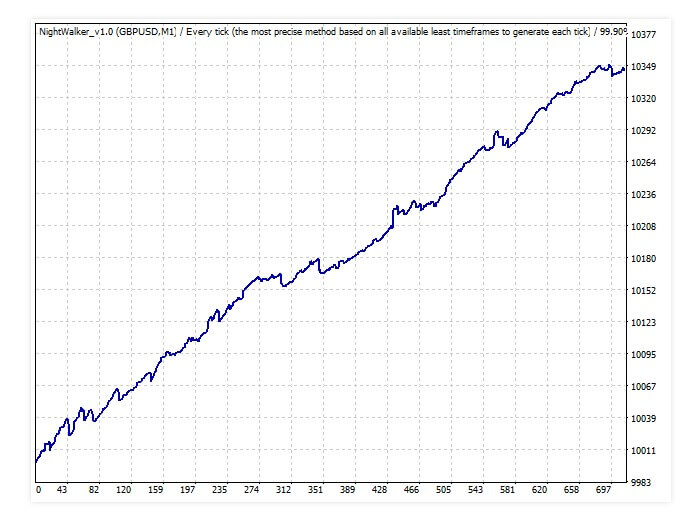

One of its great advantages is to be able to quantify the performance of the strategy that has been programmed. With a programmed strategy, you can perform a backtest and evaluate how that strategy has behaved before. If you have done discretionary or manual trading you will surely have tried different systems without having statistics or results of whether they have worked or not in the past. Come on, you’ve been playing with your money without knowing if what you were doing was profitable or not. Think for a moment, if you don’t quantify, how are you gonna know you’re making progress?

You need objectivity in making decisions when you make decisions. Otherwise, your results will be affected by your interpretation and here you have a good extra factor to make a mistake. How are you going to correct it? Systems or robots allow an objective market approach.

As you know, the accuracy of execution when trading is key. When you trade manually, you analyze wait for the moment and execute the order. When the process is automated, the order is released in less than a second without hesitation or analysis, or thoughts.

Another advantage more than considerable is that to execute the operations you do not have to leave your eyes looking at graphics for hours. You can do it uninterruptedly over time, even if you’re not in front of the screen. If you’re on a trip for a week or you have to do anything to stop you from being there, your operation may be running simultaneously. Be very clear, however, that they must be monitored and that the creation of automated systems requires time and work.

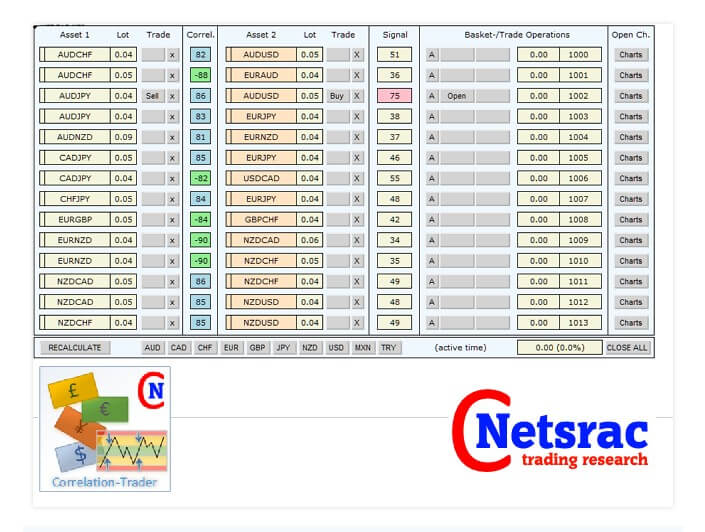

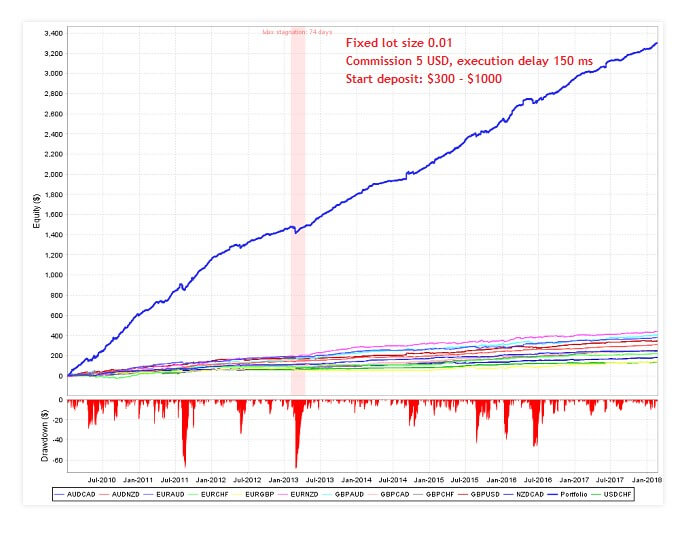

Closely related to the previous one, with robots you can trade in different assets simultaneously. Manually we are limited in this aspect. So you can diversify without problems.

And yes, the psychological approach. As you know, in this trading, psychology is important and it affects a lot. When the strategies are done in an automated way you reduce the psychological component quite a lot since your buying and selling decisions are not biased by your psychology. I say it’s reduced because you have to know that when robots have a negative or positive performance it will still affect you. But the main difference is that the results affect your psychology and not your decisions as it usually happens when operating in a discretionary manner.

Key Disadvantages

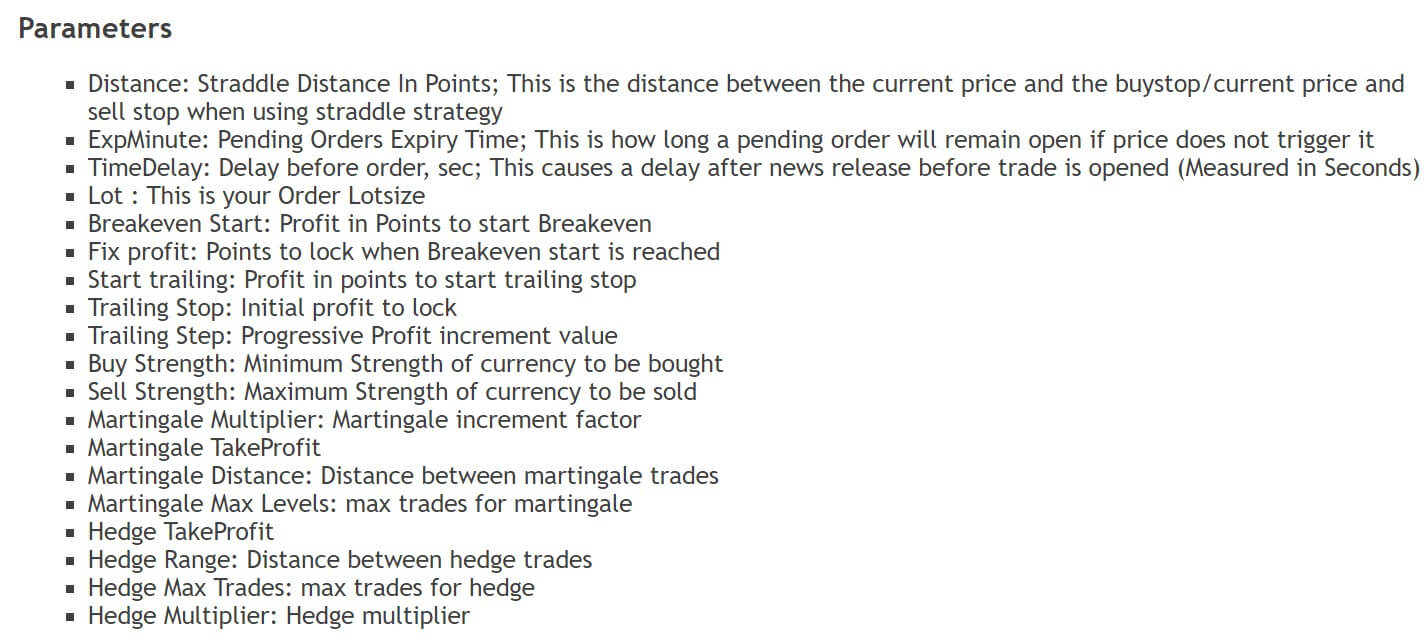

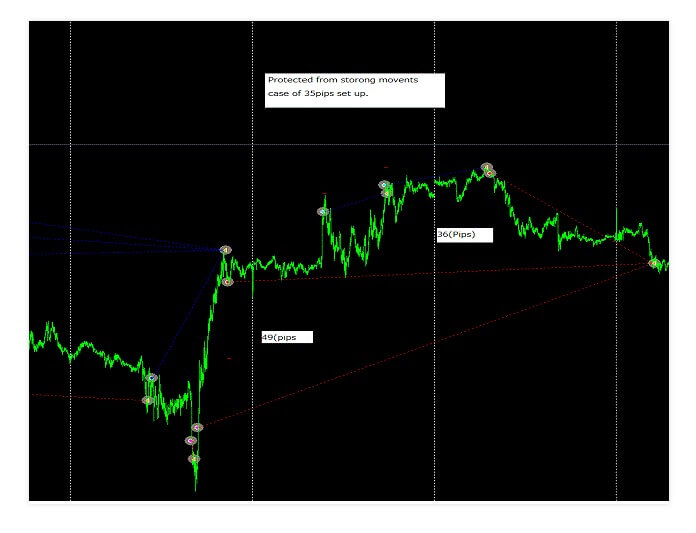

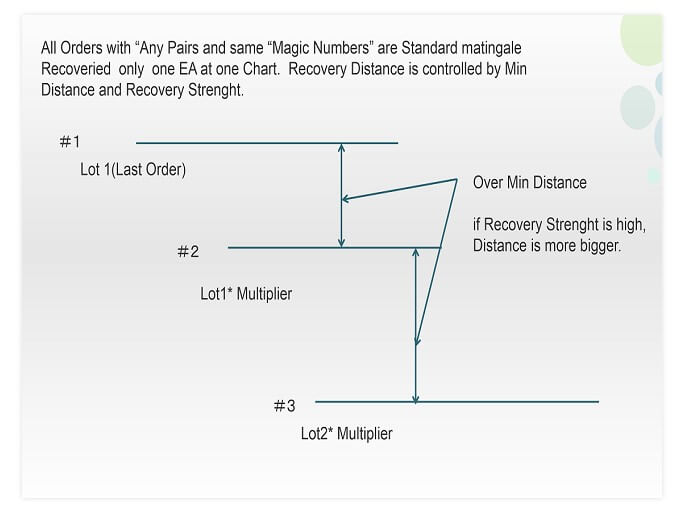

Although the advantages are clear, there are disadvantages. Most of the robots that are marketed on the Internet are based on martingales, grid. that reflect very good results and almost perfect performance curves but one day they break. Why? Because of the aggressive risk management rules they use. If you don’t think so, try downloading some for free and look at their results over a long period of time.

Why does this happen? Creating a good, cost-effective automated system is not easy. Programming a martingale or grid is not easy. So before you buy any robot, make sure they don’t use these techniques and that there’s no one hiding under a brand that can disappear tomorrow.

As for disadvantages when trading with robots something important is any technical failure that may arise and cause it not to run well. It is advisable to use VPS (a private virtual server) if this failure can affect your operation. I explain what a VPS is in this video:

Although it’s something that’s never happened to me yet, it is something that can happen. But it is as if the Internet connection fails. Also, failures or errors when programming the strategy (before executing it in real test it in demo or with very little capital).

Disadvantages are anything you might think might affect something that’s running remotely. Many such tasks already exist in different areas today.

What are the Limits of Robots?

We could say that robots do not work (always). I mean, there are systems that work perfectly for many years, but the vast majority die first. So? The solution is to have clear rules to disable these robots. If you don’t have an established plan, what are you going to do if your robot keeps losing money? Learn how to manage them.

Another limitation when using automated strategies is the over-optimization of parameters. What is that? Adjust your variables so that past results are very good. What’s the problem here? That we don’t know what’s going to happen on the market tomorrow, so it’s very likely that that robot won’t work well with new data when you apply it. Solution? Create a strategy and then validate it. Not the other way around. Remember that it is not about looking for perfect results, it is about getting real results.

Robots do not do magic, they have an added value with respect to manual trading that is quite clear, but it is something that you connect and you sit down to see how you drop the money. To take advantage of them is to be intelligent, but to ignore limitations is to be naive.

How to Choose A Forex Robot?

We talked about an important point earlier. Avoid using robots that apply aggressive risk management. If you’re going to choose a robot, spend some time contacting the person who created it, their background.

Don’t buy on pages you don’t know, in fact, I would tell you not to buy a robot as such but have expert supervision. As we’ve already seen, robots need to be managed. Be sure that you are able to learn to do all this by yourself in a simple way. You also have other alternatives in portals like Darwinex.

How to Program a Forex Robot

Today there are many tools to do so. From my experience, don’t get complicated and use those that allow you to start with a short learning curve. Some tips to create a good robot:

Set clear market entries and exits.

These things have to be made as easy as possible. You don’t need a thousand lines to make it work. Use the rule that your logic fits in a post it.

- Always use stop-loss unless you don’t use any leverage.

- Do it on assets that have liquidity so as not to pay a surcharge.

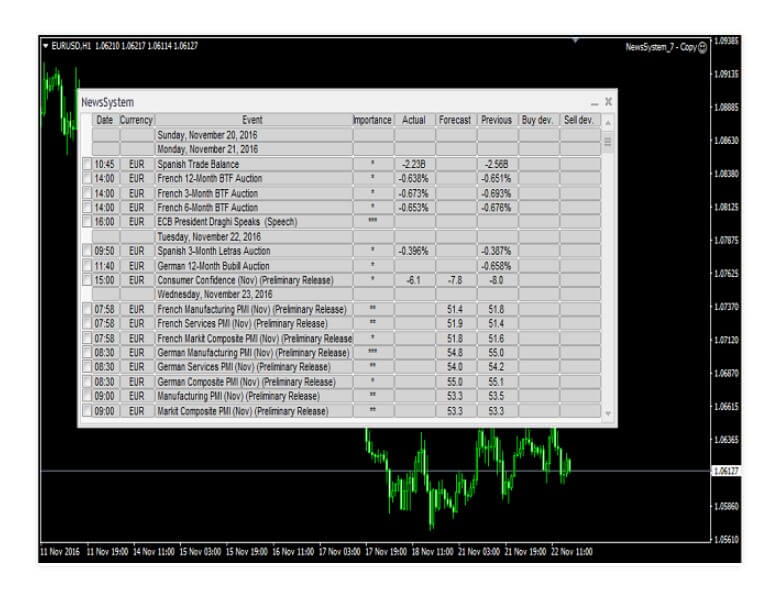

- Schedule them to run in hours where there is volume on the market.

The Best Account Types

The Best Account Types

The most suitable accounts for trading with robots are the same as for manual trading. Accounts with low spreads, direct market execution, and adjusted swaps. Forex brokers are many, but with these features no longer so many. It is important that no use standard accounts or the behavior on the outcome curve you are going to get will be very different.

The Best Forex Robots

The best robots are the ones you know and create. Those that you can build in a simple way and also do different tests of robustness to know first hand their weaknesses and strengths.

For me, there are no good robots or bad robots. There are robots that work and there are robots that don’t work. I try to apply those who do and discard those who stop. I use more than a hundred strategies that I monitor daily and follow up. In this way everything is dynamic and although there are always strategies that do not work over a limited period of time, which is involved is that there are others that generate more than those.

Manual Trading or Robots?

Within the world of investment and trading, there are defenders of manual trading versus robots and vice versa. To say that manual trading doesn’t work seems very bold to me. In case a person hasn’t worked, why won’t it work?

After all, a robot can be a manual trading system that runs automatically. Provided that there are clear rules and a methodology, it is clear that both can be valid. Now, a forex robot has a number of advantages over manual trading that it doesn’t have. If we have the ability and the judgment that a person can have and the means to carry it out through robots, why not use both?