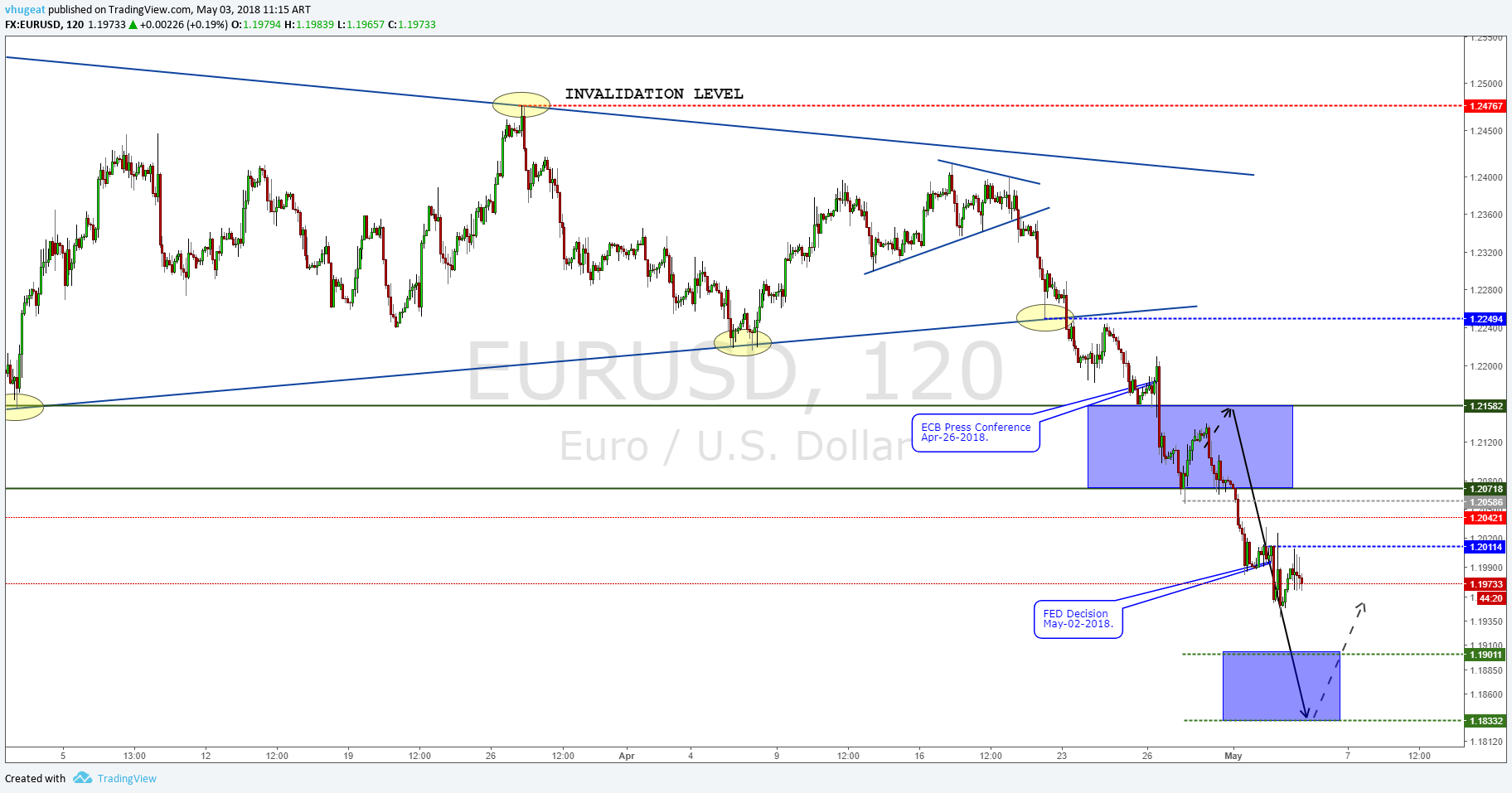

EUR/USD

The US Dollar is hesitant as President D. Trump told reporters he is very close to a decision about who should chair the Federal Reserve, which includes current Fed Chair, Janet Yellen. It also weighs on the US currency the rumors about Trump’s plan to reform taxes.

On the Euro front, European Central Bank is expected to announce on Thursday a possible timetable for a reduction of its asset purchases, as economic data suggest the Eurozone might witness a higher than expected economic expansion in 2017. Reducing asset purchases might, likely, be accompanied with a continuation of low interest rated, as Eurozone inflation data seems to be stable

Sideways channel movement on the EUR/USD pair

The Euro 1-hour price has been trending down since Oct, 19 when it draws an almost perfect triple top (1). Yesterday it touched Oct, 18th lows and bounced from there, and piercing up the downward trendline

Overall, the EUR/USD pair seems to trade in a sideways channel, but its current price may allow for a profitable trade, with a target touching the upper trend line (fig.1).

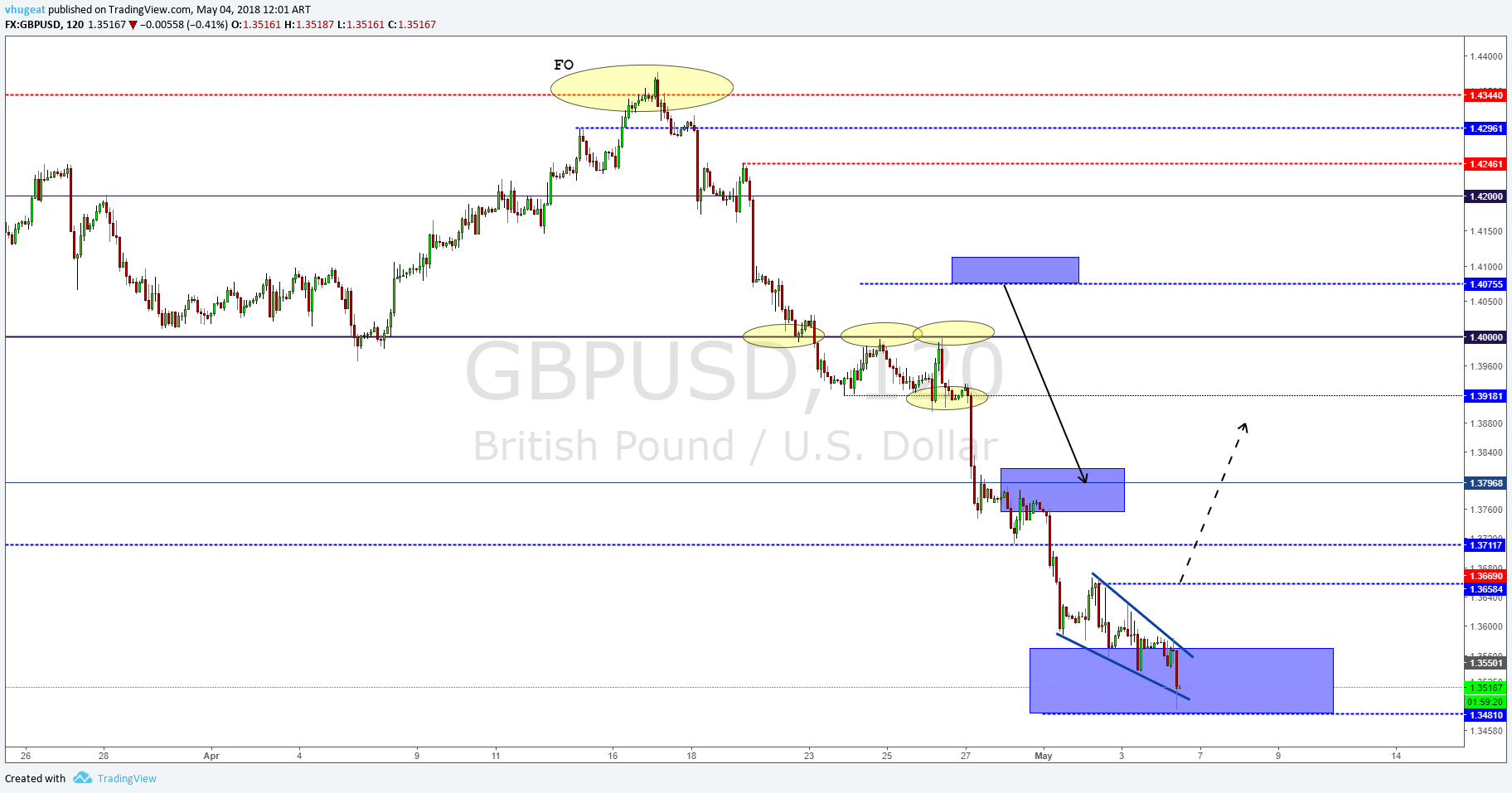

GBP/USD

JP Morgan analysts are convinced that shorting the GBP is still the way to go

The GBP is, still, affected by the Brexit process, but no major news about it is expected today. Slower consumer expending and softening of economic sentiment press policymakers to keep interest rates unchanged, which weighs on the British currency.

Daniel Hui, a foreign exchange strategist at J.P. Morgan said that their conviction to short the GBP is still high because they felt UK rate hikes were “overpriced”, given the “weak starting point for UK growth” and the reality of a Brexit shock that keeps dominating the medium-term outlook.

There is evidence that today’s lows might be the start of a new up-leg that may carry GBP/USD prices up to, at least, the highs of this lateral channel

GBP/USD daily price is experiencing a sideways movement, after retracing more 70% of its upward movement from its lows in August 2017

Possible scenarios:

- Today’s lows (1.31653) might be the start of a new up-leg that may carry GBP/USD prices up to, at least, the highs of this lateral channel (1.32272), provided that prices cross over the downward trend line.

- If the price does not continue up and reverse near the BB mean, then the downward leg is continuing to its next floor, at 1.31, and a good reward to risk trade is possible at about 1.3177.

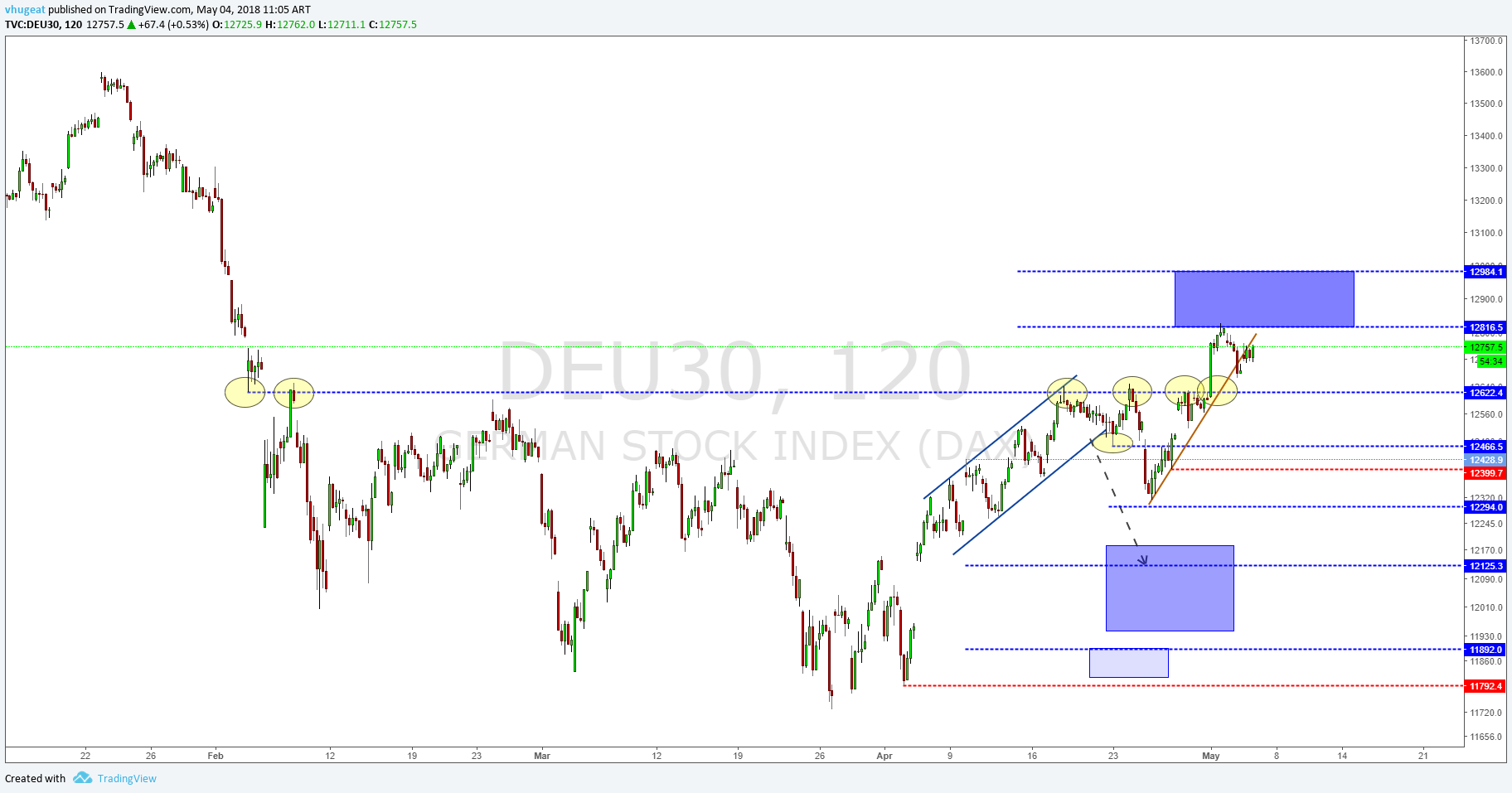

USD/JPY

Japan was in focus yesterday, as prime minister, Shinzo Abe is back in power

Japan was in focus yesterday, as prime minister, Shinzo Abe is back in power, after his victory this weekend, that drove the yen downward yesterday. Today, we see a bounce that set prices to test the highs of yesterday’s session. Tuesday, the Japanese currency, instead of focusing on Japan’s manufacturing PMI, slightly lower in October, it seems to pay more attention to interest rate differentials.

Mid-term, the USD/JPY is trading on a lateral price channel whose low is at about 107.7 and it’s high is at 114.34. Currently, the price, trading at 113.71, is moving closer to the top of that channel.

A short-term bottom at (1) in sync with the MACD signal crossover, marks the start of a new uptrend. The red 10-period BB is sloping strongly up, so prices are heading for a test of the recent highs at (3), and, potentially break them up.

The best possible action here is to scalp on a short timeframe, such as 15 min charts or shorter, being aware that we are at the highs of a mid-term channel. Long and short-swing trades must wait for a clear signal or news event

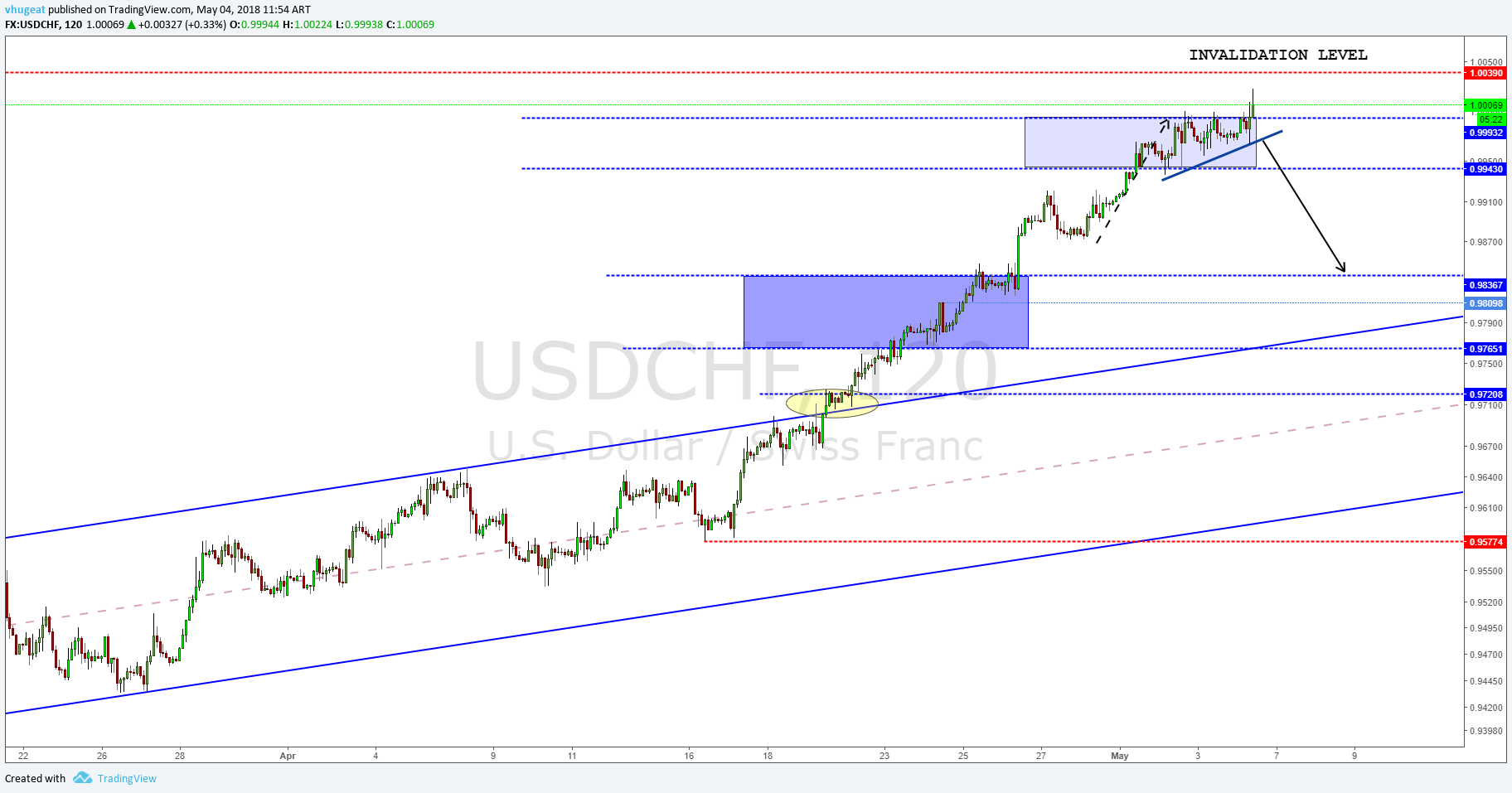

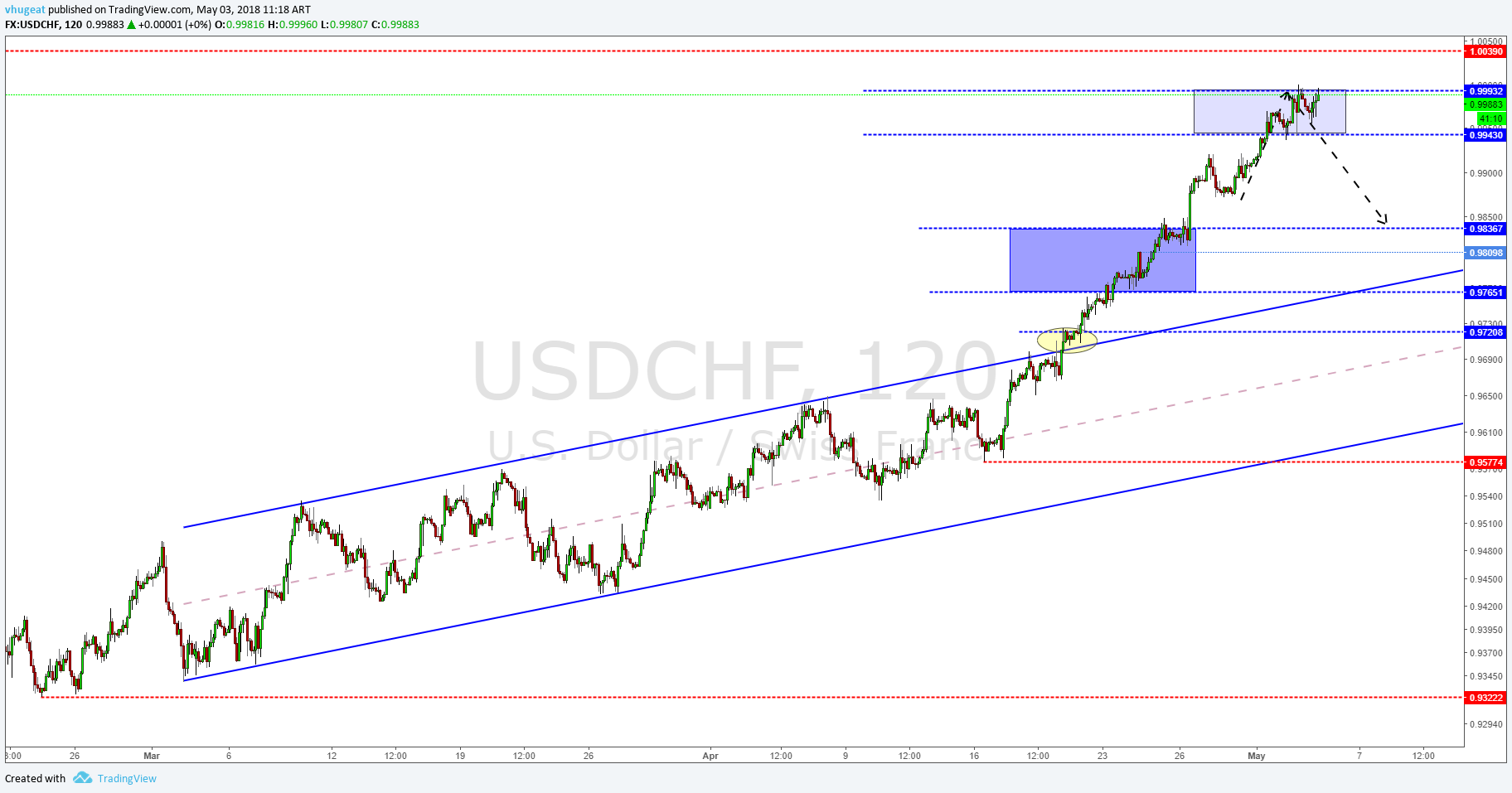

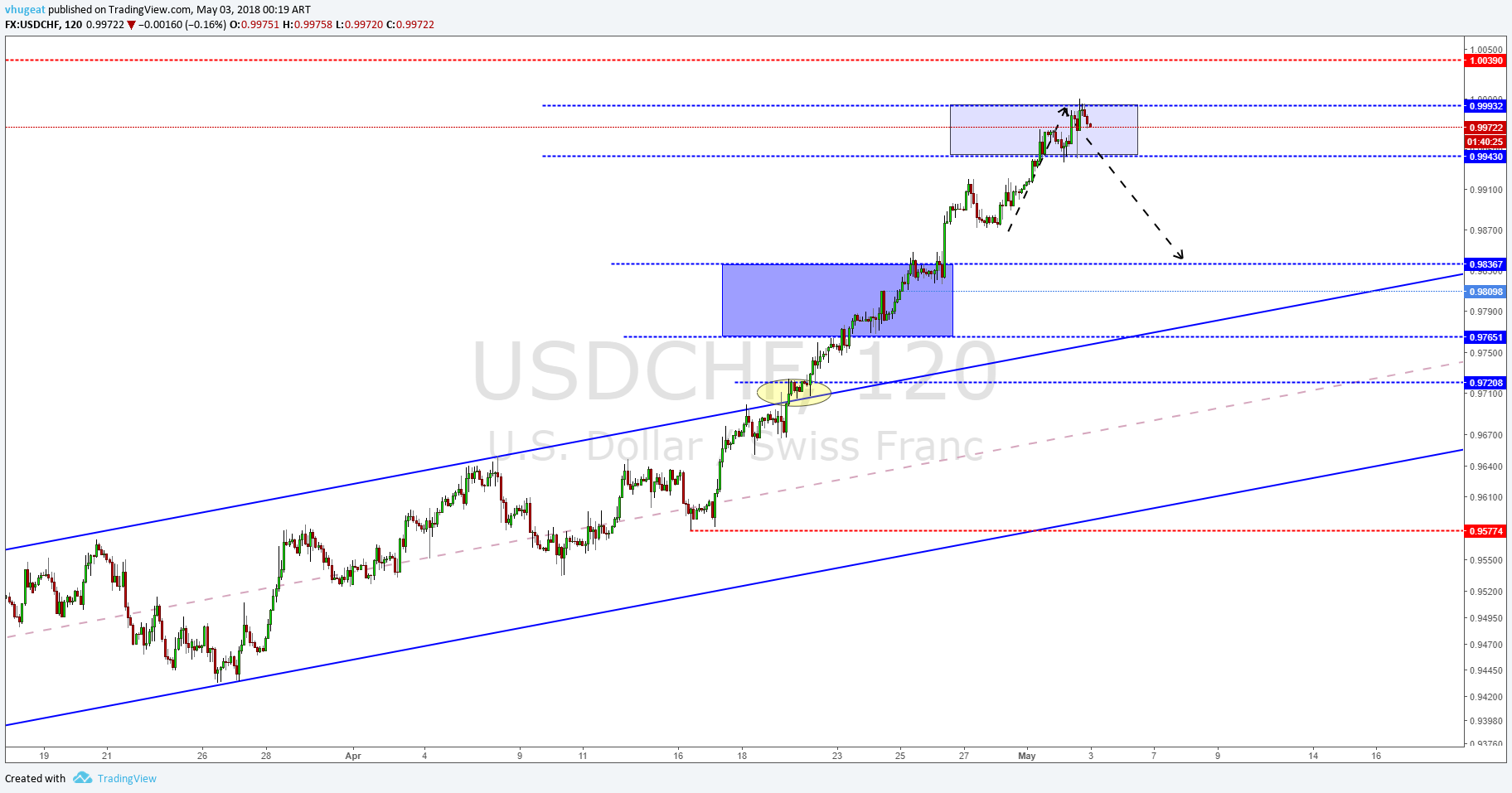

USD/CHF

The Swiss National Bank (SNB) is keeping an expansive monetary policy that drives Swiss CHF down

The Swiss National Bank (SNB) considers the CHF to be over-valued, so it is keeping an expansive monetary policy that is driving the Swiss currency down. The SNB policy of negative interest rates contributes to the downward currency trend.

To sum up, the Swiss economy is slowing down, its growth rate (+0.3%) is losing track compared to the one registered in the Eurozone (+2.3%) in the second 2017 quarter.

USD/CHF is at overbought but still strongly moving up

The USD/CHF weekly is on a sideways channel with a lower limit at 0.942, and an upper limit at 1.0365. Its current price – 0.9896- is at about the middle of this channel. On a daily and weekly basis, the price is in overbought territory.

Today the USD/CHF is trading strongly up, and its hourly chart is currently at overbought territory as well, with its price touching the 3rth Bollinger band (+3STD) (1). On such a strong trend, the best thing to do is wait for a price pullback to create a short-term support near the mean of the Bollinger bands (2) and set a long trade there.

AUD/USD

Tomorrow, Australia’s quarterly inflation data will be released.

The Aussie is under pressure as the soft Chinese housing data was weaker than expected. China is a major partner for Australia, and China’s economic health shakes Australian currency for the good and the bad. The Housing Price Index grew in China by 6.3%, after an 8.3% increase in August. Next Wednesday, Australia will release its quarterly inflation figures.

AUD/USD is currently in a downtrend

The AUD/CAD pair, on a weekly chart, is moving on a downward leg, in a sideways channel that started in Jan 2015. The channel has a slight upward bias.

On the daily chart, the AUD/USD pair is down-trending after drawing a double top (July and September 2017). Actually, the price is below the -1 Bollinger Band showing that the downtrend is still in place

The most probable scenario for the AUD/USD pair is to go down to at least 0.766, or, even deeper, to touch the lower weekly trend line (0.7518). The MACD crossover to the downside confirms the bearish bias of this currency pair

USD/CAD

USD continues to show strength against the Canadian currency. Tomorrow’s interest rate decision by the Bank of Canada will bring a confirmation (or denial) to the strong uptrend od this currency pair. The odds of a new rate hike are getting lower, after weak economic data ahead of the BoC meeting.

Canada Wholesale sales rose by just 0.5% in line with forecasts, although, it seems the market expected a bit more increment.

USD/CAD moving up with strength

The USD/CAD pair, on a weekly chart, is in the middle of a retracing trend, starting at the beginning of September, which has retraced 35% of the length of the downward move. Its daily chart shows the currency pair approaching the ceiling of a potential wide and sideways price channel. The other notable fact being, a price breakout through 1.25953, starting a new impulsive leg up.

NZD/USD

NZ Government to reform RBNZ process to set rates.

The Kiwi dollar is under pressure since the government announced its plans to reform the Reserve Bank of New Zealand. NZ Labor-led coalition said it will modernize the bank’s process for rate-setting and adapt it into a format that was more “growth-friendly”. Giving hints about expansionist monetary policy. Analysts say the RBNZ reform is already well priced by the market, and have downplayed its impact on interest rate expectations.

NZD/USD is currently at the bottom of a down-trending channel

On a daily chart, the NZD/USD pair is trending down on a channel that started on July, 27. Actually, the price is oversold, well below the -2 Bollinger Band. The price is near a mid-term support, so it’s in the process of bottoming out, as is clearly seen in its hourly chart.

A possible scenario for the next few hours is a retracement from here to test resistance points at about 0.695. If it stalls without breaking 0.6908, and MACD turns bearish the retracement is failing, and the downtrend might resume testing the lows made in May 2017.

(c) Forex.Academy

(c) Forex.Academy