FED Interest Rates

The Federal Reserve kept interest rates unchanged on Wednesday, as expected, but indicated that inflation was nearing its 2% target, lining up a further rate hike at its next meeting in June.

The dollar went down against other major currencies. Position adjustments were discouraged ahead of the statement on the expectations of more hawkish monetary policy.

The statement declared that inflation had approached the Fed’s 2% target, but there was no indication that it was accelerating. It also mentioned the word “symmetrical” twice in the statement, referring that it will not let inflation run above target just because it had previously run below target.

“The Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate,” said the Fed in its statement. “Inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the medium term.”

A CIBC spokesman said that they expect the PCE to run a bit above the expected 2% target level, but they thought that policymakers appear to be trying to cool down expectations that such a surge would guarantee a faster pace on rate hikes.

Eyes will also be on Non-farm employment change which will be released on Friday

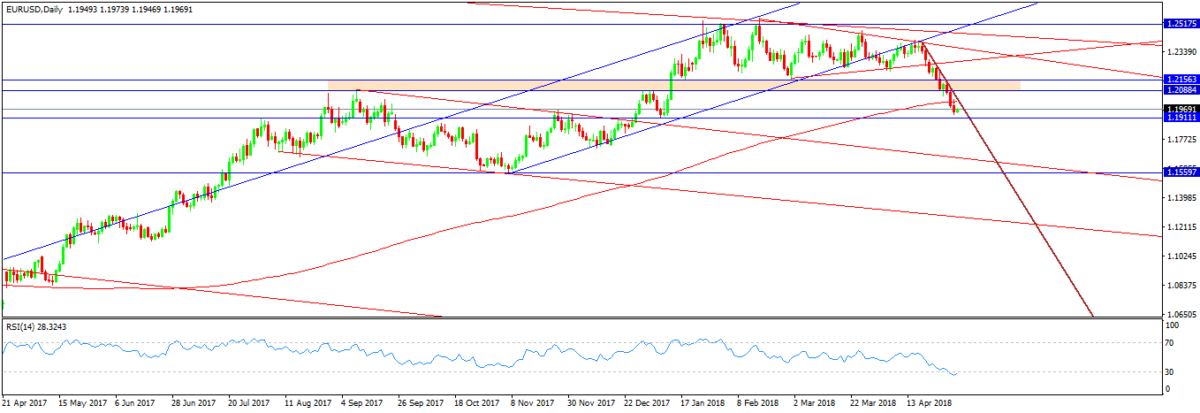

EUR/USD

On the daily chart, the price has cut its silence to eventually break the sideways movement with breaking through the upward channel & triangle. The existence of the descending trend line from the high of 2008 played a big role in this bearish way. The pair had no mercy with the support zone 1.2085-1.2155 to close below it. The price is now located on the 1.1911 support, together with its RSI in oversold condition.

If the price could bounce from this level breaking through the lower trend line as shown, it may reach the previous zone again. If the price continued going down, we may see the 1.173

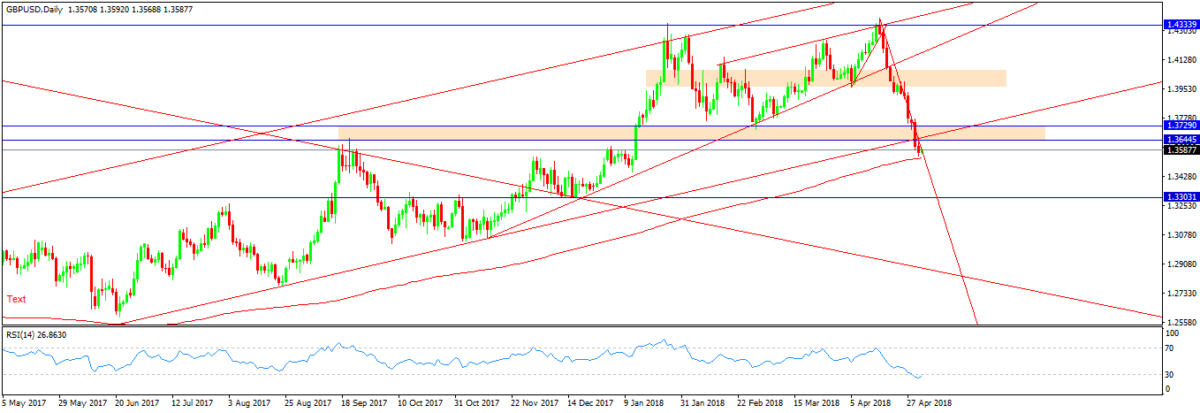

GBP/USD

For the tenth day in a row, the price forms bearish candles, breaking through support zones. The price initially bounced from its resistance level at 1.4335, then closing under the wedge & first zone 1.4055-1.396.

The price eventually broke through the second zone 1.373-1.3645 & the upward trend line from the low of 2017. The pair is now located at its 200-day moving average, also with its RSI in the oversold area. If the price reverses from this area, it could retest 1.373. If not, we can see that the way is wide open to 1.33

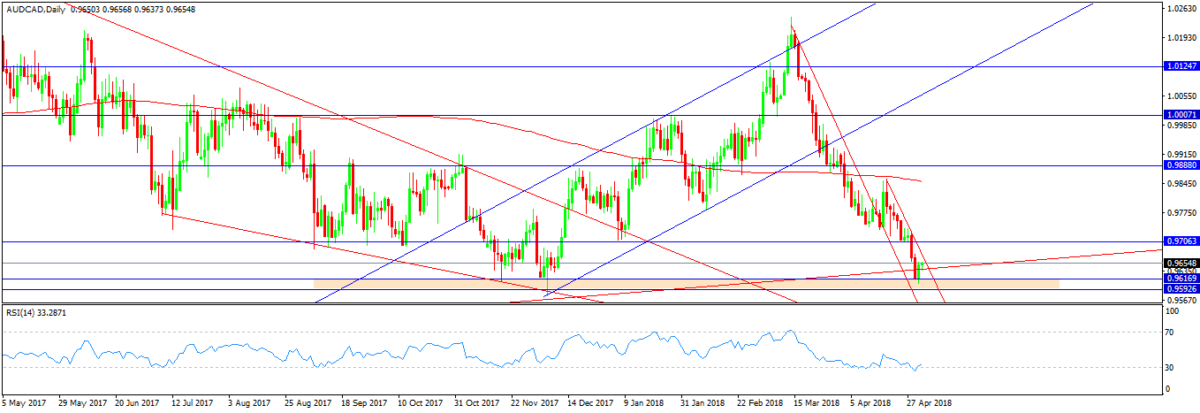

AUD/CAD

The pair had seven consecutive bearish weeks, finally reaching its support zone at 0.9615-0.959. The pair bounced from the upward trend line from the low of 2015. The price also reached the broken descending trend line from the high of 2018, with its RSI in oversold condition.

If the price could break-up through the descending trend line from the high of April as shown, it could have its way back up to 0.971

©Forex.Academy