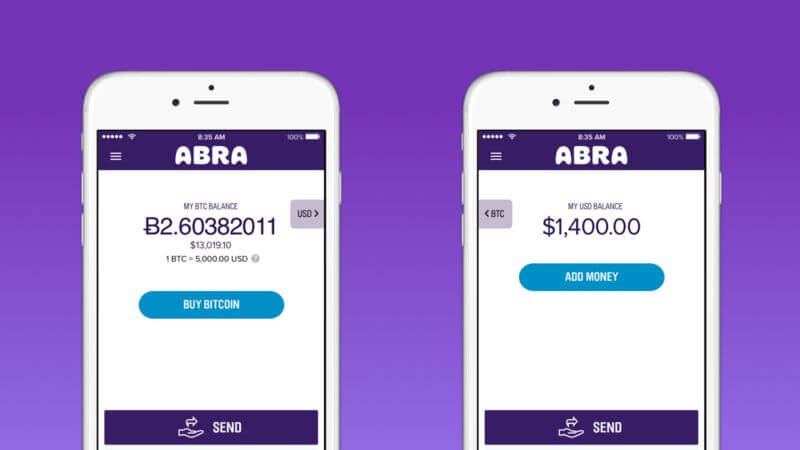

Abra Wallet is a leading virtual service company specializing in blockchain technology and cryptocurrencies. On their website, the Abra crypto wallet is hailed for its simplicity, accessibility, and flexibility. It is a versatile app that is compatible with most operating systems. The crypto wallet is also highly intuitive and simplifies the process of storing and trading cryptos for its users. Launched in 2014 in Silicon Valley and headquartered in The Philippines, Abra supports over 54 world currencies.

But how does it work, how secure is the wallet, how many cryptos can it hold, and what key features make it rise above the competition?

We have tried Abra Crypto Wallet and interacted with its different features. In this review, we tell you how it works, its security features, its usability, and everything else you need to know before downloading and installing the crypto app.

Abra wallet key features:

Simple to use: The Abra crypto wallet app is quite user-friendly and accessible to virtually everyone. It has a simplistic and highly customizable design that makes it easy to use for both beginners and expert traders.

In-built exchange: The Abra crypto wallet app also features an in-built exchange. Here, you can engage in both fiat-to-crypto and crypto-to-crypto conversions. The exchange is quite straightforward and relatively easy to use.

Highly versatile: The Abra crypto wallet app is highly versatile and compatible with both the Android and iOS operating systems. Moreover, it supports a wide range of both crypto and fiat currencies.

Portfolio creation tools: Abra wallet is more than a crypto storage app; it is a crypto investment app. In addition to storing your digital assets securely, the app will also let you invest in leading stocks from different international markets. It especially lets international crypto traders invest in U.S stocks.

Supports fiat-to-crypto purchases: Abra crypto wallet app features an in-built exchange. This tool lets you convert fiat to crypto and engage in crypto-to-crypto exchanges.

Support cash deposits: Unlike most other crypto wallet apps, Abra makes it possible for you to purchase crypto directly via different forms of cash payments. These include credit/debit card purchases and direct bank wire transfers.

Abra wallet users in the Philippines can also pay for their crypto using the Teller Payment System. Note, however, that all your funds in Abra are by default held as Bitcoin (except for Bitcoin Cash and Litecoin), but you can choose to denominate them in the form of any other currency.

Abra wallet security features:

Passcode: Your Abra wallet app has to be secured with a four-digit passcode. You get to set this PIN code when installing and activating the app.

Recovery seed: When installing the crypto wallet app, and after setting the passcode, you will be provided with a recovery seed. Record on a hardy piece of paper and keep it in a highly secure place. You will need it when resetting your app password or when recovering lost private keys.

Two-factor authentication: The Abra crypto wallet app also integrates the two-step verification security feature. This allows you to link your app with your phone number and ensures that you receive an SMS verification code when logging into the wallet and when transferring coins out.

Military-grade encryption: According to Abra wallet developers Bill Barhydt and Pete Kelly, this app collects as little sensitive information of their clients as possible. Additionally, the user data stored within the app – including passwords and private keys – is highly encrypted. All of the app’s interactions with third-party apps and websites, including payment systems, are also highly encrypted.

Non-custodial wallets: Abra wallet developers don’t store your private keys or their copies within the company servers. All the private keys are stored in individual wallets within the wallet of the owner’s devices. This effectively gives you near-absolute control over your private keys.

Hierarchically deterministic: The Abra crypto is also hierarchically deterministic, implying that it automatically generates new wallet addresses for different crypto transactions. This promotes anonymity as it makes it impossible for third parties to track your crypto transactions.

How to set up and activate the Abra Crypto wallet app:

Step 1: Start by downloading the Abra cryptocurrency app from the Google Play Store or Apple Store. You can also download these apps from the Abra’s official website.

Step 2: Initiate the installation process and proceed with creating a user account. Here, you are required to fill in your personal details, including your name, email address, physical address, and your mobile phone number.

Step 3: Activate the two-factor authentication protocol by using the code sent to your mobile number.

Step 4: Proceed to set the four-digit PIN code that secures your Abra crypto wallet.

Step 5: The app will now provide you with recovery phrases. Write them down and keep them safe.

Step 6: The installation is now complete, and the crypto mobile wallet app activated. You can start adding funds, converting/exchanging different currencies, and investing.

How to receive funds/add crypto into your Abra crypto wallet:

Step 1: Start by launching the Abra crypto wallet app and clicking on Portfolio.

Step 2: Click on ‘Add Money’ and choose the cryptocurrency you wish to add/receive into your wallet. This reveals the coin’s wallet address and its corresponding QR Code.

Step 3: Send the address to the parties sending you cash or have them scan the QR code

Step 4: Wait for the cryptocurrency to reflect on your wallet.

How to send crypto out of Abra wallet:

Step 1: Start by launching your Abra Crypto wallet app and clicking on ‘Portfolio.’

Step 2: Click on ‘Send Money’ and choose the cryptocurrency you wish to transfer.

Step 3: Key in the recipient’s wallet address or scan their wallet’s QR code and enter the amount of crypto you wish to send.

Step 4: Confirm that the wallet address and amounts entered are correct and hit send.

Abra Wallet’s ease of use

Abra crypto wallet is very user friendly. The registration process, for instance, is rather quick and straightforward. The fact that the crypto wallet app handles fiat transactions, plus its registration as a Financial Services Provider, means that you will be subjected to the different KYC and AML protocols. It also means that your crypto transactions won’t be wholly anonymous.

Unlike most other crypto apps that require you to pass through third party currency conversion systems like Simplex or Changelly, Abra processes direct fiat deposits. Here, you can make crypto purchases directly using your debit or credit cards, direct bank wire transfers, or the Teller Payment System.

One of the most unique aspects of the Abra Crypto wallet app is that your deposits into the wallet app are held as Bitcoins By default. This implies that if you deposited $10,000 into the wallet, this amount is automatically converted into its Bitcoin equivalent (say 1 BTC). Therefore, if Bitcoin’s value surges by 25%, your balances increase by a similar margin and vice versa. The account can, however, be denominated by any currency and you are free to change the default BTC base currency into any other currency at any time.

Abra wallet supported currencies and countries.

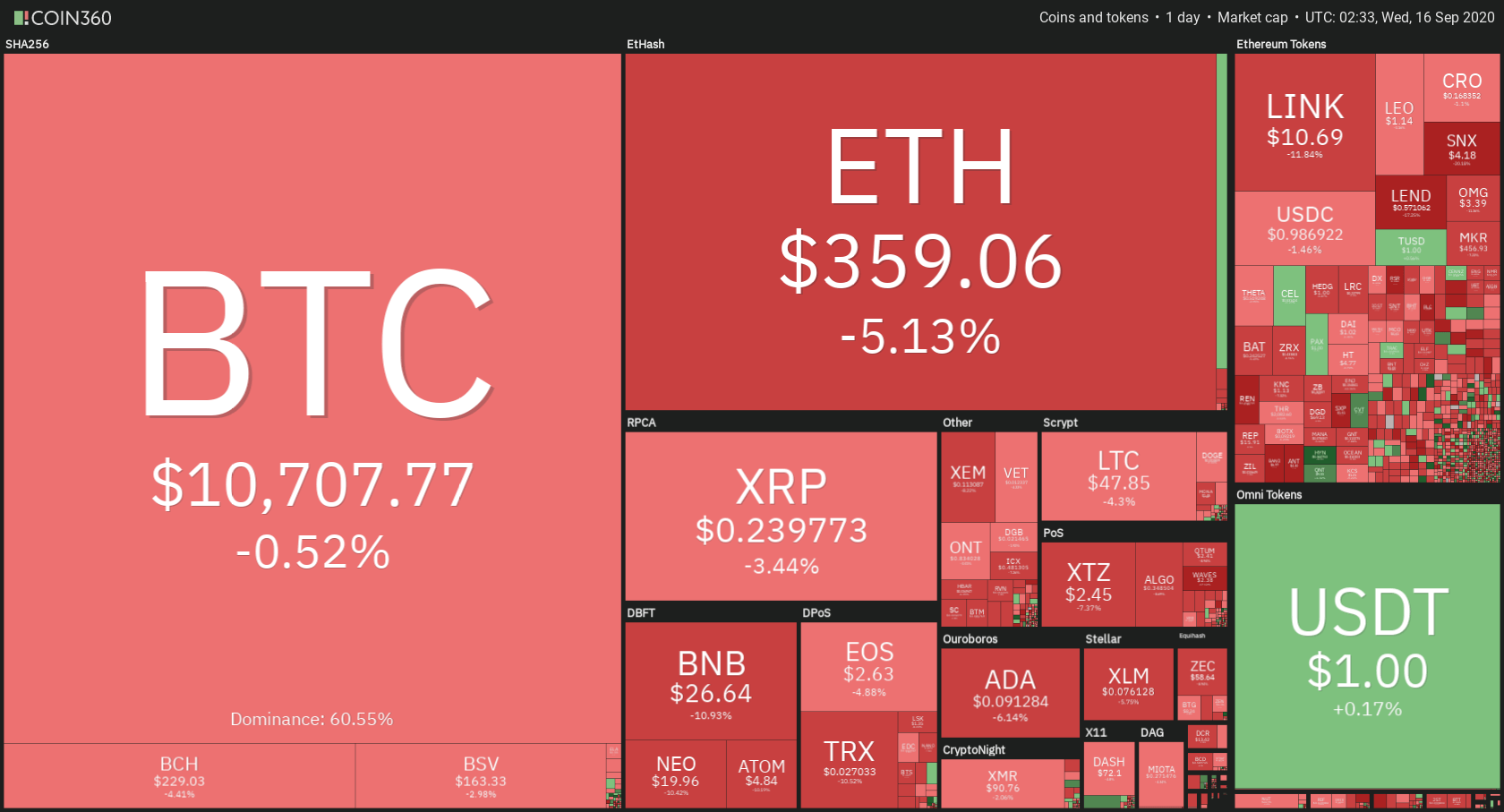

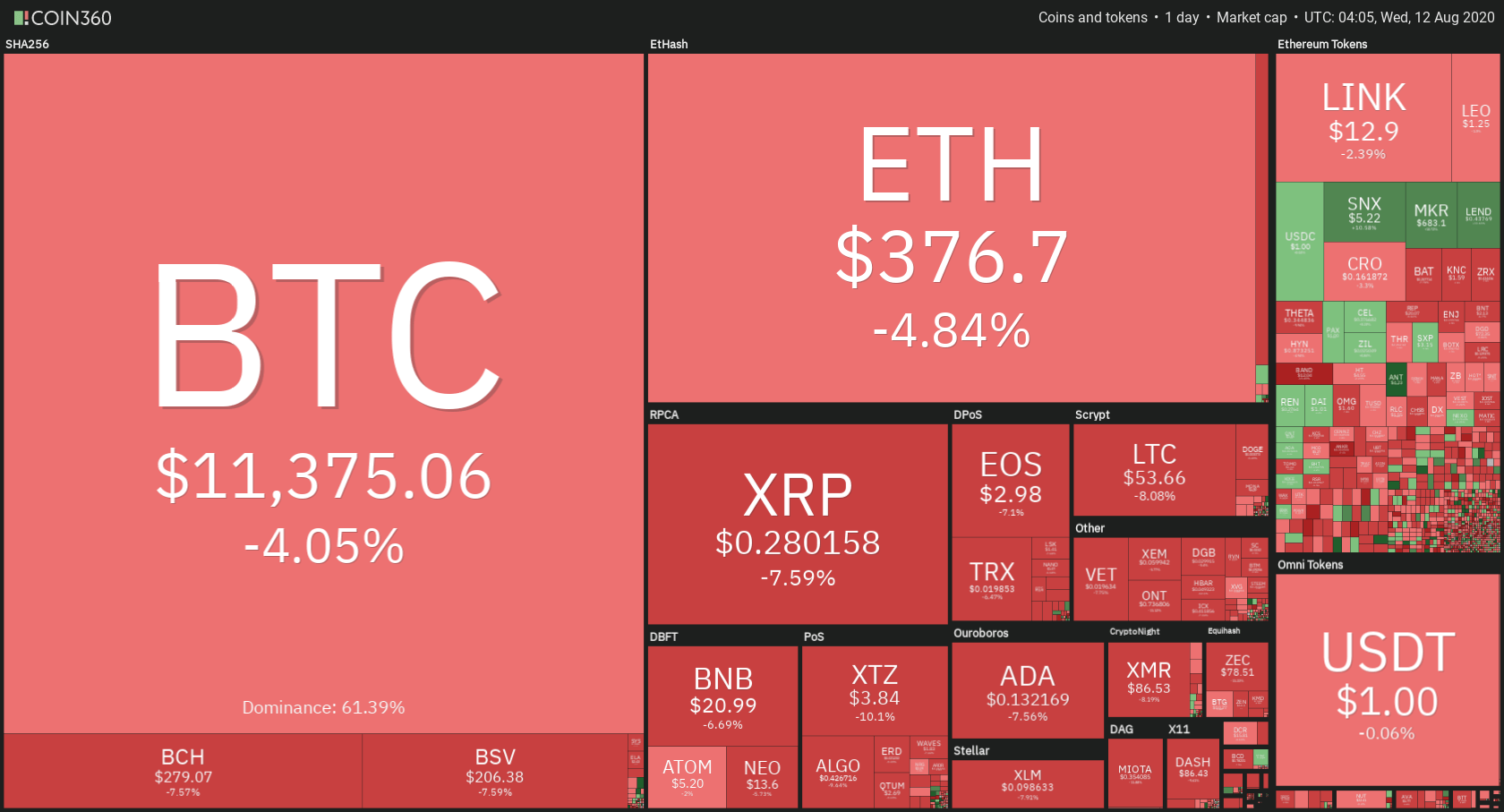

According to the Abra wallet website, the crypto vault is now accessible to residents of over 150 countries – including the U.S.

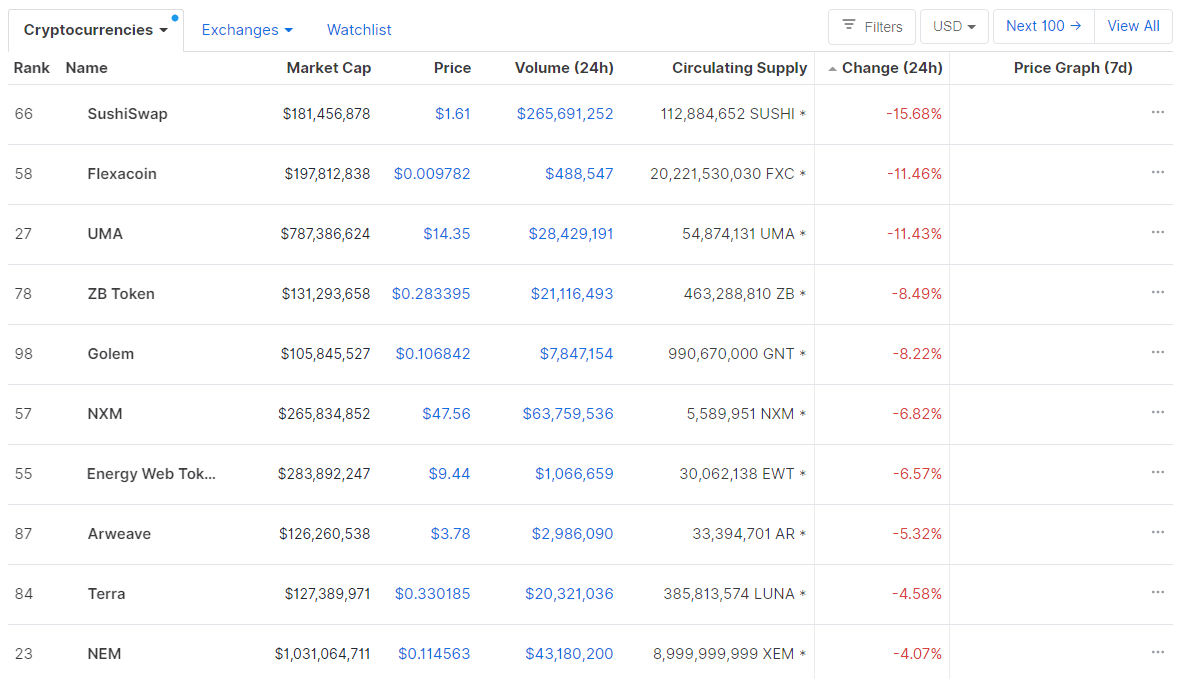

Abra users in the United States can interact with over 30 of the most popular cryptocurrencies and as much as 50 fiat currencies.

Abra crypto wallet users outside the U.S however, have access to a wider range of currencies as they get to interact with over 200 crypto+fiat currencies.

Abra wallet’s inbuilt exchange is nonetheless highly versatile and there is no limit of either crypto-to-crypto or fiat-to-crypto pairs.

Abra wallet cost and fees:

You will not be charged to download and install the Abra crypto wallet app. And neither will you be charged to activate or for storing your digital assets on your Abra Crypto wallet.

A variable transaction processing fee will, however, apply and debited from your Abra cryptocurrency wallet every time you send cryptocurrencies out of the wallet. These fees are collected by the blockchain miners or network administrators and not Abra wallets and are largely dependent on such factors as the type of cryptocurrency and the transaction amounts involved.

Within the app, you will also incur currency conversion fees in the form of spreads. And this markup price for the different cryptos is set by Abra.

Note that while Abra wallet doesn’t impose withdrawal fees, your payment processor will often charge transaction fees when you deposit into Abra.

Cash Deposit and Withdrawal limits

The app has set limits on the amount of cash you can deposit or withdraw from your Abra crypto wallet app. For instance, U.S residents can only transfer a maximum of $30,000 per wire daily. Additionally, you can only make a bank deposit or withdrawal of a maximum $2,000 daily, up to $4,000 weekly, and $8,000 monthly, while daily credit card deposits/withdrawals have a daily and monthly limit of $200 and $1,000 respectively.

While there is no limit to the number of BTC or LTC conversions you can make, non-BTC/LTC conversions have a daily limit of 5 BTC.

Abra wallet customer support

Abra Wallet’s customer support starts with the wallet’s highly elaborate FAQs page featured on the Abra website. The wallet also features a highly informative blog and the two are key towards addressing some common challenges experienced by Abra Users.

For more personalized queries, consider contacting Abra’s customer support team on their different social media pages like Telegram, Twitter, Reddit, and Facebook. You may also contact them by raising a support ticket on the Abra website.

What are the pros and cons of the Abra crypto wallet app?

Pros:

- Abra is an all-in-one wallet that doesn’t just let you store your cryptocurrencies but also lets you invest in the stock exchange.

- The mobile crypto app also features an in-built exchange.

- Abra wallet supports both fiat and cryptocurrencies.

- It allows you to change the base currency of your wallet from the highly volatile Bitcoin to Fiat, effectively guarding your assets against possible crypto falls.

- Installing the app and storing coins therein is free.

Cons:

- One may consider the currency conversion rates for the wallet’s inbuilt exchange rather high.

- By holding your cash deposits into the app in the form of Bitcoin, the wallet subjects your cash to volatility risks.

- The app subjects you to both KYC and AML procedures, which defeats the purpose of Blockchain and cryptos anonymity.

How does Abra Crypto wallet compare to other popular cryptocurrency wallets

When compared to such other crypto wallet apps as eToro, Abra carries the day because of its ease of use and the number of features included. For instance, unlike eToro’s inbuilt exchange that has a limited number of trading/exchange pairs, the Abra Crypto wallet is highly versatile and has an unlimited number of trading pairs. It also supports a wider range of deposit and withdrawal methods that include Teller payment systems. eToro, however, supports a wider range of cryptocurrencies and tokens and can also be considered more secure.

Abra crypto wallet, however, pales in the face of leading Crypto hardware wallets in terms of security and number of supported currencies. Ledger Nano S, for instance, supports more than 1000 cryptocurrencies and tokens and also stores these digital assets offline. The Abra Crypto app can, however, be considered more convenient and easier to access.

Bottom line: Is Abra wallet safe?

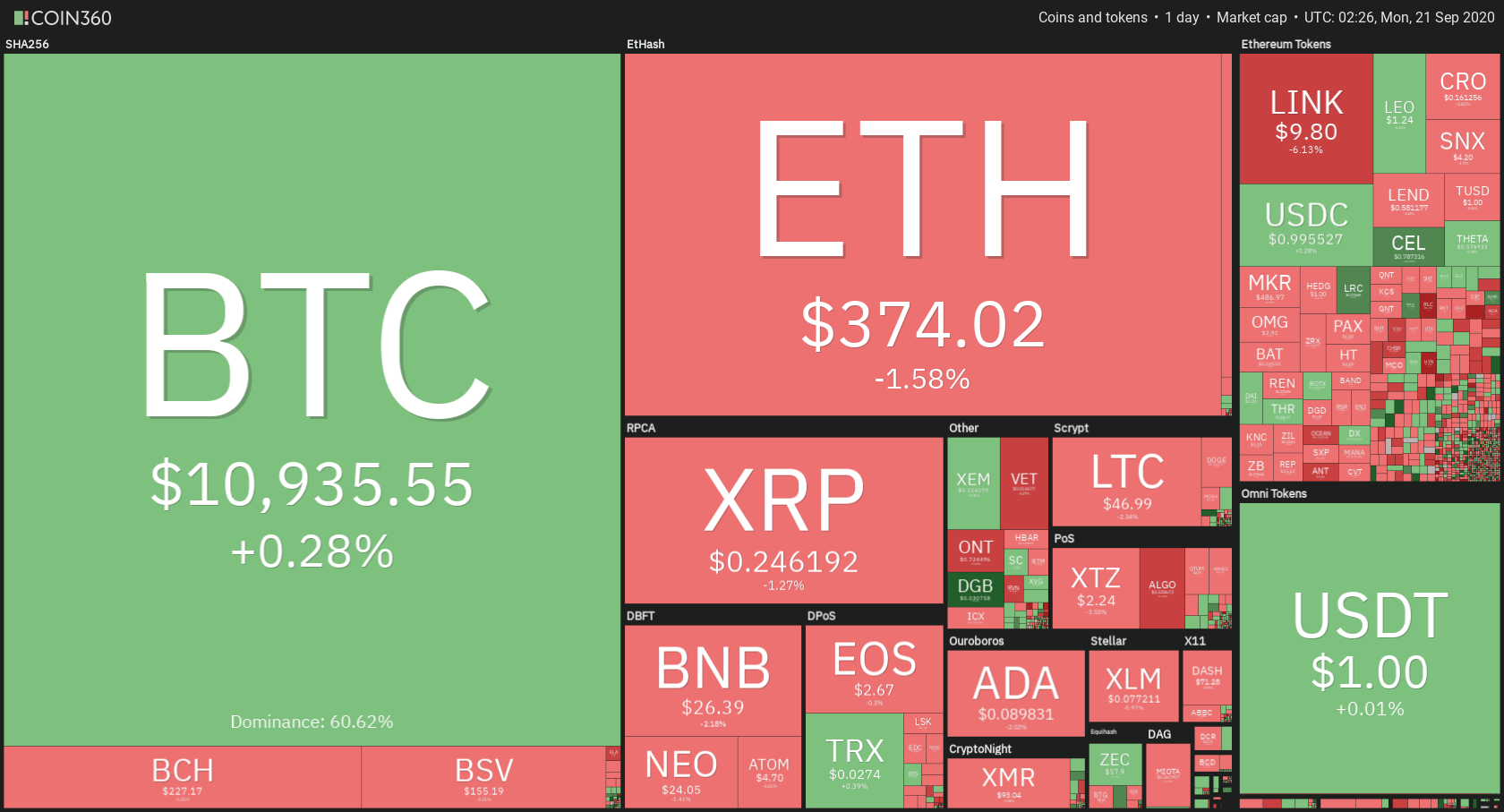

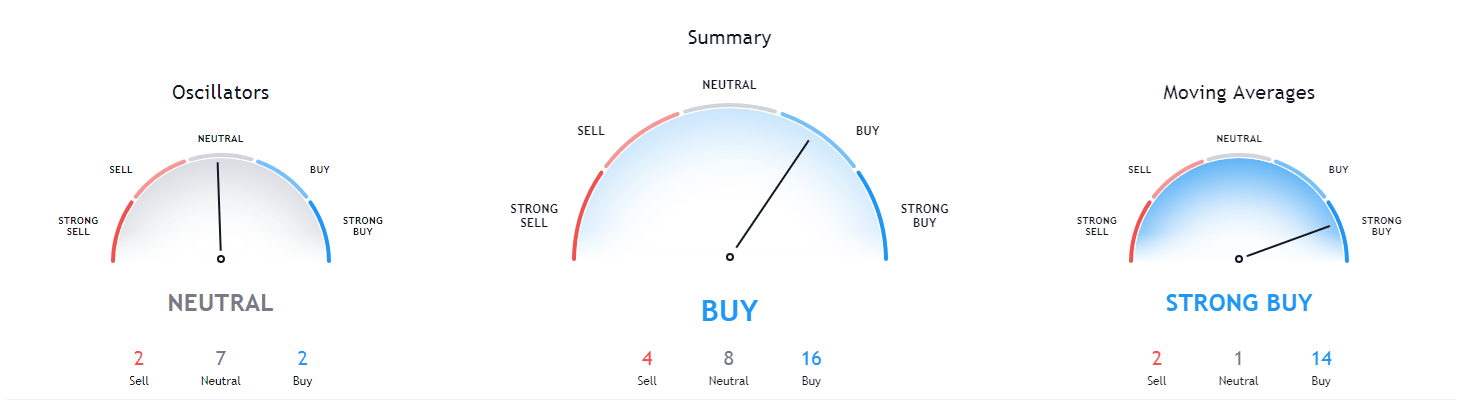

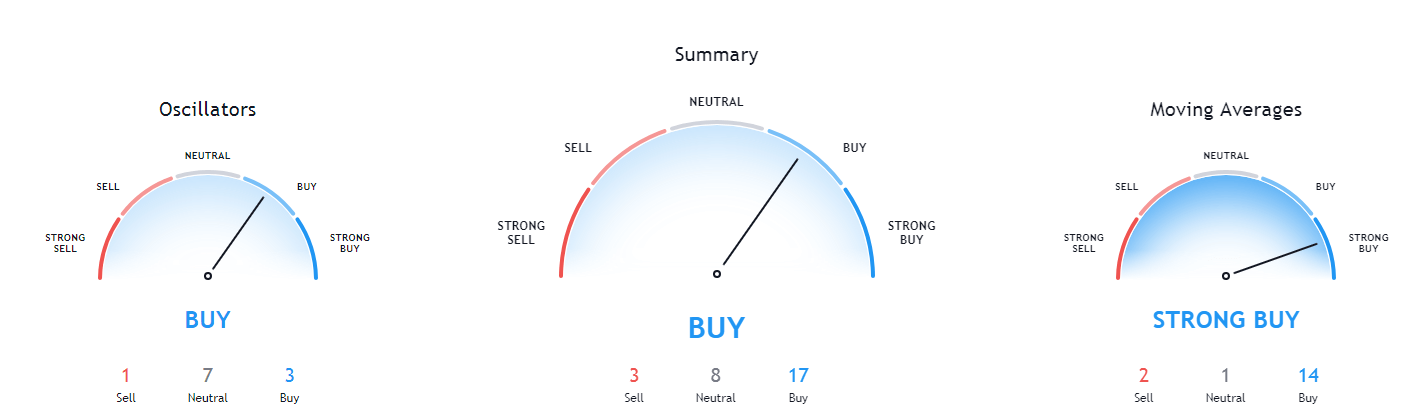

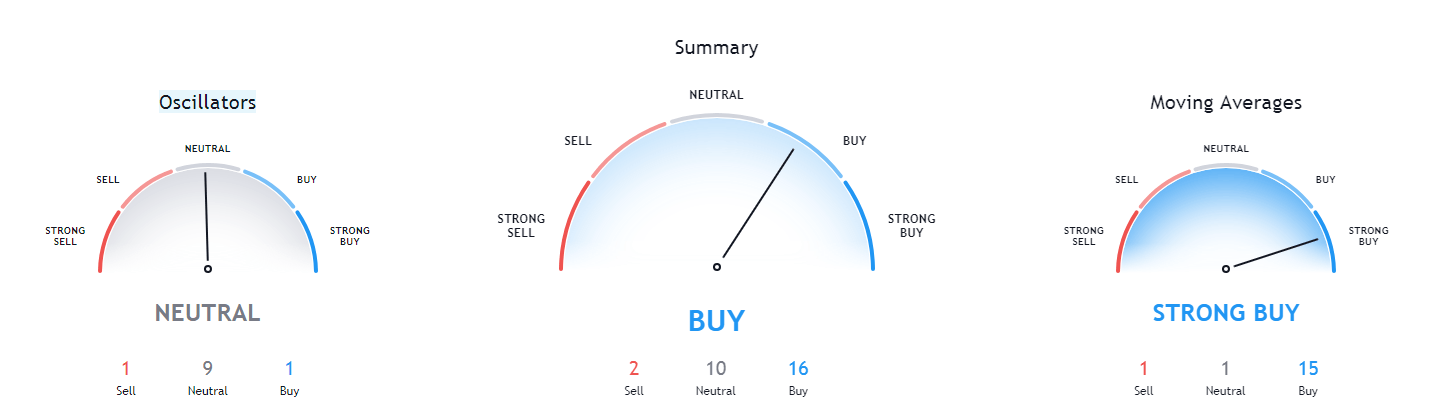

Abra has made significant strides towards creating the most sophisticated, versatile, and easy to use trading platform. Their app is not only freely available to all crypto enthusiasts but also integrates some of the most advanced trading and analysis tools.

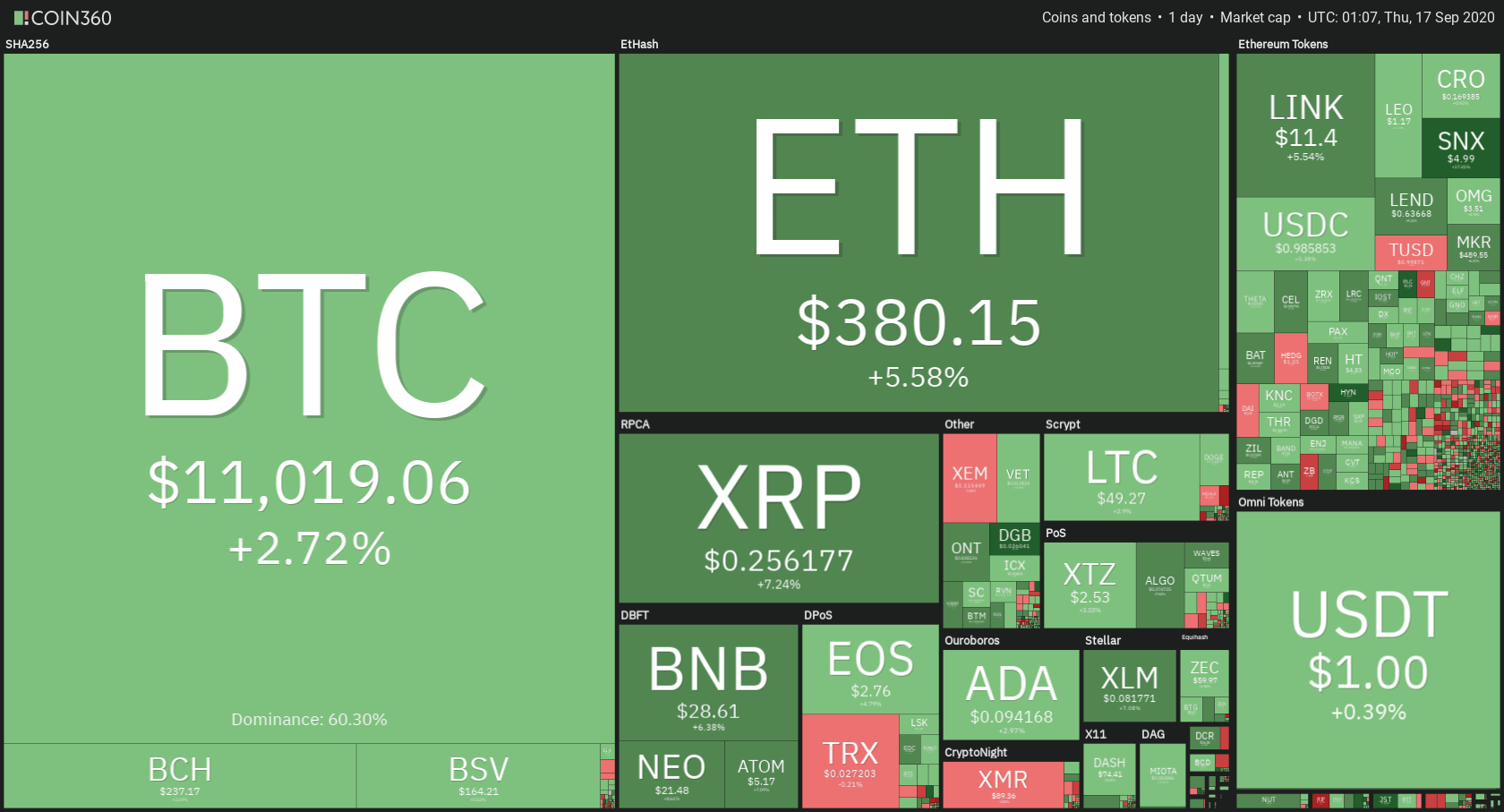

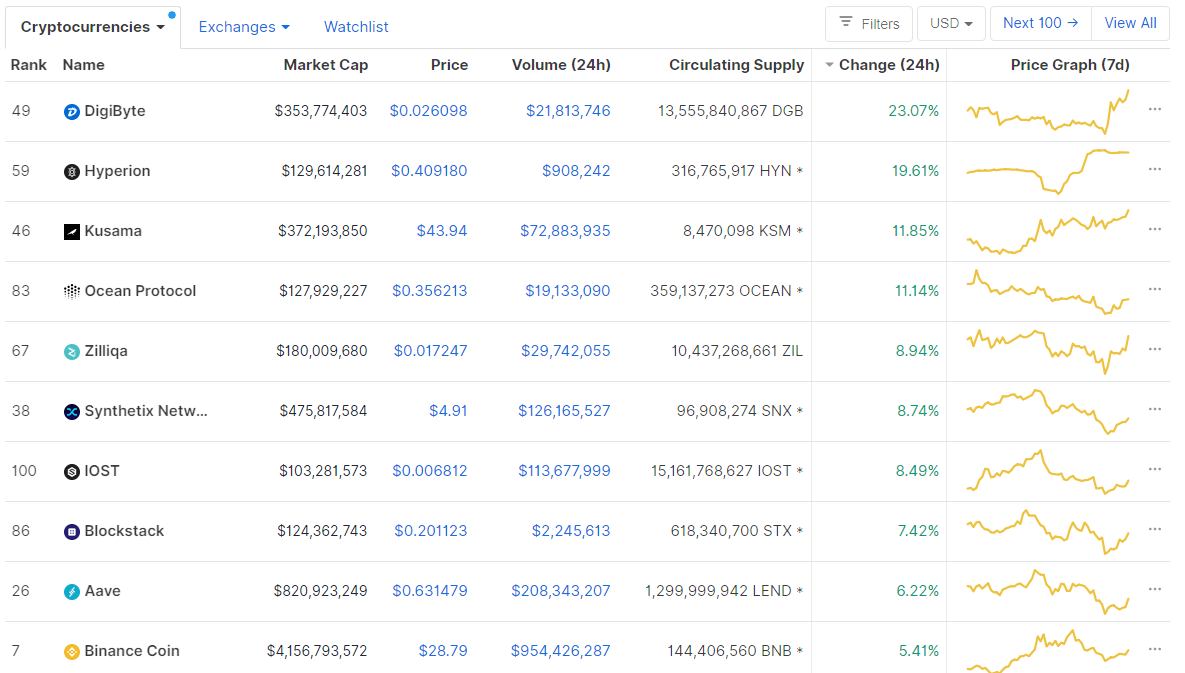

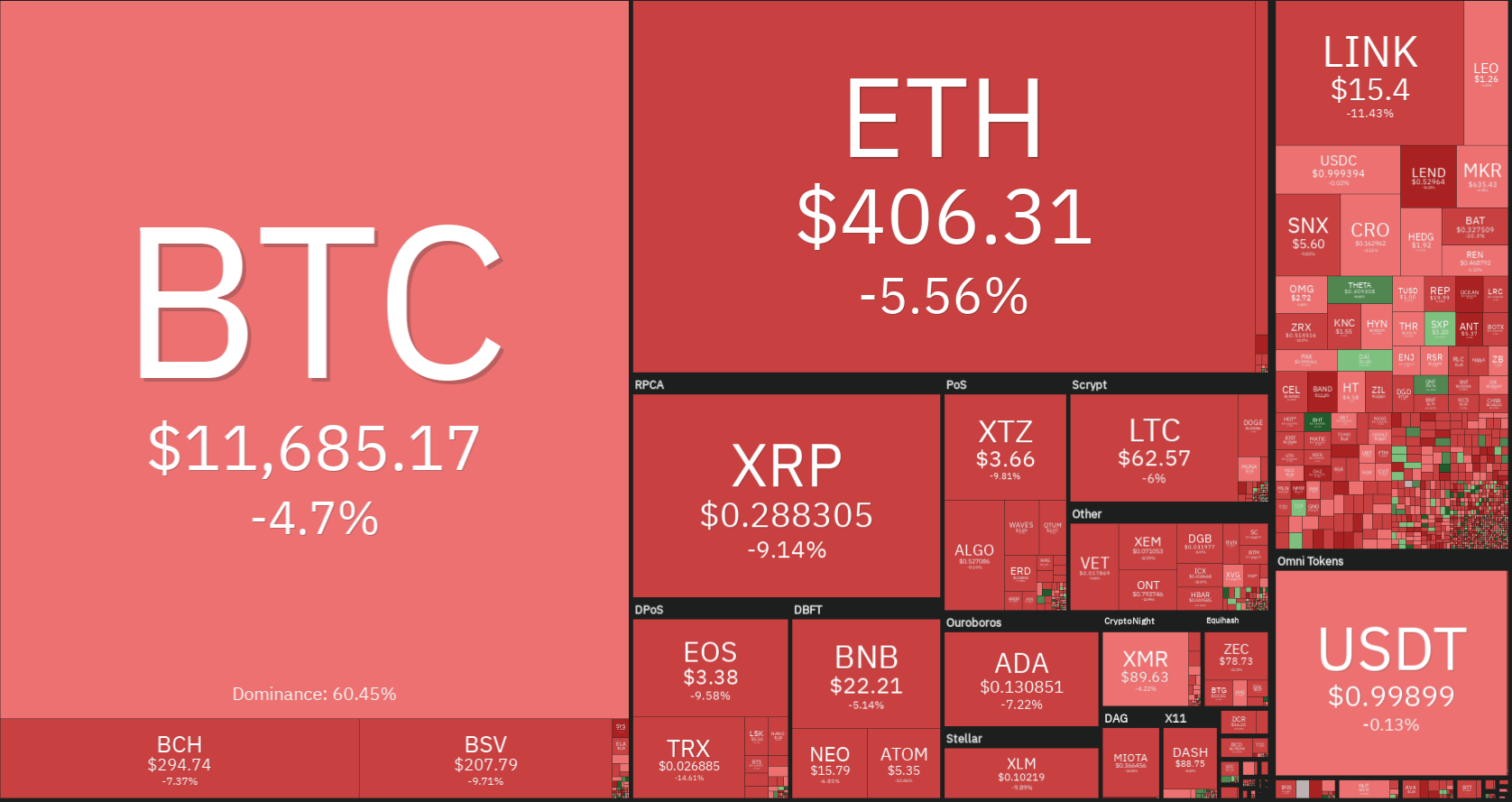

It also gives its users access to direct crypto market data, including crypto prices and the blockchain industry event calendar. But more importantly, it has put in place several sophisticated security features that make its wallet highly secure while giving you absolute control over your private keys.