Volatility in the markets is indissoluble from human passions and influences that mass psychology that also computes in stock prices in the markets. With it came the sense of risk, emotion, borderline situations, compulsive follow-up, and also brought that some investors fall into a stock market gambling addiction where the bets are named after listed companies.

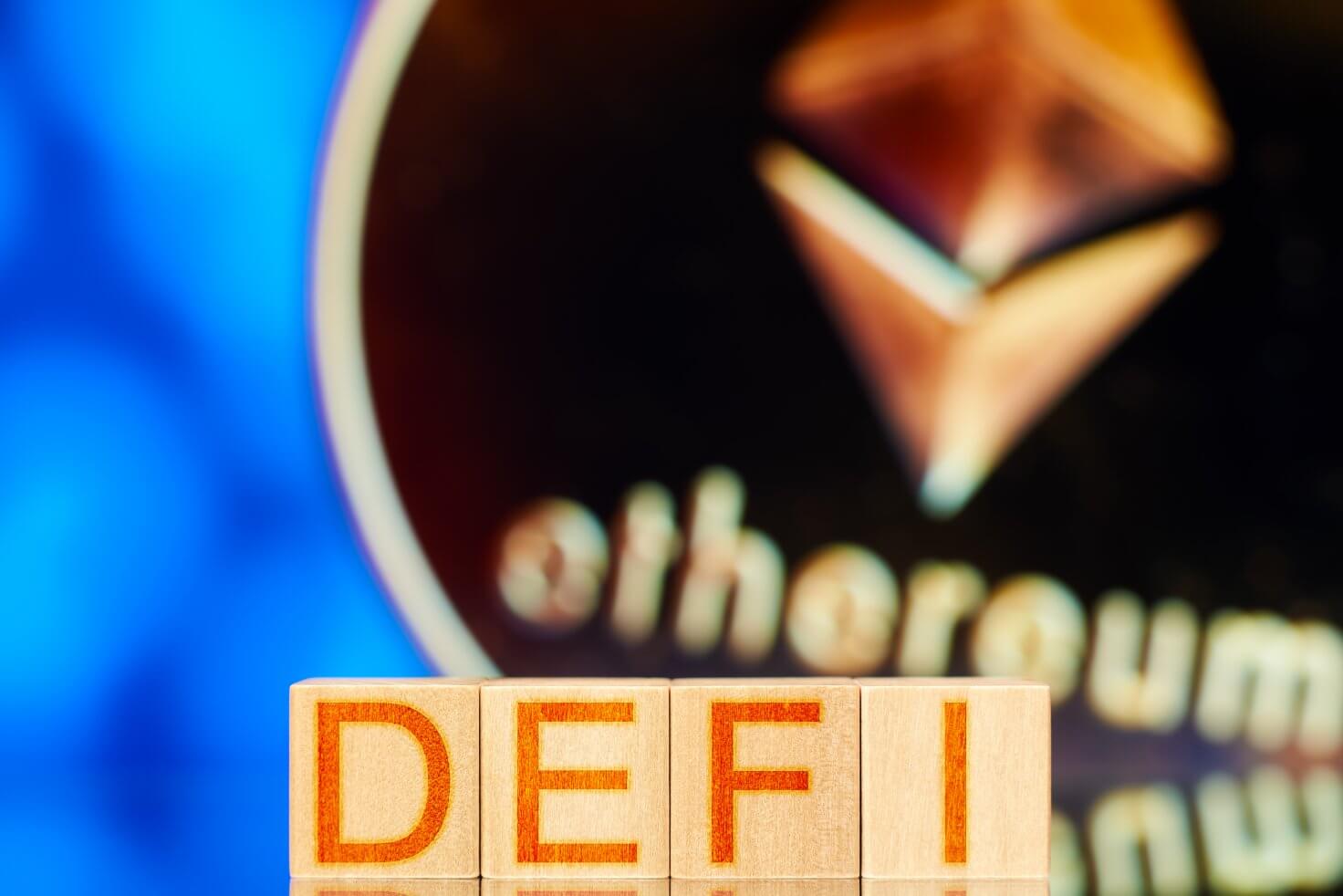

No asset is really oblivious to this type of dynamics, in which there are people more and less prone. But after the crypto-active fever that seems to be in remission (for the moment), new forms of this particular addiction are now emerging in specialized clinics. Yes, the particular characteristics of crypto-currency trading lend themselves in a special way to end up betting what is not due to a token when betting on a horse at the racetrack.

The red line that divides the inversion of the bets is often indistinguishable.

Popular capitalism gave the small shareholders the possibilities reserved until then only to the big capitals, not without the due dose of “dirigisme” of mass money that can make rich and can trigger crises. Markets arrived (theoretically) to bring liquidity and transparency to quotes from companies that could also be financed by mechanisms such as VOPs or by issuing new securities.

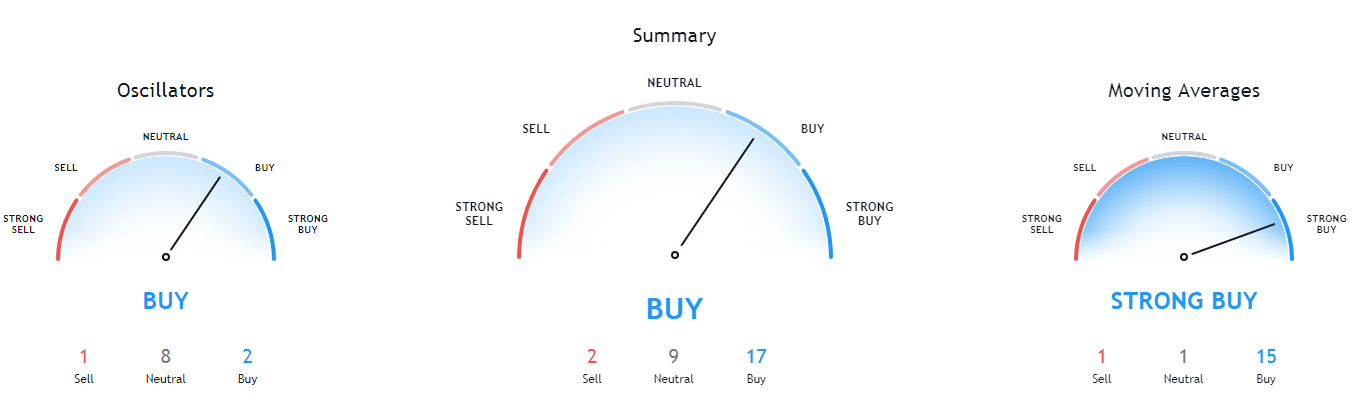

But there is much more background than it seems on this issue and its relationship to investment and markets. After all, crudely put, isn’t any investment ultimately nothing more than a simple bet? However much we put it behind us, however much we embellish it, however much we try to disguise it, even for the most pragmatic and systematic investors, guessing the future is impossible, and risking your money to a future possibility, The answer is no other than that investors bet.

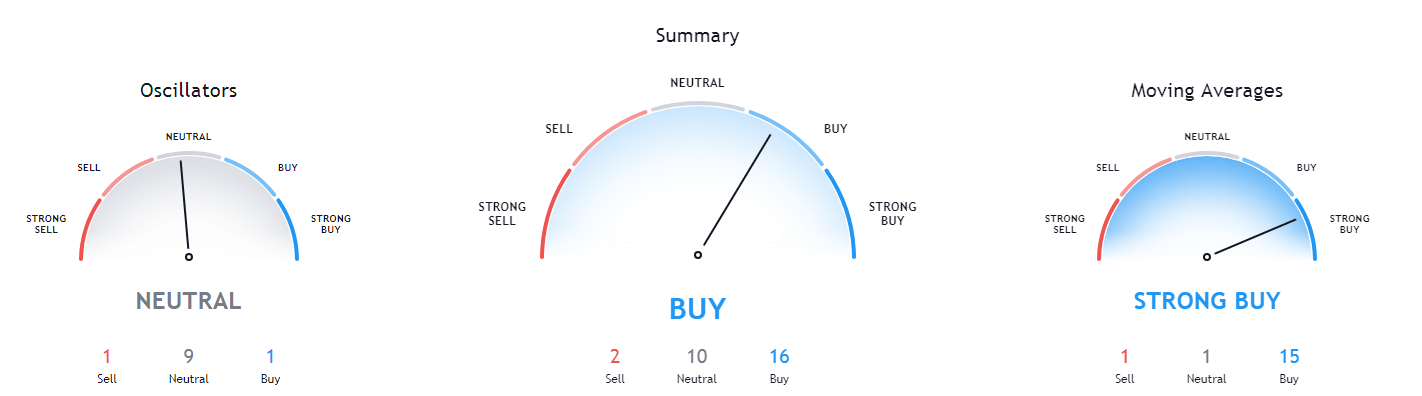

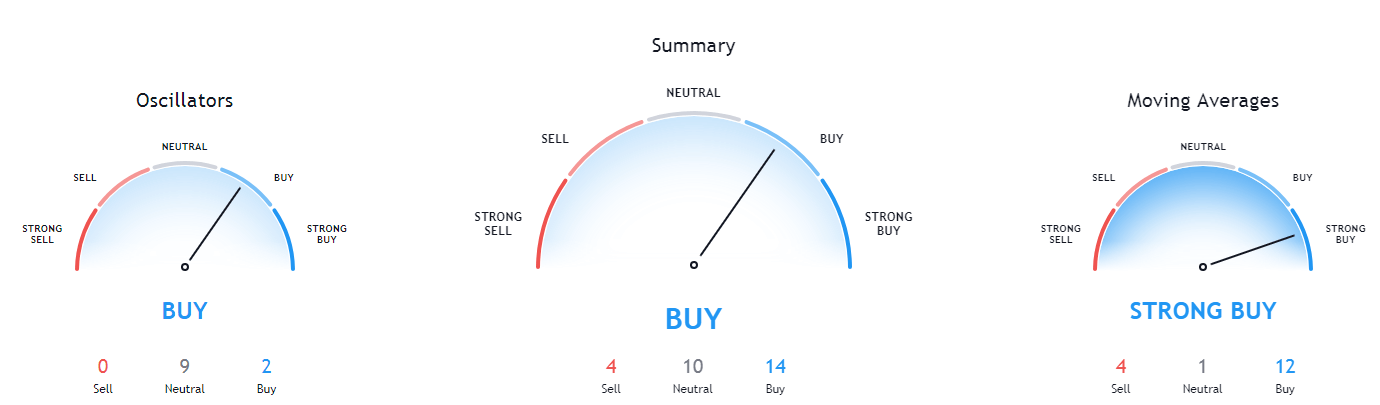

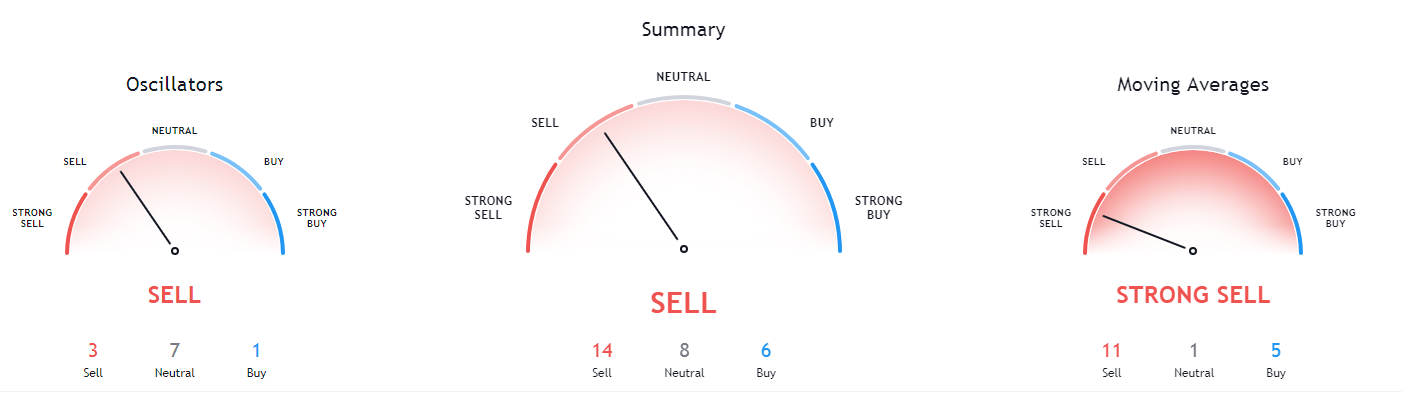

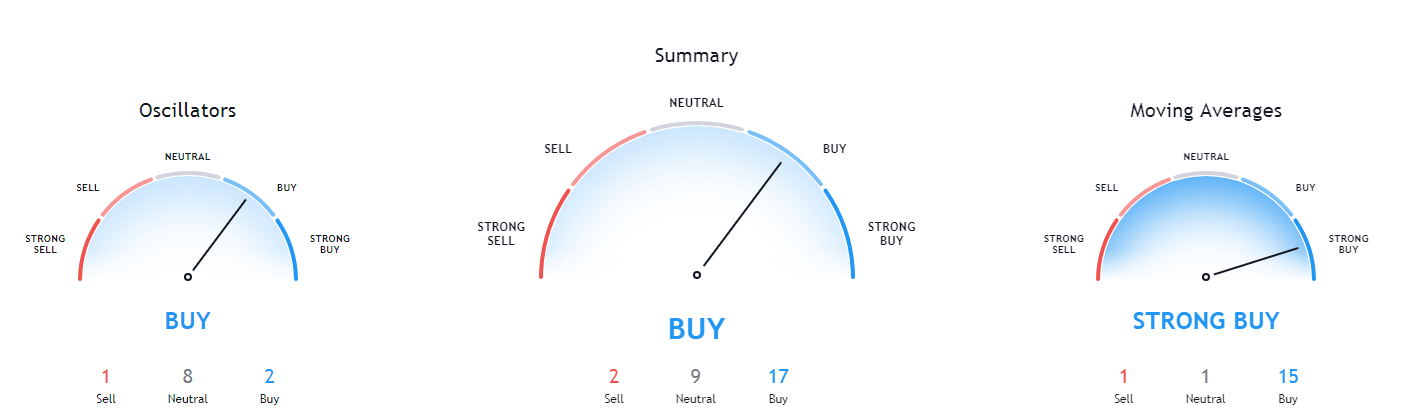

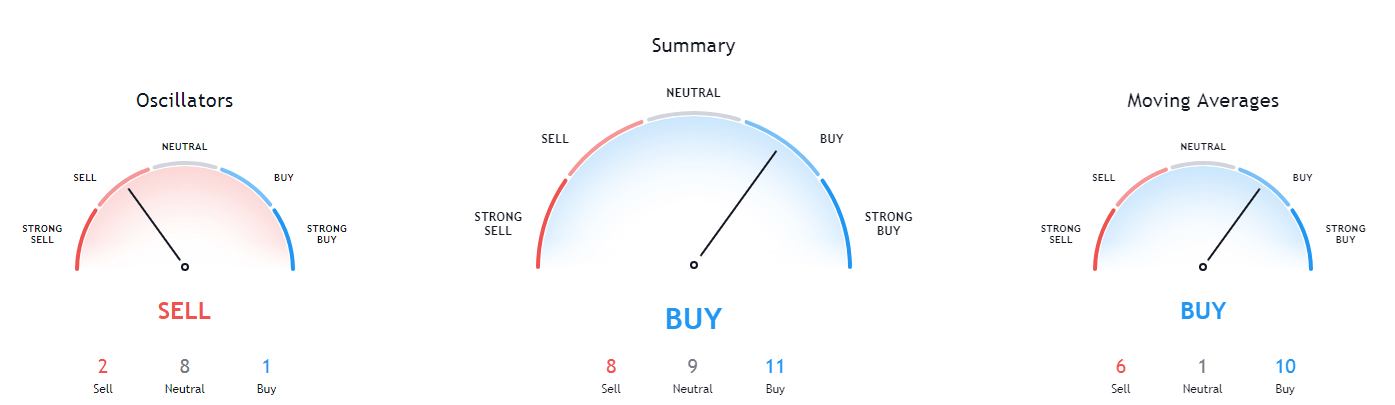

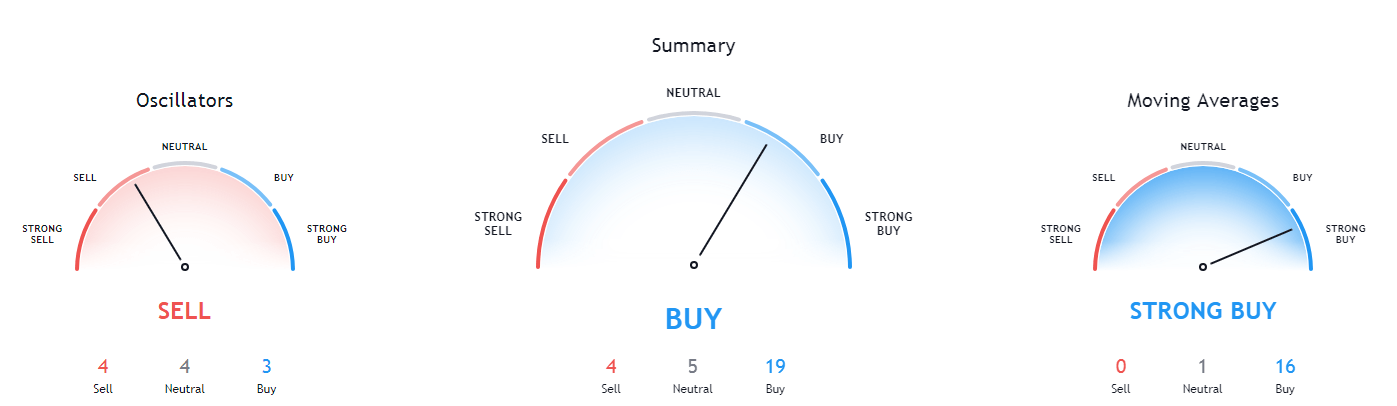

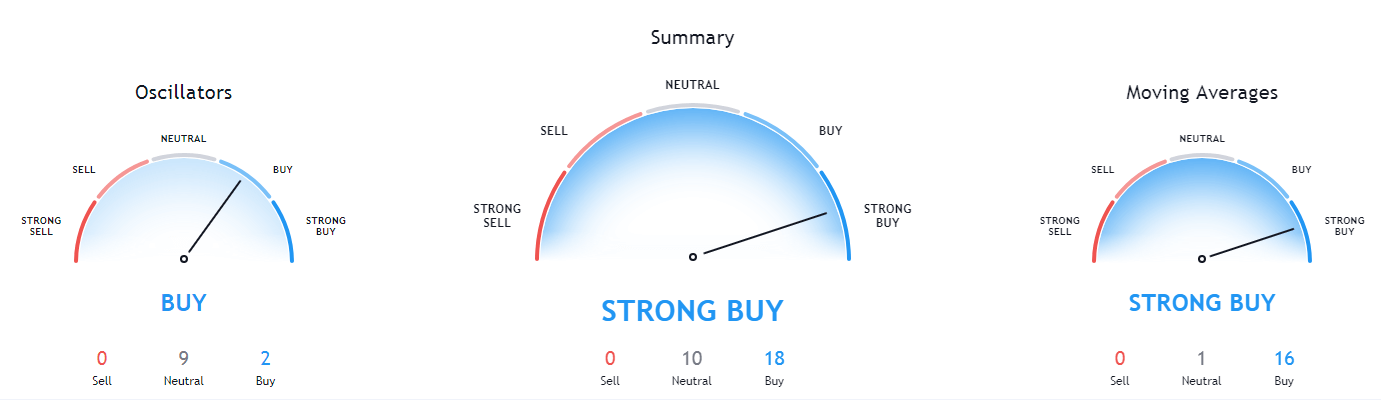

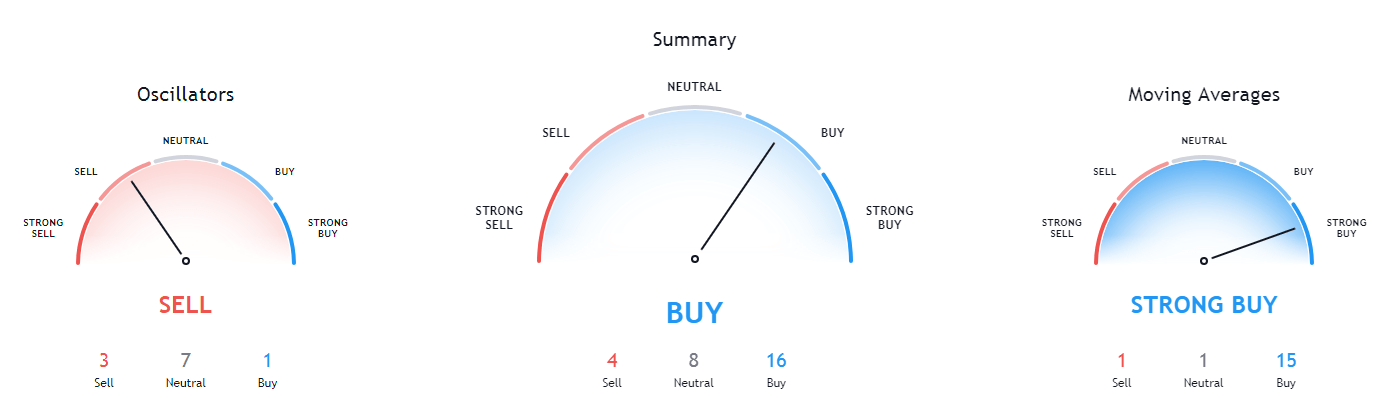

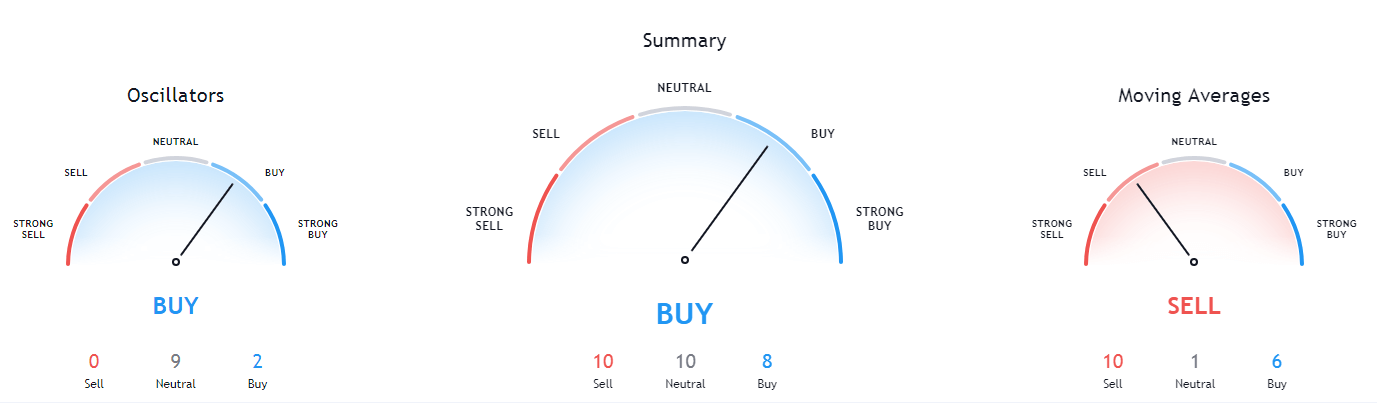

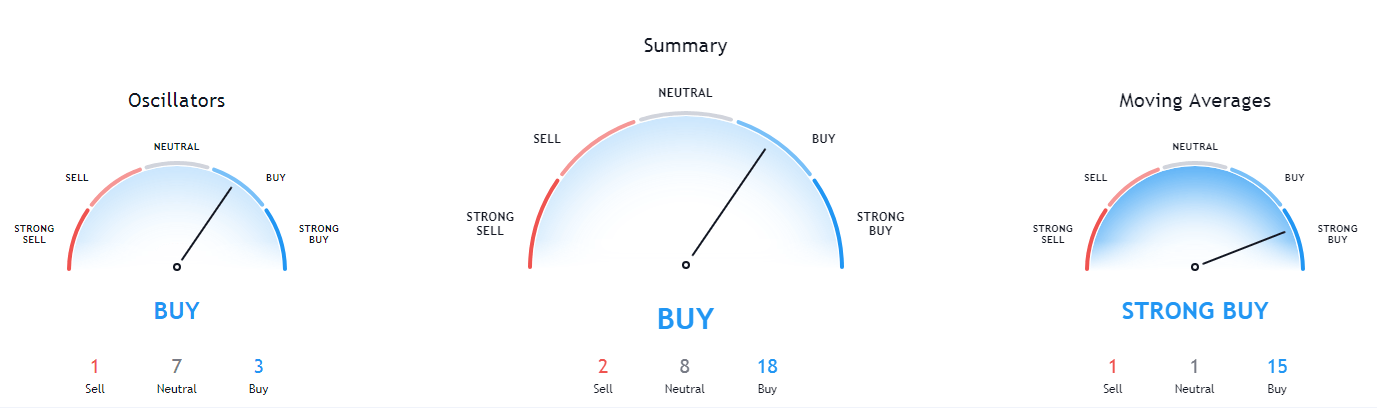

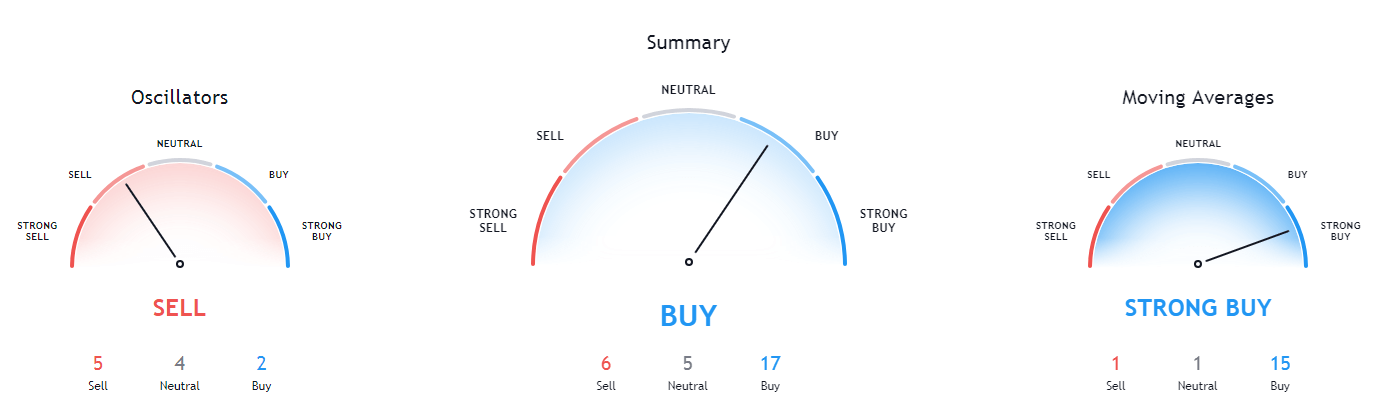

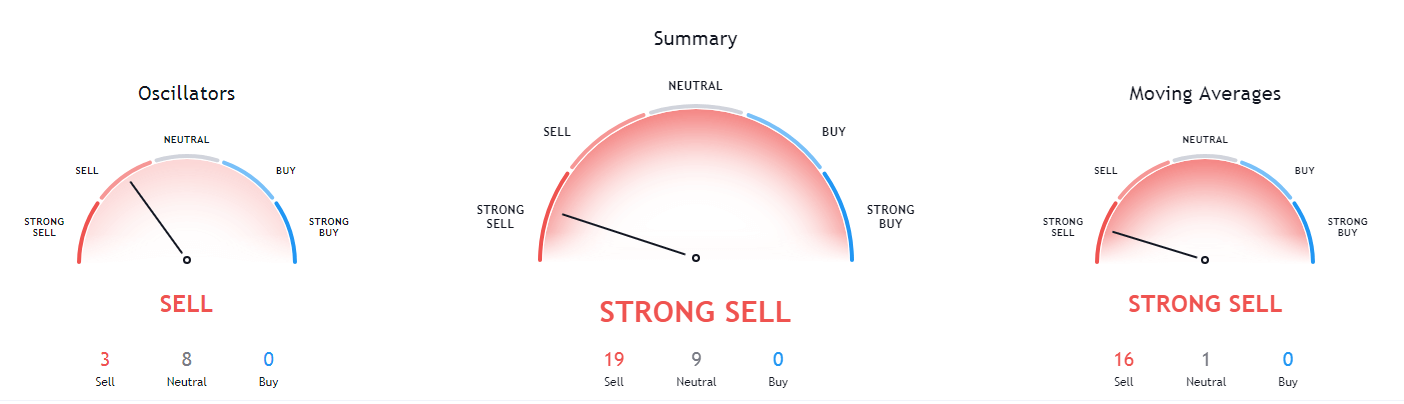

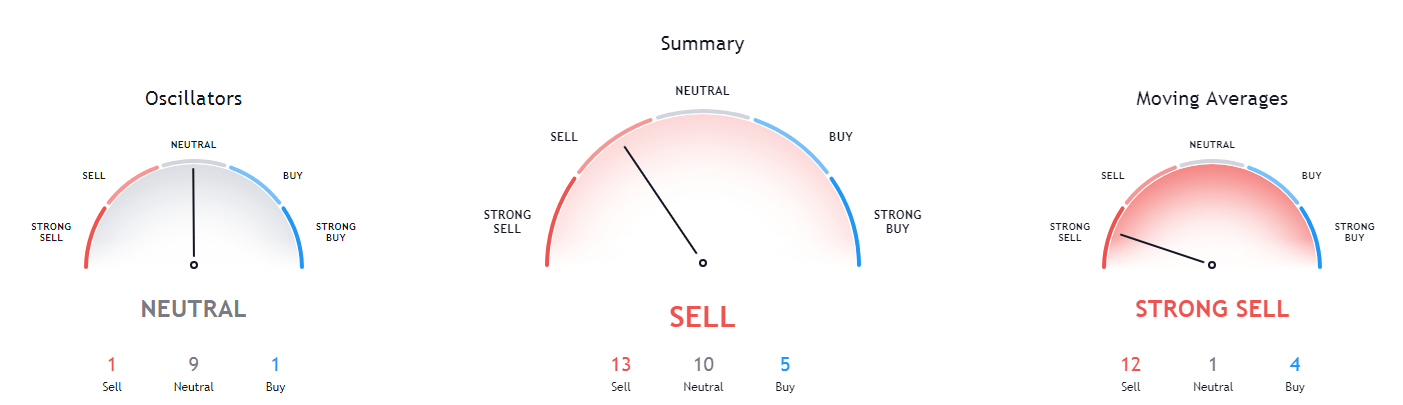

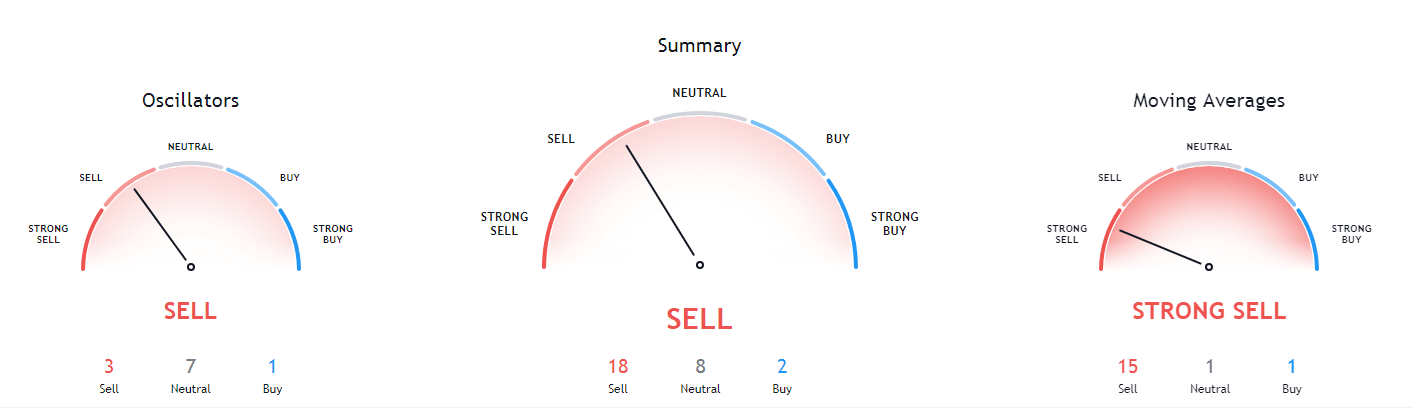

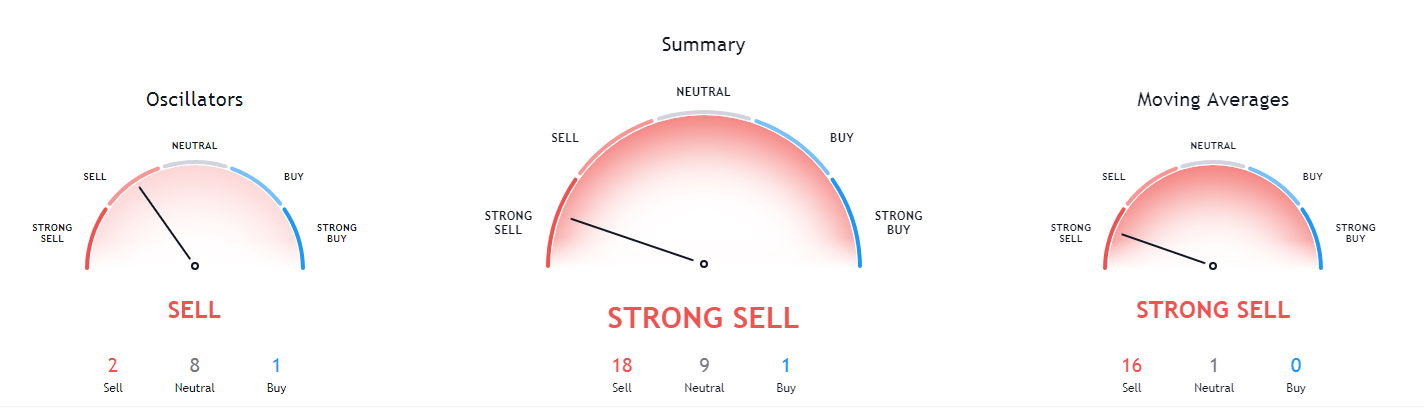

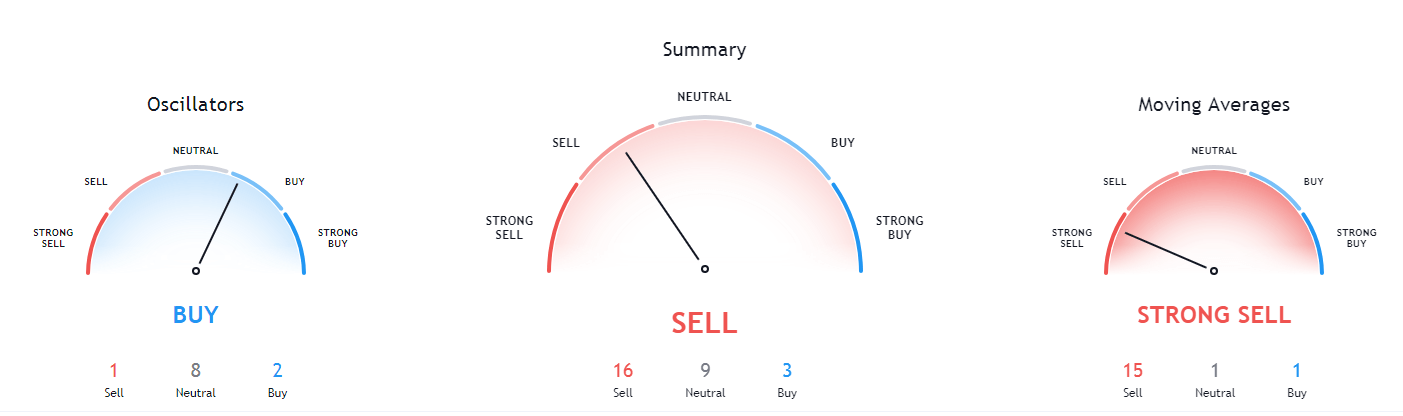

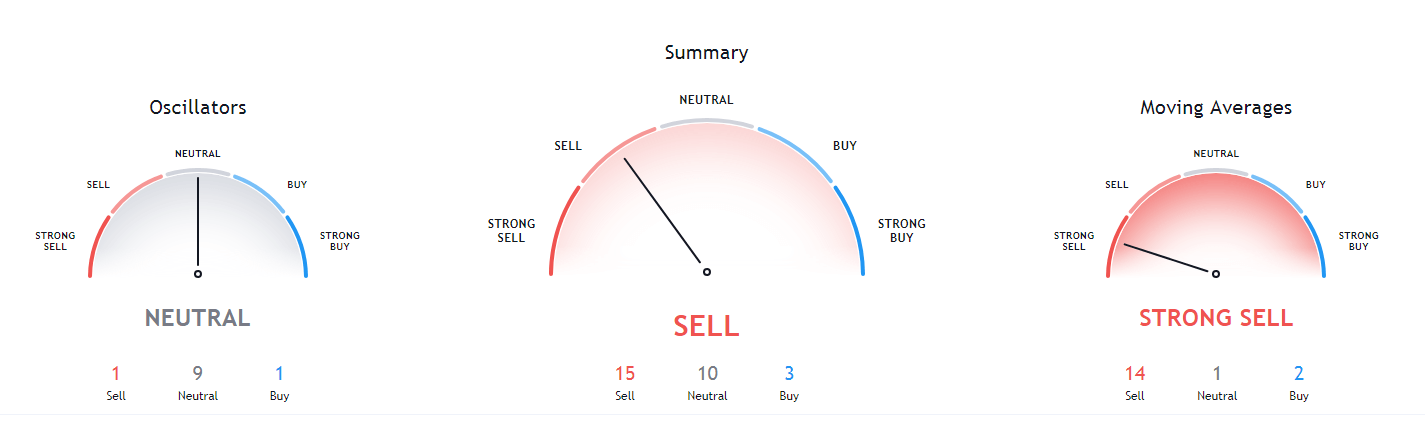

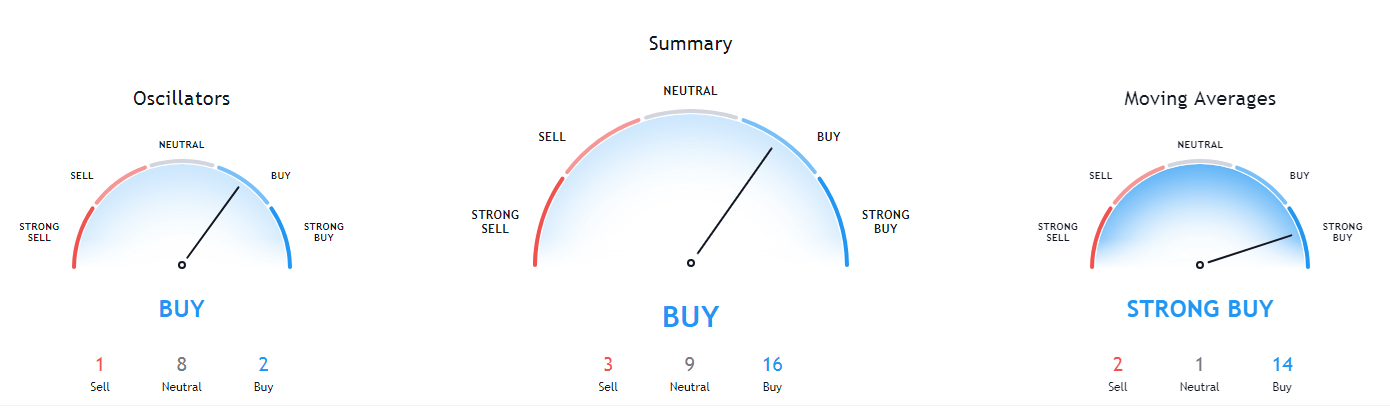

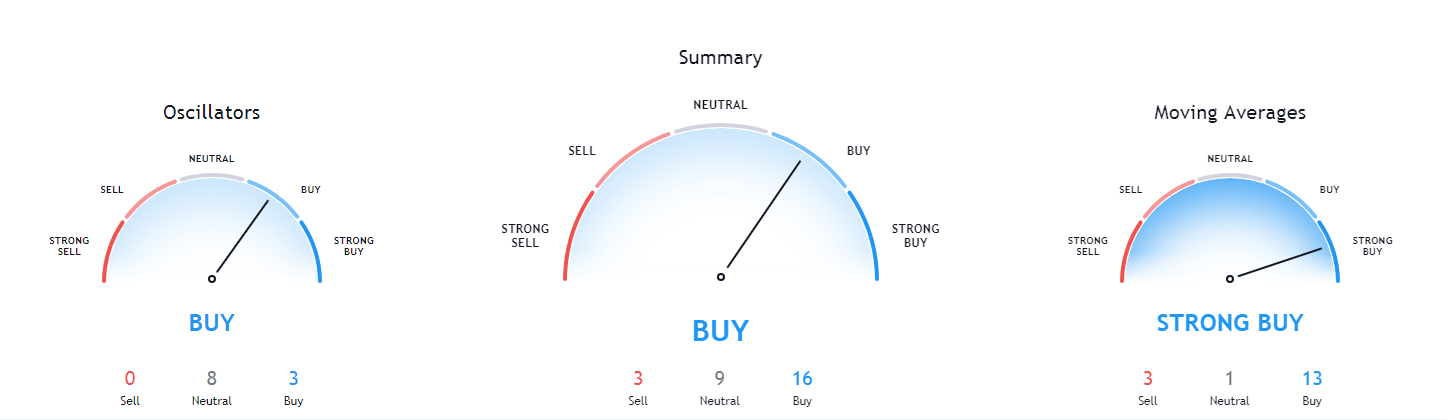

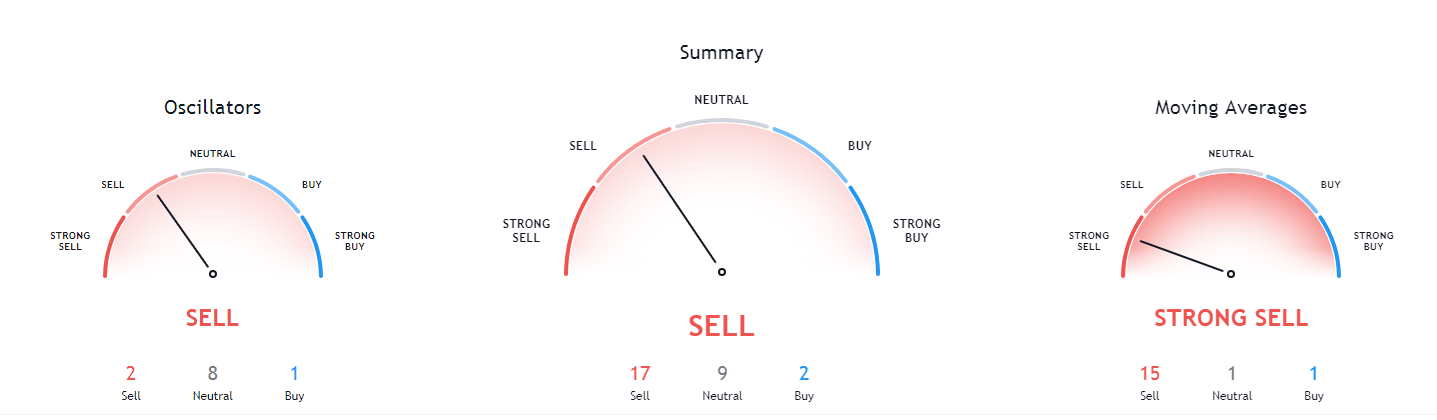

If there is risk in the future, it is a gamble; and there is always risk, since an unwavering market maxim is that without risk there is no benefit. They can bet in the short, medium or long term, they can bet rationally or compulsively, they can use indicators or based on hunches… whatever, but the union of chance and money, when it is unhealthy, has a name reliably defined by the Royal Academy of the Language: “Pathological addiction to electronic gambling or gambling”.

Crypto-assets were not to be an exception, but rather the assets that reinforce the rule.

After the previous definition, be it professional or mere amateur, we must say that in reality there is no asset that escapes the rush of adrenaline segregated before the fluctuating quotes, being able to make us pass in a matter of days or even hours from wealth to ruin. And crypto-assets are not just one of the assets that can be played like in a casino, but they have several features that make them especially prone to developing certain pathologies.

There are several factors that influence a potential ludopath to develop a pathology. Often the condition arises from the confluence of these exogenous factors with weak points in their internal and particular psychology. But it is very true that there are a number of factors common to all gamblers and all gamblers that make it possible to bring out potentially more dangerous assets than others.

It is the sense of risk that often ends up hooking these patients. A risk that is often borderline, and that causes your glands to release adrenaline and other hormones. As you may know, hormones often act as a natural drug to keep us (or drive away) certain behaviors. And in gambling enthusiasts, that loyalty involves continuing to gamble savings (and debts) on anything that looks like a winning horse. In the end, with a disproportionate and uncontrolled risk, comes psychological dependence and almost certain economic ruin.

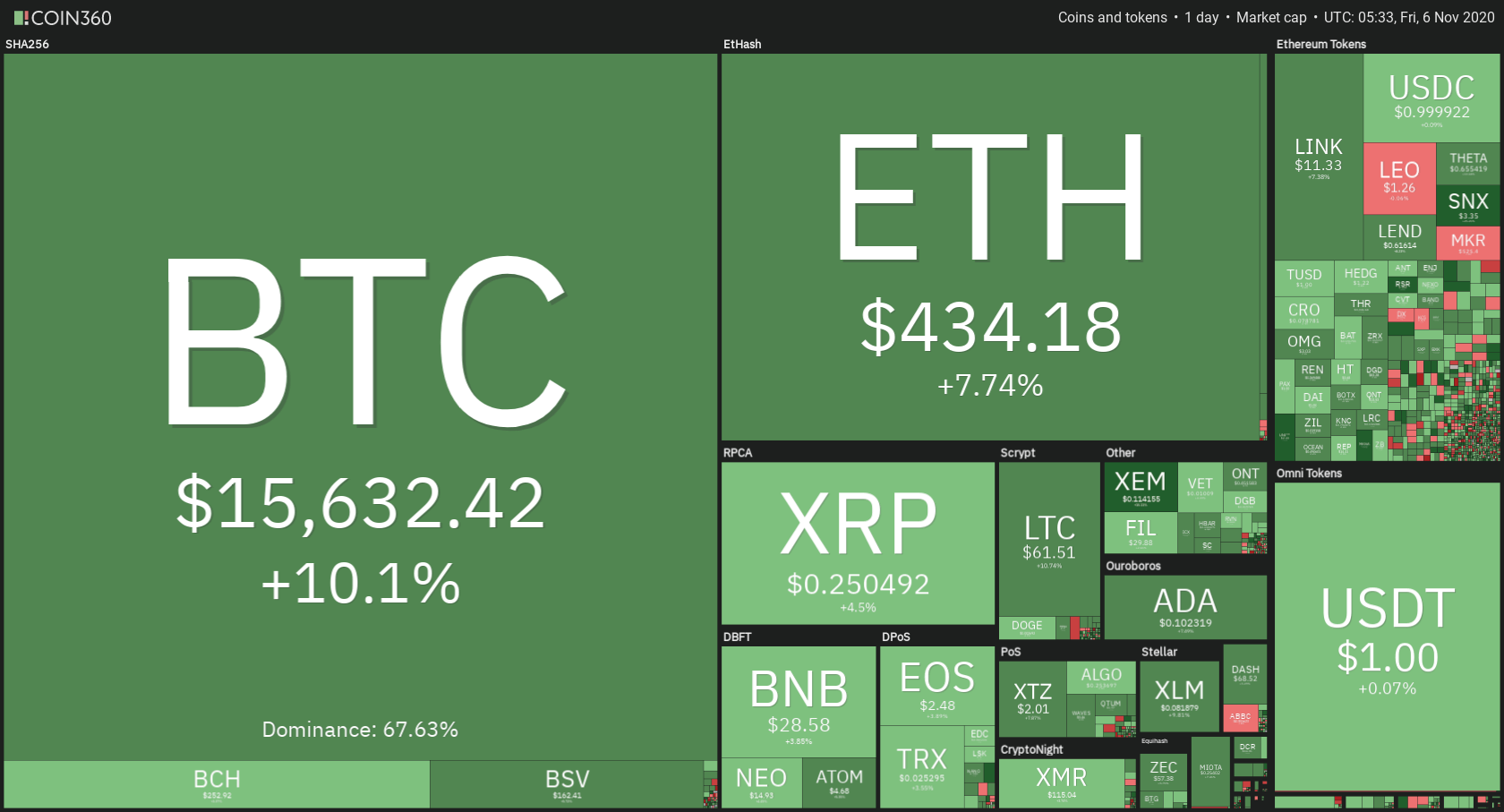

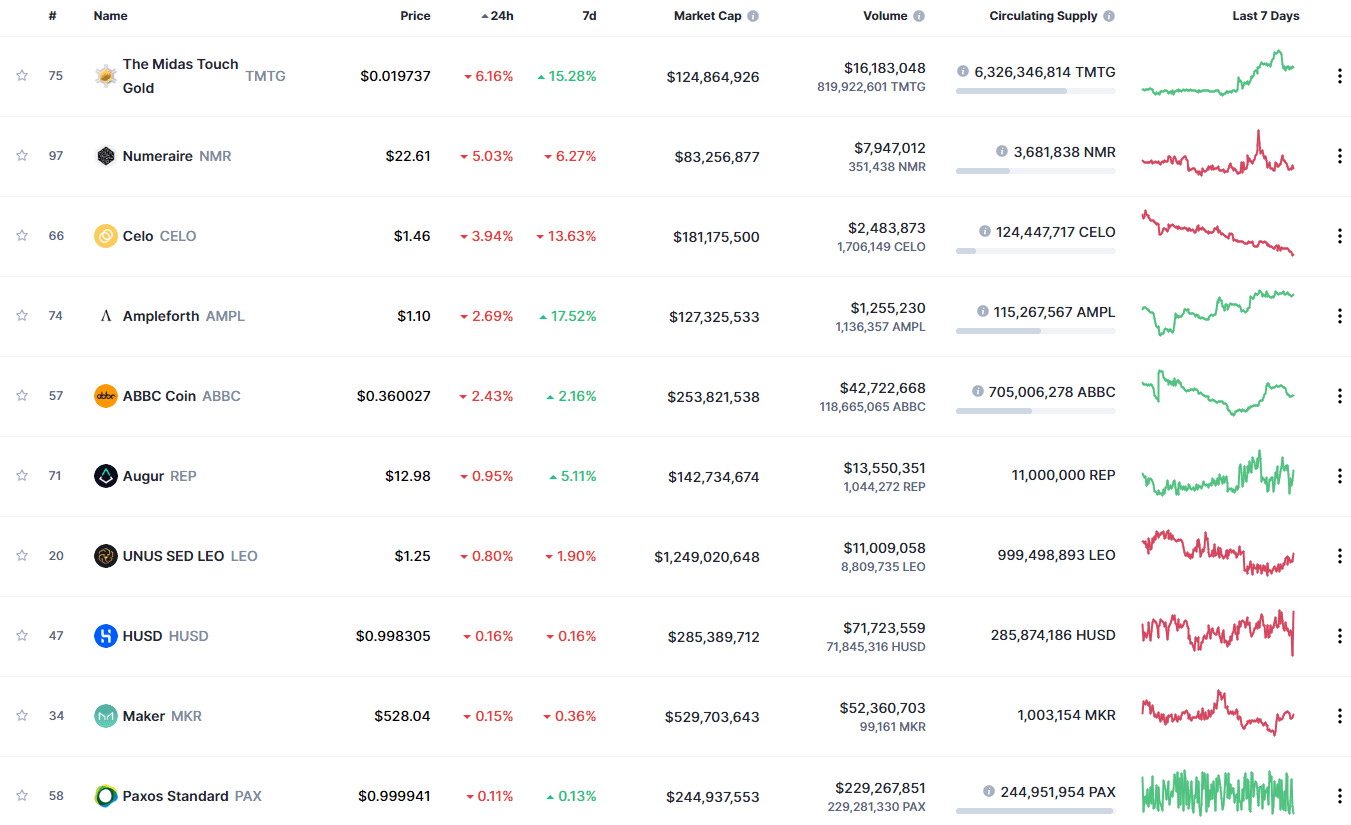

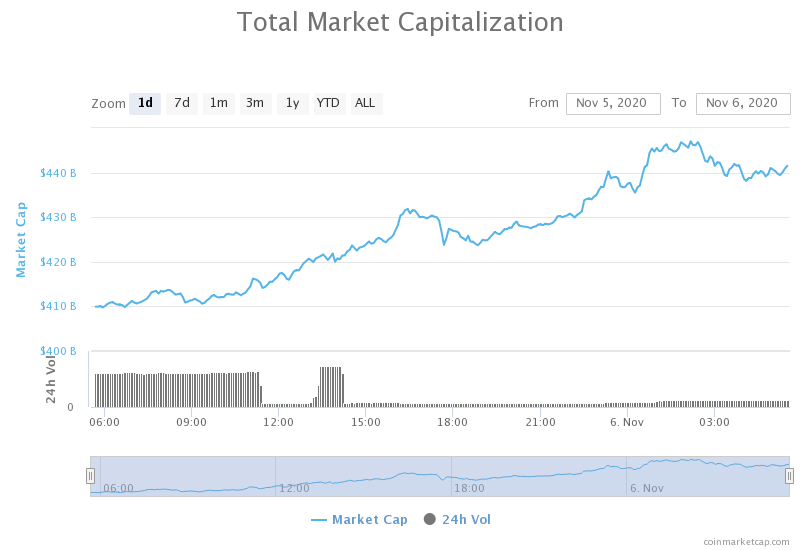

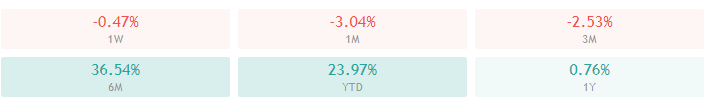

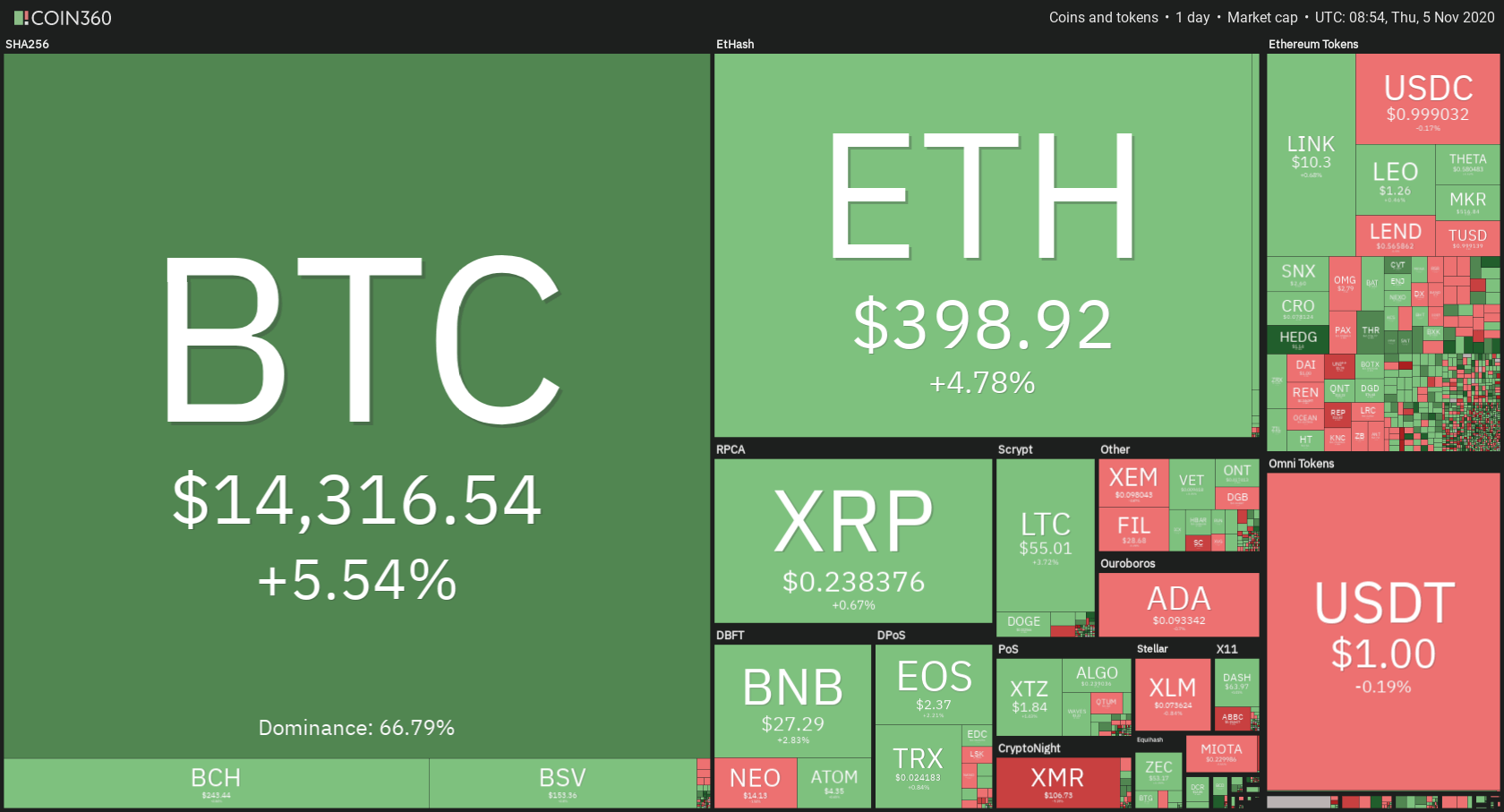

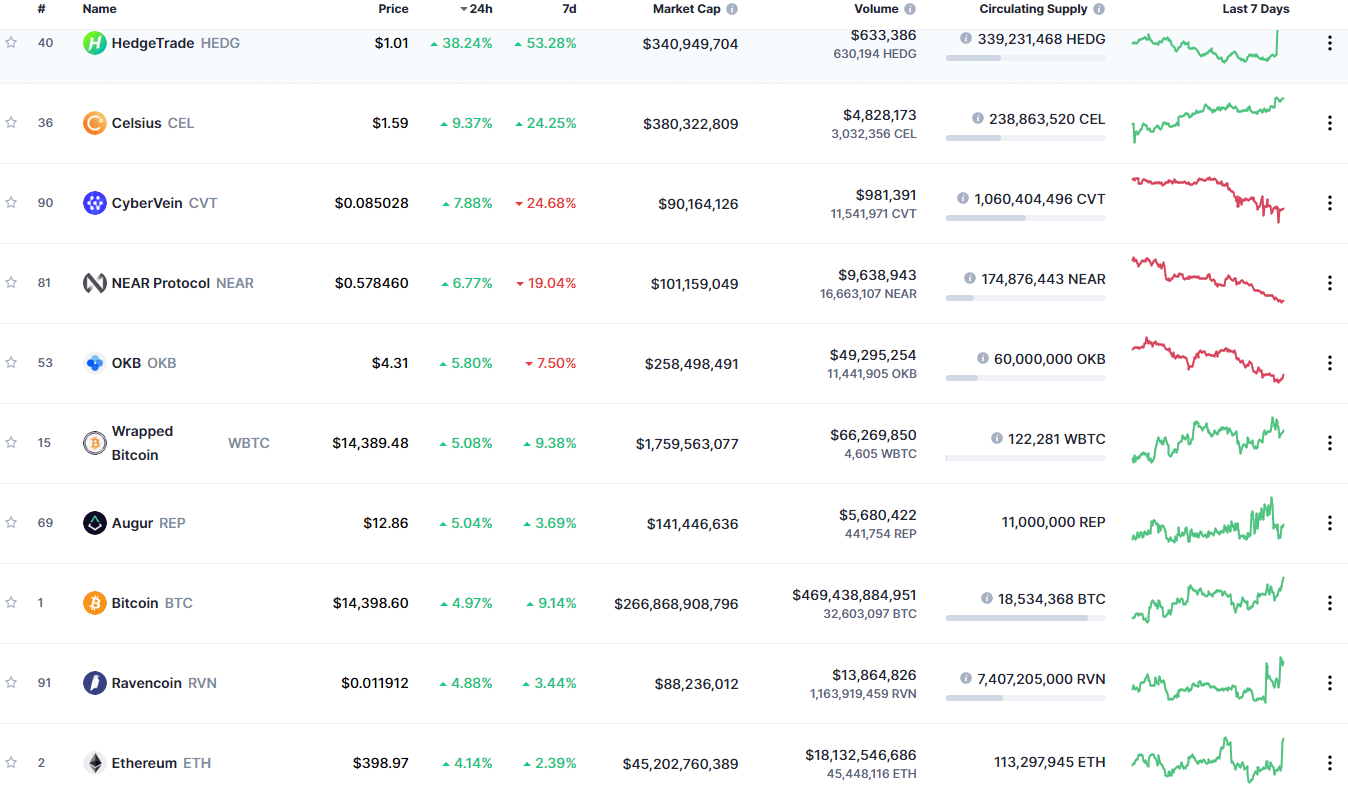

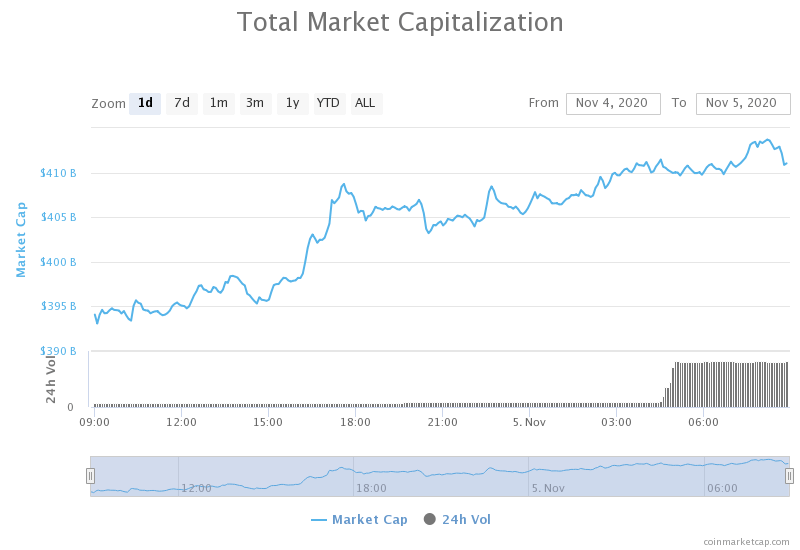

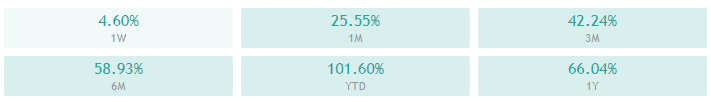

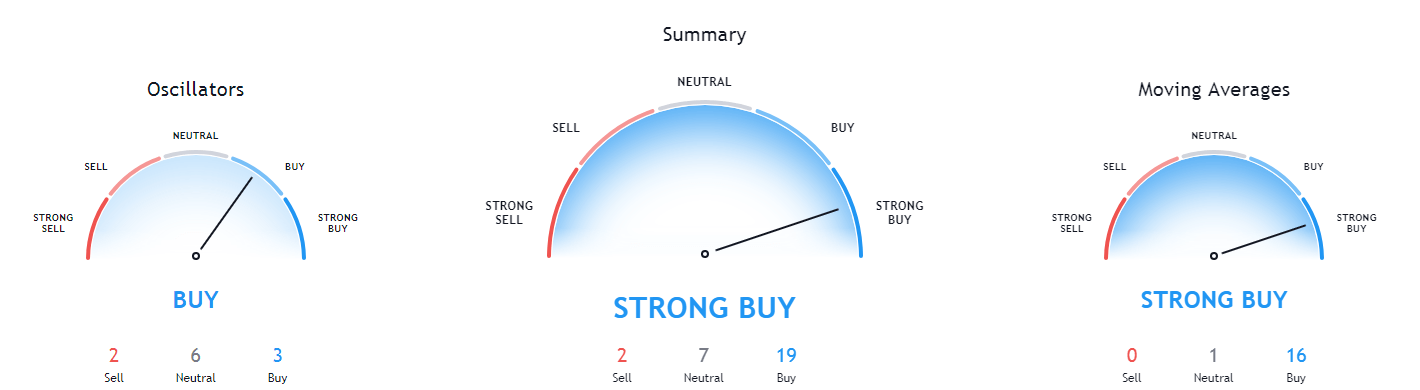

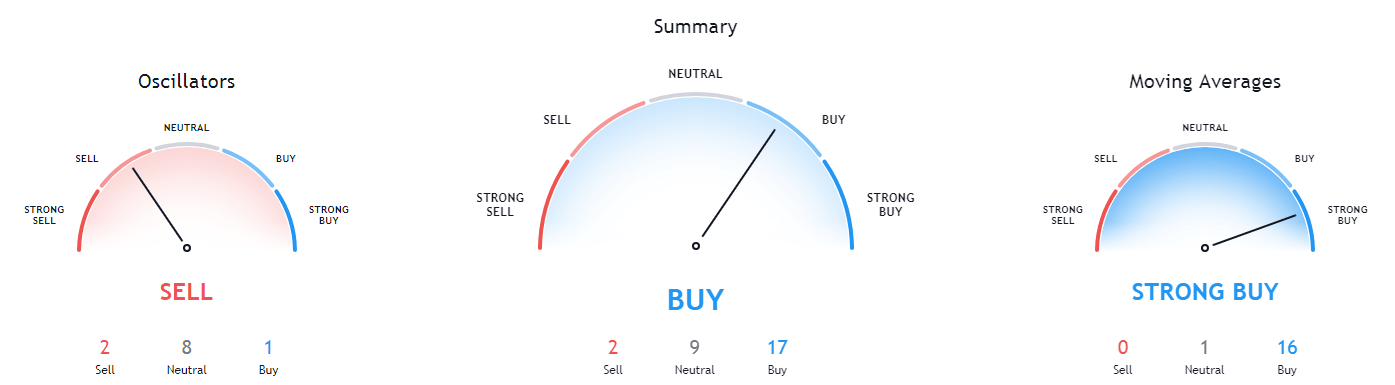

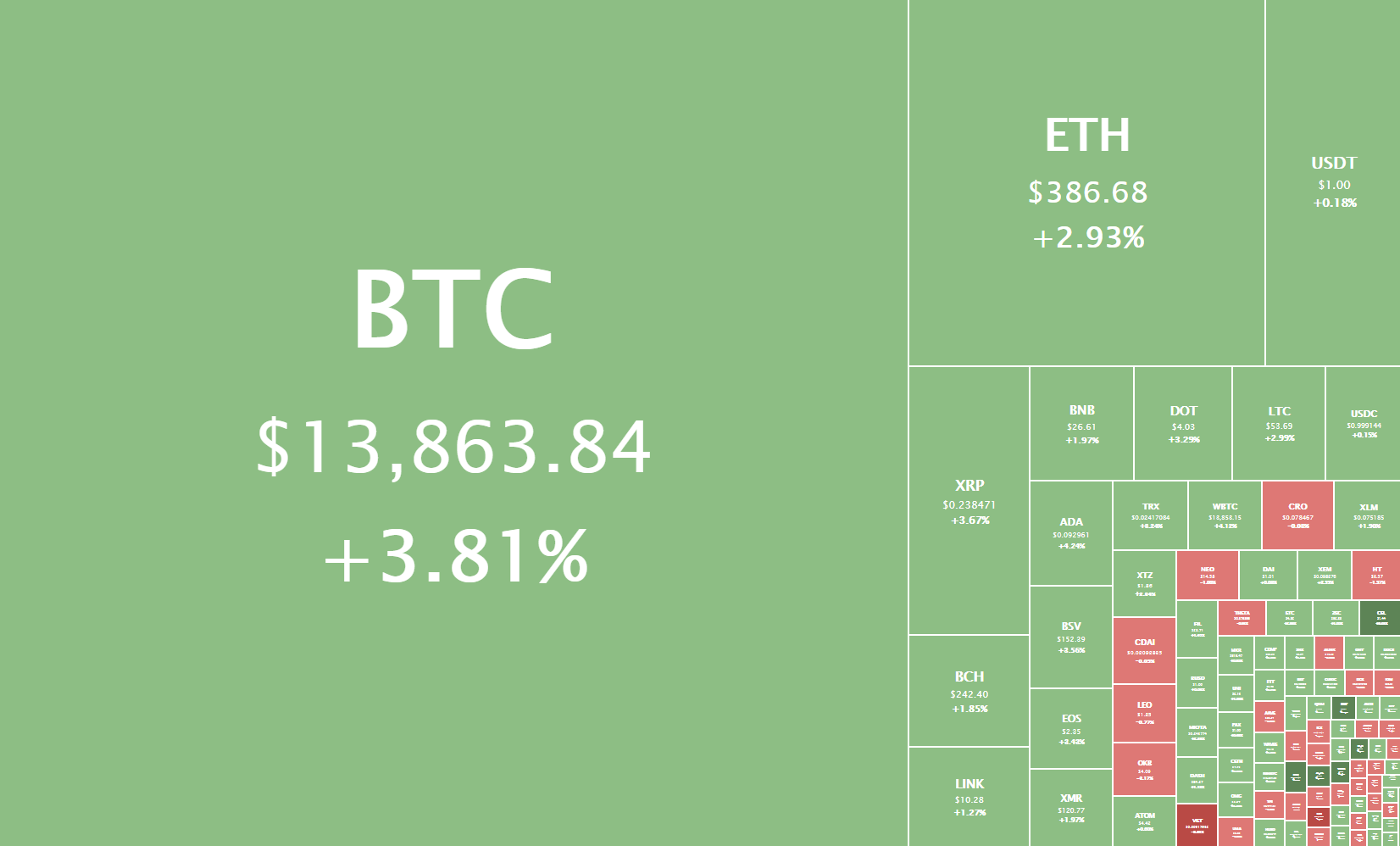

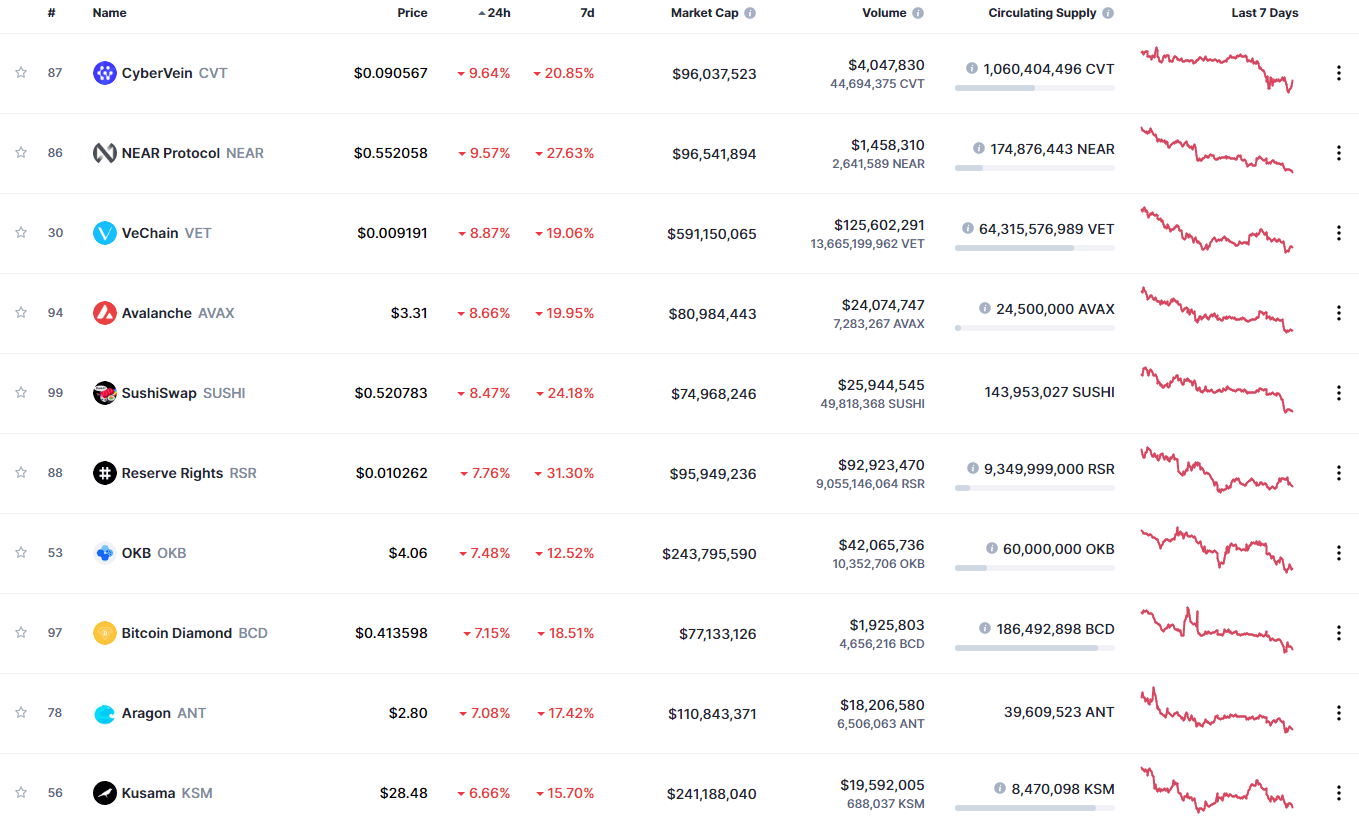

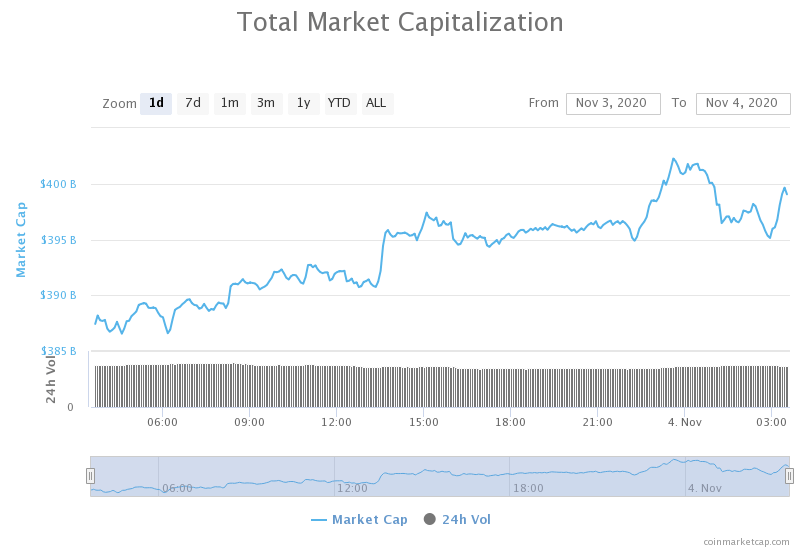

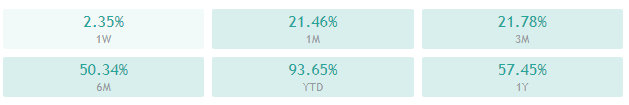

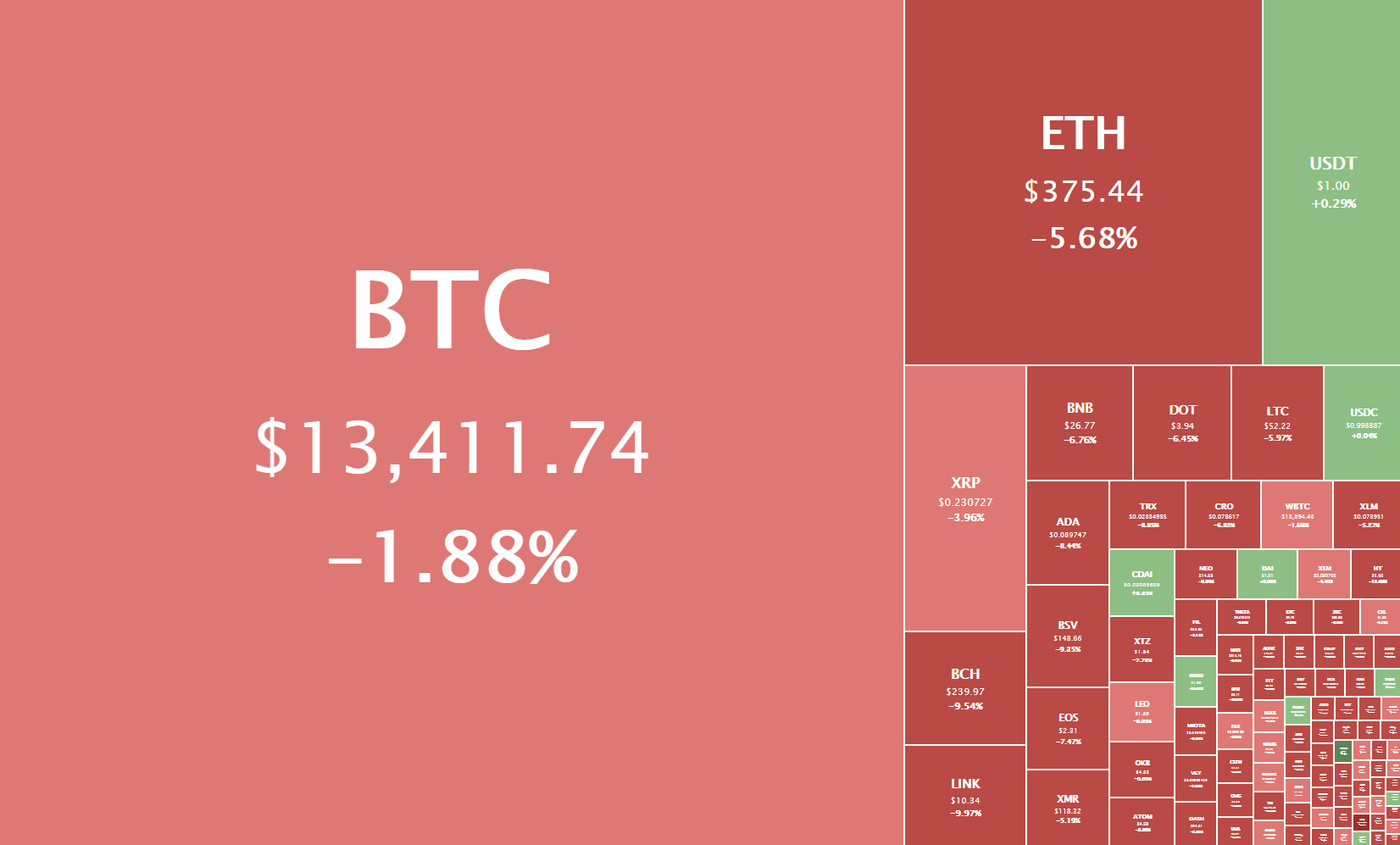

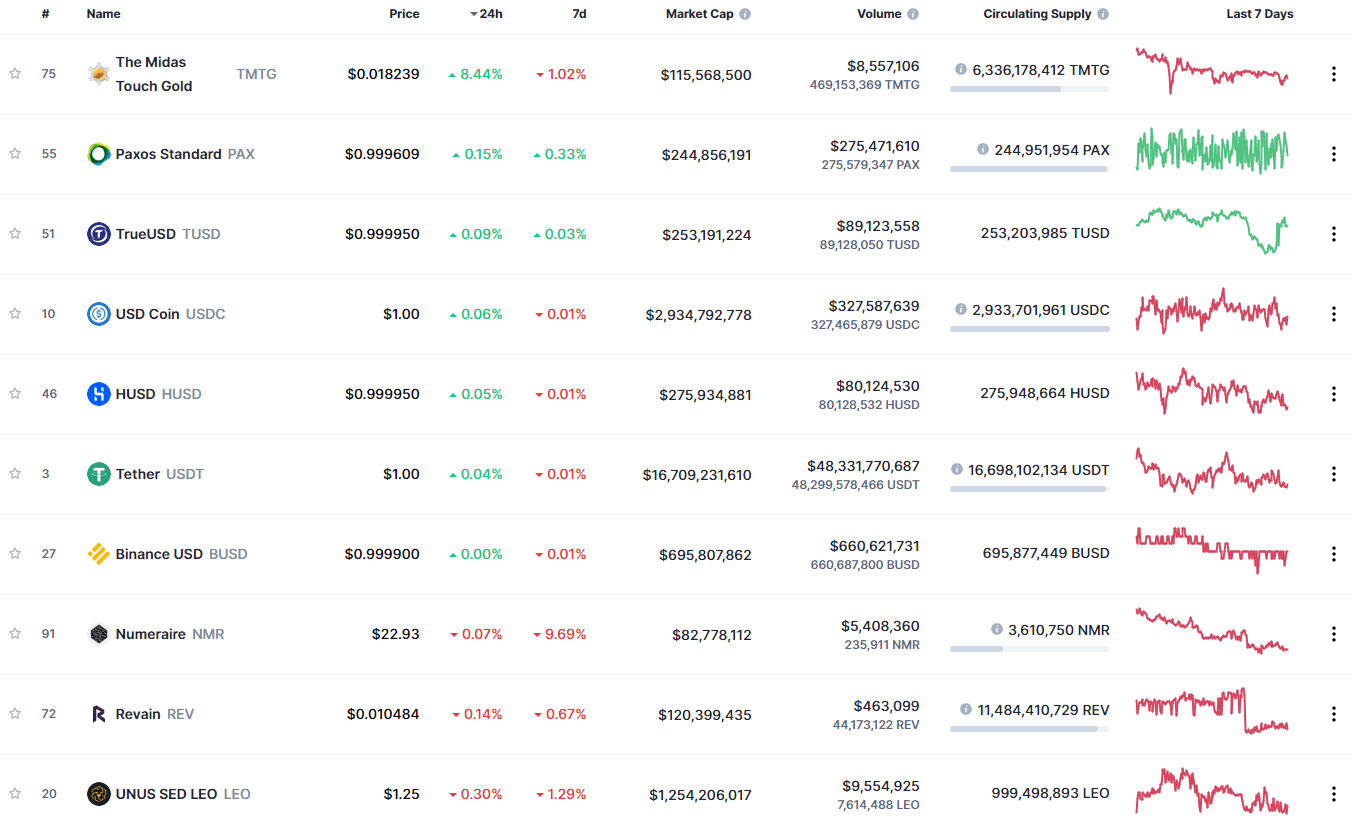

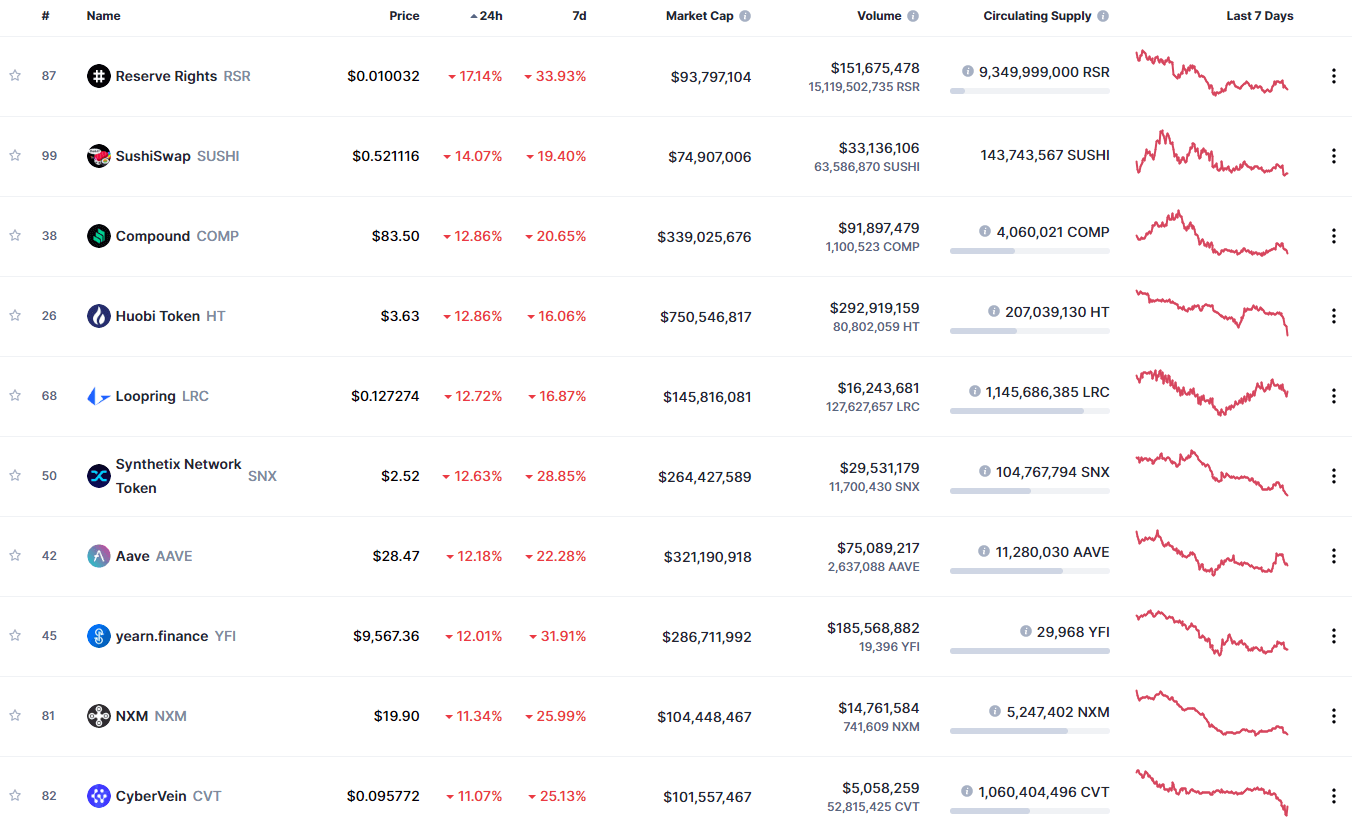

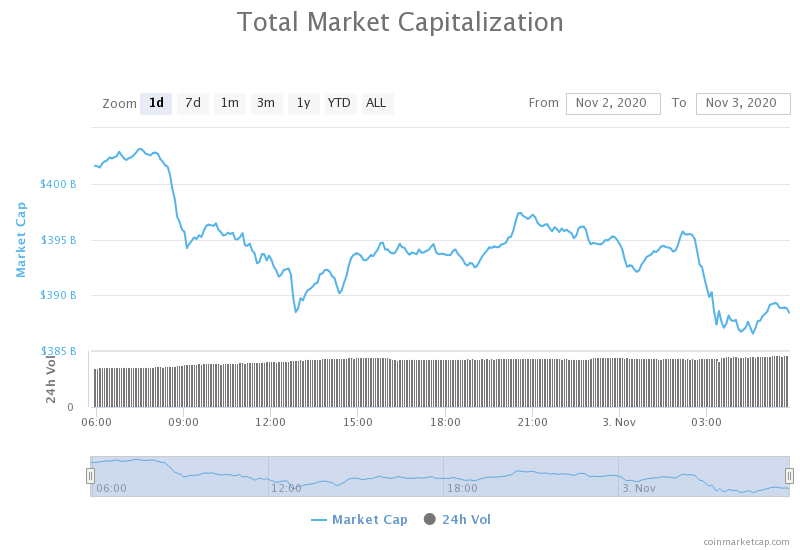

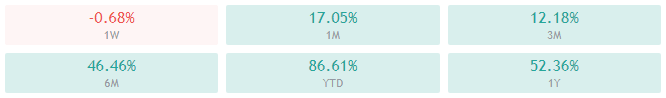

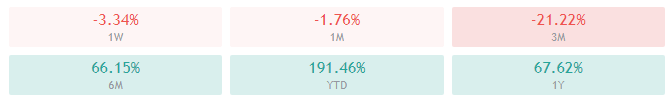

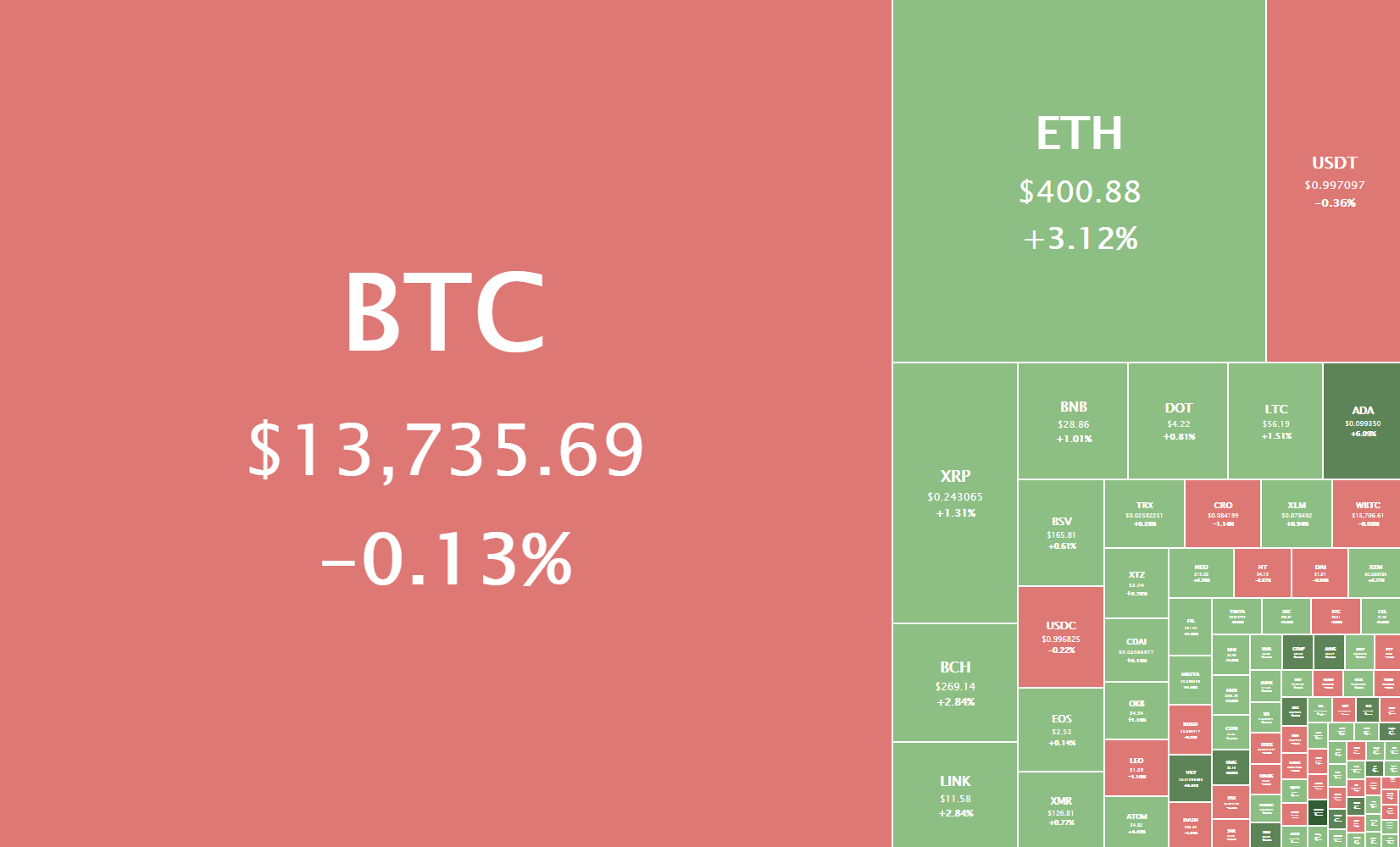

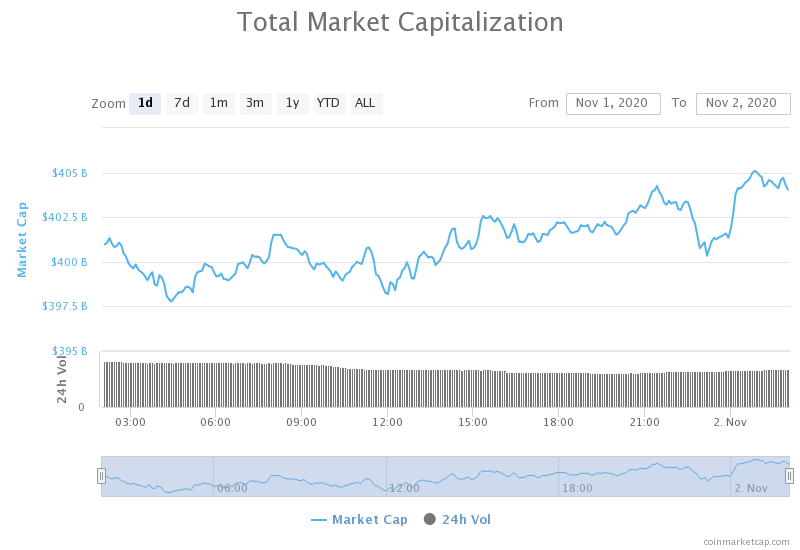

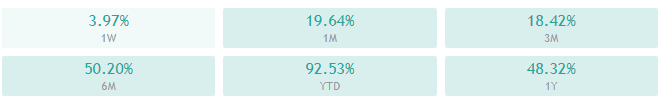

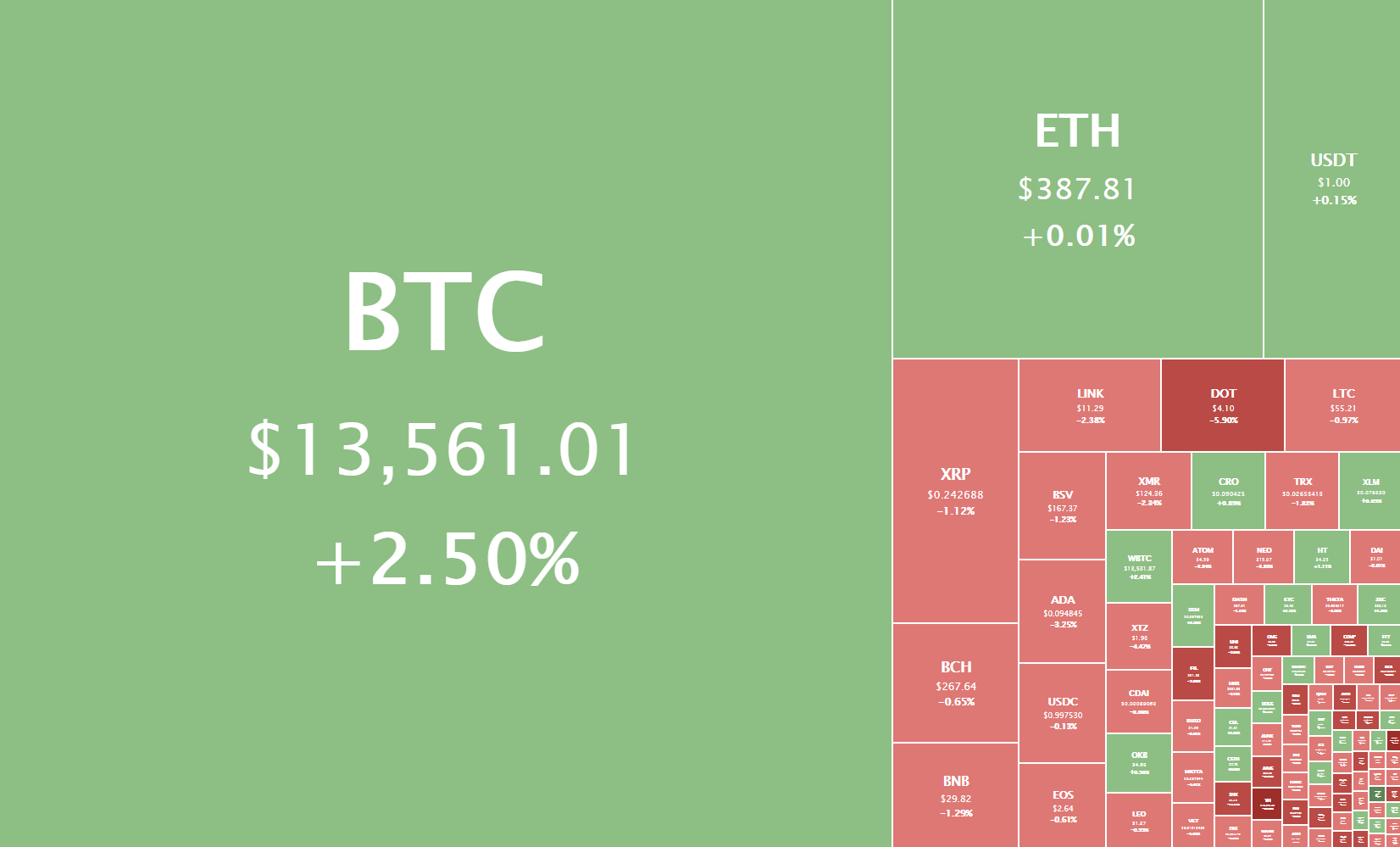

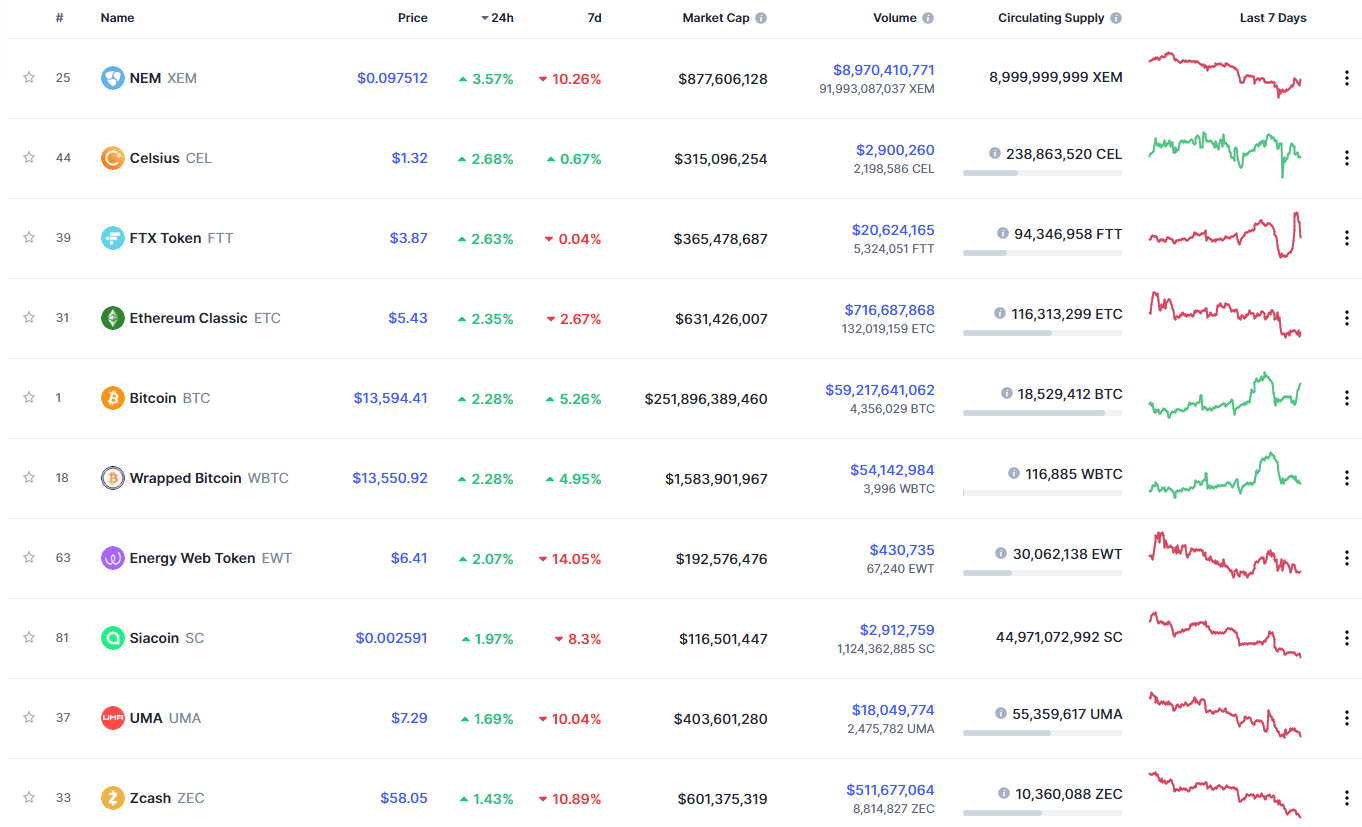

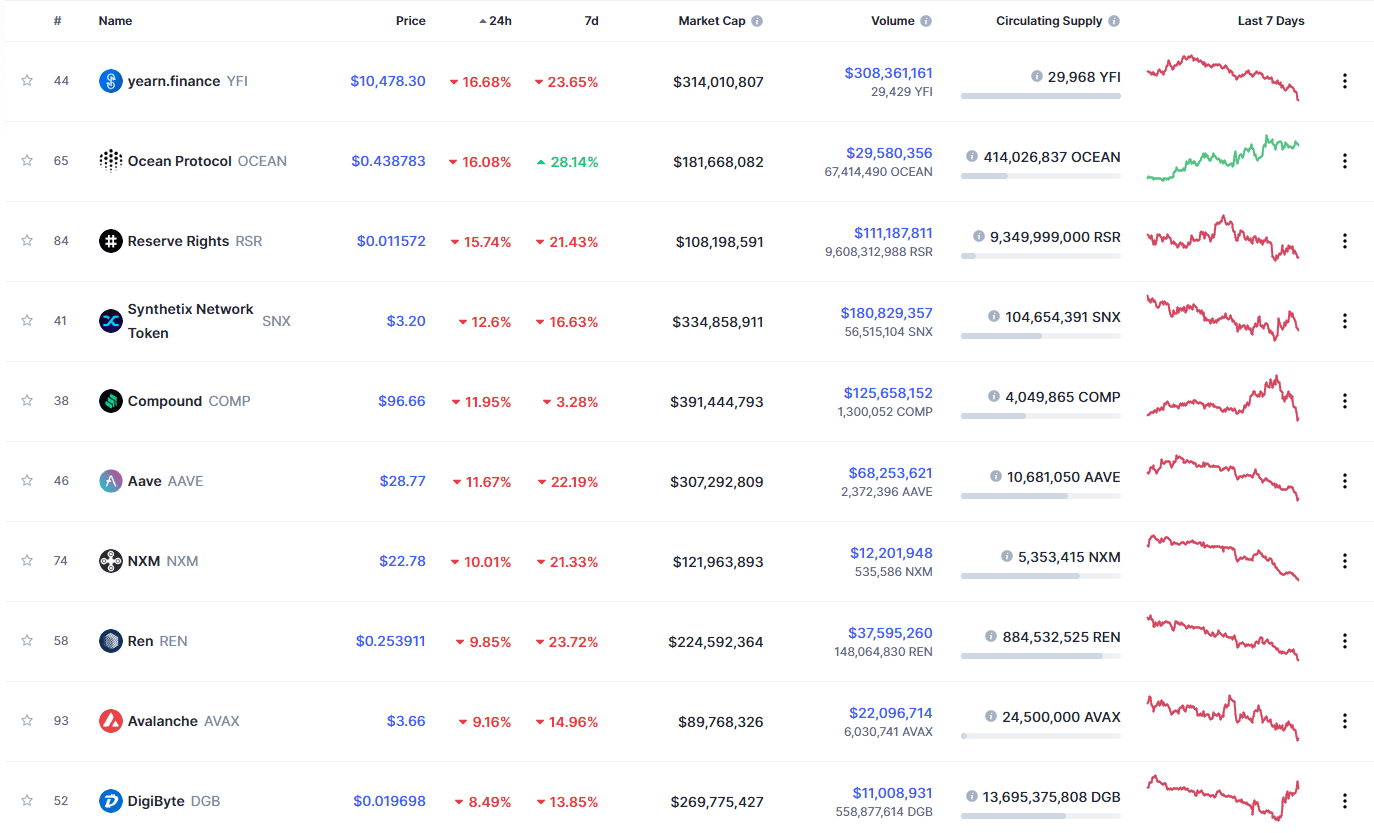

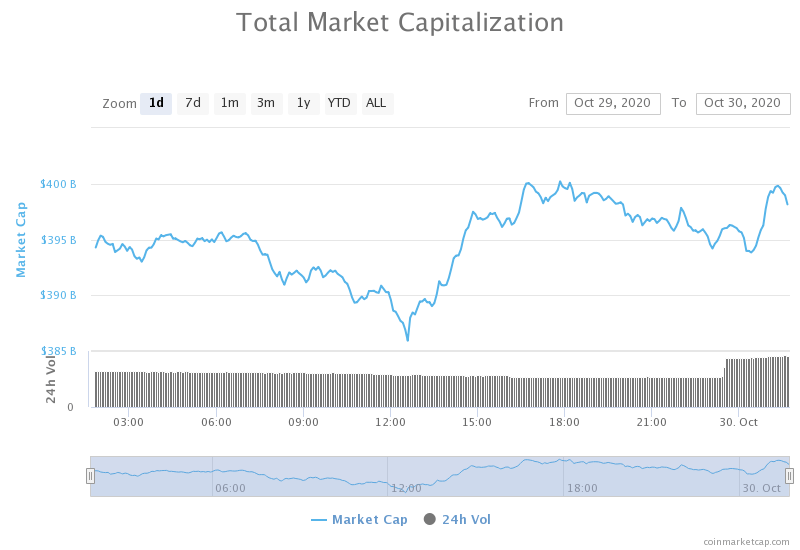

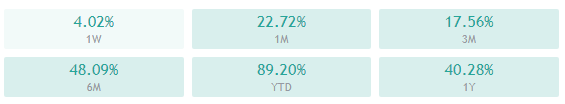

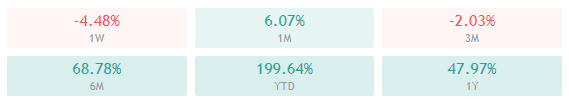

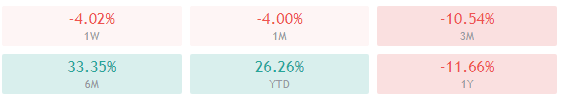

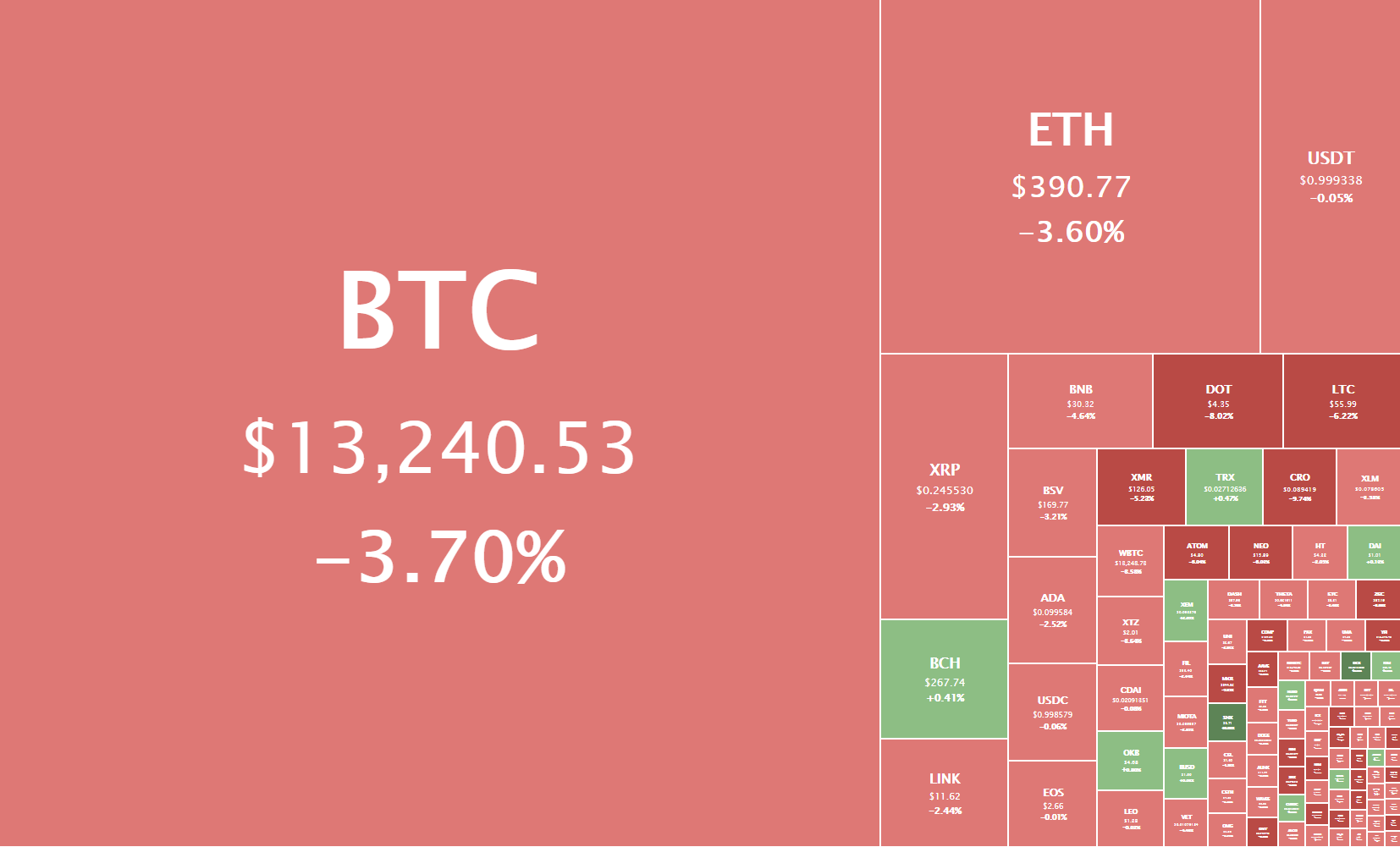

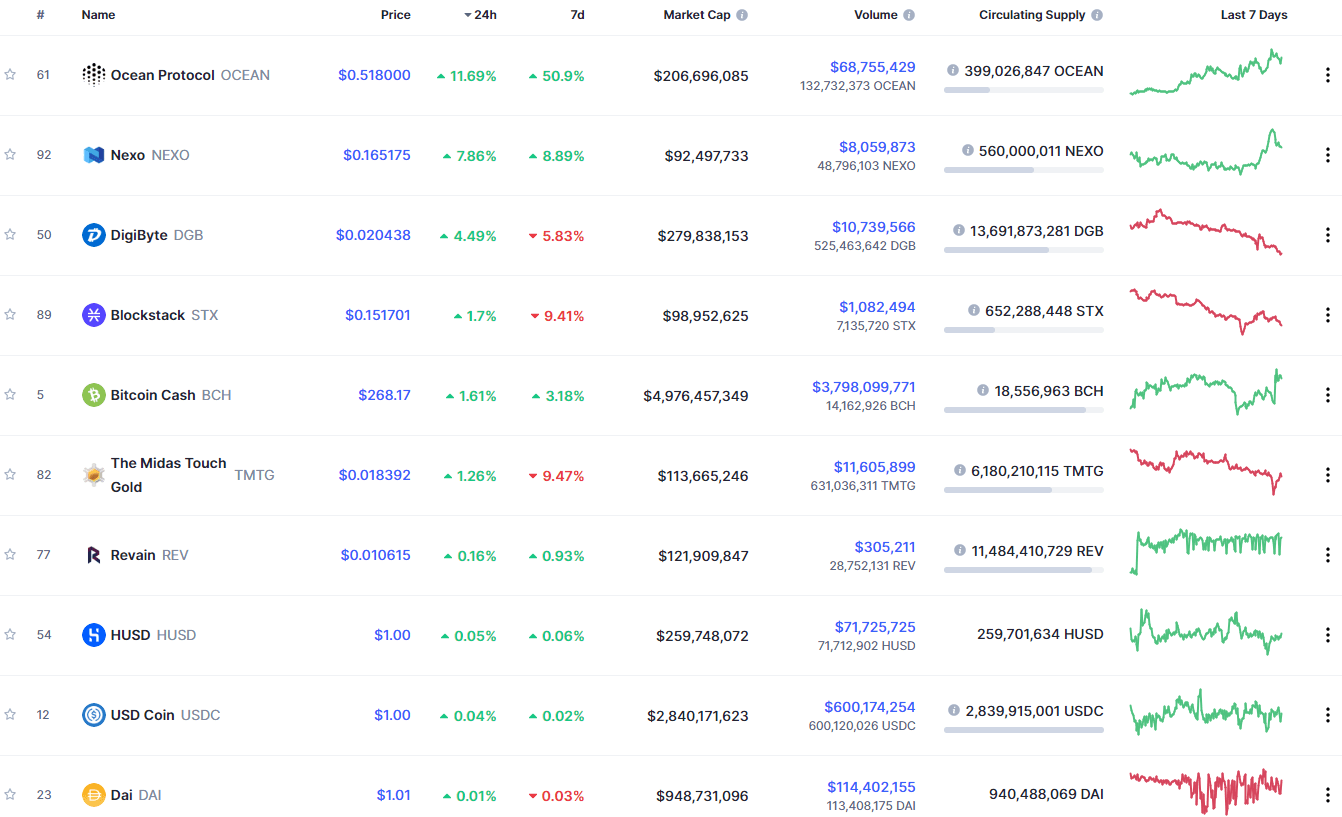

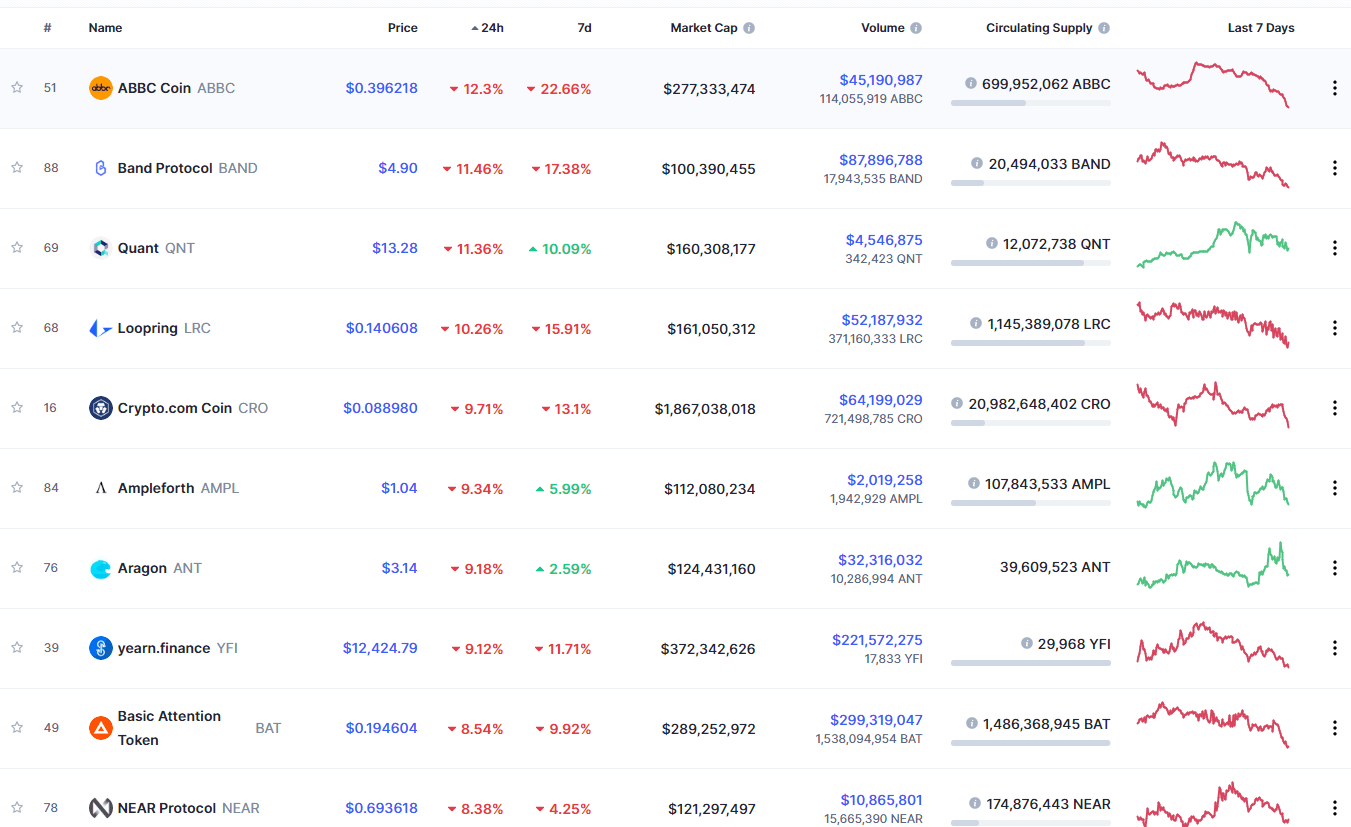

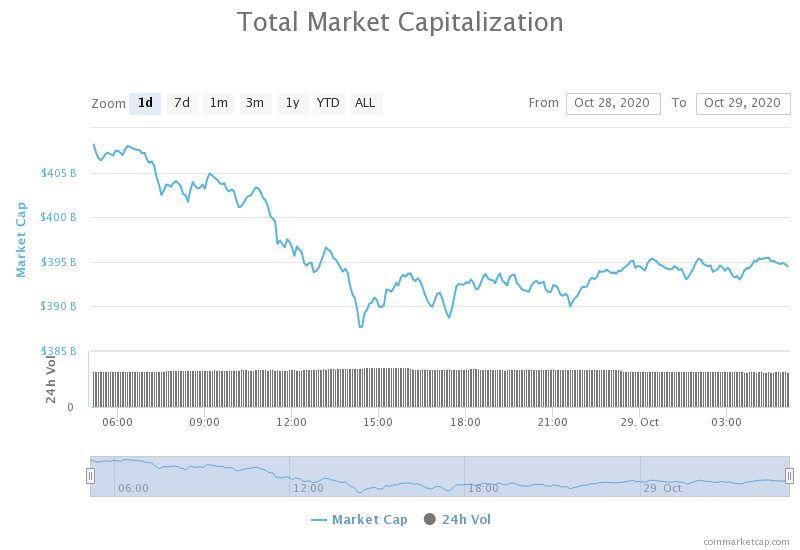

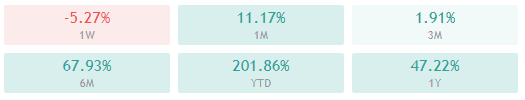

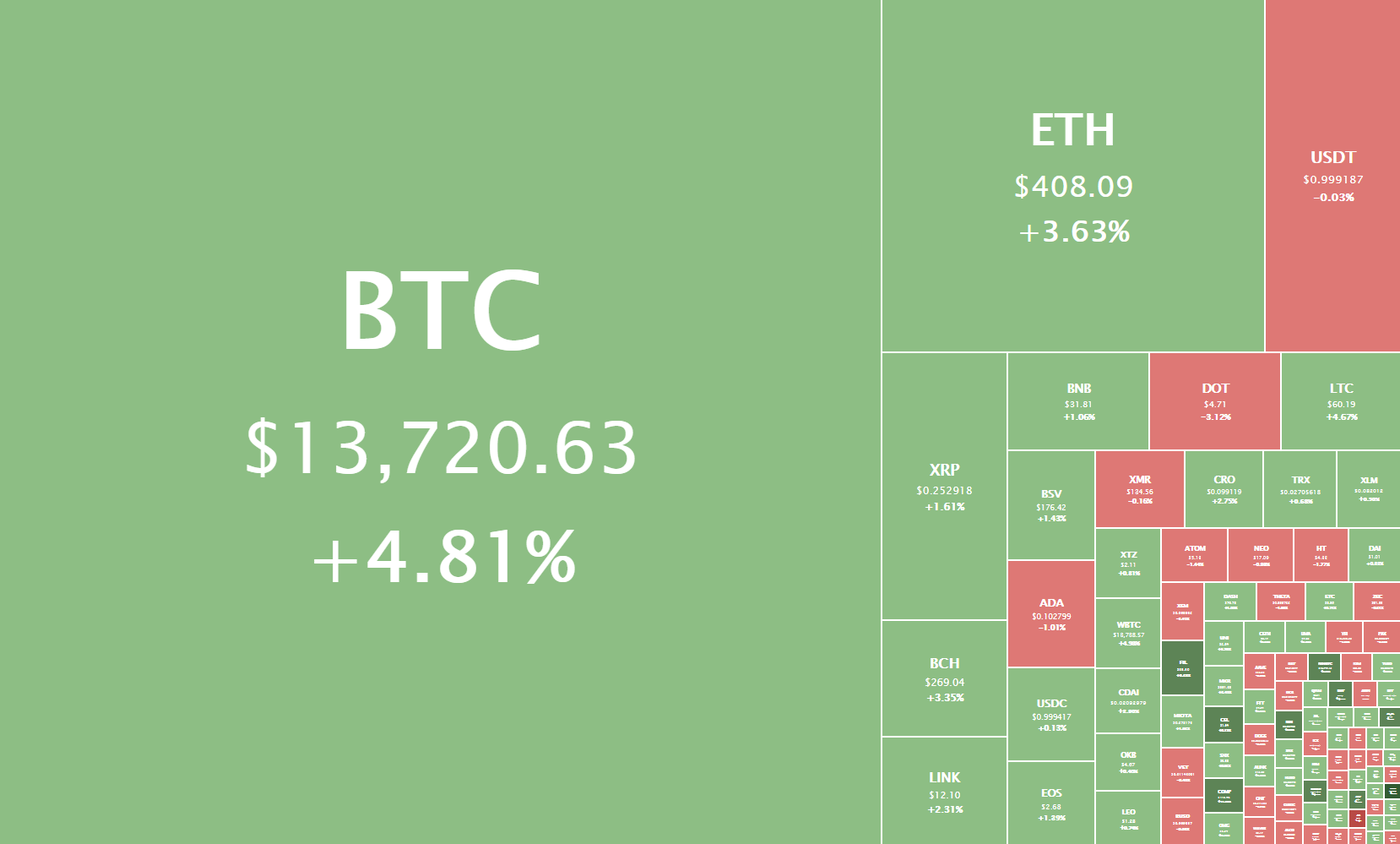

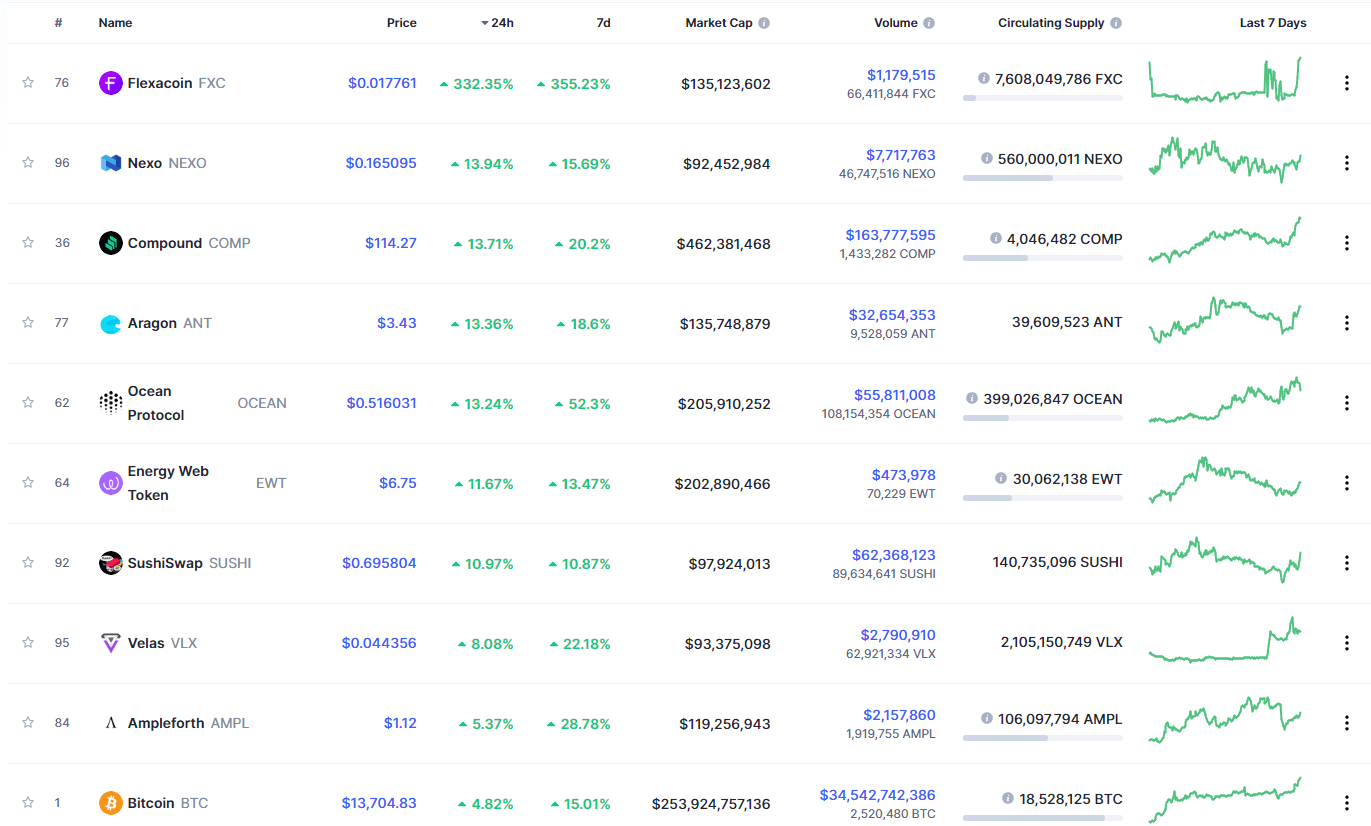

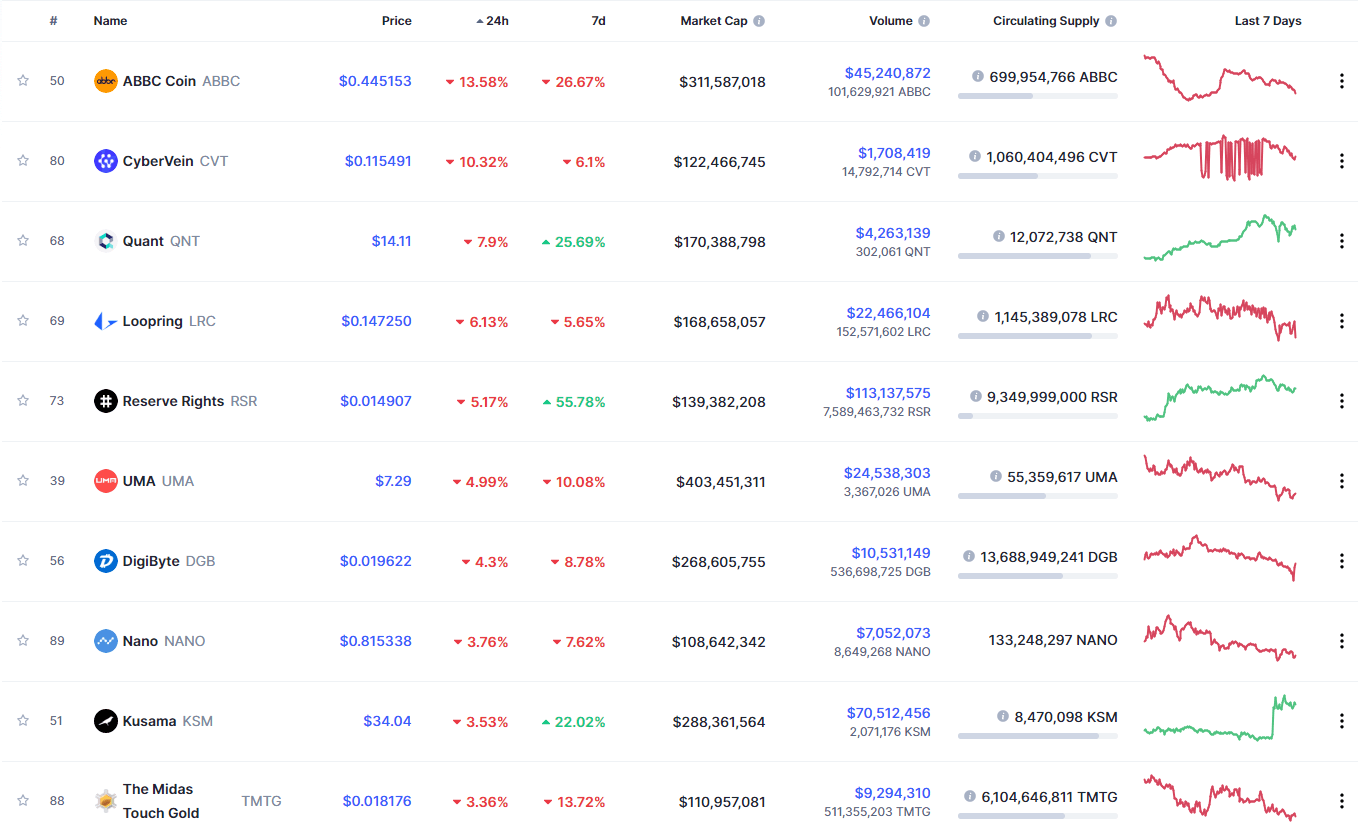

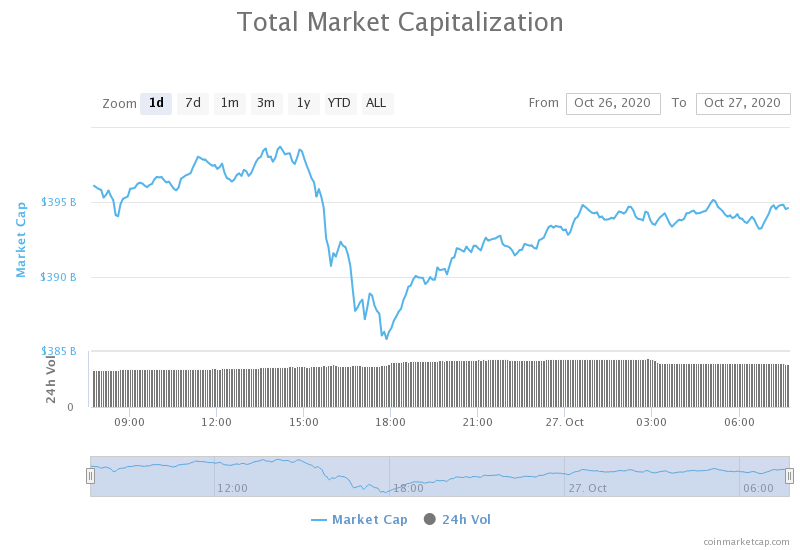

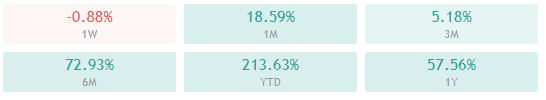

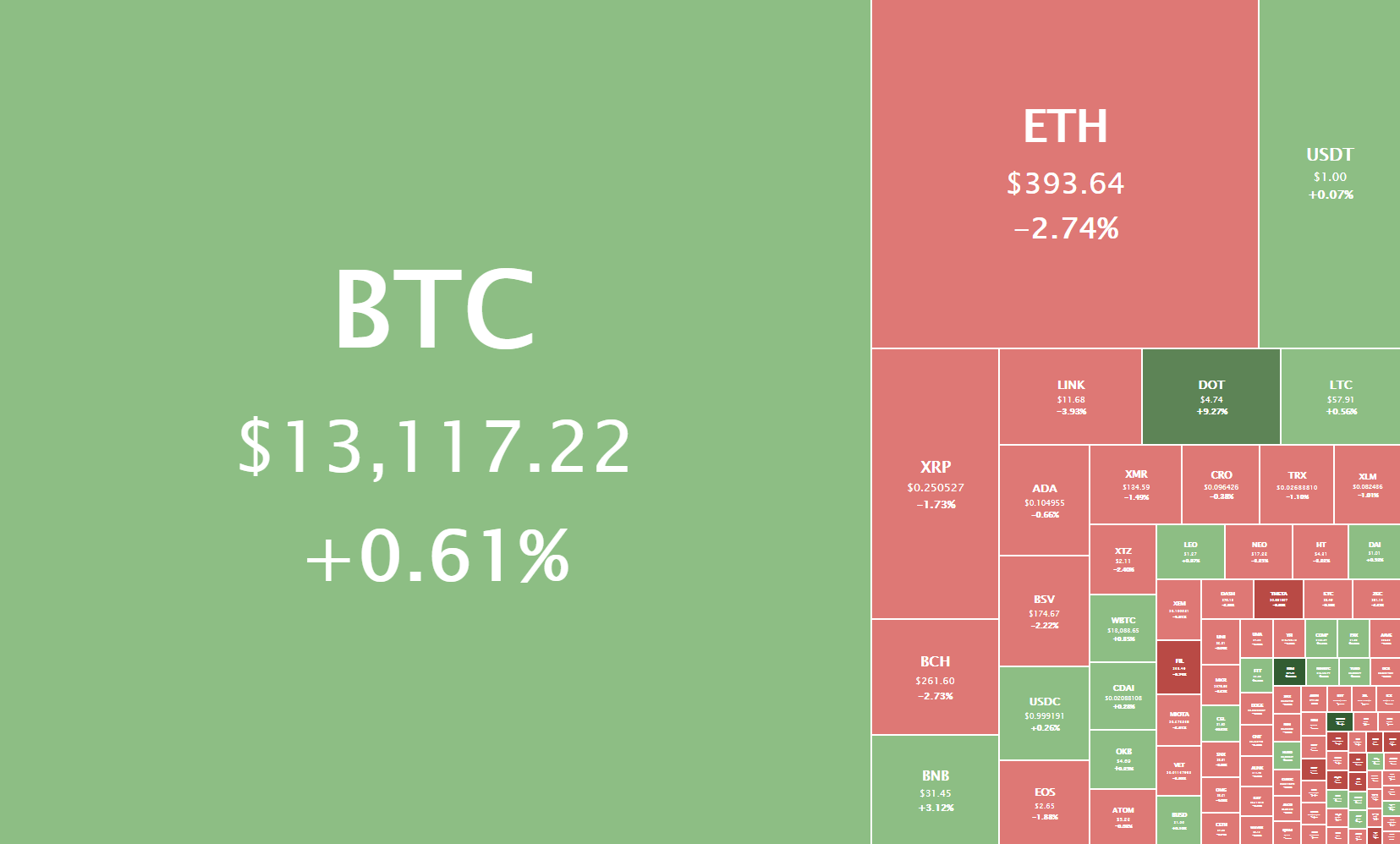

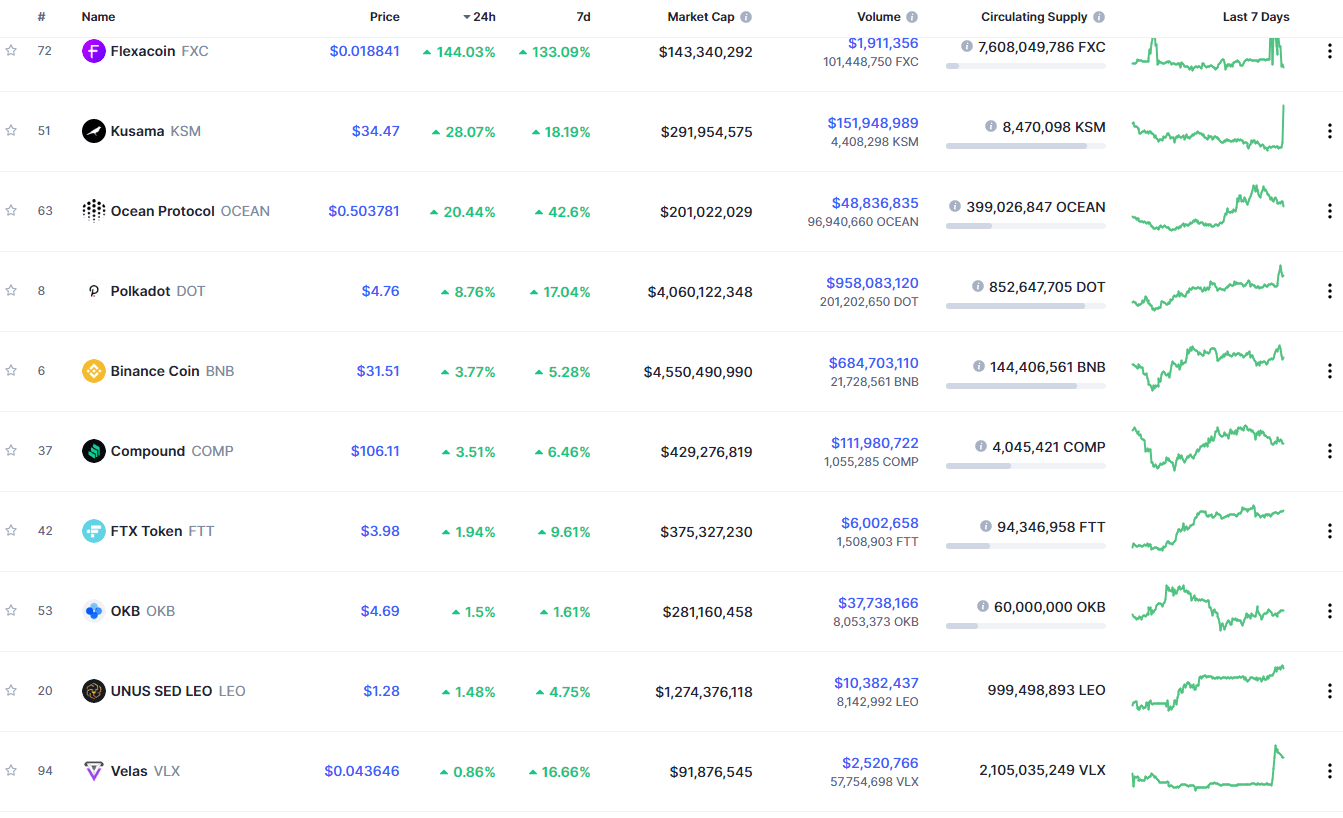

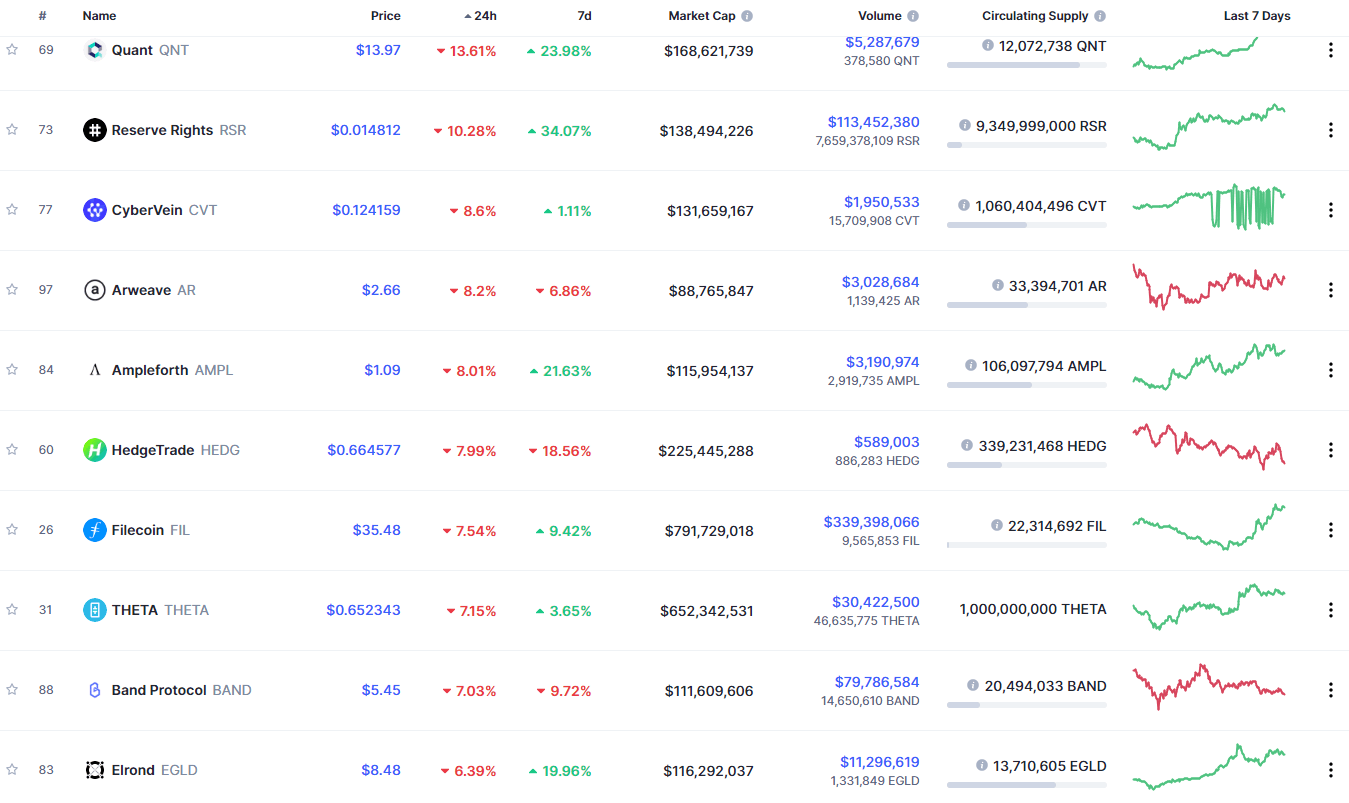

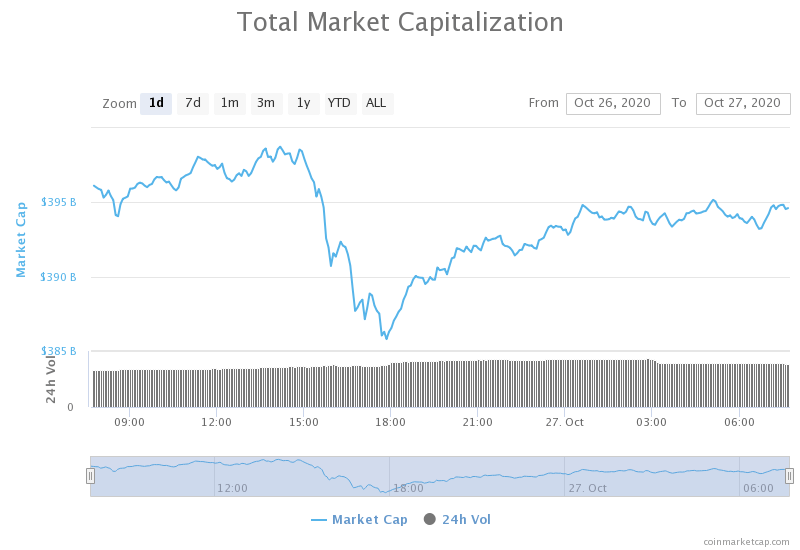

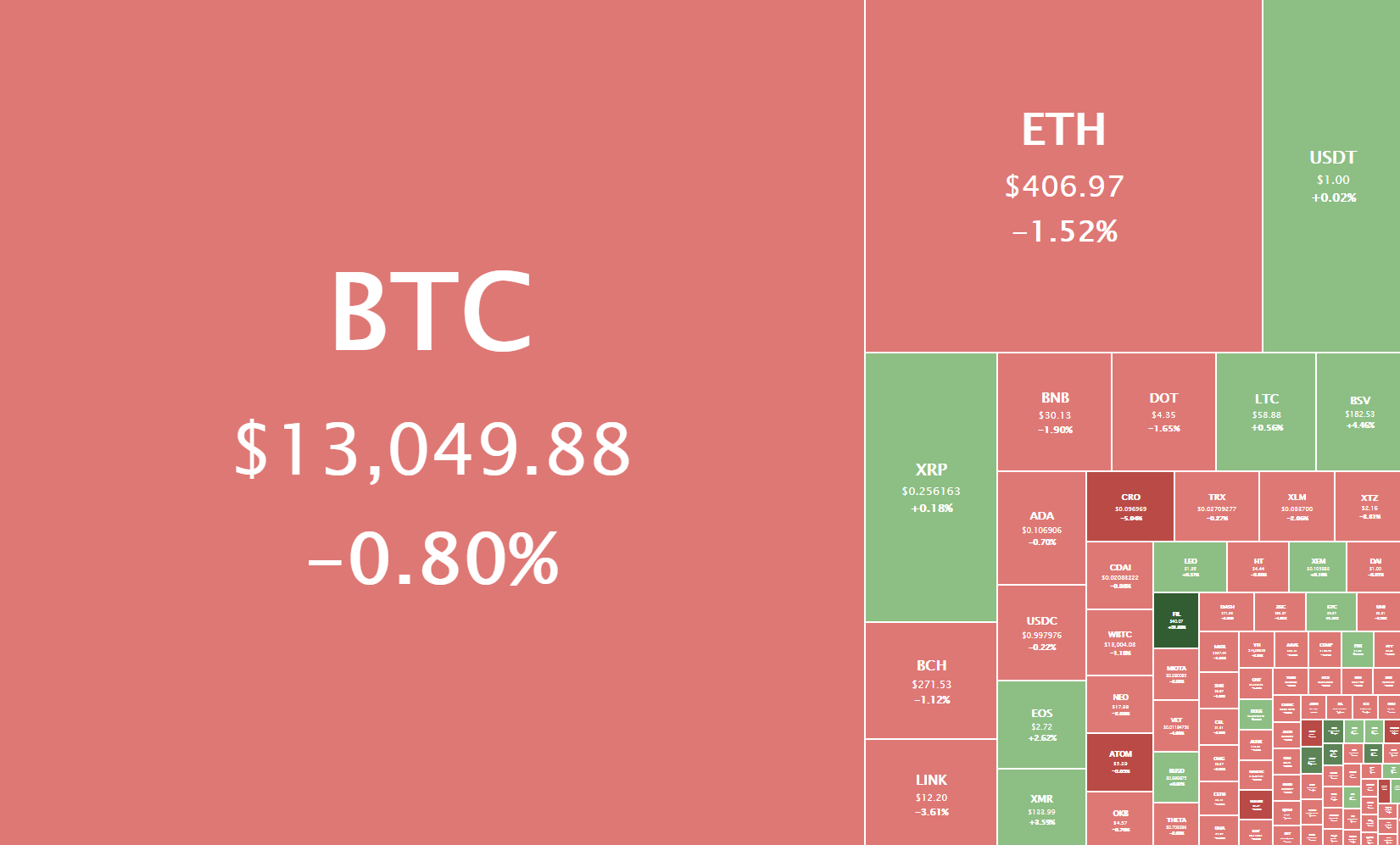

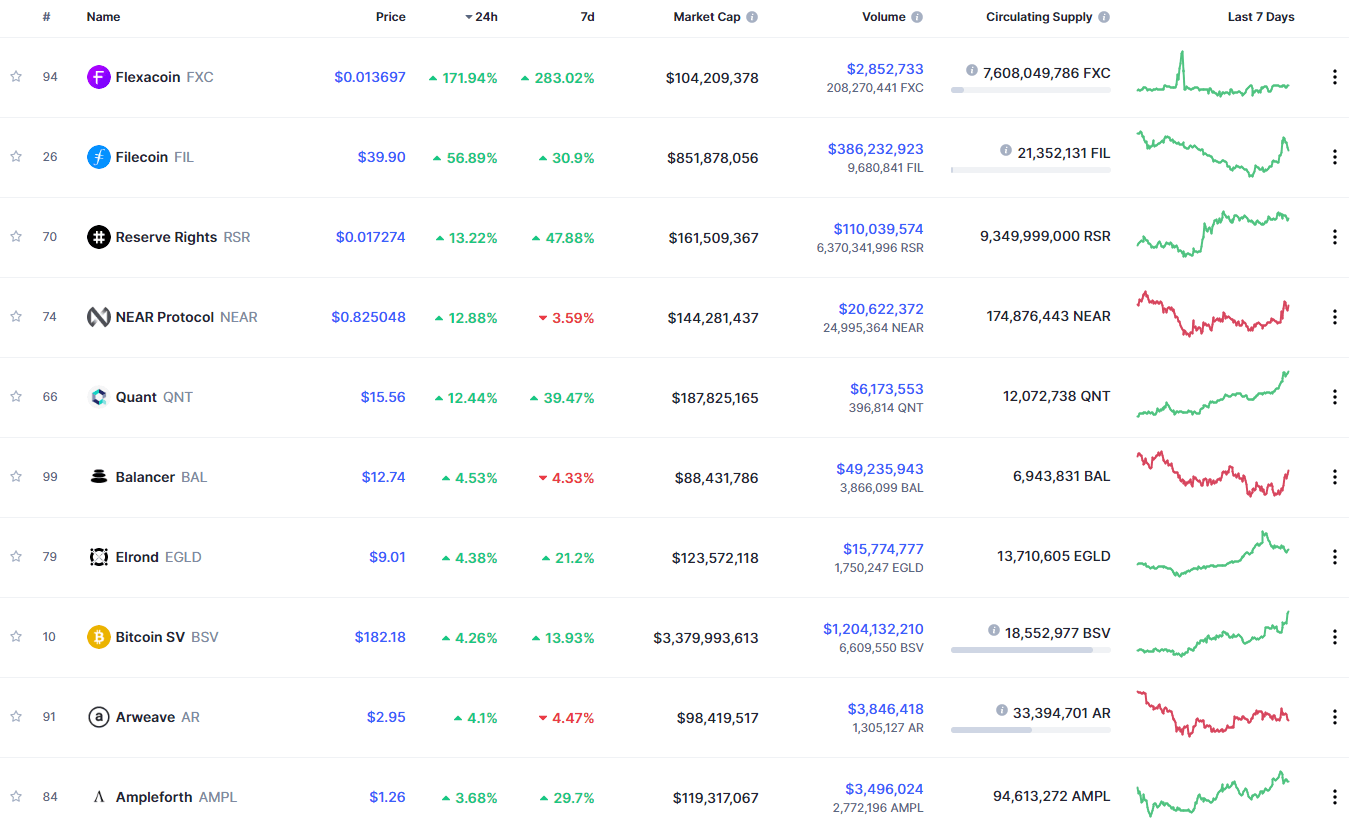

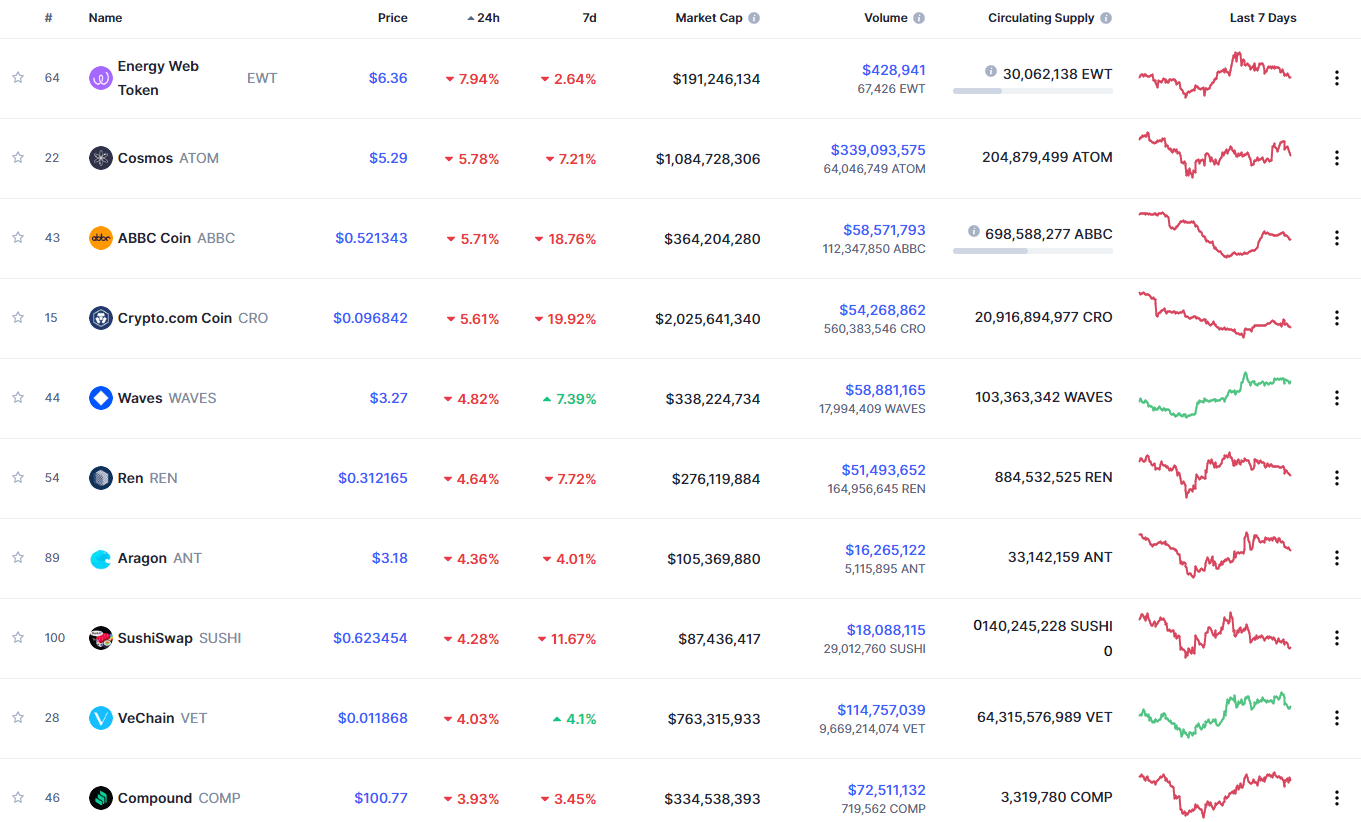

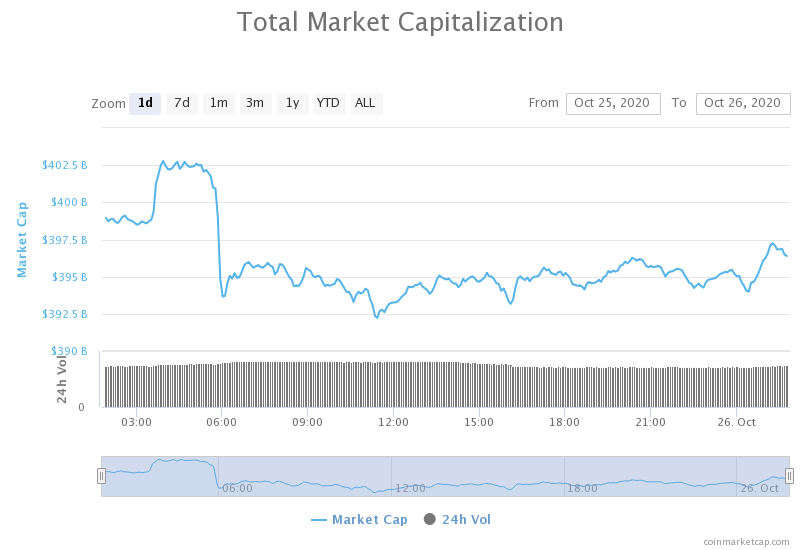

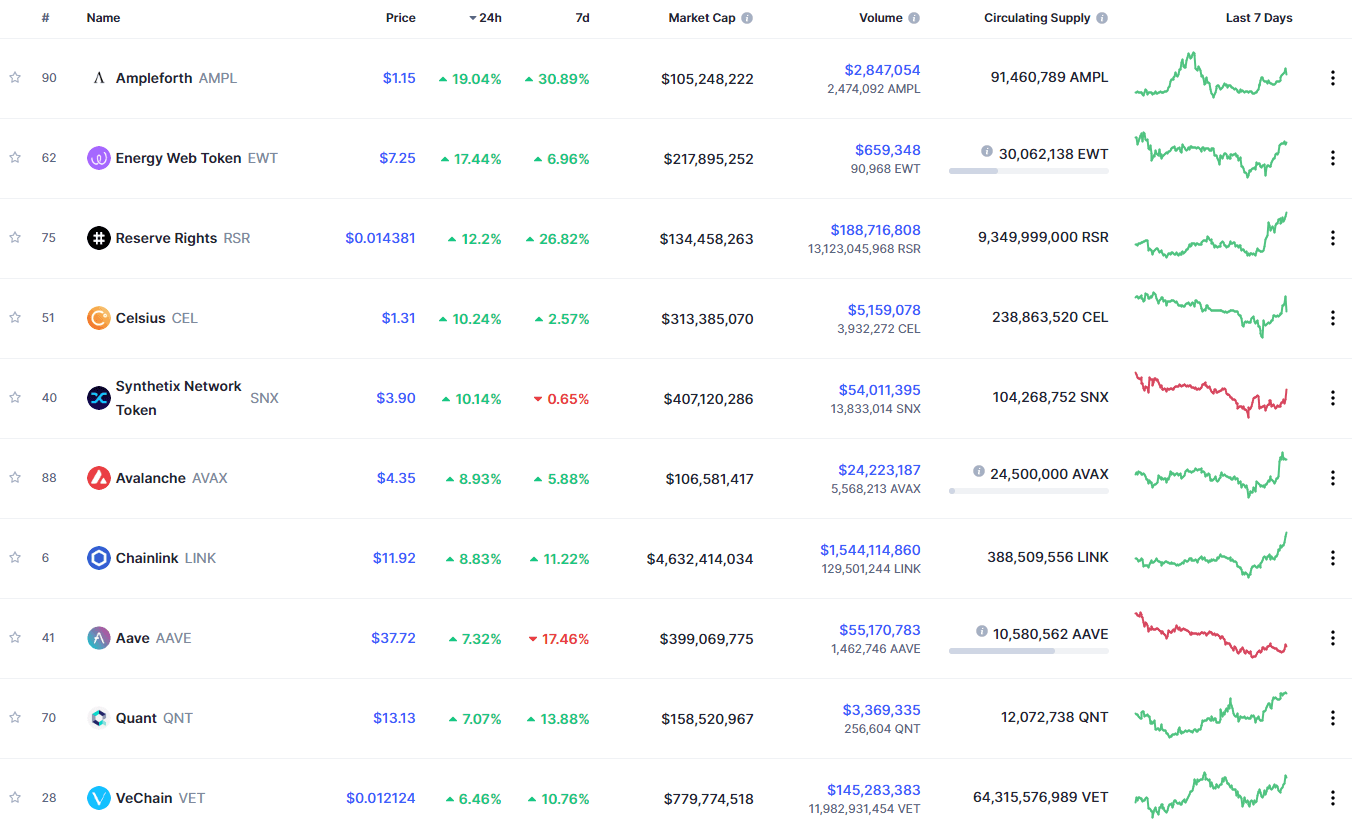

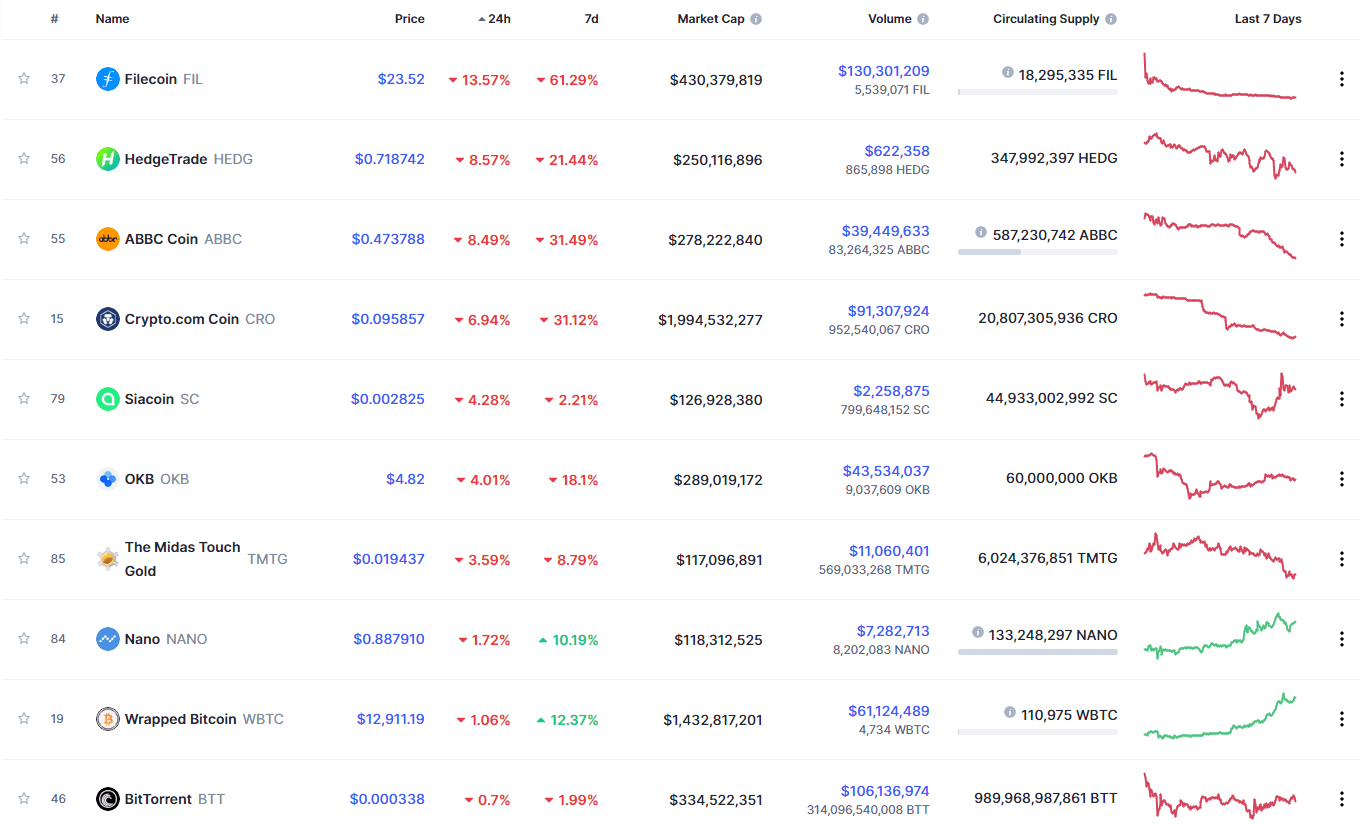

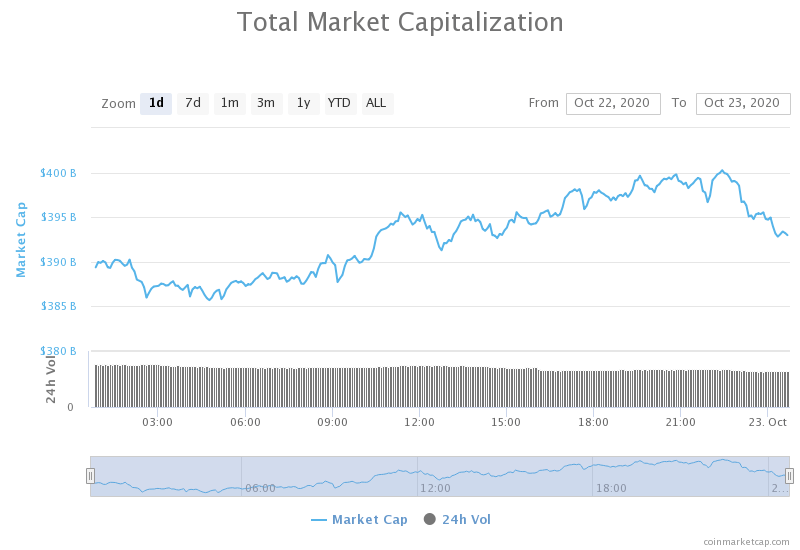

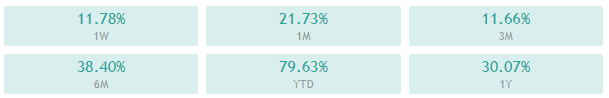

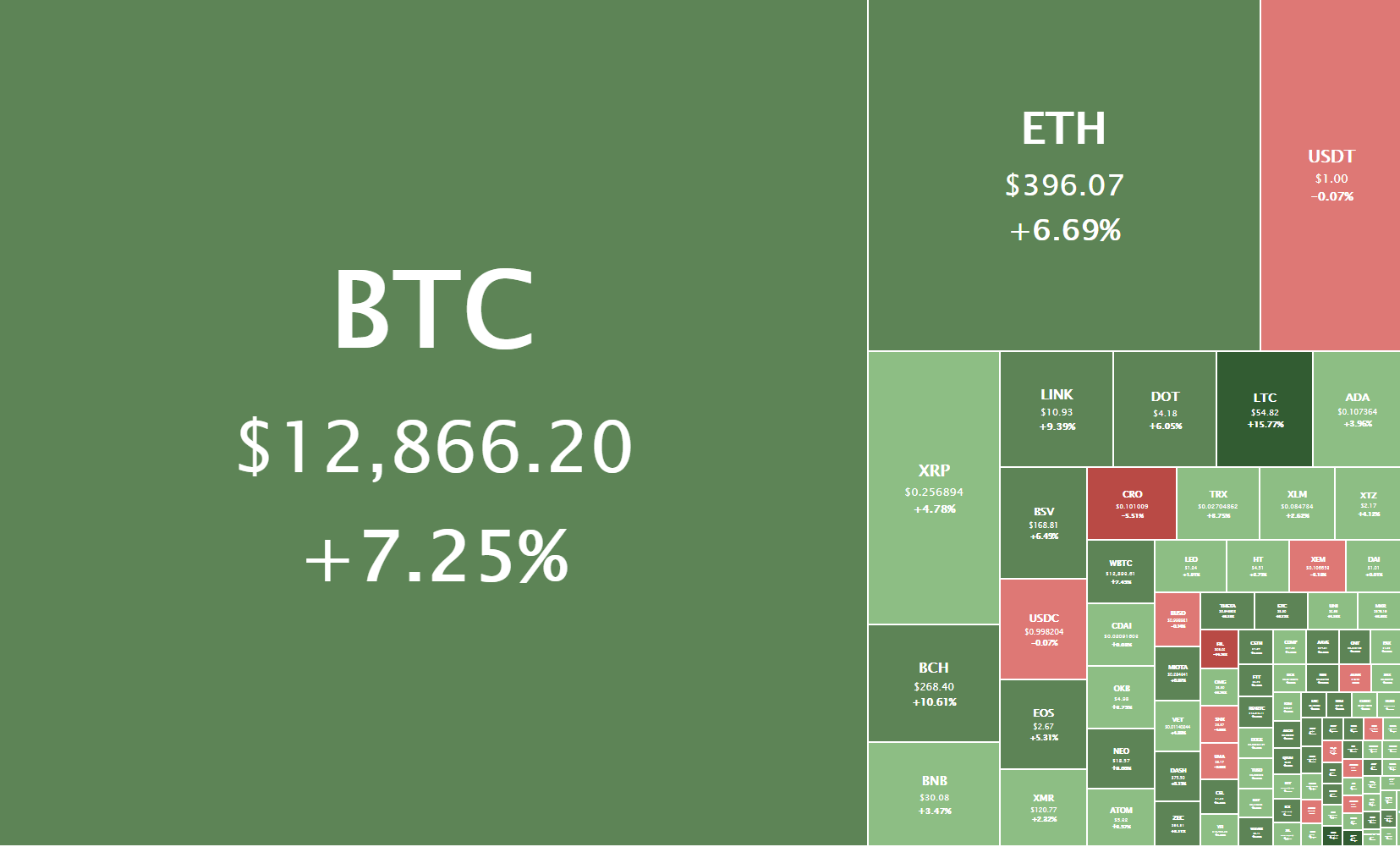

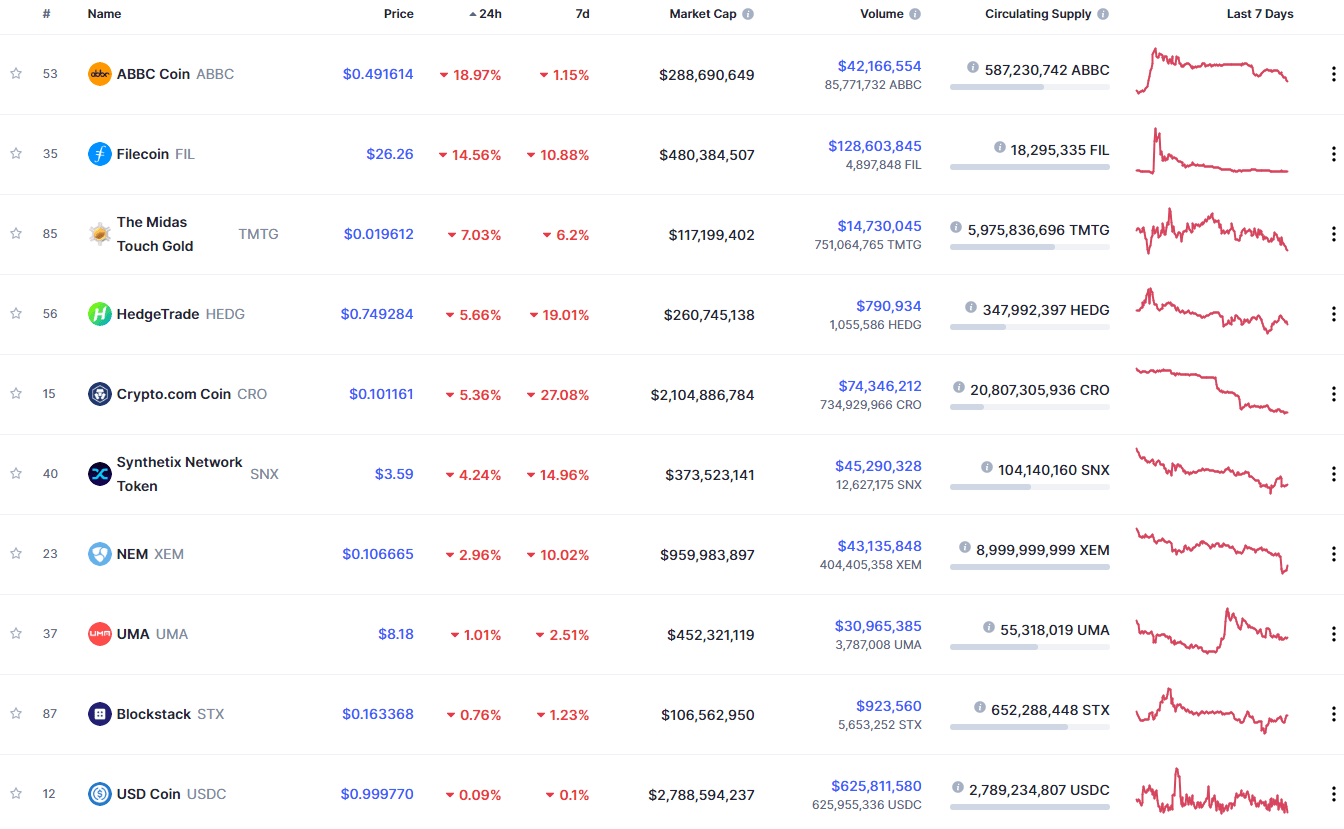

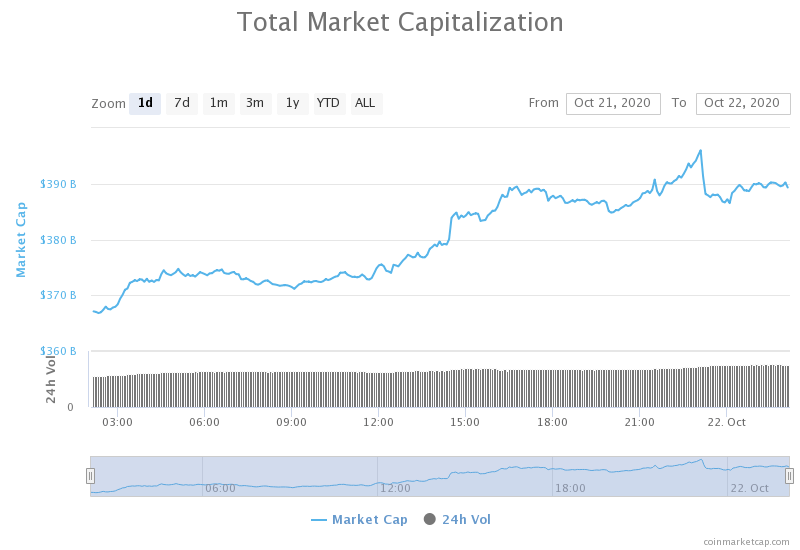

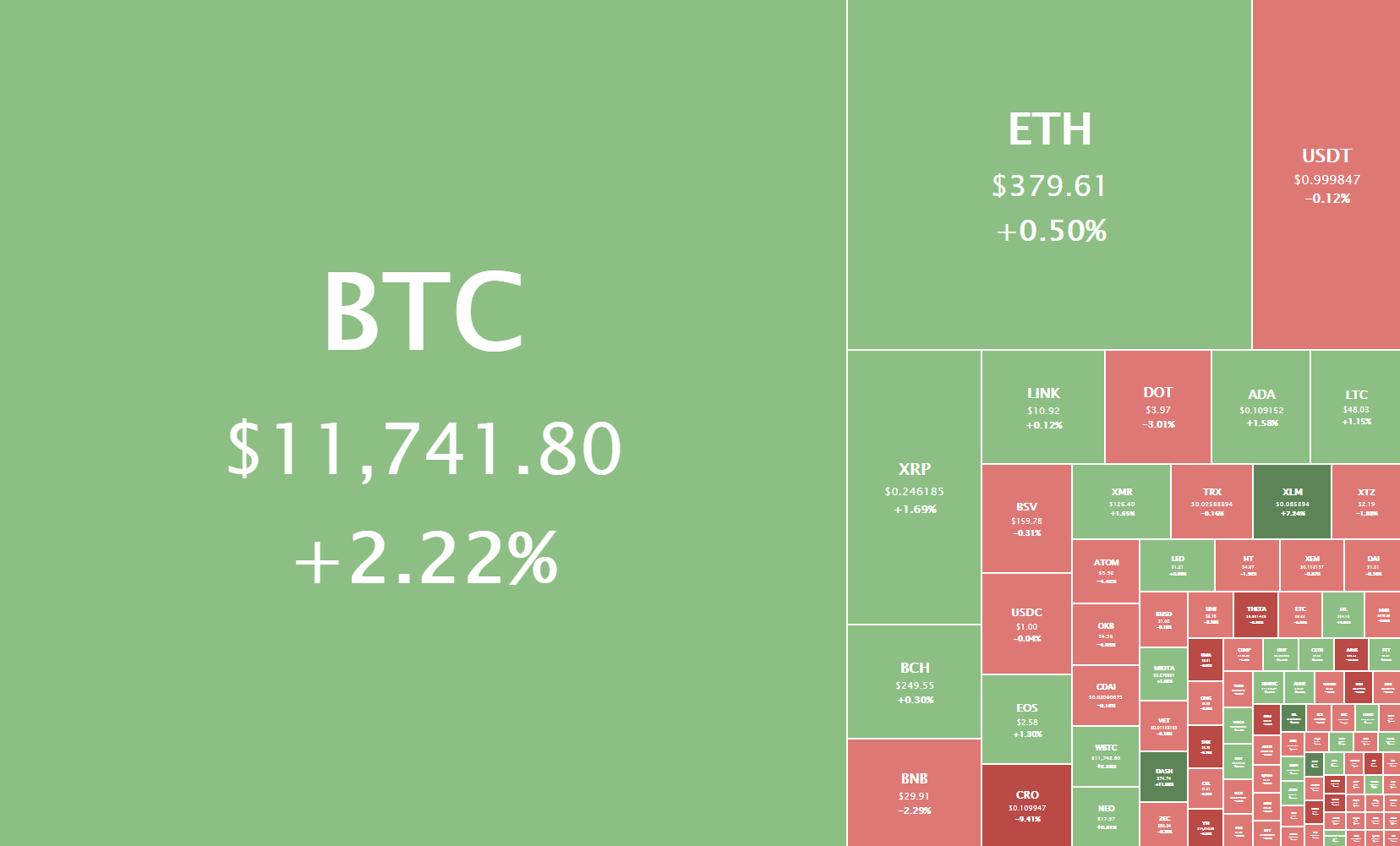

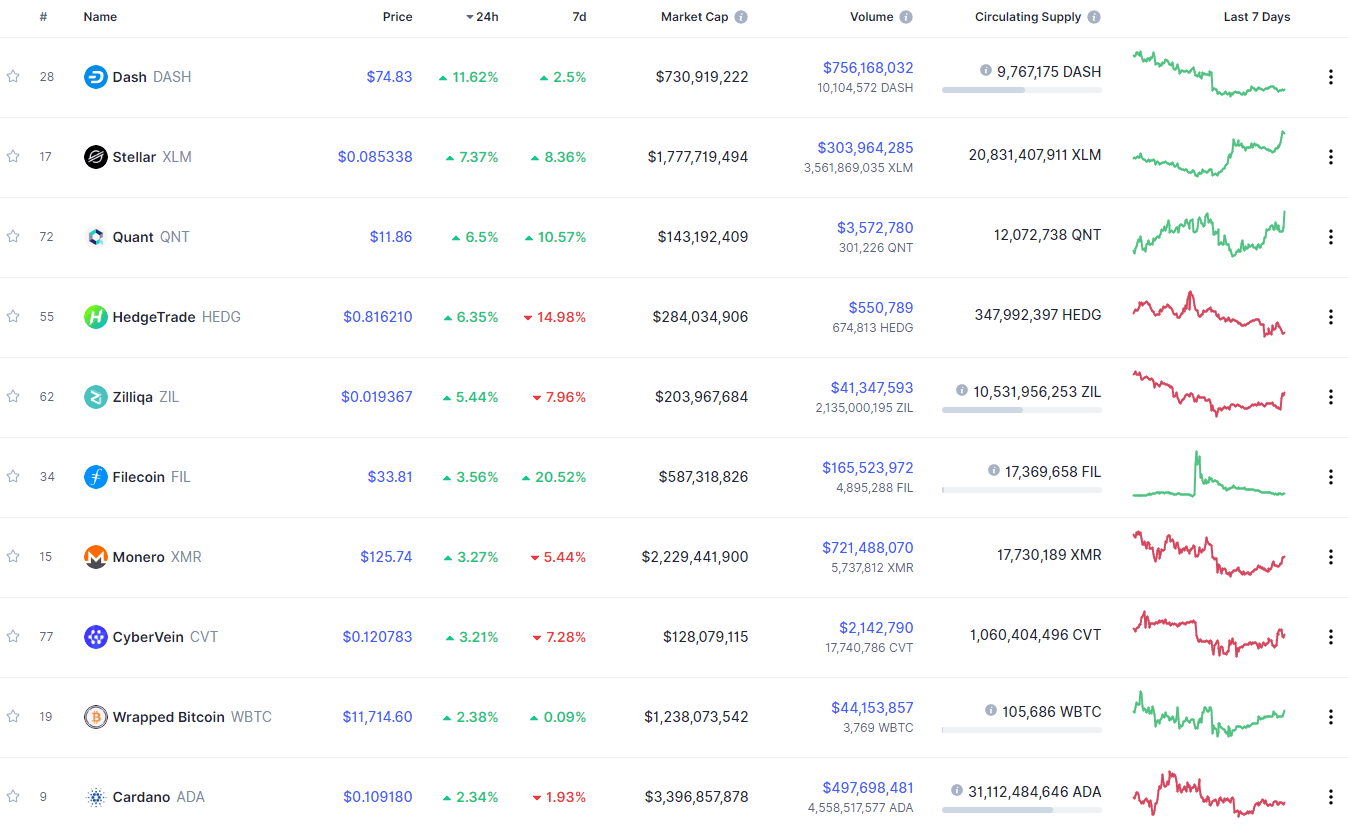

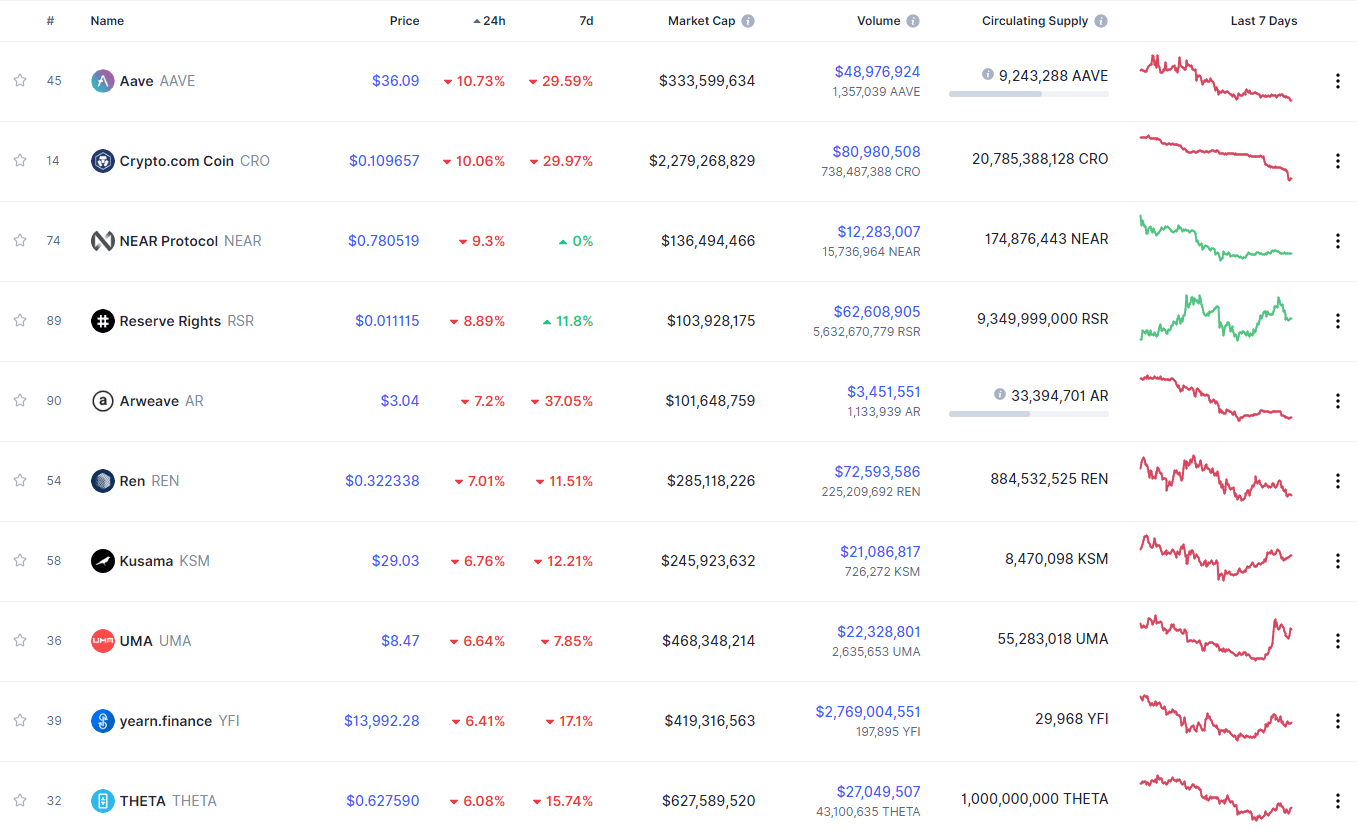

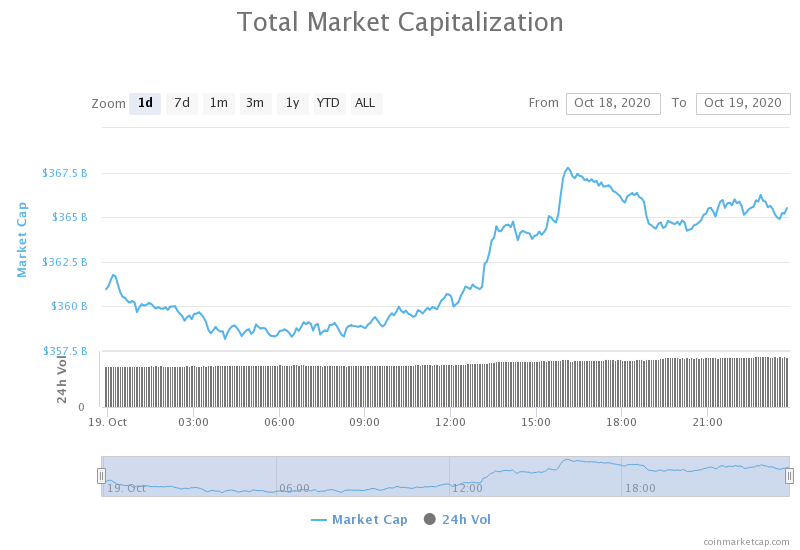

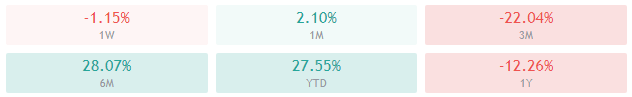

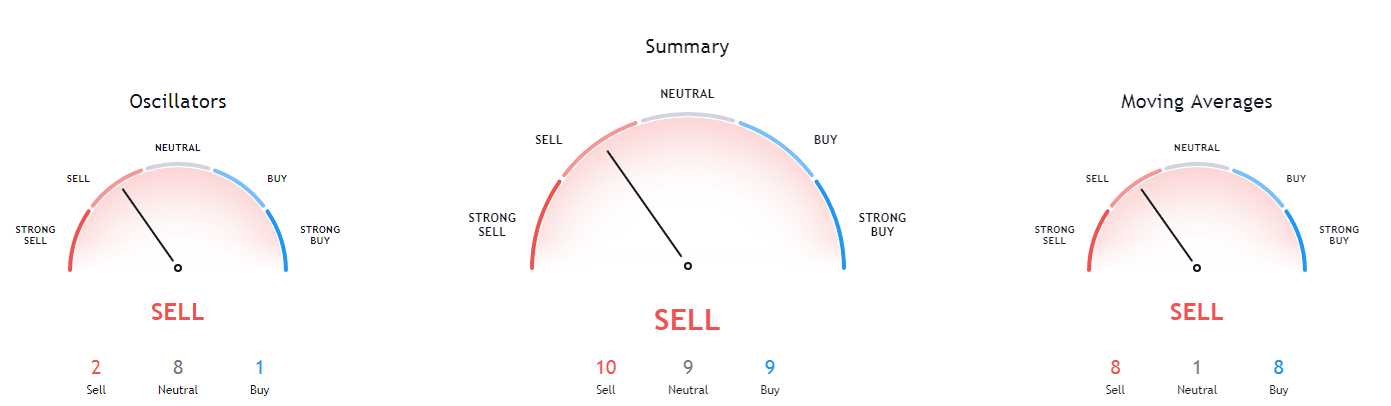

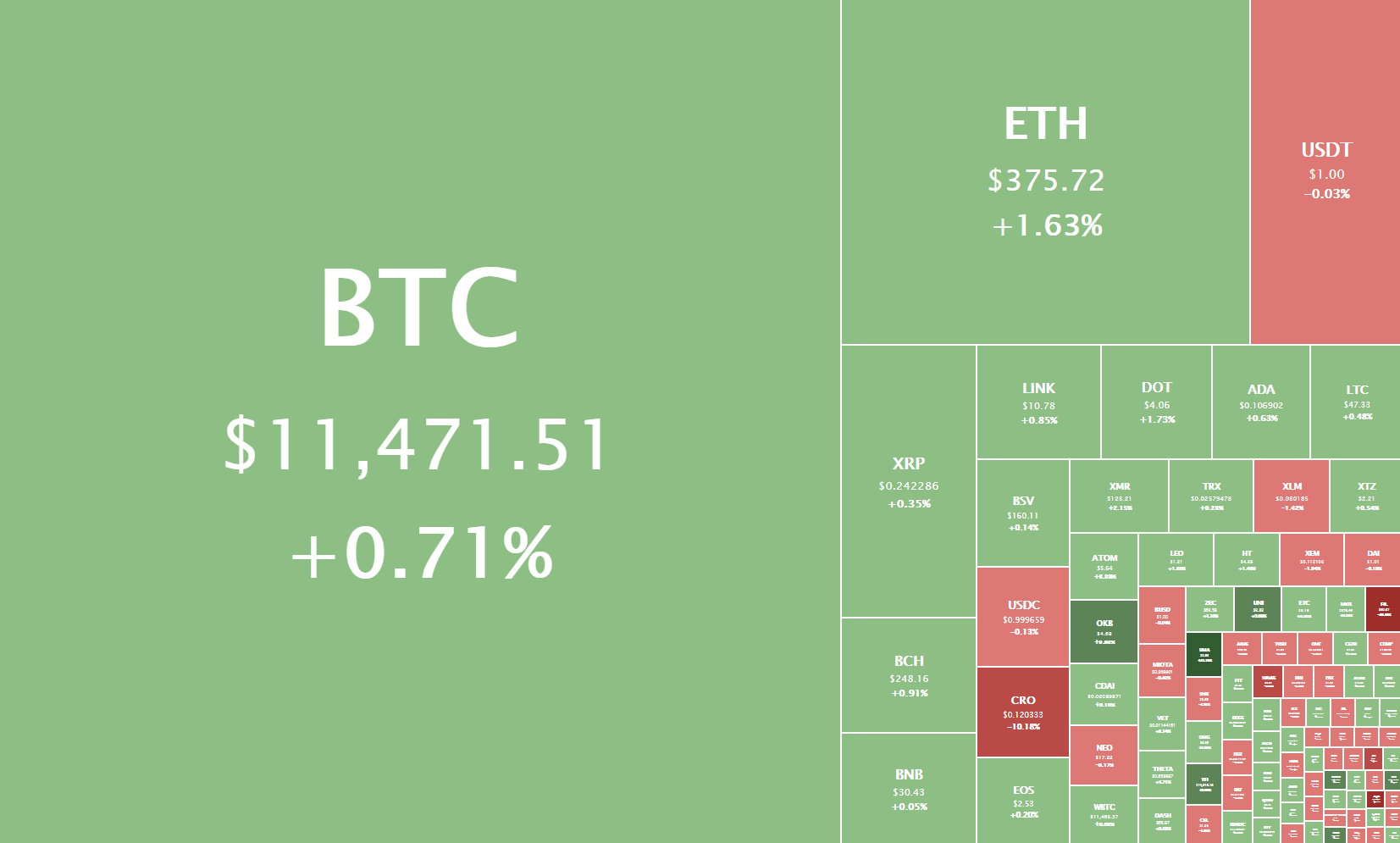

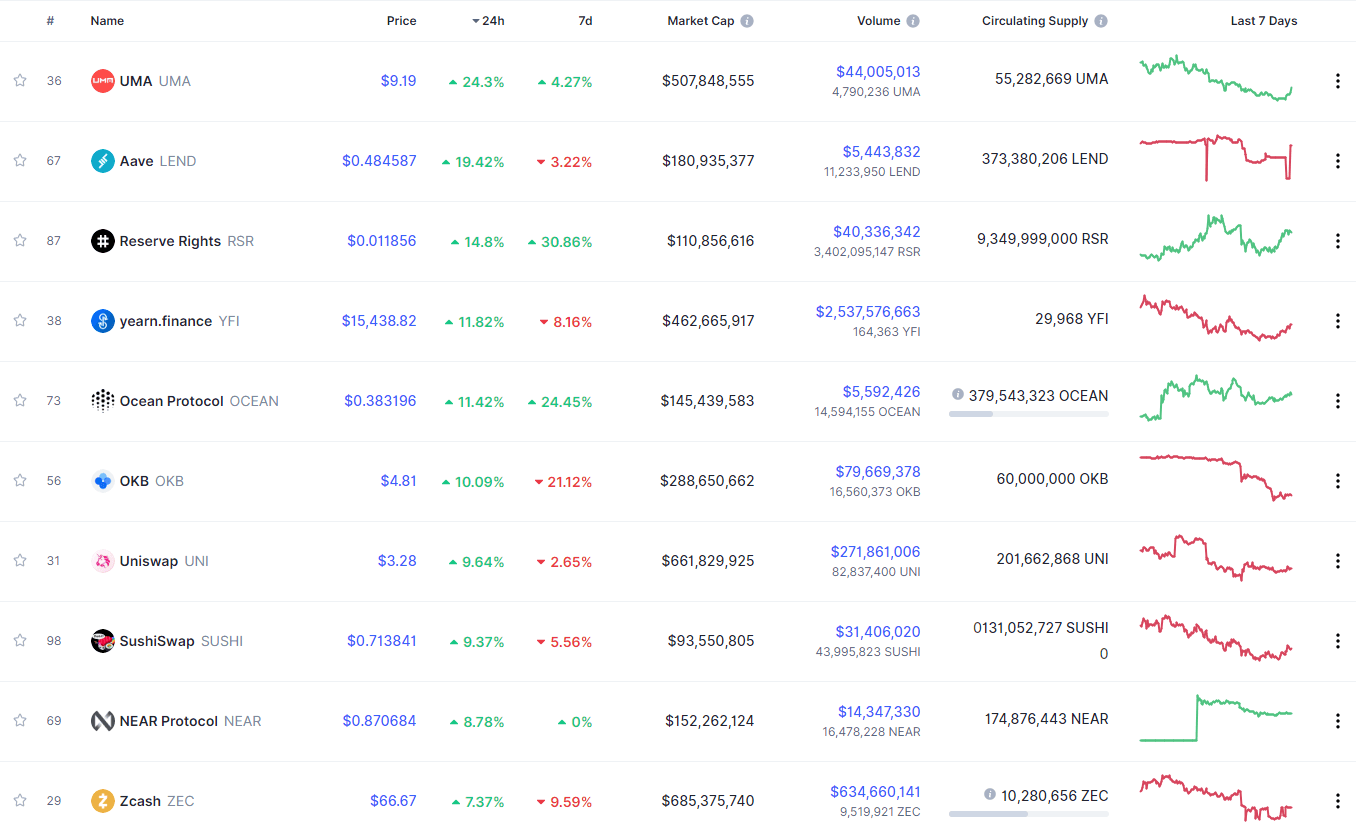

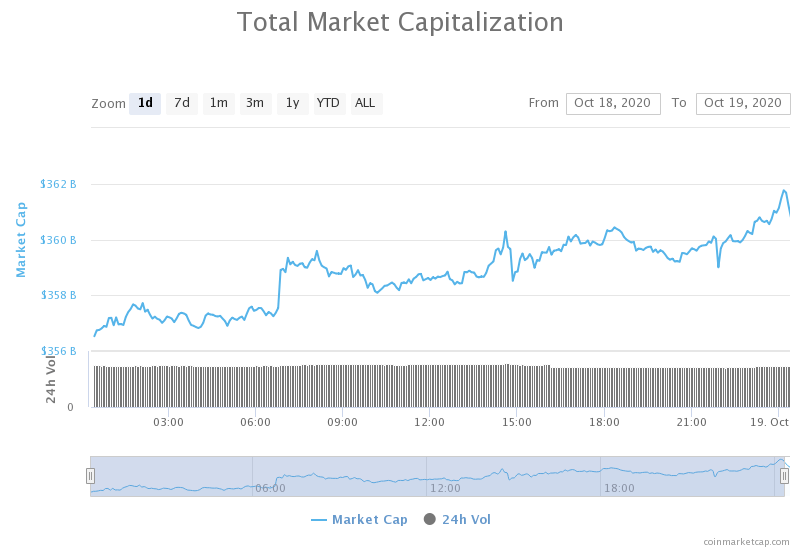

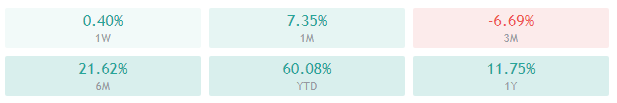

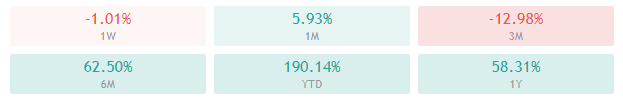

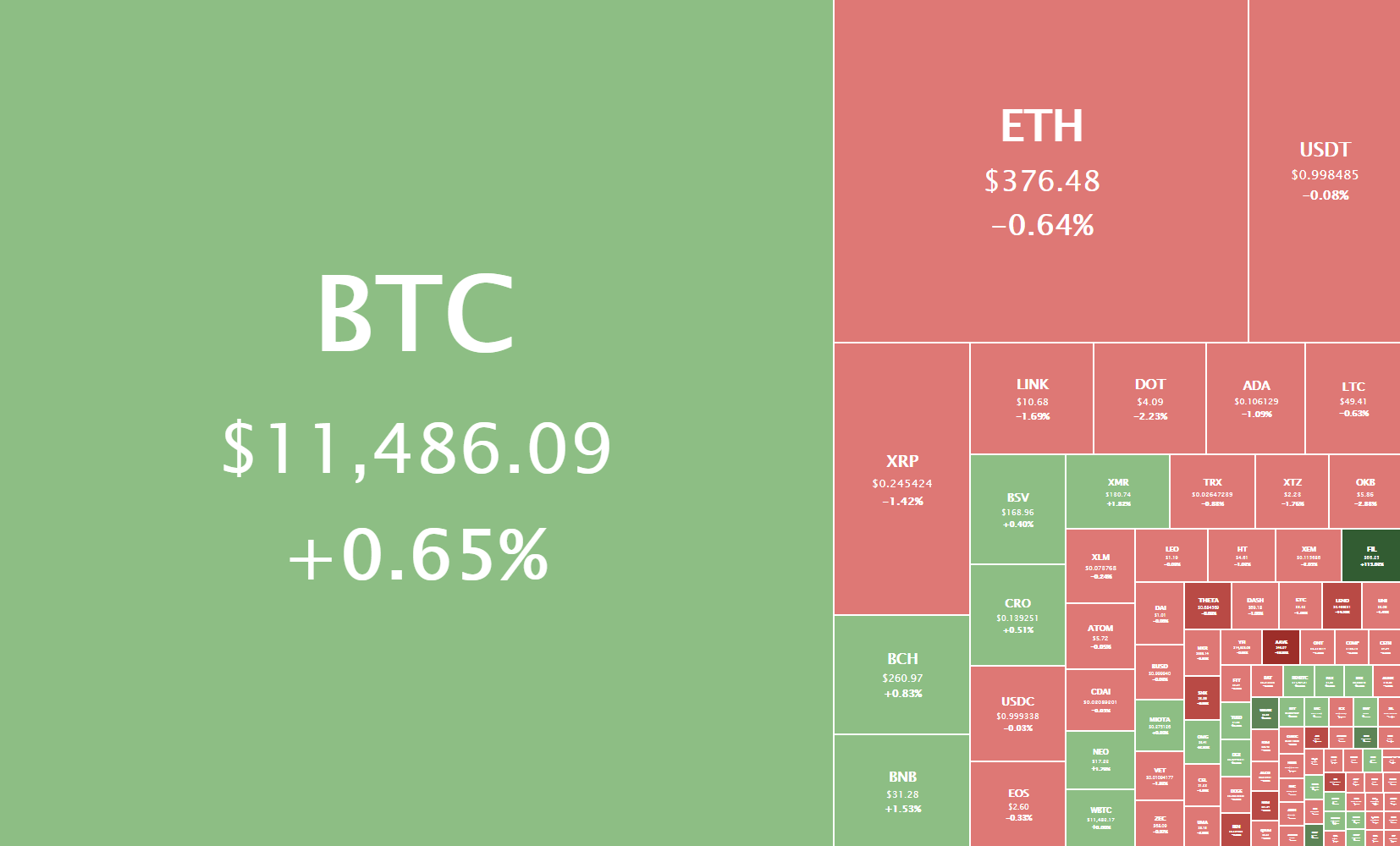

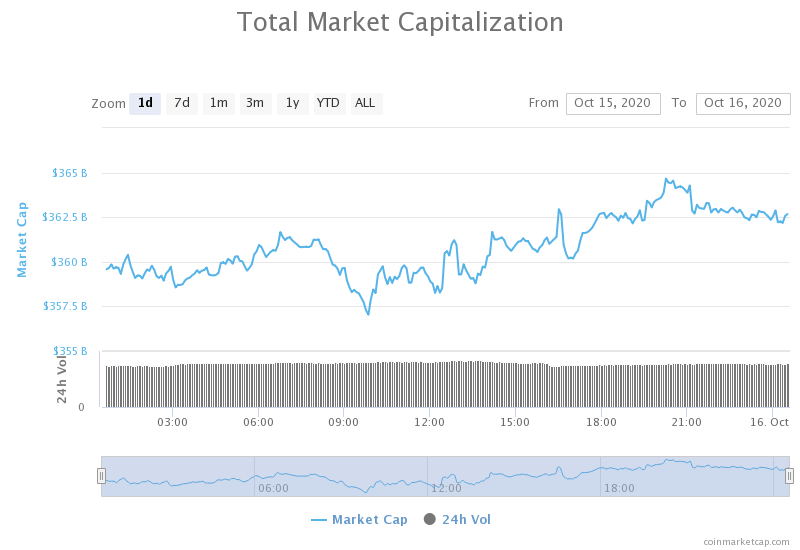

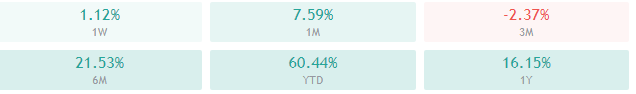

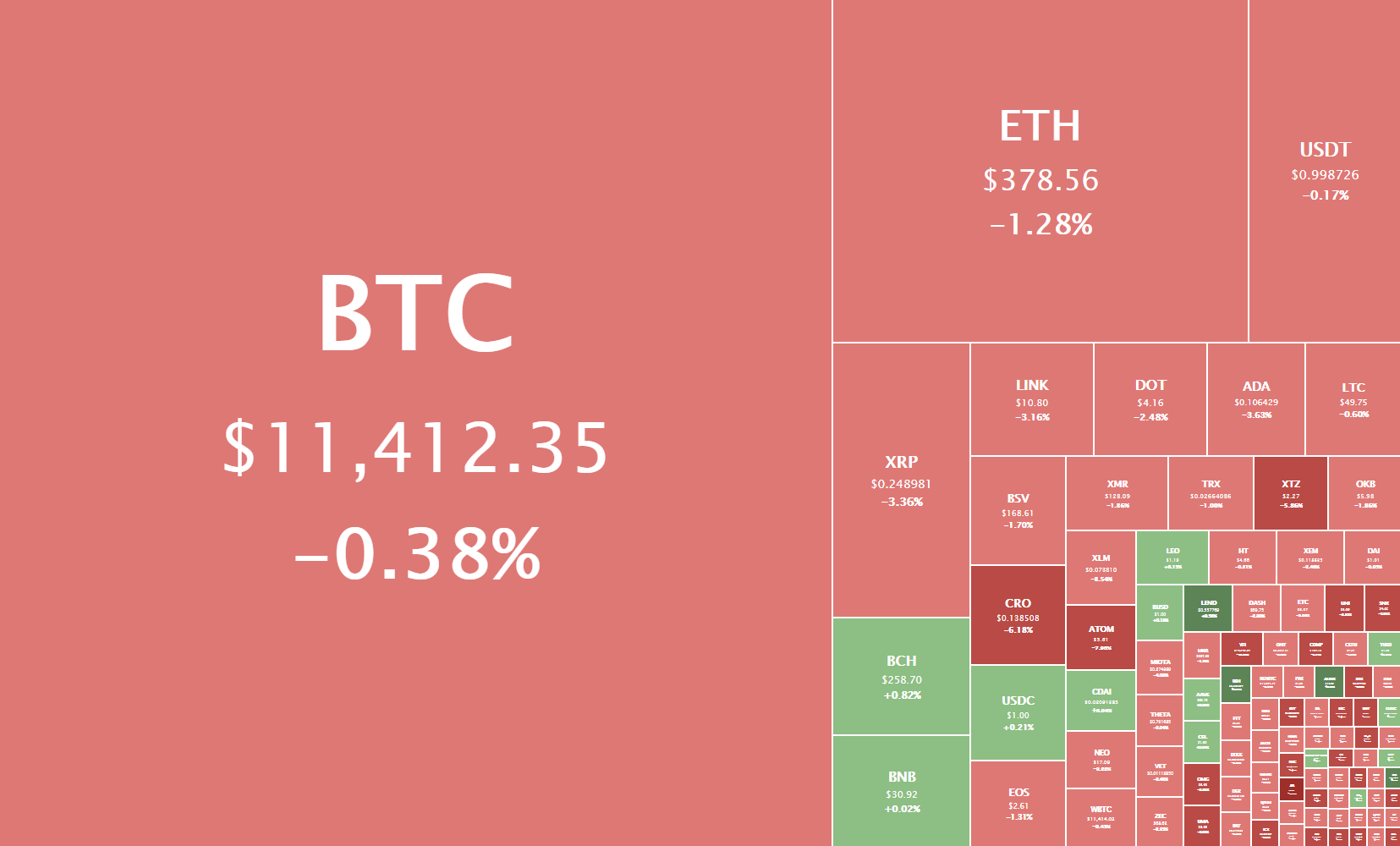

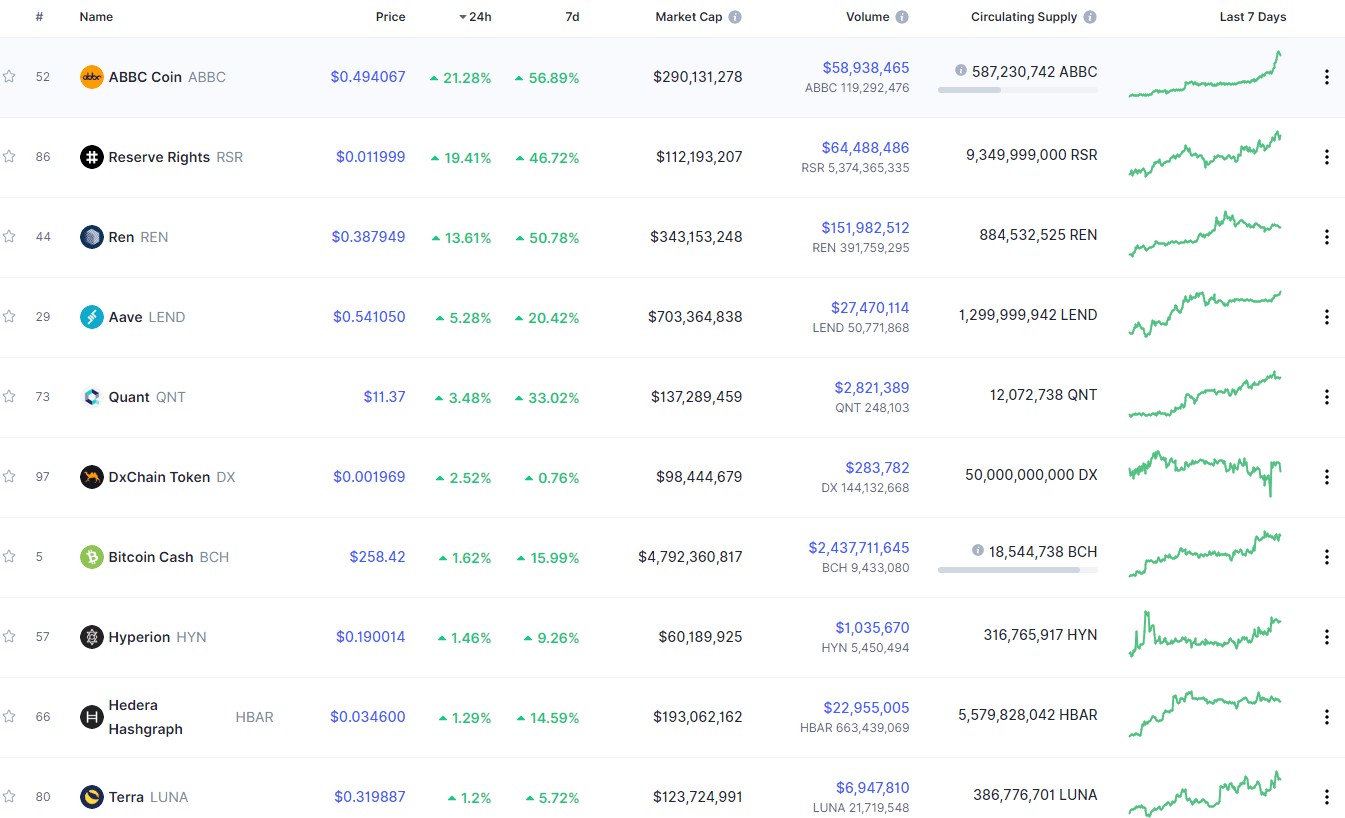

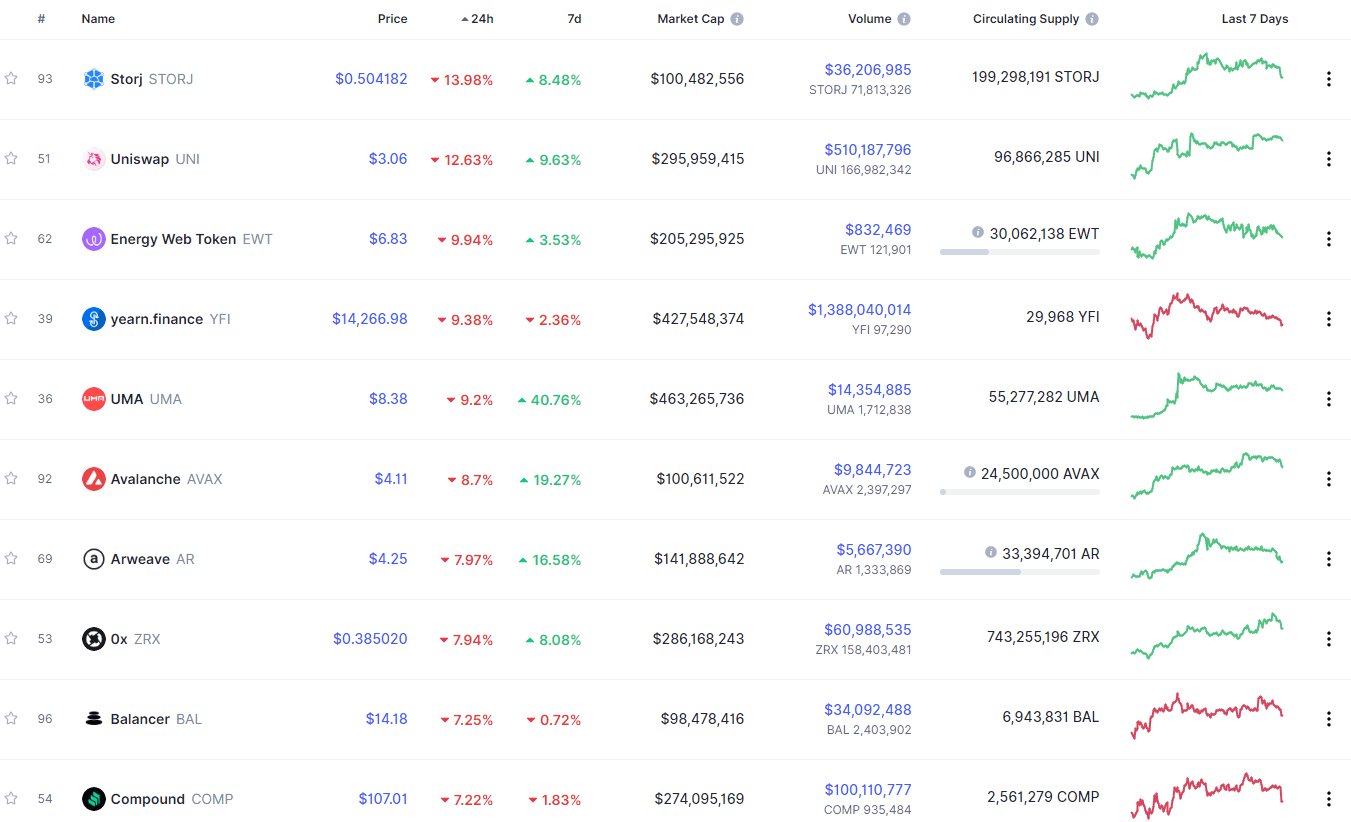

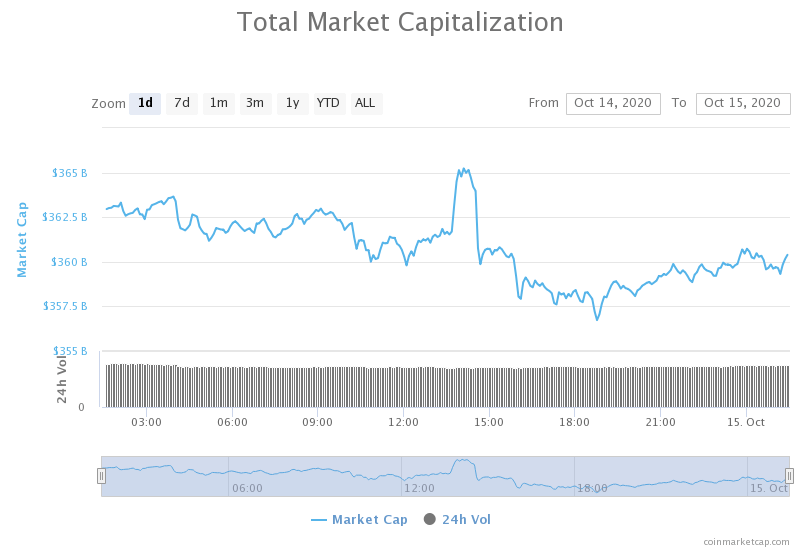

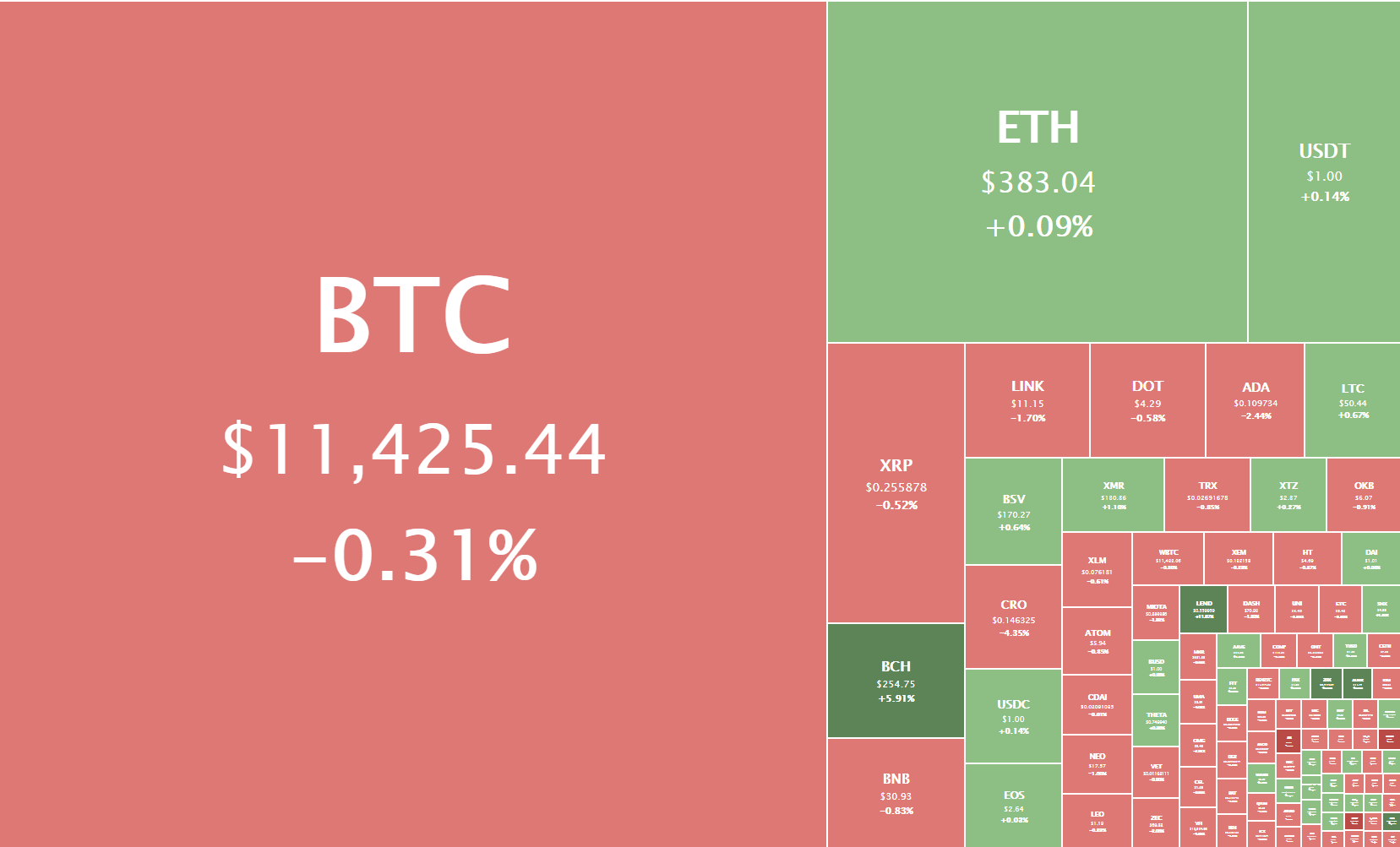

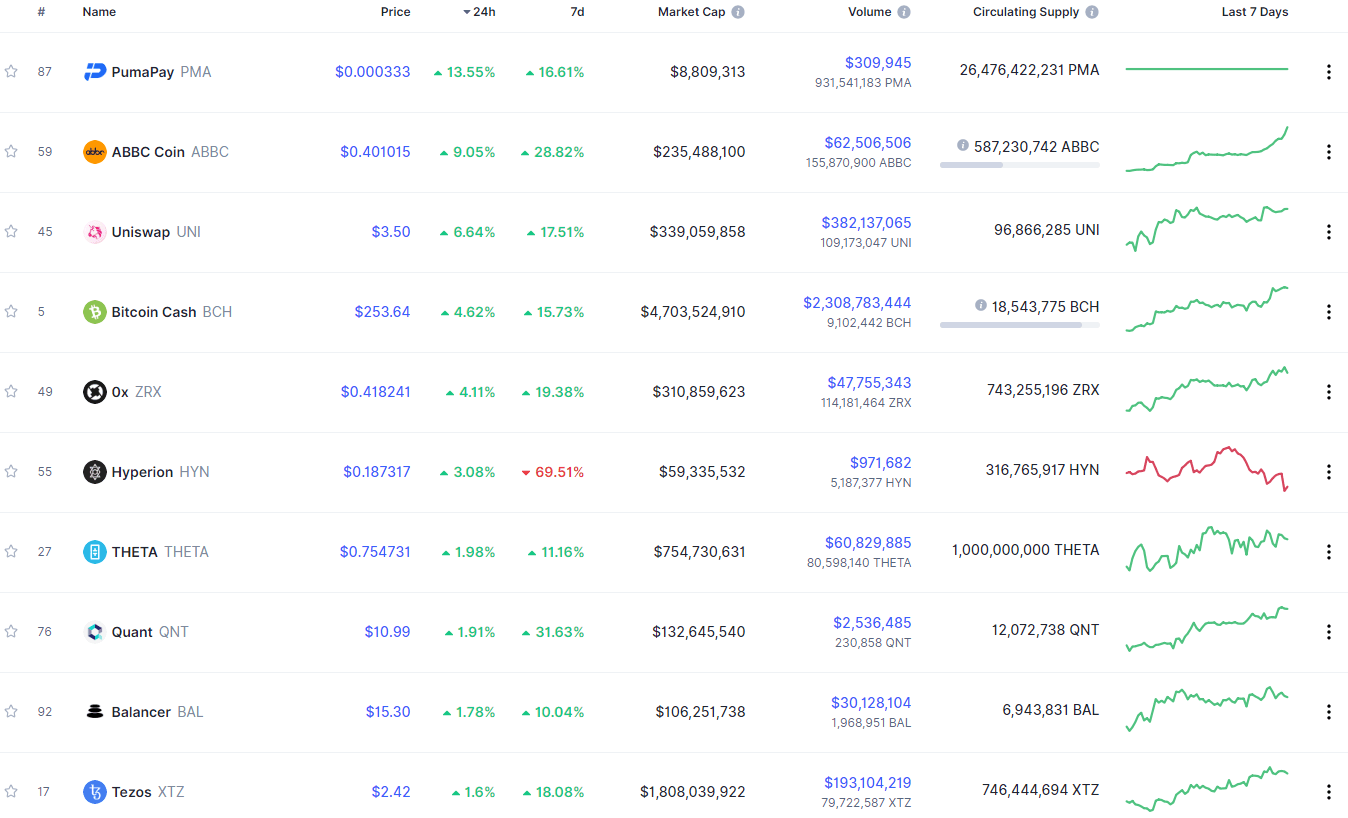

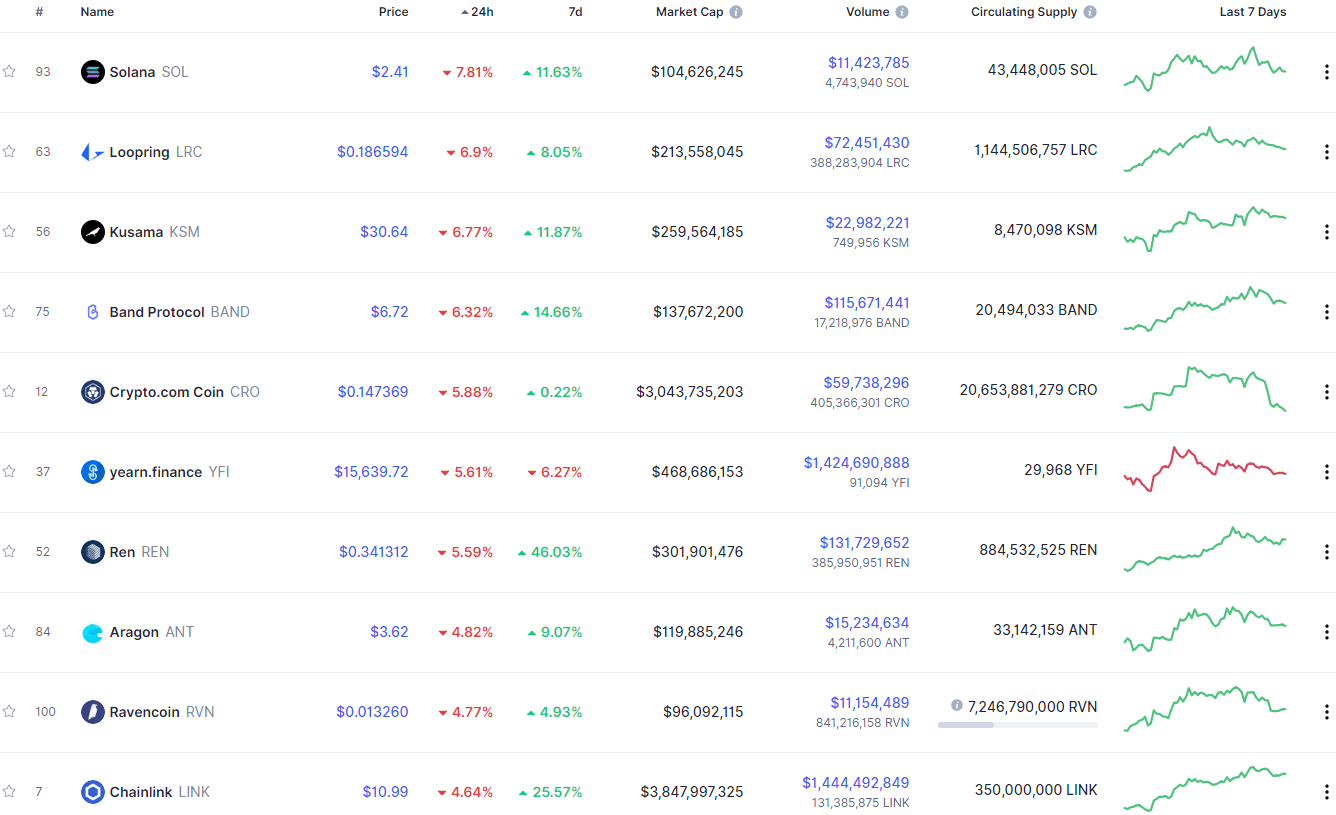

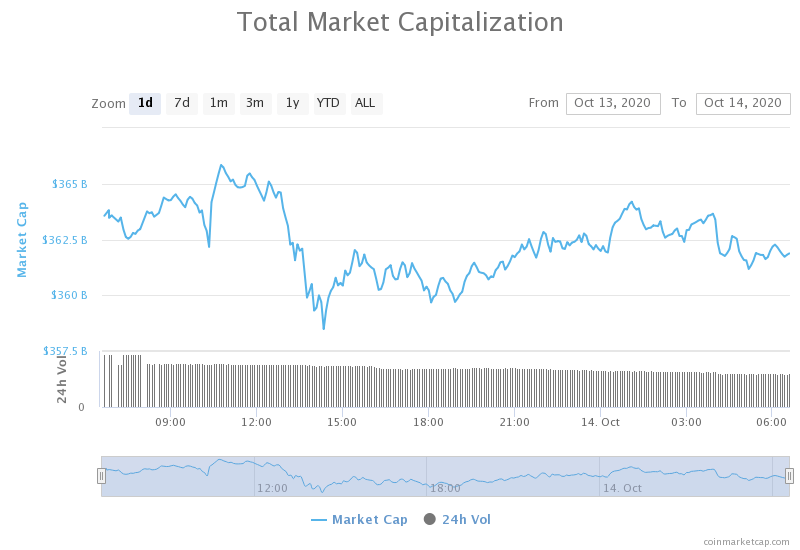

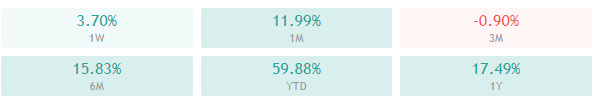

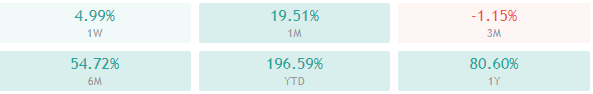

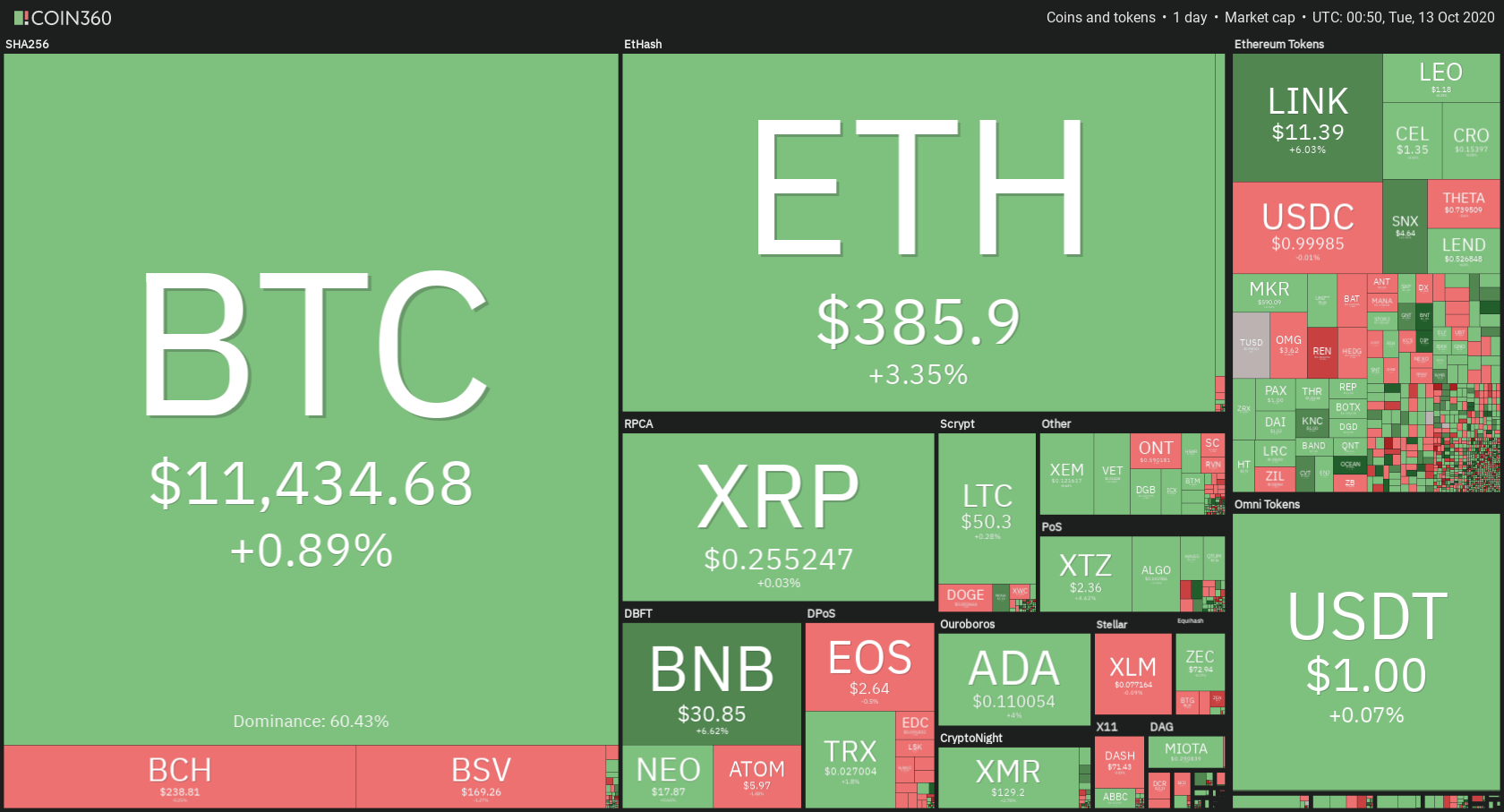

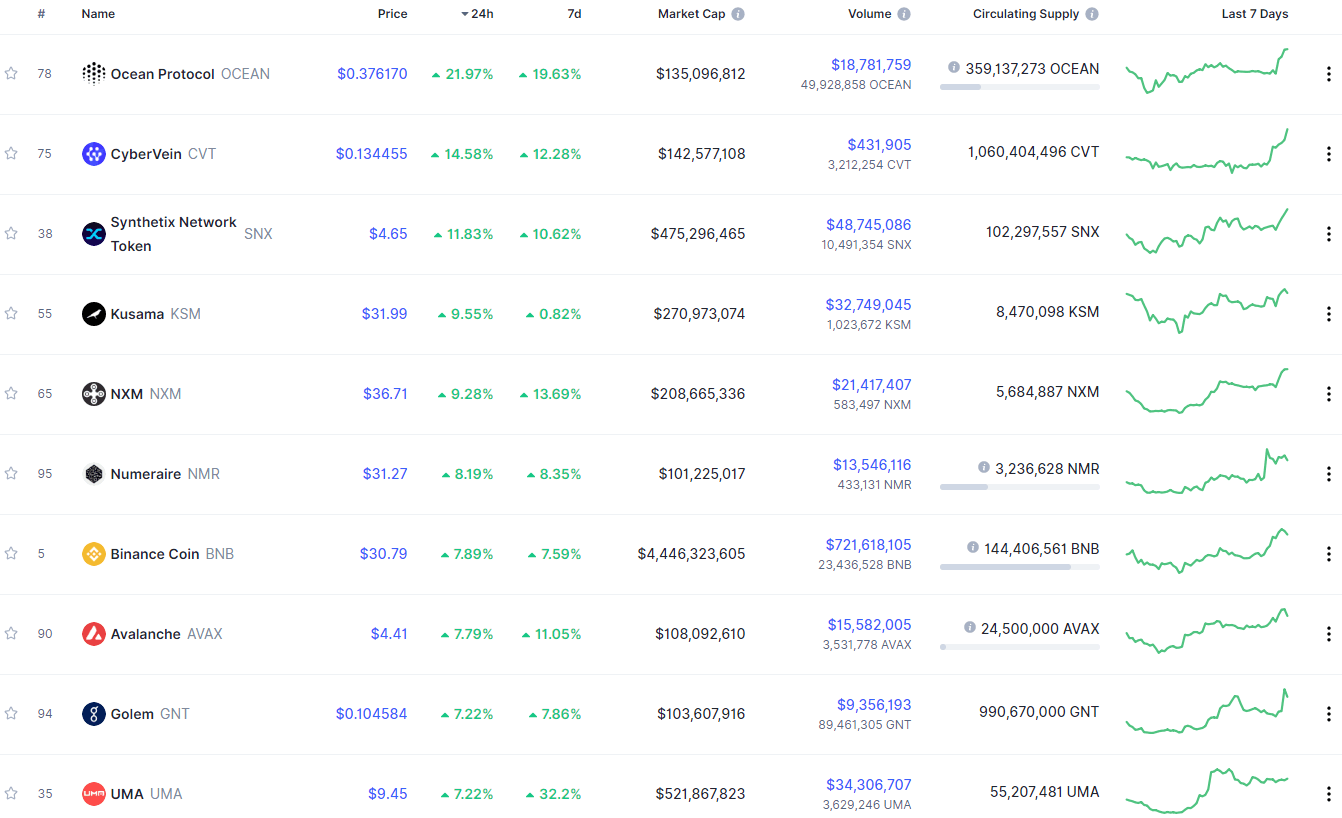

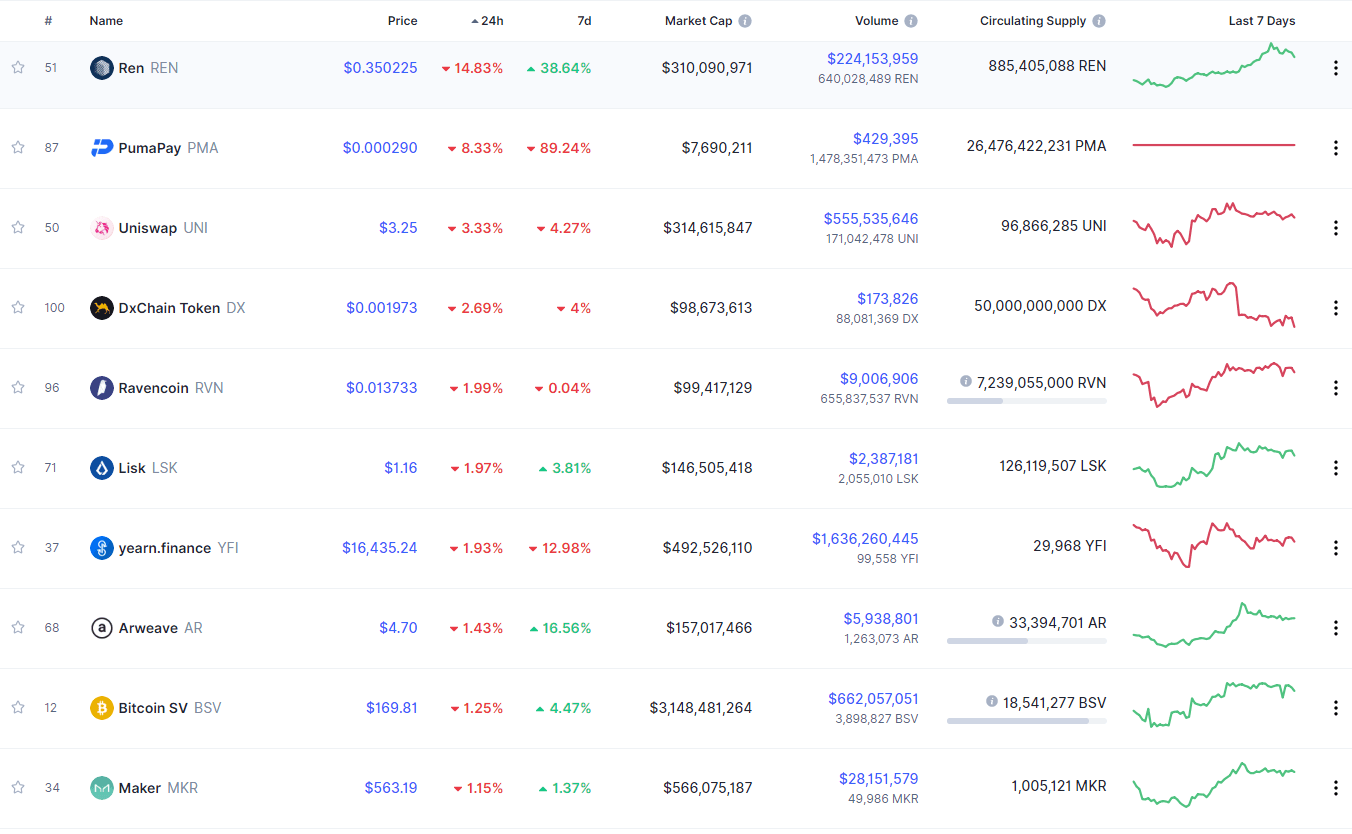

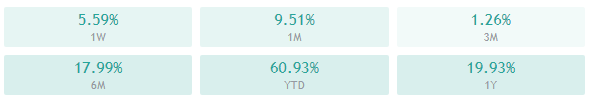

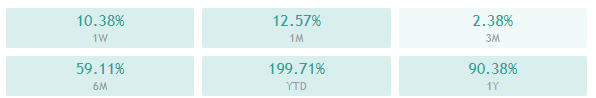

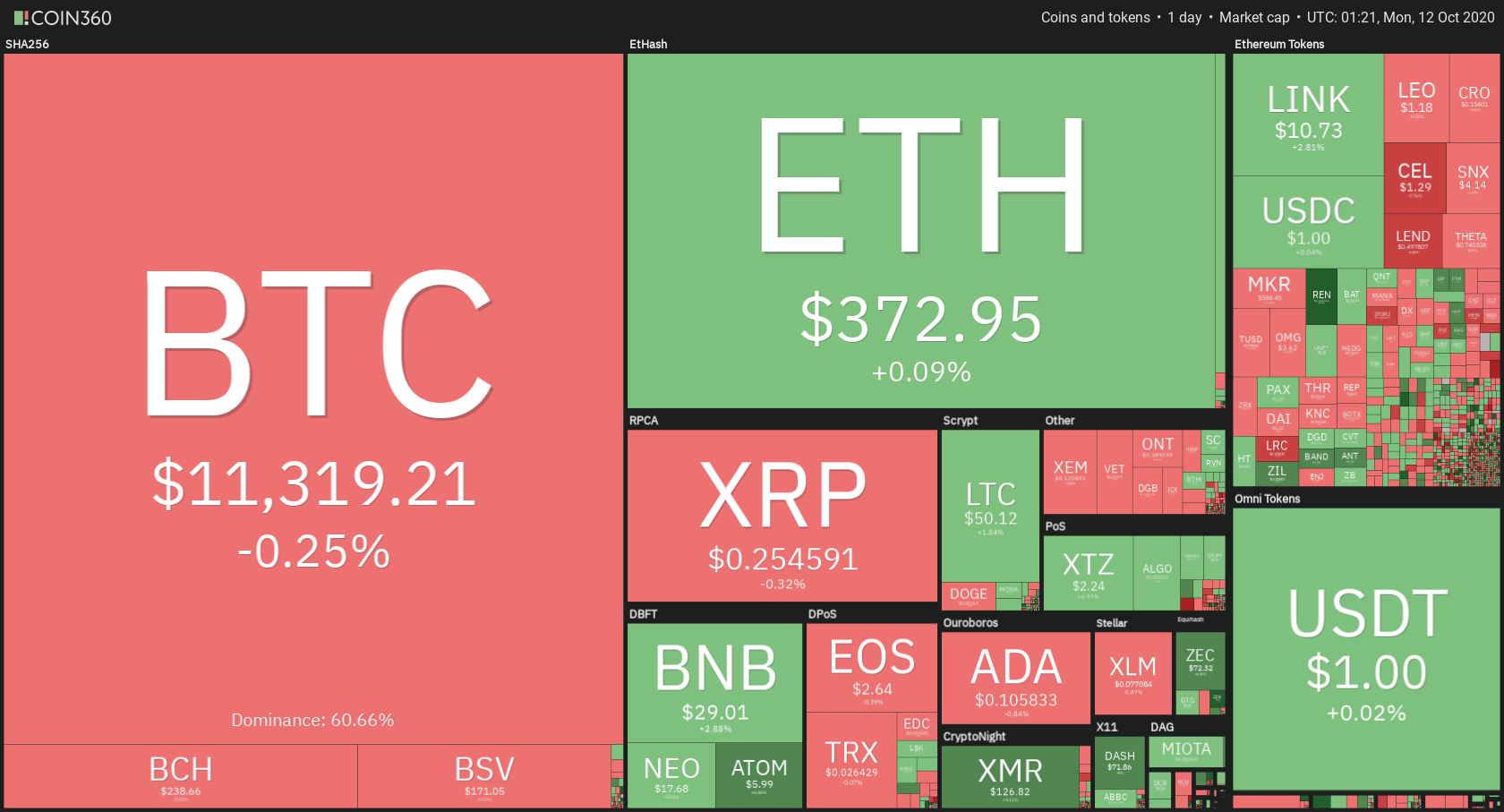

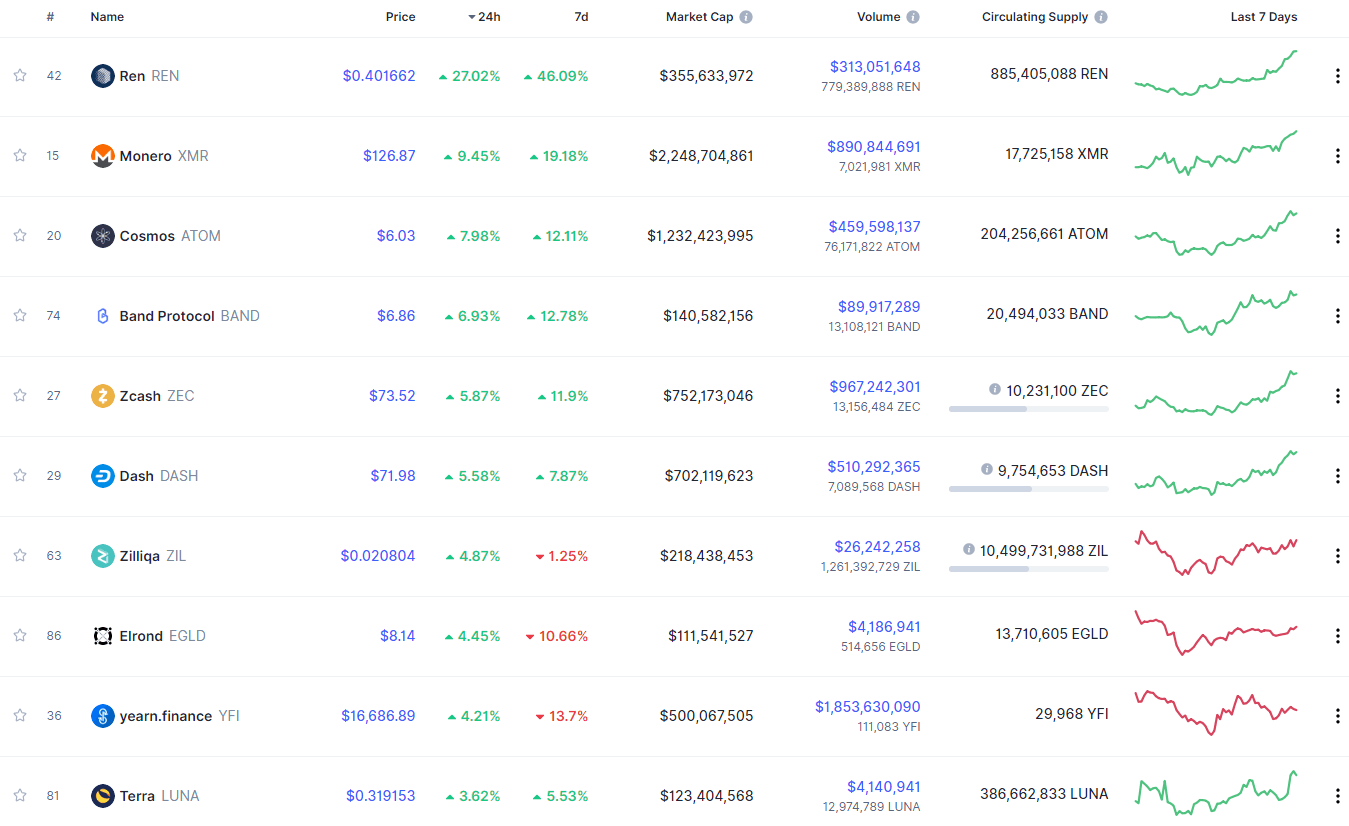

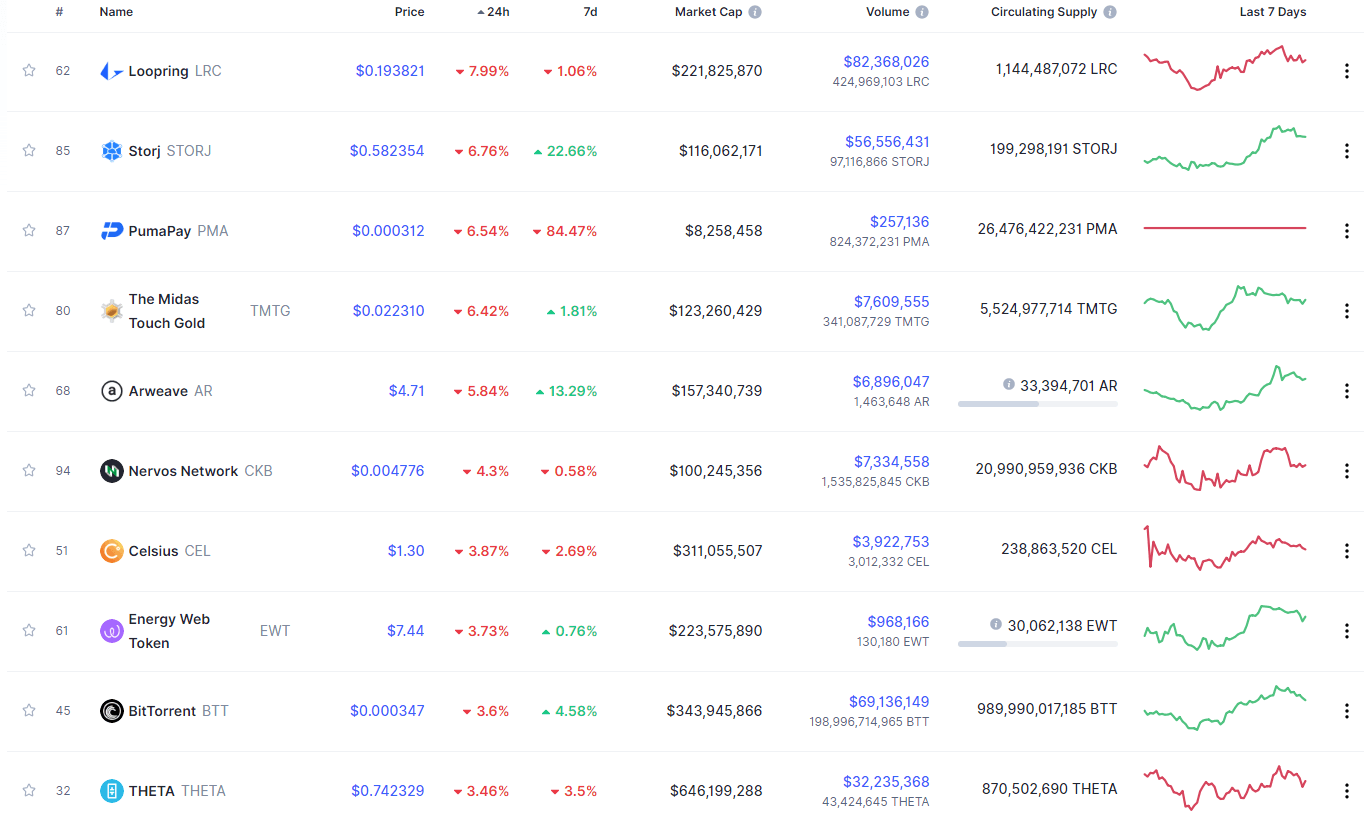

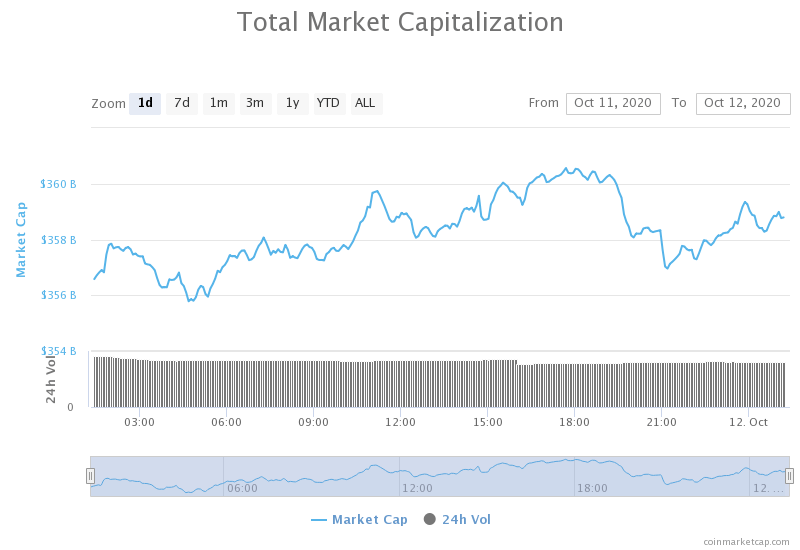

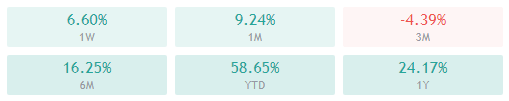

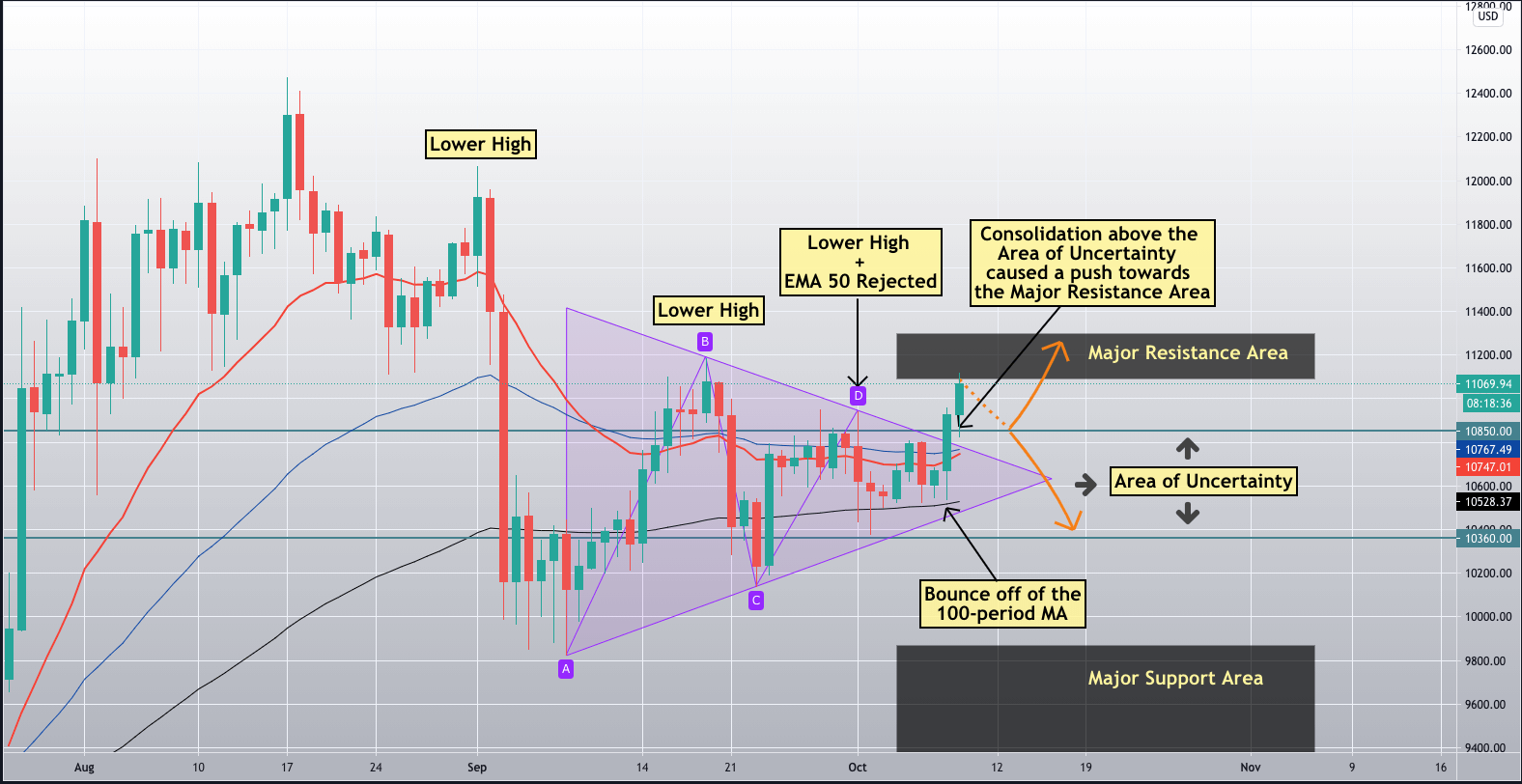

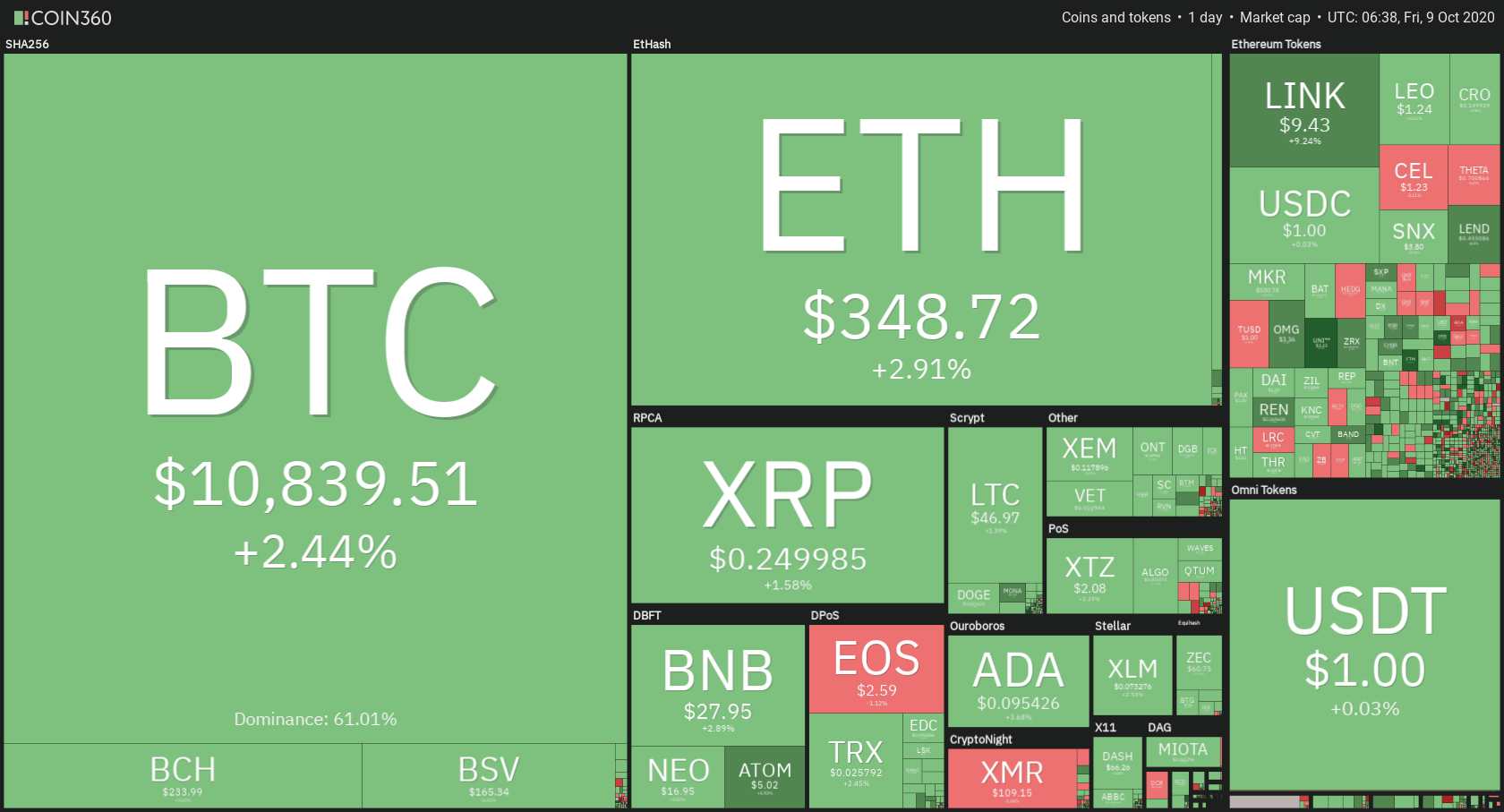

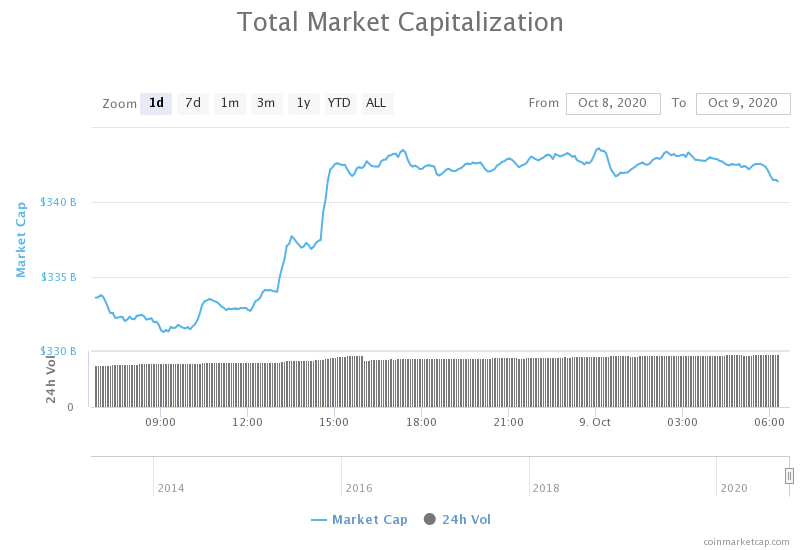

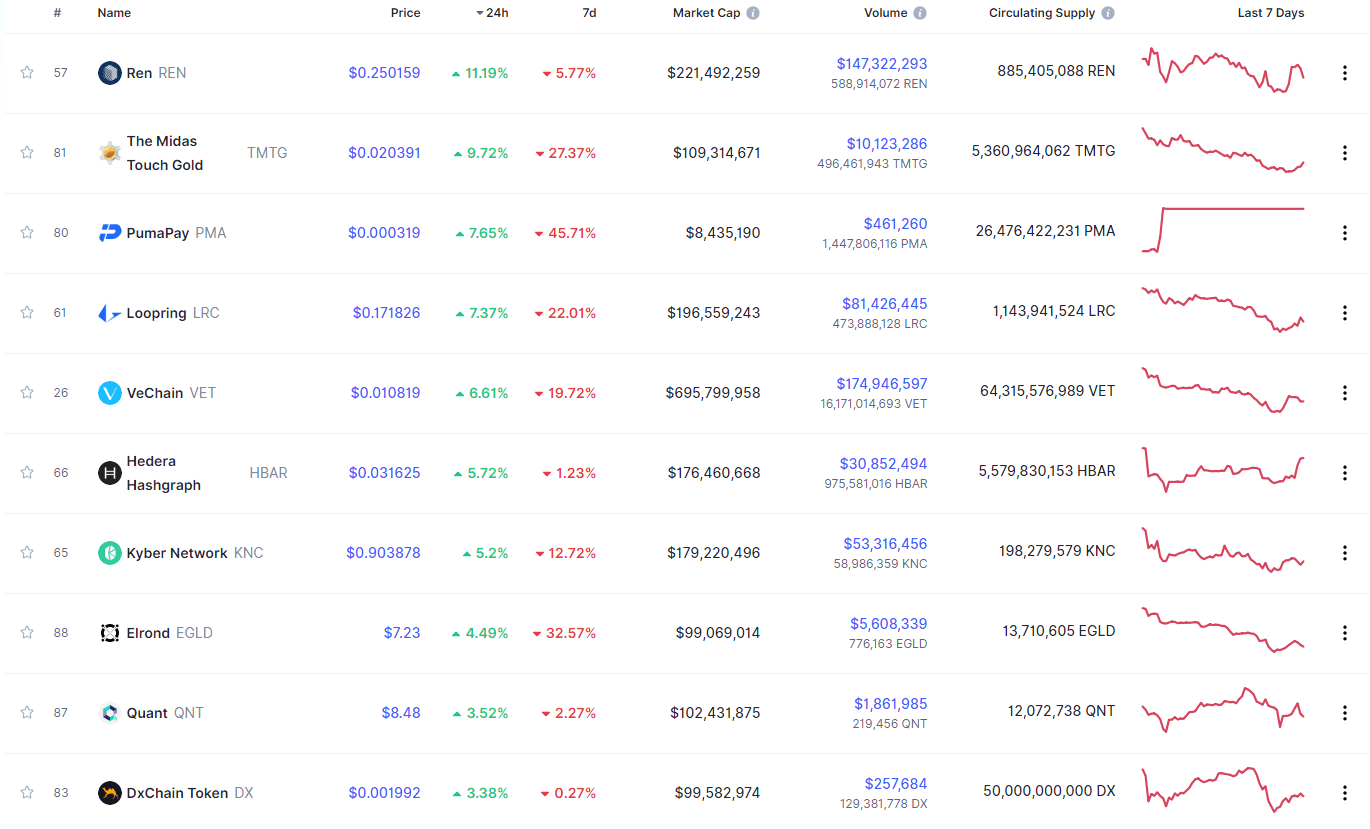

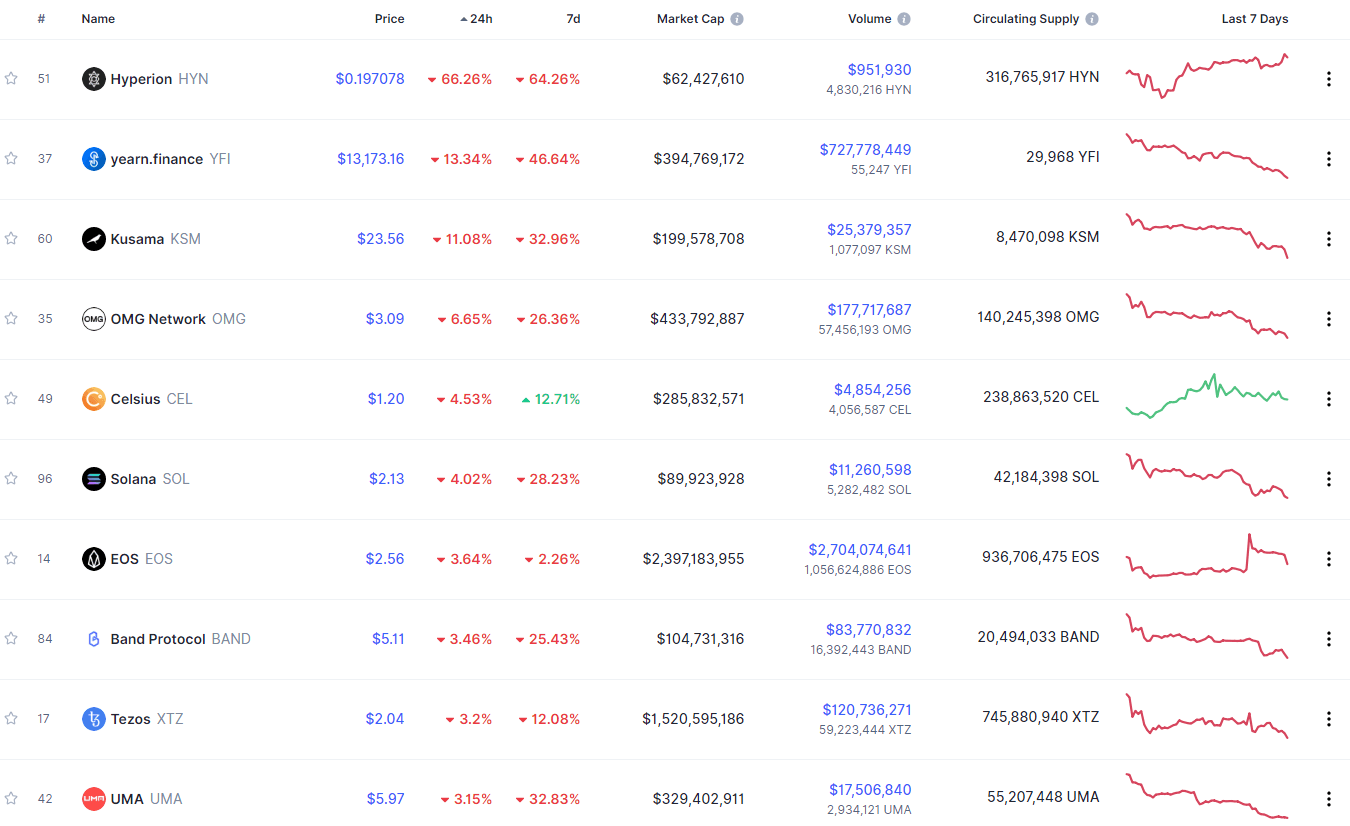

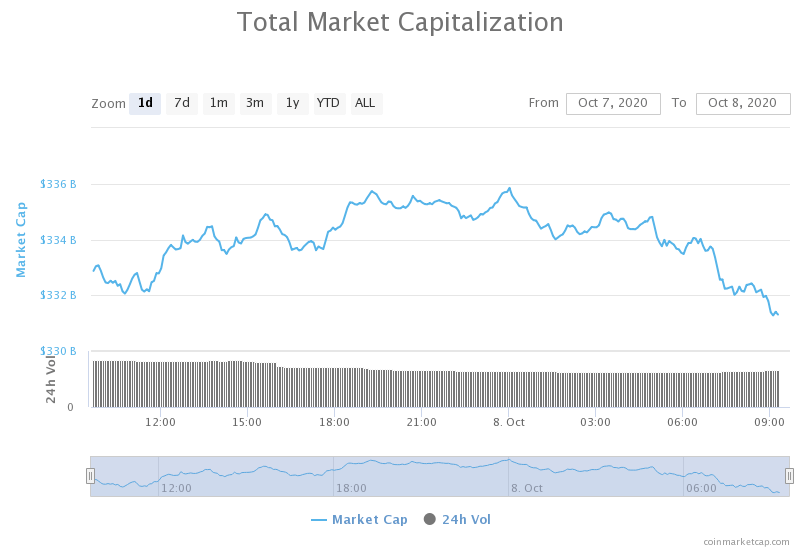

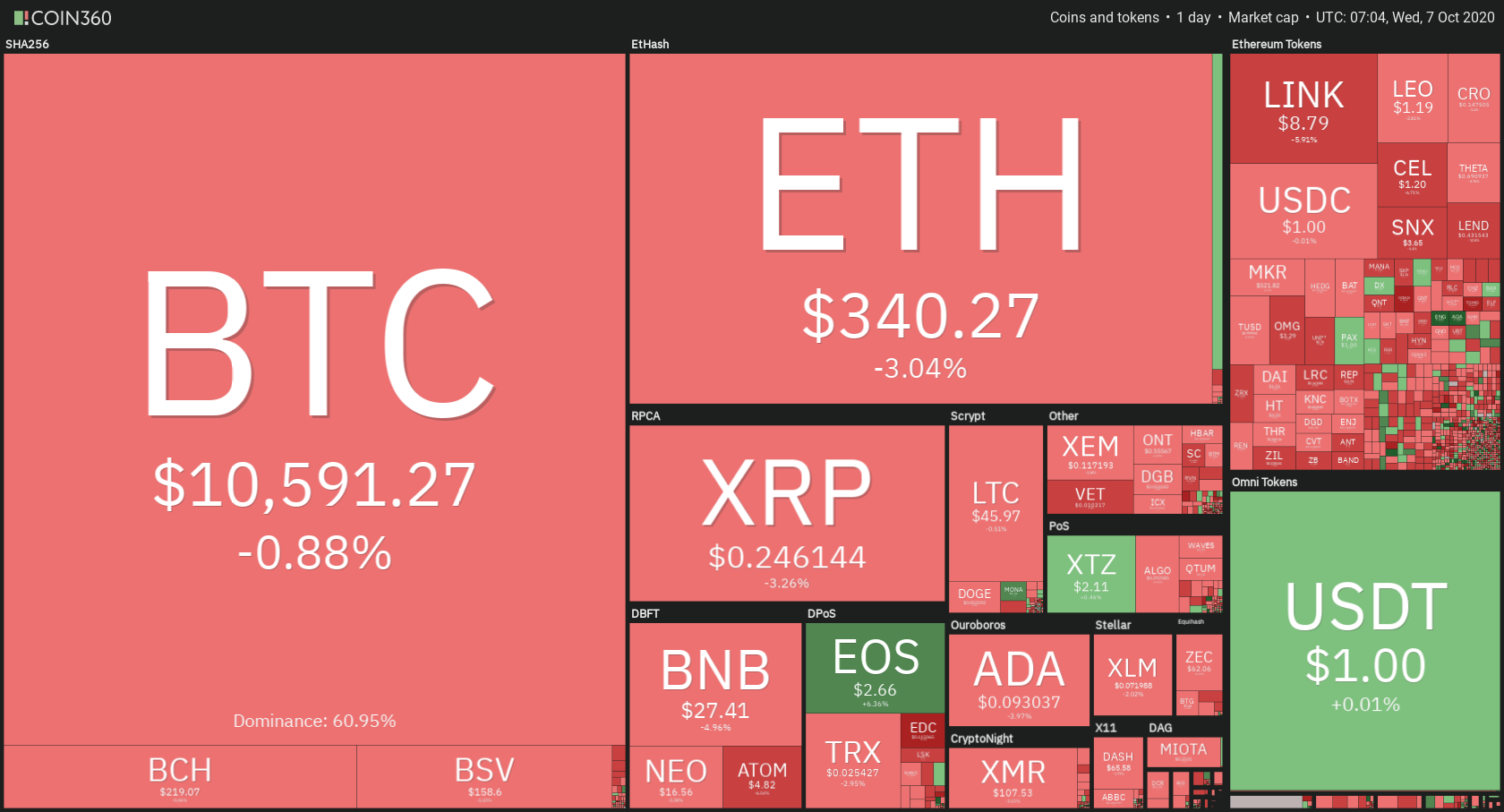

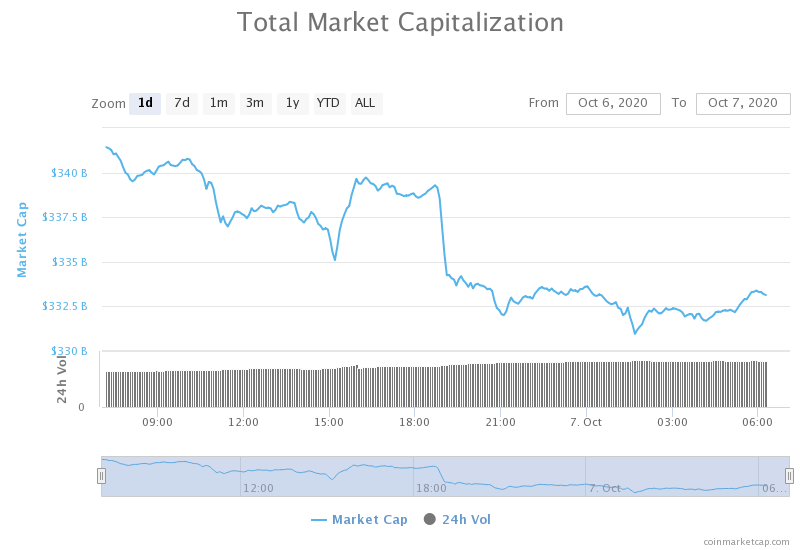

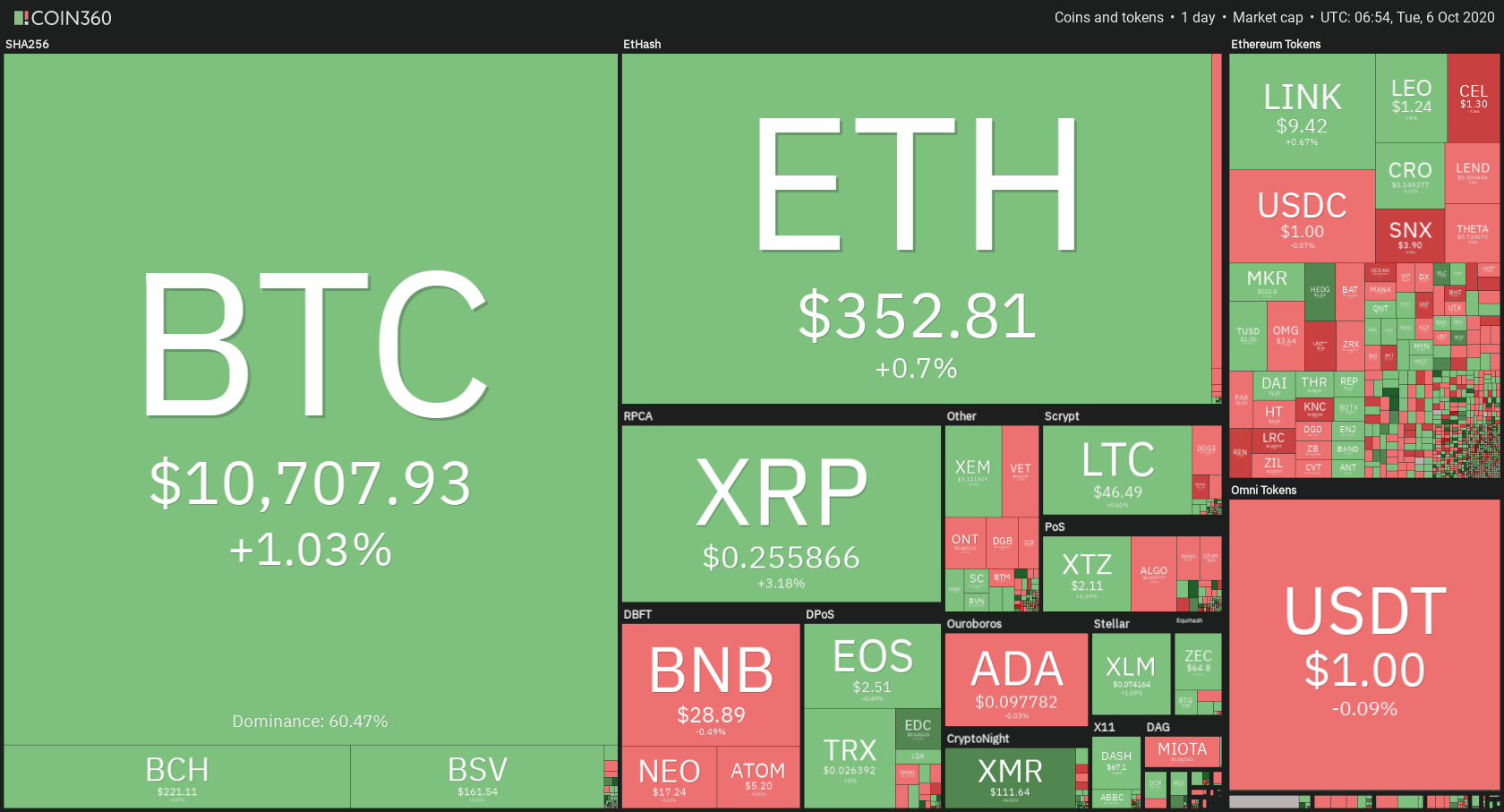

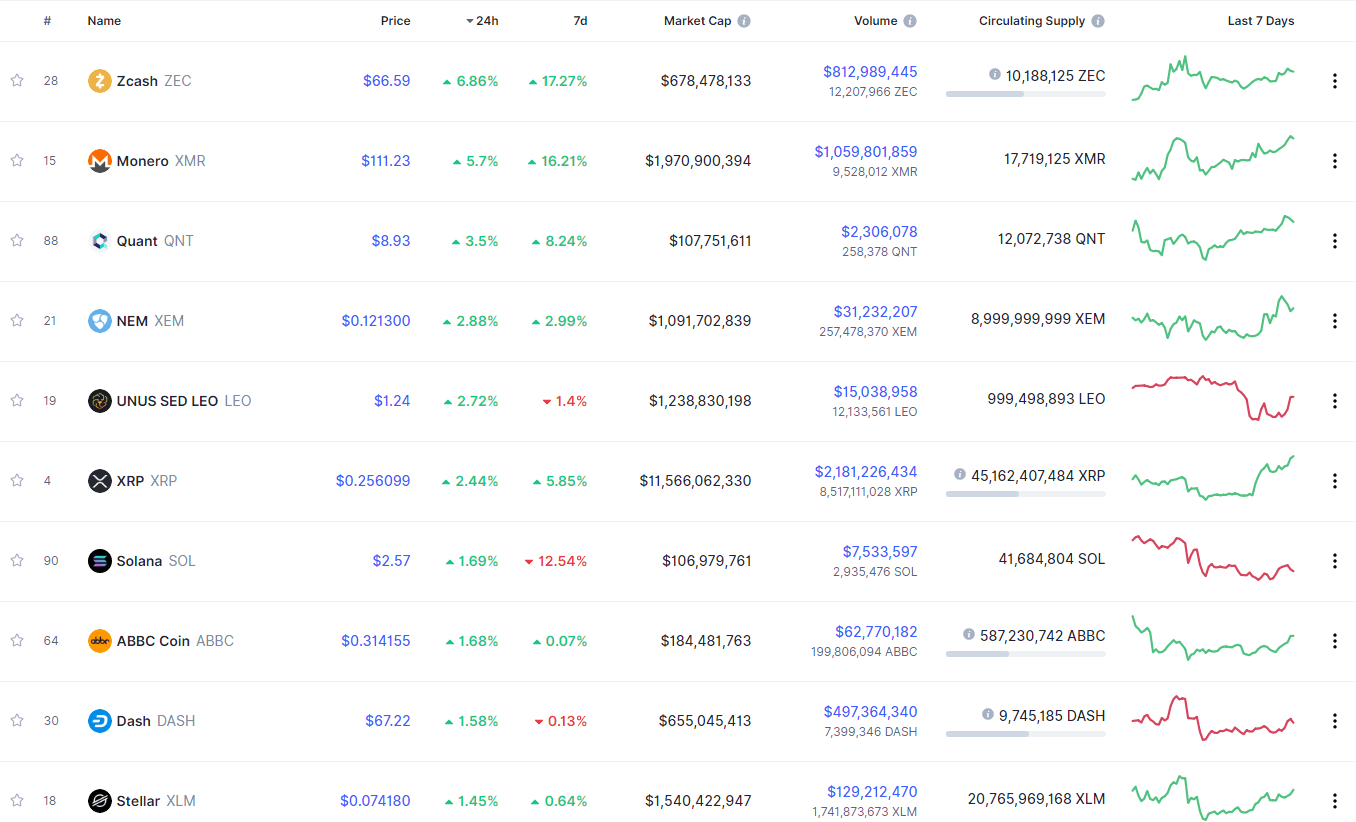

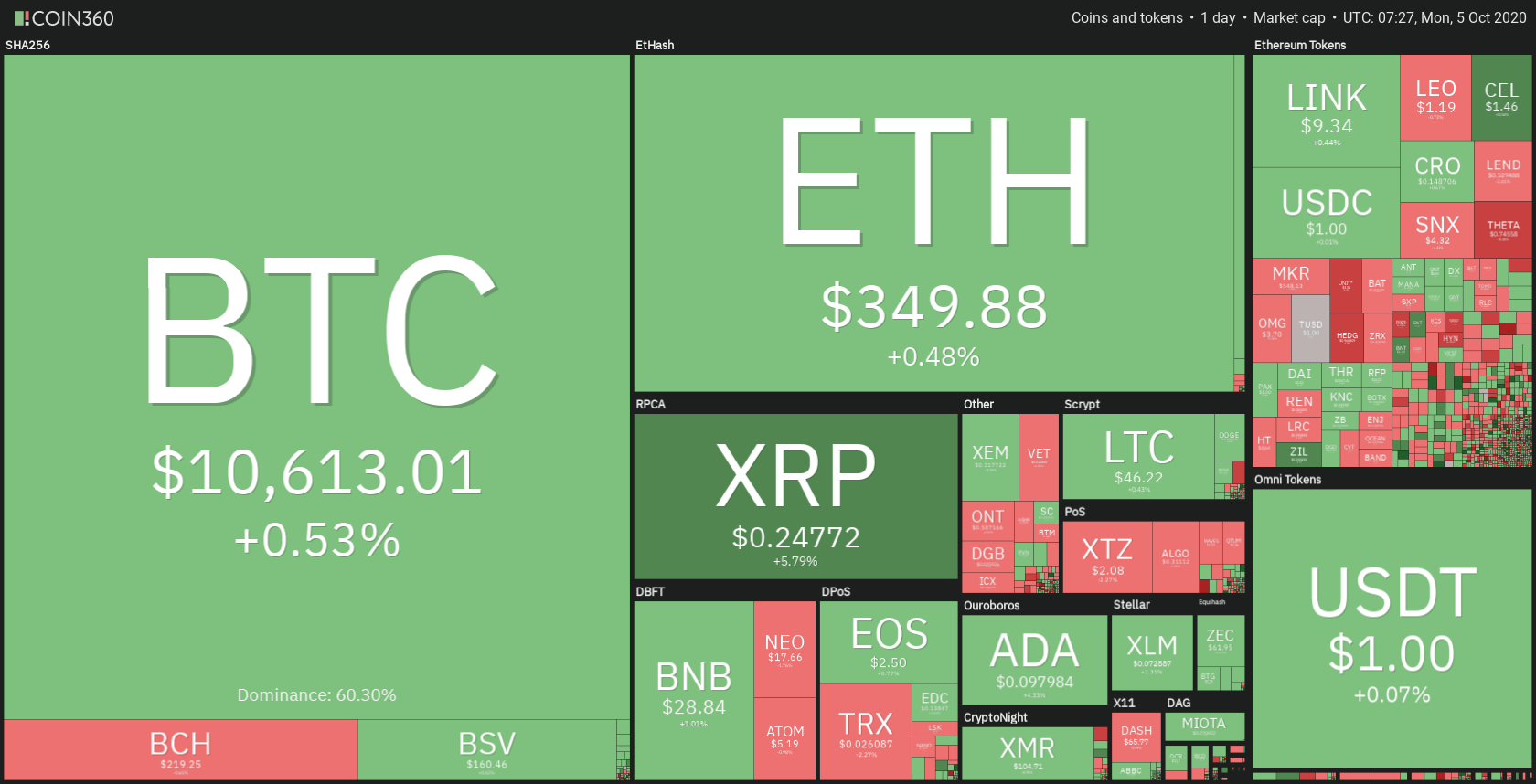

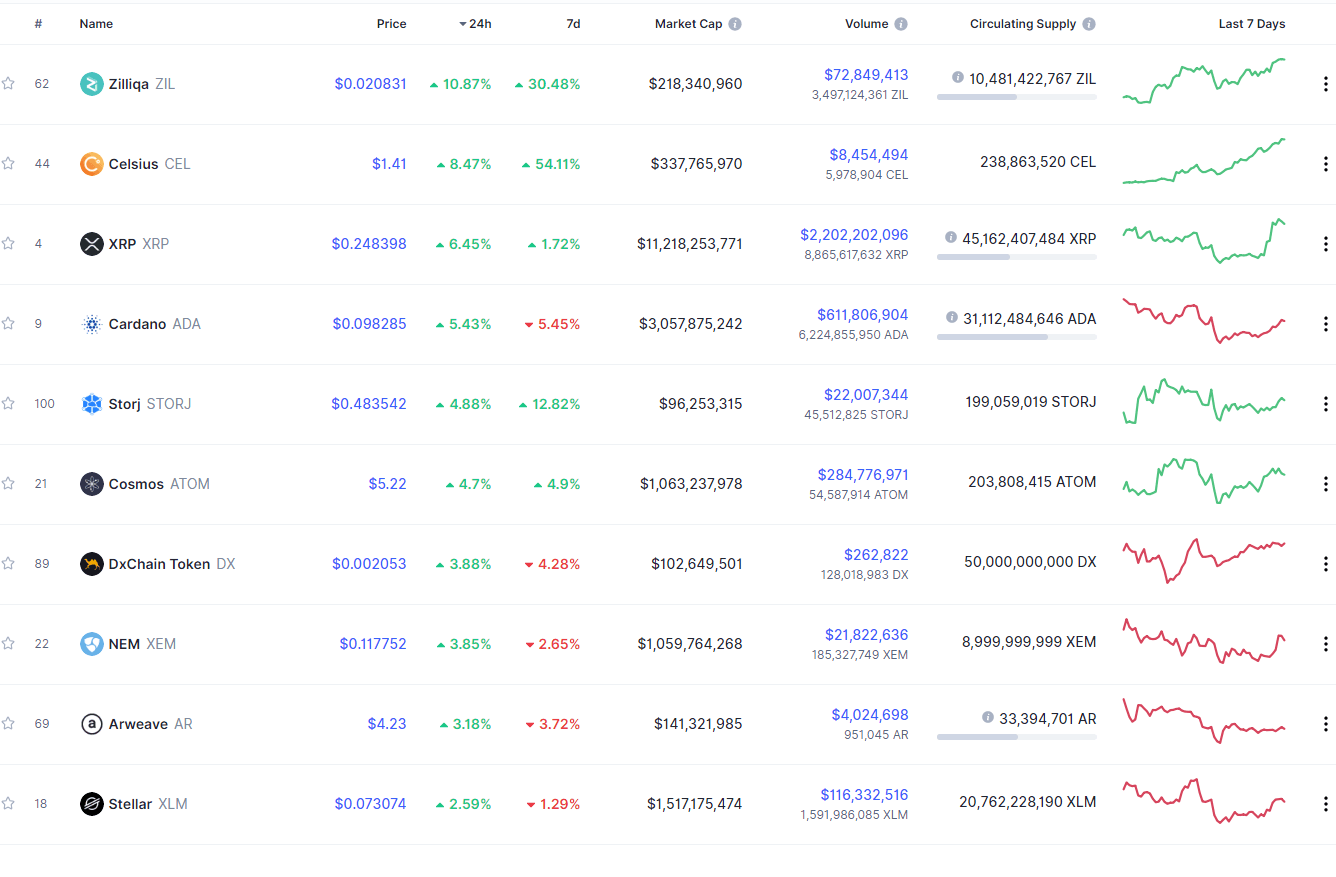

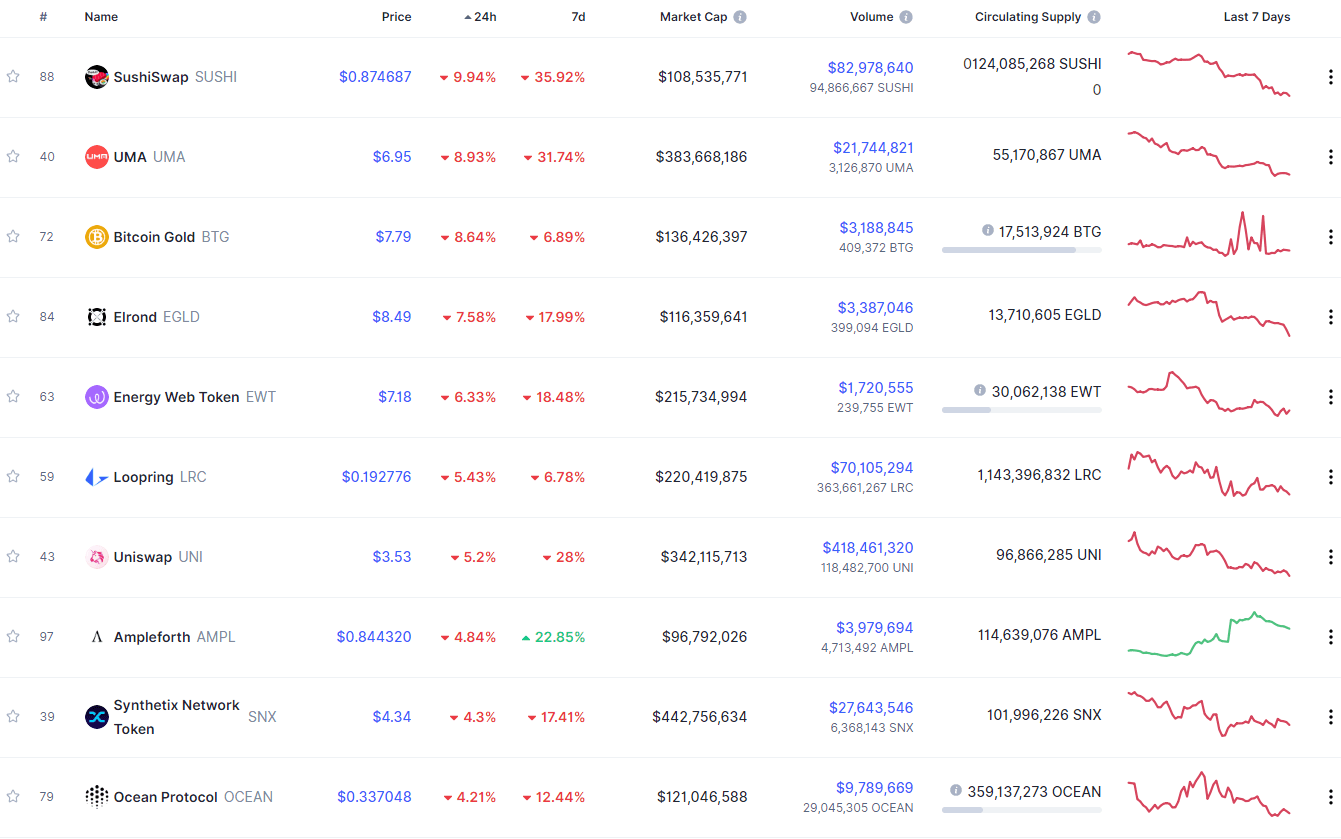

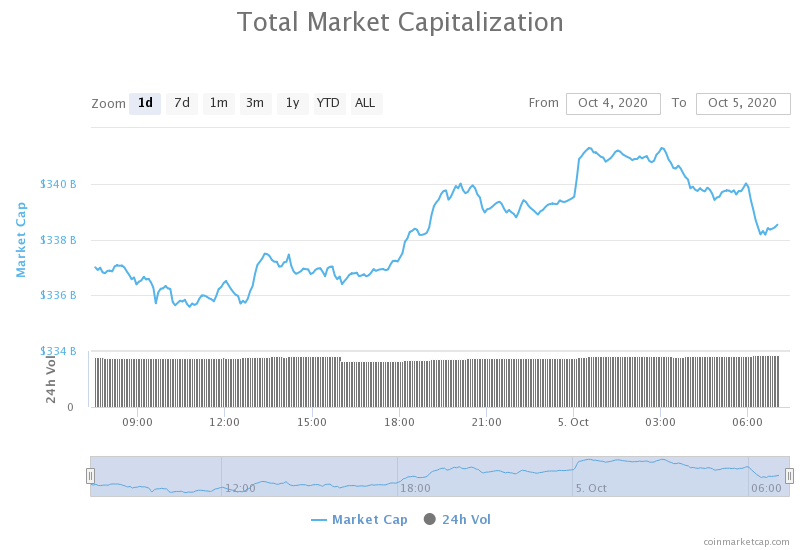

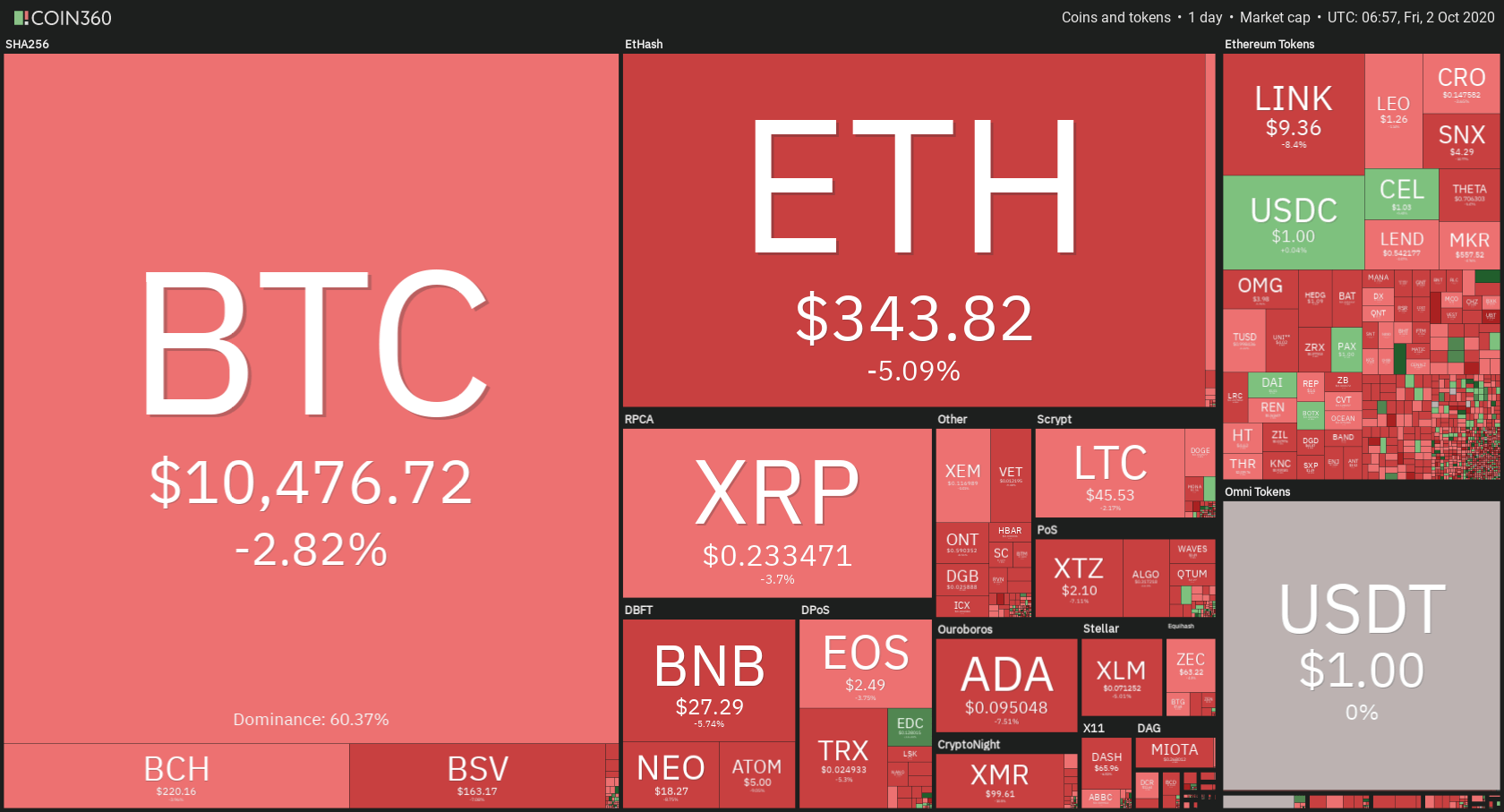

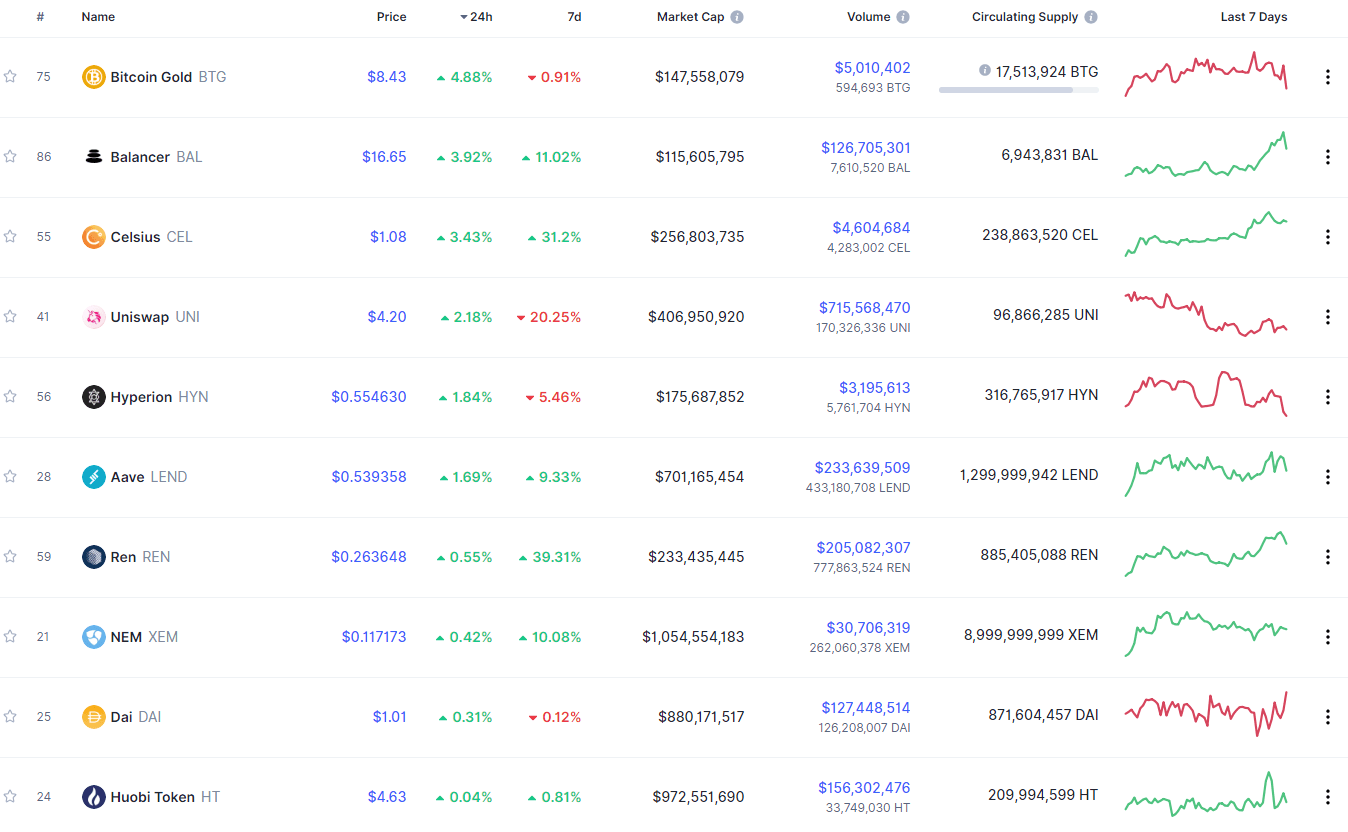

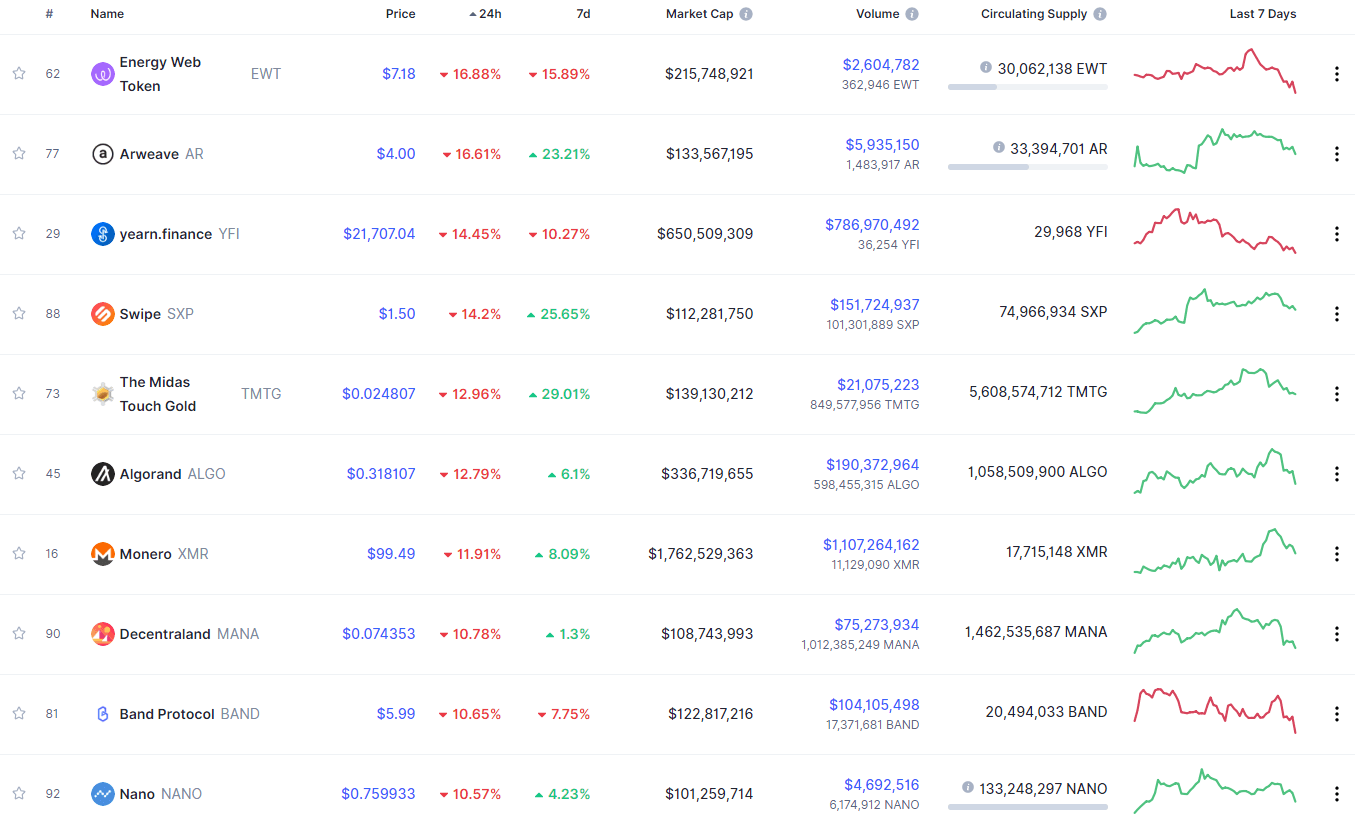

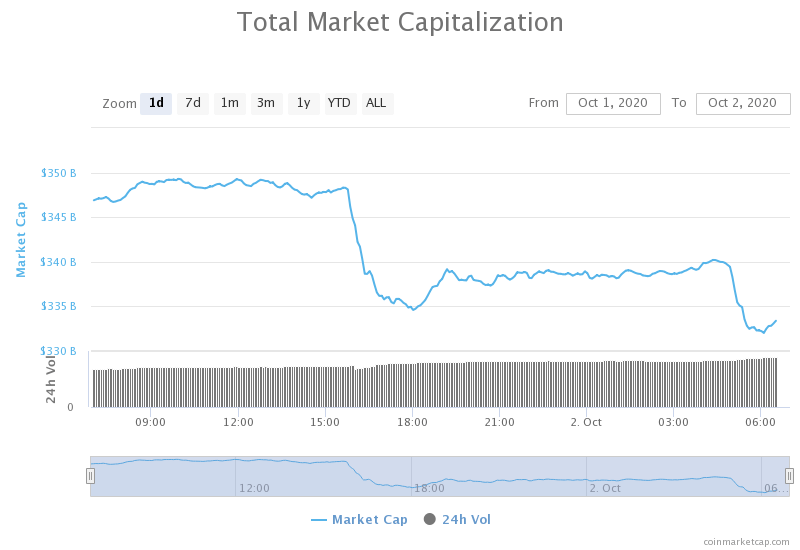

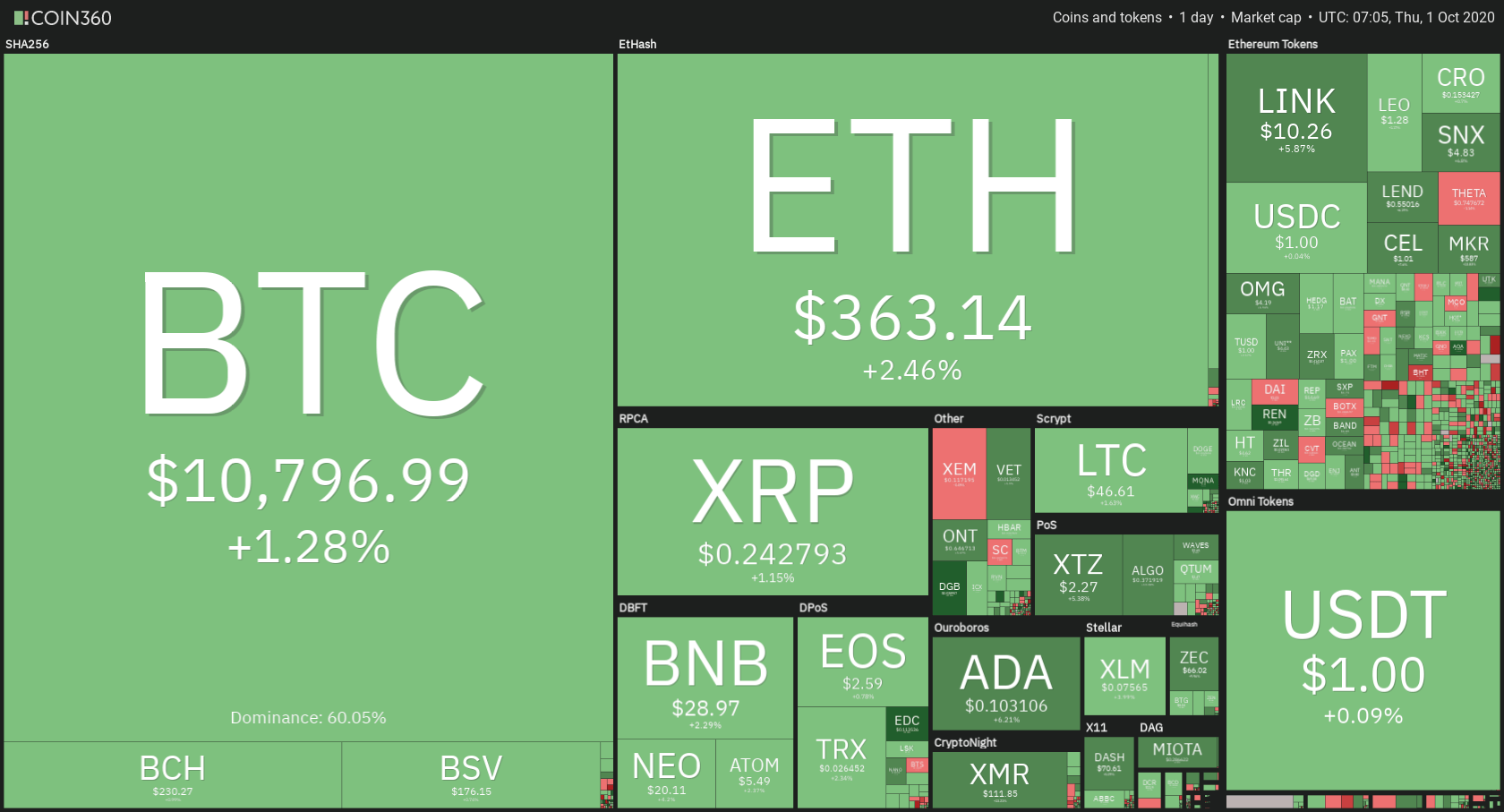

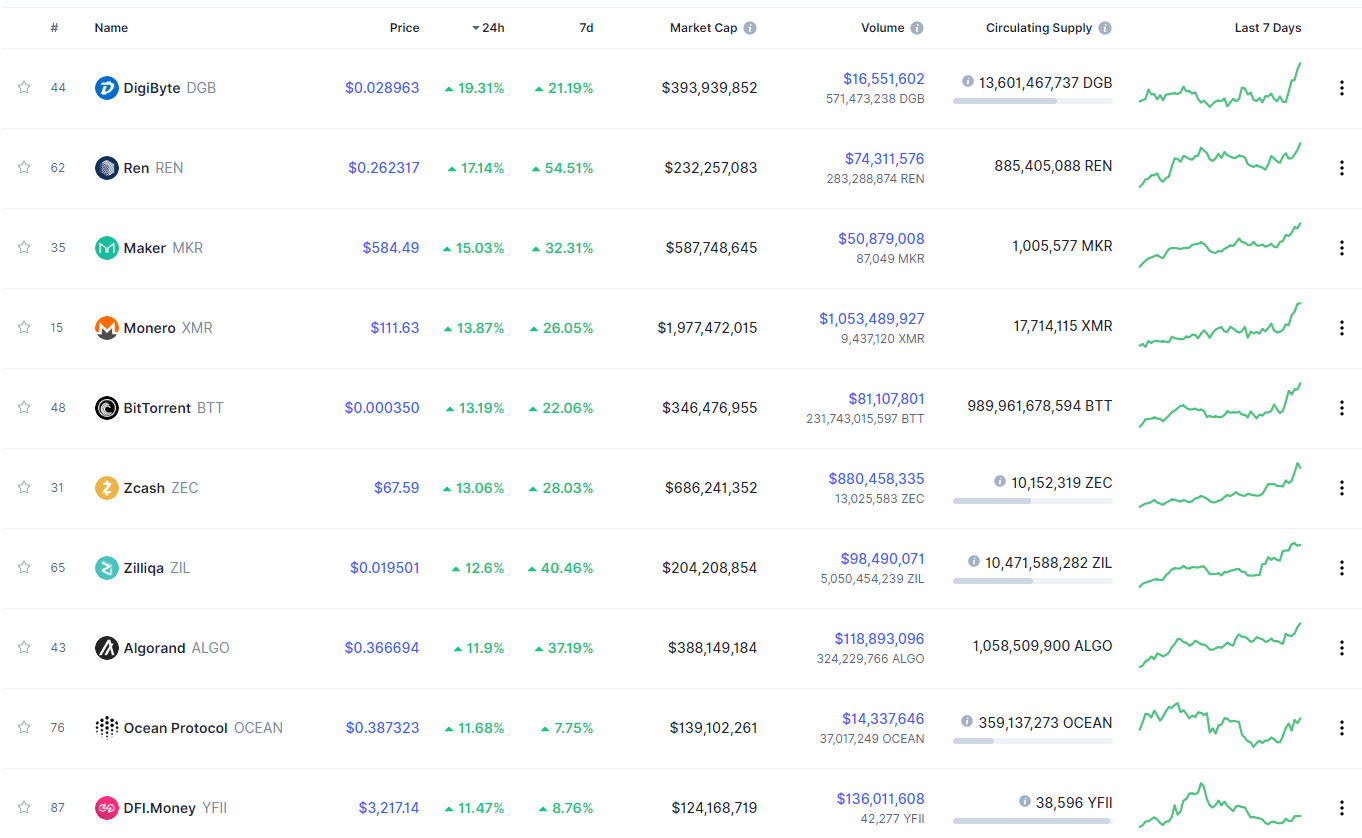

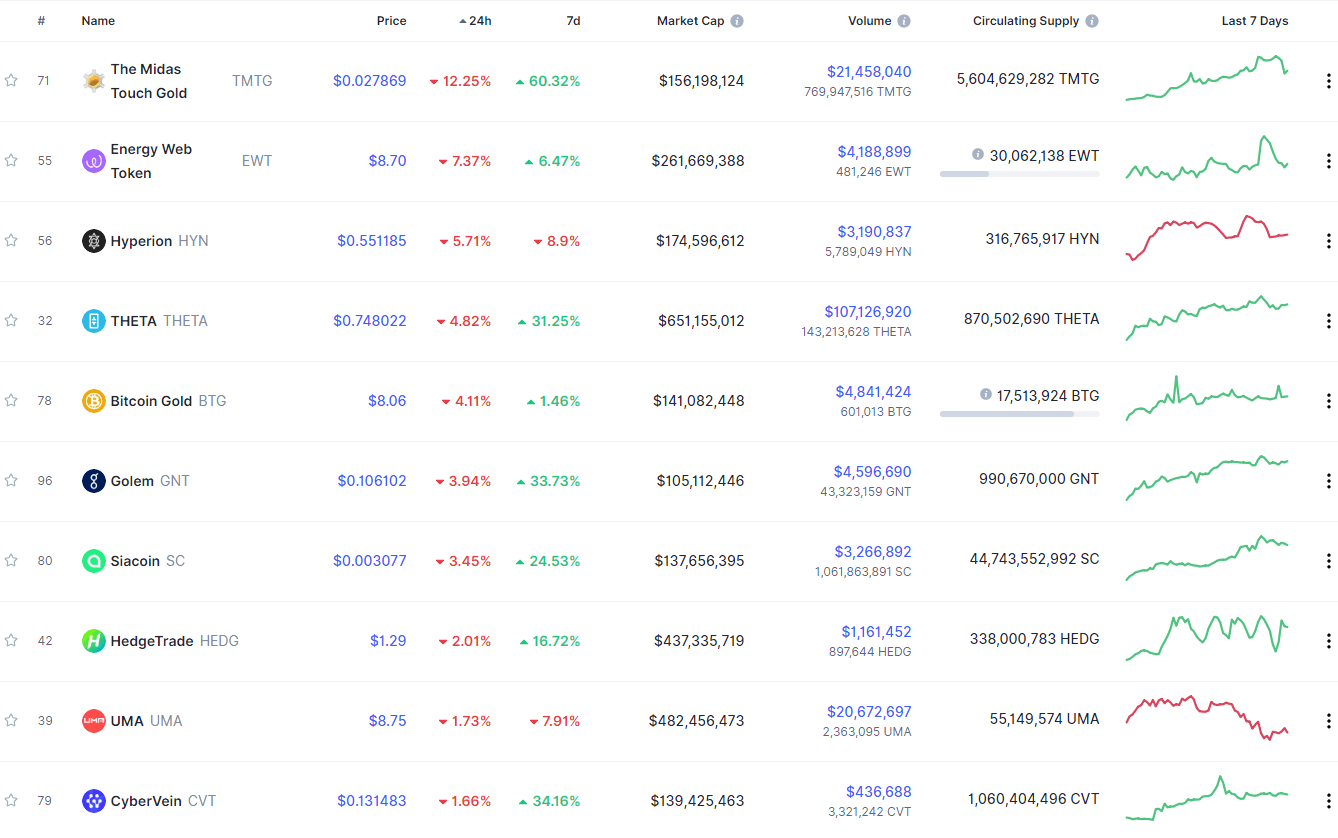

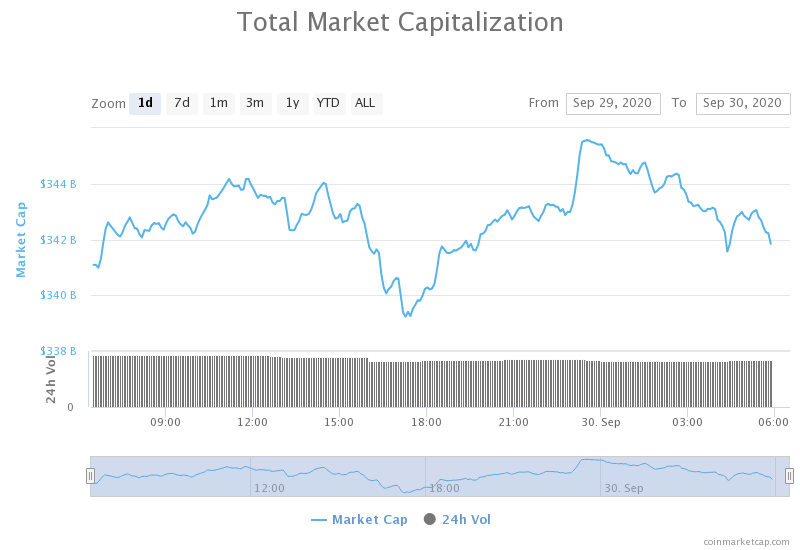

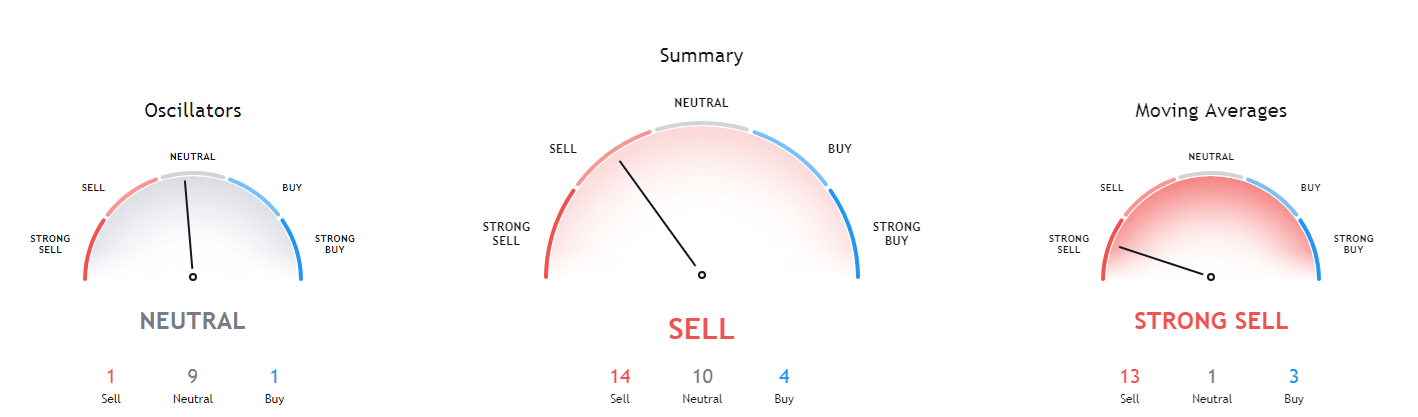

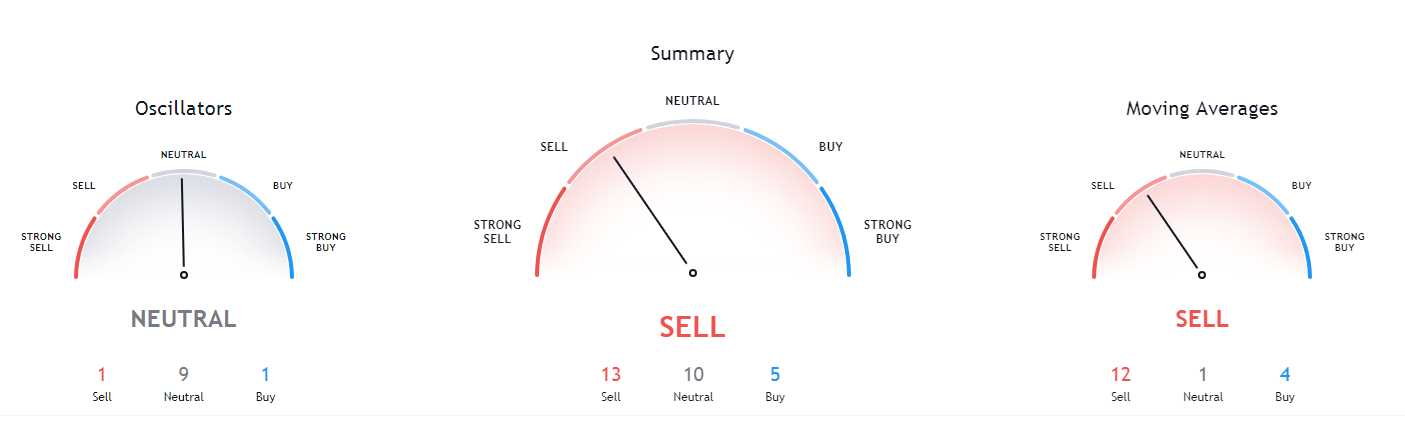

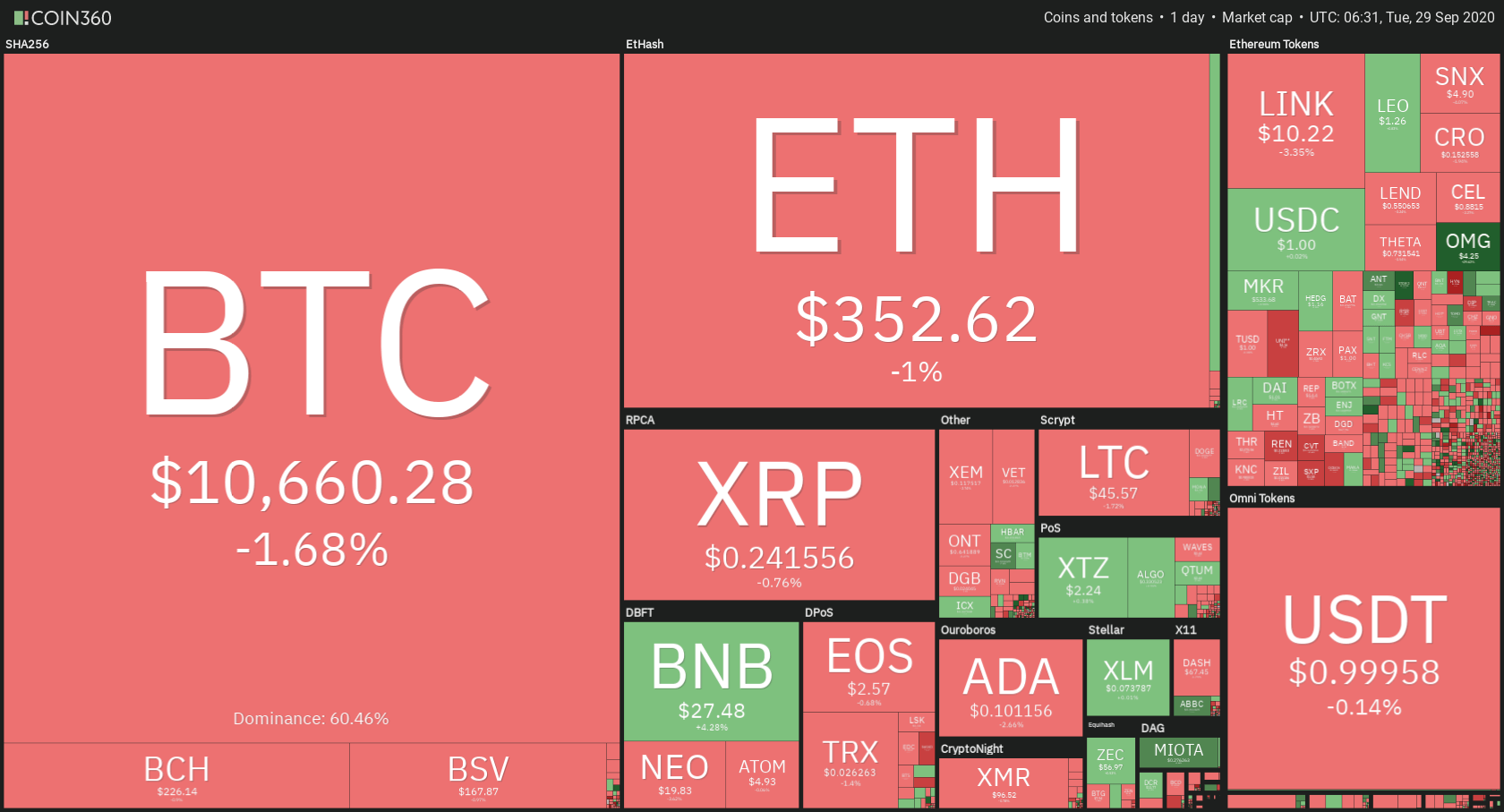

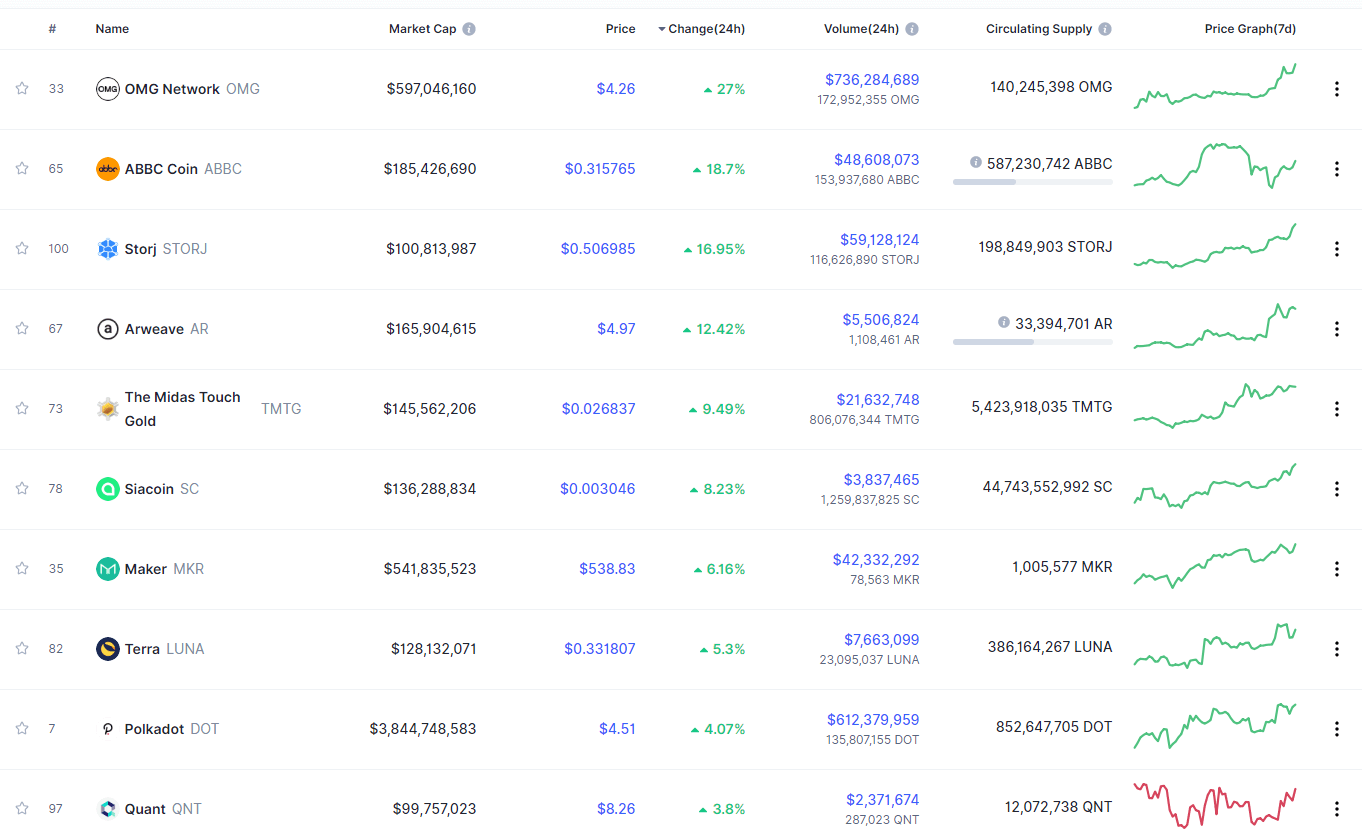

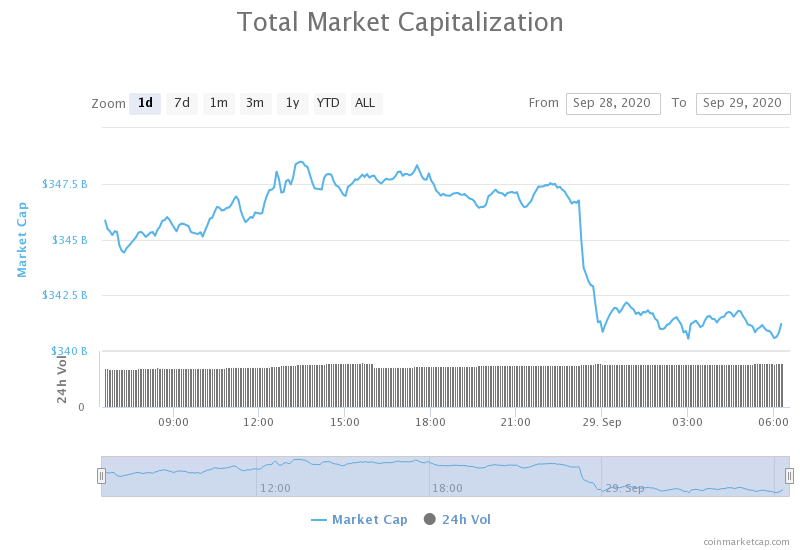

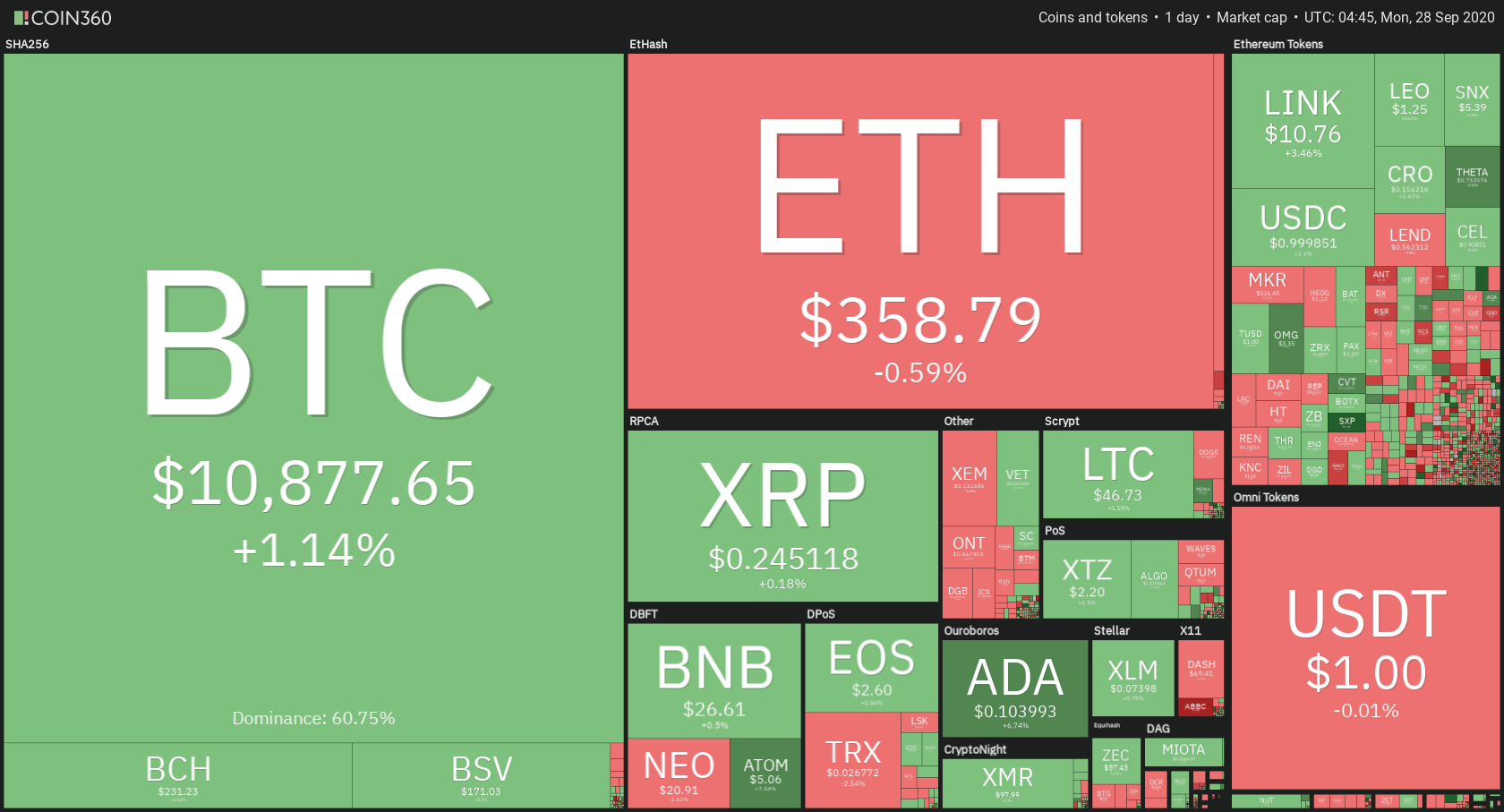

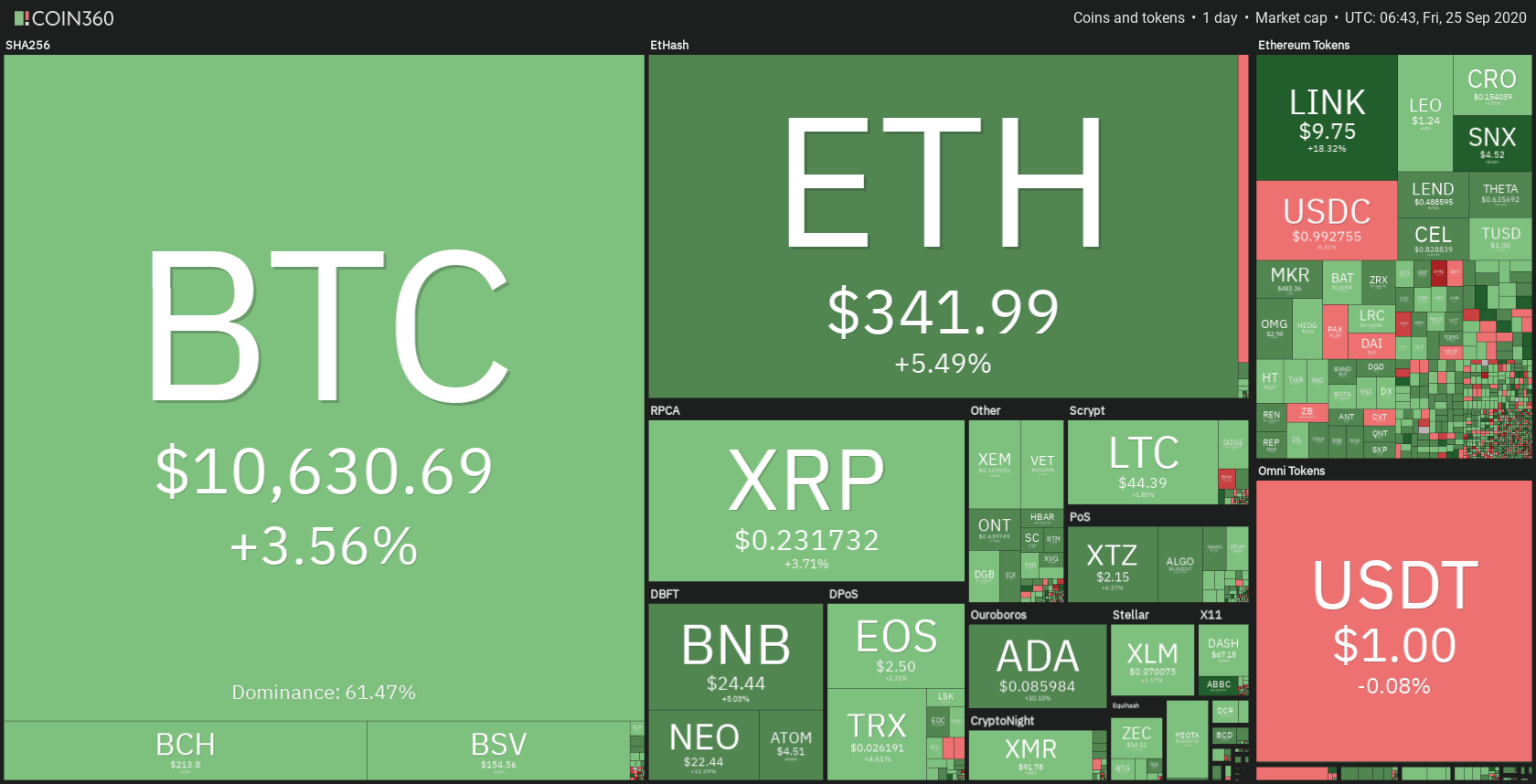

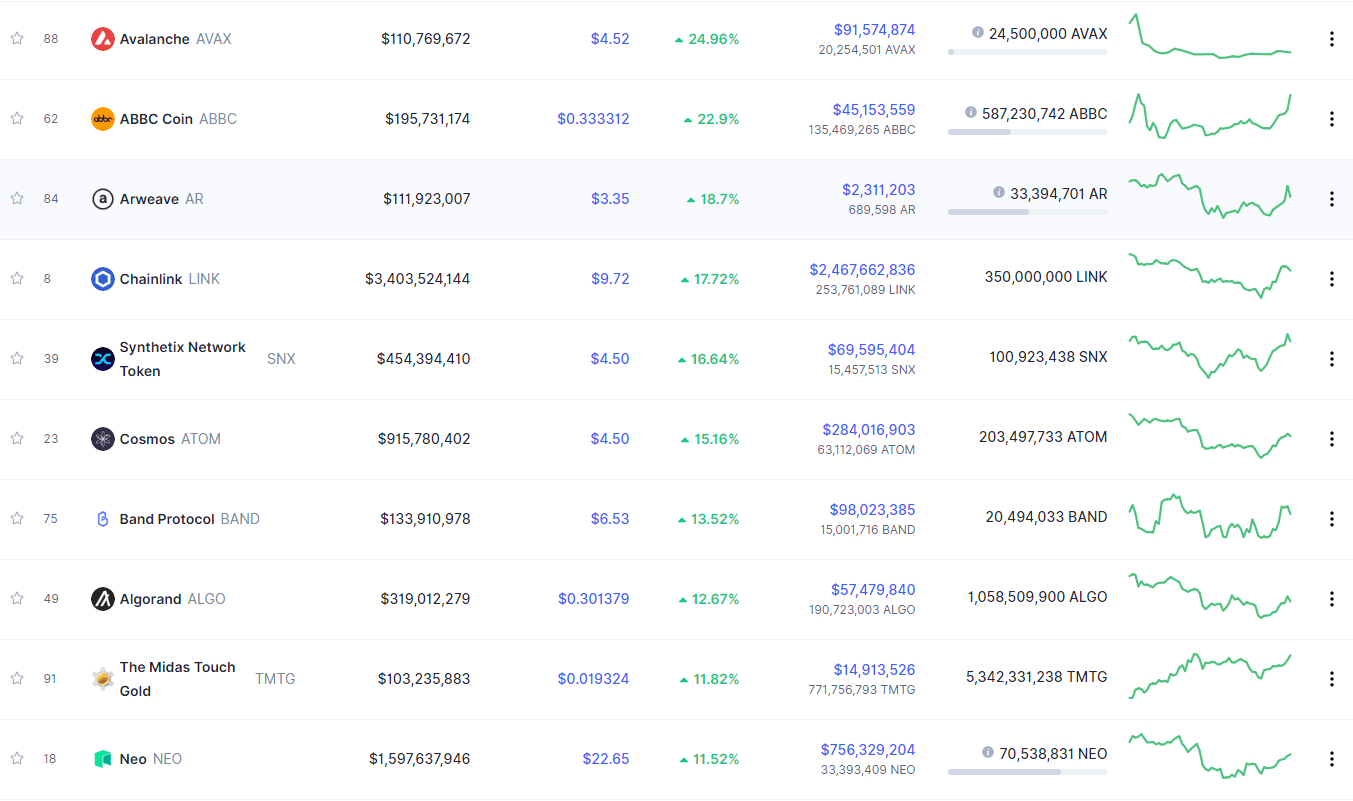

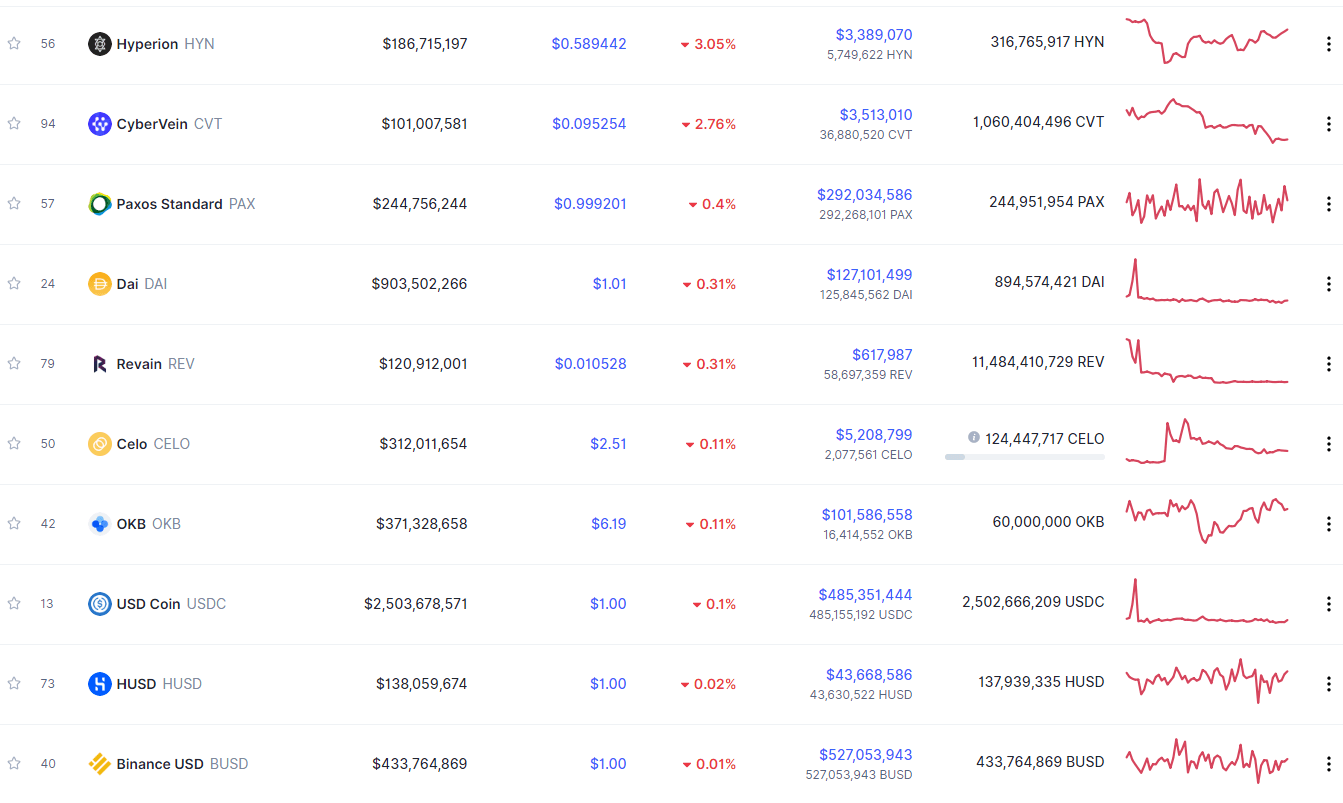

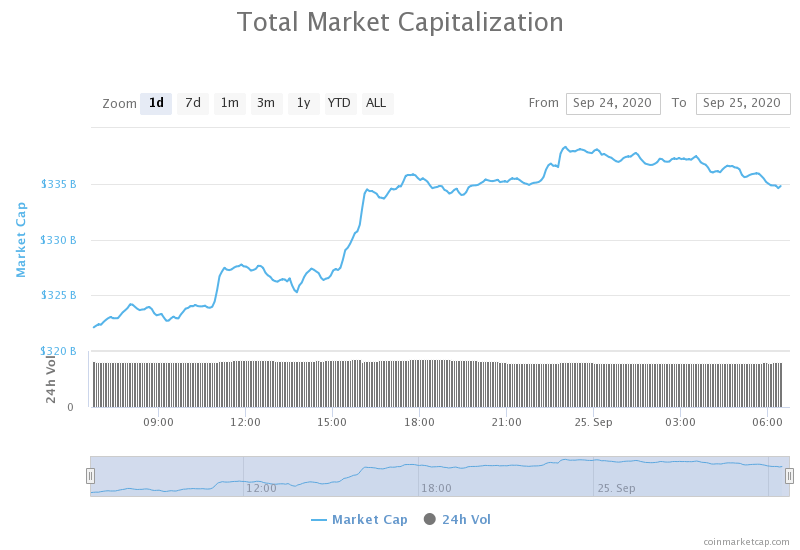

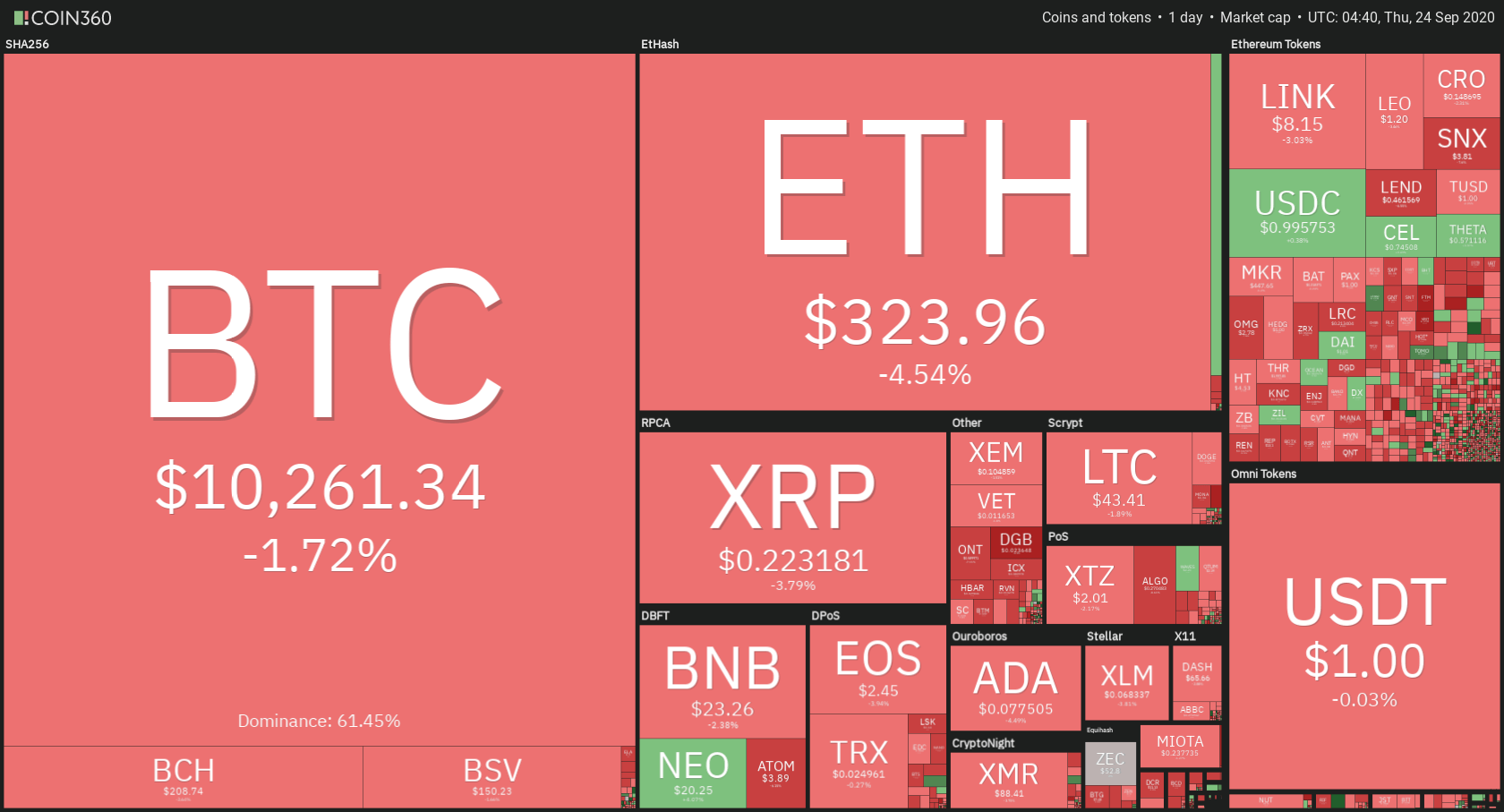

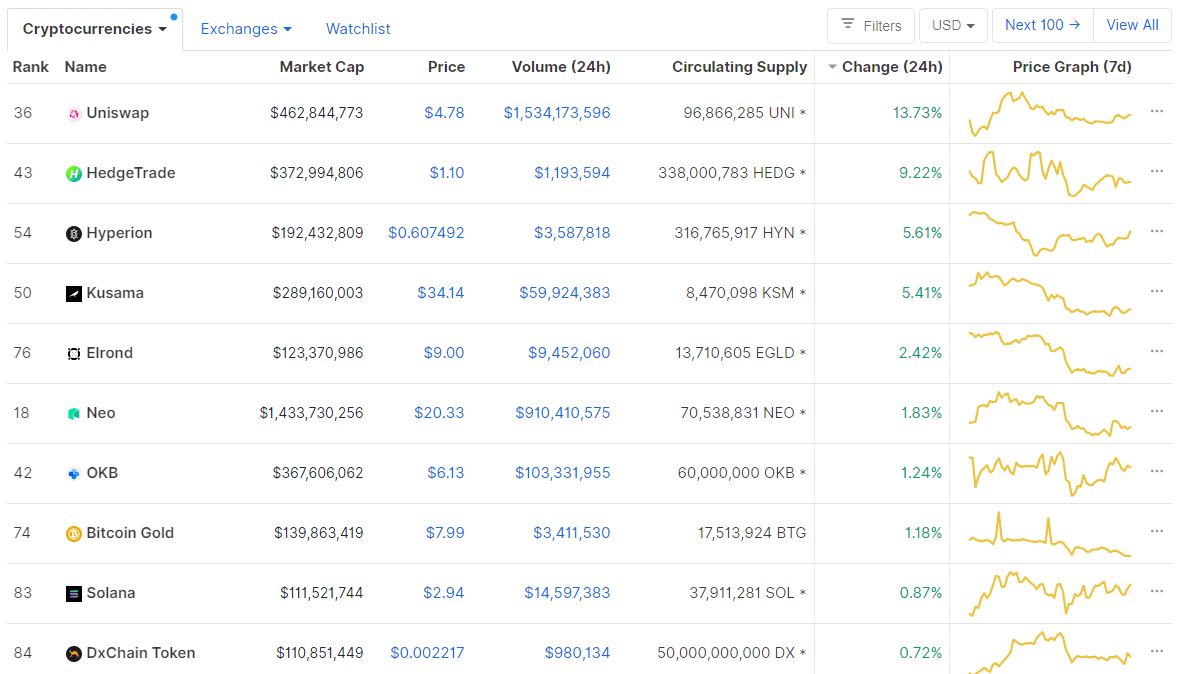

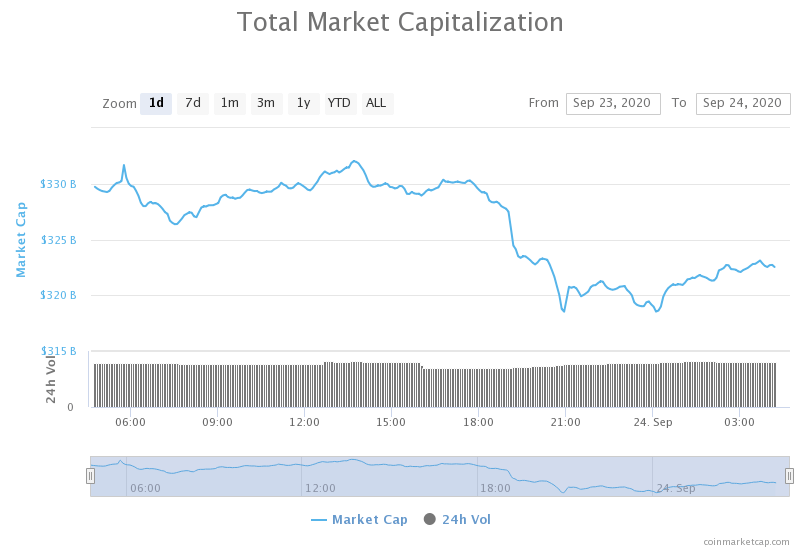

Crypto-assets have always been (and have been) advertised to us as high-risk assets. And not only because of their unreliability as an investment value and because of the bubble we have warned them about so many times, but also because of their high volatility in the markets. That volatility means only one thing in the gambler’s glands: more hormones in the bloodstream with every operation, with every look at quotes, minute after minute, hour after hour.

To the volatility, we must add other dangerous companions of travel (or investment). They are liquidity (also called Immediacy) and ubiquity (also known as compulsiveness). These two friends make the temptation not live upstairs, but live on the smartphone that we all carry around 24 hours a day. Once the pathology is developed, whether diagnosed or not, it is difficult to escape it.

And the two most important factors go through believing what you want to believe, not what you are.

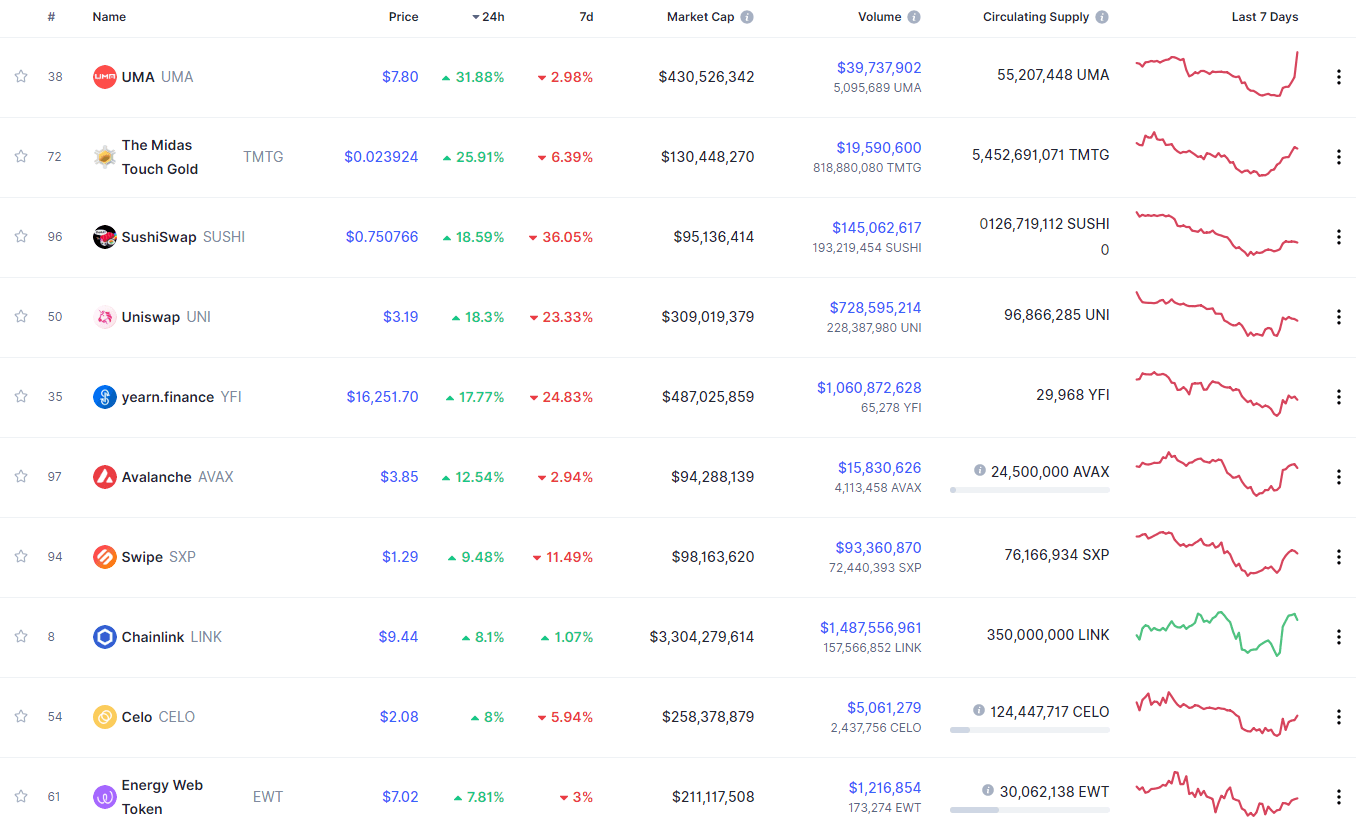

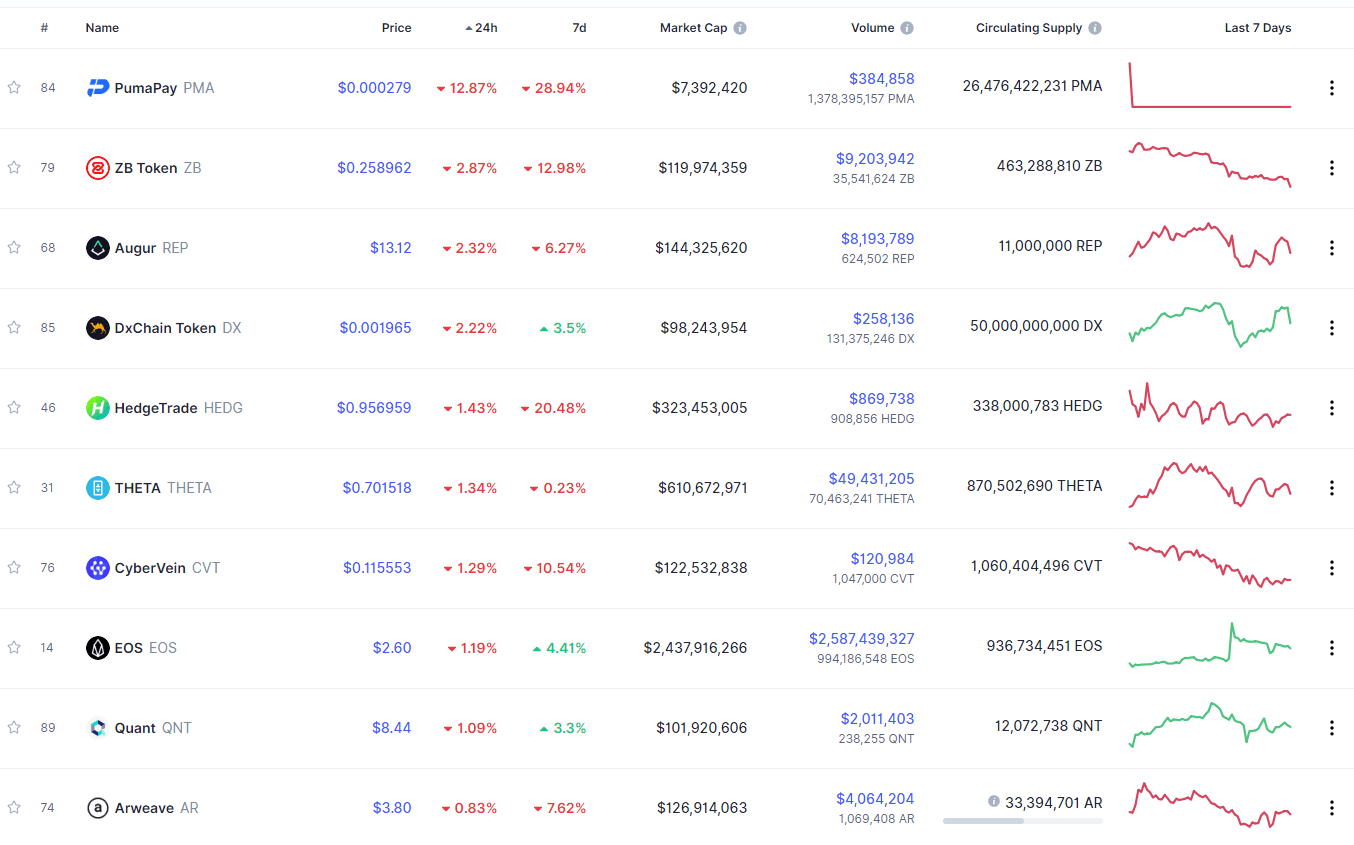

Crypto-assets have a remarkable feature in terms of addiction. Often the gambler deceives himself with philosophies or pilgrim ideas, which basically only seek to reinforce him in his incessant search for hormones (and profits). The whole philosophy surrounding crypto-economics can be a perfect disguise to be used as an excuse to convince oneself that one is not risking one’s life savings, but is investing in the future that only a few know how to see. Thus the patient can easily exonerate himself and continue to be plunged into blindness, reinforced by the fact that others have already made crypto-coins immensely rich in the past.

And one last ingredient for this poisonous potion, to which many are nevertheless immune, is the natural technical opacity inherent in crypto-economics and the halo of exciting and (something) mysterious future that surrounds it, at least as far as the general public is concerned. The reality of “Main Street” is that most crypto-asset investors do not have enough training to understand them 100% (or 50%).

With the latter, the sentence is handed down, and those likely to fall victim to this type of gambling addiction find it much easier to hide irrational passions and impulses behind crypto-tickers than after other assets. They don’t understand in detail what’s behind these token names, but in their minds, they shine like decisions of the future in the darkness that to their understanding surrounds everyone who has not seen the light of the crypto-coins.

The (relatively few) pathologically affected will not want to see it, but the therapies are there.

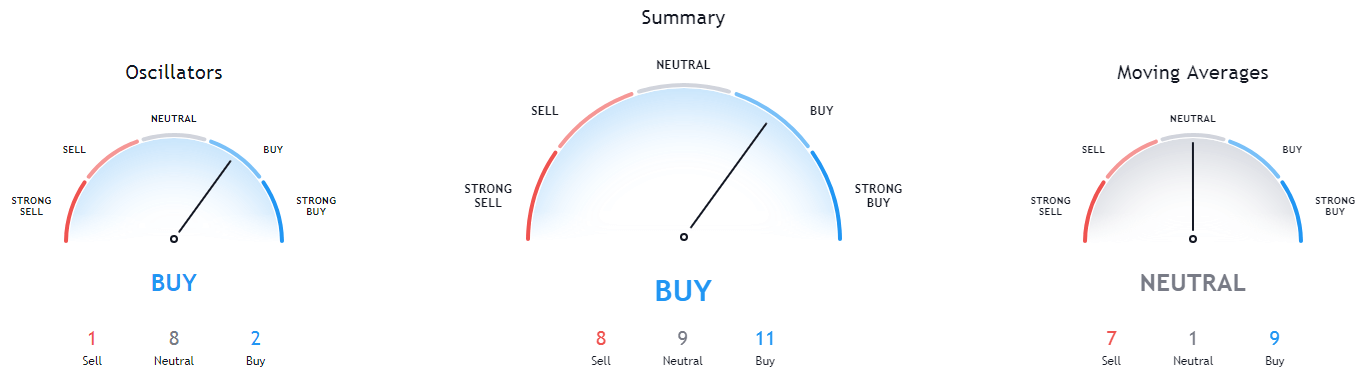

The best proof that crypto-addiction is more a reality than a theory (of course nuanced than only in certain cases), is that hospitals specializing in the treatment of gambling addiction have launched specific programs for the case of addicts to trading with crypto-assets.

This is the case of the Castle Craig Hospital in Scotland, where they say that this addiction can either be framed within a general addiction to gambling of any kind or be a dangerous obsession with its own entity. In this center, they treat both facets of the addictive pathology. Various specialists have already described how crypto-active trading is a veritable neurological roller coaster, which carries with it dangers such as developing a dangerous addiction (or ruined, don’t forget).

The new treatment of Castle Craig Hospital only represents the response of the center to the significant increase in the specific demand for crypto-trading, which were observed by numerous addicted patients. However, the same sources say that it is relatively rare to encounter pathologies focused exclusively on trading with Bitcoin or other cryptocurrencies because the underlying problem is usually a more general gambling addiction.

In any case, they also state that the data points to the fact that crypto-trading’s exclusive pathologies have been showing a clear upward trend for months. And they also remark that, although they treat it as a type of gambling addiction, the reality is that it is a particularly addictive and aggressive modality.

The reasons why they understand this to be the case are in line with what we told them before: this type of gambling addiction is available to those affected 24 hours a day, it is continuous, permanent. And this impossibility of disconnection is precisely what most “hooks” (and likes) gamblers in general. In the end, for the patient, it is no longer even a matter of winning or losing, but of repeating again and again and thus getting the hormonal response of the emotion that invades them after each crypto-trading operation. What investor has not experienced this emotion to a greater or lesser extent on more than one occasion? Well, you know what we talked about in this article.

A potential psychological profile that in some cases becomes pathological.

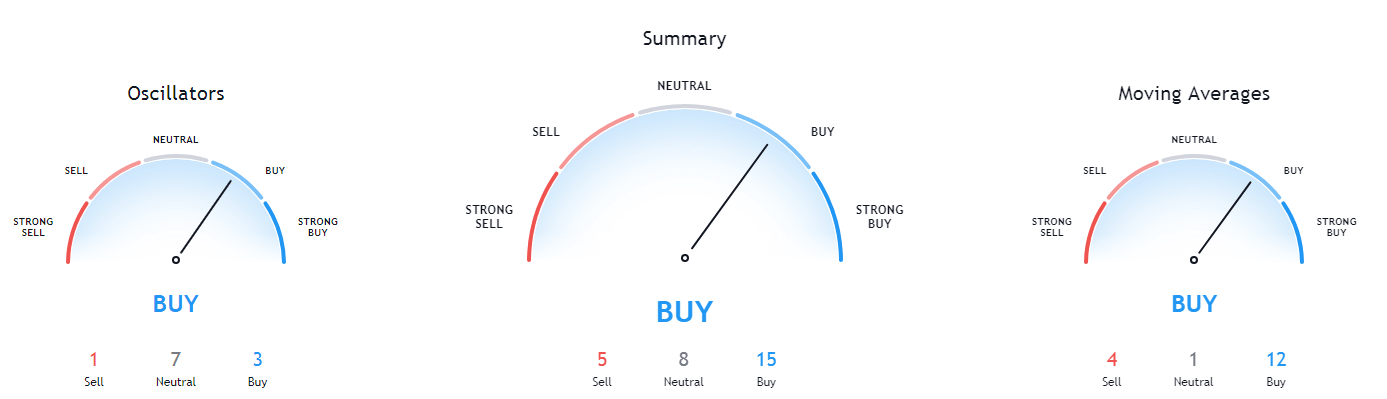

The reality is that many crypto-addicts are also “hooked” on trading with other traditional currencies other than crypto-currencies, but it is no less true that crypto-trading gives them an extra dose of adrenaline as it is a very volatile market with large fluctuations. From this specialized hospital, they point out that they believe that there are enough crypto-traders who have already developed a certain degree of addiction, but that, not only have they not become aware of it, but that being permanently and obsessively aware of the crypto-market seems normal to them.

What’s more, these traders are often convinced that they are especially smart to have entered this crypto-market and that they almost always believe they are doing very well. To this particular point in the previous Motherboard article, we would add from these lines that, in addition, crypto-addicts are characterized by reacting viscerally and very aggressively to everything that challenges their grand vision of the future, and do not listen to reasons or to the experience of the most veterans of the markets (dispute with that classic “this time is different”).

The best prevention is yourselves.

We cannot close this analysis without qualifying that what is written here is only intended to warn of a very common pathology in the markets, but significantly more dangerous in the case of crypto-assets. This does not mean that, in their theories of the future, these crypto-addicts may be quite right at certain points. In fact, from these lines, we have shown ourselves on more than one occasion as crypto-enthusiasts declared. The problem is not that. The most serious and difficult thing about this addiction is to realize when crypto-economics is a theory or a way to disguise a gambling addiction.

From here we can no longer help them to distinguish between the one and the other. And in the initial stages of this addiction, only you and your ability to see reality and make self-criticism can help you before it’s too late and your savings have already volatilized.

Even on the assumption that the crypto-currency operation will give you a positive balance on your current account, if you are one of those who spends 14 hours a day glued to crypto-quotes on the screen of your smartphone without it being your professional activity, You should seriously consider whether you have already crossed the diffuse red line separating normal from an addictively compulsive operation. To go to the specialist only when one sees that one is ruined is to go for help when it is already too late.

Be cautious and always try to put barriers of containment in the face of the burdensome terrain that already enters addiction. In this type of swamp, it is much easier to avoid entering than then leaving. As in many psychological conditions, it is really complex to realize (and even define a diagnosis for specialists) when something is normal and when it is no longer normal.

The best therapy is the one that does not need to be applied, so it is best to always stay alert, control exposure to stimulus, monitor anxiety, be attentive to your body’s responses, and, above all… of his mind. And think about whether devoting so much time to earning (and in many cases losing) money is worth it in front of being with your children, talking to your partner, or hanging out with friends… Especially when, in your right measure, you have the life to devote yourself to all of it (and also for a little trading without excesses). Enjoy in the markets (yes, also in crypto-markets), but do not live for it.