Cryptocurrencies present a world of possibilities. Trading in cryptos can be a thrilling endeavor, not just because of their novelty but also their volatility. Many traders and investors – new and experienced alike, are moving in to try their hand at crypto trading.

While trading in cryptos can be profitable, it’s also really easy to lose your money – thanks in part to their wild volatility and unpredictability. A single mistake in crypto trading can be very costly, and that’s why you should go in with a strategy.

With that, the tips below should set you in the right direction in crypto trading; whether you’re looking to dip your toe in the water or have been in the game for a while.

Research and Research More

Before diving headfirst into what is usually a murky world of cryptocurrency trading, it’s important to arm yourself with its very basic concepts. This starts with knowing the terminologies mostly thrown around and understanding what they might mean for you. Understand what cryptocurrencies are, the technology powering them (blockchain), how to be safe while trading cryptocurrencies, and so on.

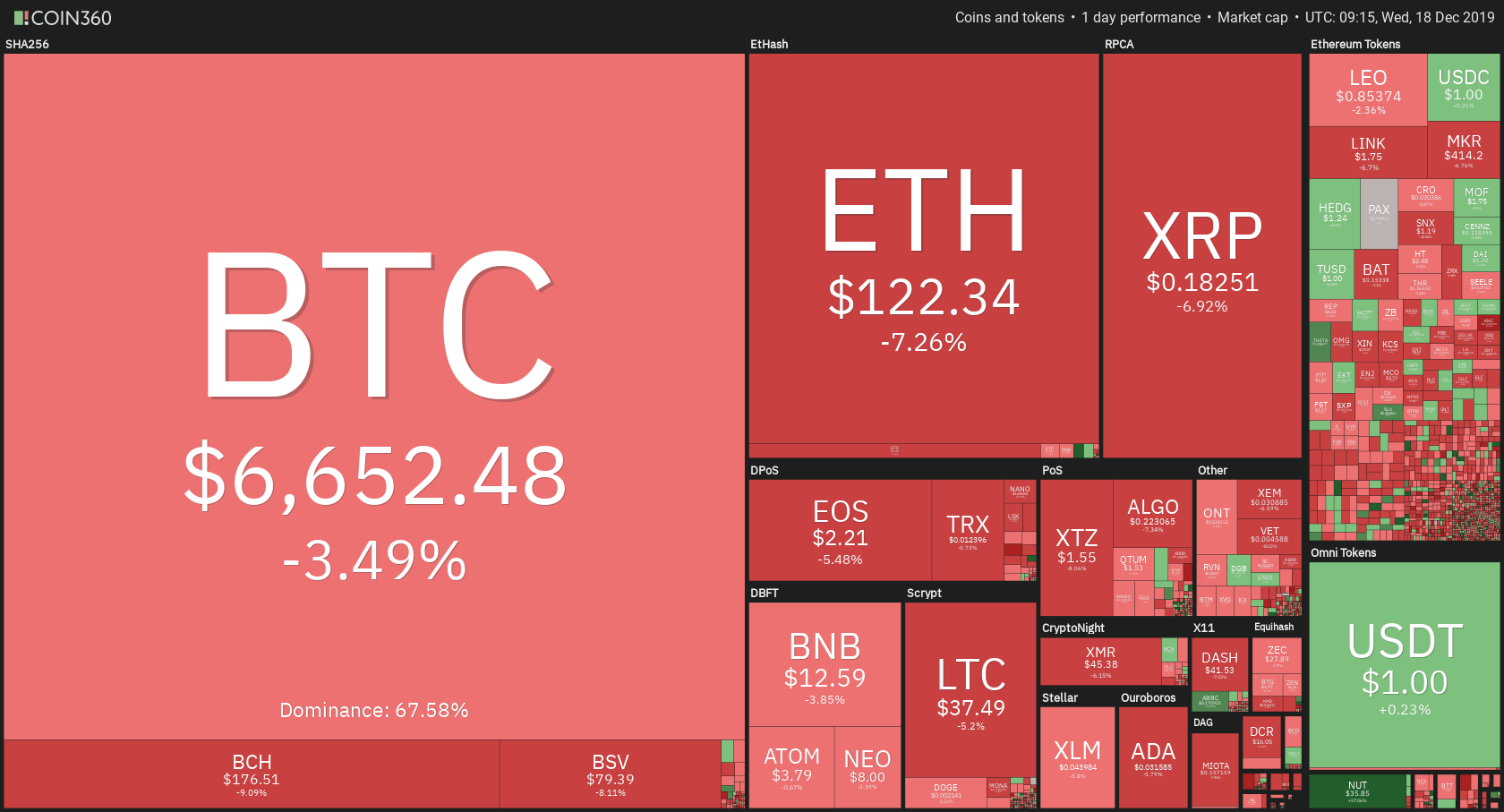

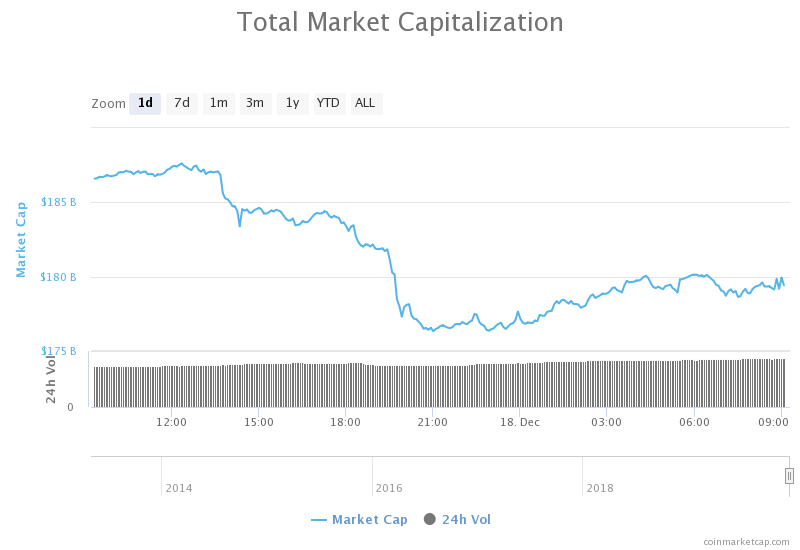

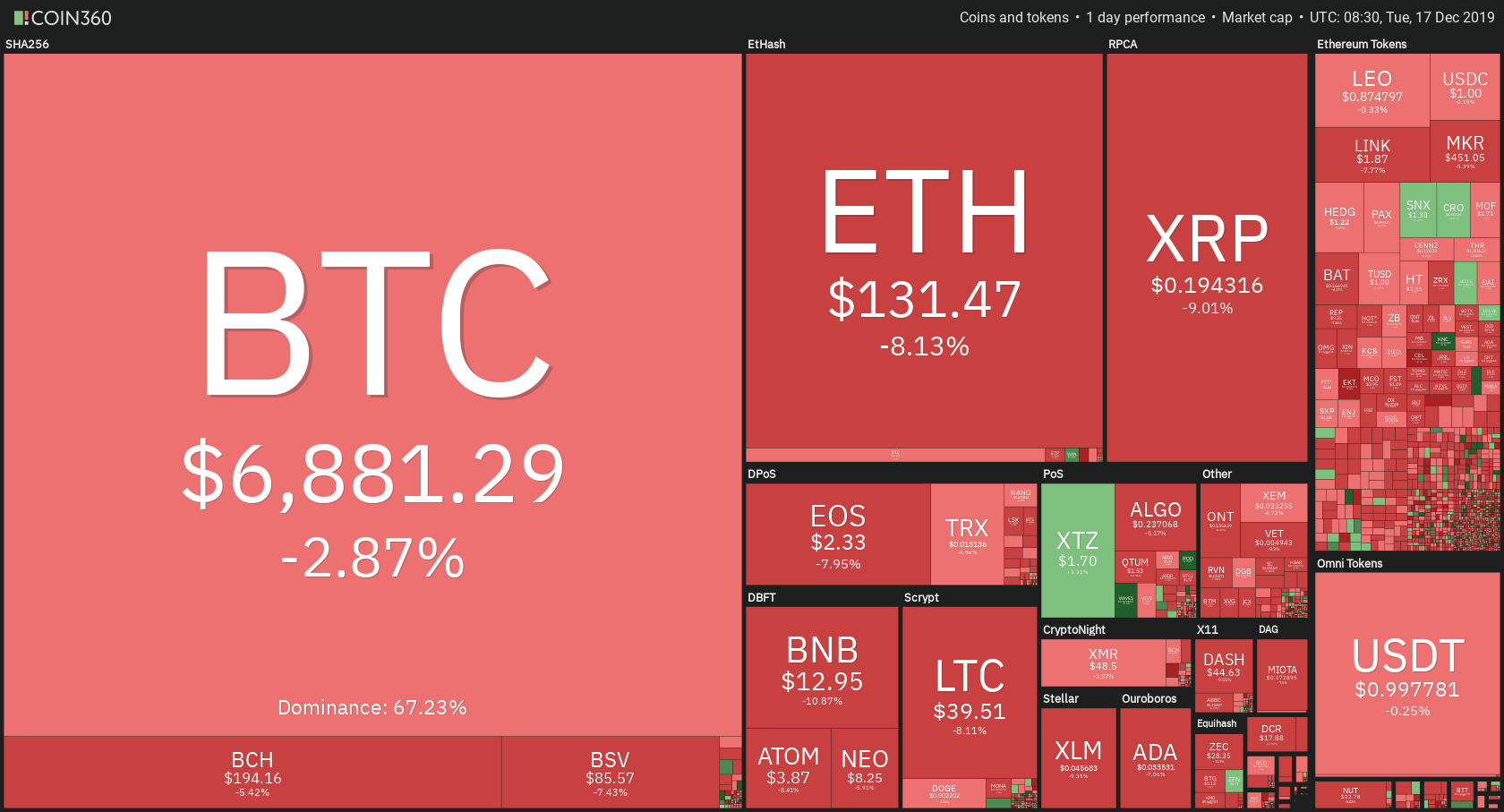

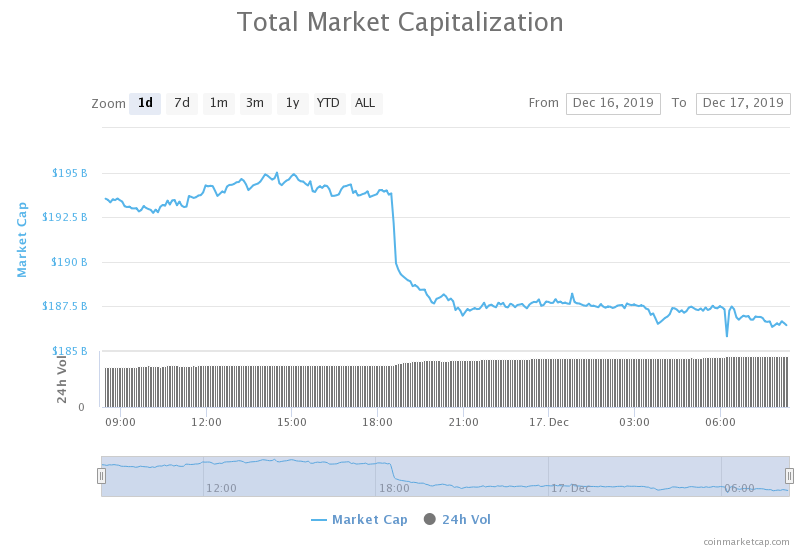

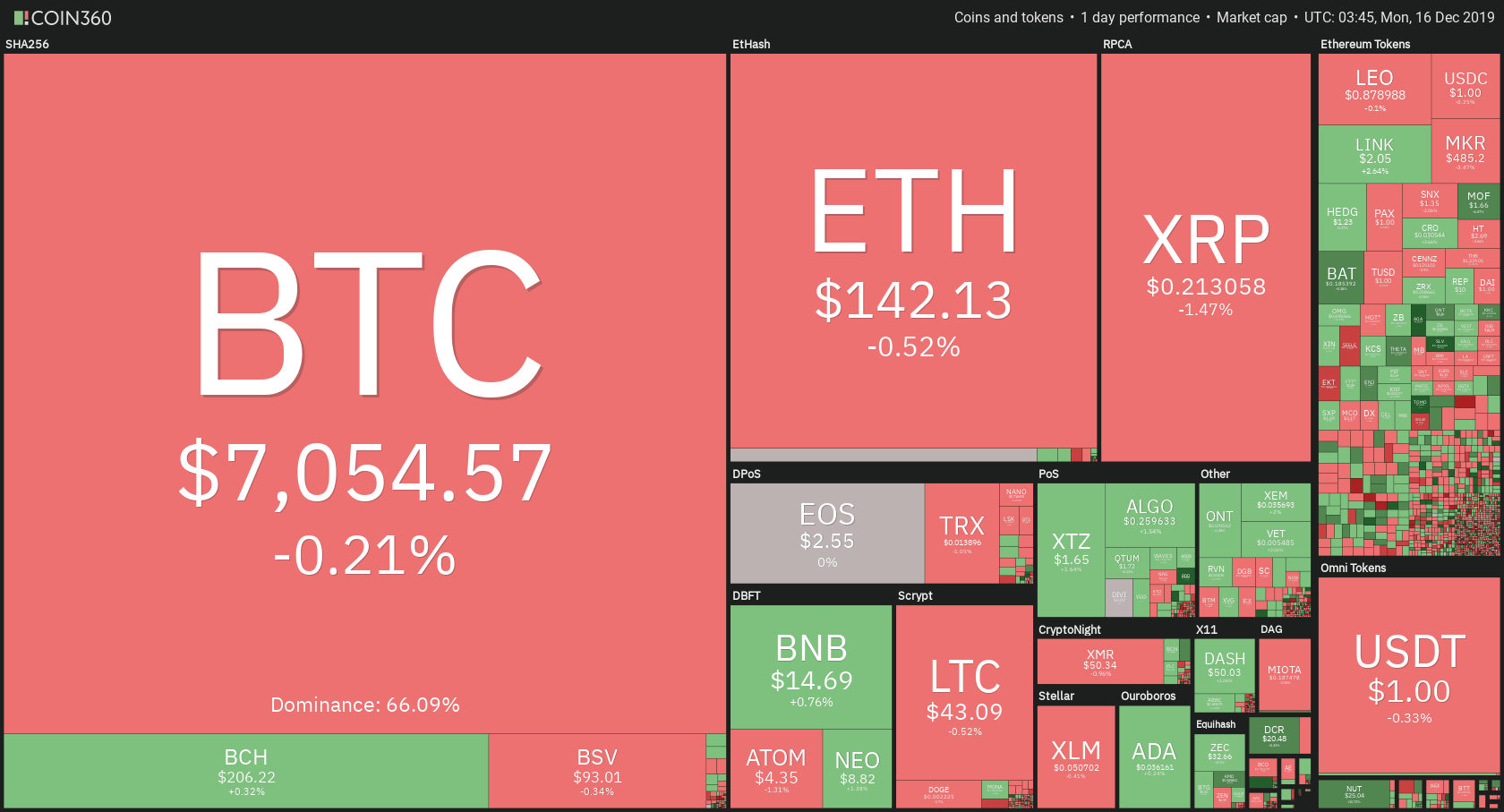

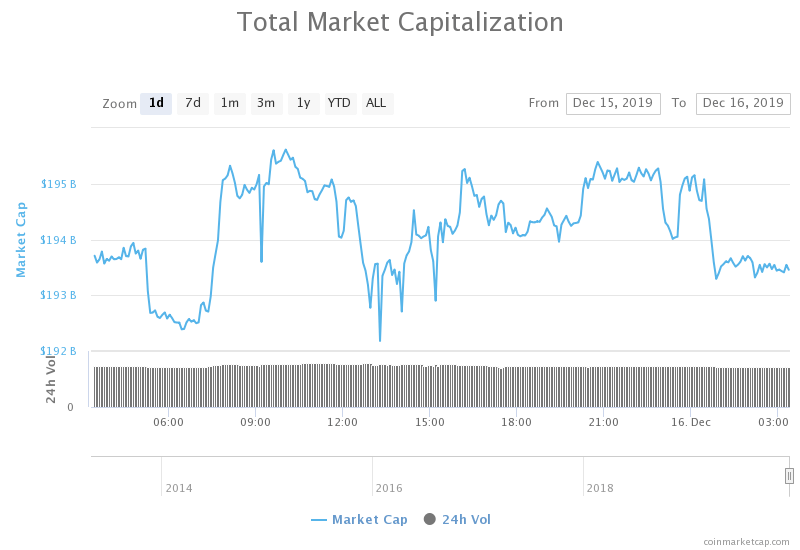

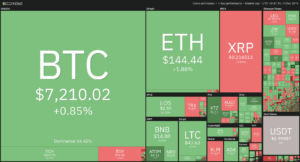

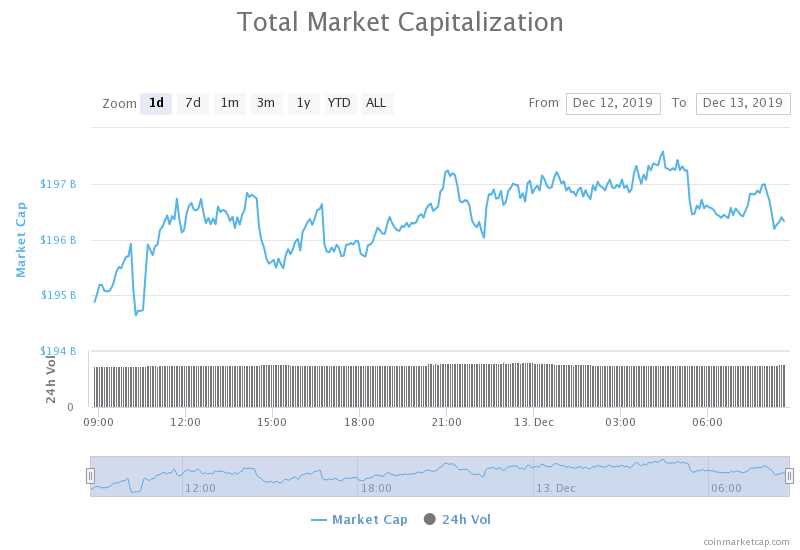

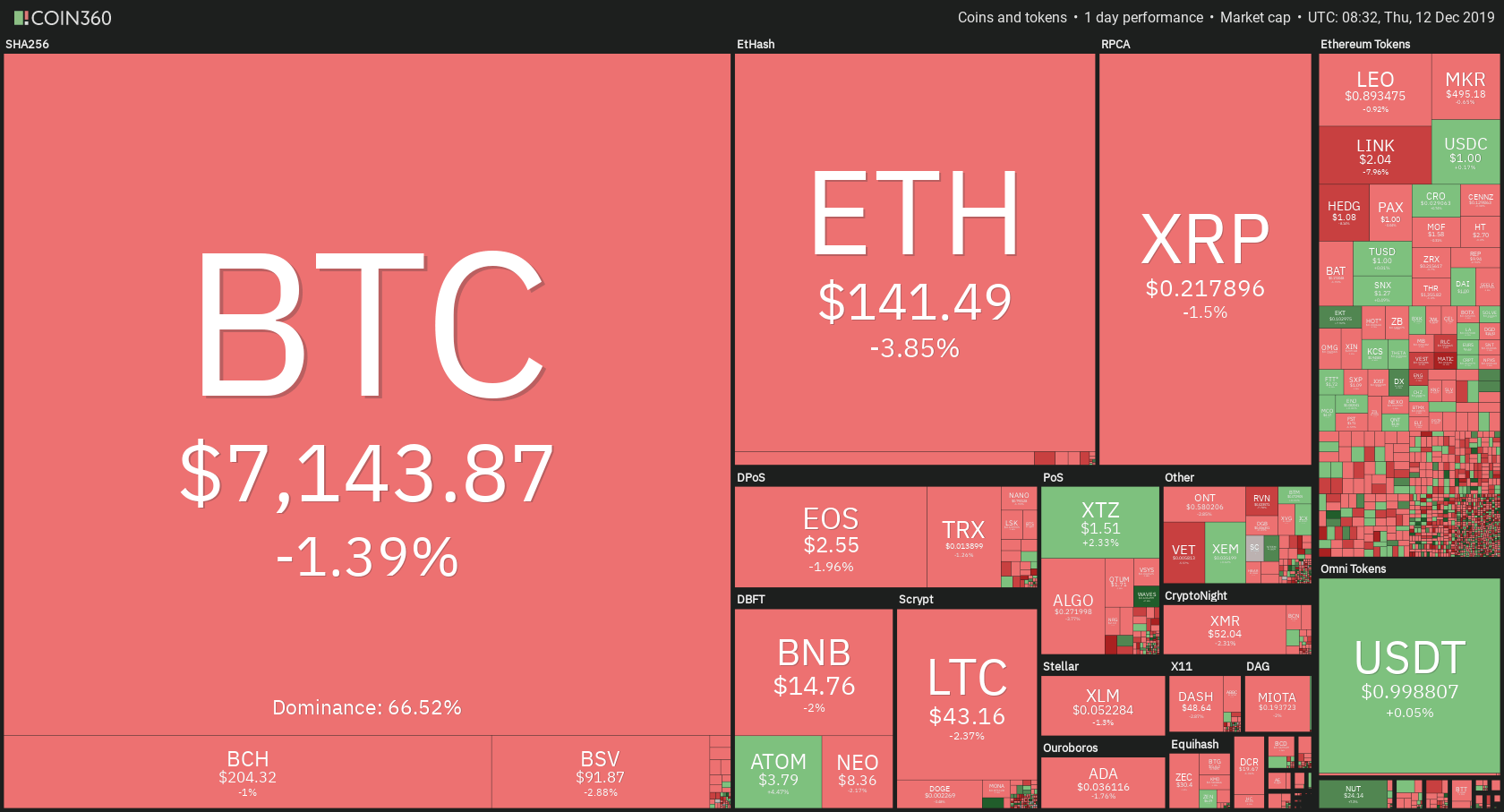

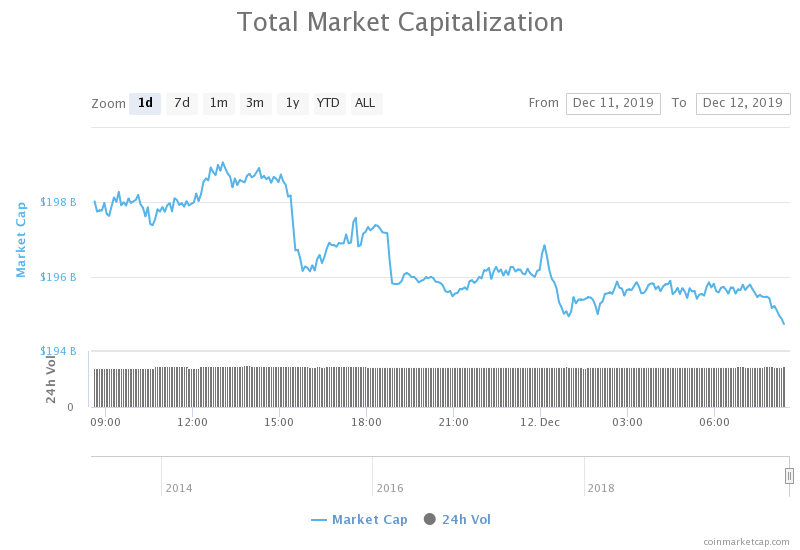

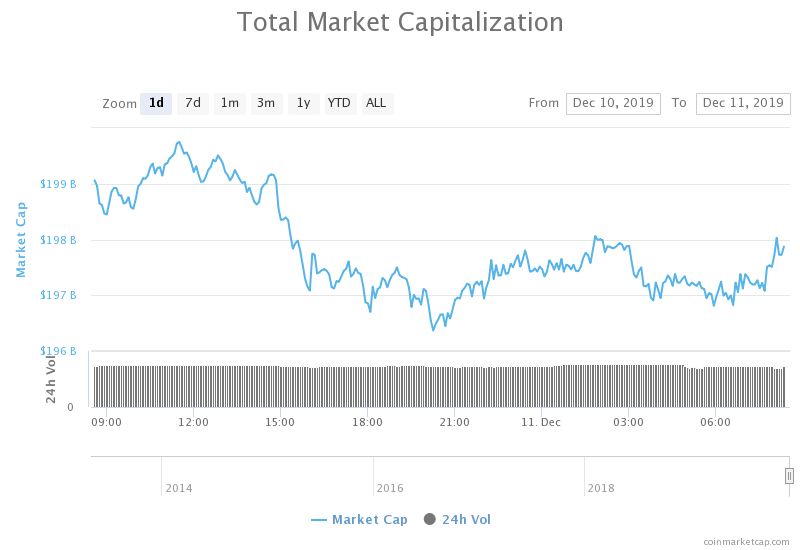

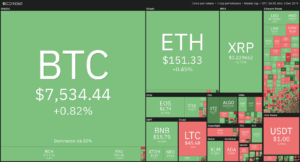

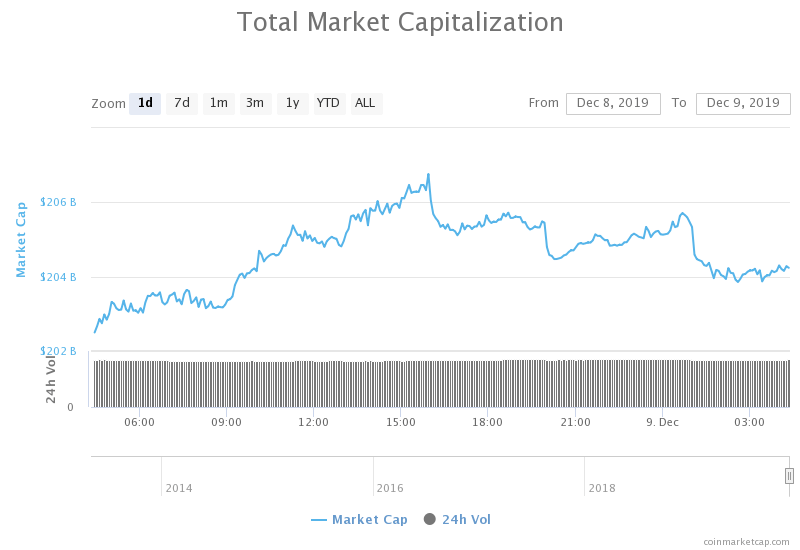

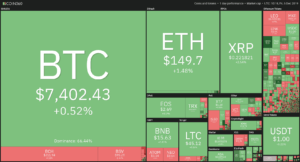

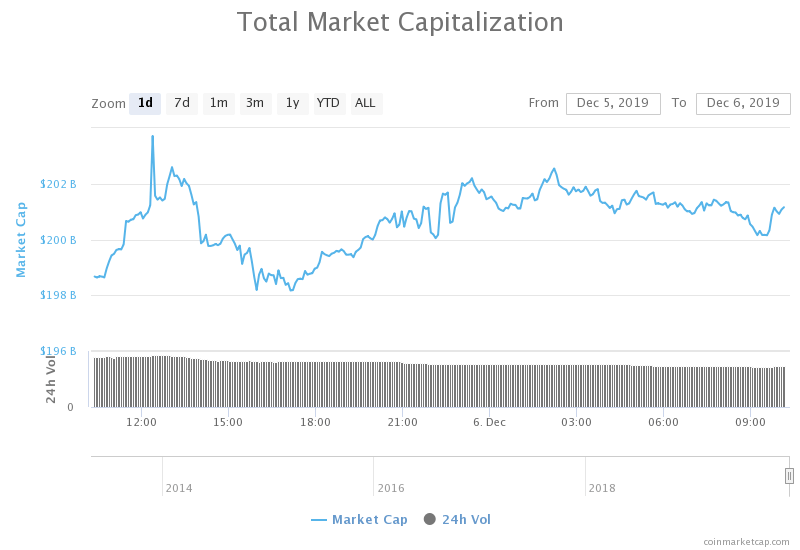

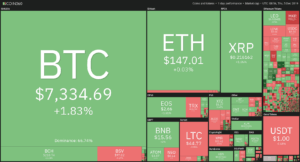

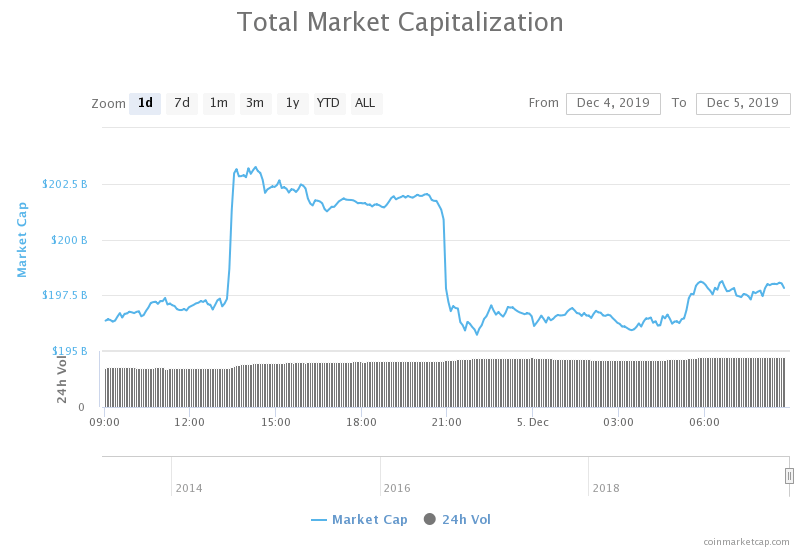

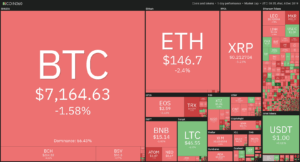

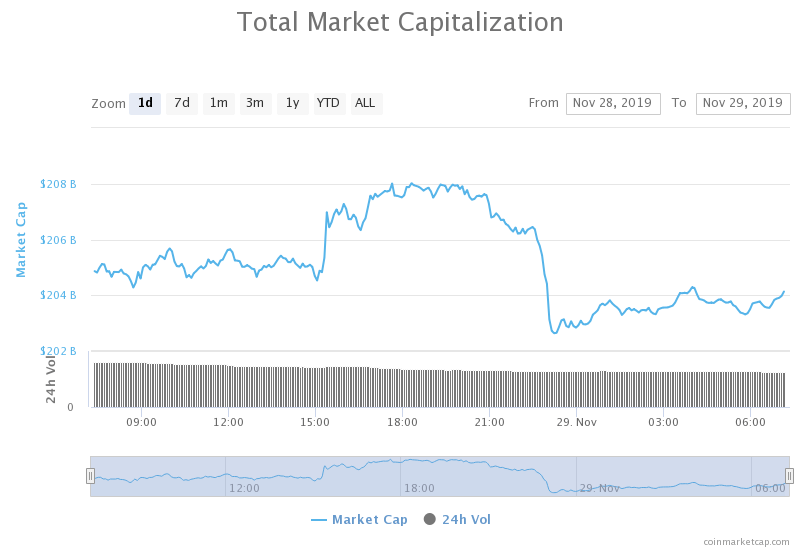

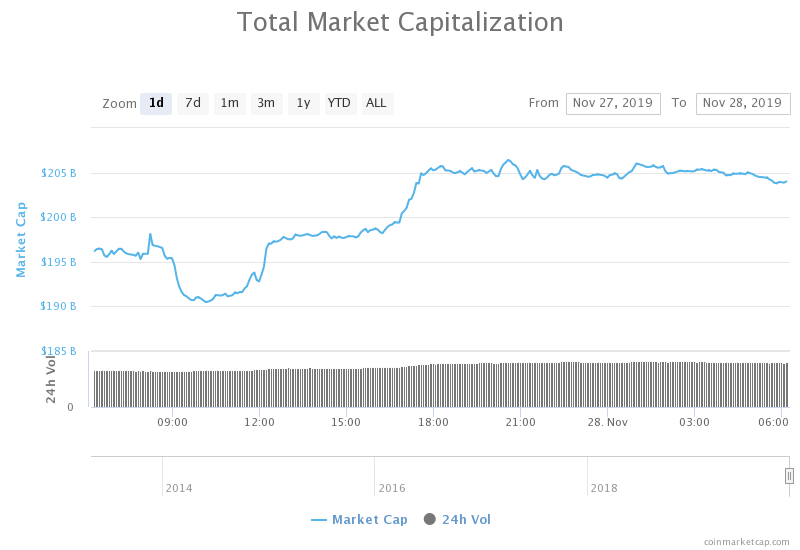

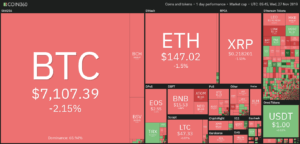

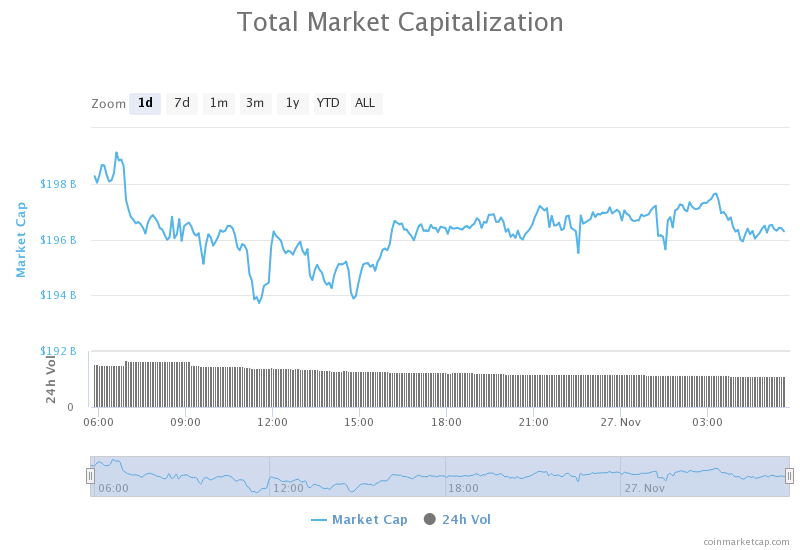

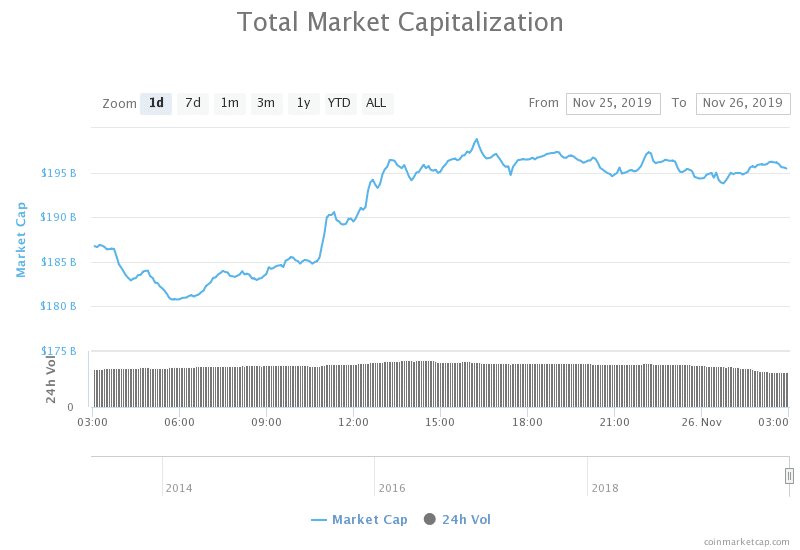

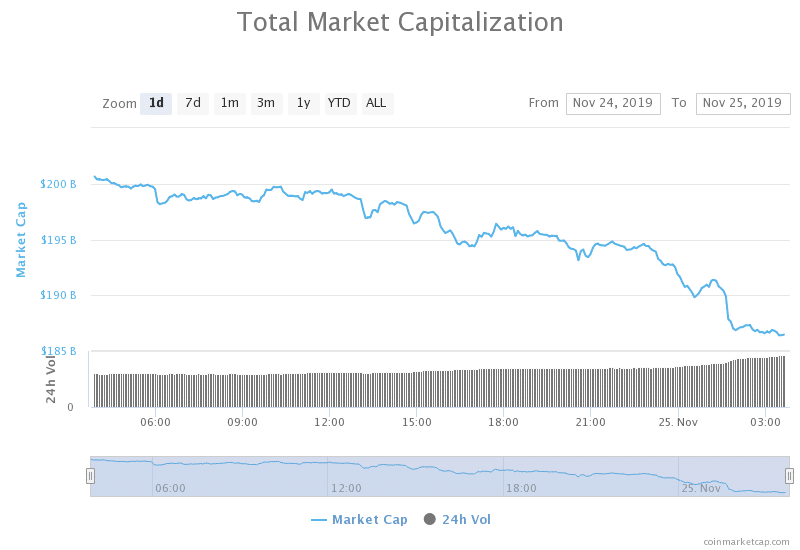

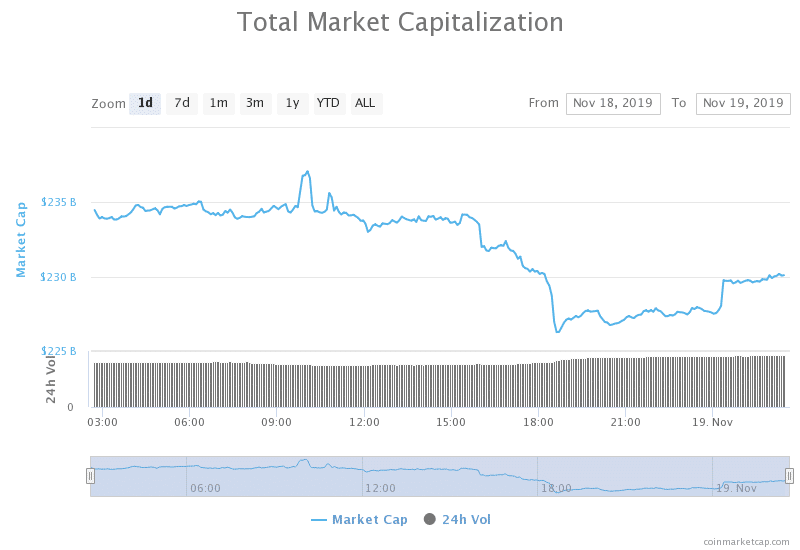

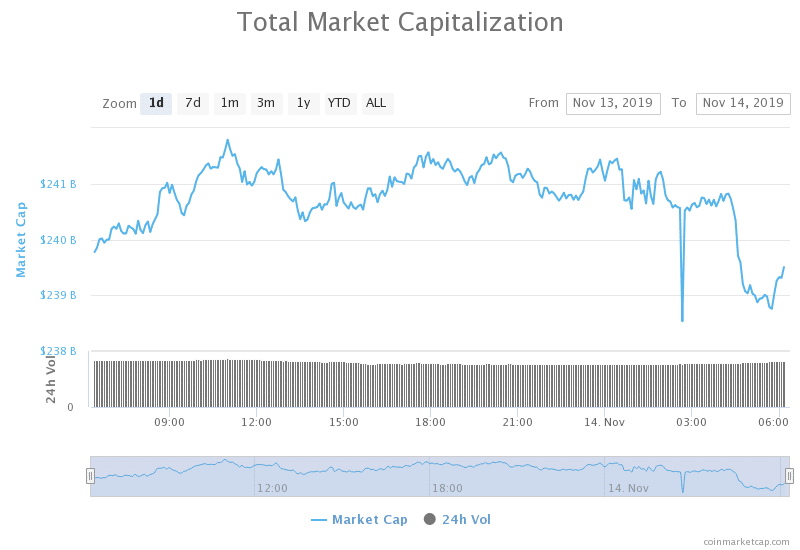

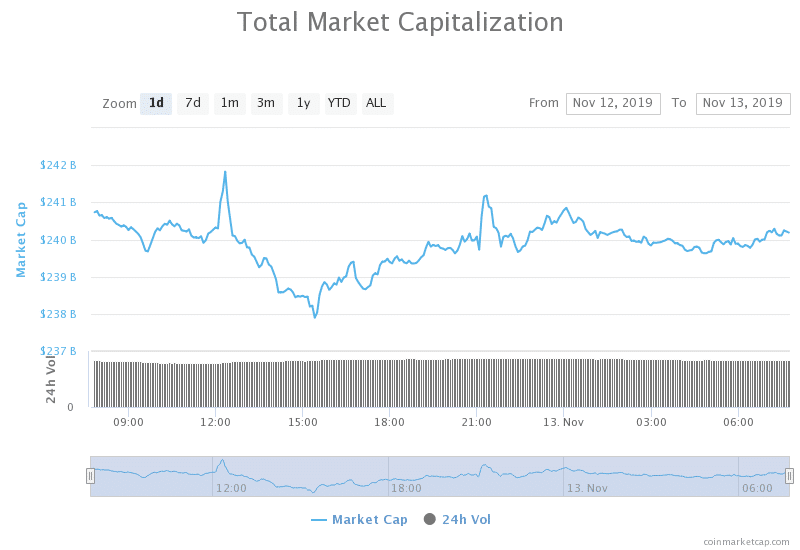

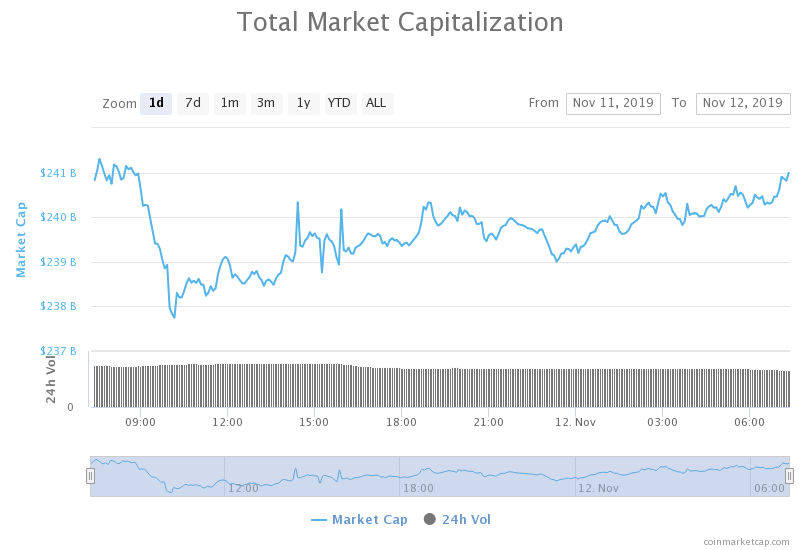

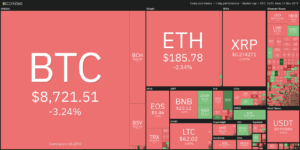

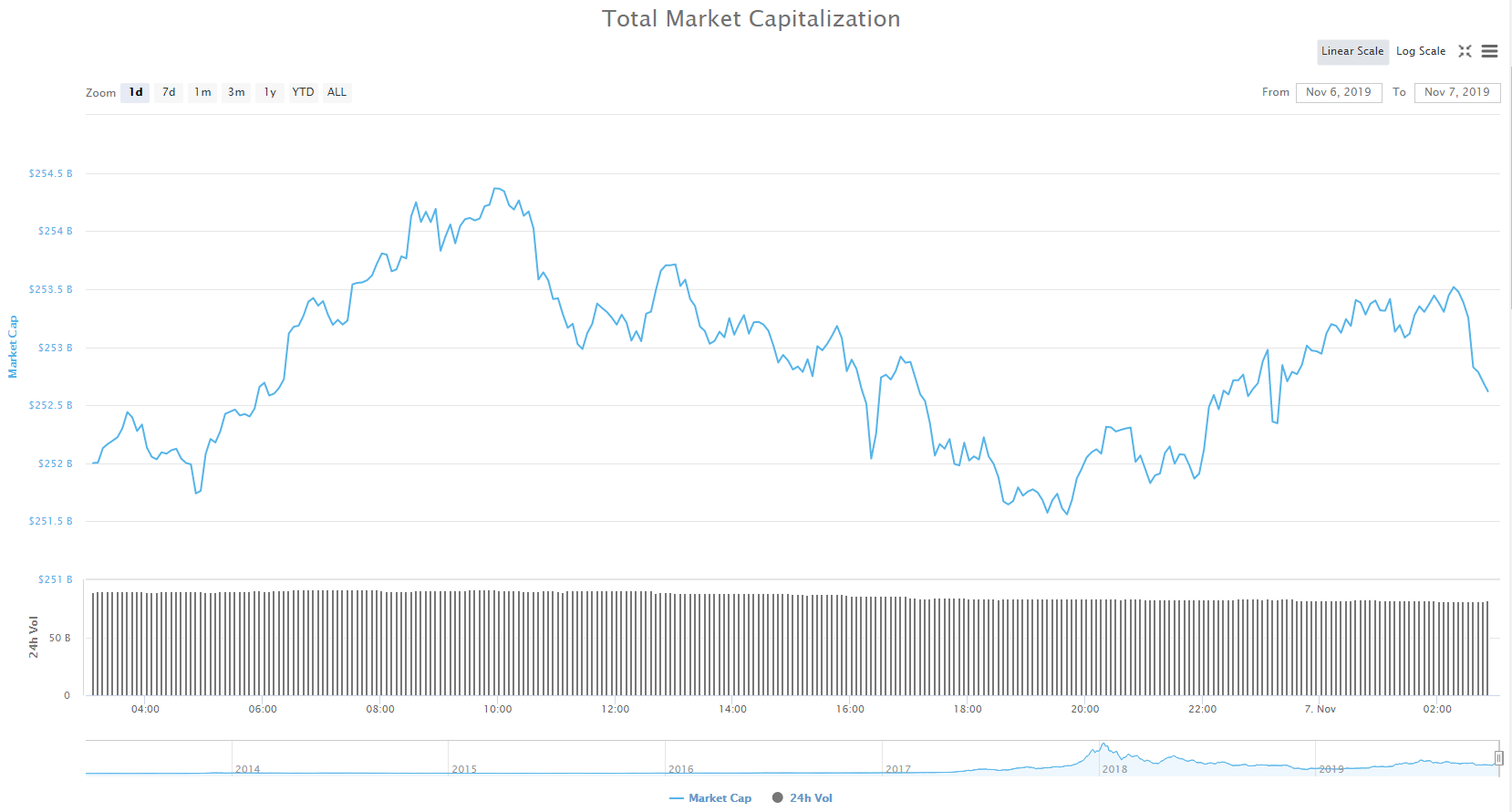

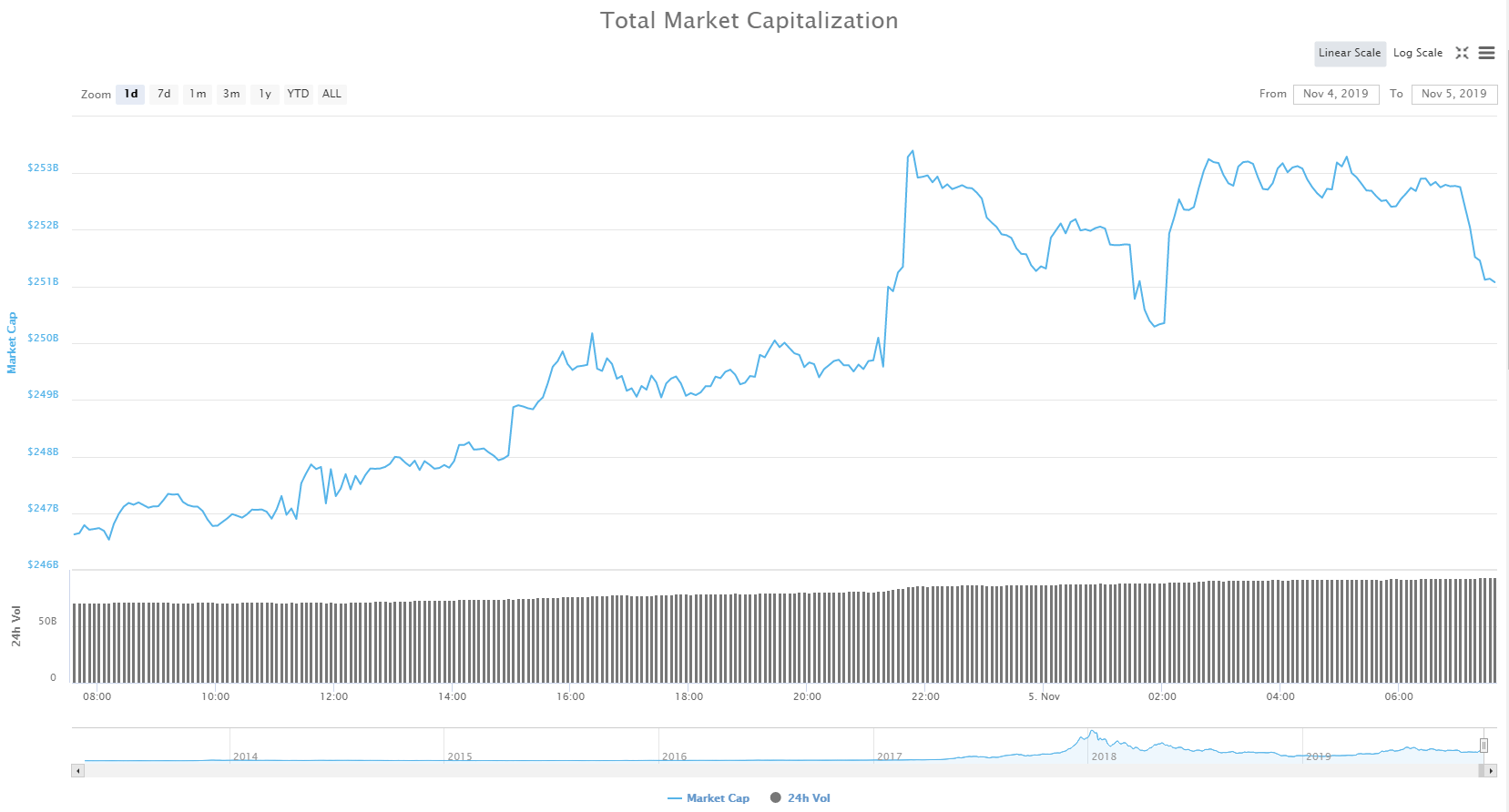

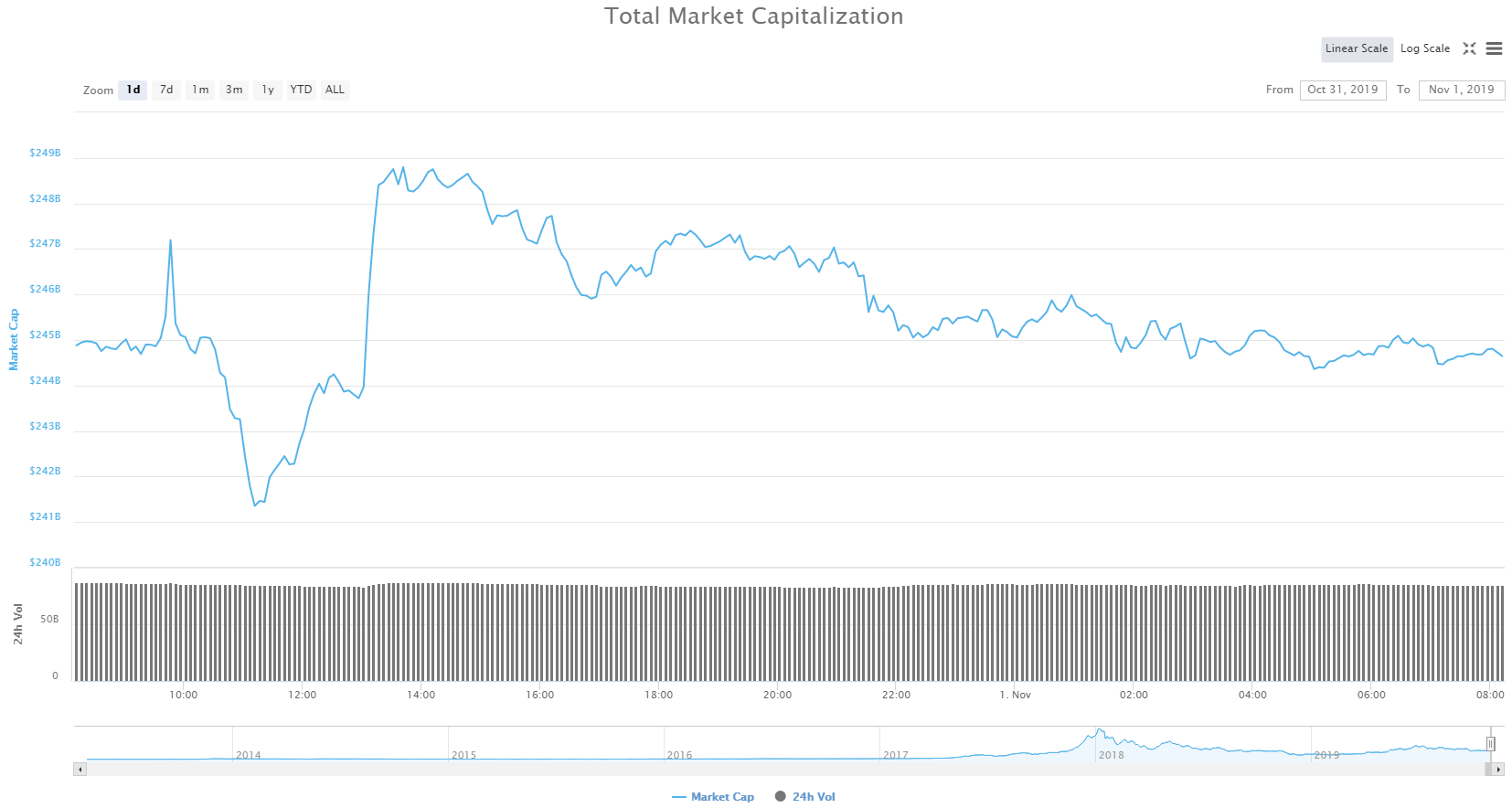

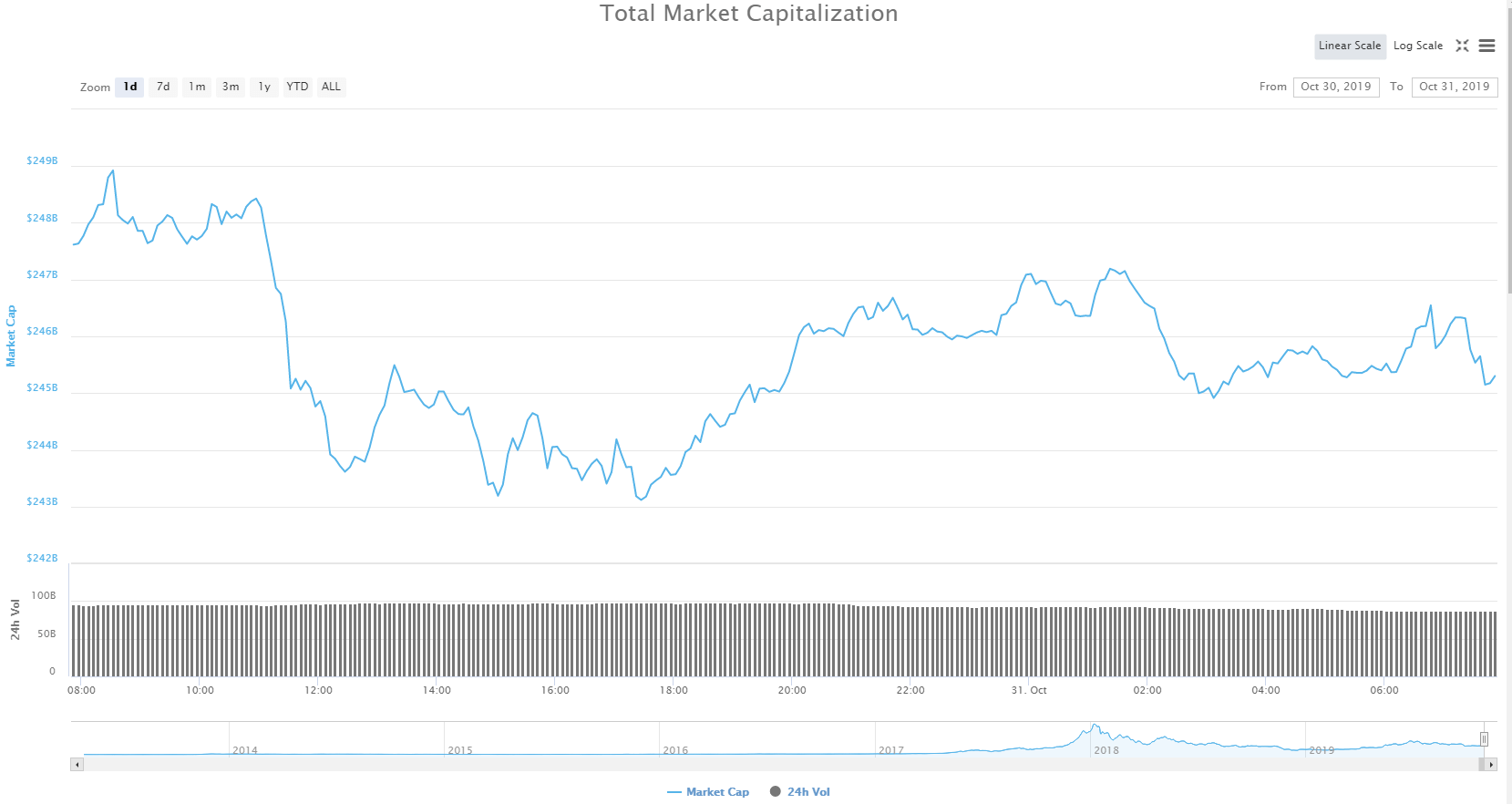

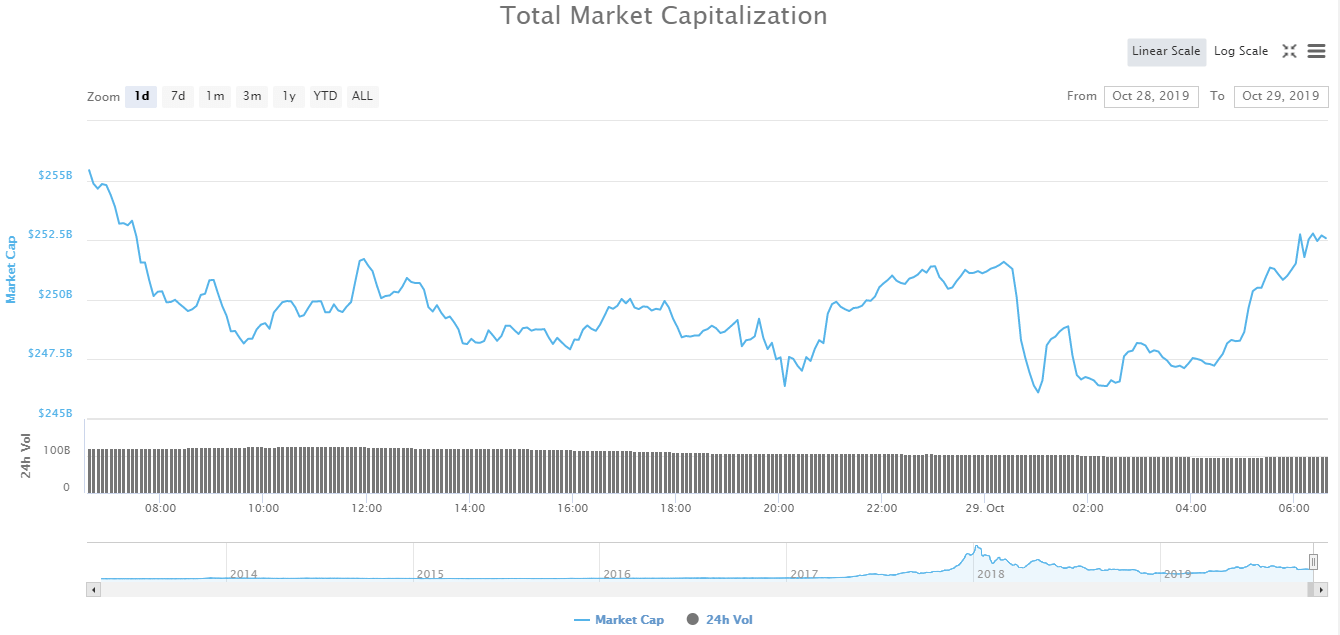

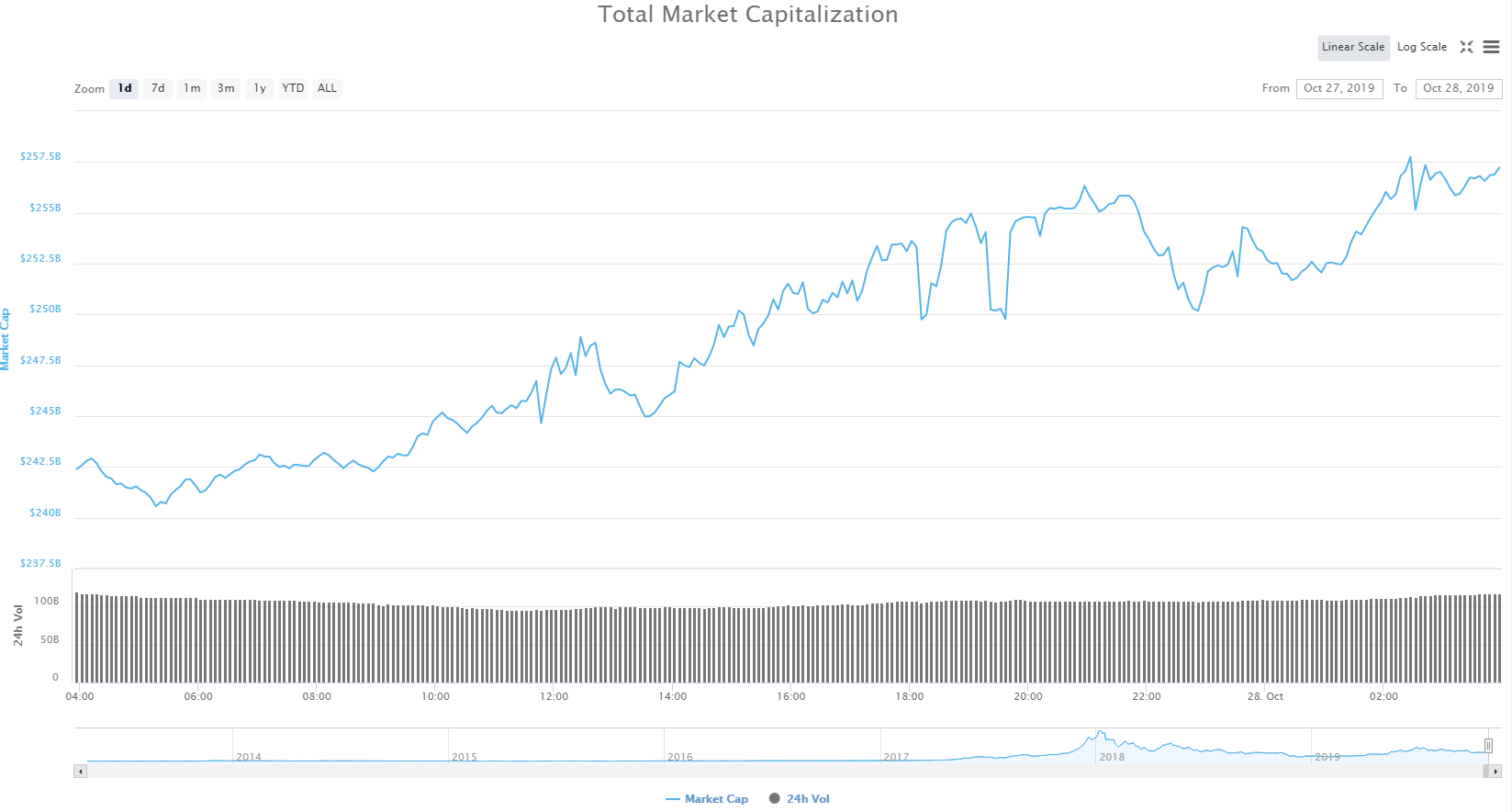

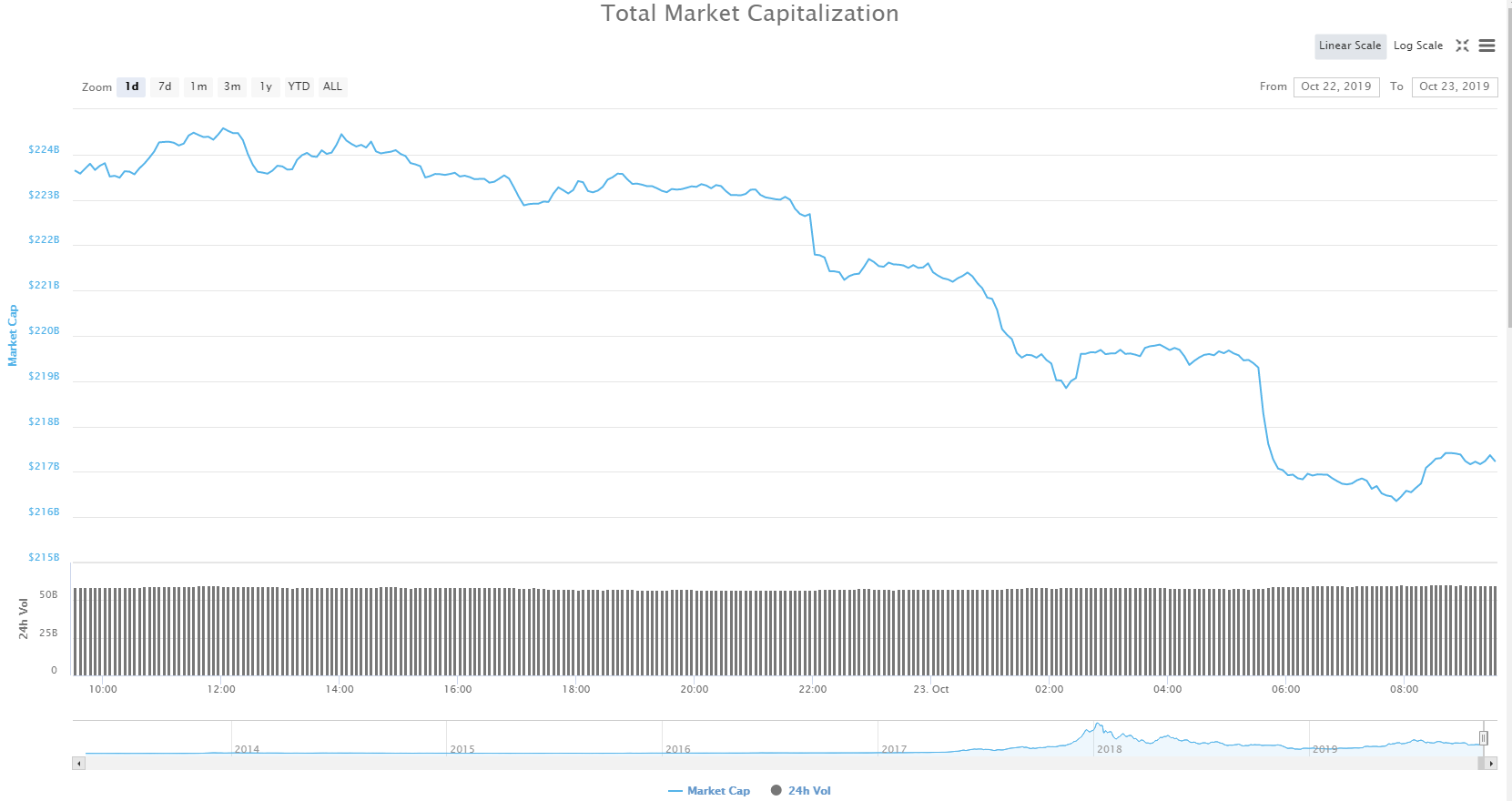

You will also need to read up on the language used in crypto trading, such as limit order, bullish, bearish, market depth, all-time lows, all-time highs, etc. It’ll also be essential to keep tabs on what is happening in the cryptocurrency world. This means knowing new cryptocurrencies, which cryptos are increasing or falling in prices, the market value of different cryptos, etc.

Knowing how different cryptocurrencies have performed in the past, their all-time lows and all-time highs is also necessary. It will help you assess the volatility of cryptos you’re interested in and determine if they’re worth investing in. It might even give you an inkling of their probable future market trends.

Bear in mind that things keep changing in cryptoverse, so one single sitting of research is not nearly enough. What was true six weeks ago may not be true today. The regulation, technology, news, and pretty much everything concerning cryptos is always changing at a fast pace.

Understand Arbitrage

Arbitrage is the difference in the price of the same commodity in two different exchanges – like, say, Bitcoin trading at a slightly lower price on Coinbase than on Binance. Understanding this and acting accordingly can be profitable for you, the trader. But keeping track of the different prices on crypto exchanges is a difficult and time-consuming thing to do.

Other factors that may affect your trading are current volumes of the currencies, variation prices, network fees. To stay on top of these elements, resources such as CoinScanner and other similar tools should be of help. They can help you understand arbitrage better and how to capitalize on it, as well as trade cryptos at the cheapest prices and gain profits.

Be Safe

The first safety rule is to find out the safest places for buying cryptos. The second is to know how to protect them once you’ve bought them. Cryptos, in particular, tend to attract scammers, hackers, phishing attacks, impostors, etc. Take precautions. Always double-check before you enter passcodes/private keys or send money to accounts. Disable any unnecessary extensions in your browser and be careful before opening any URLs.

Protection also means knowing how to store your crypto coins. There are several purpose-built crypto wallets designed with security as a priority. Ledger Nano S, TREZOR, Atomic Wallet, Abra, are some of the most trusted wallets out there.

Crypto Exchanges Are For Just That – Exchanging

Even if you’re a pro at crypto trading, you could lose your money if you’re not careful enough. Cryptocurrency has no insurance, and the responsibility of protecting your coins is yours only.

Many people make the mistake of leaving their fiat holdings on crypto exchanges after they make profitable trades. Yet, exchanges are not a secure place to store your assets. The story of Mt. Gox illustrates this too well. The former world’s leading Bitcoin exchange was put out of business, and thousands of customer coins stolen after a cyber-attack.

The best way to avoid losing your assets on exchanges is to keep your coins in a secure wallet. Also, don’t use the device that contains your assets over public Wi-Fi. Apply other precautions detailed on the safety tip above.

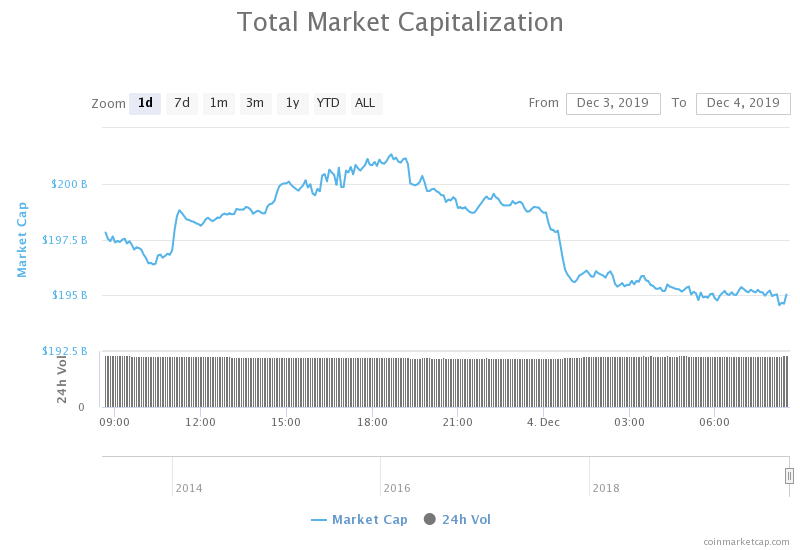

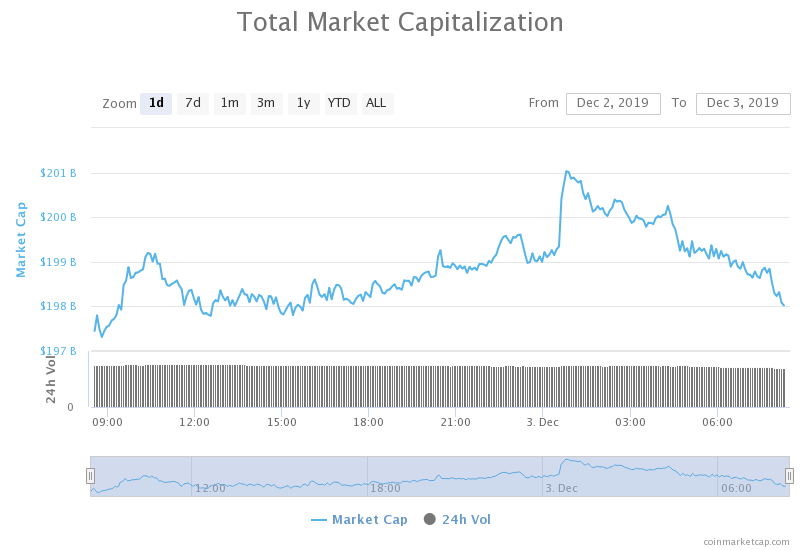

Don’t Ignore the Market Cap

Most inexperienced traders are prone to making trading decisions based solely on the current coin price of a crypto. The reality is the value of a crypto includes the current circulating supply. So when you’re considering whether to buy a cryptocurrency, try to look beyond the current going price and look at the percentage of the total market cap for the currency. The closer a cryptocurrency is to its market cap, the likelier its demand will rise in the near future.

Beware of Pump and Dump, FOMO and FUD

FOMO is an abbreviation for fear of missing out. FOMO is one of the reasons many crypto traders fail in the art. This a trick that most ‘whales’ use. Whales are people who are holding massive volumes of crypto coins. Some whales buy (pump) the coins in an attempt to show that the currency is in such high demand, only to come and sell it at high prices (dump) after many people have bought the lie. But once they’ve bought it, they may never get the opportunity to trade it for profit, making losses.

When you see a sudden euphoric rush by many traders to buy a crypto, don’t jump in too because of FOMO. Always do your research and rely on your gut to make decisions – following the crowd might cost you big time.

FUD, on the other hand, stands for fear, uncertainty, and disinformation/doubt. Some people deliberately spread FUD with fake news, fake social media accounts, and manipulated facts just to dump some coins. Always verify the sources and intentions of any crypto news before being driven by FUD to make trading decisions.

Invest With Money You Can Afford To Lose

This goes without saying. The first thing to know is: the only predictable thing about crypto prices is their unpredictability. While this might actually be a good thing for crypto trading, it also might mean that nothing’s ever really assured.

Cases abound of many who have emptied their savings in cryptos, took loans, and lost most of those savings. The bottom line: never invest too much money in a very high-risk market (like cryptos).

Diversify Your Portfolio

The reason why it’s important to diversify your portfolio when trading in cryptos comes down to their unpredictability, again. Don’t be tempted to “hold all your eggs in one basket” and invest in one crypto only.

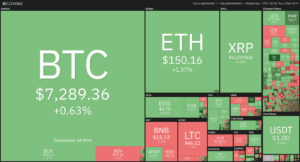

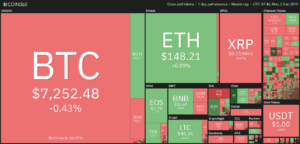

Also, many people think they should spread risk across several cryptos so that in case one tanks, the rest will turn a profit. But what they need to know is all cryptos seem to follow the pattern set by Bitcoin. When Bitcoin decreases in value against the dollar, all other coins almost always follow suit. So, diversifying among different cryptos may not be enough to cushion you against losses. The idea here is to trade in other types of assets as well.

Know Which Altcoins to Trade In

The truth about many altcoins (all other cryptos besides Bitcoin) is they end up losing value over time, sometimes unexpectedly. This means you shouldn’t hold on to an altcoin for too long.

One way to know if an altcoin is ideal for long term investment is to check the daily trading volumes. If a crypto has a high daily trading volume, then chances are it’s a good option for HODLing to sell in the future. Ethereum. Monero, Litecoin, and Dash are some of the currencies that have displayed consistent daily trading volumes.

Also, check regularly the charts of these cryptos and note spikes in price. The patterns can help to identify the perfect time to sell or buy a coin.

Have a Reason for Your Trades

You need to have a purpose for entering any crypto trade. This is because in cryptocurrency trading, someone always wins, and another one always correspondingly loses.

The crypto market is unfortunately controlled by whales who wait for the ‘small fish’ to make a mistake that will land more money on their hands.

Whether you’re a casual or active trader, sometimes it’s better to cool off and not gain anything than rush in and lose. It may seem counterproductive, but sometimes not trading at all is the only way to stay profitable.

Set Profit Targets and Stop Losses

Trading in any asset requires us to determine a point when we’ll exit the market, whether we’re profiting or losing. The target level is an upper limit where you will close the trade after you have reached a certain profit. If you had set a particular profit target and have achieved that target, it’s time to exit the market.

Also, a stop loss level can help you not lose more than you’re willing to lose. A stop-loss is the limit at which you close out your position if the price is falling. For example, if you bought a coin at $600, you can set that as the minimum point you’re willing to trade it. So if the market doesn’t go as expected, you can walk away without losing much.

The crypto market is exceptionally volatile, and prices can fall any time. Don’t let greed or emotion guide your decision making.

Do Your Due Diligence on Initial Coin Offerings (ICOs)

ICOs offer the public a way to invest in a crypto coin and make a profit when the coin is listed on an exchange. Since they promise high returns, many traders rush in without conducting some due diligence. This is a mistake because some ICOs have turned out to be scams, and many people have lost money this way.

‘‘Trust, but verify’’ is true when it comes to ICOs. Do your own research about the project. Who are the people behind it? Analyze, based on your research, if they really have the ability to deliver on their promise. Analyze, too, the feasibility of the project. Scrutinize the white paper and seek answers where it doesn’t add up. If by the end, you still doubt the credibility of the project, you’d instead give it a pass than sink your money into it.

Don’t Buy Just Because the Price Is Low

Some beginner traders make the mistake of buying a coin just because it has a low price or is “affordable.” But the decision to buy a coin shouldn’t be determined by its affordability, but rather its market cap.

It’s just like with conventional stocks – they’re evaluated with this formula: Current Market Price multiplied by the Total Number of Outstanding Shares. This same formula applies to cryptocurrencies.

Thus, it’s better to determine a coin’s worth based on its market cap than its market price. The larger a coin’s market cap, the more it is worth to invest in.

Find a Community

It can be challenging to keep up with cryptoverse. There is a lot of information about it, and everything is always changing. To stay on top of things, find a reliable group of fellow traders with whom you can share trends, ideas, strategies, and analyses. And whether it’s on Facebook, Reddit, WhatsApp, or Telegram, remember not everyone is worth listening to.

Conclusion

Crypto trading can turn handsome profits, but the opposite is also true. The very aspect that makes cryptocurrencies an attractive trading option is the same one that requires you to tread carefully when dealing with them. Before you invest your hard-earned money in cryptocurrency, remember these cardinal tips. Also, remember trading in any asset requires a cool and sober head – whether you’re winning or losing. Good luck.