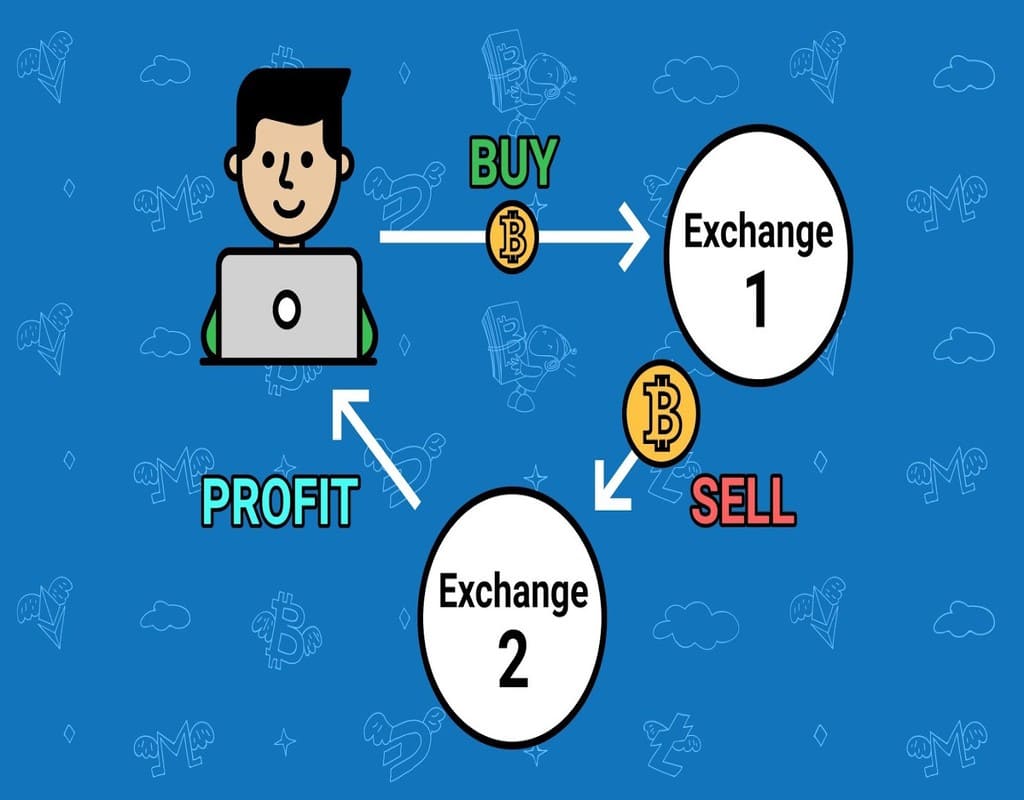

Arbitrage trading is a widespread concept in the stock market that entails capitalizing price imbalances between markets. Essentially, an investor buys an asset in one market at a lower price and proceeds to sell it in another market where the same asset is priced slightly higher.

For instance, say a particular international equity trades at $54 per share in one stock exchange. The same equity trades at $54.20 in another market. A smart investor will speedily bulk-buy the equities at the lower price and sell them at a higher price to realize a tidy profit.

This trading concept can also be replicated in the cryptocurrency market, especially by day-traders who actively monitor the market trends.

Cryptocurrency Arbitrage Trading

Arbitrage trading in the digital currency market is somewhat more efficient than the stock market. This is because there exist numerous marketplaces/crypto exchanges, unlike security trading, which is limited to one major exchange in a given geographical area. Moreover, the crypto market is relatively young, which means that most exchanges work independently and do not share information. This has led to price disparities and profitable arbitrage opportunities.

There are two major arbitrage trading strategies traders can use to make a profit.

- Simple Arbitrage

Simple arbitrage is the most common strategy that is also used in forex trading and sports betting. In cryptocurrency, the strategy involves buying and selling the same digital asset on different exchanges and pocketing the price difference.

Now, assume that in one of the exchanges, Bitcoin is priced at $6,000 while trading at $8,500 on the other exchange. To efficiently take advantage of this price difference, you need to open a trading account in both exchanges. Then, you will buy Bitcoin at $6,000, transfer the coins to the other exchange and sell them for $8,500.

Unfortunately, this approach has two major flaws. First, you’ll have to incur transactional costs associated with transferring cryptos from one exchange to the other. Also, transfers between exchanges can take days. Given the volatility of digital currencies, your profits may diminish during this extended transfer period.

To morph up tangible profits, it is recommended to trade large volumes of crypto. This way, your returns are magnified to cover the transfer and delays.

- Triangular arbitrage

Unlike simple arbitrage, triangular arbitrage is more complex as it involves leveraging the price differences among three different cryptocurrencies within one or multiple exchanges. The strategy can be termed as a cycle where you’ll be exchanging your initial crypto for a second and a third one before finally buying back your initial currency within a limited amount of time. So, the first trading action is required if you were to make any profits.

Here’s how it is done. There are three different assets on one exchange: BTC, ETH, and LTC. Deposit funds in your trading account and buy BTC as your initial crypto. Next, exchange your BTC for the low-priced LTC. Proceed to sell the LTC for ETH and finally trade the ETH back to BTC. Due to the price differences, your initial BTC holdings will have increased to reasonable amounts, which you can sell for fiat currency.

Even without owning BTC as your initial crypto, you can still make a profit by starting with a low priced crypto. In this case, you already hold some USDT in your account and want to buy 1 Bitcoin, which is currently trading at 6527.06 USDT. Instead of buying Bitcoin directly, you can trade your USDT for another currency, say ETH. Now assume that you end up buying ETH for 302.15 USDT for 1 ETH.

Your last step will be to exchange the ETH for at a rate of 1 ETH = 0.04643 BTC, which means that 1 BTC is trading at 21.5378 ETH. At the end of your trade, you’ll have bought 1 BTC for an equivalent of 6507.64USDT ( 21.5378 * 302.15). As such, you’ll have saved about 19.41 USDT, which wouldn’t be the case if you were to buy BTC directly with your USDT. If you cash out the final holdings immediately, you will make 0.3% profit, without considering the withdrawal fees.

What to Consider before using Arbitrage Trading strategy

In theory, cryptocurrency arbitrage sounds pretty straightforward to execute successfully. However, as with all trading strategies, arbitrage trading isn’t immune to risks. So, here are a couple of things to consider doing to mitigate some of the risks:

- Make use of Trading bots.

Although manual arbitrage trading is possible, it’s advisable to make use of trading bots to execute trades. This way, you can be sure that you won’t miss any opportunity, especially considering that cryptocurrencies are highly volatile, and prices may move against you if you are not fast enough to execute orders.

Besides, arbitrage trading requires constant monitoring of market movements, which can be tedious. A trading bot, on the other hand, can be configured to run for long hours and execute trades when an opportunity arises.

- Keep an Eye on the Fees

There are many costs associated with arbitrage trading that may eventually eat into your profits. Although some expenses such as transaction and withdrawal fees are unavoidable, it helps to review several exchanges and choose one whose costs are more affordable.

Also, be sure to factor in the taxes based on your jurisdiction. In countries where the law recognizes cryptocurrencies as assets, a trader will have to pay tax on every transaction. In this case, you should limit your transaction or rather use simple arbitrage instead of triangular arbitrage to minimize tax charges.

- Limit Your Exposure

As mentioned earlier, arbitrage trading requires making large volumes of trades to realize reasonable profits, especially when the price difference between assets is narrowly spread. However, it’s prudent to only risk the amount you can afford to lose based on your risk tolerance.

Conclusion

When done correctly, arbitrage trading is an ideal trading strategy for earning quick profits by leveraging the constant price swings of the cryptocurrency market. But remember to take into account the risks involved and ways to mitigate them to increase your returns.