TenX (PAY)

Market Cap: $153.75M

Circulating Supply: 109M PAY

Max Supply: 0 PAY

Volume (24h) $53.58M

PAY/USD rallied aggressively today and has reached new highs, but unfortunately, the buyers weren’t strong enough to hold the rate near 1.97956344 today’s high. Price is trading at 1.41913765 right now but is trapped below a crucial dynamic resistance.

The crypto moves somehow sideways on the short term, so we’ll have a significant move after a breakout from this minor range.

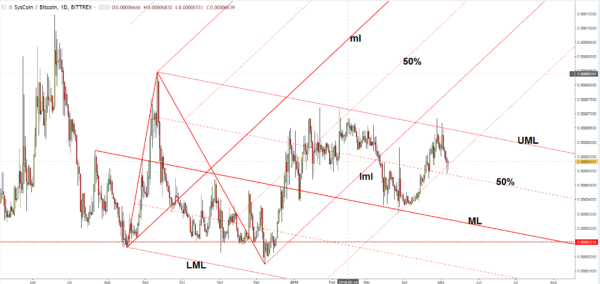

It is premature to talk about a larger upside movement as long as the rate is trapped below the minor downtrend line. You can see that the rate has found support at the lower median line (LML). The previous retreat was natural after the failure to reach and retest the median line (ML) of the ascending pitchfork.

It remains to see what will happen in the upcoming period because the current rebound could be only temporary after the today’s failure to stay higher. A further increase could be validated after a valid breakout above the downtrend line, but a major upside movement will be confirmed only after a valid breakout above the median line (ML).

Technically, we could say that the rate has developed an Inverse Head and Shoulders pattern, this could be confirmed only after a valid breakout above the downtrend line which could be considered to be the neckline.

Conclusion

We could go long on PAY/USD if it will make a valid breakout above the downtrend line and if the LML will remain intact. A breakdown below the LML will invalidate a potentially significant increase.