Introduction

CHF/MYR is the abbreviation for the Swiss Franc against the Malaysian Ringgit, and it is considered an exotic currency pair. In this case, the CHF is the base currency, and the MYR is the quote currency. The franc is the official currency of Switzerland and Liechtenstein, while MYR is the official currency of Malaysia.

Understanding CHF/MYR

The market value of CHF/MYR defines MYR’s value that is obliged to buy one franc. It is priced as 1 CHF per X MYR. If the price of the pair is 4.5465 in the market, then these many Malaysian ringgit units are required to buy one CHF.

Spread

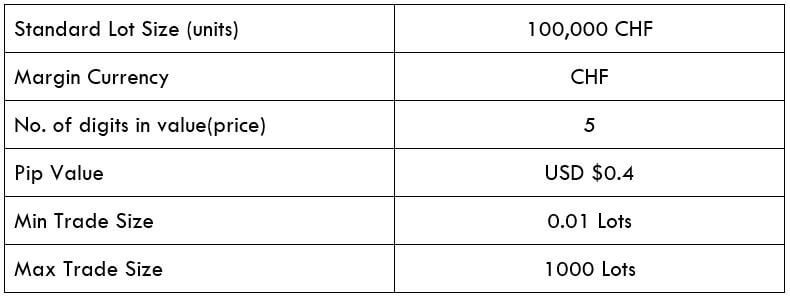

The distinction in price between the bid and ask price is determined as Spread. Bid and ask prices are set by the broker. This pip difference is where most of the brokers generate their revenue. Below are the Spread values of CHF/MYR Forex pair in both ECN & STP accounts.

ECN: 44 pips | STP: 49 pips

Fees

The fee is the price you spend on each spot you open with the broker. There is no fee imposed on STP account models, but a few extra pips are charged on ECN accounts.

Slippage

The difference between the price at which, trader implements the trade, and the price he receives from the broker is termed Slippage. This fluctuates based on the broker’s execution speed and the market’s volatility.

Trading Range in CHF/MYR

The total money you will gain or lose in a particular timeframe can be measured utilizing the trading range table. This represents the maximum, average, and minimum pip movement in a currency pair.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

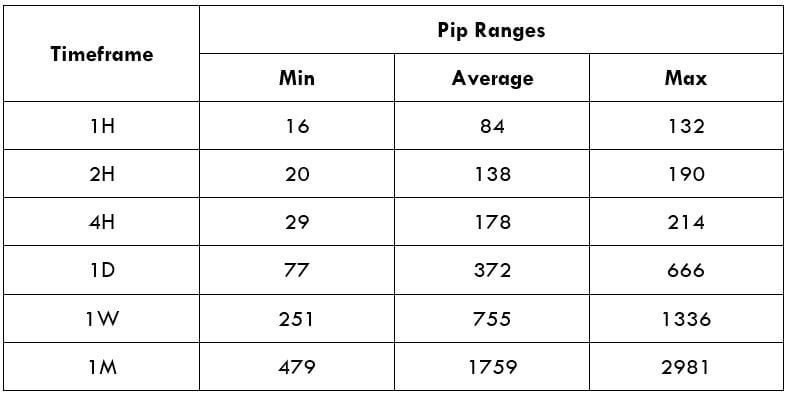

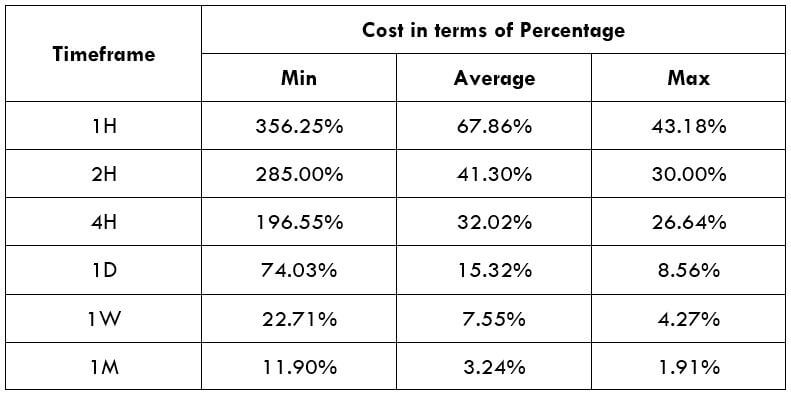

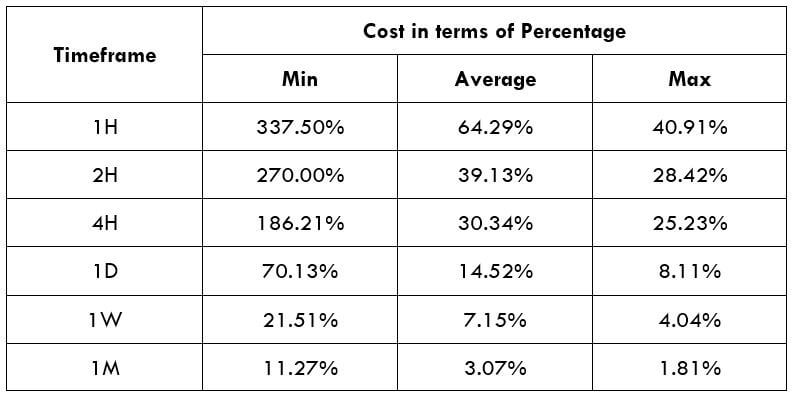

CHF/MYR Cost as a Percent of the Trading Range

The cost of trade alters based on the volatility of the market. This is for the reason that the total cost involves Slippage and spreads apart from the trading fee. Below is the interpretation of the cost variant in terms of percentages. The understanding of it is reviewed in the following sections.

ECN Model Account

Spread = 44 | Slippage = 5 |Trading fee = 8

Total cost = Slippage + Spread + Trading Fee = 5 + 44 +8 = 57

STP Model Account

Spread = 49 | Slippage = 5 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 5 + 49 + 0 = 54

Trading the CHF/MYR

The CHF/MYR is not an extremely volatile currency pair. For instance, the average pip movement on the 1H timeframe is only 84 pips. Note that the elevated the volatility, the smaller is the cost of the trade. However, this cannot be considered a benefit as it is risky to trade extremely volatile markets.

Also, the higher or lesser the percentages, the higher or lower are the costs on the trade. We can conclude that the costs are elevated for low volatile markets and high for extremely volatile markets.

To reduce your risk, it is proposed to trade when the volatility is near the average standards. In this case, the volatility is low, and the costs are slightly high related to the average and the maximum values. But, if your primary concern is on lowering costs, you may trade when the market volatility is near the maximum values.