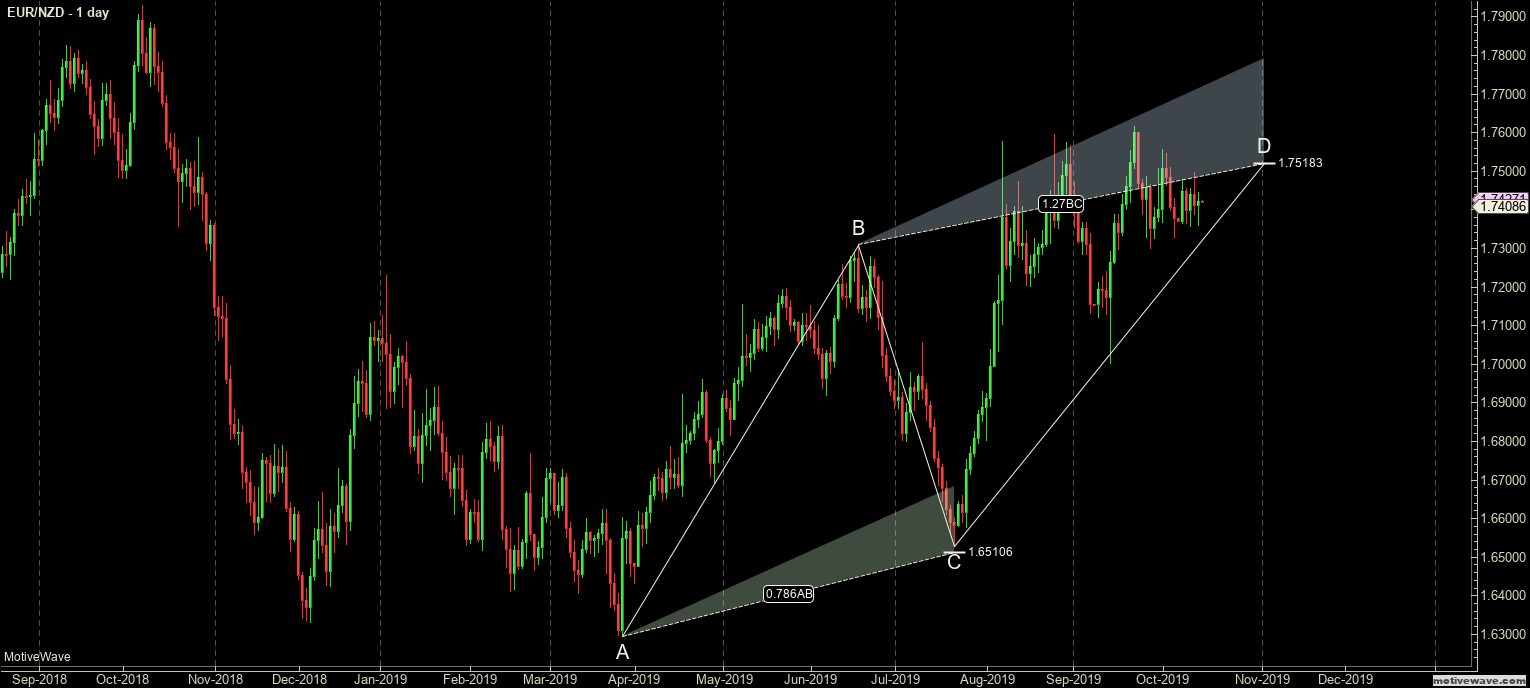

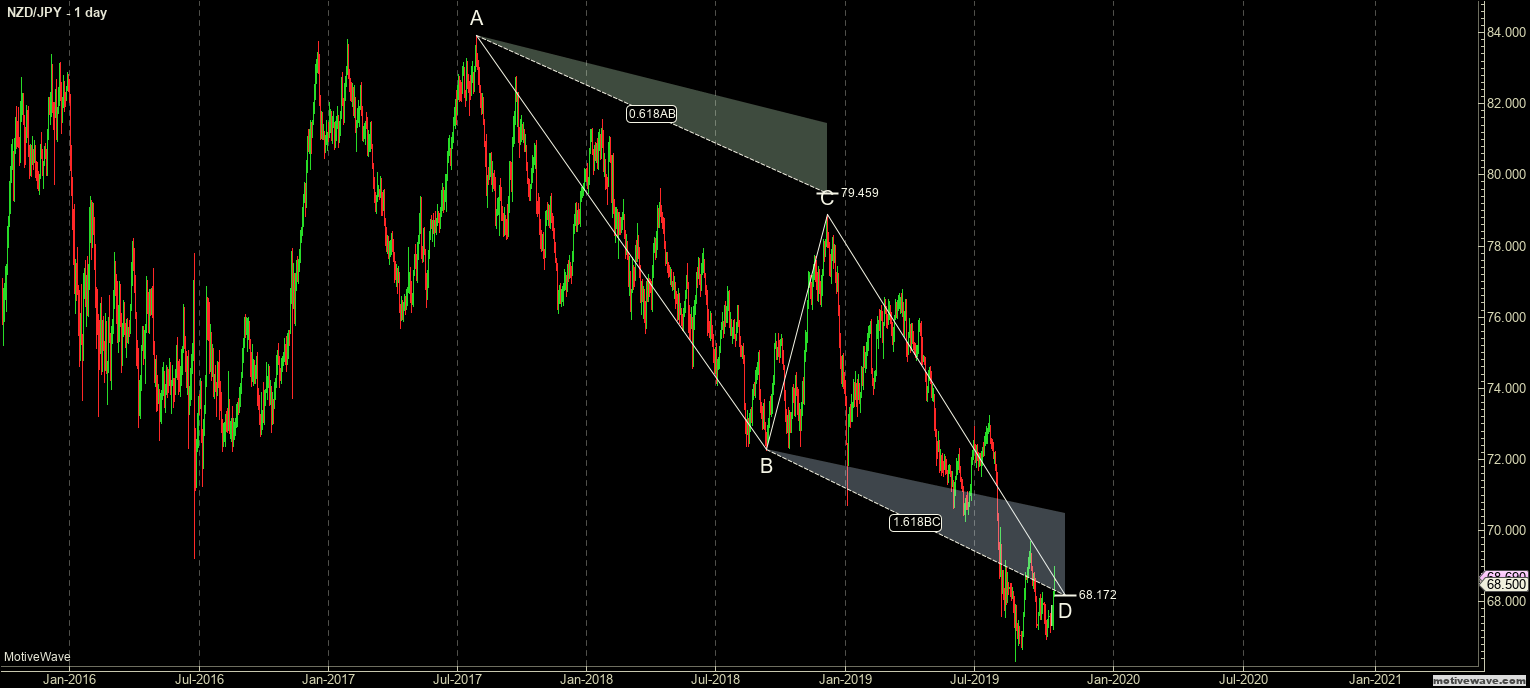

AB=CD Pattern

The AB=CD Harmonic Pattern is the most basic and common pattern in harmonic geometry. It is the building block of all other patterns. It is the ‘bread and butter’ pattern. Pesavento and Carney recommended that this pattern should be learned first – and reading this article does not qualify for having learned this pattern. Like any form of analysis, you will need to regularly and consistently train your brain and eyes to find this pattern. You won’t be able to get very far in the study of harmonic patterns until you can see this pattern just by glancing at a chart.

Rules

- BC cannot exceed AB.

- D must exceed B to form a completed AB=CD pattern.

Characteristics

- CD is an extension of AB, generally from the Fibonacci ratio of 1.27% to 2.00%.

- CD’s slope is steep or longer/wider than AB.

- BC often corrects to the Fibonacci ratios of 38.2%, 50%, 61.8%, or 78.6%.

AB=CD Pattern Reciprocal Ratios

| Point C Retracement | BC Projection |

| 38.2% | 24% or 261.8% |

| 50% | 200% |

| 61.8% | 161.8% |

| 70.7% | 141% |

| 78.6% | 127% |

| 88.6% | 113% |

Sources: Carney, S. M. (2010). Harmonic trading. Upper Saddle River, NJ: Financial Times/Prentice Hall Gartley, H. M. (2008). Profits in the stock market. Pomeroy, WA: Lambert-Gann Pesavento, L., & Jouflas, L. (2008). Trade what you see: how to profit from pattern recognition. Hoboken: Wiley