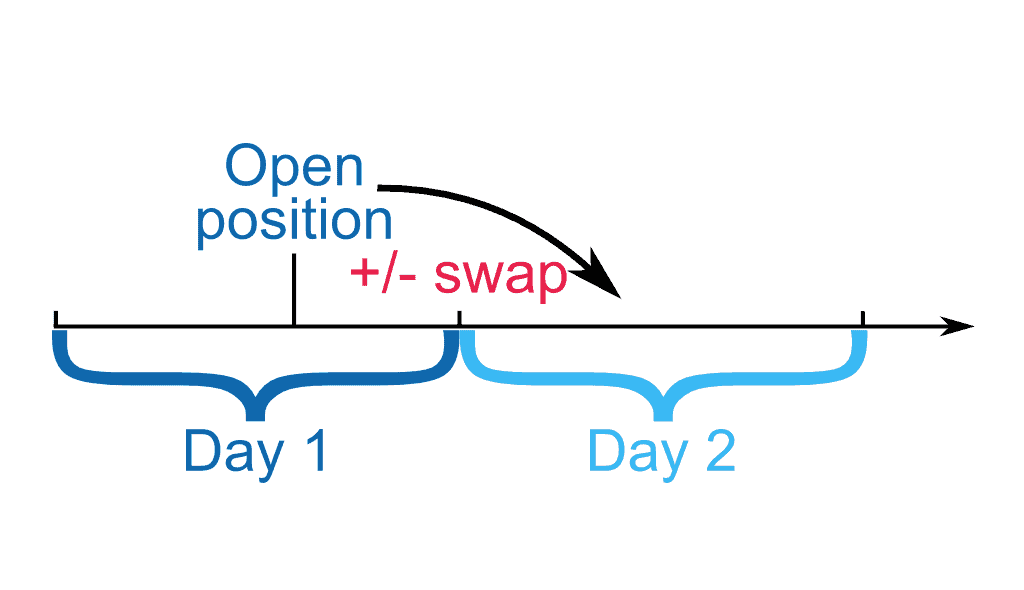

I see many people, even those who already invest in the foreign exchange market, who don’t know what forex swap is. Also known as swap points, swap commissions, or rollover on forex. Although it is true that it does not affect scalping or intraday operations, it is a charge to account when a position stays open overnight. A charge that can be both in your favor (you get paid) and against you (you get paid).

I’m a person who likes to always count all my expenses. That’s why I’m going to explain to you what a swap is, how it affects you, how you can benefit or hurt yourself, and most importantly, how a swap is calculated in forex.

What is the Swap?

There are those who call it currency rollover. Swap is the difference between the interest rates of two countries. It would therefore be correct to say that this is the difference between countries’ interest rates. However, since «currency pairs» are played on forex, it is best to say that the difference is between two countries. The two countries involved in a particular currency pair.

This annual interest must be paid on every operation we keep open from one day to the next and every day. And it exists because the interest rates to finance a country are not the same among them. We have areas with very low and even negative rates, such as the Euro area (EUR currency), Switzerland (div. CHF) or Japan (div. JPY), and higher ones, such as Russia (div. RUB). There are isolated cases of countries with huge interest rates, such as Argentina, which for example in 2019 had an interest rate of 50%.

Where Does the Swap Come From?

The difference in the central bank interest rate to which each currency corresponds. So that we can understand it, let us look at the example of the Australian Dollar (AUD) and the Swiss Franc (CHF). Among others, because the AUD/CHF pair is very interesting for trading.

Remember that the first currency of the currency crossing is the base currency, in this case, AUD. The second, is the quoted currency, in this case, CHF.

AUD is subject to an interest rate of 1.50%, and CHF has the rate at -1.25%. Its total spread is 1.50-(-1.25)=2.75%. This would be an interest in our favor if our position is bought. If, on the contrary, we sell, this interest must be paid.

If we take the crossing backward (CHF/AUD) we would have a difference of (-1’25)-1’50=-2’75%. So, in a purchased position, we would pay for that swap, and in case of a sale, we would receive it.

Remember that from the first currency if you buy it you receive its interest, and from the second when you detach it you pay. On the contrary, if you sell, from the first currency you pay the interest, and from the second you receive it. Interest rates tend to vary over time. There are very stable interest rates, to very unstable ones.

So far, you can see the logic behind the swap. If you take as reference the interest rates of the currencies involved in each crossing, you will see how in your broker you are paid or charged depending on the ones you have looked at.

The Swap/Rollover at the Broker

This is important. The broker does not express a percentage but does it in pips (for or against you). And besides, you’ll see that it’s not proportional, a long position is not the same as a short position. Shouldn’t it be the same? Yes, it is indeed. What happens in this case, is that the broker charges a commission on each and its liquidity providers. And it is understandable because it is your business and we benefit from your services.

In my case, my broker pays me for a long position (Swap Long) in AUD/CHF, 0’44 pips per day. Then, in case I opened a short position (Swap Short) I would pay -0’71 pips per day. If we did not charge a commission, we would see perhaps more accurate pip figures, such as 0.55 and -0’55 for example, depending on whether it was purchase or sale.

I explain. The first time I had any notion of the swap, my first impulse was to look for the currency that paid me the most pips to keep an open position. «I will leave my position open… Every day I will get more pips… And I will be the master of the universe». Don’t even think like that!

I explain. The first time I had any notion of the swap, my first impulse was to look for the currency that paid me the most pips to keep an open position. «I will leave my position open… Every day I will get more pips… And I will be the master of the universe». Don’t even think like that!

You can search for yourself how the quotes of these foreign exchange crossings have been with high long-term swaps. If you look for them, which I encourage you to do, you will see some graphics that are scary. Does that mean that we should forget about the swap? No, far from it! But it’s a double-edged sword, and I have to warn you. Interests don’t vary because they do, but that’s another story.

A swap can benefit you, or help you, without being a guarantee of total success, in making decisions for long-term forex trades.

How Do I Benefit from Swap Points?

I don’t like «complicating» my life. I start from a very simple base, I can’t anticipate the short term. For me, the short-term market is irrational. I don’t know what something will do in less than 1 month, and although I am suggested in forex by my way of investing in value, I do not flee this market, but I do not analyze it with more depth than I think it deserves.

There are those who can tell me: «Try this indicator», or, «Look, I have discovered that such a thing works and you can get a good monthly performance». No way, I tried a lot of things back in the day, and I wasn’t convinced by any of them. That’s why I use the swap to my advantage, only in trades I know I can have open for the long term.

To do this, I don’t buy large amounts, my forex investments are minimal but multiple. Looking for pairs without strong oscillations and that in case of having them can support them, and are in points that I consider, are favorable. Always analyzing, in the long term. And when I say long-term, I mean years and even decades.

Long term + Small multiple trades + Swap + Market oscillations = I have generated a satisfactory return. I could even say, on a regular basis.

How to Calculate Swaps

We imagine that we want to trade a purchase with the EUR/USD, and to make the numbers simple, let’s imagine that we buy a mini-lot, which is equivalent to 10,000 USD. Each pip, or what is the same, every 0’0001 EUR/USD quote, is equivalent to 1 $. U.S.A. interest rates tend to be higher than in the euro area.

Imagine this example, in the United States, for example, they are 2.25%, and in the Euro Zone 0% (As an example, I am not saying that these are now). When we buy EUR we will receive 0%, and as we part from USD we will pay 2.25%. This means we will pay 2.25% per year of 10.000$. Equivalent to $225. $225 a year, that’s $0.62 a day, which in pips would translate to -0.62 pips. Negative because in this case, that’s what we should pay. And adding, that the broker will add us commissions, can come up with a higher value of 0’9 or 1 pips.

In order for the pips/swap points to be in our favor, we would have to make a sale instead of a purchase, in this case. In case you use another currency pair, pips will always be paid for the quoted currency. Then just do the conversion to your currency, to know the exact amount you will receive.

Final Conclusions

We have seen that swaps are not a complicated issue, beyond the relevant calculation to know how it affects us. That can benefit us as well as hurt, depending on our decisions. And that is something to keep in mind, especially in long-term forex trading.