Introduction

Apart from inflation, gross domestic product growth is one of the most closely monitored macroeconomic statistics. This interest in the GDP growth rate is because GDP is one of the leading indicators of economic health in any country. Therefore, apart from understanding how the GDP growth rate impacts a nation’s economy, forex traders must comprehend how it affects the exchange rate.

Understanding the GDP Annual Growth Rate

GDP: A country’s gross domestic product is the monetary measure of the entirety of goods and services that have been produced within an economy over a specific period. The formula for calculating the GDP for a country is summing up the households’ consumption expenditure, expenditure by the national government, spending by businesses, and the net value of exports. The fact that the GDP covers the entire expenditure within an economy makes it a robust leading indicator of economic health.

GDP Growth Rate: The measure of how the various components in an economy are changing over a given period is the GDP growth rate. The GDP growth rate shows how much a country’s economy has expanded or shrunk relative to the previous period. Thus, the GDP growth rate is the primary measure of how well or poorly an economy is performing.

GDP Annual Growth Rate: The GDP growth rate is calculated every quarter. However, the annual growth rate measures the change in the real GDP between a given quarter and a similar quarter in the previous calendar year. While the QoQ GDP growth rate gives a more recent picture of how the economy is fairing, the annual growth rate is necessary to indicate the longer-term trajectory of the economy.

How the GDP Annual Growth Rate is Measured

It is worth noting that the GDP annual growth rate is calculated using the “real” GDP, meaning that the GDP has been adjusted for inflation. This adjustment is made to ensure the effects of inflation do not result in a false sense of economic progression. There are two ways of determining the GDP annual growth rate.

The first one is by annualising the QoQ GDP growth rate. Annualising means converting the short term QoQ GDP growth rate into an annual rate.

Annualised GDP growth rate = (1 + QoQ GDP)4 – 1

The second method for calculating the annual GDP growth rate is by comparing the rate of change from a given quarter with that of the same quarter in the previous year.

YoY GDP growth = (Current quarter GDP/ Similar Quarter's GDP – previous year) – 1

How the GDP Annual Growth Rate can be used for analysis

Economists track the GDP growth rate not just because it shows the current state of the economy but because it the primary objective of fiscal and monetary policy formulation. The annual GDP growth rate shows a long-term trajectory of the economy. It provides an effective measure to compare the sizes of economies of different countries.

Governments and central banks formulate their policies around the GDP growth numbers. When the YoY GDP is falling, expansionary monetary and fiscal policies that will be implemented. A falling GDP is an indicator that the economy is heading to higher levels of unemployment; reduced wages; and a general reduction in aggregate demand and supply. Therefore, to avoid recession, expansionary policies like a reduction in interest rates are introduced. These measures are reducing the cost of borrowing, which in turn leads to increased expenditure by households, businesses, and the government.

Conversely, a rapidly increasing growth rate of the annual GDP signifies that the economy is performing well. This economic prosperity translates to a higher rate of employment, higher wages; increased levels of investment and re-investments; and higher aggregate demand and supply within the economy. However, although an increasing GDP is good, a rapidly increasing annual growth rate could forebode an overheating economy.

An overheating economy is one that is experiencing an unsustainable period of prolonged economic growth. This prolonged growth risks high levels of runaway inflation in the economy due to the continually rising wages. More so, an overheating economy results in inefficient allocation of the factors of production since producers oversupply the economy to take advantage of the higher prices. These inefficiencies are likely to result in a nationwide economic recession.

To prevent the effects of an overheating economy, the government and central banks will implement contractionary monetary and fiscal policies. They include a reduction in government expenditure and increasing the interest rate. These policies will help slow down the rate of inflation and increase the cost of borrowing, effectively reducing the aggregate demand.

Therefore, the YoY GDP growth rate provides an important metric for the relevant authorities to ensure that the economy is progressing at a sustainable pace. Furthermore, it is a way for the governments and central banks to gauge the effectiveness of the policies put in place.

Impact on Currency

Forex traders keenly follow the changes in fundamental economic indicators to establish whether there will be a future hike or cut in the interest rate. A falling annual GDP growth rate is accompanied by expansionary monetary policies such as a reduction of the interest rate. This cut tends to depreciate a country’s currency. Therefore, a falling annual GDP growth rate is negative for the currency.

Conversely, an increasing annual GDP growth rate forestalls an increase in the interest rate to prevent runaway inflation. Therefore, it is expected that a rising annual GDP growth rate leads to the appreciating of the currency.

Sources of the GDP Annual Growth Rate

The statistics on global GDP annual growth rate can be accessed at Trading Economics and The World Bank.

How GDP Annual Growth Rate Data Release Affects The Forex?

This analysis will focus on the annual GDP growth rate in Australia. The most recent data release was on September 2, 2020, at 1.30 AM GMT and can be accessed at Forex Factory here. A more in-depth review of the data release can be accessed from the Australia Bureau of Statistics.

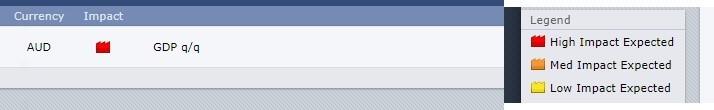

The screengrab below is of the annualised QoQ GDP growth rate from Forex Factory. On the right of the image is a legend that indicates the level of impact it has on the AUD.

As can be seen, both the annualised QoQ GDP growth rate data is expected o result in a high impact on the AUD.

In the 2nd quarter of 2020, the Australian economy contracted by an annualised rate of 7% compared to a 0.3% contraction in the first quarter. This contraction was worse than analysts’ expectation of 6%. This contraction is expected to depreciate the AUD relative to other currencies.

Let’s now analyse the impact made by this release on the Forex price charts of a few selected pairs.

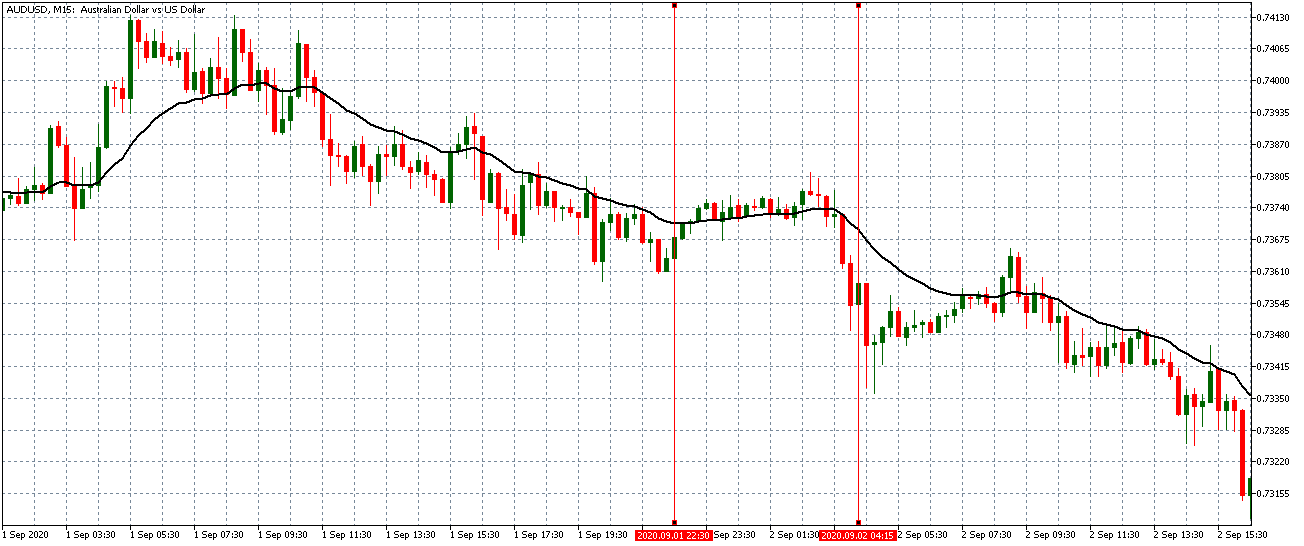

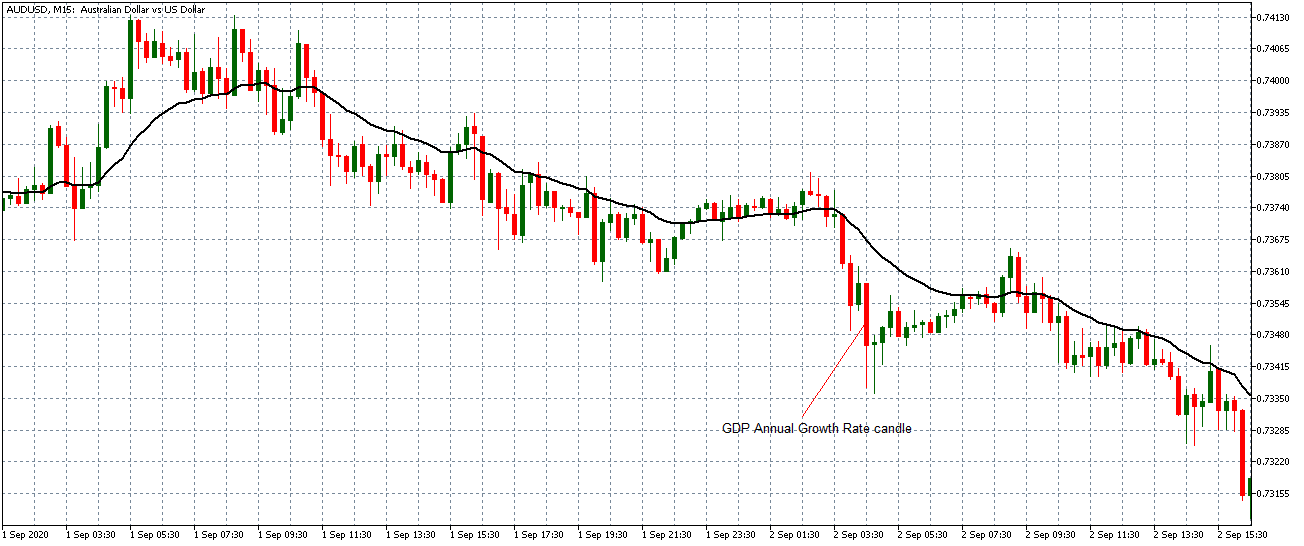

AUD/USD: Before Annualised QoQ GDP Growth Rate Release on September 2, 2020, Just Before 1.30 AM GMT

From the above 15-minute chart, the AUD/USD pair was trading in a neutral trend before the data release. This trend is evidenced by candles forming just around an already flat 20-period Moving Average. However, 30 minutes to the news release, the pair adopted a steep downtrend forming two long bearish candles with the 20-period MA falling.

AUD/USD: After the Annualised QoQ GDP Growth Rate Release on September 2, 2020, at 1.30 AM GMT

After the data release, extreme volatility is observed. As expected, the pair forming a long 15-minute bearish candle due to the weakening AUD. The 20-period MA continued to fall steeply even though the pair started recovering from the worse than expected data release. Subsequently, the steepness of the 20-period MA subsided.

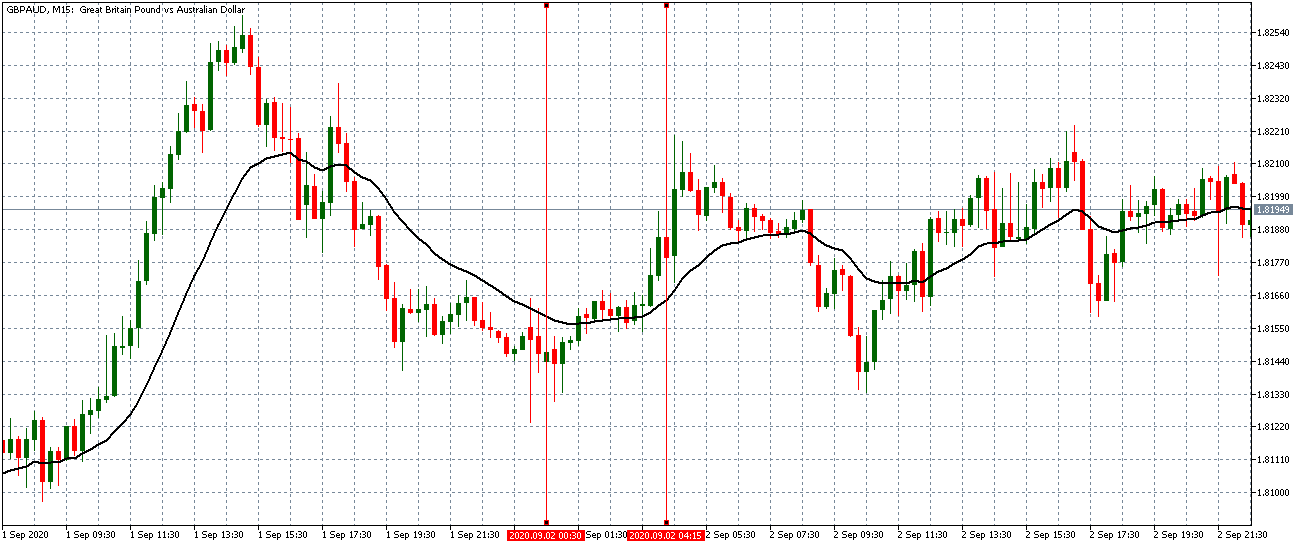

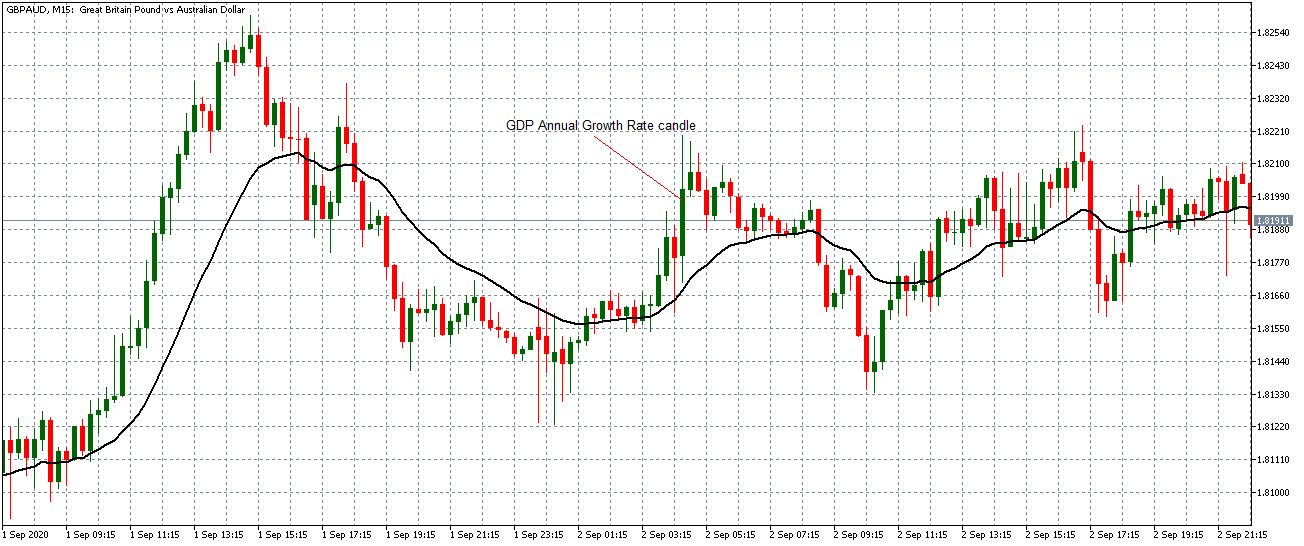

GBP/AUD: Before Annualised QoQ GDP Growth Rate Release on September 2, 2020, Just Before 1.30 AM GMT

The GBP/AUD pair traded in a similar pattern as observed with the AUD/USD pair before the annualised GDP data release.

GBP/AUD: After the Annualised QoQ GDP Growth Rate Release on September 2, 2020, at 1.30 AM GMT

As expected, after the news release, the pair formed a long 15-minute bullish candle due to the weakening AUD. As with the AUD/USD pair, the GBP/AUD pair underwent a period of correction with the 20-period MA flattening and the subsequent candles forming lower than the news candle.

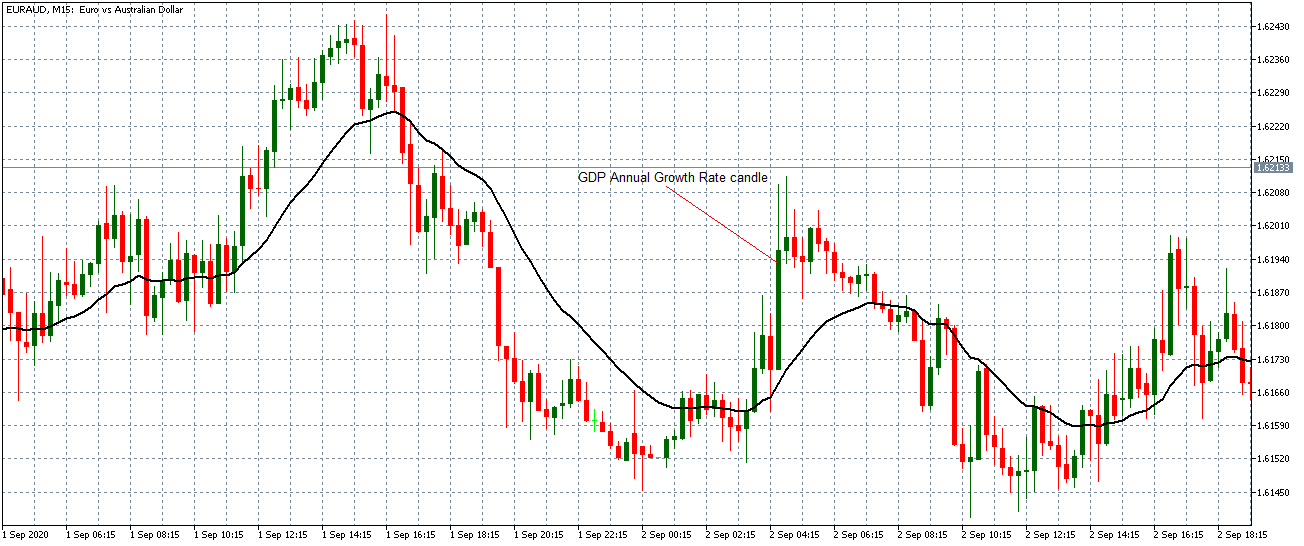

EUR/AUD: Before Annualised QoQ GDP Growth Rate Release on September 2, 2020, Just Before 1.30 AM GMT

EUR/AUD: After the Annualised QoQ GDP Growth Rate Release on September 2, 2020, at 1.30 AM GMT

Like the other pairs, the EUR/AUD pair traded within a neutral trend with a significant shift in the trend immediately before the GDP data release. Like the GBP/AUD pair, the EUR/AUD pair formed a long 15-minute bullish candle after the news release due to the worse than expected data.

Bottom Line

The above analyses have shown that the GDP annual growth has a significant effect on price action. The period of relative market inactivity before the data release indicates that most forex traders avoid opening any new, significant positions until the data is released.