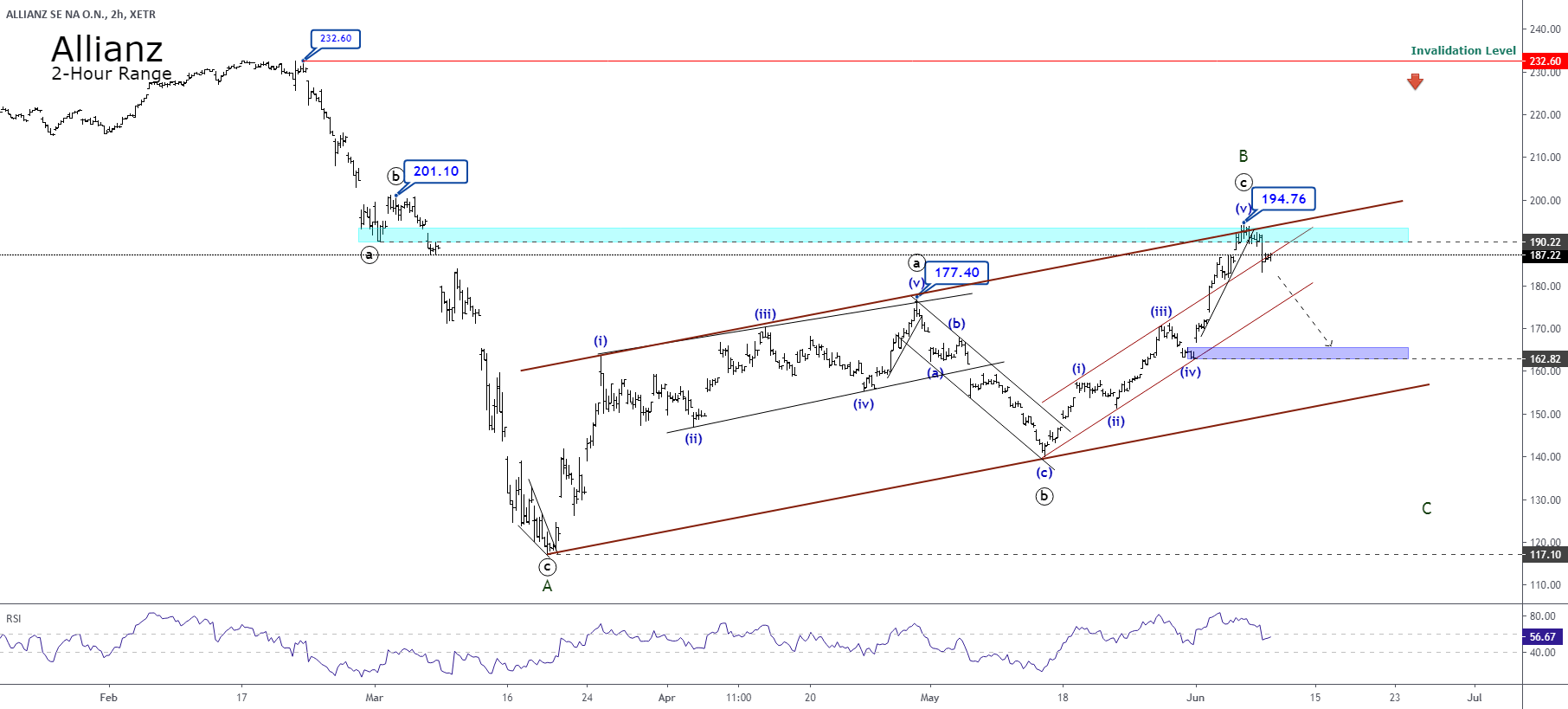

Allianz (XETRA:ALV), a German-based financial company, sinks near 3% in the current week after having completed a zigzag pattern (5-3-5) when the price reached the level of €194.76 per share.

ALV exposes in its 2-hour chart the rejection in the zone of the upper line of the ascending channel that converges with the pause zone of the first downward sequence started on February 21ts when the price topped at €232.60 per share.

In the previous chart, we observe that ALV completed its first bearish three-wave sequence corresponding to wave A of Minor degree labeled in green. In this first leg, we distinguish that Allianz, in its last move, developed a terminal Elliott wave pattern corresponding to an ending diagonal that was completed on March 19th when the stock price found fresh buyers at €117.10.

Once the price jumped in a three-wave sequence, ALV raised until €163.74 per share, completing the wave (i) of the Minuette degree labeled in blue. This movement reveals an overlapped structural series that corresponds to a leading diagonal.

According to the Elliott wave principle, a leading diagonal tend to appear in waves 1 or A. Its internal structure follows a subdivision as 3-3-3-3-3. In the figure, we observe that the leading diagonal pattern ended at €177.40 per share, where the price found fresh sellers and completed its wave ((a)) of Minute degree labeled in black.

The breakdown of the intraday trendline that advances with wave (v) of ((a)) validated the end of wave ((a)) and the start of a new movement corresponding to wave ((b)). This new corrective move carried down to ALV to find support at €139.78 per share on May 14th, where the German financial company found the incorporation of fresh buyers, who moved the market in an upward five-wave sequence corresponding to wave ((c)) of Minuette degree in blue.

The third movement corresponding to wave ((c)) of Minute degree, which belongs to the corrective structure of upper-degree, developed its rally in a five-wave sequence until the level €194.76. This move shows its fifth internal wave as an extended move.

Following the Elliot Wave Theory, we can observe that the retracement that Allianz is starting to develop could drag to the stock price until the zone of the beginning of wave (v) in blue, where the price should find support.

In conclusion, our preferred positioning remains on the bearish side until the zone that marks the beginning of wave (v) of the Minuette degree.