In our previous article about the preliminary wave analysis, we commented on the relation between price and time and distinguished the difference between directional and non-directional movement. In this educational post, we will extend new concepts to develop a wave analysis.

Finding the end of a Movement

Identifying the end of a movement is usually a tough task, especially when the wave analyst makes its first analysis.

To reduce the subjectivity in this stage, the basic rule to identify the end of a segment is: if the price action of the following section of a directional movement experiences a retrace for more than 100%, it is indicative that the movement has ended.

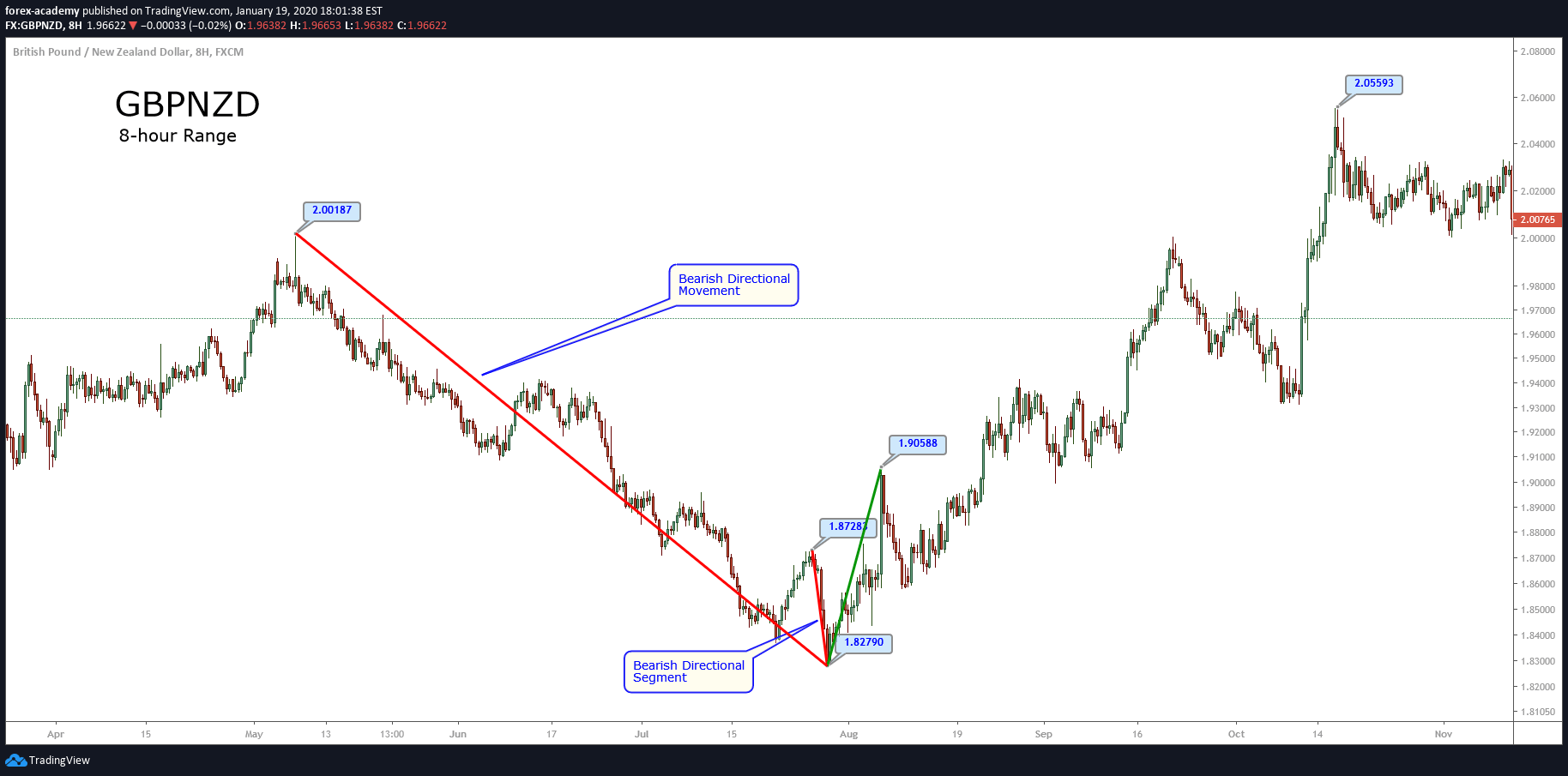

To illustrate this rule, let us consider the GBPNZD in its 8-hour chart. In the figure, we observe the bearish directional movement starts at 2.00187. The last directional segment that begins at 1.87283 and declines until 1.82790.

Once the price surges from the lowest level, and advances over 1.87283, reaching at 1.90588, we observe that the bearish directional movement has finished.

In the case of a non-directional movement, the segments series that conforms to the consolidation formation frequently tends to finish once the price exceeds the 161.8% level of the non-directional range.

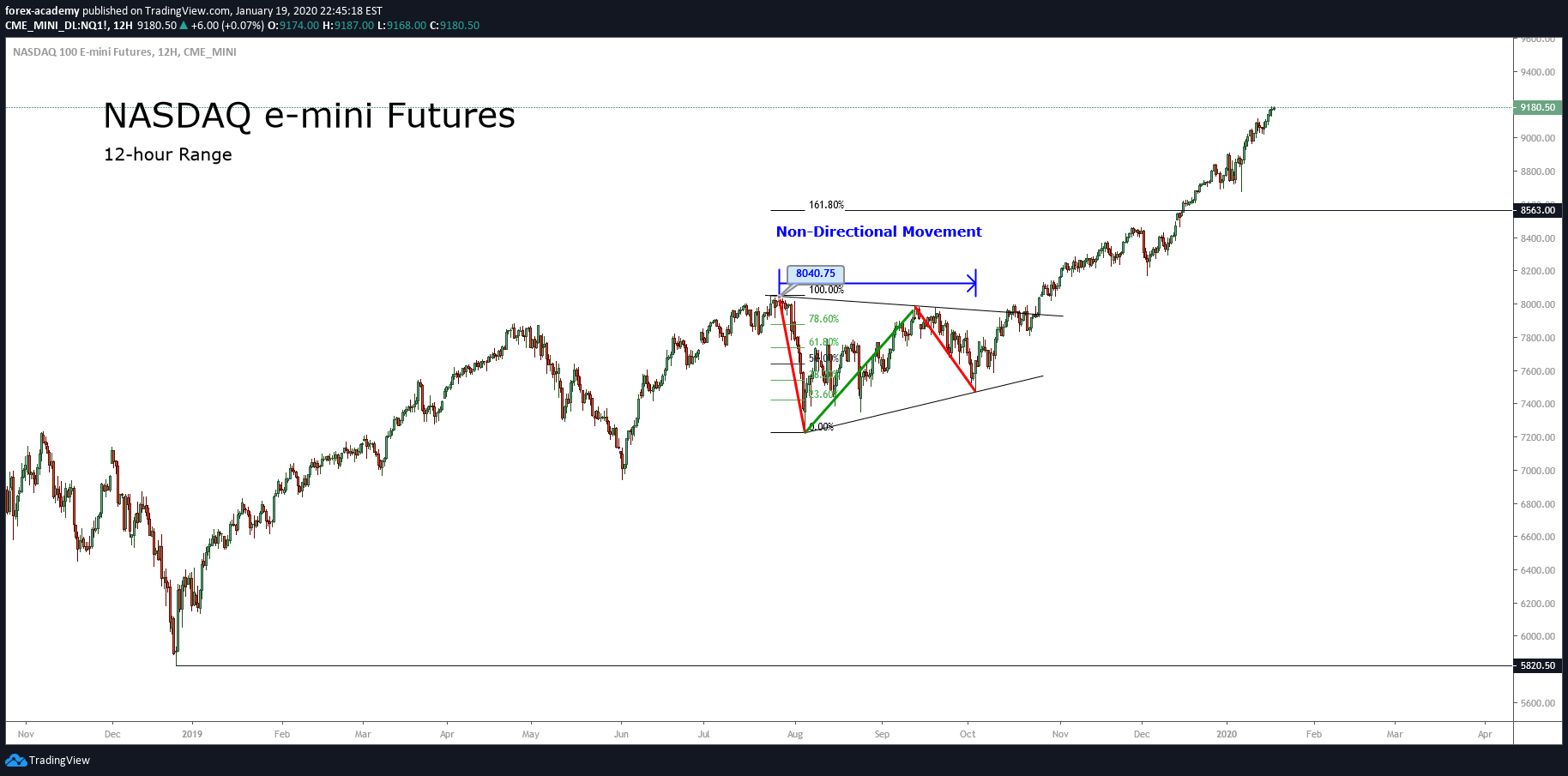

The next chart exposes to NASDAQ e-mini futures contract in its 12-hour timeframe. The figure illustrates the non-directional movement that developed once the price reached 8,040.75 pts.

The e-mini NASDAQ futures price made a first bearish segment From 8,040-75 until 7,359.75 pts. From this low, the price action reacted, making a bounce that exceeded the 61.8% of the first bearish decline. In the same way, the third internal segment retraces more than 61.8% of the second non-directional move.

After NASDAQ surpassed 8,040.75 pts, the price continued developing a directional sequence that drove the e-mini index to reach several consecutive record highs to the date.

GBPJPY Continue Developing in a Non-Directional Move

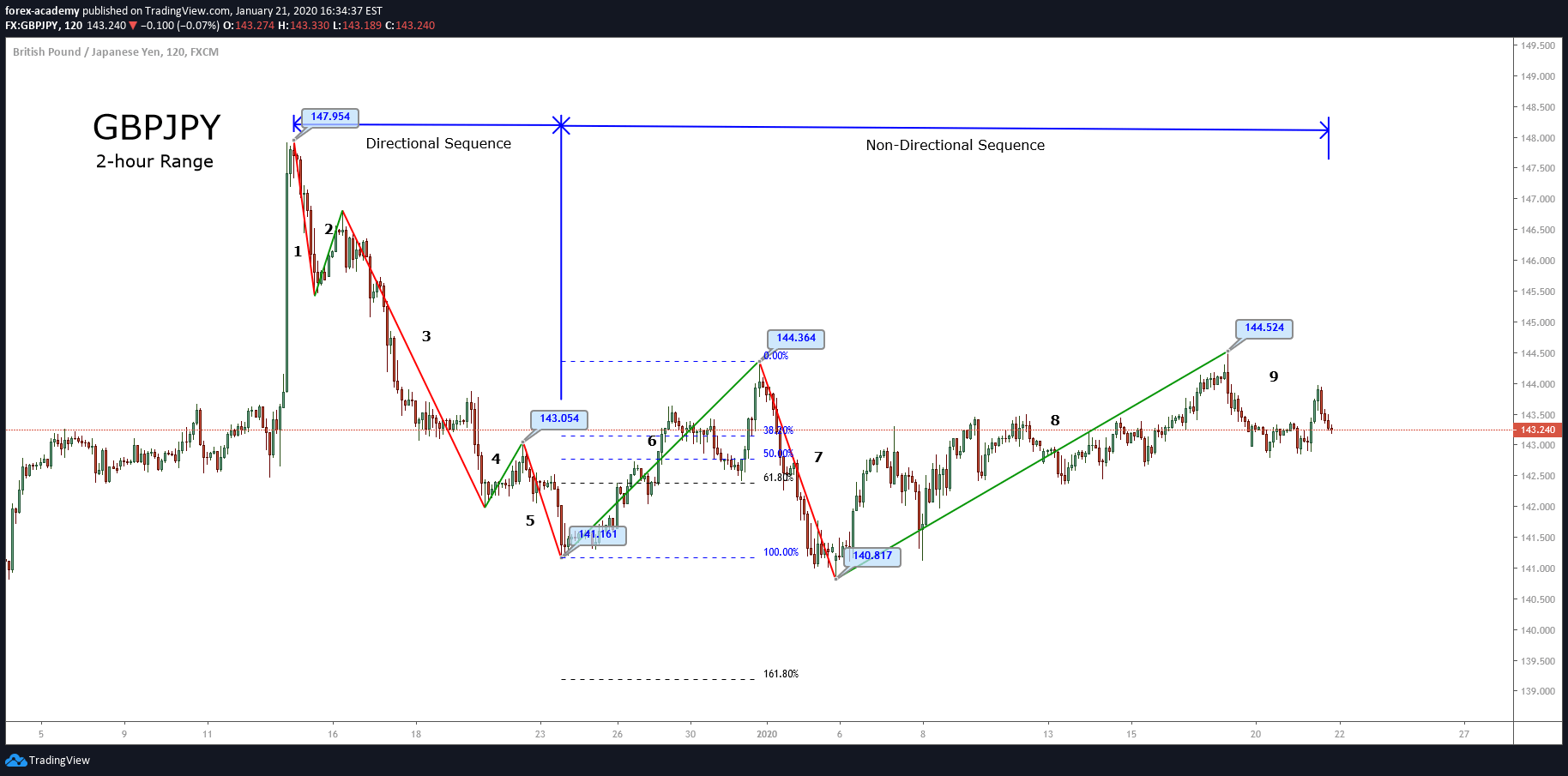

The GBPJPY cross went bearish, starting from the 147.954 level in a five-segmented wave creating a directional sequence until 141.161. From there, the price found new buyers expecting the boost of the GBPJPY once again.

The surpassing of the previous high of segment “4” at 143.054 makes us perceive that the bearish directional movement ended with the advance of leg “6” that ended at the 144.364 level.

Once the top of segment “6” at 144.364 was reached, the price reacted bearishly, making a new decline that created a new lower low at 140.818. In view that the movement exceeded a retracement of 61.8% and was less than 161.8%, the sequence corresponds to a non-directional move.

The next movement, identified as “8”, brought the price to 144.524. This path corresponds to an additional segment of the non-directional sequence. Once that fresh high was reached, the price action reacted downward. The movement remains currently active and based on the previous analysis, the price action bias is bearish.

Conclusions

The identification of the beginning and end of each segment allows the wave analyst to reduce subjectivity in the study.

We must remark that directional and non-directional movements are not the same concepts as impulsive and corrective movements.

Suggested Readings

- Neely, G.; Mastering Elliott Wave: Presenting the Neely Method; Windsor Books; 2nd Edition (1990).

- Prechter, R.; The Major Works of R. N. Elliott; New Classics Library; 2nd edition (1990).