Flash crashes in forex trading can be disastrous for traders and investors. They are sudden and extreme price movements that occur in a very short period of time, causing huge losses to traders who are not prepared for them. They can happen at any time, and no one can predict when they will occur. However, there are ways to minimize the risk of flash crashes and protect your capital. In this article, we will explore some of the best ways to avoid flash crashes in forex trading.

1. Use Stop Loss Orders

Stop loss orders are crucial in forex trading as they help minimize the risk of losses. They are automated instructions to sell a currency pair when it reaches a certain price. Stop loss orders are essential in preventing huge losses in the event of a flash crash. They help traders exit a trade before the market moves against them, thereby reducing the amount of losses incurred.

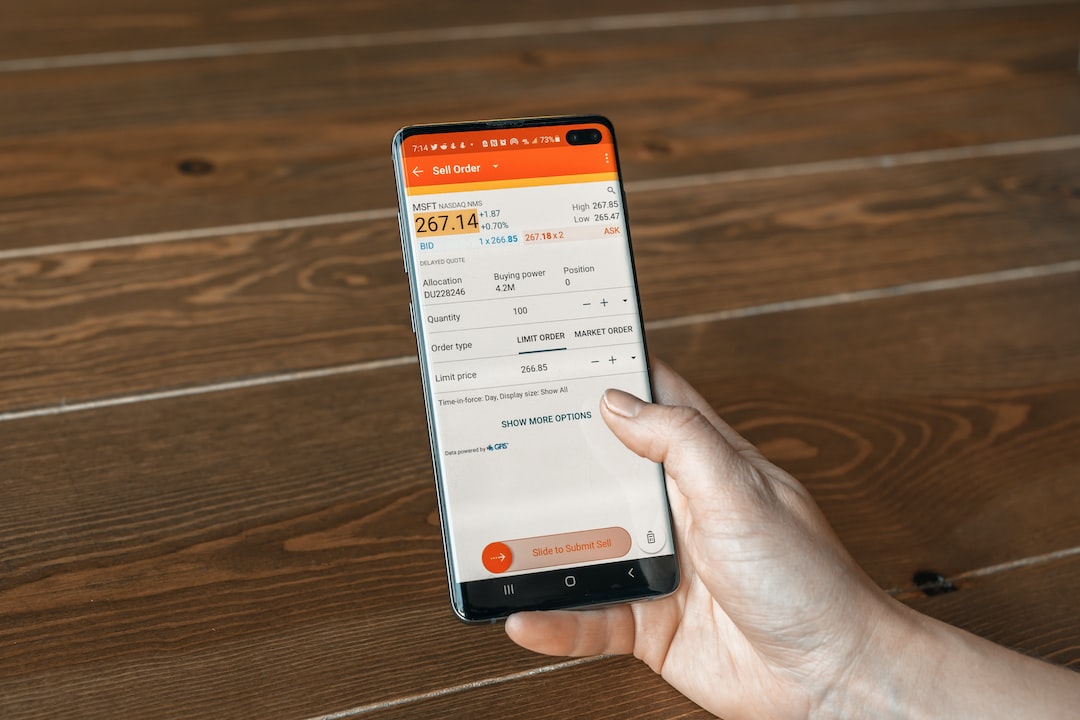

2. Use Limit Orders

Limit orders are another important tool for forex traders. They are orders to buy or sell a currency pair at a specific price. Using limit orders can help traders avoid flash crashes by ensuring that they enter and exit trades at predetermined prices. They can help traders avoid the volatility that often accompanies flash crashes.

3. Keep an Eye on Economic News

Economic news has a significant impact on the forex market. It is essential to keep an eye on economic news releases, as they can trigger flash crashes. For example, if a country’s central bank announces an unexpected interest rate hike, the currency of that country may experience a sudden increase in value, leading to a flash crash in other currencies. Traders who are aware of such news releases can take precautionary measures to avoid flash crashes.

4. Use a Trading Plan

Having a trading plan is essential for forex traders. It helps traders establish clear goals, risk management strategies, and entry and exit points. A trading plan can help traders avoid the emotional decisions that often lead to flash crashes. It can also help traders stay disciplined and focused, which is essential in avoiding flash crashes.

5. Diversify Your Portfolio

Diversification is a key risk management strategy in forex trading. Traders should diversify their portfolio by investing in different currency pairs and other financial instruments. This can help reduce the risk of losses from a single currency pair or financial instrument. Diversification can also help traders spread their risk across different markets, which can help them avoid flash crashes.

6. Use Technical Analysis

Technical analysis is a trading strategy that involves analyzing charts and other technical indicators to identify trends and patterns in the market. It can help traders identify potential flash crashes and take precautionary measures to avoid them. Technical analysis can also help traders identify entry and exit points, which can help them avoid the volatility that often accompanies flash crashes.

7. Be Prepared for Volatility

Volatility is a common occurrence in forex trading. It is essential to be prepared for volatility and have a risk management strategy in place. Traders should be aware of the potential for flash crashes and take appropriate measures to avoid them. They should also have a plan in place to manage their trades in the event of a flash crash.

In conclusion, flash crashes in forex trading can be devastating. However, traders can take several measures to avoid them. Using stop loss and limit orders, keeping an eye on economic news, using a trading plan, diversifying your portfolio, using technical analysis, and being prepared for volatility are some of the best ways to avoid flash crashes. By following these strategies, traders can protect their capital and minimize the risk of losses.